Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Certificado TPP

Caricato da

Robert TurnerDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Certificado TPP

Caricato da

Robert TurnerCopyright:

Formati disponibili

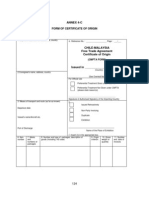

TRANS-PACIFIC STRATEGIC ECONOMIC PARTNERSHIP AGREEMENT

CERTIFICATE OF ORIGIN

Issuing Number:

1: Exporter (Name and Address) Tax ID No: 2: Producer (Name and Address) 3: Importer (Name and Address)

Tax ID No: 4. Description of Good(s) 5. HS No. 6. Preference Criterion 7. Producer 8. Regional Value Content 9. Country of Origin

10: Certification of Origin I certify that: The information on this document is true and accurate and I assume the responsibility for providing such representations. I understand that I am liable for any false statements or material omissions made on or in connection with this document. I agree to maintain and present upon request, documentation necessary to support this certificate, and to inform, in writing, all persons to whom the certificate was given of any changes that could affect the accuracy or validity of this certificate. The goods originated in the territory of the Parties, and comply with the origin requirements specified for those goods in TRANS-PACIFIC STRATEGIC ECONOMIC PARTNERSHIP AGREEMENT, and there has been no further production or any other operation outside the territories of the Parties in accordance with Article 4.11 of the Agreement.

Authorized Signature

Company Name

Name (Print or Type)

Title

Date (DD/MM/YY)

Telephone / Fax /E-mail

4-21

TRANS-PACIFIC STRATEGIC ECONOMIC PARTNERSHIP AGREEMENT CERTIFICATE OF ORIGIN INSTRUCTIONS Pursuant to Article 4.13, for the purposes of obtaining preferential tariff treatment this document must be completed legibly and in full by the exporter or producer and be in the possession of the importer at the time the declaration is made. Please print or type: Issuing Number: Fill in the serial number of the certificate of origin. Field 1: State the full legal name, address (including country) and legal tax identification number of the exporter. The legal tax identification number in Chile is the Unique Tax Number (Rol Unico Tributario). The tax identification number is not applicable for Brunei Darussalam, New Zealand and Singapore. If one producer, state the full legal name, address (including country, telephone number, fax number and email address) and legal tax identification number, as defined in Field 1, of said producer. (Tax ID is not applicable to Brunei Darussalam, New Zealand and Singapore.) If more than one producer is included on the Certificate, state "Various" and attach a list of all producers, including their legal name, address (including country, telephone number, fax number and email address) and legal tax identification number, cross referenced to the good or goods described in Field 4. If you wish this information be confidential, it is acceptable to state " Available to Customs upon request". If the producer and the exporter are the same, complete field with "SAME". If the producer is unknown, it is acceptable to state "UNKNOWN". Field 3: Field 4: Field 5: Field 6: State the full legal name, address (including country) as defined in Field 1, of the importer; if the importer is not known, state "UNKNOWN"; if multiple importers, state "VARIOUS". Provide a full description of each good. The description should be sufficient to relate it to the invoice description and to the Harmonized System (HS) description of the good. For each good described in Field 4, identify the HS tariff classification to six digits. For each good described in Field 4, state which criterion (A through C) is applicable. The rules of origin are contained in Chapter 4 and Annex II of the Agreement. NOTE: In order to be entitled to preferential tariff treatment, each good must meet at least one of the criteria below.

Field 2:

to

Preference Criteria A The good is "wholly obtained or produced entirely" in the territory of one or more of the Parties, as referred to in Article 4.1 and 4.2 of the Agreement. NOTE: The purchase of a good in the territory does not necessarily render it "wholly obtained or produced". The good is produced entirely in the territory of one or more of the Parties exclusively from originating materials. All materials used in the production of the good must qualify as "originating" by meeting the rules of Chapter 4 of the Agreement.

B C

The good is produced entirely in the territory of one or more of the Parties and satisfies the specific rule of origin set out in Annex II of the Agreement (Specific Rules of Origin) that applies to its tariff classification as referred to in Article 4.2, or the provisions under Article 4.12 of the Agreement. The rule may include a tariff classification change, regional value-content requirement and a combination thereof, or specific process requirement. The good must also satisfy all other applicable requirements of Chapter 4 (Rules of Origin) of the Agreement. Field 7: For each good described in Field 4, state "YES" if you are the producer of the good. If you are not the producer of the good, state "NO" followed by (1) or (2), depending on whether this certificate was based upon: (1) your knowledge of whether the good qualifies as an originating good; (2) Issued by the producer's written Declaration of Origin, which is completed and signed by the producer and voluntarily provided to the exporter by the producer. For each good described in Field 4, where the good is subject to a regional value content (RVC) requirement stipulated in the Agreement, indicate the percentage. Identify the name of the country. ("BN" for all goods originating from Brunei Darussalam, "CL" for all goods originating from Chile, "NZ" for all goods originating from New Zealand, "SG" for all goods originating from Singapore)

Field 8: Field 9:

Field 10: This field must be completed, signed and dated by the exporter or producer. The date must be the date the Certificate was completed and signed.

Potrebbero piacerti anche

- Certificado de Origen Ingles SofofaDocumento2 pagineCertificado de Origen Ingles SofofaCarolina GonzálezNessuna valutazione finora

- United States - Chile Free Trade Agreement Tratado de Libre Comercio Chile - Estados Unidos Certificate of OriginDocumento3 pagineUnited States - Chile Free Trade Agreement Tratado de Libre Comercio Chile - Estados Unidos Certificate of OriginSoledad AceitunoNessuna valutazione finora

- NaftaDocumento2 pagineNaftaark6of7Nessuna valutazione finora

- Product CertificationDocumento9 pagineProduct CertificationclementiNessuna valutazione finora

- CBP Form 434Documento2 pagineCBP Form 434CINTHYANessuna valutazione finora

- North American Free Trade Agreement Certificate of Origin: Please Print or TypeDocumento10 pagineNorth American Free Trade Agreement Certificate of Origin: Please Print or TypeMd Jahangir AlamNessuna valutazione finora

- North American Free Trade Agreement Certificate of Origin: (Instructions Attached)Documento2 pagineNorth American Free Trade Agreement Certificate of Origin: (Instructions Attached)jimmyjayjamesNessuna valutazione finora

- U.S. Customs Form: CBP Form 434 - North American Free Trade Agreement Certificate of OriginDocumento2 pagineU.S. Customs Form: CBP Form 434 - North American Free Trade Agreement Certificate of OriginCustoms FormsNessuna valutazione finora

- Certificate of Origining Feb WR PDFDocumento3 pagineCertificate of Origining Feb WR PDFLucero GonzalesNessuna valutazione finora

- Nafta Cert of OriginDocumento2 pagineNafta Cert of OriginCINTHYANessuna valutazione finora

- NAFTA CertificateDocumento2 pagineNAFTA Certificateapi-522706100% (4)

- CBP Form 434Documento2 pagineCBP Form 434Anonymous RuGtvuNessuna valutazione finora

- Ps Nafta InstructionsDocumento2 paginePs Nafta InstructionsUsman HameedNessuna valutazione finora

- NAFTA Certificate of Origin - B232-16-EngDocumento2 pagineNAFTA Certificate of Origin - B232-16-EngKrichelle Ann CahigNessuna valutazione finora

- Original: Certificate of Origin Form For China-Peru FTADocumento2 pagineOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyNessuna valutazione finora

- Nafta Certificate of OriginDocumento2 pagineNafta Certificate of Originneftalí_padilla_3Nessuna valutazione finora

- Certificado de Origen Peru ChinaDocumento2 pagineCertificado de Origen Peru ChinaChristianGutierrezSulcaNessuna valutazione finora

- Certificate of OriginDocumento2 pagineCertificate of Originvanessa30Nessuna valutazione finora

- A Blank Nafta CooDocumento2 pagineA Blank Nafta CooAna Patricia Castro MendozaNessuna valutazione finora

- Co Thailand - ModificadoDocumento2 pagineCo Thailand - ModificadoSebastian Aguilar EscalanteNessuna valutazione finora

- Certificate of OriginDocumento2 pagineCertificate of OriginRafael ManjarrezNessuna valutazione finora

- Annex 4-C: Form of Certificate of OriginDocumento3 pagineAnnex 4-C: Form of Certificate of OriginWei YeeNessuna valutazione finora

- NAFTA Certificate of Origin InstructionsDocumento7 pagineNAFTA Certificate of Origin InstructionsOficina GeneralNessuna valutazione finora

- Usmca Certificate of Origin Template 6 2020Documento3 pagineUsmca Certificate of Origin Template 6 2020Carmen RosalesNessuna valutazione finora

- Corea Autocertif OficialDocumento2 pagineCorea Autocertif OficialJeff J. Armas RomeroNessuna valutazione finora

- Certificate of OriginDocumento3 pagineCertificate of OriginUmair BukhariNessuna valutazione finora

- Certificado de Origen KoreanoDocumento2 pagineCertificado de Origen Koreanoandres perdomoNessuna valutazione finora

- USMCA Certificate of Origin InstructionsDocumento3 pagineUSMCA Certificate of Origin InstructionsDaniela VelazquezNessuna valutazione finora

- Co - Canada - ModeloDocumento2 pagineCo - Canada - ModeloDavid ChozoNessuna valutazione finora

- 103 NAFTA With InstructionsDocumento3 pagine103 NAFTA With Instructionsvblake0504Nessuna valutazione finora

- Formulario Certificado de OrigenDocumento2 pagineFormulario Certificado de OrigenCarolina AparicioNessuna valutazione finora

- Vcufta - Annex - 5 CO EAV PDFDocumento5 pagineVcufta - Annex - 5 CO EAV PDFXuchang Shiji Haojia FoodNessuna valutazione finora

- Korea Modelo - Con AutocertificacionDocumento2 pagineKorea Modelo - Con AutocertificacionDavid ChozoNessuna valutazione finora

- Application Form For Export of SCOMET ItemsDocumento4 pagineApplication Form For Export of SCOMET Itemsakashaggarwal88Nessuna valutazione finora

- CEO - InGLES (Recuperado Automáticamente)Documento2 pagineCEO - InGLES (Recuperado Automáticamente)ntp allisonNessuna valutazione finora

- Certificate of Origin Form F For China-Chile FTADocumento2 pagineCertificate of Origin Form F For China-Chile FTAinspectormetNessuna valutazione finora

- Chile Cert Origen ChinaDocumento2 pagineChile Cert Origen ChinamiNessuna valutazione finora

- Form AANZDocumento6 pagineForm AANZkatacumiNessuna valutazione finora

- China Formulario Certificado Origen InglesDocumento2 pagineChina Formulario Certificado Origen InglesLissette Fernanda Moraga VergaraNessuna valutazione finora

- Export LicenseDocumento3 pagineExport LicenseRoshaniNessuna valutazione finora

- Phu luc 7 Mẫu CO VJ của Nhật BảnDocumento2 paginePhu luc 7 Mẫu CO VJ của Nhật BảnHiền Vũ NgọcNessuna valutazione finora

- Original/ Duplicate/ Triplicate (Additional Page)Documento2 pagineOriginal/ Duplicate/ Triplicate (Additional Page)Moges TolchaNessuna valutazione finora

- Licenta de ExportDocumento6 pagineLicenta de Exportyonu7Nessuna valutazione finora

- AANZFTA Certificate of Origin Form ExplainedDocumento2 pagineAANZFTA Certificate of Origin Form ExplainedPurwanti PNessuna valutazione finora

- COO for Chilean BlueberriesDocumento3 pagineCOO for Chilean BlueberriesRodrigoMoralesMuñozNessuna valutazione finora

- Certificate of OriginDocumento2 pagineCertificate of OriginRaja PaluruNessuna valutazione finora

- Certificate of OriginDocumento2 pagineCertificate of OriginHimanshu KushwahaNessuna valutazione finora

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Documento4 pagineANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88Nessuna valutazione finora

- Generalized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Documento2 pagineGeneralized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Moges TolchaNessuna valutazione finora

- Form ADocumento2 pagineForm AgeorgevoommenNessuna valutazione finora

- Certificado de Origen 1Documento3 pagineCertificado de Origen 1Juan GalvisNessuna valutazione finora

- Goods Consigned CertificateDocumento6 pagineGoods Consigned CertificatekatacumiNessuna valutazione finora

- China FJ fj3 enDocumento7 pagineChina FJ fj3 enjverdugo272015Nessuna valutazione finora

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocumento3 pagineForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNessuna valutazione finora

- When and How To Complete A NAFTA Certificate of Origin White PaperDocumento15 pagineWhen and How To Complete A NAFTA Certificate of Origin White PaperRobert AdrianNessuna valutazione finora

- CBP - Form - 434 ROYALDocumento2 pagineCBP - Form - 434 ROYALRaymundo RamosNessuna valutazione finora

- Overleaf IKCEPADocumento2 pagineOverleaf IKCEPAsantoso w pratamaNessuna valutazione finora

- New Importer Security Filing ISF 10Documento6 pagineNew Importer Security Filing ISF 10Jonathan Freitas100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- Agenda for 34th TCC & 35th SRPC MeetingsDocumento105 pagineAgenda for 34th TCC & 35th SRPC MeetingsnassarkiNessuna valutazione finora

- Section 2 From Idea To Opportunity Section 2 From Idea To OpportunityDocumento22 pagineSection 2 From Idea To Opportunity Section 2 From Idea To OpportunityJAYANT MAHAJANNessuna valutazione finora

- Ex-BSI banker told witness to 'remain cool' as Malaysia faced 'war timeDocumento33 pagineEx-BSI banker told witness to 'remain cool' as Malaysia faced 'war timemohdkhidirNessuna valutazione finora

- L3, Reading - TTP - Street VendorsDocumento9 pagineL3, Reading - TTP - Street VendorsKhương VũNessuna valutazione finora

- R44891Documento51 pagineR44891Zainub A KhanNessuna valutazione finora

- Analysis On The Opportunities and Challenges of Unilever's Differentiated Competition by Using SWOT and PESTDocumento5 pagineAnalysis On The Opportunities and Challenges of Unilever's Differentiated Competition by Using SWOT and PESTDwi WahyuniNessuna valutazione finora

- December 2011 Chamber NewsDocumento11 pagineDecember 2011 Chamber NewskingstonchamberNessuna valutazione finora

- Summer Policy Boot Camp: Hoover InstitutionDocumento9 pagineSummer Policy Boot Camp: Hoover InstitutionHoover InstitutionNessuna valutazione finora

- ContemporaryDocumento9 pagineContemporaryClarence Jan AmatacNessuna valutazione finora

- Industry AnalysisDocumento8 pagineIndustry Analysislai yeowNessuna valutazione finora

- The USA, A Country in GlobalizationDocumento3 pagineThe USA, A Country in GlobalizationMelania RyuNessuna valutazione finora

- The Question of American Strategy in The Indo-PacificDocumento21 pagineThe Question of American Strategy in The Indo-PacificHoover InstitutionNessuna valutazione finora

- New War Fronts Lie in The Economic ZonesDocumento8 pagineNew War Fronts Lie in The Economic ZonesAfzaal Ahmad67% (3)

- Do Thi Ngan An - 10170350 - ME - A2 Le Ngoc Anh - 10170315 - ME - A2 Pham Hoang Phuong Hanh - 10160240 - ME - A2 Le Hong Ngoc - 10170335 - ME - A2 Tatsuro Kawahara - ES002818 - ME - A2Documento48 pagineDo Thi Ngan An - 10170350 - ME - A2 Le Ngoc Anh - 10170315 - ME - A2 Pham Hoang Phuong Hanh - 10160240 - ME - A2 Le Hong Ngoc - 10170335 - ME - A2 Tatsuro Kawahara - ES002818 - ME - A2Quang Minh ĐinhNessuna valutazione finora

- Paper 2 May To AugustDocumento204 paginePaper 2 May To AugustCritchfieldNessuna valutazione finora

- Curriculum Vitae: Professor Tri Widodo, M.Ec - Dev., PH.DDocumento21 pagineCurriculum Vitae: Professor Tri Widodo, M.Ec - Dev., PH.DPrasetyo SetiawanNessuna valutazione finora

- European Yearbook of International Economic LawDocumento847 pagineEuropean Yearbook of International Economic LawВладиславNessuna valutazione finora

- CSIPR E-Newsletter Issue 1Documento8 pagineCSIPR E-Newsletter Issue 1Bar & BenchNessuna valutazione finora

- Nusret HanjalicDocumento61 pagineNusret HanjalicmornaricaNessuna valutazione finora

- CPTPP Overview Agreement Asia-Pacific CountriesDocumento2 pagineCPTPP Overview Agreement Asia-Pacific CountriesNhư NguyễnNessuna valutazione finora

- February 9, 2018Documento16 pagineFebruary 9, 2018Anonymous KMKk9Msn5Nessuna valutazione finora

- FTA VietnamDocumento10 pagineFTA Vietnamkiki rulitaNessuna valutazione finora

- Global Management Managing Across Borders: ©olivier Renck/ Getty ImagesDocumento40 pagineGlobal Management Managing Across Borders: ©olivier Renck/ Getty ImagesAshikin AzlinNessuna valutazione finora

- Business in Action 8th Edition Chapter 3:the Global MarketplaceDocumento4 pagineBusiness in Action 8th Edition Chapter 3:the Global MarketplaceFatima MajidliNessuna valutazione finora

- Thayer, The Impact of The China Factor On Vietnam's Trade and Comprehensive Strategic Partnerships With The WestDocumento25 pagineThayer, The Impact of The China Factor On Vietnam's Trade and Comprehensive Strategic Partnerships With The WestCarlyle Alan ThayerNessuna valutazione finora

- Cuomo and AJC Correspondence On BDSDocumento139 pagineCuomo and AJC Correspondence On BDSMax BlumenthalNessuna valutazione finora

- Defending The Indo-Pacific Liberal International Order: Lessons From France in Cold War Europe For Promoting Détente in AsiaDocumento27 pagineDefending The Indo-Pacific Liberal International Order: Lessons From France in Cold War Europe For Promoting Détente in AsiaBenedict E. DeDominicis100% (1)

- AIIB Neg Starter Pack VersionDocumento285 pagineAIIB Neg Starter Pack VersionJimmy AndersonNessuna valutazione finora

- Obama-Xi Summit: What Happened & What Comes Next in US-China RelationsDocumento33 pagineObama-Xi Summit: What Happened & What Comes Next in US-China RelationsUSChinaStrong100% (2)

- 2015 State of The Freeport AddressDocumento62 pagine2015 State of The Freeport Addressmysubicbay100% (2)