Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cai 2009

Caricato da

Adeniyi AleseDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cai 2009

Caricato da

Adeniyi AleseCopyright:

Formati disponibili

April 2010

Capital Access Index 2009

Capital Access Index: Overall Results

Capital Access Index 2009

Best Markets for Business Access to Capital

APRIL 2010

James R. Barth, Tong Li, Wenling Lu, and Glenn Yago

About the Milken Institute

The Milken Institute is an independent economic think tank whose mission is to improve the lives and economic conditions of diverse populations in the United States and around the world by helping business and public policy leaders identify and implement innovative ideas for creating broad-based prosperity. We put research to work with the goal of revitalizing regions and finding new ways to generate capital for people with original ideas. We focus on: human capital: the talent, knowledge, and experience of people, and their value to organizations, economies, and society; financial capital: innovations that allocate financial resources efficiently, especially to those who ordinarily would not have access to them, but who can best use them to build companies, create jobs, accelerate life-saving medical research, and solve long-standing social and economic problems; and social capital: the bonds of society that underlie economic advancement, including schools, health care, cultural institutions, and government services. By creating ways to spread the benefits of human, financial, and social capital to as many people as possibleby democratizing capitalwe hope to contribute to prosperity and freedom in all corners of the globe. We are nonprofit, nonpartisan, and publicly supported.

2010 Milken Institute

Table of Contents

Capital Access Index 2009: A Reversal of Fortunes.................................................................1 Ranking Countries for Access to Capital.................................................................................3 Top Ten..........................................................................................................................4 Big Movers.....................................................................................................................6 Top Half.........................................................................................................................6 Bottom Half...................................................................................................................7 Appendix A: Methodology...................................................................................................15 Appendix B: Capital Access Index Components....................................................................17 About the Authors...............................................................................................................24

Capital Access Index 2009

Capital Access Index: A Reversal of Fortunes

In 2008, while wealthier nations faced a severe credit crunch and struggled mightily to keep a recession from becoming a depression, emerging nations weathered the storm remarkably well. Unlike in other downturns, when the industrialized world caught the flu and poor nations caught pneumonia, many emerging countries had built up their immunity this time around. When the U.S. subprime mortgage market and real estate bubble began to collapse in summer 2007, much of the world economy eventually tumbled into recession. By the end of 2008, the worlds financial institutions had posted losses of $685 billion, had cut 150,000 jobs, and had to raise $688 billion to replenish capital, according to Bloomberg. As a result, credit markets suffered major damage. Where once there had been too much liquiditythe easy lending that was one cause of the housing bubblenow there was not enough. In 2008, corporate bond issuance worldwide plummeted by 60 percent in value. The world equity market lost nearly half its value. The volume of international trade and foreign investment dropped. And the issuance of structured financial instruments stagnated. In short, 2008 was not a good year for businesses seeking funding, and it was one of the worst credit crunches for businesses since the Great Depression.

The Top Ten

The list of the nations with the best access to business capital in 2008 (with each nations ranking the previous year in parentheses):

1. 2. 3. 4. 5. 6. 7. 8. 9.

Canada (1) Hong Kong (2) United Kingdom (4) Singapore (5) United States (6) Switzerland (3) Sweden (11) Australia (9) Netherlands (7) Finland (10)

10.

But emerging markets typically avoided the domino effect. Their growth slowed but did not sink. In general, they were simply better positioned than their U.S. and European counterparts because of larger market reserves, lower debt burdens, and stronger growth rates, due in large part to increased internal demand. Many developing nations were able to ride out the crisis while their industrialized counterparts were nearly trampled by it. Among those riding it out were East Asia countries, which did not exhibit the extreme vulnerability they experienced in the 1997 financial crisis. In China, economic growth remained strong because its prompt policy reactions offset the negative effects of the crisis. Still, developing nations were not completely immune, though the impacts were often more indirect than direct. For example, the sharp decline in imports by developed countries, especially the United States, led to worries as trade surpluses dropped significantly in countries such as China. For that matter, not all industrialized nations took a severe hit, with No. 1 ranked Canada in particular being a standout. (See sidebar on Page 5.) That nation benefited from a stable housing market that was not as heavily securitized as that of the United States and from strict capital reserve requirements that kept money flowing to the private sector. This is Canadas second year at the top of the Capital Access Index.

Capital Access Index 2009

In the intervening months since the crisis started, major industrialized countries have used existing and innovative tools to mitigate the credit crunch and to stimulate the economy. To restart the credit markets, central banks all over the world cut target interest rates to historical lows in response to the crisis. In the United States, the government provided guarantees for some consumer and business loans, as well as for some mortgage-backed securities. By the end of 2008, many of these programs were already in place. European and Asian countries adopted similar strategies. However, some economists argue that loose monetary policies may again lead to excessive liquidity. Also in response to the crisis, worldwide efforts have been made to reduce excessive leverage at financial institutions. The International Monetary Fund, among many others, has called for coordinated regulatory changes to reduce systemic risk and enhance financial institutions capital base. Reforms are being proposed to rein in excessively risky, exotic financial derivatives. Some have proposed that the so-called shadow banking system the investment banks, hedge funds, and other non-banking intermediaries between investors and borrowersbe regulated by banking supervisors. To be sure, the goal of most of these measures is to promote healthier and more transparent financial systems. However, it is also true that reduced leverage at financial institutions will lead to less credit available for business borrowers, domestic or international. Consequently, the credit markets worldwide will be adversely affected, and both the financial sector and real sectors will suffer. World GDP growth was 3 percent in 2008 after adjusting for inflation, compared to 5.2 percent the previous year. The International Monetary Fund has projected that world GDP growth in 2009 would be negative 1 percent. In fact, the IMFs World Economic Outlook in October 2009 projected that 124 countries of 182 in its database would experience negative growth in 2009 compared with just seven countries in 2008 meaning the aftermath of the financial crisis had yet to fully impact the real sector worldwide. All the factors discussed above had an impact on this years Capital Access Index. Now in its 11th year, the Capital Access Index is a ranking tool designed to track the ability of businesses and entrepreneurs to access domestic and foreign capital in countries around the world. Today the CAI assesses the performance of the capital markets in 122 nations. It is used to examine macroeconomic and institutional factors that impact market efficiencies, and to identify factors that could signal a potential crisis or, conversely, contribute to improved access to capital. Signaling the ability of countries to provide and to attract foreign funding for businesses, the CAI has significant implications as countries today compete for jobs and capital. Keep in mind that the Capital Access Index is a ranking. It shows the relative strength of financing for businesses in different countries. This ranking needs to be interpreted carefully, together with trend data for each individual country. Perhaps most important, the CAI ranking points to the direction where improvements could be made to broaden access to business finance, which is critical to a countrys sustainable economic growth.

Capital Access Index 2009

Ranking Countries for Access to Capital

The 2009 index ranks 122 countries on six continents for which sufficient data were available. Together they account for 94 percent of world population, 95 percent of all countries gross domestic products, and 98 percent of the worlds financial assets. Fifty-six variables are assessed across seven components of each countrys economic, financial, and social infrastructures. A country that scores extremely well in one component may score much lower in others. The result is a composite score that determines the countrys overall position in the index. A list of all the variables used to calculate the scores can be found in appendix A. Country rankings for each component can be found in appendix B. The seven components are:

Macroeconomic environment: the favorableness of conditions for running and financing a business,

based on such variables as inflation, interest rates, tax rates, and financial sophistication relative to international norms

Institutional environment: the extent to which institutions support and enhance business financing

activities, based on variables that include the enforceability of property rights, the impartiality of the judicial system, the efficiency of bankruptcy procedures, and the levels of corruption

Financial and banking institutions: the involvement of deposit-taking institutions in financing

businesses, based on such variables as the extension of credit to the private sector, the soundness of financial institutions, the ease of access to bank loans, and the efficiency of the banking system

Equity market development: the importance of equity financing of business operations, based

on such variables as stock market capitalization relative to GDP , stock market liquidity, and changes in the number of listings

Bond market development: the importance of bond financing for businesses, based on variables

such as the value of private and public bonds relative to GDP and securitized asset issuance relative to GDP

Alternative sources of capital: the level of usage of diverse financing sources, such as venture

capital, credit cards, and non-public stock offerings or other private placements

International funding: the availability of foreign capital to businesses in a particular country, based

on such variables as the volatility of exchange rates, international reserve holdings, portfolio and foreign direct investment, capital inflows and outflows, and sovereign ratings

Capital Access Index 2009

The Top Ten

The gap between the best-performing countries and the worst-performing countries widened in 2008. The average score was 4.73, a modest increase from 4.68 in 2007, and the median score was 4.62, an increase of 0.04 percentage points from 4.58 the year before. Canada and Hong Kong remained first and second in the Capital Access Index. Canadas performance relative to other countries improved in all aspects except for equity market development. Most remarkable was its strong performance with respect to the bond market and international funding. Canada continued to benefit from stability in its macroeconomic environment, institutional environment, and banking sector development. Hong Kong continued to lead the world in macro environment and international funding. Lower tax rates and a sound macroeconomic performance combined with growing foreign exchange reserves signaled a stable credit environment for entrepreneurs. However, to achieve a more balanced capital market structure, Hong Kong could benefit from measures to promote further development of the corporate bond market and securitization. The United Kingdom and Singapore ranked third and fourth, respectively. The United Kingdom suffered significantly from the financial crisis. However, the bond market provided some backup when bank lending slowed. Bond issuance grew by 2 percent in 2008. Corporate and financial bond issuance grew slightly faster than government bonds. In addition, securitized bond issuance relative to GDP remained at the same level as last year. Singapore saw some improvement in international fund and bond market development, but it lost some ground in alternative capital and equity market development. Both countries benefited from a sound institutional environment. Somewhat surprisingly, the United States managed to stay in the top 10 in 2009, even moving up one ranking to No. 5, despite the significant damage caused by the financial crisis. Several factors helped interest rates were at historical lows, and its international investment position improved as the result of a weak dollar. Perhaps most importantly, while the private credit market was largely frozen, the government stepped in to help provide short-term credit for businesses. Also, the United States still has the highest country rating for deposits and sovereign debt, thanks to the deposit insurance system and the U.S. dollars special status as an international reserve currency. In times of turbulent financial markets, investors search for safe havens, so many put a substantial portion of their investments into U.S. government securities and agency securities, providing funding for U.S. governments, businesses, and households.

Capital Access Index 2009

No. 1 Canada Shows Stability You Can Bank On

In 2008, the World Economic Forum ranked Canadas banking system as the healthiest in the world. The United States came in at No. 40. Its no wonder that among industrialized nations only Canada can say not one of its banks has failed in a financial meltdown that initially decimated U.S. financial institutions.1 Through 2008, Canada performed extremely well amid the financial crisis and was in a good position to weather the storm. Prior to the crisis, Canadas macroeconomic performance had been solid: Average real GDP growth from 2004 to 2007 was 3 percent, one of the highest among industrialized countries. Unemployment dropped slightly during the same time period. The Canadian economy benefited from the run-up in energy price in recent years. A large country with abundant natural resources, Canada enjoyed this comparative advantage at a time of rising demand for energy. Well-established institutional and legal frameworks further helped remove barriers for business financing. There are two major contributors to Canadas exceptional performance in 2008.

n

The Canadian housing market was relatively stable. In Canada, the housing market is not as heavily securitized as in the United States. In 2008, just 29 percent of all mortgages were securitized, compared with 69 percent in the United States. Lenders (mainly banks) held these unsecuritized mortgages on their balance sheets, bearing a substantial part of the risks related to these mortgages. Such constraints helped to improve lending standards and led to smoother, albeit much slower, growth in the housing sector. Perhaps most importantly, mortgage insurance played a significant role in reining in excessive speculation in the market. Canadian banks are subject to strict capital reserve requirements. Leverage caps are put on both tier 1 and tier 2 capital ratios. Off-balance-sheet exposures are also regulated, unlike in the United States. The more conservative approach of bank regulators helps ensure that banks have sufficient reserves even in a time of economic downturn to keep the capital flowing to the private sector.

Regulators engage in a delicate balancing act between growth and prudence. The excellent performance (relative to other developed countries) of the Canadian financial sector in the aftermath of the global financial crisis proves the Canadians are on the right track. Several challenges remain: The current account surplus weakened and likely continued to deteriorate in 2009. Equity financing has been slow. The housing market, though performing relatively well, still has suffered from slower sales of new homes. However, its strong institutional environment and solid banking sector should keep Canada safe through the financial storm.

1. Susan Bourette, In Canada, Obama gets warm welcome and tips on managing an economy, Christian Science Monitor, February 20, 2009. http://www.csmonitor.com/World/Americas/2009/0220/p25s16-woam.html (accessed March 24, 2010).

Capital Access Index 2009

Switzerland, Sweden, Australia, the Netherlands, and Finland ranked sixth through 10th, respectively. While 2007 was a good year for Switzerlandit ranked third in the CAI, the highest position it has achieved in the past 10 yearsit lost three positions in 2008. Switzerland scored higher in institutional environment and in international funding but saw declines in the performance of all aspects of financial markets: equity market, bond market, banks and securitized market. In particular, bond issuance dropped 9 percent, and private placements dropped almost 50 percent relative to GDP . Six of the top 10 countries saw some decline in their financial and banking institutions scores. Six experienced worsening equity market performance. Five of them reported fewer activities in alternative capital. However, the institutional and macroeconomic environments remained relatively stable for these countries.

The Big Movers

China and Portugal made the largest leaps in ranking. China jumped 13 places, to No. 32, with improvements in all subcomponents except for the bond market and alternative sources of capital. Although Chinas trade surplus started to shrink toward the end of the year, sound economic growth and a robust banking sector helped stabilize the economy and keep credit flowing. While the countrys institutional environment continued to improve, the absence of a meaningful corporate bond market has to an extent limited Chinese businesses access to capital. Portugal moved up eight places to No. 18, its first time in the top 20. Portugal saw improvements in its macroeconomic and institutional environments and growth in bond issuance. Thanks to a relatively robust banking sector, credit kept flowing. However, in 2008 Portugal received less alternative capital than in 2007, signaling an area that needs future improvements.

The Top Half

All 27 industrialized countries2 are included in the top half of the CAI rankings. Thirteen improved their rankings, eight saw declines, and the remainder were unchanged. Rounding out the top half are thirteen developing European countries, seven Middle Eastern countries, five developing Asian countries, six Latin American countries, and three African countries. Most industrialized countries saw a significant drop in their equity market development scores. This is caused by either higher volatility or fewer new listings. Some exceptions are Hong Kong, Sweden, Taiwan, and Slovenia. Also, most industrialized countries lost some ground in the area of financial and banking institutions. Bond market development and institutional environment remained exceptional for industrialized countries as a group.

2. Industrialized economies include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong SAR, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Slovenia, South Korea, Spain, Sweden, Switzerland, Taiwan, the United Kingdom, and the United States.

Capital Access Index 2009

BRIC countriesBrazil, Russia, India and Chinawere all in the top half, and all saw some improvements in both their composite scores and rankings this year.

n

Brazil moved from No. 51 to No. 49, with significant advances in bond market development and alternative sources of capital. Russia ranked 54th this year, compared to 58th last year. The country saw improvements in all index components except for financial and banking institutions and equity market development. Like Brazils, Russias highlights were improvements in bond market development and alternative sources of capital. India moved from No. 47 to No. 44. It saw declines in macroeconomic environment and institutional environment scores but made progress in alternative sources of capital and in international funding.

China, as mentioned above, skyrocketed 13 positions, from No. 45 to No. 32.

The Bottom Half

Of the 61 countries in the bottom half of this years CAI rankings, 30 were African countries. They exhibited some of the greatest shifts both upward and downwardin the bottom half.

n

Central African Republic plummeted 19 places, from No. 94 to No. 113, mainly as a result of deteriorating equity market conditions. Angola leaped 17 places, from No. 110 to No. 93, because of substantial improvements in macroeconomic environment and international funding. Syria dived 15 places from No. 92 to No. 107, placing it in the bottom 20. The only component that saw some progress in Syria was alternative sources of capital.

Moldova vaulted 14 places from No. 98 to No. 84. Moldova saw improvements in every component, but the greatest strides were in institutional environment and bond market development. Ukraines ranking continued to declinefrom No. 65 in 2007 to No. 74 in 2008, to No. 77 in the latest ranking.

Capital Access Index 2009

Of the bottom 20 countries, 17 were African nations. Almost all suffered from further declines in their already dismal institutional environments, emphasizing the need for these countries to improve their economic infrastructure to provide a stable platform for private business financing.

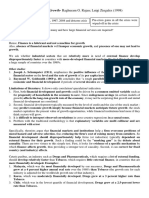

Table 1: 2009 Capital Access Index

RANK 2009 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 39 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 58 60 61 RANK 2008 1 2 4 5 6 3 11 9 7 10 13 12 17 8 13 17 15 26 19 23 22 19 15 27 21 24 32 25 29 31 28 45 30 34 33 37 36 35 39 38 41 40 46 47 44 42 52 52 51 54 42 50 57 58 48 48 61 64 56 67 62 COUNTRY Canada Hong Kong SAR United Kingdom Singapore United States Switzerland Sweden Australia Netherlands Finland Denmark South Korea Ireland Norway Malaysia France Estonia Portugal New Zealand Germany Belgium United Arab Emirates Japan Spain Israel Taiwan, China Thailand Austria Chile Kuwait South Africa China Italy Lithuania Oman Saudi Arabia Hungary Czech Republic Lebanon Panama Greece Slovakia Slovenia India Mexico Jordan Latvia Tunisia Brazil Egypt Poland Turkey Colombia Russia Bulgaria Croatia Romania Macedonia Peru Morocco Philippines CAI 2009 8.25 7.99 7.95 7.92 7.88 7.68 7.54 7.52 7.49 7.47 7.44 7.39 7.23 7.18 7.06 6.99 6.89 6.86 6.85 6.84 6.83 6.77 6.72 6.71 6.66 6.54 6.51 6.45 6.36 6.22 6.15 6.00 5.96 5.92 5.91 5.90 5.82 5.72 5.66 5.66 5.64 5.59 5.53 5.51 5.50 5.47 5.22 5.21 5.14 5.08 5.03 5.02 4.97 4.96 4.94 4.90 4.88 4.86 4.86 4.74 4.62

MEAN: 4.73

10

RANK 2009 62 63 64 64 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 85 87 88 88 88 91 92 93 94 95 96 97 98 98 100 101 102 103 104 105 106 107 108 109 110 111 111 113 114 115 116 117 118 119 120 121 122

RANK 2008 62 65 60 59 70 54 66 68 71 75 69 81 73 72 80 74 77 82 83 86 85 79 98 84 92 78 98 89 88 87 76 110 90 100 103 105 95 97 95 102 101 109 108 110 104 92 106 113 91 114 106 94 115 121 117 122 116 119 110 120 118

COUNTRY El Salvador Indonesia Costa Rica Uruguay Jamaica Belarus Vietnam Botswana Namibia Kenya Sri Lanka Ghana Pakistan Argentina Guatemala Ukraine Nigeria Ecuador Iran Armenia Bosnia and Herzegovina Honduras Moldova Bangladesh Zimbabwe Dominican Republic Tanzania Venezuela Zambia Bolivia Papua New Guinea Angola Nicaragua Mongolia Yemen Malawi Paraguay Uganda Cambodia Lesotho Senegal Mozambique Cameroon Rwanda Burkina Faso Syria Benin Sierra Leone Ethiopia Laos Mali Central African Republic Togo Guinea Mauritania Republic of Congo Madagascar Chad Niger Haiti Burundi

CAI 2009 4.61 4.60 4.43 4.43 4.35 4.34 4.27 4.20 4.13 4.08 3.96 3.94 3.93 3.84 3.79 3.76 3.73 3.72 3.65 3.61 3.60 3.53 3.52 3.48 3.48 3.47 3.36 3.36 3.36 3.30 3.26 3.20 3.19 3.18 3.09 3.04 3.03 3.03 2.91 2.87 2.84 2.74 2.67 2.64 2.63 2.59 2.58 2.56 2.44 2.37 2.37 2.32 2.31 2.19 2.18 2.17 2.13 2.06 2.03 1.95 1.87

MEAN: 4.73

10

Capital Access Index 2009

Table 2 shows the component scores for different country groups. Industrialized countries, not surprisingly, remained strong in all seven components. The greatest gap between industrialized countries and other groups was in alternative funding. Among developing nations, Middle Eastern countries received the highest scores for macroeconomic environment, bond market development, institutional environment, and international funding, while developing European countries were relatively stronger in equity market development and alternative sources of capital. Developing Asian countries lost some momentum compared to the previous year. Overall, macroeconomic and institutional environments were the two strongest components driving the composite CAI scores for all nations, while alternative funding lagged for most developing countries. Table 2: Average of components for 2009 Capital Access Index

Financial and banking institutions (FI)

Industrialized countries Middle East Europe Asia Americas and the Caribbean Africa

7.09 5.03 4.83 4.50 4.17 3.07

7.61 7.21 6.92 5.42 5.57 4.33

7.66 5.71 5.30 4.74 4.63 4.08

6.96 3.96 4.91 4.34 3.79 2.74

6.22 4.13 2.82 4.42 2.77 1.76

6.76 2.83 3.36 3.96 3.46 1.55

6.60 3.08 2.64 2.85 2.44 1.02

6.21 4.03 4.03 3.99 3.79 2.59

Table 3 shows each nations CAI composite scores for the past three years. The average composite score for all countries was 4.73 in the 2009 index (see table 4), compared with 4.68 in the 2008 index and 4.71 in the 2007 index. The median scores were 4.62 in the 2009 index, 4.58 in the 2008 index, and 4.51 in the 2007 index. The higher median scores reflect some improvement among countries in the middle range. However, the gap between the best-performing country and the worst-performing country increased from 6.03 last year to 6.38 this year.

International Funding (IF)

Alternative sources of capital (AC)

Bond market development (BM)

Equity market development (EM)

Macroeconomic environment (ME)

Institutional environment (IE)

2009 CAI score

Capital Access Index 2009

Table 3: Capital Access Index scores and country rankings, 2007-2009

2009 CAI Canada Hong Kong SAR United Kingdom Singapore United States Switzerland Sweden Australia Netherlands Finland Denmark South Korea Ireland Norway Malaysia France Estonia Portugal New Zealand Germany Belgium United Arab Emirates Japan Spain Israel Taiwan, China Thailand Austria Chile Kuwait South Africa China Italy Lithuania Oman Saudi Arabia Hungary Czech Republic Lebanon 8.25 7.99 7.95 7.92 7.88 7.68 7.54 7.52 7.49 7.47 7.44 7.39 7.23 7.18 7.06 6.99 6.89 6.86 6.85 6.84 6.83 6.77 6.72 6.71 6.66 6.54 6.51 6.45 6.36 6.22 6.15 6.00 5.96 5.92 5.91 5.90 5.82 5.72 5.66 Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 CAI 7.90 7.82 7.70 7.64 7.56 7.76 7.13 7.26 7.28 7.21 7.03 7.06 6.95 7.27 7.03 6.95 6.96 6.40 6.92 6.67 6.76 6.92 6.96 6.33 6.81 6.63 6.09 6.49 6.19 6.10 6.21 5.45 6.11 5.87 5.97 5.76 5.79 5.86 5.54 2008 Rank 1 2 4 5 6 3 11 9 7 10 13 12 17 8 13 17 15 26 19 23 22 19 15 27 21 24 32 25 29 31 28 45 30 34 33 37 36 35 39 CAI 8.01 8.27 8.23 7.88 7.50 7.62 7.86 7.61 7.07 7.56 7.12 6.87 7.66 7.56 7.14 6.83 6.87 6.79 7.00 7.05 6.86 6.13 7.07 5.34 7.15 6.57 6.36 6.80 6.32 6.09 6.12 5.26 5.96 6.25 5.36 5.73 6.11 5.63 5.12 2007 Rank 3 1 2 4 11 7 5 8 15 9 14 19 6 9 13 22 19 24 18 17 21 29 15 43 12 25 26 23 27 32 30 45 33 28 42 36 31 37 48

10

Capital Access Index 2009

Table 3: Capital Access Index scores and country rankings, 2007-2009 (cont.)

2009 CAI Panama Greece Slovakia Slovenia India Mexico Jordan Latvia Tunisia Brazil Egypt Poland Turkey Colombia Russia Bulgaria Croatia Romania Macedonia Peru Morocco Philippines El Salvador Indonesia Costa Rica Uruguay Jamaica Belarus Vietnam Botswana Namibia Kenya Sri Lanka Ghana Pakistan Argentina Guatemala Ukraine Nigeria 5.66 5.64 5.59 5.53 5.51 5.50 5.47 5.22 5.21 5.14 5.08 5.03 5.02 4.97 4.96 4.94 4.90 4.88 4.86 4.86 4.74 4.62 4.61 4.60 4.43 4.43 4.35 4.34 4.27 4.20 4.13 4.08 3.96 3.94 3.93 3.84 3.79 3.76 3.73 Rank 39 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 58 60 61 62 63 64 64 66 67 68 69 70 71 72 73 74 75 76 77 78 CAI 5.56 5.52 5.53 5.34 5.33 5.46 5.51 4.90 4.90 4.92 4.85 5.51 4.95 4.82 4.80 4.97 4.97 4.60 4.53 4.84 4.30 4.55 4.55 4.42 4.61 4.63 4.19 4.85 4.41 4.28 4.14 4.03 4.21 3.71 4.07 4.12 3.75 4.06 3.79 2008 Rank 38 41 40 46 47 44 42 52 52 51 54 42 50 57 58 48 48 61 64 56 67 62 62 65 60 59 70 54 66 68 71 75 69 81 73 72 80 74 77 CAI 5.53 5.87 5.29 5.22 5.50 5.78 5.14 5.61 4.60 4.76 4.36 5.54 4.97 4.76 5.00 4.85 4.77 4.66 4.30 4.98 4.08 4.50 4.95 4.40 4.22 4.77 4.52 4.46 3.98 4.29 4.04 3.67 4.11 3.81 4.06 4.52 3.83 4.36 3.40 2007 Rank 40 34 44 46 41 35 47 38 59 56 65 39 51 56 49 53 54 58 67 50 71 62 52 64 69 54 60 63 74 68 73 81 70 78 72 60 77 65 88

11

Capital Access Index 2009

Table 3: Capital Access Index scores and country rankings, 2007-2009 (cont.)

2009 CAI Ecuador Iran Armenia Bosnia and Herzegovina Honduras Moldova Bangladesh Zimbabwe Dominican Republic Tanzania Venezuela Zambia Bolivia Papua New Guinea Angola Nicaragua Mongolia Yemen Malawi Paraguay Uganda Cambodia Lesotho Senegal Mozambique Cameroon Rwanda Burkina Faso Syria Benin Sierra Leone Ethiopia Laos Mali Central African Republic Togo Guinea Mauritania Republic of Congo 3.72 3.65 3.61 3.60 3.53 3.52 3.48 3.48 3.47 3.36 3.36 3.36 3.30 3.26 3.20 3.19 3.18 3.09 3.04 3.03 3.03 2.91 2.87 2.84 2.74 2.67 2.64 2.63 2.59 2.58 2.56 2.44 2.37 2.37 2.32 2.31 2.19 2.18 2.17 Rank 79 80 81 82 83 84 85 85 87 88 88 88 91 92 93 94 95 96 97 98 98 100 101 102 103 104 105 106 107 108 109 110 111 111 113 114 115 116 117 CAI 3.59 3.57 3.50 3.52 3.76 3.07 3.53 3.12 3.77 3.07 3.23 3.25 3.43 4.01 2.46 3.22 3.01 2.82 2.78 3.09 3.08 3.09 2.84 2.89 2.48 2.63 2.46 2.79 3.12 2.72 2.44 3.13 2.37 2.72 3.10 2.24 1.89 2.11 1.87 2008 Rank 82 83 86 85 79 98 84 92 78 98 89 88 87 76 110 90 100 103 105 95 97 95 102 101 109 108 110 104 92 106 113 91 114 106 94 115 121 117 122 CAI 3.56 3.71 3.96 3.44 3.61 3.39 3.24 2.62 3.47 3.45 3.21 3.00 3.85 3.77 2.56 3.66 3.36 2.68 2.63 3.16 3.25 3.00 3.08 3.05 2.60 2.61 2.32 2.81 2.78 2.48 2.09 3.11 2.11 2.85 2.97 2.48 2.33 2.63 2.32 2007 Rank 84 80 75 87 83 89 92 107 85 86 93 98 76 79 110 82 90 104 105 94 91 98 96 97 109 108 117 102 103 111 120 95 119 101 100 111 116 105 117

12

Capital Access Index 2009

Table 3: Capital Access Index scores and country rankings, 2007-2009 (cont.)

2009 CAI Madagascar Chad Niger Haiti Burundi 2.13 2.06 2.03 1.95 1.87 Rank 118 119 120 121 122 CAI 2.14 2.02 2.46 1.94 2.05 2008 Rank 116 119 110 120 118 CAI 2.38 1.69 2.42 2.09 2.34 2007 Rank 114 122 113 120 115

The average score of each CAI component is summarized in table 4 for countries grouped by their rankings. The average score for all countries was lowest for alternative sources of capital, a result of the declining securitization market worldwide. For the first time, bond market development was not the weakest area of performance for all countries, primarily because bond issuance supported funding for businesses when bank lending sharply declined in many countries. The gap between the top and bottom 20 countries has enlarged. Last year the average scores for the two groups were 7.27 and 2.17, with a gap of 5.1; this year the gap grew to 5.26. The largest gap lies in alternative sources of capital, followed by equity market development. In fact, for the bottom 20 countries, equity markets and alternative sources of capital were almost nonexistent. Banks and bond issuancemainly government bondswere better developed in comparison. The gap has widened considerably in institutional environment and international funding, while it shrank somewhat in financial and banking institutions. Table 4: Component averages of 2009 Capital Access Index by ranking groups

Financial and banking institutions (FI)

Alternative sources of capital (AC)

7.11 5.14 3.10 1.07 0.33

Bond market development (BM)

Equity market development (EM)

Macroeconomic environment (ME)

Institutional environment (IE)

2009 CAI score

Top 20 Top 50% All Bottom 50% Bottom 20

7.42 6.24 4.73 3.22 2.16

7.90 7.31 6.01 4.72 3.65

8.11 6.59 5.36 4.12 3.02

7.21 6.07 4.45 2.84 1.57

6.50 5.47 3.55 1.63 0.14

6.94 5.48 3.66 1.84 1.00

13

International funding (IF)

6.44 5.47 4.08 2.68 1.91

Capital Access Index 2009

Appendix A: Methodology

The Capital Access Index is based on the evaluation of seven components: macroeconomic environment (ME), institutional environment (IE), financial and banking institutions (FI), equity market development (EM), bond market development (BM), alternative sources of capital (AC), and international funding (IF).

Macroeconomic environment: the favorableness of conditions for running and financing a business,

based on such variables as inflation, interest rates, tax rates, and financial sophistication relative to international norms

Institutional environment: the extent to which institutions support and enhance business financing

activities, based on variables that include the enforceability of property rights, the impartiality of the judicial system, the efficiency of bankruptcy procedures, and the levels of corruption

Financial and banking institutions: the involvement of deposit-taking institutions in financing

businesses, based on such variables as the extension of credit to the private sector, the soundness of financial institutions, the ease of access to bank loans, and the efficiency of the banking system

Equity market development: the importance of equity financing of business operations, based

on such variables as stock market capitalization relative to GDP , stock market liquidity, and changes in the number of listings

Bond market development: the importance of bond financing for businesses, based on variables such as

the value of private and public bonds relative to GDP and securitized asset issuance relative to GDP

Alternative sources of capital: the level of usage of diverse financing sources, such as venture

capital, credit cards, and non-public stock offerings or other private placements.

International funding: the availability of foreign capital to businesses in a particular country, based

on such variables as the volatility of exchange rates, international reserve holdings, portfolio and foreign direct investment, capital inflows and outflows, and sovereign ratings. To calculate component scores, first the non-surveyed or missing variables in the FI, EM, BM, AC, and IF components are assigned a score of zero. This step reflects the fact that the variable in question is so small that its effect on capital access is immaterial. For some countries, non-surveyed variables are missing due to slow data reporting but exist for prior years. In these cases, the prior years values are used for the current year rather than assigning a score of zero. Second, the variables are ranked by decile according to the directional relationship to capital access. The resulting scores of one to 10 are then assigned for countries ranking lowest to highest in terms of capital access. The score for each subcategory is calculated by a simple average of the variables, but only if the data in the category are greater than or equal to 50 percent of the total variables in that category. Third, the Capital Access Index is calculated using the weighted average of the seven components. The first two components, ME and IE, are weighted 25 percent each. The other five components, FI, EM, BM, AC, and IF, are each weighted as 10 percent of the final CAI score. Theoretically, the scores can range from zero to 10. However, because every country has some kind of macroeconomic and institutional structure, the minimum for each of these two categories is one; therefore the lowest possible score is 0.5.

15

Capital Access Index 2009

Capital Access Index variables

Code

ME01 ME02 ME03 ME04 ME05 ME06 IE01 IE02 IE03 IE04 IE05 IE06 IE07 IE08 IE09 IE10 IE11 IE12 IE13 IE14 IE15 IE16 IE17 FI01 FI02 FI03 FI04 FI05 FI06 FI07 FI08 FI09 FI10 EM01 EM02 EM03 EM04 EM05 EM06 BM01 BM02 BM03 BM04 BM05 AC01 AC02 AC03 AC04 IF01 IF02 IF03 IF04 IF05 IF06 IF07 IF08

Component

Macro environment Macro environment Macro environment Macro environment Macro environment Macro environment Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Economic institution Bank Bank Bank Bank Bank Bank Bank Bank Bank Bank Equity market development Equity market development Equity market development Equity market development Equity market development Equity market development Bond market development Bond market development Bond market development Bond market development Bond market development Alternative sources of capital Alternative sources of capital Alternative sources of capital Alternative sources of capital International funding International funding International funding International funding International funding International funding International funding International funding

Variable

Absolute inflation rate Lending rate The absolute value of difference between interest rate volatility and the volatility of the International Monetary Funds SDR (special drawing right) and LIBOR (London Interbank Offered Rate) Corporate tax Personal tax Financial market sophistication Contract enforcement (procedures, days, and costs) Absence of corruption Registering property (procedures, days, and costs) Minimum paid in capital/ GNI (gross national income) Cost to create and register collateral Index of legal rights of borrowers and lenders Index of credit information availability Coverage of public registries Disclosure requirements Bankruptcy (procedure and costs) Bankruptcy recovery rate per dollar Effectiveness of bankruptcy law Judicial independence Efficiency of legal framework Property rights Intellectual property protection Burden of local government regulation Claims to non-financial firms/GDP Bank assets/GDP Domestic assets/foreign assets Moodys deposit rating Net interest margin Syndicated loans/GDP Actual reserves/ bank assets Soundness of banks Access to credit Ease of access to loans Equity market cap/GDP Equity market liquidity (turnover ratio) Relative equity market volatility (standard deviation of 12-month daily returns) Change in number of listings Local equity market access Regulation of securities exchange Private-sector bond/GDP Public-sector bond/GDP Private-sector bond/public-sector bond % Change in number of issuance Securitized bond issuance/GDP Venture capital funds/GDP Private placements/GDP Credit card issuance/GDP Venture capital availability Total international reserves/annual imports Relative currency volatility Portfolio inflow/GDP Portfolio outflow/GDP Direct investment inflow/GDP Direct investment outflow/GDP Fitch ratings S&P ratings

Source

IFS IFS IFS Heritage Heritage WEF WBD ICRG WBD WBD WBD WBD WBD WBD WBD WBD WBD WEF WEF WEF WEF WEF WEF IFS IFS IFS Moodys IFS SDC, IFS IFS WEF WEF WEF GMFB GMFB Datastream GMFB WEF WEF BIS, IFS BIS, IFS BIS BIS SDC, IFS SDC, IFS SDC, IFS NIL WEF IFS Datastream IFS IFS IFS IFS Fitch S&P

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

16

Notes: IFS: International Financial Statistics; Heritage: The 2007 Index of Economic Freedom; WEF: World Economic Forum, The Global Competitiveness Report, various issues; WBD: The World Bank Group Doing Business Database http://www.doingbusiness.org ; ICRG: International Country Risk Guide; Moodys: Moodys Ratings; SDC: Thomson Financial SDC Platinum; GMFB: S&P Global Stock Markets Factbook; BIS: Bank of International Settlements, BIS quarterly review; Datastream: Thomson Datastream; NIL: The Nilson Report, various issues; Fitch: Fitch Ratings; S&P: Standard & Poors Ratings

Directional relationship

Capital Access Index 2009

Appendix B: Capital Access Index Components

Appendix B.1: The Macroeconomic Environment (ME)

ME captures the extent to which a countrys macroeconomic environment is conducive to business.

RANK 1 2 2 4 5 6 7 8 9 10 11 11 11 11 11 16 16 18 18 20 20 22 22 22 22 26 26 26 26 26 26 32 33 33 33 36 37 37 37 37 37 42 42 42 42 46 46 48 48 48 48 52 52 52 52 52 57 58 59 59 59 COUNTRY Hong Kong SAR Canada Singapore United Arab Emirates Slovakia Lebanon Czech Republic Malaysia Switzerland Finland United Kingdom Netherlands Estonia Kuwait Oman South Korea Macedonia Israel Lithuania Ireland Saudi Arabia United States Thailand Slovenia Bosnia and Herzegovina Germany Japan Italy Panama El Salvador Ecuador Belarus Norway Hungary Mexico Denmark Australia Portugal Taiwan, China Austria China New Zealand Chile Croatia Romania Sweden Greece Belgium Jordan Latvia Bulgaria Spain Poland Turkey Russia Uruguay Egypt France Tunisia Philippines Angola ME 9.67 9.50 9.50 9.25 9.17 9.00 8.83 8.67 8.50 8.25 8.17 8.17 8.17 8.17 8.17 8.00 8.00 7.83 7.83 7.75 7.75 7.67 7.67 7.67 7.67 7.50 7.50 7.50 7.50 7.50 7.50 7.40 7.33 7.33 7.33 7.25 7.00 7.00 7.00 7.00 7.00 6.83 6.83 6.83 6.83 6.75 6.75 6.67 6.67 6.67 6.67 6.50 6.50 6.50 6.50 6.50 6.33 6.25 6.00 6.00 6.00

MEAN: 6.01

10

RANK 59 63 63 65 65 67 67 69 69 71 71 71 74 74 74 74 74 74 74 81 81 81 81 81 81 81 81 81 81 91 91 93 93 95 96 97 98 99 100 100 100 100 100 105 105 105 105 109 110 110 112 113 114 115 115 115 115 119 119 121 122

COUNTRY Yemen South Africa India Iran Papua New Guinea Armenia Bolivia Ghana Cambodia Indonesia Botswana Guatemala Brazil Colombia Costa Rica Ukraine Nigeria Moldova Paraguay Peru Morocco Jamaica Namibia Kenya Honduras Dominican Republic Tanzania Senegal Syria Nicaragua Lesotho Sierra Leone Central African Republic Burkina Faso Cameroon Mongolia Rwanda Bangladesh Venezuela Uganda Mozambique Mauritania Republic of Congo Vietnam Argentina Malawi Madagascar Haiti Pakistan Benin Togo Sri Lanka Laos Zambia Guinea Chad Niger Ethiopia Mali Burundi Zimbabwe

ME 6.00 5.83 5.83 5.80 5.80 5.67 5.67 5.50 5.50 5.33 5.33 5.33 5.17 5.17 5.17 5.17 5.17 5.17 5.17 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 4.83 4.83 4.80 4.80 4.75 4.67 4.50 4.20 4.17 4.00 4.00 4.00 4.00 4.00 3.83 3.83 3.83 3.83 3.80 3.75 3.75 3.67 3.50 3.40 3.33 3.33 3.33 3.33 3.25 3.25 3.00 2.17

MEAN: 6.01

10

17

Capital Access Index 2009

Appendix B.2: Institutional Environment (IE)

IE reflects the extent to which a country has the institutions needed to support and enhance business financing activities.

RANK 1 2 2 4 4 6 6 6 6 6 11 12 13 14 15 16 17 17 17 20 21 22 23 24 25 26 26 28 29 30 31 32 33 34 35 36 37 38 38 40 40 42 43 43 45 46 46 48 48 48 51 52 53 53 53 56 57 57 59 59 59 COUNTRY Singapore Finland New Zealand Canada United Kingdom Hong Kong SAR United States Australia Denmark Norway Japan Switzerland Ireland Sweden Germany Austria Netherlands South Korea Estonia Taiwan, China Malaysia France Belgium Saudi Arabia Portugal Spain South Africa Lithuania Tunisia Chile Oman Namibia Thailand China Botswana Latvia Israel United Arab Emirates Hungary Romania Belarus Colombia Kuwait Armenia Morocco Jordan Uruguay Slovakia Turkey Bulgaria Yemen Iran Italy Peru Costa Rica Sri Lanka Slovenia Zambia Greece Egypt El Salvador IE 8.88 8.71 8.71 8.47 8.47 8.35 8.35 8.35 8.35 8.35 8.24 8.12 8.06 8.00 7.94 7.88 7.76 7.76 7.76 7.47 7.41 7.29 7.24 7.13 7.06 6.94 6.94 6.88 6.82 6.76 6.75 6.71 6.65 6.59 6.53 6.24 6.12 6.06 6.06 6.00 6.00 5.94 5.88 5.88 5.82 5.71 5.71 5.65 5.65 5.65 5.64 5.45 5.41 5.41 5.41 5.35 5.29 5.29 5.24 5.24 5.24

MEAN: 5.36

10

RANK 62 63 64 65 65 65 68 69 70 71 72 73 74 74 74 74 78 79 80 80 82 83 84 85 86 87 87 87 90 91 92 93 94 95 96 97 98 99 99 101 102 102 104 104 106 106 106 109 110 110 112 113 114 115 115 117 118 119 120 121 122

COUNTRY Moldova Lebanon Mexico Panama Vietnam Guatemala Rwanda Honduras Pakistan India Mongolia Jamaica Brazil Indonesia Ghana Argentina Macedonia Czech Republic Poland Russia Tanzania Kenya Dominican Republic Ethiopia Syria Croatia Malawi Paraguay Mali Nigeria Senegal Lesotho Burkina Faso Nicaragua Ecuador Uganda Mauritania Papua New Guinea Guinea Bolivia Bosnia and Herzegovina Mozambique Philippines Zimbabwe Angola Togo Niger Madagascar Ukraine Bangladesh Benin Cameroon Cambodia Laos Central African Republic Sierra Leone Republic of Congo Venezuela Chad Burundi Haiti

IE 5.19 5.18 5.18 5.12 5.12 5.12 4.89 4.88 4.82 4.76 4.75 4.71 4.65 4.65 4.65 4.65 4.63 4.59 4.47 4.47 4.38 4.35 4.25 4.24 4.13 4.12 4.12 4.12 4.00 3.94 3.94 3.93 3.88 3.82 3.76 3.71 3.67 3.64 3.64 3.53 3.50 3.50 3.29 3.29 3.27 3.27 3.27 3.25 3.24 3.24 3.20 3.19 3.14 3.00 3.00 2.82 2.55 2.35 2.33 2.21 2.09

MEAN: 5.36

10

18

Capital Access Index 2009

Appendix B.3: Financial and Banking Institutions (FI) FI measures the level of involvement of deposit-taking institutions in financing businesses.

RANK 1 2 3 4 5 6 6 8 9 10 10 12 12 12 12 16 16 18 19 19 19 19 19 24 24 24 27 28 28 30 31 32 32 34 35 36 37 37 37 37 37 42 42 42 45 46 46 46 46 50 50 52 53 53 53 53 53 53 53 60 60 COUNTRY New Zealand Canada Australia Netherlands Hong Kong SAR Singapore United States Switzerland Denmark Spain Panama United Kingdom Portugal Japan Slovenia Sweden Chile Estonia Finland South Korea Ireland Malaysia South Africa Belgium Israel Kuwait France United Arab Emirates Lithuania Thailand Jordan Taiwan, China Slovakia Germany Hungary Latvia Austria Italy Czech Republic Greece Namibia Colombia Bulgaria Croatia Vietnam Oman India Tunisia Brazil China Romania Costa Rica Norway Mexico Indonesia Belarus Ukraine Honduras Mongolia Saudi Arabia Peru FI 8.70 8.60 8.20 8.10 7.90 7.80 7.80 7.60 7.50 7.30 7.30 7.10 7.10 7.10 7.10 7.00 7.00 6.80 6.70 6.70 6.70 6.70 6.70 6.60 6.60 6.60 6.50 6.40 6.40 6.30 6.20 6.10 6.10 6.00 5.90 5.80 5.50 5.50 5.50 5.50 5.50 5.30 5.30 5.30 5.20 5.10 5.10 5.10 5.10 5.00 5.00 4.80 4.60 4.60 4.60 4.60 4.60 4.60 4.60 4.50 4.50

MEAN: 4.54

10

RANK 62 62 62 65 66 66 66 69 69 69 72 72 72 75 75 75 78 78 78 81 81 83 84 84 84 87 87 89 89 89 89 93 94 94 96 96 98 98 100 101 101 101 101 101 106 106 108 109 109 111 112 113 113 115 116 117 117 119 119 121 122

COUNTRY Egypt Morocco Sri Lanka Russia Poland Turkey Ghana Macedonia Guatemala Bangladesh Pakistan Moldova Zimbabwe Botswana Kenya Bosnia and Herzegovina Philippines Jamaica Nigeria El Salvador Venezuela Tanzania Lebanon Papua New Guinea Nicaragua Zambia Malawi Argentina Armenia Senegal Mozambique Dominican Republic Bolivia Ethiopia Angola Uganda Lesotho Central African Republic Iran Uruguay Paraguay Cambodia Burkina Faso Mali Benin Republic of Congo Laos Cameroon Madagascar Burundi Sierra Leone Togo Chad Niger Haiti Ecuador Mauritania Syria Guinea Rwanda Yemen

FI 4.40 4.40 4.40 4.30 4.20 4.20 4.20 4.00 4.00 4.00 3.90 3.90 3.90 3.80 3.80 3.80 3.70 3.70 3.70 3.50 3.50 3.40 3.30 3.30 3.30 3.10 3.10 2.90 2.90 2.90 2.90 2.80 2.70 2.70 2.50 2.50 2.40 2.40 2.30 2.20 2.20 2.20 2.20 2.20 2.10 2.10 2.00 1.80 1.80 1.70 1.60 1.50 1.50 1.20 1.10 0.70 0.70 0.60 0.60 0.50 0.20

MEAN: 4.45

10

19

Capital Access Index 2009

Appendix B.4: Equity Market Development (EM) EM reflects the importance of equity markets for business financing.

RANK 1 2 3 4 5 5 7 7 7 10 11 11 13 14 14 14 17 17 17 17 21 21 23 23 23 23 23 28 28 30 30 30 33 33 33 33 33 38 38 40 40 42 42 42 42 42 47 47 47 50 50 50 50 54 54 54 57 57 57 60 60 COUNTRY Sweden United States Taiwan, China Jordan Australia South Africa Denmark South Korea France Switzerland Chile Kuwait United Kingdom Hong Kong SAR Malaysia India Norway Belgium Spain Thailand Canada Germany Netherlands Portugal New Zealand Israel Morocco Singapore Japan Finland Oman Indonesia Estonia United Arab Emirates Philippines Kenya Bangladesh Saudi Arabia Poland Sri Lanka Pakistan Italy Lithuania Panama Colombia Peru China Mexico Tunisia Ireland Brazil Croatia Malawi Greece Egypt Nigeria Austria Vietnam Zimbabwe Hungary Ghana EM 8.33 7.83 7.67 7.50 7.33 7.33 7.17 7.17 7.17 7.00 6.83 6.83 6.67 6.50 6.50 6.50 6.33 6.33 6.33 6.33 6.17 6.17 6.00 6.00 6.00 6.00 6.00 5.83 5.83 5.67 5.67 5.67 5.50 5.50 5.50 5.50 5.50 5.33 5.33 5.17 5.17 5.00 5.00 5.00 5.00 5.00 4.83 4.83 4.83 4.67 4.67 4.67 4.67 4.50 4.50 4.50 4.33 4.33 4.33 4.00 4.00

MEAN: 3.55

10

RANK 62 62 62 65 65 67 67 69 69 69 69 69 74 75 76 76 78 79 79 81 82 82 84 84 86 86 86 89 90 91 91 91 91 95 96 96 96 96 96 96 96 96 96 96 96 96 96 96 96 111 111 111 111 111 111 111 111 111 111 111 111

COUNTRY Slovenia Ecuador Zambia Turkey Botswana Czech Republic Lebanon Slovakia Russia Jamaica Argentina Venezuela Latvia El Salvador Bulgaria Mongolia Macedonia Romania Iran Namibia Costa Rica Tanzania Bolivia Papua New Guinea Uruguay Ukraine Paraguay Uganda Armenia Guatemala Bosnia and Herzegovina Nicaragua Burkina Faso Benin Honduras Moldova Dominican Republic Cambodia Lesotho Senegal Mozambique Cameroon Syria Ethiopia Mali Mauritania Madagascar Chad Burundi Belarus Angola Yemen Rwanda Sierra Leone Laos Central African Republic Togo Guinea Republic of Congo Niger Haiti

EM 3.83 3.83 3.83 3.67 3.67 3.50 3.50 3.17 3.17 3.17 3.17 3.17 3.00 2.83 2.50 2.50 2.33 2.17 2.17 2.00 1.83 1.83 1.67 1.67 1.17 1.17 1.17 1.00 0.83 0.67 0.67 0.67 0.67 0.50 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.33 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 MEAN: 3.755

10

20

Capital Access Index 2009

Appendix B.5: Bond Market Development (BM) BM captures the importance of bond financing for businesses.

RANK 1 2 2 2 5 5 5 5 5 5 11 11 13 13 13 13 13 13 19 19 19 19 23 23 23 23 27 27 29 29 31 31 33 33 33 33 33 33 33 40 40 40 40 44 45 45 45 48 48 48 48 48 48 48 48 48 48 58 58 58 58 COUNTRY United Kingdom Ireland Italy Netherlands Austria Belgium Canada France Portugal United States Norway Spain Chile Denmark Finland Malaysia Sweden Zimbabwe Brazil Germany Greece South Korea Australia Philippines Singapore Switzerland China Hungary Lebanon United Arab Emirates South Africa Thailand Czech Republic Estonia Hong Kong SAR India Japan Mexico Russia Jamaica Poland Taiwan, China Venezuela Turkey Pakistan Panama Ukraine Argentina Colombia Costa Rica Dominican Republic Indonesia Israel Macedonia Peru Slovakia Slovenia Bulgaria New Zealand Oman Uganda BM 8.25 8.00 8.00 8.00 7.75 7.75 7.75 7.75 7.75 7.75 7.50 7.50 7.25 7.25 7.25 7.25 7.25 7.25 7.00 7.00 7.00 7.00 6.25 6.25 6.25 6.25 6.00 6.00 5.75 5.75 5.50 5.50 5.25 5.25 5.25 5.25 5.25 5.25 5.25 5.00 5.00 5.00 5.00 4.75 4.25 4.25 4.25 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 4.00 3.75 3.75 3.75 3.75

0 MEAN: 3.66

10

RANK 62 62 62 62 66 67 67 69 69 69 69 69 69 69 76 76 78 78 78 78 82 82 82 85 85 85 85 89 90 90 90 90 90 90 90 90 90 90 90 90 90 90 90 90 90 107 107 107 107 107 107 107 107 107 107 107 107 107 107 107 107

COUNTRY Bangladesh Benin Croatia Egypt Angola Laos Lithuania Belarus Chad El Salvador Ghana Latvia Romania Uruguay Saudi Arabia Sri Lanka Guatemala Iran Tunisia Vietnam Bolivia Ecuador Morocco Cameroon Jordan Kuwait Papua New Guinea Moldova Guinea Haiti Kenya Lesotho Malawi Mali Mozambique Namibia Nicaragua Niger Nigeria Paraguay Republic of Congo Senegal Tanzania Yemen Zambia Armenia Bosnia and Herzegovina Botswana Burkina Faso Burundi Cambodia Central African Republic Ethiopia Honduras Madagascar Mauritania Mongolia Rwanda Sierra Leone Syria Togo

BM 3.50 3.50 3.50 3.50 3.25 3.00 3.00 2.75 2.75 2.75 2.75 2.75 2.75 2.75 2.50 2.50 2.25 2.25 2.25 2.25 2.00 2.00 2.00 1.75 1.75 1.75 1.75 1.50 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 1.25 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 MEAN: 3.66

10

21

Capital Access Index 2009

Appendix B.6: Alternative Sources of Capital (AC) AC measures the use of alternative financing tools such as venture capital, private placements, and credit cards.

RANK 1 2 3 3 3 6 7 7 9 9 11 11 11 14 14 16 16 18 18 18 18 22 22 24 25 25 25 25 29 29 29 32 32 34 34 34 34 34 34 34 34 34 43 44 44 44 47 47 47 47 47 47 53 53 53 53 53 58 58 58 58 COUNTRY United Kingdom Sweden Canada United States Australia South Korea Hong Kong SAR Israel Ireland France Switzerland Finland Norway United Arab Emirates Spain Netherlands Portugal Denmark New Zealand Belgium India Singapore Estonia South Africa Germany Thailand Kuwait Brazil Taiwan, China China Greece Japan Mexico Malaysia Austria Italy Saudi Arabia Czech Republic Egypt Poland Russia Peru Vietnam Lithuania Latvia Philippines Panama Jordan Turkey Colombia Costa Rica Uruguay Hungary Croatia Kenya Ukraine Zimbabwe Chile Lebanon Slovenia Tunisia AC 9.00 8.75 8.50 8.50 8.50 8.25 7.75 7.75 7.50 7.50 7.00 7.00 7.00 6.75 6.75 6.50 6.50 6.25 6.25 6.25 6.25 6.00 6.00 5.75 5.25 5.25 5.25 5.25 4.75 4.75 4.75 4.50 4.50 4.25 4.25 4.25 4.25 4.25 4.25 4.25 4.25 4.25 4.00 3.75 3.75 3.75 3.50 3.50 3.50 3.50 3.50 3.50 3.25 3.25 3.25 3.25 3.25 3.00 3.00 3.00 3.00

0 MEAN: 3.10

10

RANK 58 58 64 64 64 64 68 68 70 70 72 72 74 74 74 74 78 78 78 78 82 82 84 84 86 86 86 86 86 91 91 91 91 91 91 91 91 99 99 99 99 99 99 99 99 99 99 99 99 99 99 99 114 114 114 114 114 114 114 114 114

COUNTRY Morocco Argentina Oman Romania Macedonia Indonesia Jamaica Venezuela Bulgaria Togo Sri Lanka Honduras Slovakia El Salvador Botswana Pakistan Guatemala Dominican Republic Nicaragua Sierra Leone Nigeria Zambia Namibia Cambodia Ecuador Bangladesh Uganda Lesotho Syria Bosnia and Herzegovina Tanzania Bolivia Papua New Guinea Mozambique Benin Madagascar Burundi Ghana Iran Armenia Moldova Angola Mongolia Malawi Paraguay Senegal Cameroon Burkina Faso Ethiopia Mali Mauritania Chad Belarus Yemen Rwanda Laos Central African Republic Guinea Republic of Congo Niger Haiti

AC 3.00 3.00 2.75 2.75 2.75 2.75 2.50 2.50 2.25 2.25 2.00 2.00 1.75 1.75 1.75 1.75 1.50 1.50 1.50 1.50 1.25 1.25 1.00 1.00 0.75 0.75 0.75 0.75 0.75 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0 MEAN: 3.10

10

22

Capital Access Index 2009

Appendix B.7: International Funding (IF) IF measures the level of foreign capital available to businesses in a country.

RANK 1 1 3 3 5 6 6 6 9 10 11 12 12 14 14 16 17 17 19 19 21 22 22 22 25 25 25 28 28 30 31 32 32 34 34 34 37 37 37 40 40 40 43 43 43 43 43 43 49 49 51 51 53 53 55 55 57 57 57 60 61 COUNTRY Hong Kong SAR Switzerland Singapore Israel Denmark Sweden Norway France United Kingdom United States Kuwait Canada Belgium Australia Netherlands Portugal Ireland Thailand Malaysia Taiwan, China Finland Spain Hungary Lebanon Estonia Chile India Austria China South Korea Germany Saudi Arabia Egypt Japan Czech Republic Russia New Zealand United Arab Emirates Panama Slovenia Croatia Morocco Jordan Tunisia Brazil Bulgaria Peru Jamaica Greece Latvia Italy Oman Mexico Vietnam South Africa Lithuania Colombia Uruguay Argentina Poland Romania IF 7.42 7.42 7.33 7.33 7.25 7.17 7.17 7.17 6.92 6.83 6.67 6.58 6.58 6.50 6.50 6.08 5.92 5.92 5.75 5.75 5.67 5.58 5.58 5.58 5.50 5.50 5.50 5.42 5.42 5.36 5.33 5.25 5.25 5.17 5.17 5.17 5.00 5.00 5.00 4.92 4.92 4.92 4.83 4.83 4.83 4.83 4.83 4.83 4.67 4.67 4.58 4.58 4.50 4.50 4.25 4.25 4.17 4.17 4.17 4.08 4.00

MEAN: 4.08

10

RANK 61 63 64 65 65 67 67 67 70 70 72 73 74 75 76 76 78 78 78 81 82 82 82 82 82 87 88 89 89 91 91 93 94 95 96 97 97 99 100 100 102 103 104 105 105 107 108 108 110 110 112 113 113 113 113 117 117 119 120 121 122

COUNTRY Indonesia Cambodia Macedonia Slovakia Nigeria Turkey Philippines Costa Rica Honduras Mozambique Kenya Venezuela Nicaragua Sierra Leone El Salvador Sri Lanka Guatemala Ukraine Moldova Armenia Botswana Tanzania Bolivia Rwanda Burundi Bosnia and Herzegovina Uganda Dominican Republic Cameroon Ghana Angola Pakistan Laos Guinea Zambia Belarus Bangladesh Zimbabwe Ethiopia Haiti Namibia Paraguay Lesotho Togo Republic of Congo Benin Ecuador Papua New Guinea Burkina Faso Chad Mali Iran Mongolia Syria Mauritania Senegal Niger Malawi Central African Republic Madagascar Yemen

IF 4.00 3.92 3.91 3.83 3.83 3.75 3.75 3.75 3.67 3.67 3.58 3.55 3.50 3.45 3.42 3.42 3.33 3.33 3.33 3.25 3.17 3.17 3.17 3.17 3.17 3.09 3.08 2.92 2.92 2.82 2.82 2.75 2.67 2.64 2.58 2.50 2.50 2.45 2.42 2.42 2.33 2.25 2.09 2.00 2.00 1.83 1.75 1.75 1.58 1.58 1.50 1.36 1.36 1.36 1.36 1.33 1.33 1.27 1.25 1.00 0.36

MEAN: 4.08

10

23

Capital Access Index 2009

About the Authors

James R. Barth is the Lowder Eminent Scholar in Finance at Auburn University and a Senior Fellow at the Milken Institute. His research focuses on financial institutions and capital markets, both domestic and global, with special emphasis on regulatory issues. Most recently, he served as leader of an international team advising the Peoples Bank of China on banking reform. Barth was an appointee of Presidents Ronald Reagan and George H.W. Bush as chief economist of the Office of Thrift Supervisionand of the Federal Home Loan Bank Board. He has also held the positions of professor of economics at George Washington University, associate director of the economics program at the National Science Foundation, and Shaw Foundation Professor of Banking and Finance at Nanyang Technological University. He has been a visiting scholar at the U.S. Congressional Budget Office, the Federal Reserve Bank of Atlanta, the Office of the Comptroller of the Currency, and the World Bank. He is the co-author of The Rise and Fall of the U.S. Mortgage and Credit Markets: A Comprehensive Analysis of the Meltdown (John Wiley & Sons, 2009) and Rethinking Bank Regulation: Till Angels Govern (Cambridge University Press, 2006), co-editor of Chinas Emerging Financial Markets: Challenges and Opportunities (Springer, 2009) and Financial Restructuring and Reform in Post-WTO China (Kluwer Law International, 2007), and overseas associate editor of The Chinese Banker. Tong (Cindy) Li is a Research Economist in the Capital Studies group at the Milken Institute. She specializes in hedge fund performance, the U.S. mortgage market, banking regulations, and Chinese capital markets. Her papers have been presented at major academic and regulator conferences, including the 2006 American Economic Association annual meeting and the 2006 Federal Reserve Bank of Chicago Conference on International Financial Instability: Cross-Border Banking and National Regulation. She received her Ph.D. in economics from the University of California, Riverside, with research focused on microfinance and economic development, and special emphasis on China. She received a bachelors degree in international finance from Peking University. She is a co-author of The Rise and Fall of the U.S. Mortgage and Credit Markets: A Comprehensive Analysis of the Meltdown (John Wiley & Sons, 2009). Wenling (Carol) Lu is a Research Analyst in the Capital Studies group at the Milken Institute. Her research interest focuses on financial institutions and mergers and acquisitions. Prior to joining the Institute, she worked as a research assistant at Auburn University, providing support to projects related to corporate governance, IPOs, and bankruptcies. Lu previously held positions with ACE Group and Dresdner Asset Management Corporation in Taipei, Taiwan. She received her M.B.A. with a concentration in finance from Auburn University and a bachelors degree in business from National Taiwan University of Science and Technology, Taiwan. She is a co-author of The Rise and Fall of the U.S. Mortgage and Credit Markets: A Comprehensive Analysis of the Meltdown (John Wiley & Sons, 2009). Glenn Yago is Executive Director of Financial Research at the Milken Institute and an authority on financial innovations, capital markets, emerging markets, and environmental finance. He focuses on the innovative use of financial instruments to solve social, environmental, and economic development challenges. He is a recipient of the 2002 Gleitsman Foundation Award of Achievement for social change. Yago was a professor at the State University of New York at Stony Brook and at the City University of New York Graduate Center. Additionally, he directs the KoretMilken Institute Fellows Program and is a visiting professor at the Hebrew University of Jerusalems Graduate School of Business. He is the author of five books, including Financing the Future, Restructuring Regulation and Financial Institutions, Beyond Junk Bonds and Global Edge; he is also co-editor of the Milken Institute Series on Financial Innovation and Economic Growth. Yago received a Ph.D. from the University of Wisconsin-Madison.

24

1250 Fourth Street Santa Monica, CA 90401 Phone: 310.570.4600 Fax: 310.570.4601 E-mail: info@milkeninstitute.org www.milkeninstitute.org

Cert no. XXX-XXX-XXXX

Potrebbero piacerti anche

- Country Risk Analysis and Managing Crises - Tower AssociatesDocumento8 pagineCountry Risk Analysis and Managing Crises - Tower AssociatesKW75% (4)

- Answer/Solution Case: The BRICs: Vanguard of The RevolutionDocumento3 pagineAnswer/Solution Case: The BRICs: Vanguard of The RevolutionEvan Octviamen67% (6)

- Yoon - Jun Lee-FINALDocumento19 pagineYoon - Jun Lee-FINALAqua SehrNessuna valutazione finora

- Lessons Learned From Eplanet Ventures "Pakistan: A Story of Technology, Entrepreneurs and Global Networks"Documento8 pagineLessons Learned From Eplanet Ventures "Pakistan: A Story of Technology, Entrepreneurs and Global Networks"Fez Research Laboratory75% (8)

- Research Paper Economic CrisisDocumento5 pagineResearch Paper Economic Crisisafmcqeqeq100% (1)

- Term Paper International FinanceDocumento7 pagineTerm Paper International Financeafdtzfutn100% (1)

- The Advisory FinalDocumento8 pagineThe Advisory FinalAnonymous Feglbx5Nessuna valutazione finora

- The Advisory FinalDocumento4 pagineThe Advisory FinalAnonymous Feglbx5Nessuna valutazione finora

- Research Paper 2008 Financial CrisisDocumento6 pagineResearch Paper 2008 Financial Crisisgzrvpcvnd100% (1)

- Research Papers On Global Financial CrisisDocumento4 pagineResearch Papers On Global Financial Crisisfvf237cz100% (1)

- Thesis Statement For Global Financial CrisisDocumento7 pagineThesis Statement For Global Financial CrisisKate Campbell100% (2)

- Globalisation, Financial Stability and EmploymentDocumento10 pagineGlobalisation, Financial Stability and EmploymentericaaliniNessuna valutazione finora

- CA Newsletter July 28 To 03 AugDocumento15 pagineCA Newsletter July 28 To 03 AugAshish DeshpandeNessuna valutazione finora

- Financial Crisis 2008 Research PaperDocumento6 pagineFinancial Crisis 2008 Research Paperafeasdvym100% (1)

- Global Economic Crisis Research PapersDocumento6 pagineGlobal Economic Crisis Research Papersmadywedykul2100% (1)

- ICAB-CAPA PSAconf Session1 BrianBlood AccompanyingSpeechDocumento6 pagineICAB-CAPA PSAconf Session1 BrianBlood AccompanyingSpeechBlue Blossom CeanothusNessuna valutazione finora

- Enterprising States 2012 WebDocumento90 pagineEnterprising States 2012 WebDavid LombardoNessuna valutazione finora

- Static PPM156 Johnson Testimony 120711Documento7 pagineStatic PPM156 Johnson Testimony 120711000000tvNessuna valutazione finora

- Research Paper On Economic CrisisDocumento6 pagineResearch Paper On Economic Crisisfv55wmg4100% (1)

- UntitledDocumento8 pagineUntitledapi-239404108Nessuna valutazione finora

- PHD Thesis On Global Financial CrisisDocumento8 paginePHD Thesis On Global Financial Crisisdonnakuhnsbellevue100% (2)

- Globalisation of Financial MarketDocumento17 pagineGlobalisation of Financial MarketPiya SharmaNessuna valutazione finora

- Corporate Debt in Latin America and Its Macroeconomic Implications (Pérez Caldentey Et Al 2018)Documento36 pagineCorporate Debt in Latin America and Its Macroeconomic Implications (Pérez Caldentey Et Al 2018)MarcoKreNessuna valutazione finora

- The International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanDocumento5 pagineThe International Financial Crisis and Its Impact: Convocation Address by Dr. C. RangarajanAnand SoniNessuna valutazione finora

- Thesis Financial CrisisDocumento7 pagineThesis Financial Crisisbethevanstulsa100% (2)

- 3 Lec 1 of Chapter 2Documento25 pagine3 Lec 1 of Chapter 2OKUBO SELESTINE OPIYONessuna valutazione finora

- Research Paper Banking CrisisDocumento4 pagineResearch Paper Banking Crisistijenekav1j3100% (1)

- Chap 13Documento5 pagineChap 13Jade Marie FerrolinoNessuna valutazione finora

- Literature Review On SME and Their FinancingDocumento6 pagineLiterature Review On SME and Their FinancingusamahfsdNessuna valutazione finora

- EY M&A MaturityDocumento16 pagineEY M&A MaturityppiravomNessuna valutazione finora

- Sovereign Wealth FundsDocumento25 pagineSovereign Wealth FundsdrkwngNessuna valutazione finora

- Call For Papers Managing Under Uncertainty: Paradigms For Developed & Emerging Econom EconomiesDocumento4 pagineCall For Papers Managing Under Uncertainty: Paradigms For Developed & Emerging Econom EconomiesVishal GargNessuna valutazione finora

- Research Paper On Global Economic CrisisDocumento7 pagineResearch Paper On Global Economic Crisisukefbfvkg100% (1)

- Stock Market Crash of 2008Documento4 pagineStock Market Crash of 2008Azzia Morante LopezNessuna valutazione finora

- Think Canada Again Web Version FINALDocumento32 pagineThink Canada Again Web Version FINALJean-Francois SéguinNessuna valutazione finora

- LSE - The Future of FinanceDocumento294 pagineLSE - The Future of FinancethirdeyepNessuna valutazione finora

- How Manager Should Approach in Fragile EconomyDocumento5 pagineHow Manager Should Approach in Fragile Economya.asodekarNessuna valutazione finora

- BoC GlobalImbalancesWhyWorryDocumento5 pagineBoC GlobalImbalancesWhyWorryHector Perez SaizNessuna valutazione finora

- Finance's New Avatar: Jomo Kwame Sundaram Blog de LvargasDocumento1 paginaFinance's New Avatar: Jomo Kwame Sundaram Blog de Lvargaspepitperez8266Nessuna valutazione finora

- Small and Medium Enterprises A Cross Country Analysis With A New Data Set WB2011Documento32 pagineSmall and Medium Enterprises A Cross Country Analysis With A New Data Set WB2011sergiopereiraNessuna valutazione finora

- Research Paper American EconomyDocumento4 pagineResearch Paper American Economygvyztm2f100% (1)

- Gryphon 2015 OutlookupdateDocumento10 pagineGryphon 2015 Outlookupdateapi-314576946Nessuna valutazione finora

- Artisan Autumn 2012Documento6 pagineArtisan Autumn 2012Arthur SalzerNessuna valutazione finora

- Problems of Managing Small Scale Business in The Rural AreaDocumento48 pagineProblems of Managing Small Scale Business in The Rural Areakritika soniNessuna valutazione finora

- Secular Outlook El Erian - GBLDocumento8 pagineSecular Outlook El Erian - GBLplato363Nessuna valutazione finora

- Bank Failure Research PaperDocumento8 pagineBank Failure Research Paperwihefik1t0j3100% (1)

- Financial Dependence and GrowthDocumento3 pagineFinancial Dependence and GrowthutsavNessuna valutazione finora

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Documento5 pagineMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatNessuna valutazione finora

- Course File 3 Major AssessmentDocumento6 pagineCourse File 3 Major AssessmentErnie AbeNessuna valutazione finora

- Contemporary 1Documento6 pagineContemporary 1123mineNessuna valutazione finora

- Putnam White Paper: The Outlook For U.S. and European BanksDocumento12 paginePutnam White Paper: The Outlook For U.S. and European BanksPutnam InvestmentsNessuna valutazione finora

- Quarterly Fund GuideDocumento72 pagineQuarterly Fund GuideJohn SmithNessuna valutazione finora

- Risk Management Presentation September 10 2012Documento143 pagineRisk Management Presentation September 10 2012George LekatisNessuna valutazione finora

- DR.C Rangarajan - SubprimeDocumento12 pagineDR.C Rangarajan - SubprimeRidhimohanNessuna valutazione finora

- Full Download Global Marketing 8th Edition Keegan Solutions ManualDocumento36 pagineFull Download Global Marketing 8th Edition Keegan Solutions Manualblastybrantfox.1f2s100% (43)

- Finshastra October CirculationDocumento50 pagineFinshastra October Circulationgupvaibhav100% (1)

- Imf ExplainedDocumento16 pagineImf Explainedaramlogan1990Nessuna valutazione finora

- Global Competitiveness Index 2012-2013Documento46 pagineGlobal Competitiveness Index 2012-2013Messias MorettoNessuna valutazione finora

- Chap 1 Michael Pettus Strategic ManagementDocumento4 pagineChap 1 Michael Pettus Strategic ManagementSo PaNessuna valutazione finora

- Are Emerging Markets The Next Developed Markets?: Blackrock Investment InstituteDocumento28 pagineAre Emerging Markets The Next Developed Markets?: Blackrock Investment InstituteBasavaraj MithareNessuna valutazione finora

- Red FinancialDocumento63 pagineRed Financialreegent_9Nessuna valutazione finora

- 327PVsensitivity ExcelDocumento2 pagine327PVsensitivity ExcelAdeniyi AleseNessuna valutazione finora

- How 2018 Reframed The Democrats' Biggest Choice For 2020 - CNNPDocumento7 pagineHow 2018 Reframed The Democrats' Biggest Choice For 2020 - CNNPAdeniyi AleseNessuna valutazione finora

- Lean Six Sigma Transformation: A Strategy For Achieving and Sustaining ExcellenceDocumento4 pagineLean Six Sigma Transformation: A Strategy For Achieving and Sustaining ExcellenceAdeniyi AleseNessuna valutazione finora

- How To Perform A Nonprofit SWOT AnalysisDocumento14 pagineHow To Perform A Nonprofit SWOT AnalysisAdeniyi AleseNessuna valutazione finora

- Sensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsDocumento5 pagineSensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsAdeniyi AleseNessuna valutazione finora

- Compress Ible FlowsDocumento47 pagineCompress Ible FlowsAdeniyi AleseNessuna valutazione finora

- Farming Snails For The TableDocumento3 pagineFarming Snails For The TableAdeniyi AleseNessuna valutazione finora

- Transforming OrganizationsDocumento11 pagineTransforming OrganizationsAdeniyi AleseNessuna valutazione finora

- BRM CH 09Documento12 pagineBRM CH 09Adeniyi AleseNessuna valutazione finora

- 2016 Spelling Bee Word ListDocumento10 pagine2016 Spelling Bee Word ListAdeniyi AleseNessuna valutazione finora

- BRM CH 21Documento31 pagineBRM CH 21Adeniyi AleseNessuna valutazione finora

- Research Prospectus Plan DirectionsDocumento2 pagineResearch Prospectus Plan DirectionsAdeniyi AleseNessuna valutazione finora

- BRM CH 20Documento20 pagineBRM CH 20Adeniyi AleseNessuna valutazione finora

- You Are The ConsultantsDocumento2 pagineYou Are The ConsultantsAdeniyi Alese0% (3)

- Actdu Workshop 2015: Supported by The Commonwealth Department of Education and The Australian Debating FederationDocumento38 pagineActdu Workshop 2015: Supported by The Commonwealth Department of Education and The Australian Debating FederationAdeniyi AleseNessuna valutazione finora

- BRM CH 20Documento20 pagineBRM CH 20Adeniyi AleseNessuna valutazione finora

- Research Prospectus GuidelineDocumento5 pagineResearch Prospectus GuidelineAdeniyi AleseNessuna valutazione finora

- 2016 Energy Innovation PolicyDocumento26 pagine2016 Energy Innovation PolicyChatzianagnostou GeorgeNessuna valutazione finora

- Sikkim: States' Startup Ranking 2019Documento20 pagineSikkim: States' Startup Ranking 2019Samir GurungNessuna valutazione finora

- WEF Alternative Investments 2020 FutureDocumento59 pagineWEF Alternative Investments 2020 FutureR. Mega MahmudiaNessuna valutazione finora

- Asha Katyal - Aim Presentation 4 July 07Documento27 pagineAsha Katyal - Aim Presentation 4 July 07Ganesh ShanbhagNessuna valutazione finora

- AVGIntroductionDocumento10 pagineAVGIntroductionamodatreNessuna valutazione finora

- EV Final PDF ReportDocumento44 pagineEV Final PDF ReportARIK BISWASNessuna valutazione finora

- Venture Capital FirmDocumento4 pagineVenture Capital FirmAnglelic LudocNessuna valutazione finora

- What IPO Order Flow Reveals About The Role of The UnderwriterDocumento51 pagineWhat IPO Order Flow Reveals About The Role of The UnderwriterGene SiyamNessuna valutazione finora

- Crown Corporation: Business PlansDocumento12 pagineCrown Corporation: Business Plansandresromero80Nessuna valutazione finora

- Module-3 IFSS-NoteDocumento29 pagineModule-3 IFSS-NoteAbhisekNessuna valutazione finora

- Initial Public Offerings: Technology Stock Ipos: Jay R. RitterDocumento14 pagineInitial Public Offerings: Technology Stock Ipos: Jay R. RitterAhmadi AliNessuna valutazione finora

- Business Plan DetergentDocumento14 pagineBusiness Plan DetergentAsmerom MosinehNessuna valutazione finora

- GST 223, Q&a (Kadung Samuel For Sossa 001 2019)Documento66 pagineGST 223, Q&a (Kadung Samuel For Sossa 001 2019)Japhet Gajere100% (1)

- VCMethod PDFDocumento10 pagineVCMethod PDFMichel KropfNessuna valutazione finora

- The Role of Finance To The EconomyDocumento4 pagineThe Role of Finance To The EconomyNasrudiinNessuna valutazione finora

- Standard Business Plan: Unity University, College of Business and Economics, Marketing Management ProgramDocumento19 pagineStandard Business Plan: Unity University, College of Business and Economics, Marketing Management ProgramSamrawit GetachewNessuna valutazione finora

- Chapter 13 - Lecture Notes OutlineDocumento11 pagineChapter 13 - Lecture Notes OutlineJosue SosaNessuna valutazione finora

- LAVCA Startup Directory 2020 FINAL3Documento30 pagineLAVCA Startup Directory 2020 FINAL3ingdavid1Nessuna valutazione finora

- PRISM R D PDFDocumento11 paginePRISM R D PDFVinay GuptaNessuna valutazione finora

- 2009 - SHORT - MOSS - LUMPKIN - Research in Social Entrepeneurship - Past Constributions and Future OpportunitiesDocumento34 pagine2009 - SHORT - MOSS - LUMPKIN - Research in Social Entrepeneurship - Past Constributions and Future OpportunitiesRaquel FranciscoNessuna valutazione finora

- Pe in Luxembourg Guide v2017Documento36 paginePe in Luxembourg Guide v2017Andrea FuentesNessuna valutazione finora

- Business Entrepreneurship II T. Y. B. Com Sem 6Documento105 pagineBusiness Entrepreneurship II T. Y. B. Com Sem 6Sushant kawadeNessuna valutazione finora

- Anuario AscriDocumento269 pagineAnuario Ascritamsin99Nessuna valutazione finora

- SIDBI Trader Finance Scheme Loan Application Form: A. Business InformationDocumento15 pagineSIDBI Trader Finance Scheme Loan Application Form: A. Business InformationJaveed TajiNessuna valutazione finora

- Y Combinator Startup School 2007 NotesDocumento20 pagineY Combinator Startup School 2007 Notesotterley100% (90)

- Purus Wood Products: Developing A Competitiveedge: Bu1233 International Market Entry Strategies Bu1233Documento10 paginePurus Wood Products: Developing A Competitiveedge: Bu1233 International Market Entry Strategies Bu1233Pardeep SharmaNessuna valutazione finora

- Fsa 2006 10Documento880 pagineFsa 2006 10Mahmood KhanNessuna valutazione finora

- Valuation of StartupsDocumento5 pagineValuation of Startupsomnifin.seoNessuna valutazione finora