Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Joint Astronomy Centre - Birthday Stars - Final

Caricato da

hail2pigdumTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Joint Astronomy Centre - Birthday Stars - Final

Caricato da

hail2pigdumCopyright:

Formati disponibili

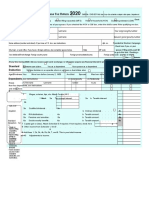

1040

L A B E L H E R E

Form

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

For the year Jan. 1Dec. 31, 2007, or other tax year beginning Your first name and initial

2007

, 2007, ending

IRS Use OnlyDo not write or staple in this space.

, 20

Label

(See instructions on page 12.) Use the IRS label. Otherwise, please print or type.

Last name

OMB No. 1545-0074 Your social security number

Christopher

If a joint return, spouses first name and initial

Powell

Last name

263

02

3824

Spouses social security number

Home address (number and street). If you have a P.O. box, see page 12.

Apt. no.

3666 Chestnut Street

City, town or post office, state, and ZIP code. If you have a foreign address, see page 12.

You must enter your SSN(s) above.

Checking a box below will not

change your tax or refund. Tampa, FL 33610 Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund (see page 12) Spouse You

Filing Status

Check only one box.

1 2 3

Single Married filing jointly (even if only one had income) Married filing separately. Enter spouses SSN above and full name here.

Head of household (with qualifying person). (See page 13.) If the qualifying person is a child but not your dependent, enter this childs name here. Qualifying widow(er) with dependent child (see page 14)

Exemptions

6a Yourself. If someone can claim you as a dependent, do not check box 6a b Spouse (4) if qualifying (3) Dependents c Dependents: (2) Dependents

(1) First name Last name social security number relationship to you

child for child tax credit (see page 15)

If more than four dependents, see page 15. d Total number of exemptions claimed

Boxes checked on 6a and 6b No. of children on 6c who: lived with you did not live with you due to divorce or separation (see page 16) Dependents on 6c not entered above Add numbers on lines above

Income

Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld.

7 Wages, salaries, tips, etc. Attach Form(s) W-2 8a Taxable interest. Attach Schedule B if required b Tax-exempt interest. Do not include on line 8a 9a Ordinary dividends. Attach Schedule B if required b Qualified dividends (see page 19) 10 11 12 13 Alimony received Business income or (loss). Attach Schedule C or C-EZ Capital gain or (loss). Attach Schedule D if required. If not required, check here Other gains or (losses). Attach Form 4797 15a IRA distributions Pensions and annuities 16a b Taxable amount (see page 21) b Taxable amount (see page 22) 8b

7 8a 9a 9b 10 11 12 13 14 15b 16b 17 18 19 b Taxable amount (see page 24)

97559

Taxable refunds, credits, or offsets of state and local income taxes (see page 20)

If you did not get a W-2, see page 19. Enclose, but do not attach, any payment. Also, please use Form 1040-V.

14 15a 16a 17 18 19 20a 21 22 23 24 25 26 27 28 29 30 31a 32 33 34 35 36 37

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation 20a Social security benefits

20b 21 22

Other income. List type and amount (see page 24) Add the amounts in the far right column for lines 7 through 21. This is your total income Educator expenses (see page 26) Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ Health savings account deduction. Attach Form 8889 Moving expenses. Attach Form 3903 One-half of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction (see page 26) Penalty on early withdrawal of savings Alimony paid b Recipients SSN

97559

23 24 25 26 27 28 29 30 31a 32 33 34 35 36

Adjusted Gross Income

IRA deduction (see page 27) Student loan interest deduction (see page 30) Tuition and fees deduction. Attach Form 8917

Domestic production activities deduction. Attach Form 8903

Add lines 23 through 31a and 32 through 35 Subtract line 36 from line 22. This is your adjusted gross income

37

97559

Form

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 83.

Cat. No. 11320B

1040

(2007)

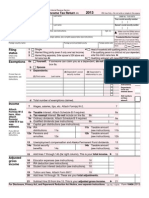

Form 1040 (2007)

Page

Tax and Credits

Standard Deduction for People who checked any box on line 39a or 39b or who can be claimed as a dependent, see page 31. All others: Single or Married filing separately, $5,350 Married filing jointly or Qualifying widow(er), $10,700 Head of household, $7,850

38 39a

Amount from line 37 (adjusted gross income) Check if:

38

97559

You were born before January 2, 1943, Blind. Total boxes Blind. checked 39a Spouse was born before January 2, 1943, b If your spouse itemizes on a separate return or you were a dual-status alien, see page 31 and check here 39b Itemized deductions (from Schedule A) or your standard deduction (see left margin) Subtract line 40 from line 38 If line 38 is $117,300 or less, multiply $3,400 by the total number of exemptions claimed on line 6d. If line 38 is over $117,300, see the worksheet on page 33 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0Tax (see page 33). Check if any tax is from: a Add lines 44 and 45 Credit for child and dependent care expenses. Attach Form 2441 Credit for the elderly or the disabled. Attach Schedule R Education credits. Attach Form 8863 Residential energy credits. Attach Form 5695 Foreign tax credit. Attach Form 1116 if required Child tax credit (see page 39). Attach Form 8901 if required Retirement savings contributions credit. Attach Form 8880 Credits from: 47 48 49 50 51 52 53 Form(s) 8814 b Form 4972 c Form(s) 8889

40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63

40 41 42 43 44 45 46

5350 92209 3400

Alternative minimum tax (see page 36). Attach Form 6251

54 Form 8859 c Form 8839 a Form 8396 b 55 Other credits: a Form 3800 b Form 8801 c Form Add lines 47 through 55. These are your total credits Subtract line 56 from line 46. If line 56 is more than line 46, enter -0Self-employment tax. Attach Schedule SE Unreported social security and Medicare tax from: a Form 4137 b Form 8919 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required Advance earned income credit payments from Form(s) W-2, box 9 Household employment taxes. Attach Schedule H Add lines 57 through 62. This is your total tax Federal income tax withheld from Forms W-2 and 1099 2007 estimated tax payments and amount applied from 2006 return Earned income credit (EIC) Nontaxable combat pay election 66b Excess social security and tier 1 RRTA tax withheld (see page 59) Additional child tax credit. Attach Form 8812 Amount paid with request for extension to file (see page 59) 64 65 66a 67 68 69

56

57 58 59 60 61 62

Other Taxes

63

Payments

64 65

If you have a 66a qualifying b child, attach Schedule EIC. 67

68 69 70 71 72

70 Payments from: a Form 2439 b Form 4136 c Form 8885 71 Refundable credit for prior year minimum tax from Form 8801, line 27 Add lines 64, 65, 66a, and 67 through 71. These are your total payments

72 73 74a

Refund

Direct deposit? See page 59 and fill in 74b, 74c, and 74d, or Form 8888.

73 74a b d 75 76 77

If line 72 is more than line 63, subtract line 63 from line 72. This is the amount you overpaid Amount of line 73 you want refunded to you. If Form 8888 is attached, check here Routing number Account number Amount of line 73 you want applied to your 2008 estimated tax 75 Amount you owe. Subtract line 72 from line 63. For details on how to pay, see page 60 Estimated tax penalty (see page 61) 77

c Type:

Checking

Savings

Amount You Owe

76 No

Third Party Designee Sign Here

Joint return? See page 13. Keep a copy for your records.

Do you want to allow another person to discuss this return with the IRS (see page 61)?

Designees name Phone no. ( )

Yes. Complete the following.

Personal identification number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number (

727

388-9994

Spouses signature. If a joint return, both must sign.

Date

Spouses occupation

Paid Preparers Use Only

Preparers signature

Date

Firms name (or yours if self-employed), address, and ZIP code

Check if self-employed EIN Phone no.

Preparers SSN or PTIN

) Form

1040

(2007)

Potrebbero piacerti anche

- The Trump Tax Cut: Your Personal Guide to the New Tax LawDa EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawNessuna valutazione finora

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocumento3 pagine2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNessuna valutazione finora

- U.S. Individual Income Tax Return: See Separate InstructionsDocumento4 pagineU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Estimated Tax for IndividualsDocumento12 pagineEstimated Tax for IndividualsJob SchwartzNessuna valutazione finora

- 2016 1040 Individual Tax Return Engagement LetterDocumento11 pagine2016 1040 Individual Tax Return Engagement LettersarahvillalonNessuna valutazione finora

- Think Computer Foundation 2009 Tax ReturnDocumento10 pagineThink Computer Foundation 2009 Tax ReturnTaxManNessuna valutazione finora

- Brooklyn Museum 2019 IRS Form 990Documento64 pagineBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNessuna valutazione finora

- Individual Tax ReturnDocumento4 pagineIndividual Tax ReturnmacNessuna valutazione finora

- CLR 2020 Tax ReturnDocumento14 pagineCLR 2020 Tax ReturnAlexander Barno AlexNessuna valutazione finora

- 2010 Income Tax ReturnDocumento2 pagine2010 Income Tax ReturnCkey ArNessuna valutazione finora

- Sanogo 2019 TFDocumento40 pagineSanogo 2019 TFbassomassi sanogoNessuna valutazione finora

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Documento1 paginaW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNessuna valutazione finora

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Documento17 pagineRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNessuna valutazione finora

- File Your 2014 Tax ReturnDocumento4 pagineFile Your 2014 Tax ReturnShakilaMissz-KyutieJenkins100% (1)

- Hillside Children's Center, New York 2014 IRS ReportDocumento76 pagineHillside Children's Center, New York 2014 IRS ReportBeverly TranNessuna valutazione finora

- 2009 Income Tax ReturnDocumento5 pagine2009 Income Tax Returngrantj820Nessuna valutazione finora

- Gene Locke Tax Return, 2006Documento25 pagineGene Locke Tax Return, 2006Lee Ann O'NealNessuna valutazione finora

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocumento42 pagine2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocumento72 pagineInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Nessuna valutazione finora

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocumento2 pagineEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNessuna valutazione finora

- Windward Fund's 2018 Tax FormsDocumento49 pagineWindward Fund's 2018 Tax FormsJoe SchoffstallNessuna valutazione finora

- Individual Tax CalculationDocumento11 pagineIndividual Tax CalculationSunil ChelladuraiNessuna valutazione finora

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Documento2 pagineRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNessuna valutazione finora

- Request for Taxpayer ID FormDocumento4 pagineRequest for Taxpayer ID FormMichael RamirezNessuna valutazione finora

- 2022 Individual Tax Organizer FillableDocumento6 pagine2022 Individual Tax Organizer FillableTham DangNessuna valutazione finora

- 2018 Form I Individual Income Tax Return 2017Documento20 pagine2018 Form I Individual Income Tax Return 2017KSeegurNessuna valutazione finora

- Individual Tax Returns - IRS 2009Documento200 pagineIndividual Tax Returns - IRS 2009Steve EldridgeNessuna valutazione finora

- U.S. Individual Income Tax Return: Filing StatusDocumento2 pagineU.S. Individual Income Tax Return: Filing Statusfelix angomasNessuna valutazione finora

- U.S. Individual Income Tax Return: Filing StatusDocumento3 pagineU.S. Individual Income Tax Return: Filing StatuspyatetskyNessuna valutazione finora

- 2016 California Resident Income Tax Return Form 540 2ezDocumento4 pagine2016 California Resident Income Tax Return Form 540 2ezapi-351598796Nessuna valutazione finora

- ECDC 2009 Tax ReturnDocumento27 pagineECDC 2009 Tax ReturnNC Policy WatchNessuna valutazione finora

- FD 941 Apr-Jun 2017 PDFDocumento3 pagineFD 941 Apr-Jun 2017 PDFScott WinklerNessuna valutazione finora

- 2014 Alabama Possible 990Documento39 pagine2014 Alabama Possible 990Alabama PossibleNessuna valutazione finora

- Individuals Tax Return - US 2016Documento2 pagineIndividuals Tax Return - US 2016Yousef M. AqelNessuna valutazione finora

- Frantz Raymond TaxDocumento1 paginaFrantz Raymond Taxjoseph GRAND-PIERRENessuna valutazione finora

- Kia Lopez Form 1040Documento2 pagineKia Lopez Form 1040Stephanie RobinsonNessuna valutazione finora

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDocumento14 pagineElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNessuna valutazione finora

- Ezra Daniels TaxDocumento11 pagineEzra Daniels TaxJulio Romero100% (1)

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Documento69 pagineCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519Nessuna valutazione finora

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Documento2 pagine1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNessuna valutazione finora

- LG FFDocumento1 paginaLG FFfeem743Nessuna valutazione finora

- US Internal Revenue Service: f1040nr - 2005Documento5 pagineUS Internal Revenue Service: f1040nr - 2005IRSNessuna valutazione finora

- Tax Return 2018-19Documento18 pagineTax Return 2018-19Kasam ANessuna valutazione finora

- Tax Return ScribdDocumento5 pagineTax Return ScribdYvonne TanNessuna valutazione finora

- Please Review The Updated Information Below.: For Begins After This CoversheetDocumento3 paginePlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNessuna valutazione finora

- 540 FinalDocumento5 pagine540 Finalapi-350796322Nessuna valutazione finora

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocumento3 pagineTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNessuna valutazione finora

- Form W-4 (2018) : Specific InstructionsDocumento4 pagineForm W-4 (2018) : Specific InstructionsRony MartinezNessuna valutazione finora

- View Tax Return PDFDocumento14 pagineView Tax Return PDFEmil AndriesNessuna valutazione finora

- 2020 Instructions For Schedule C: Profit or Loss From BusinessDocumento19 pagine2020 Instructions For Schedule C: Profit or Loss From BusinessI'm JuicyNessuna valutazione finora

- 2007 Federal ReturnDocumento2 pagine2007 Federal ReturnbradybunnellNessuna valutazione finora

- Tax ReturnDocumento26 pagineTax ReturnjoshuaharaldNessuna valutazione finora

- Request For Taxpayer Identification Number and CertificationDocumento4 pagineRequest For Taxpayer Identification Number and CertificationMarlena Anne GusmanoNessuna valutazione finora

- 2021 - TaxReturn 2pagessignedDocumento3 pagine2021 - TaxReturn 2pagessignedDedrick RiversNessuna valutazione finora

- 2011 Income Tax ReturnDocumento4 pagine2011 Income Tax Returnsalazar17Nessuna valutazione finora

- F 1040 NRDocumento5 pagineF 1040 NRsrao_919525Nessuna valutazione finora

- Taxes Are FunDocumento2 pagineTaxes Are Funlfoirirjrkjbghghg999Nessuna valutazione finora

- Form 1040A Tax Credit DetailsDocumento3 pagineForm 1040A Tax Credit DetailsYosbanyNessuna valutazione finora

- 2011 Federal 1040Documento2 pagine2011 Federal 1040Swati SarangNessuna valutazione finora

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Documento2 pagineU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- Opera - Oxford ReferenceDocumento3 pagineOpera - Oxford Referencehail2pigdumNessuna valutazione finora

- T. L. Taylor - The Assemblage of PlayDocumento9 pagineT. L. Taylor - The Assemblage of Playhail2pigdumNessuna valutazione finora

- Why NYC Subway Lines Lack Real-Time Arrival InfoDocumento23 pagineWhy NYC Subway Lines Lack Real-Time Arrival Infohail2pigdumNessuna valutazione finora

- Cse169 04Documento57 pagineCse169 04matkabhaiNessuna valutazione finora

- Musk TranscriptDocumento58 pagineMusk TranscriptAndy HuffNessuna valutazione finora

- IMSLP61794-PMLP05770-English Suites - Czerny EditionDocumento110 pagineIMSLP61794-PMLP05770-English Suites - Czerny EditionJiji JioijioNessuna valutazione finora

- Lunch & Dinner Specials at Pibroch RestaurantDocumento2 pagineLunch & Dinner Specials at Pibroch Restauranthail2pigdumNessuna valutazione finora

- Continuum For InteractivityDocumento4 pagineContinuum For Interactivityhail2pigdumNessuna valutazione finora

- Presentation Zen - The Key To Story Structure in Two Words - Therefore & ButDocumento18 paginePresentation Zen - The Key To Story Structure in Two Words - Therefore & Buthail2pigdumNessuna valutazione finora

- T. L. Taylor - The Assemblage of PlayDocumento9 pagineT. L. Taylor - The Assemblage of Playhail2pigdumNessuna valutazione finora

- IMSLP61794-PMLP05770-English Suites - Czerny EditionDocumento110 pagineIMSLP61794-PMLP05770-English Suites - Czerny EditionJiji JioijioNessuna valutazione finora

- Ed Blackwell StudyDocumento161 pagineEd Blackwell StudySuper jazz100% (3)

- They Built The First Phone You Loved - Where in The World Is Nokia Now?Documento13 pagineThey Built The First Phone You Loved - Where in The World Is Nokia Now?hail2pigdumNessuna valutazione finora

- See Through Walls With Wi-Fi - Fadel - MSDocumento62 pagineSee Through Walls With Wi-Fi - Fadel - MShail2pigdumNessuna valutazione finora

- The First Great Works of Digital Literature Are Already Being Written - Technology - The GuardianDocumento2 pagineThe First Great Works of Digital Literature Are Already Being Written - Technology - The Guardianhail2pigdumNessuna valutazione finora

- Tensorflow PresentationDocumento13 pagineTensorflow Presentationhail2pigdumNessuna valutazione finora

- Pivot TableDocumento49 paginePivot Tablehail2pigdumNessuna valutazione finora

- Literary Lab Pamphlet 5Documento31 pagineLiterary Lab Pamphlet 5hail2pigdumNessuna valutazione finora

- Mycroft's MirrorDocumento2 pagineMycroft's Mirrorhail2pigdumNessuna valutazione finora

- 2 - 4 - Can Our Feelings Be Trusted - (15-33)Documento8 pagine2 - 4 - Can Our Feelings Be Trusted - (15-33)hail2pigdumNessuna valutazione finora

- Qcs 2010 Section 11 Part 1.5 Regulatory Document - OTHER HAZARDOUS A PDFDocumento124 pagineQcs 2010 Section 11 Part 1.5 Regulatory Document - OTHER HAZARDOUS A PDFbryanpastor106100% (1)

- The Ultimate Job Seeker's Guide to Ace Your InterviewDocumento19 pagineThe Ultimate Job Seeker's Guide to Ace Your InterviewVhinda NurNessuna valutazione finora

- It Now MagazineDocumento68 pagineIt Now MagazineHvinHesltdNessuna valutazione finora

- Isyu Sa Paggawa 2Documento19 pagineIsyu Sa Paggawa 2Jeric Ating Guro Cuenca0% (1)

- HRM Final Report ("Recruitment and Selection Process of The Nestlé Bangladesh Limited")Documento34 pagineHRM Final Report ("Recruitment and Selection Process of The Nestlé Bangladesh Limited")mirraihan37100% (1)

- Cost Accounting Practice TestDocumento27 pagineCost Accounting Practice Testaiswift100% (1)

- HRM Chapter Summaries and Job Analysis QuestionsDocumento99 pagineHRM Chapter Summaries and Job Analysis QuestionsSavitha RavindranathNessuna valutazione finora

- Cachitty@samford - Edu: Chad Chitty Cell: (205) 317-2072 Current AddressDocumento2 pagineCachitty@samford - Edu: Chad Chitty Cell: (205) 317-2072 Current Addressapi-240184674Nessuna valutazione finora

- Data AnalyticsDocumento11 pagineData AnalyticsSatyam TiwariNessuna valutazione finora

- 2022 Workforce Mental Health ForecastDocumento12 pagine2022 Workforce Mental Health ForecastPrabhu KumarNessuna valutazione finora

- Umiiiiiiiiiiiiiiiiii GGGGGGGGGGDocumento13 pagineUmiiiiiiiiiiiiiiiiii GGGGGGGGGGMuhammad Umair YunasNessuna valutazione finora

- OSHE Definitions and Terms ExplainedDocumento15 pagineOSHE Definitions and Terms ExplainedZeeshan BajwaNessuna valutazione finora

- LabStan FT Arco To AlmodielDocumento129 pagineLabStan FT Arco To AlmodielChielsea CruzNessuna valutazione finora

- TDL4 Truck Driving CalculationsDocumento14 pagineTDL4 Truck Driving CalculationsGoran SpasićNessuna valutazione finora

- Haier Performance ManagementDocumento7 pagineHaier Performance Management3vickishNessuna valutazione finora

- Dissertation - Poorvi PDFDocumento119 pagineDissertation - Poorvi PDFManish NigamNessuna valutazione finora

- Great Pacific Life Employees vs. Great Pacific Life AssuranceDocumento15 pagineGreat Pacific Life Employees vs. Great Pacific Life AssuranceHipolitoNessuna valutazione finora

- Peril To Pakistan'S Competitiveness Ishrat HusainDocumento5 paginePeril To Pakistan'S Competitiveness Ishrat Husainhassanbabu007Nessuna valutazione finora

- Beedi and CigarDocumento17 pagineBeedi and Cigarniraj1947Nessuna valutazione finora

- Thesis On Unemployment in Nigeria PDFDocumento7 pagineThesis On Unemployment in Nigeria PDFHelpWithYourPaperAurora100% (2)

- Assignment Brief - Unit 3 - Jan 2023 (New Syllabus)Documento13 pagineAssignment Brief - Unit 3 - Jan 2023 (New Syllabus)apssarahNessuna valutazione finora

- Strategies in The Job-Search ProcessDocumento27 pagineStrategies in The Job-Search ProcessKhan AbdullahNessuna valutazione finora

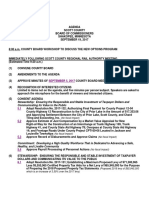

- 9/19/17 Scott County MN AgendaDocumento24 pagine9/19/17 Scott County MN AgendaBrad TabkeNessuna valutazione finora

- IN Work Immersion: Grade 12 Senior High School Immersion ManualDocumento28 pagineIN Work Immersion: Grade 12 Senior High School Immersion ManualVincent PolicarNessuna valutazione finora

- Occupational Health and CounsellingDocumento30 pagineOccupational Health and CounsellingSamjhana Neupane100% (1)

- Autosys JobDocumento26 pagineAutosys JobkondalraodNessuna valutazione finora

- Women's Rights Convention AnalyzedDocumento10 pagineWomen's Rights Convention AnalyzedJuvylynPiojoNessuna valutazione finora

- HRM 611 ReportDocumento24 pagineHRM 611 Reportafroz ashaNessuna valutazione finora

- Internship SummaryDocumento3 pagineInternship Summaryapi-494587938Nessuna valutazione finora