Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Purchase - Principles of Accounting

Caricato da

Abdulla MaseehDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Purchase - Principles of Accounting

Caricato da

Abdulla MaseehCopyright:

Formati disponibili

Business Purchase - Principles Of Accounting

Page 1 of 5

Principles Of Accounting

Principles of Accounting Made Easy

Home Topics Pricacy Policy

Accounting

Contact Us

Balance Sheet Business Credit Loan for Business

Search

Business reporting

Business Opportunity

www.hktdc.com

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/ Business Purchase

A buyer may decide to purchase a business for several reasons. They may include1. An attractive purchase price 2. An opportunity to expand business activities 3. An opportunity to acquire profit making businessUsually the purchaser does not takeover all the assets and liabilities of the vendor (i.e.) the vendor will retain the cash and be left to pay off some or all of the liabilities. Business Purchase price: This is the price to be given by the purchaser to the vendor. The purchaser and the vendor will calculate this price together (usually on the basis of the assets and liabilities taken over by the purchaser) or on the basis of the average profit of the business during the past years. Calculation of Goodwill or Capital Reserves(negative goodwill): Sometimes the purchaser will have to pay for Goodwill or receive Capital Reserve. Goodwill or capital reserve is the difference between net assets and business purchase price. Goodwill / Capital reserve = Business Purchase Price Net Assets (Positive figure is goodwill and negative figure is capital reserve) Factors / reasons for Good will:

Our Free Travel Data Whitepaper Is Essential For Business - Get it Now www.Amadeus.com/BigData

Source quality products at Best SMB Site - hktdc.com

/ http://www.principlesofaccounting2.com/

A person has to pay for goodwill when taking over a business or when admitted as a partner because of Profitability Reputation Locality Public relation Existing business means, the business is being operated and a balance sheet is there for the business at any time. The types of business purchase can be mentioned as follows: a) b) c) d) An individual (a person) purchases a business A partnership or a sole trader acquires the business of a sole trader Two or more sole traders join together to form a partnership A limited company takes over the business of a partnership or a sole trader

Why business purchases are taking places? a) b) c) d) e) To avoid competition ( competition will lead the business to cutthroat and lose) To enjoy the profit of the business which is to be purchased To enlarge the size of the business To avoid the burdens and toil of organizing a new business To enjoy the Good will of the business

Double Entries necessary in the books of the Purchaser.

1. For the assets taken overVarious Assets taken over Business Purchase Dr Cr (including Goodwill)

1. 2. For the liabilities taken overBusiness Purchase Various Liabilities taken over Dr Cr

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

1. 3. For recording the business purchase price-

http://principlesofaccounting2.com/topics/business-purchase/

8/12/2013

Business Purchase - Principles Of Accounting

Page 2 of 5

Business Purchase Vendor

Dr Cr

(with Business Purchase Price)

1. 4.For the capital brought in the businessBank/ Cash Share Capital Dr Cr

1. 5. For recording the payments to vendorVendor Bank / cash Dr Cr

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Key points Only the revalued amounts are considered for the calculation of business purchase price and the purchasers balance sheet shows only these values. In the purchasers books goodwill is always debited as a fixed asset and capital reserve (negative goodwill) is always credited as capital profit.

Q 1.Following is the Balance Sheet of M. Moof as at 31.12.1998.

Assets Land Building

/ http://www.principlesofaccounting2.com/

Furniture Debtors 70 400 Stock Cash in Hand 8 700 1 300 Cash at Bank 4 600 97 400 97 400 G. Grant decided to purchase the business of M. Moof on 01.01.1999. He will take over the assets and liabilities on the following valuationsLand Building Furniture 32 000 23 000 15 000 Debtors Stock Creditors 11 000 9 000 16 000

Liabilities 30 000Creditors 25 000Bank Loan 15 500Capital 12 300

$ 17 000 10 000

He will not take over the cash in hand, cash at bank and bank loan. The purchase price is fixed at $ 80,000.

You are required to calculate the amount of Goodwill and pass journal entries in the books of G. Grant assuming that G. Grant settled the amount payable to M. Moof by cheque. Q 2. M. Martin is a sole trader. His Balance Sheet as on 01.01.1998 was as follows.

Assets Buildings Furniture Fittings Stock Debtors Cash in hand

$ Liabilities 37 000Creditors 20 000Bank Overdraft 10 000Capital 17 000 1 000 2 350 87 350

$ 15 000 3 000 69 350

87 350

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Building at book value Furniture at book value less $ 2 000 depreciation less 10% depreciation

R. Robin decided to purchase the business of M. Martin on 01.01.1998 and he decided to take over all the assets and liabilities except cash in hand and bank overdraft on the following valuations.

http://principlesofaccounting2.com/topics/business-purchase/

8/12/2013

Business Purchase - Principles Of Accounting

Page 3 of 5

Fittings at Debtors at Stock at Creditors

$ 9 000 $ 950 $ 18 500 $ 15 500

The business purchase price was fixed at $ 70 000. He brought into the business sufficient amount of money to settle the business purchase price. You are asked to calculate the Goodwill or Capital Reserve. Prepare Journal Entries in the books of R. Robin assuming that he settled the account by cash on 01.01.1998

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Assets

Q 3.The following Balance Sheet is taken from the books of l. Lawrence on 01.01.1998 on which date he decided to sell his business-

Fixed Assets

Premises Fixtures & Fittings Motor Van

Liabilities Capital 1 00 000Creditors 7 000 4 000 13 000 10 000 4 300 1 38 300

$ 1 26 300 12 000

Current Assets

Stock Debtors Bank

1 38 300

T. Terry decided to purchase the above business and take over all the assets and liabilities except bank balance on the revaluations of the following assets. Premises Stock Furniture & Fittings $ 1 05 000 $ 11 000 $ 5 000

/ http://www.principlesofaccounting2.com/

1995 1996 1997 $ 10 000 $ 12 000 $ 14 000 On 01.01.1998 T. Terry deposited $ 1 55 000 into the business bank account as Capital and settled the business purchase price by cheque. You are required to: a) b) c) Calculate the business purchase price Pass Journal Entries in the books of T. Terry Prepare his Balance Sheet after the purchase transactions are over

T. Terry has to pay an additional amount as Goodwill, which is equal to 2 years purchase of average of past 3 years profits which were:

Q 4. M. Mortan decided to purchase the business of R. Rocky on 01.01.1997. He deposited into the business bank account an amount of $ 80,000, out of which $ 30,000 he borrowed from a bank. The Balance Sheet of R. Rocky on 01.01.1997 was as shown below. Assets Premises Fixtures Stock Debtors Bank $ 50 000Capital 10 000Creditors 9 000 4 000 1 250 74 250 Liabilities $ 60 050 14 200

74 250

It was agreed that:a) M. Mortan should take over all the assets, except the balance at bank, and all liabilities but that the following assets should be revalued: Premises Stock $ 55000 $ 8550

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

1994 1995 $ 12500 $ 13000

b) M. Mortan should pay an additional amount equal to the average profit of R. Rockys business over the last three years. The profits were:

http://principlesofaccounting2.com/topics/business-purchase/

8/12/2013

Business Purchase - Principles Of Accounting

Page 4 of 5

1996

$ 15000

The sale was completed on 01.01.1997 and the payment was made by cheque. (I) Calculate the amount paid for the business by M. Mortan purchase of R. Robbins

(II) Show the Journal Entries necessary in M. Mortans books to record the business.

(III) Assuming no other transactions except the settlement of the business purchase price, calculate M. Mortans working capital.

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

Liabilities Capital Creditors Bank Overdraft $ Assets 1 09 300Land 12 000Buildings 4 200Furniture Fittings Stock Debtors Cash in hand 1 25 500 $ 50 000 40 000 7 500 5 000 12 500 10 000 500 1 25 500

Q 5. Sanal is the owner of a business. His Balance Sheet on 01.01.1998 was as follows.

Amal is also a businessman carrying on a similar business concern. His balance sheet on the above date appeared as follows:

Liabilities Capital Creditors

Amount 110500Land 25000Building Fixtures Stock Debtors

Assets

Amount 70000 30000 7000 12000 10000 2500 4000

/ http://www.principlesofaccounting2.com/

Cash in hand Cash at bank 135500 135500 Amal decided to purchase the business of Sanal on the following conditionsa) b) $ Land Furniture Buildings Fittings Stock Debtors Creditors c) 57 000 7 000 38 000 4 000 13 000 Book value less 1 000 as bad debts 12 200 Amal will take over all the assets and liabilities except bank overdraft and cash in hand. Sanal revalued the assets and liabilities as follows:

The purchase price is fixed at 130800.

d) Amal has to pay an additional amount equal to the average of Sanals Business over the past 3 years profit. The profits were:1995 $ 20 000, 1996 $ 15 000, 1997 $ 10 000.

Amal took a loan from the bank $ 75 000 and the balance amount of business purchase price he arranged from his private property and deposited the amount in the business bank account.. On 01.01.1998 he settled the Business Purchase Price. Required toi) ii) Calculate the Goodwill Prepare the journal entries including the bank transactions

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

iii) Prepare the business purchase account Prepare Amals revised balance sheet after the purchase transactions have been completed. Incoming search terms:

http://principlesofaccounting2.com/topics/business-purchase/

8/12/2013

Business Purchase - Principles Of Accounting

Page 5 of 5

accounting entries for acquisition of a business journal entry goodwill account and capital reserve journal entry for purchase of business how is a business purchase accounting entries business purchase accounts acquisition of business accounting entries acquisition of a company journal entry accounting for the purchase of a business accounting for purchase of new business accounting for purchase of a business

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

http://www.principlesofaccounting2.com

/ http://www.principlesofaccounting2.com/

http://principlesofaccounting2.com/ http://principlesofaccounting2.com/

http://principlesofaccounting2.com/topics/business-purchase/

8/12/2013

Potrebbero piacerti anche

- PDF PDFDocumento7 paginePDF PDFMikey MadRatNessuna valutazione finora

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Documento6 pagineQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNessuna valutazione finora

- Understanding Intangible AssetsDocumento8 pagineUnderstanding Intangible AssetsMya B. Walker100% (1)

- Fbla Practice Stuff - GoldDocumento278 pagineFbla Practice Stuff - Goldapi-239528259100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocumento7 pagineA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNessuna valutazione finora

- T1 - Tutorial MaDocumento10 pagineT1 - Tutorial Matylee970% (1)

- Cashflow Statements IAS 7 - P4Documento10 pagineCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- CH 6 Classpack With SolutionsDocumento20 pagineCH 6 Classpack With SolutionsjimenaNessuna valutazione finora

- Instructions To CandidatesDocumento17 pagineInstructions To CandidatesBiplob K. SannyasiNessuna valutazione finora

- Assignment 3 (f5) 10341Documento8 pagineAssignment 3 (f5) 10341Minhaj AlbeezNessuna valutazione finora

- Zica t1 Financial AccountingDocumento363 pagineZica t1 Financial Accountinglord100% (2)

- Review Questions Final Accounts For A Sole TraderDocumento3 pagineReview Questions Final Accounts For A Sole TraderdhanyasugukumarNessuna valutazione finora

- Past Papers - Partnership ChangesDocumento10 paginePast Papers - Partnership ChangesFarhan JehangirNessuna valutazione finora

- Brkeven Ex2 PDFDocumento1 paginaBrkeven Ex2 PDFSsemakula Frank0% (1)

- Practice Problems Ch12Documento57 paginePractice Problems Ch12Kevin Baconga100% (2)

- Chapter 10 and 11 HWDocumento4 pagineChapter 10 and 11 HWkanielafinNessuna valutazione finora

- BCom Financial Accounting Study Material Notes Branch Accounts PDFDocumento45 pagineBCom Financial Accounting Study Material Notes Branch Accounts PDFsimran32366Nessuna valutazione finora

- Simplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMDocumento378 pagineSimplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMKushagra SoniNessuna valutazione finora

- Manufacturing AccountDocumento15 pagineManufacturing Accountbalachmalik50% (2)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocumento5 pagineIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNessuna valutazione finora

- Frank Wood's Business Accounting (PDFDrive - Com) - 42 PDFDocumento9 pagineFrank Wood's Business Accounting (PDFDrive - Com) - 42 PDFlordNessuna valutazione finora

- Mgt325 m4 Solutions Ch8Documento25 pagineMgt325 m4 Solutions Ch8Matt DavisNessuna valutazione finora

- Chapter # 6 Departmental AccountDocumento36 pagineChapter # 6 Departmental AccountRooh Ullah KhanNessuna valutazione finora

- Accounting SolutionsDocumento11 pagineAccounting SolutionsKrittima Parn SuwanphorungNessuna valutazione finora

- Revaluating partnership assets upon dissolutionDocumento32 pagineRevaluating partnership assets upon dissolutionERICK MLINGWANessuna valutazione finora

- 201.01 Financial Statements From Incomplete Information - CMA - PL-II - AFA-I - Special Class No. 01 - 1st SessionDocumento15 pagine201.01 Financial Statements From Incomplete Information - CMA - PL-II - AFA-I - Special Class No. 01 - 1st SessionBiplob K. SannyasiNessuna valutazione finora

- Chapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) BudgetDocumento35 pagineChapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) Budgetፍቅር እስከ መቃብርNessuna valutazione finora

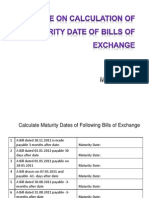

- Calculation of Maturity DateDocumento4 pagineCalculation of Maturity Dateyogeshdhuri22Nessuna valutazione finora

- Exercises Budgeting ACCT2105 3s2010Documento7 pagineExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Accounts Ques Nov06Documento48 pagineAccounts Ques Nov06api-3825774Nessuna valutazione finora

- NFRS 15 - Revenue From Contracts With CustomerDocumento18 pagineNFRS 15 - Revenue From Contracts With CustomerApilNessuna valutazione finora

- Adjusting Entries & Questions PDFDocumento18 pagineAdjusting Entries & Questions PDFshahroz QadriNessuna valutazione finora

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocumento17 pagineACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNessuna valutazione finora

- Fair ValueDocumento8 pagineFair Valueiceman2167Nessuna valutazione finora

- Financial Reporting WDocumento345 pagineFinancial Reporting Wgordonomond2022Nessuna valutazione finora

- Finance Chapter 17Documento30 pagineFinance Chapter 17courtdubs75% (4)

- Exercises On Issue of Shares and DebenturesDocumento6 pagineExercises On Issue of Shares and Debenturesontykerls100% (1)

- Question 3: Ias 8 Policies, Estimates & ErrorsDocumento2 pagineQuestion 3: Ias 8 Policies, Estimates & ErrorsamitsinghslideshareNessuna valutazione finora

- ManufacturingDocumento6 pagineManufacturingapi-3034896990% (1)

- Accounting For LeasesDocumento9 pagineAccounting For LeasesNelson Musili100% (3)

- Chapter 21Documento4 pagineChapter 21Rahila RafiqNessuna valutazione finora

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionDocumento41 pagineIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadNessuna valutazione finora

- Homework Chapter 18 and 19Documento7 pagineHomework Chapter 18 and 19doejohn150Nessuna valutazione finora

- JOB, BATCH AND SERVICE COSTING-lesson 11Documento22 pagineJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNessuna valutazione finora

- Selling Goods Through Agents: Consignment Accounts ExplainedDocumento43 pagineSelling Goods Through Agents: Consignment Accounts ExplainedSWAPNA IS FUNNYNessuna valutazione finora

- JB Limited Is A Small Specialist Manufacturer of Electronic ComponentsDocumento2 pagineJB Limited Is A Small Specialist Manufacturer of Electronic ComponentsAmit PandeyNessuna valutazione finora

- Wiley - Chapter 7: Cash and ReceivablesDocumento33 pagineWiley - Chapter 7: Cash and ReceivablesIvan Bliminse100% (2)

- Management Science FinalDocumento8 pagineManagement Science FinalAAUMCLNessuna valutazione finora

- Additional topics in variance analysisDocumento33 pagineAdditional topics in variance analysisAnthony MaloneNessuna valutazione finora

- E-14 AfrDocumento5 pagineE-14 AfrInternational Iqbal ForumNessuna valutazione finora

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocumento4 pagineBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Revision Test Paper CAP II Dec 2017Documento163 pagineRevision Test Paper CAP II Dec 2017Dipen AdhikariNessuna valutazione finora

- 109Documento34 pagine109danara1991Nessuna valutazione finora

- 12Documento82 pagine12Alex liaoNessuna valutazione finora

- BUSI 353 S18 Assignment 5 SOLUTIONDocumento5 pagineBUSI 353 S18 Assignment 5 SOLUTIONTan100% (2)

- Financial Accounting 2Documento89 pagineFinancial Accounting 2Colince johnson0% (1)

- Property, Plant and Equipment Notes for Ntlale LimitedDocumento10 pagineProperty, Plant and Equipment Notes for Ntlale LimitedJohn Ibrahim James MohammadNessuna valutazione finora

- Chapter 1 & 2Documento33 pagineChapter 1 & 2ENG ZI QINGNessuna valutazione finora

- f3 Financial AccountingDocumento11 paginef3 Financial AccountingSam KhanNessuna valutazione finora

- Payroll Accounting - Principles of AccountingDocumento7 paginePayroll Accounting - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Company Accounts - Principles of AccountingDocumento9 pagineCompany Accounts - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Rectification of Errors - Principles of AccountingDocumento7 pagineRectification of Errors - Principles of AccountingAbdulla Maseeh100% (1)

- Partnership - Principles of AccountingDocumento9 paginePartnership - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Clubs and Societies - Principles of AccountingDocumento3 pagineClubs and Societies - Principles of AccountingAbdulla Maseeh100% (1)

- Double Entry Bookkeeping - T-AccountsDocumento4 pagineDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Final Accounts With Adjustments - Principles of AccountingDocumento9 pagineFinal Accounts With Adjustments - Principles of AccountingAbdulla Maseeh100% (1)

- Manufacturing Accounts - Principles of AccountingDocumento6 pagineManufacturing Accounts - Principles of AccountingAbdulla Maseeh100% (1)

- Incomplete Records - Principles of AccountingDocumento8 pagineIncomplete Records - Principles of AccountingAbdulla Maseeh100% (2)

- Departmental Accounts - Principles of AccountingDocumento3 pagineDepartmental Accounts - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Final Accounts - Principles of AccountingDocumento9 pagineFinal Accounts - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Bad Debts and Provision For Bad Debt - Principles of AccountingDocumento7 pagineBad Debts and Provision For Bad Debt - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Depreciation and Assets Disposal - Principles of AccountingDocumento8 pagineDepreciation and Assets Disposal - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Control Accounts - Principles of AccountingDocumento7 pagineControl Accounts - Principles of AccountingAbdulla Maseeh67% (3)

- Cash Book - Principles of AccountingDocumento13 pagineCash Book - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Books of Prime Entry and Ledgers - Principles of AccountingDocumento10 pagineBooks of Prime Entry and Ledgers - Principles of AccountingAbdulla Maseeh100% (1)

- Accounting Rules - Principles of AccountingDocumento5 pagineAccounting Rules - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Bank Reconciliation Statement - Principles of AccountingDocumento8 pagineBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Accounting Ratios - Principles of AccountingDocumento5 pagineAccounting Ratios - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Accruals and Prepayments - Principles of AccountingDocumento6 pagineAccruals and Prepayments - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Amalgamation - Principles of AccountingDocumento4 pagineAmalgamation - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Accounting Concepts - Principles of AccountingDocumento3 pagineAccounting Concepts - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Introduction To Accounting - Principles of AccountingDocumento178 pagineIntroduction To Accounting - Principles of AccountingAbdulla MaseehNessuna valutazione finora

- Directorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Documento76 pagineDirectorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Pankaj kumarNessuna valutazione finora

- Interest Rate Risk and Bond PricesDocumento61 pagineInterest Rate Risk and Bond PricesMarwa HassanNessuna valutazione finora

- LD Case Study - Auditing Leases (PARTICIPANT)Documento26 pagineLD Case Study - Auditing Leases (PARTICIPANT)Jefri SNessuna valutazione finora

- MEPCO ONLINE BILL KamiDocumento1 paginaMEPCO ONLINE BILL KamiMisali SchoolNessuna valutazione finora

- Affidavit for Housing Loan SubsidyDocumento2 pagineAffidavit for Housing Loan Subsidyatul lengareNessuna valutazione finora

- 1 - Introduction - Our Changing World and The Evolution of CSRDocumento17 pagine1 - Introduction - Our Changing World and The Evolution of CSRMariana CorreiaNessuna valutazione finora

- MCQs Financial AccountingDocumento12 pagineMCQs Financial AccountingPervaiz ShahidNessuna valutazione finora

- Principles of Sound Lending ExplainedDocumento2 paginePrinciples of Sound Lending ExplainedRajat Das100% (1)

- State Bank of India Welcomes You To Explore The World of Premier Bank in IndiaDocumento4 pagineState Bank of India Welcomes You To Explore The World of Premier Bank in Indiakishan kanojiaNessuna valutazione finora

- Unit 2: Financial Analysis 2.0 Aims and ObjectivesDocumento13 pagineUnit 2: Financial Analysis 2.0 Aims and ObjectiveshabtamuNessuna valutazione finora

- An Overview of Money Laundering Causes, Methods and EffectsDocumento46 pagineAn Overview of Money Laundering Causes, Methods and EffectsMunir Ahmed KakarNessuna valutazione finora

- IVALIFE - IVApension Policy BookletDocumento12 pagineIVALIFE - IVApension Policy BookletJosef BaldacchinoNessuna valutazione finora

- Final AccountsDocumento15 pagineFinal AccountsVaishnavi VyapariNessuna valutazione finora

- Investment Appraisal Camb AL New (1) RIKZY EESADocumento14 pagineInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabNessuna valutazione finora

- Golis University: Faculty of Business and Economics Chapter Five Income StatementDocumento21 pagineGolis University: Faculty of Business and Economics Chapter Five Income Statementsaed cabdiNessuna valutazione finora

- Sprott Gold Report: The Gold Investment Thesis RevisitedDocumento8 pagineSprott Gold Report: The Gold Investment Thesis RevisitedOwm Close CorporationNessuna valutazione finora

- Components of Balance of Payments I: NtroductionDocumento3 pagineComponents of Balance of Payments I: NtroductionSamuel HranlehNessuna valutazione finora

- Identify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetDocumento1 paginaIdentify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetTitser JeffNessuna valutazione finora

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFDocumento23 pagineAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DNessuna valutazione finora

- SALN 2022 TolentinoDocumento2 pagineSALN 2022 TolentinoDexter TolentinoNessuna valutazione finora

- Corporate InvestmentDocumento20 pagineCorporate InvestmentJuan Manuel FigueroaNessuna valutazione finora

- Cba Sonia Ustinov 010318 - 260518Documento3 pagineCba Sonia Ustinov 010318 - 260518Ranji SoulNessuna valutazione finora

- FormulaDocumento10 pagineFormulaAngel Alejo Acoba100% (1)

- Portfolio Investment ProcessDocumento17 paginePortfolio Investment ProcessPrashant DubeyNessuna valutazione finora

- Chapter 5 HW Compound Interest QuestionsDocumento4 pagineChapter 5 HW Compound Interest QuestionsAshish Bhalla0% (1)

- FAR Notes-DoneDocumento122 pagineFAR Notes-DoneJovylyn Balbines LictagNessuna valutazione finora

- Fund Transfer Request - Combined Form: RTGS/NEFT/DD Issuance/RBL Account To Account Transfer (ATAT)Documento1 paginaFund Transfer Request - Combined Form: RTGS/NEFT/DD Issuance/RBL Account To Account Transfer (ATAT)shri halaNessuna valutazione finora

- CFA Level 1 - Test 2 - AMDocumento35 pagineCFA Level 1 - Test 2 - AMHongMinhNguyenNessuna valutazione finora

- United States v. John Napoli, A/K/A John Bianco, A/K/A "Vince," Barry D. Pincus Robert San Filippo Darrin Wigger, 179 F.3d 1, 2d Cir. (1999)Documento25 pagineUnited States v. John Napoli, A/K/A John Bianco, A/K/A "Vince," Barry D. Pincus Robert San Filippo Darrin Wigger, 179 F.3d 1, 2d Cir. (1999)Scribd Government DocsNessuna valutazione finora

- 1) History: Evolution of Indian Banking SectorDocumento8 pagine1) History: Evolution of Indian Banking SectorPuneet SharmaNessuna valutazione finora