Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1) Introduction To Forex - Major Currencies 1

Caricato da

shubh_braTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1) Introduction To Forex - Major Currencies 1

Caricato da

shubh_braCopyright:

Formati disponibili

OFB

Introduction to Forex - Basics

Table of Contents

History of forex market

1) Introduction to Forex Major Currencies

a) The U.S. Dollar. b) The Euro. c) The Japanese Yen. d) The British Pound. e) The Swiss Franc. We will do the practical study (7 days) the above said factors are affecting the market or not Introduction to forex financial products

2) Introduction to Forex - Concepts and Terminologies

a) Spot rate b) Bid & ask c) Base currency and counter currency d) Quotes in terms of base currency e) Basis points or 'pips' f) Euro cross & cross rates introduction to fprex-factors affecting the forex market

3) Introduction to Forex - Profit and Loss 4) Introduction to Forex - Understanding Margins 5) Introduction to Forex - Order Types

a) Market Order b) Limit Order c) Stop Order d) Once Cancels the Other (OCO) e) IF DONE Order

5 6 7

www.orientfinance.com

OFB

Introduction to Forex - Basics

1) Introduction to Forex - Major Currencies

a) The U.S. Dollar. The United States dollar is the world's main currency an universal measure to evaluate any other currency traded on Forex. All currencies are generally quoted in U.S. dollar terms. Under conditions of international economic and political unrest, the U.S. dollar is the main safe-haven currency, which was proven particularly well during the Southeast Asian crisis of 1997-1998. As it was indicated, the U.S. dollar became the leading currency toward the end of the Second World War along the Breton Woods Accord, as the other currencies were virtually pegged against it. The introduction of the euro in 1999 reduced the dollar's importance only marginally. The other major currencies traded against the U.S. dollar are the euro, Japanese yen, British pound, and Swiss franc. b) The Euro. The euro was designed to become the premier currency in trading by simply being quoted in American terms. Like the U.S. dollar, the euro has a strong international presence stemming from members of the European Monetary Union. The currency remains lagued by unequal growth, high unemployment, and government resistance to structural changes. The pair was also weighed in 1999 and 2000 by outflows from foreign investors, particularly Japanese, who were forced to liquidate their losing investments in euro-denominated assets. Moreover, European money managers rebalanced their portfolios and reduced their euro exposure as their needs for hedging currency risk in Europe declined. c) The Japanese Yen. The Japanese yen is the third most traded currency in the world; it has a much smaller international presence than the U.S. dollar or the euro. The yen is very liquid around the world, practically around the clock. The natural demand to trade the yen concentrated mostly among the Japanese keiretsu, the economic and financial conglomerates. The yen is much more sensitive to the fortunes of the Nikkei index, the Japanese stock market, and the real estate market. d) The British Pound. Until the end of World War II, the pound was the currency of reference. The currency is heavily traded against the euro and the U.S. dollar, but has a spotty presence against other currencies. Prior to the introduction of the euro, both the pound benefited from any doubts about the currency convergence. After the introduction of the euro, Bank of England is attempting to bring the high U.K. rates closer to the lower rates in the euro zone. The pound could join the euro in the early 2000s, provided that the U.K. referendum is positive. e) The Swiss Franc. The Swiss franc is the only currency of a major European country that belongs neither to the European Monetary Union nor to the G-7 countries. Although the Swiss economy is relatively small, the Swiss franc is one of the four major currencies, closely resembling the strength and quality of the Swiss economy and finance. Switzerland has a very close economic relationship with Germany, and thus to

www.orientfinance.com

OFB

Introduction to Forex - Basics

the euro zone. Therefore, in terms of political uncertainty in the East, the Swiss franc is favored generally over the euro. Typically, it is believed that the Swiss franc is a stable currency. Actually, from a foreign exchange point of view, the Swiss franc closely resembles the patterns of the euro, but lacks its liquidity. As the demand for it exceeds supply, the Swiss franc can be more volatile than the euro.

2) Introduction to Forex - Concepts and Terminologies

Here are some important concepts/terminologies of Forex. a) Spot rate A spot transaction is a straightforward (or outright) exchange of one currency for another. The spot rate is the current market price or 'cash' rate. Spot transactions do not require immediate settlement, or payment 'on the spot'. By convention, the settlement date, or value date, is the second business day after the deal date on which the transaction is made by the two parties. b) Bid & ask In the foreign exchange market (and essentially in all markets) there is a buying and selling price. It is important to perceive these prices as a reflection of market condition. A market maker is expected to quote simultaneously for his customers both a price at which he is willing to buy (the bid) and a price at which he is willing to sell (the ask) standard amounts of any currency for which he is making a market. Generally speaking the difference between the bid and ask rates reflect the level of liquidity in a certain instrument. On a normal trading day, the major currency pairs EURUSD, USDJPY, USDCHF and GBPUSD are traded by a multitude of market participant every few seconds. High liquidity means that there is always a seller for your buy and a buyer for your sell at actual prices. c) Base currency and counter currency Every foreign exchange transaction involves two currencies. It is important to keep straight which is the base currency and which is the counter currency. The counter currency is the numerator and the base currency is the denominator. When the counter currency increases, the base currency strengthens and becomes more expensive. When the counter currency decreases, the base currency weakens and becomes cheaper. In telephone trading communications, the base currency is always stated first. For example, a quotation for USDJPY means the US dollar is the base and the yen is the counter currency. In the case of GBPUSD (usually called 'cable') the British pound is the base and the US dollar is the counter currency. d) Quotes in terms of base currency Traders always think in terms of how much it costs to buy or sell the base currency. When a quote of 1.1750 / 53 is given that means that a trader can buy EUR against USD at 1.1753. If he is buying EURUSD for 1'000'000 at that rate he would have USD 1,175,300 in exchange for his million Euro. Of course traders are not actually interested in exchanging large amounts of different currency, their main focus is to buy at a low rate and sell at higher one. e) Basis points or 'pips' For most currencies, bid and offer quotes are carried down to the fourth decimal place. That represents one-hundredth of one percent, or 1/10,000th of the counter currency unit, usually called a

www.orientfinance.com

OFB

Introduction to Forex - Basics

'pip'. However, for a few currency units that are relatively small in absolute value, such as the Japanese yen, quotes may be carried down to two decimal places and a 'pip' is 1/100th of the terms currency unit. In foreign exchange, a 'pip' is the smallest amount by which a price may fluctuate in that market. f) Euro cross & cross rates Euro cross rates are currency pairs that involve the Euro currency versus another currency. Examples of Euro crosses are EURJPY, EURCHF and GBPEUR. Currency pairs that involve neither the Euro nor the US dollar are called cross rates. Examples of cross rates are GBPJPY and CHFJPY. Of course hundreds of cross rates exist involving exotic currency pairs but they are often plagued by low liquidity. Ever since the Euro the number of liquid cross rates have decreased and have been replaced (to a certain extent) by Euro crosses.

www.orientfinance.com

OFB

Introduction to Forex - Basics

3) Introduction to Forex - Profit and Loss

Profit and Loss (P&L) for every position is calculated in real-time on most trading platforms. This enables traders to track their P&L tick by tick as the market fluctuates. Approximate USD values for a one (1) "pip" move per contract in our traded currency pairs are as follows, per 100,000 units of the base currency: EURUSD 1 pip = 0.0001 1 pip move per 100k (lot) = EUR 100'000 x .0001 = USD 10.00 USDJPY 1 pip = 0.01 1 pip move per 100k (lot) = USD 100'000 x .01 = JPY 1'000 /spot = approx USD 9.7 USDCHF 1 pip = 0.0001 1 pip move per 100k (lot ) = USD 100'000 x .0001 = CHF 10.00 /spot = approx USD 8.5 GBPUSD 1 pip = 0.0001 1 pip move per 100k (lot ) = GBP 100'000 x .0001 = USD 10.00 EURJPY 1 pip = 0.01 1 pip move per 100k (lot ) = EUR 100'000 x .01 = JPY 1'000 /spot = approx USD 9.7 EURCHF 1 pip = 0.0001 1 pip move per 100k (lot ) = EUR 100'000 x .0001 = CHF 10.00 /spot = approx USD 8.5 EURGBP 1 pip = 0.0001 1 pip move per 100k (lot ) = EUR 100'000 x .0001 = GBP 10.00 /spot = approx USD 19.00 USDCAD 1 pip = 0.0001 1 pip move per 100k (lot ) = USD 100'000 x .0001= CAD 10.00 /spot = approx USD 8.00 AUDUSD 1 pip = 0.0001 1 pip move per 100k (lot ) = AUD 100'000 x .0001 = USD 10.00 On a typical day, liquid currency pairs like EUR/USD and USD/JPY can fluctuate a full point (.0100, 100 pips). On a EUR 1'000'000 position a full point on EUR/USD equates to 10'000 USD.

www.orientfinance.com

OFB

Introduction to Forex - Basics

4) Introduction to Forex - Understanding Margins

Trading on a margined basis in foreign exchange is not a complicated concept as some may make it out to be. The easiest way to view margin trading is like this: Essentially when a trader trades on margin he is using a free short-term credit allowance from the institution that is offering the margin. This short-term credit allowance is used to purchase an amount of currency that greatly exceeds the account value of the trader. Let's take the following example: Example: Trader x has an account with EUR 50'00. He trades ticket sizes of 100'000 EUR/USD. This equates to a margin ratio of 2% (2000 is 2% of 100'000). How can trader x trade 50 times the amount of money he has at his disposal? The answer is that the OFB temporarily gives the necessary credit to make the transaction s/he is interested in making. Without margin, trader x would only be able to buy or sell tickets of 2000 at a time. On standard accounts OFB applies a minimum 2% margin. Margin serves as collateral to cover any losses that you might incur. Since nothing is actually being purchased or sold for delivery, the only requirement, and indeed the only real purpose for having funds in your account, is for sufficient margin.

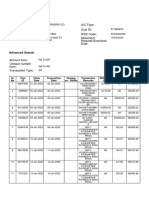

An Example

A Foreign exchange quote , e.g. EUR/USD "1.2700 /03" represents the bid / offer spread in this case for EUR / USD. The rate of 1.2703 is the rate at which you can Buy EUR against the US Dollar. The rate of 1.2700 is the rate at which you can Sell EUR against the US Dollar.

Opening Trade

Price Shown Sell Price Quantity size Margin Required (2%) Commission

1.2700 Bid / 03 Offer

1.2703 100,000 100,000 x 1.2703 x 2% = $2,540.6 $20.00

The Euro appreciates against the US Dollar and the client wishes to close the position. OFB is now quoting 1.2750 / 1.2753.

Closing Trade

www.orientfinance.com

OFB

Introduction to Forex - Basics

Price Shown Buy Price Price/point movement Gross profit/loss

1.2750 Bid / 1.2753 offer 1.2753

50 points 50 x $10 = $500.00 profit

Net profit/(loss)

$ 500 (Commission $ 20) = $480

5) Introduction to Forex - Order Types

a) Market Order An order to buy or sell which is to be done at the price immediately available: the 'spot' rate, the current ratres at which the market is dealing. b) Limit Order An instruction to deal if a market moves to a more favorable level (i.e. an instruction to buy if a market goes down to a specified level or to sell if a market goes up to a specified level) is called a Limit Order. A Limit Order is often used to take profit on an existing position but can also be used to establish a new one. c) Stop Order An instruction nto deal if a market moves to a less favorable level (i.e. an instruction nto buy if a market goes up to a specified level, or to sell if a market goes down to a specified level) is called a Stop Order. A Stop Order is often placed to put a cap on the potential loss on an existing position; which is why Stop Orders are sometimes called Stop-loss Orders. But can be used to entere into a new position if the market breaks a certain level. d) Once Cancels the Other (OCO) An 'OCO' (One Cancels the Other) Order is a special type of Order where a Stop Order and a Limit Order in the same market are linked together. With an OCO Order, the execution of one of the two linked Orders results in the automatic cancellation of the other Order. e) IF DONE Order An IF DONE Order is a two-legged order in which the execution of the second leg can occur only after the conditions of the first leg have been satisfied. The first leg, either a Stop or a Limit, is created in an active state and the second, which can be a Stop, a Limit, or an OCO, is created in a dormant state. When the desired price is reached for the first leg, it is executed and the second leg is then activated.

www.orientfinance.com

Potrebbero piacerti anche

- An easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketDa EverandAn easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketValutazione: 5 su 5 stelle5/5 (2)

- Introduction To Forex (English)Documento7 pagineIntroduction To Forex (English)B.INessuna valutazione finora

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Da EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.Nessuna valutazione finora

- FX Markets and Exchange RatesDocumento15 pagineFX Markets and Exchange RatesKath LeynesNessuna valutazione finora

- Role of RBI in FOREX MarketDocumento14 pagineRole of RBI in FOREX Marketlagfdf88Nessuna valutazione finora

- Introduction To Foreign Exchange Rates, Second EditionDocumento32 pagineIntroduction To Foreign Exchange Rates, Second EditionCharleneKronstedt100% (1)

- Topic 7 - FE Markets 2015 FVDocumento57 pagineTopic 7 - FE Markets 2015 FVJje JjeNessuna valutazione finora

- Forex Trading Guide & Tutorial For Beginner: Website: EmailDocumento53 pagineForex Trading Guide & Tutorial For Beginner: Website: EmailSalman LabiadhNessuna valutazione finora

- Week 2 Tutorial QuestionsDocumento4 pagineWeek 2 Tutorial QuestionsWOP INVESTNessuna valutazione finora

- Foreign Exchange MarketDocumento25 pagineForeign Exchange MarketKiran Kumar KuppaNessuna valutazione finora

- Finibrain Services PVT LTD: What Is Forex (FX)Documento8 pagineFinibrain Services PVT LTD: What Is Forex (FX)Chandan ArunNessuna valutazione finora

- Foreign Exchange Rates, Introduction ToDocumento202 pagineForeign Exchange Rates, Introduction ToKulbir Singh100% (1)

- Chapter 1Documento37 pagineChapter 1Elma UmmatiNessuna valutazione finora

- Introduction FX NewDocumento17 pagineIntroduction FX NewRahul ChalisgaonkarNessuna valutazione finora

- Introduction To Forex TradingDocumento8 pagineIntroduction To Forex TradingGauravSinghNessuna valutazione finora

- New Microsoft Word DocumentDocumento17 pagineNew Microsoft Word Documentmahesh_zorrick8907Nessuna valutazione finora

- Forex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David CDocumento74 pagineForex Trading Course - Turn $1,260 Into $12,300 in 30 Days by David Capi-3748231Nessuna valutazione finora

- #1 Forex Trading CourseDocumento63 pagine#1 Forex Trading Courseitsrijo100% (1)

- Euro EconomyDocumento26 pagineEuro EconomyJinal ShahNessuna valutazione finora

- Lecture 21 ME Ch.15 Foreign Exchange MarketDocumento50 pagineLecture 21 ME Ch.15 Foreign Exchange MarketAlif SultanliNessuna valutazione finora

- CH 11 - International Finance - NurhaiyyuDocumento62 pagineCH 11 - International Finance - NurhaiyyukkNessuna valutazione finora

- Introduction To TradingDocumento29 pagineIntroduction To TradingMario Galindo QueraltNessuna valutazione finora

- 1 Exchange Rates FX MarketDocumento11 pagine1 Exchange Rates FX Marketreamadeus820905Nessuna valutazione finora

- Currency Exchange RatesDocumento37 pagineCurrency Exchange RatesPrachi Gupta100% (1)

- The Foreign Exchange MarketDocumento145 pagineThe Foreign Exchange MarketNikita JoshiNessuna valutazione finora

- Starter: Focus Group: Options VideoDocumento19 pagineStarter: Focus Group: Options VideoPradeepPattarNessuna valutazione finora

- Forexpresentation-Rotaru G.C.Documento18 pagineForexpresentation-Rotaru G.C.George Cristinel RotaruNessuna valutazione finora

- Forex GuideDocumento6 pagineForex GuideMukund FarjandNessuna valutazione finora

- Contemporary Prelim 3Documento7 pagineContemporary Prelim 3kokero akunNessuna valutazione finora

- Pairs Stock MarketDocumento3 paginePairs Stock MarketManish HarlalkaNessuna valutazione finora

- Foreig N Excha NGE Marke TSDocumento77 pagineForeig N Excha NGE Marke TSIrish Jane Patricio AcumanNessuna valutazione finora

- Module 3 Lesson 3Documento15 pagineModule 3 Lesson 3Marivic TolinNessuna valutazione finora

- Chapter Fourteen Foreign Exchange RiskDocumento14 pagineChapter Fourteen Foreign Exchange Risknmurar01Nessuna valutazione finora

- Forex Trading CourseDocumento69 pagineForex Trading Courseapi-3703868Nessuna valutazione finora

- Chapter Eight: 8. Foriegn Exchange MarketsDocumento26 pagineChapter Eight: 8. Foriegn Exchange MarketsNhatty WeroNessuna valutazione finora

- Forex or Currency Futures?: See More AboutDocumento3 pagineForex or Currency Futures?: See More AboutpranabanandarathNessuna valutazione finora

- Foreign Exchange: Level 1 Forex Intro - Currency TradingDocumento6 pagineForeign Exchange: Level 1 Forex Intro - Currency Tradingmohamad hifzhanNessuna valutazione finora

- Introduction To Foreign Exchange MarketsDocumento16 pagineIntroduction To Foreign Exchange MarketsMalik BilalNessuna valutazione finora

- Forex Free E-Book1Documento17 pagineForex Free E-Book1clickgold2Nessuna valutazione finora

- The Demand For and Supply of A Currency: Exchange RateDocumento9 pagineThe Demand For and Supply of A Currency: Exchange RateAzharNessuna valutazione finora

- Topic 1Documento30 pagineTopic 1jainsumit_shndNessuna valutazione finora

- Foreign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolDocumento47 pagineForeign Exchange Markets: Prof Mahesh Kumar Amity Business SchoolasifanisNessuna valutazione finora

- Chapter - 1: An Analytical Study On Gold On Commodity MarketDocumento90 pagineChapter - 1: An Analytical Study On Gold On Commodity MarketGauravsNessuna valutazione finora

- Financial Forces: (Business Incident, Fluctuating Currency Values, and Foreign Exchange Quotations)Documento3 pagineFinancial Forces: (Business Incident, Fluctuating Currency Values, and Foreign Exchange Quotations)Christine LuarcaNessuna valutazione finora

- Ch02 Foreign Exchange MarketsDocumento8 pagineCh02 Foreign Exchange MarketsPaw VerdilloNessuna valutazione finora

- 3.2 Exchange RatesDocumento26 pagine3.2 Exchange Ratestaufeek_irawan7201Nessuna valutazione finora

- Role of RBI in FOREX MarketDocumento14 pagineRole of RBI in FOREX Marketcoolboy60375% (8)

- Screenshot 2022-08-20 at 12.30.26 PMDocumento32 pagineScreenshot 2022-08-20 at 12.30.26 PMfavour okparaNessuna valutazione finora

- Forex Currency Trading ExplainedDocumento11 pagineForex Currency Trading ExplainedDemi Sanya100% (1)

- Basic ForexDocumento76 pagineBasic ForexCPaul DonaldoNessuna valutazione finora

- Lecture 2. Foreign Exchange Market and Exchange RateDocumento27 pagineLecture 2. Foreign Exchange Market and Exchange RatePhan Hoang Que Phuong B2112395Nessuna valutazione finora

- Advance Financial Accounting Assignment 2Documento45 pagineAdvance Financial Accounting Assignment 2chanie TeshomeNessuna valutazione finora

- The Foreign Exchange Market: QuestionsDocumento3 pagineThe Foreign Exchange Market: QuestionsCarl AzizNessuna valutazione finora

- Forex 2023Documento55 pagineForex 2023Sammy MosesNessuna valutazione finora

- Evolution and Future of ForexDocumento44 pagineEvolution and Future of Forexsushant1903Nessuna valutazione finora

- Introduction To Foreign ExchangeDocumento17 pagineIntroduction To Foreign Exchangepstmdrn2gNessuna valutazione finora

- Ifm 1Documento36 pagineIfm 1Dheeraj UppiNessuna valutazione finora

- Introduction To Forex Trading PDFDocumento25 pagineIntroduction To Forex Trading PDFEdy Engl100% (1)

- Module 3 - The Exchange Rate Risk ManagementDocumento9 pagineModule 3 - The Exchange Rate Risk ManagementMarjon DimafilisNessuna valutazione finora

- Consumers Behaviour Towards eDocumento9 pagineConsumers Behaviour Towards eshubh_braNessuna valutazione finora

- Business Project Weight LossDocumento18 pagineBusiness Project Weight Lossshubh_bra100% (1)

- Vaastu RemediesDocumento18 pagineVaastu Remediesshubh_bra0% (1)

- University Grants Commission New DelhiDocumento2 pagineUniversity Grants Commission New Delhishubh_braNessuna valutazione finora

- Keto With CRPDocumento13 pagineKeto With CRPshubh_braNessuna valutazione finora

- World For Pollution".: X'LN$F FreqfurffiDocumento2 pagineWorld For Pollution".: X'LN$F Freqfurffishubh_braNessuna valutazione finora

- Praposal ScaleDocumento1 paginaPraposal Scaleshubh_braNessuna valutazione finora

- Advisory SlagDocumento15 pagineAdvisory Slagshubh_braNessuna valutazione finora

- Psychosocial Study of RaggingDocumento252 paginePsychosocial Study of Raggingshubh_braNessuna valutazione finora

- Affirmative ScaleDocumento10 pagineAffirmative Scaleshubh_braNessuna valutazione finora

- Emotinal InteligenceDocumento1 paginaEmotinal Inteligenceshubh_braNessuna valutazione finora

- Self Visionary BookDocumento26 pagineSelf Visionary Bookshubh_braNessuna valutazione finora

- Subscription FormDocumento1 paginaSubscription Formshubh_braNessuna valutazione finora

- Rich Dad Poor Dad PresentationDocumento31 pagineRich Dad Poor Dad Presentationbindu15100% (1)

- Guidelines On Securitisation of Standard AssetsDocumento14 pagineGuidelines On Securitisation of Standard AssetsPrianca GalaNessuna valutazione finora

- Lecture Sheet 07Documento10 pagineLecture Sheet 07Rj Aritro SahaNessuna valutazione finora

- Neighborhood 3 B29 L19Documento4 pagineNeighborhood 3 B29 L19Kate CastañaresNessuna valutazione finora

- Draft Version - Article On Cross Collateralization-C1Documento6 pagineDraft Version - Article On Cross Collateralization-C1Rohit Anand DasNessuna valutazione finora

- Global Market Outlook - Trends in Real Estate Private EquityDocumento20 pagineGlobal Market Outlook - Trends in Real Estate Private EquityYana FominaNessuna valutazione finora

- Currency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, ToDocumento3 pagineCurrency Hedging: Currency Hedging Is The Use of Financial Instruments, Called Derivative Contracts, Tovivekananda RoyNessuna valutazione finora

- Capital Structure Theories AssumptionsDocumento1 paginaCapital Structure Theories AssumptionsKamala Kris100% (1)

- Control AccountingDocumento7 pagineControl AccountingAmir RuplalNessuna valutazione finora

- Indian Bank Debit Card Application Form 1Documento2 pagineIndian Bank Debit Card Application Form 1Devil World0% (1)

- Financial Management For ArchitectsDocumento10 pagineFinancial Management For ArchitectsARD SevenNessuna valutazione finora

- Foreign Exchange RiskDocumento5 pagineForeign Exchange RiskPushpa BaruaNessuna valutazione finora

- JAIIB-PPB-Free Mock Test - JAN 2022Documento3 pagineJAIIB-PPB-Free Mock Test - JAN 2022kanarendranNessuna valutazione finora

- Chapter 4 - Partnership LiquidationDocumento4 pagineChapter 4 - Partnership LiquidationMikaella BengcoNessuna valutazione finora

- Agreement IBBA-HCIM - V20211026 SignedDocumento16 pagineAgreement IBBA-HCIM - V20211026 SignedНизами КеримовNessuna valutazione finora

- Modern Theory of Interest: IS-LM CurveDocumento36 pagineModern Theory of Interest: IS-LM CurveSouvik DeNessuna valutazione finora

- Health Development Corporation Spread Sheet (Sol)Documento8 pagineHealth Development Corporation Spread Sheet (Sol)Surya Kant100% (2)

- 3) From - SF - To - VaRDocumento48 pagine3) From - SF - To - VaRDunsScotoNessuna valutazione finora

- Application For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFDocumento6 pagineApplication For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFdasuyaNessuna valutazione finora

- CR Ma 21Documento22 pagineCR Ma 21Sharif MahmudNessuna valutazione finora

- History of Index NumberDocumento1 paginaHistory of Index NumbersyukrizzNessuna valutazione finora

- Detailstatement - 19 4 2024@14 46 25Documento28 pagineDetailstatement - 19 4 2024@14 46 25SONU SNessuna valutazione finora

- Industrial FinanceDocumento11 pagineIndustrial Financedesaijpr90% (10)

- Notification 93 2023Documento1 paginaNotification 93 2023tax.contactNessuna valutazione finora

- Vision of Microfinance in IndiaDocumento28 pagineVision of Microfinance in Indiashiva1720Nessuna valutazione finora

- Acct Statement XX5033 07072023Documento4 pagineAcct Statement XX5033 07072023Prosenjjit GhosalNessuna valutazione finora

- What Is EMD in Contract Work - Google SearchDocumento3 pagineWhat Is EMD in Contract Work - Google SearchRanjanNessuna valutazione finora

- Tax Calculator by Tax GurujiDocumento4 pagineTax Calculator by Tax GurujiSunitKumarChauhanNessuna valutazione finora

- Century Paper and Board Mills Limited - Case StudyDocumento23 pagineCentury Paper and Board Mills Limited - Case StudyJuvairiaNessuna valutazione finora

- Business InfographicDocumento1 paginaBusiness InfographicLuck BananaNessuna valutazione finora

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyDa EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyValutazione: 3 su 5 stelle3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursDa EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursValutazione: 5 su 5 stelle5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsDa EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNessuna valutazione finora

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsDa EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsValutazione: 4.5 su 5 stelle4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondDa EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondNessuna valutazione finora

- Mind over Money: The Psychology of Money and How to Use It BetterDa EverandMind over Money: The Psychology of Money and How to Use It BetterValutazione: 4 su 5 stelle4/5 (24)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Da EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Valutazione: 4 su 5 stelle4/5 (5)

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsDa EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsValutazione: 5 su 5 stelle5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismDa EverandThe Value of a Whale: On the Illusions of Green CapitalismValutazione: 5 su 5 stelle5/5 (2)