Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Justification For Cost Accounting System

Caricato da

Veeravalli Shrouthasmaarthaathreya AdhvaryuDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Justification For Cost Accounting System

Caricato da

Veeravalli Shrouthasmaarthaathreya AdhvaryuCopyright:

Formati disponibili

Justification for cost accounting system: R.Veeraraghavan FCMA.

CAS Justification

Cost Accounting standards are basically an attempt to standardise the Cost Accounting practices among businesses and Governance. The Existing and Generally Accepted cost accounting practices are gradually attempted to be replaced with a set of documents in the nature of guidance to treatment of Transactions in the cost Accounting system of any enterprise,governance and charity.This will inturn standardise the practices of drawing general purpose cost statements for an entity, governance or charity and specifically standardise the entire Cost accounting practices in the entity, governance or charity. General Purpose Cost Statements will generally address: 1.Total cost of production or service.(Average and incremental cost as a corollary) 2.Resource utilisation statement. 3.Wastage reports and recycling cost. 4.Production or service efficiency. 5.Project cost to benefit. 6.Varience reports on standard cost and budgeted cost. STAKE HOLDERS THAT CAS will Transfer Benefit: 1.Business, its Management: Business survives on its operations and strategy both depends on proper measurement and timely reporting. An evolved cost accounting system exactly enables the right decision support in the area of operations and strategy by measuring Cost of production , resource consumption, wastage analysis ,Variances from the plan and helps In project planning,improving efficiency in operations and capital investment decision making.It also helps the management in reorienting, re-engineering the supply chain and enables assessment of improving revenues through alternative Cost incurrence path. Some of the standardised techniques such as Target Costing , life-cycle costing helps in realtime assessment of business sustainability. 2.Owners.-These category of stakeholders play dual role of Investor-manager, specially family owned businesses, they are keen on operations and strategy of the enterprise and are eager to improve the operation and devise a sustainable strategy for the enterprise. As an Investor they are permanent stakeholder and not fly-by-night kind of a investor, they look at long term projections and sometimes take certain steps that are pretty risky proposition to stay-put in the business.As there is no delienation between their role as manager and investor they are cautious as well on sustainability issues,An evolved cost accounting in the enterprise is a window for implementing their perception on operations and strategy into a decision goal. 3.Investors.-Investors are of different categories , the bankers and the FIIs, the venture capitalist and HNIs,all have different perception of how to make money out of money,the commonality being they stay away from business operation, though most of them may be satisfied by certain statements reflected in the Annual reports specially when the exit route is easy(liquidation of stakes through organised markets), they may yet be interested in specific operation details on Cost,Efficiency,Projections of revenue,product life-cycle,strategic goals for sustenance,resource availability among other things to make a clear decision to stayinvested.Most of these investors occupy board membership and hence become insiders from outside and have access to all data of operations. 4.Regulators.-these are authorities in the form of SEBI,RBI,tariff authorities,environment authority,energy regulator,Licensing authorities and others who may need specific window of access to operations regularly and would have either a tailor driven format to fill in and submit

or may undertake regular physical inspection of records maintained.Most of these information pertains to Cost, Quality,wastage and efficiency and process transperancy.An evolved CAS would assure the regulators of relying on the reports generated for the purpose. 4A.Taxmen.-Tax authorities are keen in looking at the business from two angles 1. Income disclosure(direct taxes) 2.Production or service rendered figures(indirect).there are other tax authorities whose focus may not be business operations or generation of revenue. As far as direct taxes are concerned the taxmen rely heavily on computation of income derived from book profit.Computation of income has two aspect the allowances and disallowances which are based on the core principles that the aspect of allowances will be needed to sustain business and the aspect of disallowances would be needed to cut exhorbitance and notionality. The primary defect in arriving at the computation of income currently is heavy reliance on Financial statements and judgemental nature of assessment,be it depriciation or investment allowance,there are two ends to each issue one is at the hands of the assessing which he pulls southward and the other is with the authorised representative which he pulls northward for the business.A "cost-based computation of income" is currently lacking even while framing various amendment in the finance act and also while assessing income of business for tax purpose.A right use of this technique will result in objective assessment of income and lesser disputes and lead to healthier business practices and compliance. Indirect taxmen requires data correlating Input-output and since the tax is based on production or rendering of service all the operational data are vital for assessment.Currently Indirect tax collection takes the help of existing cost accounting system where ever available and this needs to be nehanced and applicability made universal from current selective mandate. 5.Government.-Government and governance are focal point of any accountability mechanism and a Democratic-socialist republic of India which endeavour equality of opportunity and freedom, it is essential to ensure proper utilisation of resources,delivering the right product or services at reasonable cost.Government is entrusted with the planning process for overall development of the economy and society and to ensure this it needs to keep track of the Business to ensure its operations are not detrimental to the societal needs and an evolved CAS its consumption by the government will infuse healthy and transperant economic progress,Government has already an evolved mechanism of consumption of CAS through CARR and cost audit which need to mature at the highest level through good governance practices. 6.Courts.-Cases often reaches court specially under the consumer protection act,environmental laws and various other punitive legislations which require thorough insights into business operations before being judgemental on the issue.A transperant and an evolved mechanism of reporting to the management is assurance of credibility in the system and can be relied upon by the courts. 7.Consumers.-Consumers are the main stakeholders- interested- yet currently deprived of Cost statements and related details.As a consumer every one is interested in cost of product and the quality, while this needs a transperant and an accountable approach by the business, to assure the customers that they are not cheated,often these are never addressed as an issue and there are people in the establishment to propagate Demand-supply theory overarching other requirements and to that extent the society is yet to evolve.Some positive action has been taken by enactment of the consumer protection act to redress the grievance through courts. 8.General Public or Citizens.Democracy functions through representation and is run by the three pillers-the Legislature, executive and judiciary,The Polity of India belongs to all and deprives none.There is an assurance to equality of opportunity in the constitution and protection of socially and economically deprived.Economic deprivation occurs through cornering of wealth and commanding a price for it.While the resources of the country and its utilisation is the concern of the citizens who constitute the State, the right price and currently the environmental concerns cannot be neglected and hence the transperancy in doing business and assurance as to the cost, quality and price.

9.International community.A standardised Cost Accounting system which is accountable and transperant will reaasure the international community, which is globalised and moving towards global practices, that the price of the commodity and services they pay are realistic as to the cost components while adjusting to other value criteria,The resources of the globe are not wasted in the production processes and while rendering of service,that there is continuous innovation to improve efficiency of nations and their quality of output.CAS will enable such a decision support mechanism. 10.Environmentalist.We are green and we want to be in the near future and pass it on to the GenNext , so that the planet is not left barren.The concerns emerge from exploitation of resources that create imbalances. Greens want assurances from the micro-level and CAS will trigger a set of practices that will assure the world that activity performed in the course of business is not violating the nature.All utilisation reports will pass efficiency reviews and thus will enable business to be on track and address the concerns of the greens. CAS coverage: 1.All Business and enterprise. 1A.Commercial Agriculture. 2.NGOs 3.Not-for profit. 4.Governance. 5.Charity. CAS Principles: Bringing about Commonality in-------1.Identification 2.Recognition 3.Measurement 4.Assignment 5.Absobtion ---------------------METHODOLOGIES of determining components of cost. Using appropriate techniques..... For determination of .... 1.Unit cost of product/process/job/operation/or service. 2.Consumption of Resources on an average for the product/ process/ job/ operation or service. 3.Incremental usage of resources for the process dynamics. 4.Wastage measurement. 5.Re-cycling cost. 6.Price-determination. 7.Cost as a social obligation.

Potrebbero piacerti anche

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Da Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Nessuna valutazione finora

- Integrated and Non Integrated System of AccountingDocumento46 pagineIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)

- Cost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingDocumento37 pagineCost Assignment SEM 2 - Integrated-And-Non-Integrated-System-Of-AccountingShubashPoojariNessuna valutazione finora

- Management AccountingDocumento7 pagineManagement AccountingRathan SantoshNessuna valutazione finora

- Introduce To Management AccountingDocumento9 pagineIntroduce To Management AccountingSagung AdvaitaNessuna valutazione finora

- Subashini U Final ReportDocumento39 pagineSubashini U Final ReportPonselviNessuna valutazione finora

- Ch01&02 CA PDFDocumento26 pagineCh01&02 CA PDFsolomonaauNessuna valutazione finora

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersDa EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNessuna valutazione finora

- ACCOUNTSDocumento9 pagineACCOUNTSKrishna RainaNessuna valutazione finora

- Chapter One: Accounting Practice and PrinciplesDocumento16 pagineChapter One: Accounting Practice and PrinciplesTesfamlak MulatuNessuna valutazione finora

- 1st Reading Financial Accounting Versus Cost ManagementDocumento6 pagine1st Reading Financial Accounting Versus Cost ManagementDaniel Cortes GNessuna valutazione finora

- Process Financial TNXN TTLM Nigussie BDocumento40 pagineProcess Financial TNXN TTLM Nigussie Bnigus100% (1)

- Cost and Financial AccountingDocumento9 pagineCost and Financial AccountingSrikant RaoNessuna valutazione finora

- Chapter-One: 1.1 BackgroundDocumento25 pagineChapter-One: 1.1 BackgroundSamsher KathayatNessuna valutazione finora

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideDa EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNessuna valutazione finora

- Chapter-1 2022Documento36 pagineChapter-1 2022Makai CunananNessuna valutazione finora

- Cost AccountingDocumento5 pagineCost AccountingArjD' AinNessuna valutazione finora

- MA Cabrera 2010 - SolManDocumento4 pagineMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- BBA - III Yr-Cost Accounting - Unit 1 Amp 2Documento35 pagineBBA - III Yr-Cost Accounting - Unit 1 Amp 2Alba PeaceNessuna valutazione finora

- Chapter 1 2022Documento36 pagineChapter 1 2022Ralph EmmanuelNessuna valutazione finora

- M1 Handout 4 Conceptual Framework of AccountingDocumento9 pagineM1 Handout 4 Conceptual Framework of AccountingAmelia TaylorNessuna valutazione finora

- CHP 1 - OmaDocumento28 pagineCHP 1 - Omapranju_pr8Nessuna valutazione finora

- Q # 1 (A) Ans: Sole ProprietorshipsDocumento6 pagineQ # 1 (A) Ans: Sole ProprietorshipsSyeda TehniatNessuna valutazione finora

- LESSON 6 Accounting Concepts and PrinciplesDocumento5 pagineLESSON 6 Accounting Concepts and PrinciplesUnamadable UnleomarableNessuna valutazione finora

- Assignment: Principles of AccountingDocumento11 pagineAssignment: Principles of Accountingmudassar saeedNessuna valutazione finora

- Costing Accounts AssignmentDocumento7 pagineCosting Accounts AssignmentLionel MuchemwaNessuna valutazione finora

- 1.1 What Is Accounting?Documento38 pagine1.1 What Is Accounting?Viky SinghNessuna valutazione finora

- The Secrets of Accounting and Financial ManagementDa EverandThe Secrets of Accounting and Financial ManagementNessuna valutazione finora

- Ibiye Roject WorkDocumento49 pagineIbiye Roject Workpeter eremieNessuna valutazione finora

- Module 1 PDFDocumento13 pagineModule 1 PDFWaridi GroupNessuna valutazione finora

- Final Term Project 15-01-2020Documento7 pagineFinal Term Project 15-01-2020Muhammad Umer ButtNessuna valutazione finora

- Financial Statement Analysis: Business Strategy & Competitive AdvantageDa EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- Overview of Cost AccountingDocumento21 pagineOverview of Cost AccountingVinayNessuna valutazione finora

- Financial Accounting and ReportingDocumento8 pagineFinancial Accounting and ReportingJulieta Bucod CutarraNessuna valutazione finora

- Introduction To Financial AccountingDocumento19 pagineIntroduction To Financial AccountingRONALD SSEKYANZINessuna valutazione finora

- Conceptual Framework & Accounting Standards: Three Important ActivitiesDocumento12 pagineConceptual Framework & Accounting Standards: Three Important ActivitiesKendiNessuna valutazione finora

- Topic One Cost AccountingDocumento11 pagineTopic One Cost Accountingmercy kirwaNessuna valutazione finora

- Cost AccountingDocumento12 pagineCost AccountingMeenakshi SeerviNessuna valutazione finora

- Accounting Chapter 1 What Is AccountingDocumento32 pagineAccounting Chapter 1 What Is AccountingDaniel LaurenteNessuna valutazione finora

- Cost AccountancyDocumento197 pagineCost AccountancymirjapurNessuna valutazione finora

- 1Documento21 pagine1Na RaunaNessuna valutazione finora

- Chap 2 NotesDocumento3 pagineChap 2 Notes乙คckคrψ YTNessuna valutazione finora

- Chapter 1 AnswerDocumento11 pagineChapter 1 Answerelainelxy2508Nessuna valutazione finora

- Chapter 1 Introduction To AccountingDocumento7 pagineChapter 1 Introduction To AccountingkajsdkjqwelNessuna valutazione finora

- Adieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordsDocumento5 pagineAdieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordspRiNcE DuDhAtRaNessuna valutazione finora

- Unit 1 of Cost Accounting Ggsipu Bba 2nd SemDocumento32 pagineUnit 1 of Cost Accounting Ggsipu Bba 2nd SemAkshansh Singh ChaudharyNessuna valutazione finora

- Cost A:c & BankingDocumento130 pagineCost A:c & BankingAbu anas100% (1)

- Cost Accounting Refers To The Recording of The Transaction Related To The Cost IncurredDocumento3 pagineCost Accounting Refers To The Recording of The Transaction Related To The Cost IncurredFelicity LumapasNessuna valutazione finora

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsDa EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNessuna valutazione finora

- Accountancy: Financial AccountingDocumento5 pagineAccountancy: Financial AccountingIndah PutriNessuna valutazione finora

- Acc 1-4Documento26 pagineAcc 1-4Inzaghi CruiseNessuna valutazione finora

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 1Documento12 pagineSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 1jasperkennedy064% (11)

- Chapter 1 AccDocumento6 pagineChapter 1 AccMarta Fdez-FournierNessuna valutazione finora

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocumento14 pagineCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataNessuna valutazione finora

- Introduce To Management Accounting, An Introduction To Cost Terms and ConceptsDocumento10 pagineIntroduce To Management Accounting, An Introduction To Cost Terms and ConceptsSagung AdvaitaNessuna valutazione finora

- Protiviti Qa We v10n3Documento2 pagineProtiviti Qa We v10n3jayapNessuna valutazione finora

- Chapter-1 Introduction To Accounting and BusinessDocumento17 pagineChapter-1 Introduction To Accounting and BusinessTsegaye Belay100% (1)

- FABM1TGhandouts L23BranchesOfAcctgDocumento2 pagineFABM1TGhandouts L23BranchesOfAcctgKarl Vincent DulayNessuna valutazione finora

- ATKT-A Way To SalvationDocumento1 paginaATKT-A Way To SalvationVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Visishtadhvata-The Pinnacle of Non-DualismDocumento1 paginaVisishtadhvata-The Pinnacle of Non-DualismVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Visishtadhvata-The Pinnacle of Non-DualismDocumento1 paginaVisishtadhvata-The Pinnacle of Non-DualismVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Tiru KK UralDocumento3 pagineTiru KK UralVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Disabled Protection-Global Concern For Disabled.Documento2 pagineDisabled Protection-Global Concern For Disabled.Veeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Av InterestDocumento2.523 pagineAv InterestVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Supthaeshu PrinciplesDocumento1 paginaSupthaeshu PrinciplesVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Direct and Indirect TaxesDocumento2 pagineDirect and Indirect TaxesVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Function Difference Between CA and CMADocumento2 pagineFunction Difference Between CA and CMAVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Concept of HinduismDocumento3 pagineConcept of HinduismVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Extant Tamil and Extinct Other Classical LanguagesDocumento2 pagineExtant Tamil and Extinct Other Classical LanguagesVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Voluntary Cost AuditDocumento5 pagineVoluntary Cost AuditVeeravalli Shrouthasmaarthaathreya AdhvaryuNessuna valutazione finora

- Accounting Standards (Basics)Documento10 pagineAccounting Standards (Basics)Sohail AhmedNessuna valutazione finora

- Finance - For Non-Finance - ExecutivesDocumento4 pagineFinance - For Non-Finance - Executivesabhimani5472Nessuna valutazione finora

- Intermediate Accounting 3 - January 24, 2023, F2F DiscussionDocumento8 pagineIntermediate Accounting 3 - January 24, 2023, F2F DiscussionZhaira Kim CantosNessuna valutazione finora

- CH 04Documento25 pagineCH 04Beast aNessuna valutazione finora

- Accounting CycleDocumento12 pagineAccounting CycleAwais KhanNessuna valutazione finora

- The Auditing and Assurance Standards CouncilDocumento1 paginaThe Auditing and Assurance Standards CouncilJaydie CruzNessuna valutazione finora

- PT Unitex LaptahunanDocumento108 paginePT Unitex LaptahunanbereniceNessuna valutazione finora

- BDO Unibank 2020 Annual Report Financial SupplementsDocumento236 pagineBDO Unibank 2020 Annual Report Financial SupplementsDanNessuna valutazione finora

- Introduction To BookkeepingDocumento92 pagineIntroduction To BookkeepingJosueelialNessuna valutazione finora

- Assumptions - : Cash Flow From Operations $ 0Documento4 pagineAssumptions - : Cash Flow From Operations $ 0Krish HegdeNessuna valutazione finora

- Financial Accounting Weekly PlanDocumento2 pagineFinancial Accounting Weekly PlanASMARA HABIBNessuna valutazione finora

- Deloitte-A Roadmap To Accounting For Income Taxes (Nov2011)Documento505 pagineDeloitte-A Roadmap To Accounting For Income Taxes (Nov2011)mistercobalt3511Nessuna valutazione finora

- GST Configuration in SAP FICODocumento5 pagineGST Configuration in SAP FICOKingpinNessuna valutazione finora

- Overview of Cost Management and StrategyDocumento6 pagineOverview of Cost Management and StrategyMaribeth BetewanNessuna valutazione finora

- Senarai Kursus Pindahan Kredit Fep 011019Documento20 pagineSenarai Kursus Pindahan Kredit Fep 011019CintopanNessuna valutazione finora

- Configuring The General LedgerDocumento7 pagineConfiguring The General LedgerKui MangusNessuna valutazione finora

- Accounting PrinciplesDocumento20 pagineAccounting PrinciplesAlly AsiNessuna valutazione finora

- Understanding Accruals R12 05012013Documento58 pagineUnderstanding Accruals R12 05012013prasanthbab7128Nessuna valutazione finora

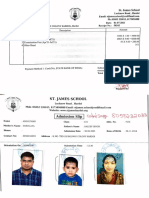

- Admission ST James Naman& AnshuDocumento7 pagineAdmission ST James Naman& AnshuDaleep SinghNessuna valutazione finora

- MODULE 8 Closing and Reversing EntriesDocumento5 pagineMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNessuna valutazione finora

- Final Exam ConceptualDocumento8 pagineFinal Exam ConceptualJun GilloNessuna valutazione finora

- CS2 Speaking TestDocumento9 pagineCS2 Speaking TesthansanakarunanayakeNessuna valutazione finora

- Interimreport 3M 2010 SecoToolsDocumento10 pagineInterimreport 3M 2010 SecoToolsPlant Head PrasadNessuna valutazione finora

- BRSDocumento18 pagineBRSSunandaNessuna valutazione finora

- FA Study Text 2019 PDFDocumento476 pagineFA Study Text 2019 PDFsmlingwa100% (1)

- Material Purchase Procedure and Documentation-1Documento1 paginaMaterial Purchase Procedure and Documentation-1Abdul RehmanNessuna valutazione finora

- Hilton7e PrefaceDocumento37 pagineHilton7e PrefaceErma WulandariNessuna valutazione finora

- 6-4B SolutionDocumento3 pagine6-4B SolutionAnish AdhikariNessuna valutazione finora

- Chapter 16 Advanced Accounting Solution ManualDocumento94 pagineChapter 16 Advanced Accounting Solution ManualVanessa DozonNessuna valutazione finora

- PRTC Manufacturing Co.Documento2 paginePRTC Manufacturing Co.hersheyNessuna valutazione finora