Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Knut Wicksell

Caricato da

NatháliDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Knut Wicksell

Caricato da

NatháliCopyright:

Formati disponibili

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 May 3, 1926) was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought.

Biography[edit source | editbeta]

Wicksell was born in Stockholm, Sweden on December 20, 1851. His father was a relatively successful businessman and real estate broker. He lost both his parents at a relatively young age his mother died when he was only six years old, and his father died when he was fifteen. His father's considerable estate allowed the now fatherless child to enroll at the University of Uppsala in 1869 to studymathematics and physics. He received his first degree in two years, but continued in graduate studies until 1885 when he received his doctorate in mathematics. In 1887, Wicksell received a scholarship to study on the continent where he heard lectures by the economist Carl Menger in Vienna. In the following years, his interests began to shift toward the social sciences, and in particular, economics. As a lecturer at Uppsala, Wicksell had attracted attention for his opinions about labor. At one lecture, he condemned drunkenness and prostitution as alienating, degrading, and impoverishing. Although he was sometimes identified as a socialist, his solution to the above problem was decidedly Malthusian in advocating birth control a theory he would defend to the end of his life. Although he had attracted some attention for his fiery ideas, his first work in economics, Value, Capital and Rent, published in 1892, was largely unnoticed. In 1896, he published Studies in the theory of Public Finance, applying the ideas of marginalism to progressive taxation, public goods, and other aspects of public policy, attracting considerably more interest. Wicksell married Anna Bugge in 1887, although he found it difficult to support his family on his irregular positions and publications. Economics in Sweden at the time was taught as part of the law school and Wicksell was unable to gain a chair as a professor until he was awarded a law degree. He returned to the University of Uppsala where he completed a four-year law degree in two years, and subsequently became an associate professor at that university in 1899. The next year, he became a full professor at Lund University, where he would undertake his most influential work. After giving a lecture in 1908 satirizing the Immaculate Conception, Wicksell was deemed guilty [1] of blasphemy and imprisoned for two months. Eight years later, in 1916, Wicksell retired from his post at Lund and took a position at Stockholm advising the government on financial and banking issues. In Stockholm, Wicksell associated himself with other future great economists of the so-called "Stockholm School," such as Bertil Ohlin, Gunnar Myrdal and Erik Lindahl. He also taught a young Dag Hammarskjld, the future Secretary-General of the United Nations. Wicksell died in 1926 while writing a final work on the theory of interest. Elements of his public policy were taken strongly to heart by the Swedish government, including his price-level targeting rule during the 1930s (Jonung 1979), and also his vision of a welfare state. Wicksell's contributions to economics have been described by some economists, includinghistorian-ofeconomics Mark Blaug, as fundamental to modern macroeconomics. Michael Woodford has especially praised Wicksell's advocacy of using the interest rate to maintain price stability, noting that this was a remarkable insight at a time when most monetary policy was based on

the gold standard (Woodford, 2003, p. 32). Woodford calls his own framework 'neo-Wicksellian', and he titled his textbook on monetary policy in homage to Wicksell's work.

Theoretical contributions[edit source | editbeta]

Wicksell was enamored with the theory of Lon Walras (the Lausanne school), Eugen von Bhm-Bawerk (the Austrian school), and David Ricardo, and sought a synthesis of the three theoretical visions of the economy. Wicksell's work on creating a synthetic economic theory earned him a reputation as an "economist's economist." For instance, although the marginal productivity theory the idea that payments to factors of production equilibrate to their marginal productivity had been laid out by others such as John Bates Clark, Wicksell presented a far simpler and more robust demonstration of the principle, and much of the present conception of that theory stems from Wicksell's model. Wicksell's (1898, 1906) theory of the "cumulative process" of inflation remains the first decisive swing at the idea of money as a "veil" as well as Say's Law. Extending from Ricardo's investigation of income distribution, Wicksell concluded that even a totally unfettered economy was not destined to equalize wealth as a number of Wicksell's predecessors had predicted. Instead, Wicksell posited, wealth created by growth would be distributed to those who had wealth in the first place. From this, and from theories of marginalism, Wicksell defended a place for government intervention to improve national welfare. Wicksell influenced the field of constitutional political economy. His 1896 work on fiscal theory Finanztheoretische Untersuchungen called attention to the significance of the rules within which choices are made by political agents, and he recognized that efforts at reform must be directed toward changes in the rules for making decisions rather than trying to influence the [2] behaviour of the actors. Wicksell's most influential contribution was his theory of interest, published in his 1898 work, Interest and Prices. He made a key distinction between the natural rate of interest and the money rate of interest. The money rate of interest, to Wicksell, was merely the interest rate seen in the capital market; the natural rate of interest was the interest rate that was neutral to prices in the real market, or rather, the interest rate at which supply and demand in the real market was at equilibrium as though there were no need for capital markets. This theory was taken after of the Austrian School, which theorized that an economic boom happened when the natural rate of interest was higher than the market rate. This contribution, called the "cumulative process," implied that if the natural rate of interest was not equal to the market rate, demand for investment and quantity of savings would not be equal. If the market rate is beneath the natural rate, an economic expansion occurs, and prices, ceteris paribus, will rise. This gave an early theory of endogenous money money created by the internal workings of the economy, rather than external factors, and various [3] theories of endogenous money have since developed. Knut Wicksell's theory of the "cumulative process" of inflation remains the first decisive swing at the idea of money as a "veil". Wicksell's process has its roots in that of Henry Thornton . Recall that the start of the Quantity Theory's mechanism is a helicopter drop of cash: an exogenous increase in the supply of money. Wicksell's theory claims, indeed, that increases in the supply of money leads to rises in price levels, but the original increase is endogenous, created by the relative conditions of the financial and real sectors. With the existence of credit money, Wicksell argued, two interest rates prevail: the "natural" rate and the "money" rate. The natural rate is the return on capital or the real profit rate. It can be roughly considered to be equivalent to the

marginal product of new capital. The money rate, in turn, is the loan rate, an entirely financial construction. Credit, then, is perceived quite appropriately as "money". Banks provide credit, after all, by creating deposits upon which borrowers can draw. Since deposits constitute part of real money balances, therefore the bank can, in essence, "create" money. Wicksell's main thesis, that disequilibrium engendered by real changes leads endogenously to an increase in the demand for money and, simultaneously, its supply as banks try to accommodate it perfectly. Given full employment, (a constant Y) and payments structure (constant V), then in terms of the equation of exchange, MV = PY, a rise in M leads only to a rise in P. Thus, the story of the Quantity Theory of Money, the long-run relationship between money and inflation, is kept in Wicksell. Primarily, Say's Law is violated and abandoned by the wayside. Namely, when real aggregate supply does constrain, inflation results because capital goods industries cannot meet new real demands for capital goods by entrepreneurs by increasing capacity. They may try but this would involve making higher bids in the factor market which itself is supply-constrained thus raising factor prices and hence the price of goods in general. In short, inflation is a real phenomenon brought about by a rise in real aggregate demand over and above real aggregate supply. Finally,for Wicksell the endogenous creation of money, and how it leads to changes in the real market (i.e. increase real aggregate demand) is fundamentally a breakdown of the Neoclassical tradition of a dichotomy between monetary and real sectors. Money is not a "veil" agents do react to it and this is not due to some irrational "money illusion". However, we should remind ourselves that, for Wicksell, in the long run, the Quantity Theory still holds: money is still neutral in the long run, although to do so, Knut Wicksell have broken the cherished Neoclassical principles of dichotomy, money supply exogeneity and Say's Law. (source:newschool.edu/~het/home.htm) Parts of Wicksells ideas would be expanded upon by the Austrian school, which used it to form a theory of the business cycle based on central bank policy changes in the level of money in the economy would shift the market rate of exchange in some way relative to the natural rate, and thus trigger a change in the relative proportion of the production of consumer goods to investment, which would ultimately result in an economic correction, or recession, in which the proportion of production of consumption goods to investment in the economy is pushed back towards the level that the natural rate of interest would result in. The cumulative process was the leading theory of the business cycle until John Maynard Keynes' The General Theory of Employment, Interest and Money. Wicksell's theory would be a strong influence in Keynes's ideas of growth and recession, in Gunnar Myrdal's key concept Circular Cumulative Causation and also in Joseph Schumpeter's "creative destruction" theory of the business cycle. Wicksell's main intellectual rival was the American economist Irving Fisher, who espoused a more succinct explanation of the quantity theory of money, resting it almost exclusively on long run prices. Wicksell's theory was considerably more complicated, beginning with interest rates in a system of changes in the real economy. Although both economists concluded from their theories that at the heart of the business cycle (and economic crisis) was government monetary policy, their disagreement would not be solved in their lifetimes, and indeed, it was inherited by the policy debates between the Keynesians and monetarists beginning a half-century later. Wicksell also expressed his views on many social issues and was often a critic of the status quo. He questioned the institutions of rank, marriage, the church, the monarchy, and the [4] military. While Wicksell fought for a more equal distribution of wealth and income, he saw

himself primarily as an educator of the public. He desired to influence more than just the field of monetary economics.

Potrebbero piacerti anche

- Economics KnutDocumento4 pagineEconomics KnutPotchi Chinchin RamirezNessuna valutazione finora

- Interest and Prices: A Study of the Causes Regulating the Value of MoneyDa EverandInterest and Prices: A Study of the Causes Regulating the Value of MoneyNessuna valutazione finora

- Axel LeijonhufvudDocumento7 pagineAxel LeijonhufvudDario CoceresNessuna valutazione finora

- Book Review: The General Theory of Employment, Interest and Money by John M. Keynes: A turning point in economic historyDa EverandBook Review: The General Theory of Employment, Interest and Money by John M. Keynes: A turning point in economic historyNessuna valutazione finora

- Austrian Economic School of ThoughtDocumento6 pagineAustrian Economic School of ThoughtfahmisallehNessuna valutazione finora

- Knut Wicksell and Nordic EconomyDocumento2 pagineKnut Wicksell and Nordic EconomyMahu VictorNessuna valutazione finora

- History: DiscoveringDocumento20 pagineHistory: DiscoveringDaniel Gabriel PunoNessuna valutazione finora

- HET Chapter 4Documento23 pagineHET Chapter 4Soul AbNessuna valutazione finora

- Wicksell and Pareto: Their Relationship in The Theory of Public FinanceDocumento28 pagineWicksell and Pareto: Their Relationship in The Theory of Public FinanceOyuna Bat-OchirNessuna valutazione finora

- Henry Hazlitt and The Failure of Keynesian Economics: by Richard M. EbelingDocumento5 pagineHenry Hazlitt and The Failure of Keynesian Economics: by Richard M. EbelingqqaazzzNessuna valutazione finora

- Wicksell General Equilibrium and The Way To MacroeconomicsDocumento24 pagineWicksell General Equilibrium and The Way To MacroeconomicsBhuwanNessuna valutazione finora

- Ipe Working Paper 32Documento43 pagineIpe Working Paper 32Krezel kaye BarbadilloNessuna valutazione finora

- Neo - Classical School of Economics: Leading Economists: Alfred Marshall (English), Knut Wicksell (Swedish)Documento18 pagineNeo - Classical School of Economics: Leading Economists: Alfred Marshall (English), Knut Wicksell (Swedish)Ishrat Jahan DiaNessuna valutazione finora

- Hayek ArticleDocumento13 pagineHayek Articletóth_ilona_2Nessuna valutazione finora

- Did Austrian Economists Predict The Financial Crisis?, Dante A. UrbinaDocumento15 pagineDid Austrian Economists Predict The Financial Crisis?, Dante A. UrbinaDavid Arevalos100% (1)

- Why Your Grandfather's Economics Was Better Than YourDocumento26 pagineWhy Your Grandfather's Economics Was Better Than YourantônioNessuna valutazione finora

- Book Review: Capital in the Twenty-First Century by Thomas Piketty: Understand inequality in the modern worldDa EverandBook Review: Capital in the Twenty-First Century by Thomas Piketty: Understand inequality in the modern worldNessuna valutazione finora

- Keynesian EconomicsDocumento12 pagineKeynesian EconomicsMaria Shams100% (1)

- Keynesian EconomicsDocumento12 pagineKeynesian EconomicsSheilaNessuna valutazione finora

- Classical Economics: Free-Market Laissez-Faire MercantilismDocumento13 pagineClassical Economics: Free-Market Laissez-Faire MercantilismleerooneyvnNessuna valutazione finora

- Mubashir AssignmentDocumento9 pagineMubashir AssignmentQaiser AhmadNessuna valutazione finora

- Summary Of "Keynes & The New Role Of The State" By Unknown Author: UNIVERSITY SUMMARIESDa EverandSummary Of "Keynes & The New Role Of The State" By Unknown Author: UNIVERSITY SUMMARIESNessuna valutazione finora

- Political Economy for Beginners (Barnes & Noble Digital Library)Da EverandPolitical Economy for Beginners (Barnes & Noble Digital Library)Nessuna valutazione finora

- Imagined Economies - Real Fictions: New Perspectives on Economic Thinking in Great BritainDa EverandImagined Economies - Real Fictions: New Perspectives on Economic Thinking in Great BritainNessuna valutazione finora

- The Keynesian EconomicsDocumento17 pagineThe Keynesian EconomicsIshrat Jahan DiaNessuna valutazione finora

- Published in 1936 The Interpretations of Keynes Are Contentious, andDocumento14 paginePublished in 1936 The Interpretations of Keynes Are Contentious, andPratik PatelNessuna valutazione finora

- Friedrich August Von Hayek: Prof. Ing. Ján Lisý, Phd. Faculty of National Economy, University of Economics in BratislavaDocumento4 pagineFriedrich August Von Hayek: Prof. Ing. Ján Lisý, Phd. Faculty of National Economy, University of Economics in BratislavaAmy MiNessuna valutazione finora

- Schumpeter and Keynes - Peter DruckerDocumento4 pagineSchumpeter and Keynes - Peter DruckerLye Chien Chai100% (1)

- Gunnar MyrdalDocumento3 pagineGunnar MyrdalAnonymous GQXLOjndTbNessuna valutazione finora

- Irving FisherDocumento26 pagineIrving FisherWilson SequeiraNessuna valutazione finora

- V Jothi Prakas-116 PDFDocumento13 pagineV Jothi Prakas-116 PDFUmesh NaikNessuna valutazione finora

- New Financial Architecture - English Version 01 2010sep28Documento28 pagineNew Financial Architecture - English Version 01 2010sep28Adam KhanNessuna valutazione finora

- Economics Finance: Key TakeawaysDocumento13 pagineEconomics Finance: Key TakeawaysAngeliePanerioGonzagaNessuna valutazione finora

- Blanc AcceleratedDocumento15 pagineBlanc AcceleratedMilan PetrikNessuna valutazione finora

- Working Paper No. 822: The Socialization of Investment, From Keynes To Minsky and BeyondDocumento20 pagineWorking Paper No. 822: The Socialization of Investment, From Keynes To Minsky and BeyondhyperdupertollNessuna valutazione finora

- Keynes Hayek: The Clash That Defined Modern EconomicsDocumento8 pagineKeynes Hayek: The Clash That Defined Modern EconomicsMikko ArevuoNessuna valutazione finora

- Irving FisherDocumento6 pagineIrving FisherKshitij AnandNessuna valutazione finora

- Institutional Economics: Veblen, Commons, and Mitchell ReconsideredDa EverandInstitutional Economics: Veblen, Commons, and Mitchell ReconsideredNessuna valutazione finora

- Horwitz - Capital Theory, Inflation, and Deflation The Austrians and Monetary Disequilibrium Theory ComparedDocumento32 pagineHorwitz - Capital Theory, Inflation, and Deflation The Austrians and Monetary Disequilibrium Theory ComparedGina IoanNessuna valutazione finora

- The Evolution of EconomicsDocumento4 pagineThe Evolution of EconomicsShena Mae AlicanteNessuna valutazione finora

- Capitalism and the Dark Forces of Time and Ignorance: Economic and Political ExpectationsDa EverandCapitalism and the Dark Forces of Time and Ignorance: Economic and Political ExpectationsNessuna valutazione finora

- General Theory of Employment, Money and Interest: John Maynard KeynesDocumento4 pagineGeneral Theory of Employment, Money and Interest: John Maynard KeyneszdfgbsfdzcgbvdfcNessuna valutazione finora

- John Kenneth Galbraith2Documento19 pagineJohn Kenneth Galbraith2Mauricio Gutierrez QuezadaNessuna valutazione finora

- ECONDEV4Documento22 pagineECONDEV4Korin StaanaNessuna valutazione finora

- History of Economic Thought 2nd Exam - Take HomeDocumento5 pagineHistory of Economic Thought 2nd Exam - Take HomeUDecon100% (1)

- Eamonn Butler - Austrian Economics - A PrimerDocumento128 pagineEamonn Butler - Austrian Economics - A PrimerMarc LassortNessuna valutazione finora

- Intro To Austrain EconomicsDocumento98 pagineIntro To Austrain EconomicsIbrahim MasoodNessuna valutazione finora

- JournalDocumento23 pagineJournalAndrésLuisIpurreHuamaníNessuna valutazione finora

- " The Great Thinkers": ADAM SMITH (1723-1790)Documento8 pagine" The Great Thinkers": ADAM SMITH (1723-1790)Amor Vinsent AquinoNessuna valutazione finora

- Blanchard Macroeconomicsw7550Documento49 pagineBlanchard Macroeconomicsw7550yzl100% (1)

- David RicardoDocumento22 pagineDavid RicardoY D Amon GanzonNessuna valutazione finora

- About Austrian Economics Everything You Always Wanted To KnowDocumento4 pagineAbout Austrian Economics Everything You Always Wanted To Knowabdul_muhminNessuna valutazione finora

- Keynes and National Income MultiplierDocumento30 pagineKeynes and National Income MultiplierfarahNessuna valutazione finora

- 2006-3 Axel Leijonhufvud and The Quest For Micro-Foundations - SDocumento23 pagine2006-3 Axel Leijonhufvud and The Quest For Micro-Foundations - SArtur CoelhoNessuna valutazione finora

- Economic TheoriesDocumento4 pagineEconomic TheoriesGlaiza AdelleyNessuna valutazione finora

- François QuesnayDocumento2 pagineFrançois QuesnayNatháliNessuna valutazione finora

- Max Ferdinand SchelerDocumento7 pagineMax Ferdinand SchelerNatháliNessuna valutazione finora

- Rammstein Is A: Sehnsucht and Live Aus Berlin (Late 1996Documento3 pagineRammstein Is A: Sehnsucht and Live Aus Berlin (Late 1996NatháliNessuna valutazione finora

- Boris Zakharovich SchumyatskyDocumento1 paginaBoris Zakharovich SchumyatskyNatháliNessuna valutazione finora

- Joan Robinson's EconomicsDocumento413 pagineJoan Robinson's EconomicsFelis_Demulcta_MitisNessuna valutazione finora

- EisensteinDocumento5 pagineEisensteinNatháliNessuna valutazione finora

- Edmund HusserlDocumento5 pagineEdmund HusserlNatháliNessuna valutazione finora

- Freddie MercuryDocumento4 pagineFreddie MercuryNatháliNessuna valutazione finora

- Advanced Macroeconomics David RomerDocumento550 pagineAdvanced Macroeconomics David Romerمحمد شاه مير100% (2)

- THW Theory of Economic Growth - F.H. HahnDocumento125 pagineTHW Theory of Economic Growth - F.H. HahnNatháliNessuna valutazione finora

- Michael JacksonDocumento5 pagineMichael JacksonNatháliNessuna valutazione finora

- Bedrich SmetanaDocumento5 pagineBedrich SmetanaNatháliNessuna valutazione finora

- Twentieth Century Political ThoughtDocumento644 pagineTwentieth Century Political ThoughtNatháli50% (2)

- Gramsci's Political ThoughtDocumento157 pagineGramsci's Political ThoughtΑντώνης Βαρσάμης67% (3)

- Advanced Macroeconomics David RomerDocumento550 pagineAdvanced Macroeconomics David Romerمحمد شاه مير100% (2)

- Public Bank AnalysisDocumento25 paginePublic Bank Analysisbennyvun80% (5)

- Module 8 SolDocumento10 pagineModule 8 SolMae Ann GonzalesNessuna valutazione finora

- Reciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyDocumento18 pagineReciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyAjay PannuNessuna valutazione finora

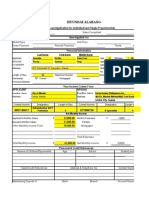

- Hyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipDocumento4 pagineHyundai Alabang: Auto Loan Application For Individual and Single ProprietorshipXierylleAngelicaNessuna valutazione finora

- Mathematics Vi For 3rd Grading PeriodDocumento6 pagineMathematics Vi For 3rd Grading PeriodRonaldo YabutNessuna valutazione finora

- Sugar MillDocumento26 pagineSugar MillRaman AhitanNessuna valutazione finora

- International Bond Market: Chapter ObjectiveDocumento16 pagineInternational Bond Market: Chapter ObjectiveSam Sep A SixtyoneNessuna valutazione finora

- Engels PresentatieDocumento2 pagineEngels PresentatieNadieThorborgNessuna valutazione finora

- Accounting BasicsDocumento144 pagineAccounting BasicsSabyasachi Srimany100% (1)

- Deficiency, Also Called A Working Capital DeficitDocumento66 pagineDeficiency, Also Called A Working Capital DeficitBalakrishna ChakaliNessuna valutazione finora

- Bacolod, Adinrane P. Bsba Finman IiiDocumento25 pagineBacolod, Adinrane P. Bsba Finman IiichenlyNessuna valutazione finora

- Investment Banking Interview GuideDocumento228 pagineInvestment Banking Interview GuideNeil Grigg100% (2)

- Quiz Week 3 AnswersDocumento5 pagineQuiz Week 3 AnswersDaniel WelschmeyerNessuna valutazione finora

- Tax Cases - 1 - 49Documento165 pagineTax Cases - 1 - 49KennethMacawiliRagazaNessuna valutazione finora

- New Commercial Company Law in Uae PDFDocumento7 pagineNew Commercial Company Law in Uae PDFAli AdnanNessuna valutazione finora

- Audit of The Capital Acquisition and Repayment CycleDocumento32 pagineAudit of The Capital Acquisition and Repayment CycleHEHENessuna valutazione finora

- StressTesting Guidelines by SBPDocumento21 pagineStressTesting Guidelines by SBPkrishmasethiNessuna valutazione finora

- Agreement For Right of Pre-Emption: Form No. 9Documento2 pagineAgreement For Right of Pre-Emption: Form No. 9Sudeep SharmaNessuna valutazione finora

- International Storytelling Center - Chapter 11 Bankruptcy Filings - Amended Creditor MatrixDocumento4 pagineInternational Storytelling Center - Chapter 11 Bankruptcy Filings - Amended Creditor MatrixTennesseeTuxedoNessuna valutazione finora

- Overall Banking Activities OF Everest Bank Limited: An Internship ReportDocumento37 pagineOverall Banking Activities OF Everest Bank Limited: An Internship ReportPEmaa LMNessuna valutazione finora

- Role of Banks in Economic DevelopmentDocumento11 pagineRole of Banks in Economic Developmentakashscribd01100% (5)

- 1 Republic v. Security Credit and Acceptance Corp.Documento2 pagine1 Republic v. Security Credit and Acceptance Corp.Word MavenNessuna valutazione finora

- Cvs Mail Service Invoice/ReceiptDocumento1 paginaCvs Mail Service Invoice/Receipthbryant587Nessuna valutazione finora

- Vilakshan-2 2Documento208 pagineVilakshan-2 2Prashant LalNessuna valutazione finora

- Collection Application Form: Financial Process ExchangeDocumento2 pagineCollection Application Form: Financial Process ExchangeMohd Rafie HashimNessuna valutazione finora

- G.R. No. 212731: Factual AntecedentsDocumento5 pagineG.R. No. 212731: Factual AntecedentsGennard Michael Angelo AngelesNessuna valutazione finora

- Capital Reserves and Bank ProfitabilityDocumento49 pagineCapital Reserves and Bank Profitabilityjen18612Nessuna valutazione finora

- Rich Dad Poor Dad-Summary2 PDFDocumento10 pagineRich Dad Poor Dad-Summary2 PDFar10bb100% (1)

- Aguenza Vs Metrobank DigestDocumento1 paginaAguenza Vs Metrobank DigestVincent Quiña PigaNessuna valutazione finora

- Mercury Athletic FootwearDocumento9 pagineMercury Athletic FootwearJon BoNessuna valutazione finora