Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FGN Bond Market

Caricato da

Oladipupo Mayowa PaulCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FGN Bond Market

Caricato da

Oladipupo Mayowa PaulCopyright:

Formati disponibili

Warning: m ysql_conne ct() [function.m ysql-conne ct]: Acce ss de nie d for use r 'dm ogovn_adm in'@'208.91.199.

233' (using password: YES) in /home/dmogoxuy/public_html/debtprofile/dbconnect.php on line 2 Warning: m ysql_se le ct_db() [function.m ysql-se le ct-db]: Acce ss de nie d for use r 'dm ogox uy'@'localhost' (using password: NO ) in /home/dmogoxuy/public_html/debtprofile/dbconnect.php on line 3 Warning: m ysql_se le ct_db() [function.m ysql-se le ct-db]: A link to the se rve r could not be e stablishe d in /home/dmogoxuy/public_html/debtprofile/dbconnect.php on line 3

C ontact DMO

FAQ s

Home

Domestic Debt Profile FGN Bonds

About DMO

Debt Profile

Debt Relief

News and Events

Publications

FGN BOND MARKET FGN bonds are Federal Government of Nigeria securities issued under the authority of Debt Management Office (DMO). Since 2003, DMO has been regulating the activities of the FGN bonds market, while the Central Bank of Nigeria acts as the Issuing House and the Registrar. The bonds are listed and traded on the floors of the Nigerian Stock Exchange. The Central Securities Clearing Systems Ltd acts as the depository of the bonds listed on the Nigerian Stock Exchange. An introduction to FGN Bonds The Regulators/Agents in the FGN Bond Operations The licensed Primary Dealer and Market Makers (PDMMs) How to invest in FGN Bonds Bond Auctions, Operations and Results FGN Bond Issuance Calendar Current and Historical data on FGN Bonds Frequently Asked Questions(FAQs) Information on contractors and pension bonds

Basis of Allotments Offer C ircular FGN Bonds FAQs

An introduction to FGN Bonds About FGN Bonds FGN Bonds are debt securities (liabilities) of the Federal Government of Nigeria issued under the authority of DMO and listed on the Nigerian Stock Exchange. The FGN has an obligation to pay the bondholder the principal and agreed interest as they fall due.

FGN Bonds When you buy FGN bonds you are lending to the federal government for a specified period of time. The FGN bond is considered as the safest of all investments in domestic currency securities market because it is backed by the full faith and credit of the government. They have no default risk, meaning that it is virtually certain your interest and principal will be paid as and when due. The income you earn is exempt from state and local taxes. The Government Issues Bonds for the following reasons To finance government deficits in a non-inflationary and sustainable manner To enhance fiscal discipline and for the management of monetary policies To restructure the existing debt stock of short term debt to longer term obligations To establish a benchmark yield curve, which acts as a reference for pricing other bonds issued by other bodies To develop the domestic bond market on a sustainable basis To enhance and deepen the savings and investment opportunities

Special Purpose FGN Bond

Special Purpose FGN bonds are bonds issued to meet specific needs of the federal government. For instance, following the approval of Mr. President, special purpose bonds were issued to selected banks for settlement of N75 billion pension arrears in 2006. Five deposit money banks participated in the private placement arrangement. In addition, in 2006 FGN floated bonds for the payment of debt owed to local contractors worth N91.7 billion. Recently, FGN indicated interest to raise funds through bonds for funding specific projects such as Methanol plant, revival of textile industry, terminal wages of workers, building of infrastructural facilities, etc.

Nature of FGN bonds Denomination: minimum subscription of N10,000.00 + multiple of N1,000.00 thereafter

Yield: - Interest payment Fixed interest rates: Most FGN bonds have fixed interest rates which are paid semi-annually: Floating interest rates: Some FGN bonds (e.g. 3rd & 4TH tranches of the 1st FGN bonds) have floating rates of interest which fluctuates around a reference rate(NTB rates) on the basis of specified parameters There are also zero-coupon bonds(not yet in issue in Nigeria) whereby both interest and principal are repaid at the final maturity date of the bond

Tenor: Minimum of two (2) years. There are bonds with maturities of 3. 5, 7 and 10 years, in issue and for the future we may have bonds with maturities of 15, 20,30 years or more Default Risk: FGN bonds as a sovereign debt are the safest investment instrument. Default risk is nil. The Government always pays what is due to subscribers on the agreed date

The licenced Primary Dealer and Market Makers (PDMMS) These are banks and discount houses appointed by the DMO to act as authorized dealers in FGN bonds. These PDMMs are required among other functions to take up, market and distribute primary issues of FGN bonds, provide for secondary markets liquidity in FGN bonds by making two--way quotes in all market conditions. That is, they are obliged to buy or sell at these rates while dealing with customers. The fifteen (15) PDMMs institutions are: Access Bank Plc Afribank Nigeria Plc Associated Discount House Ltd Citi Bank Nigeria Limited Consolidated Discount House Ltd Express Securities Discount House Ltd Ecobank Nigeria Plc Fidelity Bank Nigeria Plc First Bank Nigeria Plc First City Monument Bank Plc First Security Discount House Ltd Guaranty Trust Bank Plc Kakawa Discount House Ltd Platinum Habib Bank Plc Stanbic-IBTC Bank Plc Union Bank of Nigeria Plc

United Bank of Nigeria Plc Zenith Bank Plc

The Regulators/ and Government Agencies in the FGN Bond Operation Debt Management Office (DMO) : DMO is the Agency authorized by statute to issue FGN Bonds on behalf of the Federal Government. The DMO also regulates the activities of the bond market and the Primary Dealer/Market Makers. Central Bank of Nigeria (CBN) : The Central Bank of Nigeria acts as the issuing House and the Registrars for FGN Bonds. The Nigerian Stock Exchange (NSE): FGN bonds are listed and traded on the Floors of the Nigerian Stock Exchange. Central Securities Clearing Systems Ltd (CSCS) : Acts as the depository of the bonds listed on the Nigerian Stock Exchange. Investors who opted for physical certificates at the issue must have their certificates deposited in CSCS before transactions on them on the floors of the Nigerian Stock Exchange. Security and Exchange Commission (SEC): The apex regulator in the capital market; it regulates the activities of all operators as far as operations and their transactions in the market is concerned. How to invest in FGN Bond Application forms can be obtained from any of the authorized dealers(PDMMs), or download from the DMOs website Complete the application forms and submit through any of the PDMMs Common- price auction system is normally employed as opposed to multiple price auctions Payments for the allotment are payable in full on application Minimum of N10,000.00 and multiple of N1,000 thereafter Investors can also access the FGN bonds after the auction through the secondary market FGN bonds purchase is confirmed by registration in the depository (CSCS) or by issue of certificates Interest is paid semi-annually until the maturity date when the principal amount is repaid Payment of interest is through issue of interest warrant(cheque) or direct transfer to current or savings bank accounts Bondholders who do not want to hold the bonds until maturity date can sell them at any time on the floors of Nigerian Stock Exchange or Over the Counter (OTC), through, any of the PDMMs.

Bond Auction, Operations and Result: Bond Auction: This is a process where the bonds are offered to diverse investors for subscription. Upon subscription, allotment is made to investors at the lowest price/highest yield that clears the market otherwise called marginal rate. The investor base for FGN bond is developing. It comprises mainly deposit money banks, foreign investors, pension funds, insurance funds, etc. Domestic individuals are yet to be fully involved in the market. Auction Type: Auction can be done through single pricing (Dutch Auction) or multiple pricing (Competitive Auction). DMO currently uses the Dutch Auction, which, is conducted on a yield, single price basis, where successful bidders are allotted bonds at the lowest price/highest yield that clears the market. Markets: The Primary or Secondary markets:. Investors can purchase bonds either from the Primary or secondary markets. The primary market is for securities that are newly issued in the market. These securities are sold directly to purchasers, usually through Primary Dealers/ Market Makers. On the other hand, Secondary market is for securities that are already issued and are traded among existing holders. Currently, Primary market offerings are issued through bond auctions, while PDMMs undertake or facilitate secondary market trading by making twoway quotes under all market conditions..

Frequency of Auction: FGN Bonds of various maturities are auctioned on a monthly basis. Amounts issued vary depending on the quantum of bonds to be issued for the year. Pricing: Common price auction system is often used instead of the multiple price system. Here, though each bidder quotes different yields, all successful bids are allotted securities at the marginal rate/cut-off price. Bidding Agents: All investors submit their bids to appointed agents (Primary Dealers/Market Makers) who bid for their agents and on behalf of their clients. Schedule of FGN Bonds Issued to Date Please see the insert document (Table A)

Historic and Current Data of FGN Bonds

1.

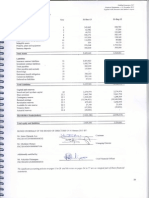

Domestic Debt Profile of Nigeria: An Overview 2000 2003

Table 1: Profile of Nigerias Domestic Debt. 2000 2003 (N Billions)

Composition of Debt Treasury Bills Treasury Bonds FRN Development Stocks* FGN Bonds* Total

2000 465.54 430.31 2.11 897.95

2001 584.54 430.61 1.830 -

2002 733.76 430.61 1.63 -

2003 825.1 430.61 1.47 72.56

1,016.98 1,166.00 1,329.72

*Note: Federal Government of Nigeria (FGN) bond is successor to Federal Republic of Nigeria Development Stocks (FRNDS) Table 1 shows Nigerias domestic debt stock as at December 2000 2003. In 2002, the debt stock was N1, 166.00 billion against N897.95 in 2000 representing 29.85% increase. It comprised 62.93 percent 91-day Treasury Bills, 36.93 percent Treasury Bonds (issued by the Federal Government and held by CBN to raise money at artificially low rates) and 0.14 percent Development Stocks (issued to finance various capital projects). The Federal Government resuscitated the floatation of bonds on the Nigerian capital market in 2003, after 18 years, with the issuance of the 1st FGN Bonds 2003 series. The Debt Management Office was able to raise N72.56 billion in the issuance that was 48.3 percent subscribed. The aim of the bond issuance was: To help government fund its deficits in a way consistent with macroeconomic stability and fiscal prudence and to subject it to the discipline of the market. To provide a benchmark yield curve which serves as reference for bond issuance by other bodies like the state governments or corporate bodies to facilitate rapid development of the economy.

To create and sustain a liquid and deep secondary market which will impact positively on other bonds.

2. FGN Bond 2004-2005 Table 2: Profile of Nigerias Domestic Debt. 2000 2005 (N Billions)

Composition of Debt

Treasury Bills Treasury 430.31 430.61 Bonds FRN Development 2.11 1.830 Stocks FGN Bonds Total

2000 2001 465.54 584.54

2002 733.76 430.61

2003 825.1 430.61

2004 871.57 424.94

2005 854.83 419.27

1.63 -

1.47 72.56

1.25 72.56

0.98 250.83

897.95 1,016.98 1,166.00 1,329.72 1,370.32 1,525.91

The FGN bonds issued in 2004 marked the beginning of restructuring exercise for the 91-day Nigeria Treasury Bills (NTBs) into longer-maturities. These bills had been a dominant instrument in securitizing outstanding Ways and Means Advances by the CBN. The restructuring was to help in solving problems inherent in the weekly issuance programme. These were roll-over and interest rate risk which engendered uncertainty about the future in the minds of investors. The successful implementation of the restructuring would reduce the volatility in the short-term rate market, sustain, revive and develop a deep and liquid secondary market for bonds.

FGN Bond 2006 Table 3: Profile of Nigerias Domestic Debt. 2000 2006 (N Billions)

Composition of Debt

Treasury Bills Treasury 430.31 430.61 Bonds FRN Development 2.11 1.830 Stocks FGN Bonds Total

2000 2001 465.54 584.54

2002 733.76 430.61

2003 825.1 430.61

2004 871.57 424.94

2005 854.83 419.27

20 69

41

1.63 -

1.47 72.56

1.25 72.56

0.98 250.83

0. 64

897.95 1,016.98 1,166.00 1,329.72 1,370.32 1,525.91 1,

As at December 2006, the structure of the domestic debt had changed with the Federal Government issuing more instruments with longer maturities (182-day NTBs, 365-day NTBs and FGN Bonds) to replace part of the 91-day Treasury Bills. The total FGN securities outstanding increased from N897.95 in 2000 to N1,753.26 billion in 2006 representing 95.25% increase.. The FGN Bonds accounted for 36.73%, from 0.14% in 2002, domestic debt securities outstanding in 2006. All this indicate the increasing emphasis on the FGN Bonds as instrument for funding FGN programme. FGN Bond Issuance Calendar 2007 FGN Bond Issuance Calendar Background: The debt management strategy for 2007 is anchored on the imperative to continue to provide low cost funding for the FGN, subject to the containment of

risks within acceptable limits. Other objectives include: the need to maintain a prudent debt structure; promote and build a liquid and efficient market for government securities; increase reliance on market-determined instruments for domestic debt issuance; increase the transparency and predictability of primary market debt issuance; and Develop the market for long-term debt instrument and thereby creating a benchmark yield curve for government securities in Nigeria. 2007 FGN Bond Issuance Objective: The objective of the issuance calendar is to enable market players plan their cash flow so as to maximize benefits from the FGN Bond issuance programme. In sustaining the efforts to develop the Nigerian Bond Market, DMO plans to issue N446 billion 4th FGN Bond in 2007. The maturities of the bond are 3, 5, 7 and 10 years while the purpose for the bond issuance includes the following: Restructuring of N120 billion 365-day NTBs into FGN Bonds of longer maturities Refinancing N61.00 billion 2nd FGN Bond maturing in 2007 Funding budget deficit of N200 billion for the 2007 fiscal year Balance of N63 billion 5-year Special FGN Bond for the securitization of local contractors debt Features of the 2007 FGN Bond Issuance The 2007 Bond issuance have the following features: Only fixed coupon instruments are being issued Competitive bidding process based on common pricing system continue to be used The auctions is monthly as in the past Submission of bids takes place in one day, and within a specified timeline while settlement takes place two days after. Consequently, there is no opening and closing days for submission of tender/application forms as done in the past The DMOs portfolio strategy is aimed at creating benchmark issues around the 3 and 5 years maturities, while gradually extending the domestic debt portfolio toward longer maturities. In 2007, DMO may introduce a re-opening system to increase liquidity and create benchmark issues as well as make bonds with identical maturities and coupon rates fungible. The 2007 FGN Bond Issuance calendar has been fashioned and designed to ensure availability of bonds of various maturities to cater for the different appetite of investors, (See Tables 3 and 4). Table 4: 2007 Quarterly Issuance Programme for the 4th FGN Bond

S/N 1 2 3 4

Quarter 1st quarter 2007 2nd quarter 2007 3rd quarter 2007 4th quarter 2007

Amount N110 N110 N110 N116 billion billion billion billion

Tenor

The maturities has been determined to reflect both DMO strategic objectives and market preference Total Amount to be Issued for the Year N446 billion

Table 5: 2007 FGN Bond 1st Quarter Calendar

Month

Amount

Tenor

S/N 1. 2. 3.

January 2007 February 2007 March 2007 Total For the 1st Quarter

N40 billion 3-year N35 billion 5-year N35 billion 7-year N110 billion

Frequently asked questions What is a bond? A bond is a loan and the investor or holder of the bond is the lender. When you purchase a bond, you are lending money to a government, local government council, state government, federal agency or a corporation, known as the issuer. The government uses it to fund budget deficit, for instance, or to build roads, electric power stations, finance factories, etc. When you purchase a bond, in return the issuer promises to pay you a specified rate of interest during the life of the bond and to repay the face value of the bond (the principal) when it matures

What is the difference between a bond and a stock? The key difference between stocks and bond is that stocks make no promise about dividends or returns, but when the Government Issue a bond, it guarantees to pay back your principal (the face value) plus interest. If you buy the bond and hold it to maturity, you know exactly how much you are going to get back. That is why bonds are also known as fixed-income investment you are sure of a steady payback or yearly income. The buyer of stocks or shares in a company has purchased part of the equity and becomes part owner. He is only entitled to dividend declared by the company when it makes profit. What are the types of Bonds? Sovereign Bond(such as FGN Bond)

When you buy FGN bonds you are lending funds to the federal government for a specified period of time. The FGN bond is considered as the safest of all the investments because it is backed by the full faith and credit of the government. They have no default risk, meaning that it is virtually certain your interest and principal will be paid as and when due. The income you earn is exempted from state and local taxes. State and Local Government Council Bonds

When you purchase state and local government council bonds you are lending to the issuers who promise to pay you a specified amount of interest (usually semi annually) and return the principal to you on a specific maturity date. State and local government bonds are debt obligation issued by the state government, local government councils and other governmental entities to raise money to build schools, roads, hospitals as well as other projects for public good.

Government Sponsored Enterprise Bond These are bonds that help support project relevant to public policies, such as helping certain groups, such as farmers, homeowners, students, etc to raise money for financing specific projects. These bonds do not carry the full-faith andcredit of government. The investors are likely to hold them in high regard because they have been issued by a government agency.

Corporate Bond Corporate bond are debt obligation issued by private or public corporations. The corporations use the funds for building facilities, purchase of equipment to expand the business, etc. When you purchase corporate bond, the corporation promises to return your money, or principal at maturity date, but you are being paid interest semi - annually. The interests you receive are taxable. Corporate bonds do not give you an ownership interest in the issuing corporation. Are there Risk and Reward in investing in bond? Any time you lend money you run the risk that it will not be paid back credit risk. Another source of risk for certain bonds (bond with call option) is that your loan may be paid back early, or called this is known as prepayment risk. When you buy a bond, the prospectus will indicate whether a bond is callable and give you a yield-to-call figure. The greatest danger for a buy and-hold bond to an investor is rising inflation rate inflation risk. A rise in inflation makes prices fall and yields-or interest rates-rise. However, inflation risk, credit risk and prepayment risk are all figured into the pricing of bonds. The more the risk the higher the yield. Investors demand higher yields for longer maturities, as the longer you tie your money up in a bond the more at-risk.

Why should I invest in FGN bond? Retirement Starting or expanding a business Settlement after apprenticeship Pay children school fees in future(e.g for University education) Building a house Future projects by town unions, associations, student union To fund future social events such as Marriages and weddings, etc Settlement of pension insurance obligation( for Corporate Fund Managers), etc

What is the attractiveness/benefits of FGN Bonds to the investors? It serves as risk-free investment It is income is tax exempt It provides relatively high and stable returns The principal element ( collected at maturity) can be used as collateral for securing credit facilities from banks Bondholders that want cash can trade the bonds on the floor of Nigeria Stock Exchange(NSE) for immediate cash before maturity It qualifies as liquid assets for banks from two years to maturity

What are the benefits of FGN bonds to the Economy? It fosters economic development by promoting the use of lon-term funds for lon-term investment in the economy It serves as an efficient way of mobilizing domestic financial resources for productive investment in a non-inflationary manner It allows self reliance of the country by reducing over reliance on shortterm borrowing form CBN & commercial banks It provides a basic infrastructure for the development of the financial system and the overall economy It serves as a diversified portfolio investment outlet to corporate and individual investors

What are the benefits of FGN bonds to the Government? It helps government funds its deficits in a non-inflationary manner It provides benchmark yield-curve for pricing other securities/bonds It engenders rational management of Governments fiscal and monetary operations

It provides the basic infrastructure for the development of the financial system and the overall economy It strengthens the implementation of monetary policy by the Central Bank of Nigeria It introduces transparency, discipline and stability in the financial system

What is dematerialization of bond certificates? It is a term which describes a shift from issuance of physical certificate to an electronic form. It involves the use of a depository, in this case, the Central Securities Claering Systems Ltd(CSCS) which provides the platform for the securities. Although DMO still issues physical certificates on request, modern securities trading system de-emphasizes the use of physical certificates. Advancement in electronic communication and custodian services allow book-entry records and trade verification which has made trading more reliable and easier to manage than the use of physical certificates. How can I be aware of the forth coming issues? National Dailies DMO Website - FGN bond Issuance Calendar

Information on contractors and pension bonds The report on FGN bonds issued for settlement of pension arrears and local contractors are provided as Special FGN Bonds in the Schedule of FGN Bonds Issued to Date (Bond Auction, Operations and Result)

2000-2013 DMO Nige ria| All rights re se rve d

Potrebbero piacerti anche

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Da EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Nessuna valutazione finora

- Investment in Govt Securities - CompleteDocumento5 pagineInvestment in Govt Securities - CompleteAtharva SamantNessuna valutazione finora

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Documento5 pagineFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelNessuna valutazione finora

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingDa EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNessuna valutazione finora

- Financial Institutions: Submitted To: Sharique Ayubi Submitted By: Abdul Samad Munaf ID: 8905 Date: 9 December 2009Documento18 pagineFinancial Institutions: Submitted To: Sharique Ayubi Submitted By: Abdul Samad Munaf ID: 8905 Date: 9 December 2009Muzammil YounusNessuna valutazione finora

- Money BankingDocumento11 pagineMoney BankingRose DallyNessuna valutazione finora

- Understanding of Debt and Debt Markets 2Documento3 pagineUnderstanding of Debt and Debt Markets 2gohar azizNessuna valutazione finora

- The IB Business of Debt - Fixed IncomeDocumento36 pagineThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNessuna valutazione finora

- Lecture - Bond MarketDocumento6 pagineLecture - Bond MarketAngel GarciaNessuna valutazione finora

- How To Buy Bonds?Documento23 pagineHow To Buy Bonds?topeq100% (1)

- Addis Ababa University College of Business and Economics School of Commerce Department of Marketing Management Commodity Derivative MarketingDocumento19 pagineAddis Ababa University College of Business and Economics School of Commerce Department of Marketing Management Commodity Derivative Marketingez leNessuna valutazione finora

- XXX Final FimDocumento50 pagineXXX Final FimSiddhesh RaulNessuna valutazione finora

- Debt MarketDocumento25 pagineDebt Marketketan dontamsettiNessuna valutazione finora

- Money Market Instruments in Pakistan Term PaperDocumento16 pagineMoney Market Instruments in Pakistan Term PaperUmair AzizNessuna valutazione finora

- MPRA Paper 13126Documento25 pagineMPRA Paper 13126Rituparna DasNessuna valutazione finora

- Fixed Income Markets - Assignment: Symbiosis School of Banking and Finance (SSBF)Documento10 pagineFixed Income Markets - Assignment: Symbiosis School of Banking and Finance (SSBF)Abhilash NNessuna valutazione finora

- Call Money Market: An OverviewDocumento11 pagineCall Money Market: An OverviewAnirudh ShrivastavNessuna valutazione finora

- Financial Markets (Chapter 8)Documento4 pagineFinancial Markets (Chapter 8)Kyla DayawonNessuna valutazione finora

- Chapter 2 MONEY MARKETDocumento14 pagineChapter 2 MONEY MARKETNur Dina AbsbNessuna valutazione finora

- Financial Markets and Institution: The Bond MarketDocumento44 pagineFinancial Markets and Institution: The Bond MarketDavid LeowNessuna valutazione finora

- Guide To Fixed InterestDocumento12 pagineGuide To Fixed InterestfaberoniNessuna valutazione finora

- Module #03 - Money MarketDocumento13 pagineModule #03 - Money MarketRhesus UrbanoNessuna valutazione finora

- Notes - MARKETING - OF - FINANCIAL SERVICES - 2020Documento69 pagineNotes - MARKETING - OF - FINANCIAL SERVICES - 2020Rozy SinghNessuna valutazione finora

- MAS2 BSA2A Debt Markets PPT 1Documento33 pagineMAS2 BSA2A Debt Markets PPT 1Henry RufinoNessuna valutazione finora

- L4 Money Market & Instrument TradingDocumento32 pagineL4 Money Market & Instrument TradingZhiyu KamNessuna valutazione finora

- Fixed Incme Sectors and InstrumentsDocumento64 pagineFixed Incme Sectors and InstrumentsJIROJBLOGNessuna valutazione finora

- Chapter 4 - Money Market and RfiDocumento27 pagineChapter 4 - Money Market and RfiWill De OcampoNessuna valutazione finora

- Cours FMI Intere IeDocumento6 pagineCours FMI Intere Ieremi ayadNessuna valutazione finora

- Types of Mutual FundDocumento5 pagineTypes of Mutual FundGourav BulandiNessuna valutazione finora

- Chap 5 Money Bond MarketsDocumento37 pagineChap 5 Money Bond MarketsGayatheri PerumalNessuna valutazione finora

- Lecture 02 PDFDocumento1 paginaLecture 02 PDFOuadia ElzNessuna valutazione finora

- Govt. Securities Market - 1Documento46 pagineGovt. Securities Market - 1Bipul Mishra100% (1)

- Topic - Money Market Group Members: Kunal Gharat Deepak Gohil Pradeep Gore Meenakshi Jadhav Sandeep JaigudeDocumento30 pagineTopic - Money Market Group Members: Kunal Gharat Deepak Gohil Pradeep Gore Meenakshi Jadhav Sandeep Jaigudek_vikNessuna valutazione finora

- Introduction to Fixed Income Securities LectureDocumento45 pagineIntroduction to Fixed Income Securities Lectureben tenNessuna valutazione finora

- Innovative Financial Instrument - FinalDocumento6 pagineInnovative Financial Instrument - FinalRinse JohnNessuna valutazione finora

- Assignment 1 Budgeting For International OperationsDocumento4 pagineAssignment 1 Budgeting For International OperationsNiya ThomasNessuna valutazione finora

- Secondary Market Trading and Instruments in Government SecuritiesDocumento35 pagineSecondary Market Trading and Instruments in Government Securitiesakshit_vijNessuna valutazione finora

- Long Term BorrowingDocumento32 pagineLong Term Borrowingvishal sureshNessuna valutazione finora

- Money MarketDocumento26 pagineMoney MarketPigeons LoftNessuna valutazione finora

- Capital and Money MarketsDocumento6 pagineCapital and Money Marketsalbert.lumadedeNessuna valutazione finora

- Chapter 6 BFMDocumento59 pagineChapter 6 BFMrifat AlamNessuna valutazione finora

- Tutorial Chap 5Documento3 pagineTutorial Chap 5Hasya AuniNessuna valutazione finora

- Money Market InstrumentsDocumento8 pagineMoney Market InstrumentsTej KumarNessuna valutazione finora

- Bond Market - MMSDocumento124 pagineBond Market - MMSkanhaiya_sarda5549Nessuna valutazione finora

- BondsDocumento6 pagineBondsDanish ShakeelNessuna valutazione finora

- Chapter 5 Summary - Book "Financial Markets and Institutions" Chapter 5 Summary - Book "Financial Markets and Institutions"Documento9 pagineChapter 5 Summary - Book "Financial Markets and Institutions" Chapter 5 Summary - Book "Financial Markets and Institutions"Anisa KodraNessuna valutazione finora

- BOZ FAQ'sDocumento5 pagineBOZ FAQ'sPyanga FyonseNessuna valutazione finora

- SAPMDocumento21 pagineSAPMllNessuna valutazione finora

- Chapter 10 - Investment Strategies and Risk ManagementDocumento21 pagineChapter 10 - Investment Strategies and Risk Managementcyclone man100% (1)

- CLERK Study Material-2017 Part 4Documento7 pagineCLERK Study Material-2017 Part 4asdNessuna valutazione finora

- A Guide To Operations For The DMO Nigeria in FGN Bond Market (REVISED)Documento6 pagineA Guide To Operations For The DMO Nigeria in FGN Bond Market (REVISED)mayorladNessuna valutazione finora

- FinmarDocumento4 pagineFinmarLana sereneNessuna valutazione finora

- Call Money Market Regulates Short-Term LendingDocumento49 pagineCall Money Market Regulates Short-Term LendingIqra AfsarNessuna valutazione finora

- financial-Instrumentchapter3Documento34 paginefinancial-Instrumentchapter3Antonette MallariNessuna valutazione finora

- C CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CDocumento34 pagineC CC C C CCCCCC CC CC C C CC CCCCC CC C CCCCC CC C !"C##$CCC CC C% C "C CCCC &% ' (C %C C C) % C CJayprakash MahantaNessuna valutazione finora

- Introduction To Financial Markets and InstitutionsDocumento12 pagineIntroduction To Financial Markets and Institutionssusheel kumarNessuna valutazione finora

- Debt FinancingDocumento22 pagineDebt Financingdinesh07_1984100% (1)

- Debt Markets: Corporate BondsDocumento10 pagineDebt Markets: Corporate Bondsjainy mNessuna valutazione finora

- Governmentsecurities 190520171008Documento22 pagineGovernmentsecurities 190520171008lalitNessuna valutazione finora

- Filling Station GuidelinesDocumento8 pagineFilling Station GuidelinesOladipupo Mayowa PaulNessuna valutazione finora

- Amcon Bonds FaqDocumento4 pagineAmcon Bonds FaqOladipupo Mayowa PaulNessuna valutazione finora

- 9M 2013 Unaudited ResultsDocumento2 pagine9M 2013 Unaudited ResultsOladipupo Mayowa PaulNessuna valutazione finora

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocumento4 pagineFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNessuna valutazione finora

- Abridged Financial Statement September 2012Documento2 pagineAbridged Financial Statement September 2012Oladipupo Mayowa PaulNessuna valutazione finora

- q1 2008 09 ResultsDocumento1 paginaq1 2008 09 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocumento1 paginaIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNessuna valutazione finora

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Documento3 pagine9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNessuna valutazione finora

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocumento16 pagineBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNessuna valutazione finora

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocumento1 paginaIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNessuna valutazione finora

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocumento32 pagineFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNessuna valutazione finora

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocumento31 pagineFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- 2007 Q2resultsDocumento1 pagina2007 Q2resultsOladipupo Mayowa PaulNessuna valutazione finora

- q1 2008 09 ResultsDocumento1 paginaq1 2008 09 ResultsOladipupo Mayowa PaulNessuna valutazione finora

- Diamond Bank Half Year Results 2011 SummaryDocumento5 pagineDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNessuna valutazione finora

- 2006 Q1resultsDocumento1 pagina2006 Q1resultsOladipupo Mayowa PaulNessuna valutazione finora

- FirstCity Group profit up 88% in 3 monthsDocumento1 paginaFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNessuna valutazione finora

- 5 Year Financial Report 2010Documento3 pagine5 Year Financial Report 2010Oladipupo Mayowa PaulNessuna valutazione finora

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Documento5 pagine9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNessuna valutazione finora

- GTBank H1 2011 Results PresentationDocumento17 pagineGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNessuna valutazione finora

- 5 Year Financial Report 2010Documento3 pagine5 Year Financial Report 2010Oladipupo Mayowa PaulNessuna valutazione finora

- 2011 Half Year Result StatementDocumento3 pagine2011 Half Year Result StatementOladipupo Mayowa PaulNessuna valutazione finora

- June 2009 Half Year Financial Statement GaapDocumento78 pagineJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNessuna valutazione finora

- GTBank FY 2011 Results PresentationDocumento16 pagineGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNessuna valutazione finora

- Final Fs 2012 Gtbank BV 2012Documento16 pagineFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNessuna valutazione finora

- Dec09 Inv Presentation GAAPDocumento23 pagineDec09 Inv Presentation GAAPOladipupo Mayowa PaulNessuna valutazione finora

- 2011 Year End Results Press Release - FinalDocumento2 pagine2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNessuna valutazione finora

- GTBank H1 2012 Results AnalysisDocumento17 pagineGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNessuna valutazione finora

- Fs 2011 GtbankDocumento17 pagineFs 2011 GtbankOladipupo Mayowa PaulNessuna valutazione finora

- RBI financial regulation and inclusion working noticeDocumento2 pagineRBI financial regulation and inclusion working noticeGuru VagaNessuna valutazione finora

- A Simple FTP Model For A Commercial BankDocumento80 pagineA Simple FTP Model For A Commercial BankMaratAyaibergenovNessuna valutazione finora

- What Is The Role and Importance of InsuranceDocumento7 pagineWhat Is The Role and Importance of InsurancetarachandmaraNessuna valutazione finora

- HSBC's Approach to Corporate Social ResponsibilityDocumento12 pagineHSBC's Approach to Corporate Social ResponsibilityShashank Dubey0% (1)

- Small Business 4 - Writing A Business PlanDocumento10 pagineSmall Business 4 - Writing A Business PlanChevanev Andrei CharlesNessuna valutazione finora

- VehicleLoanApplicationForm SampleOnly PDFDocumento3 pagineVehicleLoanApplicationForm SampleOnly PDFRolley DumawaNessuna valutazione finora

- ContractsDocumento645 pagineContractsFRANCISCO CARRIZALES VERDUGO100% (4)

- PESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDocumento11 paginePESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDennis Varghese0% (1)

- Annual Flood Hazard LetterDocumento5 pagineAnnual Flood Hazard LetterStatesman JournalNessuna valutazione finora

- T24 Arrangement Architecture in 40 CharactersDocumento231 pagineT24 Arrangement Architecture in 40 CharactersArun KumarNessuna valutazione finora

- Intro To Leasing NoteDocumento5 pagineIntro To Leasing NoteZain FaheemNessuna valutazione finora

- Al Asiouty DictionaryDocumento2.448 pagineAl Asiouty DictionaryMarianna MassaNessuna valutazione finora

- WACCDocumento35 pagineWACCfrq qqrNessuna valutazione finora

- Topa NotesDocumento74 pagineTopa NotesSumerNessuna valutazione finora

- Honorable A. Bruce CampbellDocumento2 pagineHonorable A. Bruce CampbellChapter 11 DocketsNessuna valutazione finora

- Oblicon DigestsDocumento33 pagineOblicon Digestsjlumbres100% (1)

- Forgery Case DigestsDocumento4 pagineForgery Case DigestsKim Arizala100% (1)

- Analysis Financial RatioDocumento24 pagineAnalysis Financial RatioQamar Mughal100% (1)

- Cbse Test Paper AccountancyDocumento3 pagineCbse Test Paper Accountancyankita roy chaudhuryNessuna valutazione finora

- Civ2 Atty - Rabanes 1st MeetingDocumento8 pagineCiv2 Atty - Rabanes 1st MeetingEleasar Banasen PidoNessuna valutazione finora

- 05 COMM LAW Bar Q - A 1994 2017 PDFDocumento75 pagine05 COMM LAW Bar Q - A 1994 2017 PDFAndrea Patricia DaquialNessuna valutazione finora

- SECURITIES FIRM V. TRADERDocumento8 pagineSECURITIES FIRM V. TRADERIyahNessuna valutazione finora

- R0404 BD040722 QuippDocumento5 pagineR0404 BD040722 QuippLovely Jane MorenoNessuna valutazione finora

- 2 Corinthians 1: 20 - 22 Explains God's Promises in ChristDocumento39 pagine2 Corinthians 1: 20 - 22 Explains God's Promises in ChristYu BabylanNessuna valutazione finora

- Cfo India 201302Documento52 pagineCfo India 201302Sandeep ViswanathNessuna valutazione finora

- BSP Circular 425Documento3 pagineBSP Circular 425G Ant Mgd100% (1)

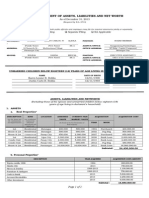

- Sworn Statement of Assets, Liabilities and Net WorthDocumento3 pagineSworn Statement of Assets, Liabilities and Net WorthJf ManejaNessuna valutazione finora

- Sathya's Iob ProjectDocumento35 pagineSathya's Iob ProjectVenkatesh ChowdaryNessuna valutazione finora

- Entrepreneurship, Marketing and Financial ManagementDocumento96 pagineEntrepreneurship, Marketing and Financial ManagementPreeti Joshi SachdevaNessuna valutazione finora

- Sec Trans Outline MEE/UBEDocumento8 pagineSec Trans Outline MEE/UBEArthur Shalagin100% (2)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Joy of Agility: How to Solve Problems and Succeed SoonerDa EverandJoy of Agility: How to Solve Problems and Succeed SoonerValutazione: 4 su 5 stelle4/5 (1)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Da EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Valutazione: 4.5 su 5 stelle4.5/5 (86)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistDa EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistValutazione: 4.5 su 5 stelle4.5/5 (73)

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsDa EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNessuna valutazione finora

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)Da EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Valutazione: 4.5 su 5 stelle4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityDa EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityValutazione: 4.5 su 5 stelle4.5/5 (4)

- Note Brokering for Profit: Your Complete Work At Home Success ManualDa EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNessuna valutazione finora

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (34)

- Connected Planning: A Playbook for Agile Decision MakingDa EverandConnected Planning: A Playbook for Agile Decision MakingNessuna valutazione finora

- Financial Risk Management: A Simple IntroductionDa EverandFinancial Risk Management: A Simple IntroductionValutazione: 4.5 su 5 stelle4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthDa EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNessuna valutazione finora

- Strategic Value Chain Analysis for Investors and ManagersDa EverandStrategic Value Chain Analysis for Investors and ManagersNessuna valutazione finora

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorDa EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionDa EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionValutazione: 5 su 5 stelle5/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)