Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Anukret On Tax Incentive in Securities Sector English

Caricato da

Chou ChantraTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Anukret On Tax Incentive in Securities Sector English

Caricato da

Chou ChantraCopyright:

Formati disponibili

KINGDOM OF CAMDODIA NATION RELIGION KING

Royal Government of Cambodia No. 70 ANKR BK ANUKRET ON TAX INCENTIVES IN SECURITIES SECTOR

*****

The Royal Government of Cambodia

Having seen the Constitution of the Kingdom of Cambodia; Having seen the Preah Reach Kret No. NS/RKT/0908/1055 on 25 September 2008 on the Appointment of the Royal Government of the Kingdom of Cambodia; Having seen the Preah Reach Kram No. 02/NS/94 on 20 July 1994 promulgating the Law on the Organizing and Functioning of the Council of Ministers; Having seen the Preah Reach Kram No. NS/RKM/0196/18 on 24 January 1996 promulgating the Law on the Establishment of the Ministry of Economy and Finance; Having seen the Preah Reach Kram No. NS/RKM/0297/03 on 24 February 1997 promulgating the Law on Taxation; Having seen the Preah Reach Kram No. NS/RKM/0303/010 on 31 March 2003 promulgating the Law on Amendment to the Law on Taxation; Having seen the Preah Reach Kram No. 03/NS/94 of 05 August 1994 promulgating the Law on Investment in the Kingdom of Cambodia; Having seen the Preah Reach Kram No. NS/RKM/0303/009 on 24 March 2003 promulgating the Law on Amendment to the Law on Investment in the Kingdom of Cambodia; Having seen the Preah Reach Kram No. NS/RKM/0107/001 on 10 January 2007 promulgating the Law on Government Securities; Having seen the Preah Reach Kram No. NS/RKM/1007/028 on 19 October 2007 promulgating the Law on the Issuance and Trading of Non-Movement Securities;

Unofficial Translation 1

Having seen the Preah Reach Kram No. NS/RKM/0508/016 on 13 May 2008 promulgating the Law on Public Finance System; Having seen the Preah Reach Kram No. NS/RKM/1209/026 on 16 December 2009 promulgating the Law on Public Finance Management 2010; Having seen the Anukret No. 134 ANKR.BK on 15 September 2008 on the Promotion of Office of Costumes and Excies, Department of Taxation, and Department of National Treasury of the Ministry of Economy and Finance to become General Department of Costumes and Excies, General Department of Taxation, General Department of National Treasury which are under the Management of the Ministry of Economic and Finance; Having seen the Anukret No. 97 ANKR/BK on 23 July 2008 on the Conduct and Organization of the Securities and Exchange Commission of Cambodia; Having seen the Anukret No. 54 ANKR/BK on 08 April 2009 on the Implementation of the Law on the Issuance and Trading of Non-Government Securities; Referring to the proposals of the Minister of Economy and Finance. HEREBY DECIDES CHAPTER 1 GENERAL PROVISIONS

Article 1.Objective The purpose of the Anukret is to prescribe types, activities and other requirements which are subjected to tax incentives in securities sector as precribed in the Article 12 of the Law on Public Finance Management 2010 promulgated by Preah Reach Kram No. NS/RKM/1209/ 026 dated on 16 December 2009. Article 2.Purpose The purpose of this Anukret is to provide tax incentives in order to promote the securities sector development in the Kingdom of Cambodia. Article 3. Scope The scope of the Anukret shall be applicable in the Kingdom of Cambodia to: 1. Equity and/or debt securities issuing companies granted approval from the Securities and Exchange Commission of Cambodia (thereafter is SECC) and listed on permitted Securities Market. 2. Public investors holding and/or buying-selling of government securities, equity and/or debt securities which are issued and listed on the permitted Securities Market. For the purpose of this Anukret, the public investors are also included both resident and nonresident investors.

CHAPTER 2

Unofficial Translation

ACTIVITIES AND REQUIRMENTS OF TAX INCENTIVES Article 4. Tax Incentives on Profit Tax for Equity and/or Debt Securities Issuing Companies Equity and/or Debt Securities issuing companies approved by the SECC and listed on the permitted Securities Market shall fulfill the form and submit to the General Department of Taxation through SECC in order to grant tax incentives by reducing 10% of total amount of tax on profit to be paid for three (03) years. The three (03) years of tax incentives above shall be calculated from: a. the beginning of the taxable year of securities issuance within the first six (6) months of the taxable year. b. the beginning of the taxable year after the taxable year by which securities are issued within the last six (6) months of the taxable year. Article 5. Tax Incentives on Withholding Tax for Securities Investors Public investors shall gain fifty (50%) percent deduction of withholding tax on interest and/or dividend which derives from holding and/or buying-selling the government securities, equity securities and debt securities for the period of three (03) years counting from the opening of securities market. The person ,withholding agents, disbursing interest and/or dividend shall calculate the withholding tax as prescribed in the paragraph 1 prior to disbursement and submission of withholding tax declaration letter to tax administration with compliance to a particular form no later than day fifteenth (15th) of the following month after withholding. Article 6. Companies Which Subject Not To Be Granted on Tax Incentives on Profit Tax Companies shall not be granted tax Incentives on profit as prescribed in the Article 4 of this Anukret if those companies are qualified investment enterprises enjoying within their tax holidays period as prescribed in the Laws and regulations on Investment in the Kingdom of Cambodia. Article 7. Tax Incentive Termination The General Department of Taxation may propose the Ministry of Economy and Finance through SECC to terminate tax incentives as prescribed in the Article 4 of this Anukret, in case the equitiy and/or debt securities issuing companies approved by SECC and listed on permitted Securities Market: - fail to file monthly tax declaration and fail to pay tax in due date set by the tax administration; - fail to file the annual tax declaration for the fiscal year and fail to pay tax in due date set by tax administration. The annual tax declaration shall be attached with audited-financial statements by professional accounting firms providing services in the securities sector, including balance sheet, income statement, statement of cash flow, and note(s) no later than three (03) months after the end of fiscal year. - Fail to allow the tax administration to conduct audit on accounting book and other documents. - Fail to pay all taxes, value added tax (VAT) and interest that set for the taxable period which is audited by the fiscal administration.

Unofficial Translation

In case the companies receiving the tax incentives on profit as prescribed in this Anukret fail to implement the Law on the Issuance and Trading of Non-Government Securities and other related regulations in the securities sector, SECC may propose the Ministry of Economy and Finance to terminate the tax incentives as prescribed in paragraph 1 of the Article 4 of this Anukret. Equity and/or Debt Securities issuing companies approved by SECC and listed on the permitted Securities Market shall not be granted the tax incentives on profit as prescribed in this Anukret, if the companies delist themselves or being delisted on the permitted Securities Market. CHAPTER 3 FINAL PROVISIONS Article 8. Abrogation All provisions contrary to this Anukret are hereby abrogated. Article 9. Application The Minister in charge of Council of Ministers, Minister of Economy and Finance and the Chairman of the Securities and Exchange Commission of Cambodia, the Ministers, the Secretaries of State of Ministries and relevant institutions and Delegates of Royal Government responsible for Director General of General Department of Taxation shall implement the Anukret from the date of signing. Phnom Penh, 22 April 2011 Prime Minister (Signed and Sealed)

SAMDECH AKAK MOHA SENA PADEI TECHO HUN SEN

Has informed to SAMDECH AKAK MOHA SENA PADEI TECHO, Prime Minister for signature Deputy Prime Minister, Minister of Economy and Finance (Signature) KEAT CHHON

Copied and Distribution: - Ministry of Royal Palace - Secretariat of Constitutional Council - Secretariat of Senate - Secretariat of National Assembly - Secretariat of Royal Government of Cambodia - Cabinet of Samdech Akak Moha Sena Padei Techo HUN SEN Prime Minister of the Kingdom of Cambodia - As prescribed in Article 9 for Implementation - All Ministries and Institutions - Royal Gazette - Archives- Records

Unofficial Translation

Potrebbero piacerti anche

- Implement Cambodian Accounting StandardsDocumento2 pagineImplement Cambodian Accounting StandardsLona CheeNessuna valutazione finora

- Prakas On Authorization of Foreign Auditors To Sign On Auditing ReportDocumento2 paginePrakas On Authorization of Foreign Auditors To Sign On Auditing ReportLona CheeNessuna valutazione finora

- Prakas On The Implementation of Cambodian Standards On Auditing (CSA)Documento2 paginePrakas On The Implementation of Cambodian Standards On Auditing (CSA)Lona CheeNessuna valutazione finora

- Kingdom of Cambodia Business Registration SubdecreeDocumento9 pagineKingdom of Cambodia Business Registration SubdecreeAxel RykerNessuna valutazione finora

- Cambodia SME Tax Incentive Sub-DecreeDocumento4 pagineCambodia SME Tax Incentive Sub-DecreeKhun MengleapNessuna valutazione finora

- Sub-Decree On SME Tax Incentives 2018 (Unofficial English Translation)Documento4 pagineSub-Decree On SME Tax Incentives 2018 (Unofficial English Translation)LydetPidorNessuna valutazione finora

- Prakas 068 On Full Implementation of Ifrs MefDocumento3 paginePrakas 068 On Full Implementation of Ifrs MefLona Chee100% (2)

- 4907-Exmptoin On Income TaxDocumento3 pagine4907-Exmptoin On Income TaxJetanNessuna valutazione finora

- Tax Incentives 10708Documento5 pagineTax Incentives 10708Hib Atty TalaNessuna valutazione finora

- April 2010 Tax BriefDocumento10 pagineApril 2010 Tax BriefAna MergalNessuna valutazione finora

- Prakas 741 On Rule and Procedure For CMT EngDocumento6 paginePrakas 741 On Rule and Procedure For CMT EngNak VanNessuna valutazione finora

- Cambodia Financial Statement Audit RequirementsDocumento4 pagineCambodia Financial Statement Audit RequirementsLona Chee50% (2)

- Executive Regulations of VAT Law No. (67) of 2016Documento60 pagineExecutive Regulations of VAT Law No. (67) of 2016Nashwa HammamNessuna valutazione finora

- 139 2016 ND-CP 327644Documento5 pagine139 2016 ND-CP 327644Hoang My VuNessuna valutazione finora

- Prakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishDocumento17 paginePrakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishChou ChantraNessuna valutazione finora

- Republic Act NoDocumento28 pagineRepublic Act NoAyen GarciaNessuna valutazione finora

- Oman Issues Executive Regulations for Income Tax LawDocumento44 pagineOman Issues Executive Regulations for Income Tax LawavineroNessuna valutazione finora

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDocumento12 paginePrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraNessuna valutazione finora

- ST TH THDocumento23 pagineST TH THgaganNessuna valutazione finora

- Ra 10708Documento6 pagineRa 10708Miguel CardenasNessuna valutazione finora

- 156 2013 TT-BTCDocumento100 pagine156 2013 TT-BTCnoooooooooonoooooooooooooNessuna valutazione finora

- TAX EXEMPTIONS FOR PEZA-REGISTERED BUSINESSESDocumento29 pagineTAX EXEMPTIONS FOR PEZA-REGISTERED BUSINESSESArne TanNessuna valutazione finora

- Case DigestsDocumento67 pagineCase DigestsCattleyaNessuna valutazione finora

- Decision 15 - Part I - Chart of Accounts - Edition 1 2 2 - Ban 18 MBDocumento447 pagineDecision 15 - Part I - Chart of Accounts - Edition 1 2 2 - Ban 18 MBapi-19845433Nessuna valutazione finora

- Balochistan ST Special Procedure (WH) Rules 2018 PDFDocumento22 pagineBalochistan ST Special Procedure (WH) Rules 2018 PDFTax PerceptionNessuna valutazione finora

- Powers of The BIRDocumento11 paginePowers of The BIRmartina lopez100% (1)

- 270MEF-EN-Prakas On TaxAuditDocumento9 pagine270MEF-EN-Prakas On TaxAuditchannat zaboroskiNessuna valutazione finora

- Code of Fiscal BenefitsDocumento19 pagineCode of Fiscal Benefitsantonior70Nessuna valutazione finora

- SFS Federal Sales Tax Input Claim On HSD, TYRES, LUB Consumption in Transportation Services in Feb 2019Documento21 pagineSFS Federal Sales Tax Input Claim On HSD, TYRES, LUB Consumption in Transportation Services in Feb 2019Sohail AwanNessuna valutazione finora

- Boletín 9 Feb 2009 EnglishDocumento8 pagineBoletín 9 Feb 2009 EnglishRodriguez-Azuero AbogadosNessuna valutazione finora

- Dof Order No. 17-04Documento10 pagineDof Order No. 17-04matinikkiNessuna valutazione finora

- LM Tax AdministrationDocumento26 pagineLM Tax AdministrationDennis PlacerNessuna valutazione finora

- Taxation Chapter 1Documento42 pagineTaxation Chapter 1Sadaqat AliNessuna valutazione finora

- Automobiles RR 2-2016Documento3 pagineAutomobiles RR 2-2016Romer LesondatoNessuna valutazione finora

- Module 3 Tax Preferences Available For Sole Proprietorship BusinessDocumento7 pagineModule 3 Tax Preferences Available For Sole Proprietorship Businessangclaire47Nessuna valutazione finora

- Excise DutyDocumento4 pagineExcise DutyDigvijay LakdeNessuna valutazione finora

- Sales Tax Special Withholding Rules 2010Documento9 pagineSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiNessuna valutazione finora

- Jordan Investment Law No. 30 of 2014Documento40 pagineJordan Investment Law No. 30 of 2014Hatem MomaniNessuna valutazione finora

- RA 10708 - Tax Incentives Management and Transparency Act (TIMTA) - 1Documento2 pagineRA 10708 - Tax Incentives Management and Transparency Act (TIMTA) - 1Vince De GuzmanNessuna valutazione finora

- Taxation Review - Soriano vs. Secretary of FinanceDocumento2 pagineTaxation Review - Soriano vs. Secretary of FinanceMaestro Lazaro100% (1)

- Legal Memorandum PDFDocumento12 pagineLegal Memorandum PDFHary Weilding FransNessuna valutazione finora

- Omani Commercial LawDocumento8 pagineOmani Commercial LawDorian BallNessuna valutazione finora

- SubjectDocumento2 pagineSubjectapi-247793055Nessuna valutazione finora

- BMBE SeminarDocumento60 pagineBMBE SeminarBabyGiant LucasNessuna valutazione finora

- Rmo 1981Documento228 pagineRmo 1981Mary graceNessuna valutazione finora

- Bir Ruling Da Il 046 797 09Documento3 pagineBir Ruling Da Il 046 797 09JianSadakoNessuna valutazione finora

- Circular No 70 - NewDocumento3 pagineCircular No 70 - NewHr legaladviserNessuna valutazione finora

- 2021326153532729circular13 2021Documento4 pagine2021326153532729circular13 2021Ahmad SafiNessuna valutazione finora

- PWC Indonesia - TaxFlash 2016 #11Documento6 paginePWC Indonesia - TaxFlash 2016 #11Denny SitumorangNessuna valutazione finora

- Serial No NoDocumento27 pagineSerial No NovenkynaiduNessuna valutazione finora

- Updates on recent issuances from government agenciesDocumento3 pagineUpdates on recent issuances from government agenciesKoko FerminNessuna valutazione finora

- 55153rr10 17Documento2 pagine55153rr10 17fatmaaleahNessuna valutazione finora

- Guide eLAs, TVNs, MOA issuanceDocumento4 pagineGuide eLAs, TVNs, MOA issuanceSammy AsanNessuna valutazione finora

- To Be Published in The Gazette of Pakistan Part-IiDocumento23 pagineTo Be Published in The Gazette of Pakistan Part-IisadamNessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- KNCCI Vihiga: enabling county revenue raising legislationDa EverandKNCCI Vihiga: enabling county revenue raising legislationNessuna valutazione finora

- KNCCI Vihiga: enabling county revenue raising legislationDa EverandKNCCI Vihiga: enabling county revenue raising legislationNessuna valutazione finora

- Securitization and Securitized Debt Instruments in Emerging MarketsDocumento64 pagineSecuritization and Securitized Debt Instruments in Emerging MarketsChou ChantraNessuna valutazione finora

- G20 Report on Improving Transparency in Commodity Derivatives MarketsDocumento25 pagineG20 Report on Improving Transparency in Commodity Derivatives MarketsChou ChantraNessuna valutazione finora

- IOSCOPD339Documento156 pagineIOSCOPD339Chou ChantraNessuna valutazione finora

- Appendix A - Client Asset Protection SummaryDocumento90 pagineAppendix A - Client Asset Protection SummaryChou ChantraNessuna valutazione finora

- Non-Professional Ownership of Audit Firms Consultation ReportDocumento126 pagineNon-Professional Ownership of Audit Firms Consultation ReportChou ChantraNessuna valutazione finora

- Effectiveness of market interventions in emerging marketsDocumento27 pagineEffectiveness of market interventions in emerging marketsChou ChantraNessuna valutazione finora

- IOSCOPD335Documento109 pagineIOSCOPD335Chou ChantraNessuna valutazione finora

- Comments Received in Response To Consultation Reports On Issues Pertaining To The Audit of Publicly Listed CompaniesDocumento22 pagineComments Received in Response To Consultation Reports On Issues Pertaining To The Audit of Publicly Listed CompaniesChou ChantraNessuna valutazione finora

- Issues Raised by Dark LiquidityDocumento30 pagineIssues Raised by Dark LiquidityChou ChantraNessuna valutazione finora

- Guidance On The Application of The 2004 Cpss-Iosco Recommendations For Central Counterparties To Otc Derivatives CcpsDocumento44 pagineGuidance On The Application of The 2004 Cpss-Iosco Recommendations For Central Counterparties To Otc Derivatives CcpsChou ChantraNessuna valutazione finora

- IOSCOPD331Documento33 pagineIOSCOPD331Chou ChantraNessuna valutazione finora

- Task Force On Commodity Futures Markets Survey: T C I O S C J 2010Documento19 pagineTask Force On Commodity Futures Markets Survey: T C I O S C J 2010Chou ChantraNessuna valutazione finora

- Task Force On Commodity Futures Markets: Report To G-20Documento6 pagineTask Force On Commodity Futures Markets: Report To G-20Chou ChantraNessuna valutazione finora

- Principles Regarding Cross-Border Supervisory Cooperation: Final ReportDocumento54 paginePrinciples Regarding Cross-Border Supervisory Cooperation: Final ReportChou ChantraNessuna valutazione finora

- Objectives and Principles of Securities RegulationDocumento12 pagineObjectives and Principles of Securities RegulationChou ChantraNessuna valutazione finora

- Considerations For Trade Repositories in OTC Derivatives MarketsDocumento21 pagineConsiderations For Trade Repositories in OTC Derivatives MarketsChou ChantraNessuna valutazione finora

- Internal Audit UnitDocumento7 pagineInternal Audit UnitChou ChantraNessuna valutazione finora

- Regulatory Implementation of The Statement of Principles Regarding The Activities of Credit Rating AgenciesDocumento38 pagineRegulatory Implementation of The Statement of Principles Regarding The Activities of Credit Rating AgenciesChou ChantraNessuna valutazione finora

- Securities Market SupervisionDocumento7 pagineSecurities Market SupervisionkakadaleeNessuna valutazione finora

- IOSCOPD315Documento128 pagineIOSCOPD315Chou ChantraNessuna valutazione finora

- 1002 Disclosure PrinciplesDocumento83 pagine1002 Disclosure PrinciplesOrgan BehNessuna valutazione finora

- R&D TrainingDocumento7 pagineR&D TrainingChou ChantraNessuna valutazione finora

- Securities IssuanceDocumento8 pagineSecurities IssuanceChou ChantraNessuna valutazione finora

- Legal AffairsDocumento6 pagineLegal AffairsChou ChantraNessuna valutazione finora

- Administration and FinanceDocumento7 pagineAdministration and FinanceChou ChantraNessuna valutazione finora

- Securities IntermediariesDocumento7 pagineSecurities IntermediariesChou ChantraNessuna valutazione finora

- IPO MechanismDocumento4 pagineIPO MechanismChou ChantraNessuna valutazione finora

- Guidelines On The Procedure of Cash Settlement in The Securities Market EnglishDocumento2 pagineGuidelines On The Procedure of Cash Settlement in The Securities Market EnglishChou ChantraNessuna valutazione finora

- Guidelines On The Procedure of Cash Settlement in The Securities Market KhmerDocumento2 pagineGuidelines On The Procedure of Cash Settlement in The Securities Market KhmerChou ChantraNessuna valutazione finora

- BattambangDocumento13 pagineBattambangapi-327820167Nessuna valutazione finora

- 10 2307@25202509 PDFDocumento28 pagine10 2307@25202509 PDFHun ChhuntengNessuna valutazione finora

- MAF News March - May 2009Documento9 pagineMAF News March - May 2009Mission Aviation FellowshipNessuna valutazione finora

- Cambodia Hardware Tools 2014-DMDocumento3 pagineCambodia Hardware Tools 2014-DMSadik ShaikhNessuna valutazione finora

- CV Na NaDocumento5 pagineCV Na NaRoeun Darian100% (1)

- Gasifier Cambodia JT PDFDocumento27 pagineGasifier Cambodia JT PDFJohn TauloNessuna valutazione finora

- FijiTimes - May 3 2013Documento48 pagineFijiTimes - May 3 2013fijitimescanadaNessuna valutazione finora

- Brunei DarussalamDocumento5 pagineBrunei DarussalamJanylin Surela BarbaNessuna valutazione finora

- Homework CHHEANG HORDocumento5 pagineHomework CHHEANG HORLY YangNessuna valutazione finora

- Q3 G8 English M1Documento32 pagineQ3 G8 English M1John David YuNessuna valutazione finora

- Arts and Crafts of Thailand, Cambodia, Laos, VietnamDocumento7 pagineArts and Crafts of Thailand, Cambodia, Laos, VietnamJudy Ann MorilloNessuna valutazione finora

- Reading Strategies for Experiential English IDocumento17 pagineReading Strategies for Experiential English IAshraf UddinNessuna valutazione finora

- Revolutionary Pacifism - Choices and ProspectsDocumento11 pagineRevolutionary Pacifism - Choices and ProspectsAnonymous gZoIU7ZNessuna valutazione finora

- Land Conflicts A Practical Guide To Dealing With Land DisputesDocumento122 pagineLand Conflicts A Practical Guide To Dealing With Land DisputesJay L Batiancila Contento100% (1)

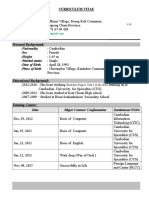

- CV 2013Documento3 pagineCV 2013Men Keo RathaNessuna valutazione finora

- Case Study Clothing IndustryDocumento4 pagineCase Study Clothing IndustryAlex Mini Andra100% (1)

- Myanmar's Framework for Economic and Social ReformsDocumento65 pagineMyanmar's Framework for Economic and Social ReformsnailaweoungNessuna valutazione finora

- AL57Documento55 pagineAL57babujisgNessuna valutazione finora

- Global History Sample ExamDocumento4 pagineGlobal History Sample ExamLe TuanNessuna valutazione finora

- Kong Chivuth Curriculum VitaeDocumento7 pagineKong Chivuth Curriculum VitaeMong SopheaNessuna valutazione finora

- Decentralization of Educational Management in Southeast AsiaDocumento4 pagineDecentralization of Educational Management in Southeast AsiaLamberto Pilatan Jr.Nessuna valutazione finora

- Sophal Manh.Documento4 pagineSophal Manh.សុផល ម៉ាញNessuna valutazione finora

- MS All WorkDocumento12 pagineMS All WorkChi PanyanhNessuna valutazione finora

- Junior High School: Pana-On Community High School, Inc. Poblacion, Pana-On Misamis OccidentalDocumento3 pagineJunior High School: Pana-On Community High School, Inc. Poblacion, Pana-On Misamis Occidentaltaw realNessuna valutazione finora

- China's 700-year influence on Cambodian culture, business and our livesDocumento12 pagineChina's 700-year influence on Cambodian culture, business and our livesChhem SronglongNessuna valutazione finora

- Khmer CompleteDocumento330 pagineKhmer CompleteEilidh100% (2)

- (Milton Osborne) Southeast Asia An Introductory HistoryDocumento361 pagine(Milton Osborne) Southeast Asia An Introductory HistoryZahra Dina HasibuanNessuna valutazione finora

- Resos Philippines PDFDocumento21 pagineResos Philippines PDFarciblueNessuna valutazione finora

- Cambodia Garment Sector Main Report NathanDocumento68 pagineCambodia Garment Sector Main Report Nathanaman.4u100% (1)

- Travel brochure questions and answers document summaryDocumento3 pagineTravel brochure questions and answers document summaryCharlene NaungayanNessuna valutazione finora