Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reserve Bank of India (RBI)

Caricato da

Deepanwita SarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reserve Bank of India (RBI)

Caricato da

Deepanwita SarCopyright:

Formati disponibili

Reserve Bank of India (RBI) - Gr8AmbitionZ

http://www.gr8ambitionz.com/2012/04/reserve-bank-of-india-rbi.html

Gr8AmbitionZ

Want to share anything with us??? you can mail your Interview Experiences, Inspirational Stories and other Articles to Gr8AmbitionZ@Gmail.com. We will publish them with your Name and Pic... Thank you

Home

English

AptitudeShortcuts

ReasoningShortcuts

Current Affairs

RBI Assistants Study Material Banking Interview Tips

National Insurance Assistants Study Material Computer Knowledge Notifications

7/27/2013 11:42 PM

Reserve Bank of India (RBI) - Gr8AmbitionZ

http://www.gr8ambitionz.com/2012/04/reserve-bank-of-india-rbi.html

SEARCH YOUR TOPIC HERE.........

Loading...

T U E S D AY, A P R I L 2 4 , 2 0 1 2

Reserve Bank of India (RBI)

BI, India's Central Bank came into existence on 1stApril 1935 as a private share holders bank. Note : 1st Central Bank in the world : Rick's Bank Sweden in 1656. But in the light of unctions, Bank of England is the 1st Central Bank 1694. Functions of RBI : Monopoly of Note issue Banker, Adviser and Agent to the Govt. of India Banker to Banks Custodian of Foreign exchange and gold. Re-discounts bills of exchange and hundis. Lender of last Resort Maintains stability of foreign value of Rupee. Acts as clearing house Credit control

Here are some important points to remember about RBI :

RBI's central office is in Mumbai. RBI has 22 regional offices. It was nationalized on 1st January 1949. It prints Currency in 15 Languages. Its predecessor was Imperial Bank of India (1921). RBI came into existence on the recommendation commission as per RBI act 1934. of Hilton Young (Royal)

It is the member bank of Asian Clearing Union (ACU) and IMF (International Monetary Fund). RBI has Board of Directors with 21 (Governor and 4 Deputy Governors etc) The present Governor of RBI is Duvvuri Subba Rao (Second Time). Deputy Governors :

K.C.Chakravarthi Urjit Patel Anand Sinha Harun Rashid Khan.

Currency notes are issued by RBI under "Minimum Reserve System 1957" with backing of Rs. 200 Cr Reserve (Gold : Rs. 115 Cr + Foreign Securities Rs. 85 Cr) RBI Invests foreign exchange reserves in multi-currency, multi-market portfolios such as securities, other central banks and Bank of International Settlements (BIS) and deposits in foreign commercial banks. The yield on such investments is low. RBI does not pay interest on Govt. deposits with it. The following monetary instruments are in the hands of RBI to control credit and to bring economic stability in the economy : Bank Rate : Rate of rediscount at which the RBI discounts the first class bills of exchange brought by the banks. Repo Rate : Injection of liquidity by the RBI is termed as " Repo Rate" . This was introduced in Dec. 1992 and Reverse Repo Rate in Nov. 1996. RBI buys Govt. Securities for a short period usually a fortnight, with an agreement to sell it later. Thus repo rate is a short-term money market instrument to stabilize short term liquidity in the economy.

7/27/2013 11:42 PM

Reserve Bank of India (RBI) - Gr8AmbitionZ

http://www.gr8ambitionz.com/2012/04/reserve-bank-of-india-rbi.html

Reverse Repo Rate Repo Rate is the rate at which the RBI lends to commercial banks where as the Reverse Repo Rate is the rate at which the RBI borrows from the commercial banks against securities for a very short period. Repo and Reverse Repo rates are used as policy instruments for day-to-day liquidity management under the liquidity adjustment facility. Cash Reserve Ratio (CRR) : It refers to the percentage of net demand and time deposits which the scheduled commercial banks have to keep with RBI at zero interest Rate as per RBI act 1934. Statutory Liquidity Ratio (SLR) : It refers to the percentage of net demand and time deposits which the scheduled commercial banks have to keep with themselves. i.e. by purchasing Govt. Securities or in the form of cash or gold as per Banking Regulation Act 1949, Sec 24. SLR is a mechanism used by Commercial Banks for providing credit to the Govt. Open market operations : RBI buys or sells Govt. Bonds in the second Ratio. RBI Amendment Bill 2005 provides flexibility to RBI in fixing the CRR and SLR. Though RBI is responsible for the safety and stability of the Banking sector, it is not legally independent.

Like

30,791 people like this.

You might also like:

Cubes

Expected GA Questions for IBPS Clerks Online Exam - October ...

UCO Bank - 1000 Clerks - IBPS

LinkWithin

at Gr8AmbitionZ, Updated at: 8:06 PM Labels: Bank Exams, Bank Jobs, Bank PO Exam, Banking Awareness

12 comments:

Malik Ehsan ul ellahi November 4, 2012 at 4:19 PM

7/27/2013 11:42 PM

Reserve Bank of India (RBI) - Gr8AmbitionZ

http://www.gr8ambitionz.com/2012/04/reserve-bank-of-india-rbi.html

Give it in PDF format please Reply

Anonymous November 21, 2012 at 8:44 PM these notes are just worth it. thanks alot . one can revise from them easily Reply

Anonymous December 6, 2012 at 1:09 PM please give it in pdf format Reply

Indu Babu December 6, 2012 at 6:07 PM Imperial Bank of India is the Predecessor of State Bank of India not RBI. SBI traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banksBank of Calcutta and Bank of Bombayto form the Imperial Bank of India, which in turn became the State Bank of India. The Government of India nationalised the Imperial Bank of India in 1955 with the Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. Reply Replies Shiv RK December 8, 2012 at 11:17 AM

Thanks for the comment Indu Babu. I think we've already uploaded this in the Short Notes on State Bank of India.... Good Day :) Reply

Anonymous January 8, 2013 at 10:50 PM thanks mam Reply

Anonymous January 8, 2013 at 10:53 PM thanks Reply

Anonymous January 8, 2013 at 10:57 PM thanku Reply

Anonymous February 16, 2013 at 10:31 PM thanks for giving notes abt rbi pls give more details abt ibps clerk interview my name is arun from sivkasi Reply

rekha agarwal June 12, 2013 at 1:16 PM pdf formate plzzz Reply

Anonymous July 12, 2013 at 9:48 PM Thanks.... Reply

Anonymous July 20, 2013 at 7:36 PM

7/27/2013 11:42 PM

Reserve Bank of India (RBI) - Gr8AmbitionZ

http://www.gr8ambitionz.com/2012/04/reserve-bank-of-india-rbi.html

in rbi assistants material imperial bank of india is known as rbi its totally wrong please note this frends... imperial bank of india is sbi Reply Add comment

Dear Friends... We are little busy in making Study Materials. We are not getting enough time to respond our readers' queries. We will try our best to answer your query. Please don't think otherwise if we are unable to respond. After all we feel our materials are more important to you than our answers. Hope you understand... Good Day :)

Comment as:

Subscribe to: Post Comments (Atom)

glitter pictures

LINKWITHIN

A Small Request Friends

If you feel our efforts useful, then please Tell your friends about us. Please Help us reach More Aspirants.... Thanks in Advance

7/27/2013 11:42 PM

Potrebbero piacerti anche

- WBT MCQ BankDocumento108 pagineWBT MCQ BankRamkishan ShindeNessuna valutazione finora

- Review (3) A Comprehensive Review On Email Spam Classification Using Machine Learning AlgorithmsDocumento6 pagineReview (3) A Comprehensive Review On Email Spam Classification Using Machine Learning Algorithmsmohammad altemimiNessuna valutazione finora

- KP3 Editor ManualDocumento11 pagineKP3 Editor ManualbodyviveNessuna valutazione finora

- CS101 Quiz 2 Spring 2020 Solved by Waqas EjazDocumento5 pagineCS101 Quiz 2 Spring 2020 Solved by Waqas EjazABDURREHMAN Muhammad IbrahimNessuna valutazione finora

- Advanced Bank Reconciliation 2010 PDFDocumento96 pagineAdvanced Bank Reconciliation 2010 PDFcallmeasthaNessuna valutazione finora

- Blood Bank Refrigerator HXC-629T PDFDocumento2 pagineBlood Bank Refrigerator HXC-629T PDFHelmut MorasNessuna valutazione finora

- Cacti ISP Billing PDFDocumento42 pagineCacti ISP Billing PDFEsteban YunisNessuna valutazione finora

- Extract PDF Dublin Core BatchDocumento2 pagineExtract PDF Dublin Core BatchRudyNessuna valutazione finora

- Latest Subsidiary BooksDocumento12 pagineLatest Subsidiary BooksRaghuNessuna valutazione finora

- MobiTV Provisioning & Billing Interface v25Documento24 pagineMobiTV Provisioning & Billing Interface v25alexfarcasNessuna valutazione finora

- Load Bank Quotation-Dingbo PowerDocumento1 paginaLoad Bank Quotation-Dingbo PowerMahmoud Abd ElhamidNessuna valutazione finora

- Personal SellingDocumento10 paginePersonal SellingYkartheek GupthaNessuna valutazione finora

- Summary Bill FormatDocumento1 paginaSummary Bill Formatmr.perfectraviranjan222Nessuna valutazione finora

- Raaziq PDFDocumento18 pagineRaaziq PDFUmair AhmedNessuna valutazione finora

- Automatic Power Factor Corrector Using Capacitive Load Bank Project ReportDocumento60 pagineAutomatic Power Factor Corrector Using Capacitive Load Bank Project ReportUtkarsh Agrawal90% (10)

- Literature Review On Computerized Water Billing SystemDocumento7 pagineLiterature Review On Computerized Water Billing SystemaflssjrdaNessuna valutazione finora

- JunoAPI SEARCH v1.3.1Documento36 pagineJunoAPI SEARCH v1.3.1Yolger Perez CondeNessuna valutazione finora

- Project On EbillingDocumento75 pagineProject On EbillingRam BobbaNessuna valutazione finora

- DRAFT Bike Share Permit Requirements 6.9.2017Documento7 pagineDRAFT Bike Share Permit Requirements 6.9.2017JimHammerandNessuna valutazione finora

- Billing FormatDocumento4 pagineBilling FormatJcube SysTechNessuna valutazione finora

- New In-Principle Approval Format Bank of BarodaDocumento13 pagineNew In-Principle Approval Format Bank of BarodaPriyanka VermaNessuna valutazione finora

- 100kW Portable Load BankDocumento9 pagine100kW Portable Load BankKarlos Miguel Lopez GomezNessuna valutazione finora

- Agent-Based System Architecture and OrganizationDocumento9 pagineAgent-Based System Architecture and OrganizationSwatiNessuna valutazione finora

- Oracle Revenue Management and Billing Banking User GuideDocumento806 pagineOracle Revenue Management and Billing Banking User GuidesaheemmirNessuna valutazione finora

- Faq Mobile BankingDocumento4 pagineFaq Mobile Bankingrezina pokhrelNessuna valutazione finora

- LoadCentral Payment SolutionsDocumento5 pagineLoadCentral Payment SolutionsJacques Andre Collantes BeaNessuna valutazione finora

- Procedure of Buying and SellingDocumento5 pagineProcedure of Buying and SellingSaloni Sarvaiya33% (3)

- SM Personal Selling Lecture 3 ADocumento49 pagineSM Personal Selling Lecture 3 ANavneet GillNessuna valutazione finora

- Personal Selling ProcessDocumento35 paginePersonal Selling ProcessAnnhad BhatiaNessuna valutazione finora

- Virtual BankDocumento114 pagineVirtual Bankbhuvana271Nessuna valutazione finora

- Hacking OdtDocumento9 pagineHacking OdtShirisha UdatewarNessuna valutazione finora

- UBA ESB ISO 8583 Protocol Specification 1.3Documento56 pagineUBA ESB ISO 8583 Protocol Specification 1.3Richard KalibataNessuna valutazione finora

- PPT-6 How To Buy and Sell Shares in Stock ExchangeDocumento79 paginePPT-6 How To Buy and Sell Shares in Stock Exchangechaudhari vishalNessuna valutazione finora

- The Billing Story of BSNL: Challenges Ahead.: Subrata Chatterjee, DGM-IT IT Project Circle, BSNLDocumento57 pagineThe Billing Story of BSNL: Challenges Ahead.: Subrata Chatterjee, DGM-IT IT Project Circle, BSNLsyeefooNessuna valutazione finora

- Choosing The Right HSM For Your Bank FinalA4Documento22 pagineChoosing The Right HSM For Your Bank FinalA4Gustavo MartinezNessuna valutazione finora

- PI For Loading System From Autower PDFDocumento5 paginePI For Loading System From Autower PDFanwar sadatNessuna valutazione finora

- Mis at Axis BankDocumento8 pagineMis at Axis BankankitasankitaNessuna valutazione finora

- BOKU Billing and Payments ProcessDocumento11 pagineBOKU Billing and Payments ProcessAfc DeetweeNessuna valutazione finora

- Credit Card UPI PresentationDocumento9 pagineCredit Card UPI PresentationAde SulaemanNessuna valutazione finora

- Online Banking ProjectDocumento13 pagineOnline Banking Projectmsnarayana9949843549100% (1)

- Charging Accounting and Billing ManagemeDocumento9 pagineCharging Accounting and Billing Managemekallolshyam.roy2811Nessuna valutazione finora

- Egov 1H 2020 Verint PDFDocumento20 pagineEgov 1H 2020 Verint PDFNa NaNessuna valutazione finora

- Cisco Prepaid Calling CardDocumento44 pagineCisco Prepaid Calling CardttafsirNessuna valutazione finora

- Bank Account Management in SAP S - 4 HANA - A Master Data Perspective - SAP BlogsDocumento22 pagineBank Account Management in SAP S - 4 HANA - A Master Data Perspective - SAP BlogsKapadia MritulNessuna valutazione finora

- Brochure - Interconnect BillingDocumento16 pagineBrochure - Interconnect Billingjunk60388Nessuna valutazione finora

- Bill Presentment ArchitectureDocumento33 pagineBill Presentment ArchitecturevenkatNessuna valutazione finora

- Aradial Billing ManualDocumento259 pagineAradial Billing ManualTtb ChiloNessuna valutazione finora

- Complete SRS!!!Documento5 pagineComplete SRS!!!Farhan SirkhotNessuna valutazione finora

- A Hand Book ON Billing and Customer Care System IN GSM NetworkDocumento19 pagineA Hand Book ON Billing and Customer Care System IN GSM NetworkGuna SekarNessuna valutazione finora

- Revised Purchase Policy Procedure 2020Documento61 pagineRevised Purchase Policy Procedure 2020Jageshwar MishraNessuna valutazione finora

- EDI Overview Data Format and Transmission ENDocumento1 paginaEDI Overview Data Format and Transmission ENDiana GrajdanNessuna valutazione finora

- SBI PO Study Material CompleteDocumento39 pagineSBI PO Study Material CompleteNitin AryaNessuna valutazione finora

- SBI Supply and Demand AnalysisDocumento19 pagineSBI Supply and Demand Analysisbilva joshiNessuna valutazione finora

- Functions - Duties of The RBI GovernorDocumento4 pagineFunctions - Duties of The RBI GovernorDeepanwita SarNessuna valutazione finora

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Ibps Po Mains Cracker - 2016Documento51 pagineIbps Po Mains Cracker - 2016Vimal PokalNessuna valutazione finora

- G H Raisoni Institute of Engineering & Technology, NagpurDocumento34 pagineG H Raisoni Institute of Engineering & Technology, NagpurPratik JainNessuna valutazione finora

- Bipolar Junction Transistor: Amplification and Switching Through 3 ContactDocumento90 pagineBipolar Junction Transistor: Amplification and Switching Through 3 ContactDeepanwita SarNessuna valutazione finora

- Drift CurrentDocumento9 pagineDrift CurrentDeepanwita SarNessuna valutazione finora

- Transistor S06Documento32 pagineTransistor S06Alran Eric CifraNessuna valutazione finora

- Wireless NetworksDocumento29 pagineWireless NetworksDeepanwita SarNessuna valutazione finora

- Electromagnetic Field TheoryDocumento32 pagineElectromagnetic Field TheoryDeepanwita SarNessuna valutazione finora

- Q. Explain About Subscriber Loop System?Documento10 pagineQ. Explain About Subscriber Loop System?Deepanwita SarNessuna valutazione finora

- LED Light RepairingDocumento11 pagineLED Light RepairingDeepanwita SarNessuna valutazione finora

- Functions - Duties of The RBI GovernorDocumento4 pagineFunctions - Duties of The RBI GovernorDeepanwita SarNessuna valutazione finora

- FFT VHDL CodeDocumento4 pagineFFT VHDL CodeDeepanwita SarNessuna valutazione finora

- Boats and Streams Shortcuts - Gr8AmbitionZDocumento6 pagineBoats and Streams Shortcuts - Gr8AmbitionZDeepanwita SarNessuna valutazione finora

- Matrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedDocumento4 pagineMatrix of Consumer Agencies and Areas of Concern: Specific Concern Agency ConcernedAJ SantosNessuna valutazione finora

- Exercise 23 - Sulfur OintmentDocumento4 pagineExercise 23 - Sulfur OintmentmaimaiNessuna valutazione finora

- Insurance Smart Sampoorna RakshaDocumento10 pagineInsurance Smart Sampoorna RakshaRISHAB CHETRINessuna valutazione finora

- Mobile Based IVR SystemDocumento17 pagineMobile Based IVR SystemIndraysh Vijay [EC - 76]Nessuna valutazione finora

- 950 MW Coal Fired Power Plant DesignDocumento78 pagine950 MW Coal Fired Power Plant DesignJohn Paul Coñge Ramos0% (1)

- Ramp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Documento2 pagineRamp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Genevieve GayosoNessuna valutazione finora

- Palm Manual EngDocumento151 paginePalm Manual EngwaterloveNessuna valutazione finora

- Chapter Two Complexity AnalysisDocumento40 pagineChapter Two Complexity AnalysisSoressa HassenNessuna valutazione finora

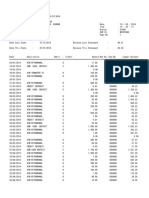

- Bank Statement SampleDocumento6 pagineBank Statement SampleRovern Keith Oro CuencaNessuna valutazione finora

- Historical DocumentsDocumento82 pagineHistorical Documentsmanavjha29Nessuna valutazione finora

- Automatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Documento7 pagineAutomatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Abdelrahman MahmoudNessuna valutazione finora

- Circuitos Digitales III: #IncludeDocumento2 pagineCircuitos Digitales III: #IncludeCristiamNessuna valutazione finora

- Czech Republic GAAPDocumento25 pagineCzech Republic GAAPFin Cassie Lazy100% (1)

- Brief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical AnalysisDocumento67 pagineBrief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical Analysisanon_136103548Nessuna valutazione finora

- Revit 2019 Collaboration ToolsDocumento80 pagineRevit 2019 Collaboration ToolsNoureddineNessuna valutazione finora

- EE1000 DC Networks Problem SetDocumento7 pagineEE1000 DC Networks Problem SetAmit DipankarNessuna valutazione finora

- Lec # 26 NustDocumento18 pagineLec # 26 NustFor CheggNessuna valutazione finora

- Risk Analysis and Management - MCQs1Documento7 pagineRisk Analysis and Management - MCQs1Ravi SatyapalNessuna valutazione finora

- Curamik Design Rules DBC 20150901Documento8 pagineCuramik Design Rules DBC 20150901Ale VuNessuna valutazione finora

- LT1256X1 - Revg - FB1300, FB1400 Series - EnglishDocumento58 pagineLT1256X1 - Revg - FB1300, FB1400 Series - EnglishRahma NaharinNessuna valutazione finora

- Capsule Research ProposalDocumento4 pagineCapsule Research ProposalAilyn Ursal80% (5)

- Writing Task The Strategy of Regional Economic DevelopementDocumento4 pagineWriting Task The Strategy of Regional Economic DevelopementyosiNessuna valutazione finora

- MOFPED STRATEGIC PLAN 2016 - 2021 PrintedDocumento102 pagineMOFPED STRATEGIC PLAN 2016 - 2021 PrintedRujumba DukeNessuna valutazione finora

- Ssasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Documento167 pagineSsasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Sunil Singh100% (1)

- An Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)Documento18 pagineAn Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)gurumurthy38Nessuna valutazione finora

- PovidoneDocumento2 paginePovidoneElizabeth WalshNessuna valutazione finora

- XI STD Economics Vol-1 EM Combined 12.10.18 PDFDocumento288 pagineXI STD Economics Vol-1 EM Combined 12.10.18 PDFFebin Kurian Francis0% (1)

- Document 3Documento3 pagineDocument 3AdeleNessuna valutazione finora

- Service Manual Lumenis Pulse 30HDocumento99 pagineService Manual Lumenis Pulse 30HNodir AkhundjanovNessuna valutazione finora

- Kompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFDocumento13 pagineKompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFEka IdrisNessuna valutazione finora