Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bton - Icmd 2009 (B11)

Caricato da

IshidaUryuuDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bton - Icmd 2009 (B11)

Caricato da

IshidaUryuuCopyright:

Formati disponibili

PTBetonjayaManunggalTbk.

Business

ConcreteIronIndustry

CompanyStatus

PMDN

Underwriter

PTAgungSecuritiesIndonesia

Shareholder

2001

GwieGunawan

JennyTanujaya

Public

2002

54.30% HengGwak

9.60% TetsuroOkano

36.10% JennyTanujaya

YancheeKiong

Public

2005

HengGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

2003

54.30%

16.67%

9.58%

8.89%

10.56%

HengGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

PTBajaTehnikRekatama

Public

2006

54.30%

16.67%

9.58%

8.89%

10.56%

HengGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

2004

54.30%

16.67%

9.58%

8.89%

5.64%

4.92%

2007

54.31%

16.67%

9.58%

8.89%

10.55%

HengGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

HengGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

54.30%

16.67%

9.58%

8.89%

10.56%

2008

54.31%

16.67%

9.58%

8.89%

10.55%

HengIIGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

2009

54.31%

16.67%

9.58%

8.89%

10.55%

HengIIGwak

TetsuroOkano

JennyTanujaya

YancheeKiong

Public

54.31%

16.67%

9.58%

8.89%

10.55%

Management & Number of Employees

Board of Commissioners

Board of Directors

Number of Employees

2001

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Yurnalis Ilyas, AK,

Hadi Sutjipto, SE

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya,

Drs. Ec. Andy Soesanto

218

2002

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

Drs. Ramelan, MM

226

2003

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

Drs. Ramelan, MM

206

2004

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

Drs. Ramelan, MM

37

2005

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

37

2006

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

37

2007

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

38

2008

President Commissioner

Commissioners

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA,

Drs. Andy Soesanto, MBA, MM

38

2009

President Commissioner

Commissioner

Gwie Gunato Gunawan

Drs. Bambang Hariadi, MEC, AK

President Director

Directors

Gwie Gunadi Gunawan

Jenny Tanujaya, MBA

Drs. Andy Soesanto, MBA, MM

36

1998

1999

2000

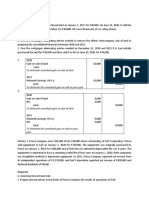

Total Assets

Current Assets

of which

Cash on hand and in banks

Cash and cash equivalents

Securities

Trade receivables

Inventories

Non-current Assets

of which

Fixed Asset Net

Deffered Tax Assets-Net

Investment

Other Assets

14,693

2,804

17,045

3,803

25,488

4,364

107

162

718

1,826

Liabilities

Current Liabilities

of which

Bank borrowings

Bank loans

Trade payables

Taxes payable

Accrued expenses

Current maturities of

long-term debt

Long-term Liabilities

Non-current Liabilities

Minority Interests in Subsidiaries

(million rupiah)

2001

2002

2003

2004

2005

32,925

13,269

25,123

6,524

23,461

6,588

28,780

13,057

27,721

12,665

681

9,319

1,455

1,390

4,274

1,402

2,206

959

2,710

381

3,488

1,550

3,377

18,599

1,846

2,542

16,873

5,133

3,252

15,722

2,234

5,036

15,056

11,863

13,242

21,123

19,656

18,567

32

16,653

220

15,406

317

14,435

621

26

11,514

11,472

13,727

13,694

13,889

13,761

13,061

12,985

3,336

3,249

1,833

1,307

5,716

5,014

2,907

2,031

6,978

106

13,123

78

12,622

1,009

2,723

423

2,487

632

130

1,011

127

169

2,219

1,110

432

1,285

430

316

43

33

128

77

86

525

702

876

5,163

3,179

3,600

3,318

3,600

11,599

3,600

19,864

18,000

21,788

18,000

21,628

18,000

23,064

18,000

24,814

18,000

7,930

30

(421)

(282)

68

1,833

530

30

3,228

530

30

3,068

530

30

4,504

530

30

6,254

25,181

24,286

895

588

307

263

570

466

17,925

16,655

1,270

769

501

(291)

210

139

16,494

15,331

1,163

758

405

140

545

350

18,284

16,091

2,193

1,116

1,077

497

1,574

1,235

20,443

20,435

8

1,575

(1,567)

490

(1,077)

2,374

18,543

17,242

1,301

1,551

(250)

278

28

52

45,812

40,782

5,031

2,076

2,955

277

3,231

2,336

54,401

50,083

4,318

2,247

2,071

296

2,367

1,750

Per Share Data (Rp)

Earnings per Share

Equity per Share

Dividend per Share

Closing Price

13

88

-

4

92

-

10

322

120

7

110

3

120

13

121

n.a

150

0

120

5

190

13

128

n.a

200

10

138

n.a

200

Financial Ratios

PER (x)

PBV (x)

Dividend Payout (%)

Dividend Yield (%)

12.33

0.37

-

17.49

1.09

0.36

0.02

11.37

1.24

n.a

n.a

656.73

1.58

17.28

0.03

15.41

1.56

n.a

n.a

20.57

1.45

n.a

n.a

0.24

3.62

0.78

0.04

0.01

0.02

13.30

1.71

3.17

14.67

0.28

4.14

0.81

0.07

0.03

0.01

7.55

1.05

0.82

4.20

0.32

1.20

0.54

0.07

0.02

0.02

5.66

0.65

1.37

3.02

1.02

0.66

0.40

0.12

0.06

0.07

4.61

0.56

3.75

6.22

2.01

0.15

0.13

0.00

n.a

0.12

6.05

0.81

9.45

10.90

5.04

0.08

0.08

0.07

n.a

n.a

6.78

0.79

0.22

0.24

2.60

0.25

0.20

0.11

6.45

0.05

12.54

1.59

8.12

10.13

6.24

0.12

0.10

0.08

3.81

0.03

9.95

1.96

6.31

7.05

2002

(23.70)

9.69

11.81

92.23

2003

(6.62)

(0.73)

(9.29)

(97.81)

Shareholders' Equity

Paid-up capital

Paid-up capital

in excess of par value

Revaluation of fixed assets

Retained earnings

Net Sales

Cost of Good Sold

Gross Profit

Operating Expenses

Operating Profit

Other Income (Expenses)

Profit before Taxes

Profit after Taxes

Current Ratio (x)

Debt to Equity (x)

Leverage Ratio (x)

Gross Profit Margin (x)

Operating Profit Margin (x)

Net Profit Margin (x)

Inventory Turnover (x)

Total Assets Turnover (x)

ROI (%)

ROE (%)

1

2

3

4

Growth (%)

Indicators

Total Asset

Share Holder's Equity

Net Sales/Income

Net Provit

1998

1999

16.01

4.37

(28.82)

(70.17)

2000

49.53

249.58

(7.98)

151.80

2001

29.18

71.26

10.85

252.86

2004

22.67

6.64

147.06

4,392.31

2005

(3.68)

7.59

18.75

(25.09)

SUMMARY OF FINANCIAL STATEMENT

PT. Betonjaya Manunggal (BTON)

2006

(millionrupiah)

2007

2008

33,674

19,863

46,469

34,365

70,509

60,424

4,585

8,482

6,479

13,811

8,220

18,969

6,223

12,105

33,818

13,093

13,122

10,085

12,755

924

10,754

1,219

8,785

1,300

8,043

7,028

12,054

10,904

15,271

13,982

5,966

247

800

1,015

5,451

4,546

907

1,150

6,925

6,275

781

1,288

Shareholders'Equity

Paidupcapital

Paidupcapital

inexcessofparvalue

Revaluationoffixedassets

Retainedearnings(accumulatedloss)

25,632

18,000

34,415

18,000

55,238

18,000

530

30

7,072

530

30

15,855

530

n.a

36,709

NetSales

CostofGoodsSold

GrossProfit

OperatingExpenses

OperatingProfit

OtherIncome(Expenses)

ProfitbeforeTaxes

ProfitafterTaxes

57,254

52,635

4,619

3,423

1,196

(133)

1,064

818

115,203

98,857

16,346

4,457

11,888

533

12,421

8,784

172,391

142,840

29,550

4,677

24,873

5,001

29,874

20,823

PerShareData(Rp)

Earnings(Loss)perShare

EquityperShare

DividendperShare

ClosingPrice

5

142

n.a

200

49

191

n.a

185

116

307

n.a

335

44.01

1.40

n.a

n.a

3.79

0.97

n.a

n.a

2.90

1.09

n.a

n.a

2.83

0.31

0.24

0.08

2.09

0.01

8.12

1.70

2.43

3.19

3.15

0.35

0.26

0.14

10.32

0.08

15.89

2.48

18.90

25.52

4.32

0.28

0.22

0.17

14.43

0.12

10.89

2.44

29.53

37.70

TotalAssets

CurrentAssets

ofwhich

Cashandcashequivalents

Tradereceivables

Inventories

NonCurrentAssets

ofwhich

FixedAssetsNet

DefferedTaxAssetsNet

Liabilities

CurrentLiabilities

ofwhich

Tradepayables

Taxespayable

Accruedexpenses

NonCurrentLiabilities

FinancialRatios

PER(x)

PBV(x)

DividendPayout(%)

DividendYield(%)

CurrentRatio(x)

DebttoEquity(x)

LeverageRatio(x)

GrossProfitMargin(x)

OperatingProfitMargin(x)

NetProfitMargin(x)

InventoryTurnover(x)

TotalAssetsTurnover(x)

ROI(%)

ROE(%)

PER=5.75x;PBV=1.37x(June2009)

FinancialYear:December31

PublicAccountant:OsmanBingSatrio&Co.

Potrebbero piacerti anche

- Ikai - Icmd 2009 (B13)Documento4 pagineIkai - Icmd 2009 (B13)IshidaUryuuNessuna valutazione finora

- Fmii - Icmd 2009 (B04)Documento4 pagineFmii - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- Ades - Icmd 2009 (B01)Documento4 pagineAdes - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- HMSP - Icmd 2009 (B02)Documento4 pagineHMSP - Icmd 2009 (B02)IshidaUryuuNessuna valutazione finora

- Rmba - Icmd 2009 (B02)Documento4 pagineRmba - Icmd 2009 (B02)IshidaUryuuNessuna valutazione finora

- Asgr - Icmd 2009 (B15)Documento4 pagineAsgr - Icmd 2009 (B15)IshidaUryuuNessuna valutazione finora

- Kici - Icmd 2009 (B12)Documento4 pagineKici - Icmd 2009 (B12)IshidaUryuuNessuna valutazione finora

- Toto - Icmd 2009 (B13)Documento4 pagineToto - Icmd 2009 (B13)IshidaUryuuNessuna valutazione finora

- BRPT - Icmd 2009 (B05)Documento4 pagineBRPT - Icmd 2009 (B05)IshidaUryuuNessuna valutazione finora

- Mlia - Icmd 2009 (B13)Documento4 pagineMlia - Icmd 2009 (B13)IshidaUryuuNessuna valutazione finora

- Sima - Icmd 2009 (B09)Documento4 pagineSima - Icmd 2009 (B09)IshidaUryuuNessuna valutazione finora

- Fasw - Icmd 2009 (B06)Documento4 pagineFasw - Icmd 2009 (B06)IshidaUryuuNessuna valutazione finora

- Voks - Icmd 2009 (B14)Documento4 pagineVoks - Icmd 2009 (B14)IshidaUryuuNessuna valutazione finora

- Doid - Icmd 2009 (B04)Documento4 pagineDoid - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- Inai - Icmd 2009 (B11)Documento4 pagineInai - Icmd 2009 (B11)IshidaUryuuNessuna valutazione finora

- Ceka - Icmd 2009 (B01)Documento4 pagineCeka - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Aisa - Icmd 2009 (B01)Documento4 pagineAisa - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Aqua - Icmd 2009 (B01)Documento4 pagineAqua - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Myor - Icmd 2009 (B01)Documento4 pagineMyor - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Kias - Icmd 2009 (B13)Documento4 pagineKias - Icmd 2009 (B13)IshidaUryuuNessuna valutazione finora

- Argo - Icmd 2009 (B03)Documento4 pagineArgo - Icmd 2009 (B03)IshidaUryuuNessuna valutazione finora

- Ricy - Icmd 2009 (B04)Documento4 pagineRicy - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- PTSP - Icmd 2009 (B01)Documento4 paginePTSP - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Dlta - Icmd 2009 (B01)Documento4 pagineDlta - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Bima - Icmd 2009 (B04)Documento4 pagineBima - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- CTBN - Icmd 2009 (B11)Documento4 pagineCTBN - Icmd 2009 (B11)IshidaUryuuNessuna valutazione finora

- KBLM - Icmd 2009 (B14)Documento4 pagineKBLM - Icmd 2009 (B14)IshidaUryuuNessuna valutazione finora

- Inru - Icmd 2009 (B06)Documento4 pagineInru - Icmd 2009 (B06)IshidaUryuuNessuna valutazione finora

- SKBM - Icmd 2009 (B01) PDFDocumento3 pagineSKBM - Icmd 2009 (B01) PDFIshidaUryuuNessuna valutazione finora

- Bati - Icmd 2009 (B02)Documento4 pagineBati - Icmd 2009 (B02)IshidaUryuuNessuna valutazione finora

- Arna - Icmd 2009 (B13)Documento4 pagineArna - Icmd 2009 (B13)IshidaUryuuNessuna valutazione finora

- Karw - Icmd 2009 (B04)Documento4 pagineKarw - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- One Day Experience Sharing Session by Deming Prize and Deming Grand Prize Winners in 2012Documento4 pagineOne Day Experience Sharing Session by Deming Prize and Deming Grand Prize Winners in 2012Balachandar SathananthanNessuna valutazione finora

- PSDN - Icmd 2009 (B01)Documento4 paginePSDN - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Tbla - Icmd 2009 (B01)Documento4 pagineTbla - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Sona Koyo Steering Systems LTD.: Fact Sheet: Particulars FY'01 FY'02 FY'03 FY'04 FY'05Documento2 pagineSona Koyo Steering Systems LTD.: Fact Sheet: Particulars FY'01 FY'02 FY'03 FY'04 FY'05DEVJONGSNessuna valutazione finora

- PT AGIS Tbk.sDocumento4 paginePT AGIS Tbk.sRizka FurqorinaNessuna valutazione finora

- Intp - Icmd 2009 (B10)Documento4 pagineIntp - Icmd 2009 (B10)IshidaUryuuNessuna valutazione finora

- SKLT - Icmd 2009 (B01)Documento4 pagineSKLT - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- CNTX - Icmd 2009 (B03) PDFDocumento4 pagineCNTX - Icmd 2009 (B03) PDFIshidaUryuuNessuna valutazione finora

- STTP - Icmd 2009 (B01)Documento4 pagineSTTP - Icmd 2009 (B01)IshidaUryuuNessuna valutazione finora

- Company Country Date of Incorporation ROE Using Net Income (%) ROA Using Net Income (%)Documento6 pagineCompany Country Date of Incorporation ROE Using Net Income (%) ROA Using Net Income (%)ZiadAbouGaziaNessuna valutazione finora

- Dsuc - Icmd 2009 (B05)Documento4 pagineDsuc - Icmd 2009 (B05)IshidaUryuuNessuna valutazione finora

- Indr - Icmd 2009 (B04)Documento4 pagineIndr - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- Maybank Expanding Regional Investment Banking Franchise Expanding Regional Investment Banking FranchiseDocumento24 pagineMaybank Expanding Regional Investment Banking Franchise Expanding Regional Investment Banking FranchiseNicholas AngNessuna valutazione finora

- CableDocumento13 pagineCableannisa lahjieNessuna valutazione finora

- Popular IndicatorsDocumento14 paginePopular IndicatorsMazlan NorinahNessuna valutazione finora

- Almi - Icmd 2009 (B11)Documento4 pagineAlmi - Icmd 2009 (B11)IshidaUryuuNessuna valutazione finora

- SMIS - Annual Report 2020Documento145 pagineSMIS - Annual Report 2020FatinNessuna valutazione finora

- Growing Sustainably: Hindustan Unilever LimitedDocumento164 pagineGrowing Sustainably: Hindustan Unilever LimitedFarid PatcaNessuna valutazione finora

- Atlas BankDocumento145 pagineAtlas BankWaqas NawazNessuna valutazione finora

- Reliance Nippon Life Asset Management-Concall Invitation-250719Documento1 paginaReliance Nippon Life Asset Management-Concall Invitation-250719darshanmadeNessuna valutazione finora

- RPR FY2009 3 Chapter 4Documento72 pagineRPR FY2009 3 Chapter 4K59 Nguyen Dang VuNessuna valutazione finora

- Ultratech Word DocumentDocumento24 pagineUltratech Word DocumentABHISHEK KHURANANessuna valutazione finora

- MAGNI AnnualReport2013Documento105 pagineMAGNI AnnualReport2013chinkcNessuna valutazione finora

- Bata - Icmd 2009 (B04)Documento4 pagineBata - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- Impiana - Annual Report 2022Documento179 pagineImpiana - Annual Report 2022bba22090030Nessuna valutazione finora

- TODAY Tourism & Business Magazine, Volume 22, April, 2015Da EverandTODAY Tourism & Business Magazine, Volume 22, April, 2015Nessuna valutazione finora

- Handbook of Singapore — Malaysian Corporate FinanceDa EverandHandbook of Singapore — Malaysian Corporate FinanceTan Chwee HuatNessuna valutazione finora

- TODAY Tourism & Business Magazine, Volume 22, February, 2015Da EverandTODAY Tourism & Business Magazine, Volume 22, February, 2015Nessuna valutazione finora

- Cement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaCement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Stone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaStone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Tobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaTobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Indr - Icmd 2009 (B04)Documento4 pagineIndr - Icmd 2009 (B04)IshidaUryuuNessuna valutazione finora

- PT Nusantara Inti Corpora TBKDocumento2 paginePT Nusantara Inti Corpora TBKIshidaUryuuNessuna valutazione finora

- Bima PDFDocumento2 pagineBima PDFIshidaUryuuNessuna valutazione finora

- Cables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaCables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- PT Kabelindo Murni TBK.: Summary of Financial StatementDocumento2 paginePT Kabelindo Murni TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- PT Ever Shine Tex TBK.: Summary of Financial StatementDocumento2 paginePT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- Construction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaConstruction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaRanking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- Automotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 paginaAutomotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuNessuna valutazione finora

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementDocumento2 paginePT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- PT Indorama Synthetics TBK.: Summary of Financial StatementDocumento2 paginePT Indorama Synthetics TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- Animal FeedDocumento1 paginaAnimal FeedIshidaUryuuNessuna valutazione finora

- PT Unitex TBK.: Summary of Financial StatementDocumento2 paginePT Unitex TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- Fasw PDFDocumento2 pagineFasw PDFIshidaUryuuNessuna valutazione finora

- AaliDocumento2 pagineAaliSeprinaldiNessuna valutazione finora

- Adhesive PDFDocumento1 paginaAdhesive PDFIshidaUryuuNessuna valutazione finora

- PT Kalbe Farma TBK.: Summary of Financial StatementDocumento2 paginePT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- PT Betonjaya Manunggal TBK.: Summary of Financial StatementDocumento2 paginePT Betonjaya Manunggal TBK.: Summary of Financial StatementIshidaUryuuNessuna valutazione finora

- ErtxDocumento2 pagineErtxIshidaUryuuNessuna valutazione finora

- Imas PDFDocumento2 pagineImas PDFIshidaUryuuNessuna valutazione finora

- BramDocumento2 pagineBramIshidaUryuuNessuna valutazione finora

- Coca Cola Company Is A Global Soft Drink Beverage Company TickeDocumento3 pagineCoca Cola Company Is A Global Soft Drink Beverage Company TickeAmit PandeyNessuna valutazione finora

- Forum s5Documento6 pagineForum s5Aruni PribadiNessuna valutazione finora

- MTAR AnchornInvestors ListDocumento6 pagineMTAR AnchornInvestors Listsaipavan999Nessuna valutazione finora

- Let's Check: To Eliminate Unrealized Gain On Sale of LandDocumento4 pagineLet's Check: To Eliminate Unrealized Gain On Sale of Landalmira garciaNessuna valutazione finora

- 52 - Offbeat Offerings Fixed Rate Capital SecuritiesDocumento3 pagine52 - Offbeat Offerings Fixed Rate Capital SecuritiesOuwehand OrgNessuna valutazione finora

- 3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczDocumento1 pagina3.the City of San Jose-Excel Modelling-Fundamentals of Financial Management-James C. Van Horne - John M. WachowiczRajib Dahal50% (2)

- Building A Better Deep Value Portfolio PDFDocumento20 pagineBuilding A Better Deep Value Portfolio PDFChrisNessuna valutazione finora

- T1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7Documento11 pagineT1-Phe2035 - Acc1005 Foundations of Finance-Tutorial 7mavisNessuna valutazione finora

- Exercises For Stock Valuation: InvestmentsDocumento2 pagineExercises For Stock Valuation: InvestmentsMiguelNessuna valutazione finora

- Sample Investment AgreementDocumento4 pagineSample Investment AgreementJeyaramNessuna valutazione finora

- Triton Presentation 1Documento28 pagineTriton Presentation 1Stelu OlarNessuna valutazione finora

- Lesson 8 Developing A Trading PlanDocumento15 pagineLesson 8 Developing A Trading Plandexter100% (1)

- This Study Resource Was: Correction of Errors - ProblemsDocumento2 pagineThis Study Resource Was: Correction of Errors - Problemsvenice cambryNessuna valutazione finora

- Document 10Documento24 pagineDocument 10Yufi Alwie PRatama RNessuna valutazione finora

- Mid Term Review OnlineDocumento16 pagineMid Term Review Onlinegeclear323Nessuna valutazione finora

- 13.final Theories ADocumento6 pagine13.final Theories AMary Joy AlbandiaNessuna valutazione finora

- CH 05Documento68 pagineCH 05Lê JerryNessuna valutazione finora

- ValueInvesting - Io - Financials & Models TemplateDocumento60 pagineValueInvesting - Io - Financials & Models TemplateTan TanNessuna valutazione finora

- Chapter 10 PDFDocumento6 pagineChapter 10 PDFbellarftNessuna valutazione finora

- Financial AnalysisDocumento18 pagineFinancial AnalysisHannah JoyNessuna valutazione finora

- M4 Budgeting For Profit and ControlDocumento8 pagineM4 Budgeting For Profit and Controlwingsenigma 00Nessuna valutazione finora

- Accounting ConceptsDocumento13 pagineAccounting ConceptsRosemarie CruzNessuna valutazione finora

- Page - 1Documento7 paginePage - 1Collins ManalaysayNessuna valutazione finora

- Acc 501 Mid Term QuizzDocumento7 pagineAcc 501 Mid Term QuizzDevyansh GuptaNessuna valutazione finora

- Return On Assets-ROA DefinitionDocumento10 pagineReturn On Assets-ROA DefinitionChristine DavidNessuna valutazione finora

- Dossier Eleve - ViergeDocumento9 pagineDossier Eleve - ViergeVincent BELLOCHENessuna valutazione finora

- Ch07 ShowDocumento57 pagineCh07 ShowBagus ZijlstraNessuna valutazione finora

- Chapter 6 Controlling CashDocumento10 pagineChapter 6 Controlling CashyenewNessuna valutazione finora

- Deutsche Bank at A Glance: Facts and FiguresDocumento14 pagineDeutsche Bank at A Glance: Facts and FiguresKaustav MukherjeeNessuna valutazione finora

- Review of Accounting: Irwin/Mcgraw-HillDocumento20 pagineReview of Accounting: Irwin/Mcgraw-HillJefferson EncaladaNessuna valutazione finora