Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fed Res Sys Treasury and Tax and Loan Program

Caricato da

ckennanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fed Res Sys Treasury and Tax and Loan Program

Caricato da

ckennanCopyright:

Formati disponibili

Treasury and Tax and Loan Program - Fedpoints - Federal Reserve Bank of New York

Page 1 of 2

FOLLOW US:

Banking

Markets

Research

Education

Regional Outreach

About the Fed

Careers

News & Events

Video

Press Center

AB OUT THE FED What We Do Fedpoints Annual Reports Frequently Asked Questions History Holiday Schedule Organization Actions Related to AIG Governance Visiting Vendor Information Diversity and Inclusion Employees Only

Home > About the Fed > What We Do FEDPOINT QUICK LINKS International Affairs

Treasury and Tax and Loan Program

Printer version

EXTERNAL LINKS Central Bank Websites

Under the Treasury Tax and Loan (TT&L) program, tax payments by individuals and businesses go into accounts at depository institutions, rather than directly to the Treasury's accounts at the Federal Reserve. TT&L accounts help to stabilize the supply of reserves in the banking system, increasing the stability of financial markets and simplifying the implementation of monetary policy. Over 80 percent of the TT&L institutions are collectors that transfer funds to the Treasury's accounts at the Federal reserve the same day, or after, they receive them. The remainder are "note option" depositories, which hold the tax funds longer. Purpose of the TT&L Program Treasury Tax and Loan (TT&L) accounts consist of federal tax payments made directly by business firms, and other federal payments that are deposited in TT&L accounts indirectly. The TT&L program aids in maintaining the stability of financial markets by reducing uncertainty about the supply of reserves in the banking system and simplifying the Fed's implementation of monetary policy. This is accomplished by having tax payments deposited into TT&L accounts at depository institutions, rather than in the Treasury's accounts at the Federal Reserve, thereby allowing the tax payments to remain in the banking system. In the absence of TT&L accounts, tax payments would generate abrupt changes in depository reserves. Taking Part in the TT&L Program To qualify as a TT&L depository, an institution must file an application. The application, when approved, is a formal agreement requiring the depository institution to follow the Treasury's rules and regulations concerning TT&L accounts. The primary regulation is that TT&L depositories must provide collateral against all deposits over the maximum insurance coverage provided by the Federal Deposit Insurance Corporation and the National Credit Union Share Insurance Fund. As of April 2, 2007, 8,950 depository institutions throughout the United States maintained TT & L accounts for the Treasury Department, taking in an estimated $2.0 trillion in tax revenue in 2006. These funds came directly from employee income tax withholding, Social Security/Medicare taxes (FICA), and corporate income taxes that are paid on a quarterly basis. However, not all funds in TT&L accounts are placed there directly. About one-third of all funds in the accounts come indirectly from other sources, such a individual income tax payments. Remit Option Depositories Depository institutions participate in two types of TT&L programs, which are distinguished by the timing of the transfers from the TT&L account to the Treasury's account. Under one such program, collector depositories transfer some payments to a Treasury account at the Federal Reserve the same day they receive them, and transfer all other payments to the Treasury's account a day later. An increasing share of all payments received by collector depositories have been transferred electronically. Companies with annual tax payments of more than $200,000 each are required by law to transfer their tax payments electronically. Under the collector option program, all funds transferred into TT&L accounts electronically must move the same day from the depository institutions at which they were deposited to the Treasury's Federal Reserve accounts. Electronic payments accomplish three objectives. First, the Internal Revenue Service has much less paperwork to process. Second, the Treasury is able to obtain data more quickly on the amounts of funds transferred to its accounts at the Federal Reserve Banks. Third, since electronic tax payments arrive in the Treasury's Federal Reserve accounts the same day they are deposited, the Treasury is able to earn interest on these funds by immediately placing them in "note option" depositories. Individual income tax payments do not go directly to collector option depositories. Rather, these tax payments go from individuals to the Internal Revenue Service, which forwards the payments to about 160 "lockbox" commercial banks nationwide. The lockbox banks process the checks and forward the payments to the Federal Reserve Bank of New York. If the Treasury does not need the funds immediately, they are transferred to the TT&L program and placed, when possible, in note option depositories.

FED EDUCATION What We Do The Key to the Gold Vault

http://www.ny.frb.org/aboutthefed/fedpoint/fed21.html

7/29/2013

Treasury and Tax and Loan Program - Fedpoints - Federal Reserve Bank of New York

Page 2 of 2

Under the collector option program, depository institutions are classified according to the amount of funds in their TT&L accounts. Class 1 depositories are those that receive more than $10 million in their TT&L accounts annually; depositories that receive less than $10 million in their TT&L accounts annually are designated Class 2 depositories. Note Option Depositories When the Treasury needs funds in order to make payments, the Federal Reserve Banks tell TT&L note option (those classified as retainers and investors) depositories, generally medium-to-large size banks, to transfer funds to the Treasury's accounts at the Fed. The Treasury may request, or "call," the full amount or a percentage of the amount in an account. Treasury calls, which normally are announced in advance and specify the date of the withdrawal and the percentage of the balance to be withdrawn, allow funds to move back into private hands as a consequence of government spending. Unlike collector depositories, note option depositories may hold TT&L balances for an extended time period. As a result, note option banks have use of the Treasury's funds for loans and investments and are required to pay interest to the Treasury. The interest rate is determined by subtracting twenty-five basis points (one-quarter of a percentage point) from the average federal funds rate for the week during which the balances are held. Note option depositories establish a balance limit that they are willing to hold in their TT&L accounts, usually based upon their anticipated flow of tax deposits and their ability to maintain adequate collateral to secure a given level of deposits. All tax deposits received in excess of the lesser of the balance limit or collateral value are transferred automatically to the Treasury. During most of the year, TT&L capacity, defined as the sum of the lesser of the balances limit or the collateral value of the 1,282 note option depositories, exceeds the supply of tax payments. The regular exception is a two-week period around April 15, when the Treasury receives a large influx of individual income tax payments. During this time, the potential flow of tax payments into TT&L accounts exceeds the supply of maximum balances, and the Treasury must hold balances in its Federal Reserve accounts involuntarily.

April 2007

Contact Us | E-mail Alerts | RSS Feeds | Terms of Use Home | Federal Reserve System

http://www.ny.frb.org/aboutthefed/fedpoint/fed21.html

7/29/2013

Potrebbero piacerti anche

- Remittance Processing System (RPS)Documento7 pagineRemittance Processing System (RPS)Noman DxNessuna valutazione finora

- 111 - Gov - Uscourts.ord.124748.111.0Documento30 pagine111 - Gov - Uscourts.ord.124748.111.0Freeman Lawyer100% (1)

- WHFIT Transition GuidanceDocumento12 pagineWHFIT Transition GuidancejpesNessuna valutazione finora

- DTCCDocumento10 pagineDTCCpoojasengar100% (1)

- 1 - Shrout Indictment December 15, 2015Documento5 pagine1 - Shrout Indictment December 15, 2015Freeman LawyerNessuna valutazione finora

- 01 Introduction To Administrative RemedyDocumento3 pagine01 Introduction To Administrative Remedyajinxa100% (2)

- Account Relationships: Federal Reserve Banks Operating Circular 1Documento18 pagineAccount Relationships: Federal Reserve Banks Operating Circular 1Wesley Davis100% (3)

- 3 - Points & Authorities BoE Bill of Exchange ActDocumento15 pagine3 - Points & Authorities BoE Bill of Exchange ActDoc PhaqNessuna valutazione finora

- US Internal Revenue Service: A-03-49Documento2 pagineUS Internal Revenue Service: A-03-49IRS100% (1)

- Federal Reserve Account InstructionsDocumento31 pagineFederal Reserve Account InstructionsCarla DiCapriNessuna valutazione finora

- Blank 4506TDocumento2 pagineBlank 4506TRoger PeiNessuna valutazione finora

- 4 Conr Nof Irs 3176CDocumento1 pagina4 Conr Nof Irs 3176CKurozato CandyNessuna valutazione finora

- WTC/ GSA Lease From GSA FOIADocumento139 pagineWTC/ GSA Lease From GSA FOIAJ. Swift (The Bulwark)Nessuna valutazione finora

- 2011 Form 1041 K 1 InstructionsDocumento37 pagine2011 Form 1041 K 1 InstructionsEltech911100% (1)

- Federal Reserve Account StructureDocumento16 pagineFederal Reserve Account Structurecamwills2100% (1)

- Operating Circular 1 AppendicesDocumento6 pagineOperating Circular 1 Appendicespurpel100% (1)

- T3 B12 Creating A Trusted Information Network FDR - Entire Contents - Markle Report - 1st Pgs and Table of Contents Scanned For Reference - Fair Use 016Documento5 pagineT3 B12 Creating A Trusted Information Network FDR - Entire Contents - Markle Report - 1st Pgs and Table of Contents Scanned For Reference - Fair Use 0169/11 Document ArchiveNessuna valutazione finora

- Frb-Boardresolutions Authorizedapproverpackage PDFDocumento10 pagineFrb-Boardresolutions Authorizedapproverpackage PDFBranden HallNessuna valutazione finora

- Introduction To James McBride ProcessDocumento6 pagineIntroduction To James McBride ProcessMichael Kovach100% (6)

- 112 - Gov - Uscourts.ord.124749.112.0Documento2 pagine112 - Gov - Uscourts.ord.124749.112.0Freeman LawyerNessuna valutazione finora

- Absolute RightsDocumento1 paginaAbsolute Rightsmoneyspout5403100% (2)

- Closing of Bank AccountDocumento15 pagineClosing of Bank AccountGurpreet Singh100% (1)

- There Are No Treasury Direct Accounts Twitter7.2.18.2Documento27 pagineThere Are No Treasury Direct Accounts Twitter7.2.18.2karen hudes63% (8)

- Gold Bond Form PDFDocumento5 pagineGold Bond Form PDFrakesh kumar100% (1)

- IboeDocumento2 pagineIboeHossein ParastehNessuna valutazione finora

- Karen Tappert Indicted On Mortgage Rescue Scheme - California, Nevada and New MexicoDocumento20 pagineKaren Tappert Indicted On Mortgage Rescue Scheme - California, Nevada and New Mexico83jjmackNessuna valutazione finora

- Rights of Drawers Banks and Holders in Bank Checks and Other CADocumento57 pagineRights of Drawers Banks and Holders in Bank Checks and Other CASiddharth Singh TomarNessuna valutazione finora

- US Internal Revenue Service: f709 - 2005Documento4 pagineUS Internal Revenue Service: f709 - 2005IRS100% (1)

- HR-25 A Bill To End The IRS Aka INTERNAL REVENUE SERVICEDocumento132 pagineHR-25 A Bill To End The IRS Aka INTERNAL REVENUE SERVICEFreeman Lawyer89% (9)

- Sf25a 16Documento2 pagineSf25a 16Pamela HowardNessuna valutazione finora

- 12408original Issue Discount (OID) DefinedDocumento13 pagine12408original Issue Discount (OID) DefinedTheplaymaker508100% (1)

- Info On BondsDocumento29 pagineInfo On BondsMaryUmbrello-Dressler100% (1)

- Trustee's ReportDocumento17 pagineTrustee's ReportragnarisapirateNessuna valutazione finora

- Depository Trust CompanyDocumento11 pagineDepository Trust CompanyAntonio Luiz100% (6)

- DTCC & CEDE Sample-LanguageDocumento3 pagineDTCC & CEDE Sample-LanguageAnonymous nYwWYS3ntV100% (1)

- F 843Documento1 paginaF 843Manjula.bsNessuna valutazione finora

- 31.1 - Shrout Memorandum Motion To DismissDocumento8 pagine31.1 - Shrout Memorandum Motion To DismissFreeman LawyerNessuna valutazione finora

- Letter of Credit For International BankingDocumento32 pagineLetter of Credit For International BankingChiragDahiya100% (1)

- TTL Note Accounts and The Money Supply ProcessDocumento12 pagineTTL Note Accounts and The Money Supply ProcessDaytonNessuna valutazione finora

- Blank1455 For Public DebtDocumento5 pagineBlank1455 For Public DebtAllen-nelson of the Boisjoli family100% (1)

- Instructions For Forms 1099-A and 1099-C: Future DevelopmentsDocumento6 pagineInstructions For Forms 1099-A and 1099-C: Future Developmentsfate1comNessuna valutazione finora

- IRS Form 1040es 2016Documento12 pagineIRS Form 1040es 2016Freeman Lawyer100% (1)

- MIL SF-30 Contract Change OrderDocumento2 pagineMIL SF-30 Contract Change Ordernoman888Nessuna valutazione finora

- AAA Treasury Direct CardDocumento2 pagineAAA Treasury Direct Cardexousiallc80% (5)

- Federal Reserve Bank SDocumento115 pagineFederal Reserve Bank STheplaymaker5080% (1)

- EFT ScamDocumento1 paginaEFT ScamTonya Banks0% (1)

- How To Redeem A Savings Bond or NoteDocumento3 pagineHow To Redeem A Savings Bond or NoteShevis Singleton Sr.100% (2)

- Negotiable Inst Representing CreditDocumento1 paginaNegotiable Inst Representing CredittrustkonanNessuna valutazione finora

- Form - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersDocumento1 paginaForm - FR2046 - Selected Balance Sheet Items For Discount Window BorrowersPratus WilliamsNessuna valutazione finora

- The Security Instrument UCC Article 9Documento7 pagineThe Security Instrument UCC Article 9A. Campbell100% (1)

- CFPB - TILA RESPA Integrated Disclosure - Frequently Asked QuestionsDocumento27 pagineCFPB - TILA RESPA Integrated Disclosure - Frequently Asked Questionsclash clansNessuna valutazione finora

- Bankers Acceptance CondensedDocumento5 pagineBankers Acceptance CondensedLuka Ajvar100% (1)

- Constitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxDa EverandConstitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxNessuna valutazione finora

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsDa EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNessuna valutazione finora

- Code Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphDa EverandCode Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphValutazione: 3.5 su 5 stelle3.5/5 (2)

- Secured transaction Complete Self-Assessment GuideDa EverandSecured transaction Complete Self-Assessment GuideNessuna valutazione finora

- Old Jamaican RecipesDocumento3 pagineOld Jamaican RecipesckennanNessuna valutazione finora

- 1950's Vintage Hoot OwlDocumento3 pagine1950's Vintage Hoot OwlckennanNessuna valutazione finora

- POPCORN From ScratchDocumento1 paginaPOPCORN From ScratchckennanNessuna valutazione finora

- Summertime Peach Ice CreamDocumento1 paginaSummertime Peach Ice CreamckennanNessuna valutazione finora

- Making Castile Soap ReciepesDocumento11 pagineMaking Castile Soap ReciepesckennanNessuna valutazione finora

- BOA Recission Texas Notary Search 05.18.2012Documento1 paginaBOA Recission Texas Notary Search 05.18.2012ckennanNessuna valutazione finora

- 1LINK Technical Document - Data Element Definitions and Message Format v5.7Documento135 pagine1LINK Technical Document - Data Element Definitions and Message Format v5.7hamza rana100% (3)

- Challan Receipt PDFDocumento1 paginaChallan Receipt PDFVandana AggarwalNessuna valutazione finora

- Know Your CustomerDocumento3 pagineKnow Your CustomerMardi RahardjoNessuna valutazione finora

- Chapter 4 - Swaps - 2022 - SDocumento51 pagineChapter 4 - Swaps - 2022 - SĐức Nam TrầnNessuna valutazione finora

- Banking Aurora BorealisDocumento22 pagineBanking Aurora BorealisEdmer FamaNessuna valutazione finora

- Interest Formulas AND Their ApplicationsDocumento27 pagineInterest Formulas AND Their ApplicationsShahzaib Anwar OffNessuna valutazione finora

- Anaalytics FirmsDocumento6 pagineAnaalytics FirmsAmit RanaNessuna valutazione finora

- Introduction of IDBI BankDocumento4 pagineIntroduction of IDBI Bankomy123100% (2)

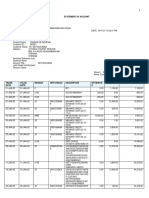

- Statement of AccountDocumento16 pagineStatement of AccountSriNessuna valutazione finora

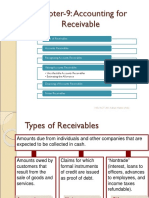

- Chapter-9: Accounting For Receivable: Types of ReceivablesDocumento24 pagineChapter-9: Accounting For Receivable: Types of ReceivablesMohammed Merajul IslamNessuna valutazione finora

- Report of Collections and DepositsDocumento27 pagineReport of Collections and DepositsRhen Robles FajardoNessuna valutazione finora

- Confidential General Customer Information Form: U U U U U U UDocumento9 pagineConfidential General Customer Information Form: U U U U U U USara AriffNessuna valutazione finora

- CASE STUDY ON MODULE A - UnlockedDocumento16 pagineCASE STUDY ON MODULE A - UnlockedRitesh UpadhyayNessuna valutazione finora

- Black Slip Deutsche Bank Ag-99euroDocumento3 pagineBlack Slip Deutsche Bank Ag-99eurohaleighcrissy49387Nessuna valutazione finora

- 789swiDocumento2 pagine789swinader alimohammadiNessuna valutazione finora

- Your Card Is Approved PDFDocumento4 pagineYour Card Is Approved PDFTara ParascandoNessuna valutazione finora

- Receivable Financing Sample ProblemDocumento3 pagineReceivable Financing Sample ProblemKathleen FrondozoNessuna valutazione finora

- (Revised) - Spa by Melinda FloresDocumento2 pagine(Revised) - Spa by Melinda FloresAtty. Mickey CellesNessuna valutazione finora

- XStxoo 7 AE1 JJYZ5 IDocumento2 pagineXStxoo 7 AE1 JJYZ5 Inani santhuNessuna valutazione finora

- Print ChalanDocumento2 paginePrint ChalanfarhanNessuna valutazione finora

- Account Statement As of 21-03-2020 11:43:46 GMT +0530Documento2 pagineAccount Statement As of 21-03-2020 11:43:46 GMT +0530Sourabh MeenaNessuna valutazione finora

- Chase StatementDocumento2 pagineChase StatementPide TanzaniaNessuna valutazione finora

- 1Documento7 pagine1Naveen JainNessuna valutazione finora

- Wak ContohDocumento5 pagineWak ContohDanial MustafaNessuna valutazione finora

- This Study Resource Was: Fraud in Banking SectorDocumento6 pagineThis Study Resource Was: Fraud in Banking SectorMeena BhagatNessuna valutazione finora

- FAQs PSBank Flexi Personal LoanDocumento6 pagineFAQs PSBank Flexi Personal Loanescolastico u. cruz, jr.Nessuna valutazione finora

- 5) Notes On SecuritizationDocumento4 pagine5) Notes On SecuritizationJerome BrusasNessuna valutazione finora

- Banking Services OperationsDocumento134 pagineBanking Services OperationsGuruKPONessuna valutazione finora

- European Bancassurance Benchmark 08-01-08Documento24 pagineEuropean Bancassurance Benchmark 08-01-08Anita LeeNessuna valutazione finora

- Relationship Between Banker and CustomerDocumento3 pagineRelationship Between Banker and CustomerEditor IJTSRDNessuna valutazione finora