Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Budgeting Quizer - MAS

Caricato da

Princess Joy VillaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Budgeting Quizer - MAS

Caricato da

Princess Joy VillaCopyright:

Formati disponibili

ACCOUNTING 7 MANAGEMENT ACCOUTING 1&2 BUDGETING SCORE NAME SECTIO N

TEST

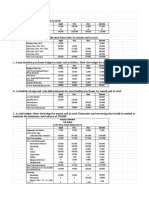

1)Key Co. manufactures beanies. The budgeted units to be produced and sold are below:

August September Expected Production 3,100 2,800 Expected Sales 2,900 3,900

It takes 24 yards of yarn to produce a beanie. The company's policy is to maintain yarn at the end of each month equal to 5% of next month's production needs and to maintain a finished goods inventory at the end of each month equal to 20% of next month's anticipated production needs. The cost of yarn is P0.20 a yard. At August 1, 3,720 yards of yarn were on hand. Instructions Compute the budgeted cost of purchases.

2) The budget components for McLeod Company for the quarter ended June 30 appear below. McLeod sells trash cans for

P12 each. Budgeted production for the next four months is: April May June 26,000 units 46,000 units 29,000 units

McLeod desires to have trash cans on hand at the end of each month equal to 20 percent of the following months budgeted sales in units. On March 31, McLeod had 4,000 completed units on hand. The number of trash cans to be produced in April and May are 26,000 and 46,000, respectively. Seven pounds of plastic are required for each trash can. At the end of each month, McLeod desires to have 10 percent of the following months production material needs on hand. At March 31, McLeod had 18,200 pounds of plastic on hand. The materials used in production costs P0.60 per pound. Each trash can produced requires 0.10 hours of direct labor. Instructions Compute the cost of the plastic inventory at the end of May.

3) Seas, Inc. makes and sells buckets. Each bucket uses 3/4 pound of plastic. Budgeted production of buckets in units for

the next three months is as follows: Budgeted production April 21,000 May 20,000 June 24,000

The company wants to maintain monthly ending inventories of plastic equal to 25% of the following month's budgeted production needs. The cost of plastic is P2.12 per pound. Instructions Prepare a direct materials purchases budget for the month of May.

4) The budget components for McLeod Company for the quarter ended June 30 appear below. McLeod sells trash cans for

P12 each. Budgeted sales and production for the next three months are: Sales Production April 20,000 units 26,000 units May 50,000 units 46,000 units

June

30,000 units

29,000 units

McLeod desires to have trash cans on hand at the end of each month equal to 20 percent of the following months budgeted sales in units. On March 31, McLeod had 4,000 completed units on hand. Seven pounds of plastic are required for each trash can. At the end of each month, McLeod desires to have 10 percent of the following months production material needs on hand. At March 31, McLeod had 18,200 pounds of plastic on hand. The materials used in production cost P0.60 per pound. Each trash can produced requires 0.10 hours of direct labor. Instructions Determine how much the materials purchases budget will be for the month ending April 30.

5) Salem Company reported the following information for 2008:

Budgeted sales Budgeted purchases October P300,000 P120,000 November P320,000 P128,000 December P360,000 P144,00

All sales are on credit. Customer amounts on account are collected 60% in the month of sale and 40% in the following month.

Instructions Compute the amount of cash Salem will receive during November.

6) Johnson Company budgeted the following information for 2008:

Budgeted purchases May P104,000 June P110,000 July P102,000

Cost of goods sold is 40% of sales. Accounts payable is used only for inventory acquisitions. Johnson purchases and pays for merchandise 60% in the month of acquisition and 40% in the following month. Selling and administrative expenses are budgeted at P40,000 for May and are expected to increase 5% per month. They are paid during the month of acquisition. In addition, budgeted depreciation is P10,000 per month. Income taxes are P38,400 for July and are paid in the month incurred.

Instructions Compute the amount of budgeted cash disbursements for July.

7) Cheney Company has budgeted direct materials purchases of P400,000 in March and P600,000 in April. Past experience

indicates that the company pays for 65% of its purchases in the month of purchase and the remaining 35% in the next month. Other costs are all paid during the month incurred. During April, the following items were budgeted: Wages expense Purchase of office equipment Selling and administrative expenses Depreciation expense Instructions Compute the amount of budgeted cash disbursements for April. P120,000 200,000 126,000 18,000

8) Robinson Inc. provided the following information:

Projected merchandise purchases April P92,000 May P78,000 June P66,000

Robinson pays 40% of merchandise purchases in the month purchased and 60% in the following month. General operating expenses are budgeted to be P31,000 per month of which depreciation is P3,000 of this amount. Robinson pays operating expenses in the month incurred. Robinson makes loan payments of P4,000 per month of which P450 is interest and the remainder is principal.

Instructions Calculate budgeted cash disbursements for May.

9) Sanders, Inc. provided the following information:

Projected merchandise purchases March P76,000 April P65,000 May P70,000

Sanders pays 40% of merchandise purchases in the month purchased and 60% in the following month. General operating expenses are budgeted to be P20,000 per month of which depreciation is P2,000 of this amount. Sanders pays operating expenses in the month incurred.

Instructions Calculate Sanders budgeted cash disbursements for May.

10) The beginning cash balance is P15,000. Sales are forecasted at P600,000 of which 80% will be on credit. 70% of credit

sales are expected to be collected in the year of sale. Cash expenditures for the year are forecasted at P375,000. Accounts Receivable from previous accounting periods totaling P9,000 will be collected in the current year. The company is required to make a P15,000 loan payment and an annual interest payment on the last day of every year. The loan balance as of the beginning of the year is P90,000, and the annual interest rate is 10%. Instructions Compute the excess of cash receipts over cash disbursements.

11) Herron Company has budgeted the following unit sales:

2008 April May June July Units 25,000 50,000 75,000 45,000

Of the units budgeted, 40% are sold by the Southern Division at an average price of P15 per unit and the remainder are sold by the Eastern Division at an average price of P12 per unit. Instructions Prepare separate sales budgets for each division and for the company in total for the second quarter of 2008.

12) Walker, Inc. makes and sells a single product, widgets. Three pounds of wackel are needed to make one widget.

Budgeted production of widgets for the next few months follows: September October 29,000 units 31,000 units

The company wants to maintain monthly ending inventories of wackel equal to 20% of the following month's production needs. On August 31, 9,000 pounds of wackel were on hand. Instructions How much wackel should be purchased in September?

13) Kelso Company manufactures two products, (1) Regular and (2) Deluxe. The budgeted units to be produced are as

follows: 2008 July August September October Units of Product Regular 10,000 6,000 9,000 8,000 Deluxe 15,000 10,000 14,000 12,000 Total 25,000 16,000 23,000 20,000

It takes 3 pounds of direct materials to produce the Regular product and 5 pounds of direct materials to produce the Deluxe product. It is the company's policy to maintain an inventory of direct materials on hand at the end of each month equal to 30% of the next month's production needs for the Regular product and 20% of the next month's production needs for the Deluxe product. Direct materials inventory on hand at June 30 were 9,000 pounds for the Regular product and 15,000 pounds for the Deluxe product. The cost per pound of materials is P5 Regular and P7 Deluxe.

Instructions Prepare separate direct materials budgets for each product for the third quarter of 2008.

14) Yount Company has budgeted the following unit sales:

January February March April May 2009 10,000 8,000 9,000 11,000 15,000 Units

The finished goods units on hand on December 31, 2008, was 1,000 units. Each unit requires 2 pounds of raw materials that are estimated to cost an average of P4 per pound. It is the company's policy to maintain a finished goods inventory at the end of each month equal to 10% of next month's anticipated sales. They also have a policy of maintaining a raw materials inventory at the end of each month equal to 20% of the pounds needed for the following month's production. There were 3,920 pounds of raw materials on hand at December 31, 2008. Instructions For the first quarter of 2009, prepare (1) a production budget and (2) a direct materials budget.

15) Cerner Company has budgeted the following unit sales:

2008 Quarter 1 2 3 4 Units 70,000 40,000 50,000 80,000 Quarter 1 2009 Units 60,000

The finished goods inventory on hand on December 31, 2007 was 14,000 units. It is the company's policy to maintain a finished goods inventory at the end of each quarter equal to 20% of the next quarter's anticipated sales. Instructions Prepare a production budget for 2008.

END OF THE QUIZ

Potrebbero piacerti anche

- 2nd Week - The Master Budget ExercisesDocumento5 pagine2nd Week - The Master Budget ExercisesLuigi Enderez BalucanNessuna valutazione finora

- Master Budget-WPS OfficeDocumento12 pagineMaster Budget-WPS OfficeRean Jane EscabarteNessuna valutazione finora

- As 12 - Full Notes For Accounting For Government GrantDocumento6 pagineAs 12 - Full Notes For Accounting For Government GrantShrey KunjNessuna valutazione finora

- M36 - Quizzer 1 PDFDocumento8 pagineM36 - Quizzer 1 PDFJoshua DaarolNessuna valutazione finora

- Business Combination Drill PDFDocumento2 pagineBusiness Combination Drill PDFMelvin MendozaNessuna valutazione finora

- Module 5Documento6 pagineModule 5Mon Ram0% (1)

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocumento30 pagineCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanNessuna valutazione finora

- M1 Introduction To Transfer Taxaion Students PDFDocumento20 pagineM1 Introduction To Transfer Taxaion Students PDFTokis SabaNessuna valutazione finora

- She QuizDocumento4 pagineShe QuizJomar Villena100% (1)

- 16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Documento7 pagine16 IFRS 6 Exploration For and Evaluation of Mineral Resources (Wasting Assets and Depletion)Zatsumono YamamotoNessuna valutazione finora

- Absorption and Variable Costing Act3Documento2 pagineAbsorption and Variable Costing Act3Gill Riguera100% (1)

- Current Liabilities and ProvisionsDocumento12 pagineCurrent Liabilities and ProvisionsRinkashizu TokimimotakuNessuna valutazione finora

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Documento1 paginaPrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNessuna valutazione finora

- Ch01 McGuiganDocumento31 pagineCh01 McGuiganJonathan WatersNessuna valutazione finora

- Ias 28: Investment in Associates and Joint VenturesDocumento7 pagineIas 28: Investment in Associates and Joint VenturesDzulija TalipanNessuna valutazione finora

- MSC-Audited FS With Notes - 2014 - CaseDocumento12 pagineMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNessuna valutazione finora

- Case 9-30 Master Budget With Supporting SchedulesDocumento2 pagineCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Notes Receivable Part 1Documento2 pagineNotes Receivable Part 1Crisangel de LeonNessuna valutazione finora

- Activity 3 123456789Documento7 pagineActivity 3 123456789Jeramie Sarita SumaotNessuna valutazione finora

- I B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1Documento4 pagineI B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1I am JacobNessuna valutazione finora

- Taxes 4 19 PDFDocumento2 pagineTaxes 4 19 PDFlana del reyNessuna valutazione finora

- IAS 23 Borrowing CostsDocumento6 pagineIAS 23 Borrowing CostsSelva Bavani SelwaduraiNessuna valutazione finora

- Investing ActivitiesDocumento7 pagineInvesting ActivitiesMs. ArianaNessuna valutazione finora

- Chapter 2 Accounting For The Service BusinessDocumento37 pagineChapter 2 Accounting For The Service BusinessKristel100% (1)

- PRACTICAL ACCOUNTING 1 Part 2Documento9 paginePRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNessuna valutazione finora

- Use The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesDocumento1 paginaUse The Following Information For The Next Two Questions.: Act1108 Financial Management Inventory Management - ExercisesMaryrose SumulongNessuna valutazione finora

- Chapter 9 Part 1 Input VatDocumento25 pagineChapter 9 Part 1 Input VatChristian PelimcoNessuna valutazione finora

- Ac102 Rev01-03Documento24 pagineAc102 Rev01-03Aaron DownsNessuna valutazione finora

- 6 BudgetingDocumento2 pagine6 BudgetingClyette Anne Flores BorjaNessuna valutazione finora

- Ms 03 - CVP AnalysisDocumento10 pagineMs 03 - CVP AnalysisDin Rose GonzalesNessuna valutazione finora

- Tfa CompiledDocumento109 pagineTfa CompiledAsi Cas JavNessuna valutazione finora

- AIS Chapter 7Documento2 pagineAIS Chapter 7Rosana CabuslayNessuna valutazione finora

- Case 8-31: April May June QuarterDocumento2 pagineCase 8-31: April May June QuarterileviejoieNessuna valutazione finora

- "The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseDocumento2 pagine"The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseKaren CaelNessuna valutazione finora

- Installment Sales ExercisesDocumento1 paginaInstallment Sales ExercisesMarlon A. RodriguezNessuna valutazione finora

- 2.3 Taxation Coverage For Performance Task 1Documento33 pagine2.3 Taxation Coverage For Performance Task 1?????Nessuna valutazione finora

- Gross Profit MethodDocumento15 pagineGross Profit MethodJeffrel Mae Montaño BrilloNessuna valutazione finora

- Far 102 - Cash and Cash EquivalentsDocumento4 pagineFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNessuna valutazione finora

- Responsibility and Transfer Pricing Solving: Answer: PDocumento3 pagineResponsibility and Transfer Pricing Solving: Answer: PPhielle MarilenNessuna valutazione finora

- Requirements:: Intermediate Accounting 3Documento7 pagineRequirements:: Intermediate Accounting 3happy240823Nessuna valutazione finora

- Economic Development Midterm ExaminationDocumento4 pagineEconomic Development Midterm ExaminationHannagay BatallonesNessuna valutazione finora

- Finman ReviewerDocumento89 pagineFinman Reviewersharon5lotino100% (1)

- BSA181A Interim Assessment Bapaud3X: PointsDocumento8 pagineBSA181A Interim Assessment Bapaud3X: PointsMary DenizeNessuna valutazione finora

- ACC 115 Ch.18 QuizDocumento3 pagineACC 115 Ch.18 QuizJoy Olivia MerrimanNessuna valutazione finora

- CVP VAnswer Practice QuestionsDocumento5 pagineCVP VAnswer Practice QuestionsAbhijit AshNessuna valutazione finora

- MQ1Documento8 pagineMQ1alellieNessuna valutazione finora

- Intermediate Accounting 3 - Week 1 - Module 2Documento6 pagineIntermediate Accounting 3 - Week 1 - Module 2LuisitoNessuna valutazione finora

- Audit of PPEDocumento6 pagineAudit of PPEJuvy DimaanoNessuna valutazione finora

- Far Completenotes Complete Notes On Financial Accounting and ReportingDocumento29 pagineFar Completenotes Complete Notes On Financial Accounting and ReportingLala Bora100% (1)

- PFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardDocumento7 paginePFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardMeg sharkNessuna valutazione finora

- CHAPTER 9 To CHAPTER 15 ANSWERSDocumento38 pagineCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNessuna valutazione finora

- Course Code and Title: Actp5 - Business Combination Lesson Number: 01 Topic: Overview of Business Combination DescriptionDocumento8 pagineCourse Code and Title: Actp5 - Business Combination Lesson Number: 01 Topic: Overview of Business Combination DescriptionTryonNessuna valutazione finora

- Chapter 4 - Job Order and Process CostingDocumento12 pagineChapter 4 - Job Order and Process Costingchelsea kayle licomes fuentesNessuna valutazione finora

- Budgets Exercises StudentDocumento5 pagineBudgets Exercises Studentديـنـا عادل0% (1)

- Chapter 07 - Exercises - Part IIDocumento4 pagineChapter 07 - Exercises - Part IIRawan YasserNessuna valutazione finora

- Master Budget Short ProblemsDocumento3 pagineMaster Budget Short ProblemsMary Berly MagueflorNessuna valutazione finora

- Cost II - Assignment & WorksheetDocumento7 pagineCost II - Assignment & WorksheetBeamlak WegayehuNessuna valutazione finora

- 2nd Week - The Master Budget ExercisesDocumento5 pagine2nd Week - The Master Budget ExercisesChin FiguraNessuna valutazione finora

- CH 9 - Class Notes - Mos 3370 - Kings - Fall 2023-2Documento24 pagineCH 9 - Class Notes - Mos 3370 - Kings - Fall 2023-2niweisheng28Nessuna valutazione finora

- Which of The Following Best Describes The MAIN Industry in Which You Personally WorkDocumento7 pagineWhich of The Following Best Describes The MAIN Industry in Which You Personally WorkNaval VaswaniNessuna valutazione finora

- Preparation of Gross - Net Value Added Statement For CompaniesDocumento6 paginePreparation of Gross - Net Value Added Statement For CompaniesKamal JoshiNessuna valutazione finora

- Strengthening & Nutrition Improvement Project (ISSNIP) - World Bank ProjectDocumento18 pagineStrengthening & Nutrition Improvement Project (ISSNIP) - World Bank ProjectNikhil JadhavNessuna valutazione finora

- Crystal V BPIDocumento2 pagineCrystal V BPIjakecarmientoNessuna valutazione finora

- 2010.12.15. The Nigerian Template Gas Sale and Aggregation Agreement Iogl Ghana PDFDocumento36 pagine2010.12.15. The Nigerian Template Gas Sale and Aggregation Agreement Iogl Ghana PDFFrank HummelNessuna valutazione finora

- Obc Home LoanDocumento97 pagineObc Home LoanArvind Sanu MisraNessuna valutazione finora

- GrandFoundy 2011Documento57 pagineGrandFoundy 2011eepNessuna valutazione finora

- Saadullah Internship ReportDocumento42 pagineSaadullah Internship ReportSaad SolangiNessuna valutazione finora

- 5-10 Resolution For Borrowing MoneyDocumento1 pagina5-10 Resolution For Borrowing MoneyDaniel93% (14)

- 7110 Y08 SP 2Documento20 pagine7110 Y08 SP 2mstudy123456Nessuna valutazione finora

- Financial Analytics Product GuideDocumento168 pagineFinancial Analytics Product GuideBhaskar SrikanthNessuna valutazione finora

- Monetary PolicyDocumento5 pagineMonetary PolicyKuthubudeen T MNessuna valutazione finora

- A Case Study On Mega Merger of Sbi With Its Associate Banks and Bhartiya Mahila BankDocumento34 pagineA Case Study On Mega Merger of Sbi With Its Associate Banks and Bhartiya Mahila BankMihirParmarNessuna valutazione finora

- Resources Policy: Md. Aminul Haque, Erkan Topal, Eric LilfordDocumento9 pagineResources Policy: Md. Aminul Haque, Erkan Topal, Eric LilfordYhoan Miller Lujan GomezNessuna valutazione finora

- Chapter 08 Interest Rates and Bond ValuationDocumento40 pagineChapter 08 Interest Rates and Bond ValuationHuu DuyNessuna valutazione finora

- Sanc Begusarai 3139382 125824Documento2 pagineSanc Begusarai 3139382 125824Aman KumarNessuna valutazione finora

- US GAAP Vs IFRS TelecommDocumento52 pagineUS GAAP Vs IFRS Telecommludin00100% (1)

- Target Capital StructureDocumento10 pagineTarget Capital StructureZyl Apaul CallantaNessuna valutazione finora

- Governance and Corporate Social Responsibility Final ExaminationDocumento16 pagineGovernance and Corporate Social Responsibility Final Examinationclara san miguelNessuna valutazione finora

- Azeze Mulugojam FINALDocumento66 pagineAzeze Mulugojam FINALSingitan YomiyuNessuna valutazione finora

- Chairperson,: Heirs of Jose Lim, Represented by ELENITO LIM, G.R. No. 172690Documento37 pagineChairperson,: Heirs of Jose Lim, Represented by ELENITO LIM, G.R. No. 172690Aleah LS KimNessuna valutazione finora

- Financial Accounting PAA198 Student ManualDocumento170 pagineFinancial Accounting PAA198 Student Manualthexplorer008100% (1)

- Solution To Case 2: Bigger Isn't Always Better!Documento9 pagineSolution To Case 2: Bigger Isn't Always Better!Muhammad Iqbal Huseini0% (1)

- How To Find The Perfect Spouse..... With 101 Simple QuestionsDocumento8 pagineHow To Find The Perfect Spouse..... With 101 Simple Questionstmcfadden5875Nessuna valutazione finora

- Securities Commision Act 1993Documento52 pagineSecurities Commision Act 1993wws3322Nessuna valutazione finora

- Melva Theresa Alviar Gonzales vs. Rizal Commercial Banking Corporation-G.r. No. 156294 PDFDocumento5 pagineMelva Theresa Alviar Gonzales vs. Rizal Commercial Banking Corporation-G.r. No. 156294 PDFJulie Rose FajardoNessuna valutazione finora

- Electricity Bill: Due Date: 19-01-2012Documento1 paginaElectricity Bill: Due Date: 19-01-2012biko137Nessuna valutazione finora

- Checklist of Requirements For Issuance of Poea LicenseDocumento4 pagineChecklist of Requirements For Issuance of Poea Licensesbagsic100% (2)

- JOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsDocumento1 paginaJOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsEda Angelica Concepcion Buena-BagcatinNessuna valutazione finora

- Economic Value AddedDocumento9 pagineEconomic Value AddedLimisha ViswanathanNessuna valutazione finora