Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RJRJRJJRJRJRJJR111111

Caricato da

John Paul ChuaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RJRJRJJRJRJRJJR111111

Caricato da

John Paul ChuaCopyright:

Formati disponibili

RJR NABISCO CASE Name: John Paul Chua Questions for RJR Nabisco case 1.

What was the value of RJR Nabisco under Asset Beta:

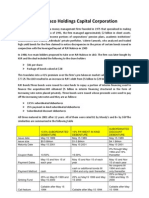

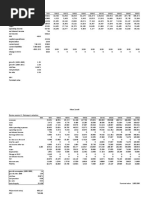

= 0.50 = 0.92 Ba=(0.50+0.92)/2 = 0.7 Assume that Rf = 9% (from the Marriott Case) Assume that Rp=8% (from the Marriott Case) Ka = Rf + BARp Ka = 9% + (0.7)(8%) = 14.6% a) The pre-bid operating strategy?

b) The Management Group's strategy?

c) KKR's operating strategy?

2. What accounts for any difference in the value of three operating plans? The difference in value of all 3 operating plans stems from the difference in operating strategies by the 2 bidders. This resulted in different capital cash flow forecasts which resulted in the different valuation. The management groups proposed strategy was to sell part of RJR Nabiscos food businesses since they believed that the business was undervalued by market. They believe that separating could help the market distinguish the tobacco business and food business and realize the true intrinsic value of each business. They believe that doing this would help market realize the companys value more efficiently and maximize shareholdersinterests. It is also part of a leveraged buyout, part of which is financed by long term debt, altering the capital structure going forwards. More debt leads to a greater valuation of the firm due to the higher tax shields. KKR on the other hand wanted to maintain all of the tobacco business and food operations. KKR want to expand the tobacco to Winston-Salem, North Carolina. KKR believes continuing operating food business properly could bring more benefit than simply sell the assets of food business and recognize gain at one time and since it involved more debt, it will also result in a new capital structure thus increasing its valuation. The three operating plans account for different amounts of assets due to varying operating strategies as well as various amounts of long-term debt. This reflects the idea that operating decisions are the main motivation behind the value of RJR Nabisco. 3. Evaluate the Special Committee's use of an auction of RJR Nabisco? The Special Committees decision to use a sealed auction for the sale of RJR Nabisco would allow potential buyers to compete with one another to propose their best bids to maximize shareholder value and prevent collusion. It fulfills Nabiscos fiduciary duty to the shareholders. Accepting bids from all over will allow competition to drive the price to the highest possible level and will also accept bids from all any willing participants instead of a select few. By putting in place anti hostile take over measures, it helps prevents any potential hostile takeovers thus protecting the sharholders which is also in the best interest of the shareholders. Secondly, the Special Committees rules of the auction will prompt a swift acquisition. KKR and Management Group have been considering a joint bid since 1987; after one year, no deal has been finalized. By participating in an auction, companies must submit their proposals by a deadline to enter each round of bidding. This allows the deal to conclude quickly as compared to if private negogiations with each individual parties where to be held. Furthermore, the use of an auction which requires each bidder to submit proposals, would allow the board to evaluate the merits of each bid in the best interest of its shareholders. This is especially attractive since the payment is mostly made in cash, and shareholders will want to receive their share as quickly as possible. However, a public auction often leads to a bidding frenzy resulting in overvaluation

of the company which may be detrimental in the long run as they pile more debt onto RJR Nabiscos balance sheet when they acquire the firm. 4. Which bid should the special committee select, if any? What other actions should the special committee take? From the companys point of view, both Management and KKRs bids result in increased cash flows from the existing operating structure as a result of tax shields from debt and change in operations. Therefore, both plans will enhance the companys performance in the foreseeable future, though KKRs plan does result in slightly higher cash flows. Under KKRs offer at $92 per share, Nabiscos operating structure would stay intact, maintaining the image of the company as well as continuing to offer job security for its existing employees. However, the Special Committees fiduciary responsibility is not fulfilled if they do not act in the shareholders best interest. Management Groups bid is $8 higher per share than KKRs, with less pay-in-kind preferred stock and more cash as payment. The Special Committee should choose Managements bid of $100 per share in order to best fulfill its duties to the shareholders and also promise cash flows for the company in the upcoming years which are comparable to the KKR bid.

Potrebbero piacerti anche

- RJRDocumento4 pagineRJRliyulongNessuna valutazione finora

- RJR Nabisco 1Documento6 pagineRJR Nabisco 1gopal mundhraNessuna valutazione finora

- RJR NabiscoDocumento22 pagineRJR Nabiscokriteesinha100% (2)

- RJR Nabisco ValuationDocumento33 pagineRJR Nabisco ValuationShivani Bhatia100% (4)

- Valuing Leveraged Buyouts with the Adjusted Present Value ApproachDocumento5 pagineValuing Leveraged Buyouts with the Adjusted Present Value ApproachFelipe Kasai MarcosNessuna valutazione finora

- RJR Nabisco ValuationDocumento38 pagineRJR Nabisco ValuationJCNessuna valutazione finora

- Case Assignment - RJR NabiscoDocumento1 paginaCase Assignment - RJR NabiscoMuhammad Rehan NasirNessuna valutazione finora

- RJR Nabisco ValuationDocumento40 pagineRJR Nabisco ValuationEdisonCaguanaNessuna valutazione finora

- RJR Nabisco Pre-Bid Valuation AnalysisDocumento13 pagineRJR Nabisco Pre-Bid Valuation AnalysisMohit Khandelwal100% (1)

- RJR Nabisco Board Committee Members and ResponsibilitiesDocumento10 pagineRJR Nabisco Board Committee Members and ResponsibilitiesSurajNessuna valutazione finora

- Calculating The NPV of The AcquisitionDocumento23 pagineCalculating The NPV of The Acquisitionkooldude1989100% (1)

- RJR NabiscoDocumento17 pagineRJR Nabiscodanielcid100% (1)

- RJR Nabisco Valuation Under Different StrategiesDocumento18 pagineRJR Nabisco Valuation Under Different StrategiesHarsha Vardhan100% (1)

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsDocumento1 paginaCases RJR Nabisco 90 & 91 - Assignment QuestionsBrunoPereiraNessuna valutazione finora

- RJR Nabisco ValuationDocumento7 pagineRJR Nabisco ValuationAnil Kotaga0% (1)

- RJR Nabisco ValuationDocumento33 pagineRJR Nabisco ValuationKrishna Chaitanya KothapalliNessuna valutazione finora

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocumento5 pagineIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNessuna valutazione finora

- RJR Nabisco Special Committee Members and AdvisorsDocumento13 pagineRJR Nabisco Special Committee Members and AdvisorsRattan Preet Singh25% (4)

- Continental Carriers Debt vs EquityDocumento10 pagineContinental Carriers Debt vs Equitynipun9143Nessuna valutazione finora

- RJR Nabisco Case - Group 4 - PPTDocumento8 pagineRJR Nabisco Case - Group 4 - PPTMeghna Saluja100% (1)

- RJR - NabiscoDocumento37 pagineRJR - NabiscoAB100% (1)

- Netscape CaseDocumento6 pagineNetscape CaseVikram RathiNessuna valutazione finora

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Documento6 pagineAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDocumento24 pagineThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- RJR Nabisco Holdings Capital CorporationDocumento3 pagineRJR Nabisco Holdings Capital CorporationManogana RasaNessuna valutazione finora

- LinearDocumento6 pagineLinearjackedup211Nessuna valutazione finora

- Fin 321 Case PresentationDocumento19 pagineFin 321 Case PresentationJose ValdiviaNessuna valutazione finora

- Airthread DCF Vs ApvDocumento6 pagineAirthread DCF Vs Apvapi-239586293Nessuna valutazione finora

- Kohler CompanyDocumento3 pagineKohler CompanyDuncan BakerNessuna valutazione finora

- Why the 3 Operating Plans for RJR Nabisco Differed in ValuationDocumento1 paginaWhy the 3 Operating Plans for RJR Nabisco Differed in ValuationSatyajeet SenapatiNessuna valutazione finora

- Continental CarriersDocumento6 pagineContinental CarriersVishwas Nandan100% (1)

- Marriott ExcelDocumento2 pagineMarriott ExcelRobert Sunho LeeNessuna valutazione finora

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalDocumento14 pagine24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasNessuna valutazione finora

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocumento30 pagineKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNessuna valutazione finora

- Analysis of Historical Financials and Projections to Calculate Stock PriceDocumento2 pagineAnalysis of Historical Financials and Projections to Calculate Stock Pricemc1012Nessuna valutazione finora

- Marriott SolutionDocumento3 pagineMarriott Solutiondlealsmes100% (1)

- SpyderDocumento3 pagineSpyderHello100% (1)

- Marriott Case FinalDocumento17 pagineMarriott Case FinalFabia BourdaNessuna valutazione finora

- Mercury AthleticDocumento13 pagineMercury Athleticarnabpramanik100% (1)

- Kohler Case Leo Final DraftDocumento16 pagineKohler Case Leo Final DraftLeo Ng Shee Zher67% (3)

- case-UST IncDocumento10 paginecase-UST Incnipun9143Nessuna valutazione finora

- RJR Nabisco LBODocumento5 pagineRJR Nabisco LBOpoojaraneifm25% (4)

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Documento25 pagineIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420Nessuna valutazione finora

- AirThread G015Documento6 pagineAirThread G015Kunal MaheshwariNessuna valutazione finora

- Group2 - Clarkson Lumber Company Case AnalysisDocumento3 pagineGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNessuna valutazione finora

- Caso HertzDocumento32 pagineCaso HertzJORGE PUENTESNessuna valutazione finora

- NetscapeDocumento3 pagineNetscapeulix1985Nessuna valutazione finora

- Mergers & AcquisitionsDocumento69 pagineMergers & Acquisitionsdhananjay7Nessuna valutazione finora

- Money & Banking 2Documento13 pagineMoney & Banking 2Kiran HasnaniNessuna valutazione finora

- MERGER AND ACQUISITION OVERVIEWDocumento25 pagineMERGER AND ACQUISITION OVERVIEWAlka KukrejaNessuna valutazione finora

- CF Case Study - 10Documento8 pagineCF Case Study - 10gitabem380Nessuna valutazione finora

- Tus NewDocumento21 pagineTus NewAnket SharmaNessuna valutazione finora

- Case Analysis Cox CommunicationsDocumento4 pagineCase Analysis Cox CommunicationsRohit AgarwalNessuna valutazione finora

- In Vertical Mergers and Acquisition What Synergies Exist?Documento5 pagineIn Vertical Mergers and Acquisition What Synergies Exist?Sanam TNessuna valutazione finora

- Kingtim Co investment and debt financing impactDocumento10 pagineKingtim Co investment and debt financing impactShaminiNessuna valutazione finora

- Solutions Corporate FinanceDocumento28 pagineSolutions Corporate FinanceUsman UddinNessuna valutazione finora

- Mergers and Acquisitions SolutionsDocumento56 pagineMergers and Acquisitions Solutionstseboblessing7Nessuna valutazione finora

- CBMDocumento31 pagineCBMGaurav BhaleraoNessuna valutazione finora

- M&a FinalDocumento42 pagineM&a FinalGaurav Kumar AgarwalNessuna valutazione finora

- DocxDocumento11 pagineDocxzhilinli2022Nessuna valutazione finora

- Fste Si IndexesDocumento1.209 pagineFste Si IndexesJohn Paul ChuaNessuna valutazione finora

- Microbrewery CaseDocumento8 pagineMicrobrewery CaseJohn Paul ChuaNessuna valutazione finora

- Hotel Standards (Design Research)Documento23 pagineHotel Standards (Design Research)JanMarcMenasalvas100% (1)

- Charges, Mortgages, Guarantees, Indemnity, Islamic Banking, PledgesDocumento9 pagineCharges, Mortgages, Guarantees, Indemnity, Islamic Banking, PledgesJohn Paul ChuaNessuna valutazione finora

- RawDocumento12 pagineRawJohn Paul ChuaNessuna valutazione finora

- Finance Law ExamsDocumento23 pagineFinance Law ExamsJohn Paul ChuaNessuna valutazione finora

- Finance (Final Final) Real EstateDocumento131 pagineFinance (Final Final) Real EstateJohn Paul Chua100% (1)

- Epic Genes and Society Super CompilationDocumento3 pagineEpic Genes and Society Super CompilationJohn Paul ChuaNessuna valutazione finora

- Private EquityDocumento25 paginePrivate EquityAman SinghNessuna valutazione finora

- Private Equity Primer (Wiki Collection)Documento83 paginePrivate Equity Primer (Wiki Collection)vincentparleNessuna valutazione finora

- RJRJRJJRJRJRJJR111111Documento4 pagineRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- Venture Capital ProjectDocumento102 pagineVenture Capital ProjectAliya KhanNessuna valutazione finora

- History History of Private Equity and Venture CapitalDocumento5 pagineHistory History of Private Equity and Venture Capitalmuhammadosama100% (1)

- In Re RJR Nabisco Inc.Documento3 pagineIn Re RJR Nabisco Inc.viva_33Nessuna valutazione finora

- Interview FBI Hostage Negotiator Chris VossDocumento16 pagineInterview FBI Hostage Negotiator Chris Vosspipul36Nessuna valutazione finora

- Vault Guide To PEDocumento96 pagineVault Guide To PEBrandon Paquette75% (4)

- Barbarians at The Gate: Penguin Readers FactsheetsDocumento4 pagineBarbarians at The Gate: Penguin Readers FactsheetssagibaNessuna valutazione finora

- Battle of Gettysburg EssayDocumento8 pagineBattle of Gettysburg Essayafabfoilz100% (2)

- Characteristics: Equity Cash Flow Cost of CapitalDocumento5 pagineCharacteristics: Equity Cash Flow Cost of CapitalfunmastiNessuna valutazione finora

- Leveraged BuyoutDocumento9 pagineLeveraged Buyoutbharat100% (1)

- Barbarein at The GateDocumento5 pagineBarbarein at The Gatemahesh.mohandas3181Nessuna valutazione finora

- FINA 652 Private Equity: Class I Introduction To The Private Equity IndustryDocumento53 pagineFINA 652 Private Equity: Class I Introduction To The Private Equity IndustryHarsh SrivastavaNessuna valutazione finora

- CBMDocumento31 pagineCBMGaurav BhaleraoNessuna valutazione finora

- RJR Nabisco LBODocumento5 pagineRJR Nabisco LBOpoojaraneifm25% (4)

- RJR - NabiscoDocumento37 pagineRJR - NabiscoAB100% (1)