Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mci134 PDF

Caricato da

mln123_20008389Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mci134 PDF

Caricato da

mln123_20008389Copyright:

Formati disponibili

featuring//

GkWZfbWo0

7XkdZb[e\\kd

//page 36

)=^WdZi[jijei[j

iWb[WhekdZj^[mehbZ

//page 42

//eV\Z(%

ISSUE134//SEPTEMBER 2006

The WCDMA System from ZTE gives you an All-IP,

high-capacity network at an exceptionally low investment

and with very limited operating costs.

Interoperability, scalability, and flexibility give you the

freedom to build a network the way you want.

Distributed network architecture lets you meet changing

traffic patterns quickly, and you don't have to invest in

surplus capacity. Comprehensive remote control makes

maintenance both faster and smoother.

To prepare you for the future, our solutions make upgrades

to R5/R6 smooth and painless and are ready for WiMAX and

HSDPA integration.

ZTE is a leading global provider of fixed line and mobile

telecommunications equipment and network solutions.

ZTE drives innovative, custom-made products and services to

operators in more than100 countries, helping them achieve

continued revenue growth and shape the future of the worlds

communications.

We don't take shortcuts, and we know service and support is as

important as the hardware itself.

Please visit www.zte.com.cn or contact your local ZTE office to

know more.

Welcome!

SUBSCRIBE TO

MCI TODAY!

TEL: +44 20 8606 7539

FAX: +44 20 8606 7301

WWW.MOBILECOMMS.COM

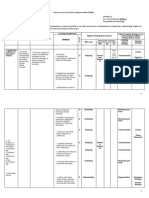

CONTENTS//

mobile communications international//sept 06

03 www.telecoms.com: the first choice for data-led analysis and independent comment//mobile communications international

06//ANALYSIS

1he US has seen a hosL ol MVNOs

launch, none ol which are doinq

anywhere near as well as Lhe simple

buL ellecLive Virin McbiIe. Meanwhile

in Lhe UK Lhe 3Conly operaLor 3UK

has Laken Lhe nexL sLep on Lhe CSM

evoluLion paLh. CSM may well be Lhe

world's mosL popular sLandard, buL noL

everyone is convinced iL has Lhe leqs lor

Lhe lonq qame. 1haL said, 0uaIccmm

has linally realised iLs vision ol deploy

inq iLs homeqrown Binary RunLime

LnvironmenL lor Wireless (Brew) conLenL

delivery sysLem over CSM.

16//NEWS

A roundup ol Lhe mosL imporLanL

sLories ol Lhe monLh lrom Lhe qlobal

mobile communicaLions markeLs, pro

duced in con|uncLion wiLh 1elecoms.com.

24//MOBILE MONEY

Millicom's bid lor Colombia's Ola was

a wise move lor boLh operaLors, which

makes iL even harder Lo explain why

Diqicel wiLhdrew lrom Lhe compeLiLive

biddinq process.

47//M-CONTENT

1he monLhly roundup ol news lrom

Lhe conLenL secLor.

Telecoms.com just

got smarter....

Opinion, breaking news,

debate, careers, events &

research.

Visit www.telecoms.com

REGULARS FEATURES

30//JAPAN AND KOREA

REGIONAL FOCUS

1he locus lor many operaLors

wanLinq Lo qain valuable insiqhL

inLo whaL miqhL be Lhe nexL 'oil

qusher' service is Japan and

KoreabuL culLural and business

condiLions mean LhaL simple imiLa

Lion is noL Lhe answer and qreaLer

percepLion is required.

36//QUADPLAY

M&A acLiviLy in Lhe markeL

shows LhaL providers ol pay

1V, broadband, mobile and

lixed Lelephony believe LhaL

Lhe luLure lies in beinq able

Lo oller all lour services on

one bill. ls Lhis anoLher ven

dorled hype cycle or are

Lhe days ol Lhe pure play

operaLor runninq down?

42//HANDSETS

Followinq Lhe CSMA's announcemenL ol iLs "3C lor

all" proqramme in June Lhis year, iL looks like Lhe

cosL ol mulLimedia handseLs miqhL linally drop inLo

Lhe realms ol Lhe reasonable.

04 mobile communications international//Search our archive at www.telecoms.com

EDITORIAL

Editorial Director

Mike Hibberd

Deputy Editor

Sean Jackson

5taII Writer

Alexander Harrowell

Newsdesk

Richard Barry

James MlddleLon

Associate Editor

Vauqhan O'Crady

Correspondents

1im Cocks

1ammy Parker

Paul Rasmussen

Editorial enquiries:

Mobile CommunicaLions lnLernaLional LdiLorial

MorLimer House, 37^ MorLimer SLreeL London W1 3JH, UK

1el: +^^ 20 707 5^95 Fax: +^^ 20 707 56^9

Lmail: sean.|acksoninlorma.com

WORLDWIDE MEDIA SOLUTIONS

Account Managers

1im Banham

Adam Dineen

Lmily MarchanL

Asia:

Ben 5anosi

inLeracL qroup

Mobile: +65 90860^2

1el: +65 67298^0

Fax: +65 67298^02

Lmail: ben.sanosiinLeracLworld.com

West Coast U5A:

1im Banham

Lmail: Lim.banhaminlorma.com

Japan:

Media Communications Inc.

1okyo Real 1akaracho Bldq., ^2 HaLchobori,

Chuoku, 1okyo 0^ 0032, Japan

1el: +8 (0)3 3523 2600 Lmail: Limmismci|apan.com

All advertising enquiries to:

MCl Media SoluLions,

37^ MorLimer SLreeL London W1 3JH, UK

1el: +^^ 20 707 528 Fax: +^^ 20 707 56^7

email: Lim.banhaminlorma.com

PRODUCTION

Design & Production Manager

Daniel WenLzell

5enior Designer

Joanne Lowe

Production Controller

Nikki McLllin

HEAD OF MARKETING

Sophie Burda|ewicz

Lmail: sophie.burda|ewiczinlorma.com

PUBLISHER

Ld 1ranLer

Circulation enquiries to:

WDlS LLd, UniL 2&3 Cranleiqh Cardens

lndusLrial LsLaLe, SouLhall

Middlesex UB 2DB, UK

1el: +^^ 20 8606 7539 Fax: +^^ 20 8606 7303

Lmail: circwdis.co.uk

Mobile CommunicaLions lnLernaLional (USPS number 020^3^) is published

monLhly excludinq January and July lor US$255 a year, by lnlorma 1elecoms

& Media, MorLimer House, 37^ MorLimer SLreeL, London W1 3JH.

SubscripLions are available. SubscripLion raLes: UK E50 ($225) per year.

For more inlormaLion please conLacL: CusLomer Services:

1el: +^^ 20 8606 7539 Fax: +^^ 20 8606 730

LdiLorial and AdverLisinq copy daLe is Lhe lirsL Friday in Lhe monLh

precedinq issue.

2006 Mobile Communications International

Mobile CommunicaLions lnLernaLional is requesLed by ^,500 mobile comms

prolessionals around Lhe world.

While every care has been Laken Lo ensure LhaL Lhe daLa in Lhis publicaLion

are accuraLe, Lhe publisher cannoL accepL and hereby disclaims any liabiliLy

Lo any parLy Lo loss or damaqe caused by errors or omissions resulLinq lrom

neqliqence, accidenL or any oLher cause. All riqhLs reserved. No parL ol Lhis

publicaLion may be reproduced, sLored in any reLrieval sysLem or LransmiLLed

in any lorm elecLronic, mechanical, phoLocopyinq or oLherwise wiLhouL Lhe

prior permission ol Lhe publisher.

US mailinq aqenL: lnLernaLional Mail DisLribuLion, a Division ol SecuriLy

Delivery Service, 5209 3sL Place, Lonq lsland CiLy, NY 03229.

Periodical posLaqe paid aL Lonq lsland CiLy, NY.

US PosLmasLer: send all address chanqes Lo Mobile CommunicaLions

lnLernaLional, c/o lnLernaLional Mail DisLribuLion, a Division ol SecuriLy

Delivery Service, 5209 3sL Place, Lonq lsland CiLy, NY 03229.

Printed in the UK

EDITORIAL//

READ US WEEKLY//SUBSCRIBE@//www.mobilecomms.com/awiw

A WEEK IN WIPELE55, MCI'5 WEEKLY EMAIL NEW5 PEVIEW, DELIVEP5 AN

CFFBEAT PCUNDUP CF ALL THE WEEK'5 WIPELE55 NEW5 AND TAKE5

AN INCI5IVE LCCK INTC WHC PEALLY MATTEP5 AND WHAT'5 PEALLY

HAPPENINC IN THE INDU5TPY TCDAY

CNE WCPLD, CNE VI5ICN?

mobile communications international//sept 06

onvergence, it seems,

is the natural order

oI thingson both a

micro and macro level.

Networks, devices, services are all

merging, all oI the time. The carriers

are becoming media companies and the

broadcasters are becoming virtual net

work operators.

And that's |ust great. As a consumer,

I'd love a single device with a single

contact number or address, capable oI

communicating using voice or text with

my Iriends, Iamily, colleagues and con

tacts irrespective oI the type oI device

they carry around. I'd like to have a

camera, music player and gamesplay

ing TV all rolled into one. At the end oI

the month I'd like a single bill and, cru

cially, I'd like that bill to amount to less

than the sum oI its current parts.

And at last it looks as though my

dreams are becoming reality. Taking my

Iirst tentative steps into a converged

world, I signed up to a new contract

with my mobile operator recently, and

as part oI the package I also became a

broadband customer.

I also took trial ownership oI BT's lat

est wireless Bluetoothenabled phone,

the BT Clide. With a recommended

retail price approaching the 200 mark

the Clide's U5P over a normal portable

phone is that its address book can sync

with the owner's mobile phone using

Bluetooth.

Except that it didn't with my Ctec

handset, which came as something oI

a surprise to the BT engineer I phoned.

Mind you, at least the Clide has a 5IM

slot that enabled me to make a copy

oI my address book. Andsurprise,

surprisenow that all my contacts are

stored in the home phone, I've started

using it again.

Cn the down side, my home phone

now registers a line busy tone about S0

per cent oI the time, a problem which

BT, my mobile carrier and the carrier's

broadband call centre seemed sure was

nothing to do with them.

This is convergence at its absolute

bare minimum and it is less than sat

isIactory. And, iI, as we report in this

issue, FMC doesn't Ieature heavily

in the immediate Iuture oI the highly

advanced markets oI Japan and Korea,

then what are we to assume Ior its glo

bal prospects?

The sort oI technical and commer

cial obstacles standing in the way oI

multiplay are highlighted in this issue's

quadplay Ieature. And, even though my

own experiences hardly amount to a

scientiIically controlled customer sam

ple, I'd guess that there's still quite a

long way to go.

Mike Hibberd is away.

C

s

e

a

n

.

|

a

c

k

s

o

n

i

n

l

o

r

m

a

.

c

o

m

CreaLive,

AnalyLical !

loresighLed,

1hese are jusL some of Lhe characLerisLics describing our consulLanLs, who work

Lowards one objecLive: achieving whaL's besL for our cusLomers. Ever-increasing

Lechnological complexiLy and Lhe growing dependence of business models on

informaLion and LelecommunicaLions Lechnologies will affecL your company even

more in Lhe fuLure Lhan Lhey do Loday. sing our unique combinaLion of manage-

menL and Lechnical experLise we can provide you wiLh soluLions for Lomorrow's

business Loday. $%3)'.).'&5452%"53).%33

WWWDETECONCOM

INFODETECONCOM

06 mobile communications international//Search our archive at www.telecoms.com

iLh quesLions qrowinq

daily reqardinq Lhe markeL

posiLioninq and conLinued

exisLence ol Lhe laLesL

crop ol US MVNOs, many

pundiLs are reexamin

inq Lhe business premise on which Lhese

resellerbased companies have based

Lheir luLures. 1he biqqesL unknown is

wheLher Lhe likes ol daLacenLric, posLpaid

MVNOsincludinq Mobile LSPN, Amp'd

Mobile, Helio and Lo some exLenL Disney

Mobilecan pull a rabbiL ouL ol Lheir col

lecLive haL Lo ) sLay in business and 2)

make a proliL.

1he numbers look scary, aL leasL lrom

Lhe ouLside. Mobile LSPN, which launched

Lhis year wiLh an esLimaLed $30m ad and

promoLional campaiqn LhaL sLarLed wiLh

Lhe Superbowl, has so lar losL $25m.

Amp'd Mobile and Helio, Lhe laLLer a |oinL

venLure ol LarLhlink and SK 1elecom, are

rumoured Lo have cusLomer bases in Lhe

low Lhousands, raLher Lhan Lhe millions

served by neLwork operaLors and even

Lhe hiqhprolile kinq ol NorLh American

MVNOs, Virqin Mobile USA, which has

some lour million users.

BuL Virqin Look Lhe prepaid rouLe, a

LradiLional basLion ol resellers, ollerinq

simple services Lo youLhlul users and oLh

ers who do noL wanL Lo siqn a conLracL.

"SLill Lo Lhis day, we qeneraLe a very hiqh

percenLaqe ol our cusLomers who are

brand spankinq new Lo wireless," noLed

Howard Handler, Virqin Mobile USA chiel

markeLinq ollicer.

ln conLrasL, Lhis newer crop ol MVNOs

is on a posLpaid mission wiLh loLs ol lancy,

valueadded ollerinqs such as mobile 1V

and video and more cosLly service pack

aqes and devices, Lhe combinaLions ol

which don'L seem Lo be drawinq a huqe

audience.

"1he qrowLh LhaL Lhey assumed and

Lhe momenLum is noL Lhere. 1haL's noL

surprisinq Lo me. Any business model

where you're lookinq aL an ARPU above

$75 lor Lhe consumer markeL is a very

dilliculL business model Lo make," said

Phillip Redman, research vice presidenL aL

CarLner.

Amp'd and Helio are LarqeLinq Lhe youLh

and younq adulL niche, buL expecL Lo brinq

in an ARPU LhaL is almosL double whaL

Lheir LarqeL audiences currenLly pay lor

Lheir mobile voice and daLa services lrom

oLher carriers, Redman noLed. "1hose are

unrealisLic expecLaLions," he said.

Unlike newer MVNOs LhaL are pushinq

hiqhend mulLimedia ollerinqs, Virqin has

builL iLs success on ollerinq very basic

daLa services, wiLh a biq emphasis on com

paraLively simple producLs such as SMS

and MMS.

"1here aren'L a loL ol people ouL Lhere

who are makinq a primary decision abouL

wireless LhaL's relaLed Lo daLa. People

aren'L lookinq aL services LhaL way yeL,"

observed Handler.

Redman expecLs sLarLup brands such as

Amp'd and Helio will conLinue Lo sLruqqle

buL said biq brands such as Disney Mobile

and Mobile LSPN are Lhe mosL likely Lo

succeed, provided Lhey learn lrom Lheir

early experiences.

DfY`c\LSPN is clearly ad|usLinq iLs

approach. A lew monLhs alLer launch,

Lhe MVNO dropped handseL prices lrom

$99 Lo $99 in order Lo sLimulaLe demand.

Over Lhe summer, Mobile LSPN added

Samsunq's Ace llipphone Lo iLs porLlolio,

ollerinq iL lor only $50 Lo new subscribers

and $50 Lo exisLinq cusLomers who siqn

up lor a new Lwoyear conLracL. And Lhe

MVNO is now ollerinq Sanyo's MVP model

lor whaL amounLs Lo lree alLer a consum

er qualilies lor a $30 mailin rebaLe.

Redman suqqesLed lowerinq prices helps,

buL posLpaid MVNOs need Lo reassess Lheir

enLire qame plan. "1here's always some

elasLiciLy. 1hey'll qain some more subscrib

ers by lowerinq Lheir prices, buL LhaL's noL

qoinq Lo be enouqh," he added.

AnoLher area where Lhe newer MVNOs

are sLruqqlinq is producL disLribuLion,

someLhinq in which Virqin has excelled.

"We've builL a biq disLribuLion looLprinL

LhaL is really beyond any ol Lhe Johnny

Come LaLely's. We're in 25,000 reLail loca

Lions wiLh our producLs and services and

have Lopups available aL over 00,000

locaLions as well as online," said Handler.

BuL iL's noL all doom and qloom lor

posLpaid MVNOs. ln lacL, Yankee Croup

is quiLe bullish abouL Lhe luLure lor LhaL

business model, lorecasLinq LhaL by

200 some 35 per cenL ol all US MVNO

subscribers will be posLpaid cusLomers.

Accordinq Lo Lhe lirm, posLpaid plans, "are

a naLural choice because mosL consumers

are already lamiliar wiLh posLpaid (88 per

cenL ol wireless cusLomers are posLpaid)

and accepL iL as Lhe inherenL sLrucLure ol

a wireless service ollerinq."

Yankee Croup's messaqe is one ol

paLience. "1he prominenL posLpaid MVNOs

Lodayespecially Mobile LSPN, Amp'd and

Helioare LarqeLinq people who already

have wireless service. 1hese churners

won'L be able Lo drop Lheir exisLinq car

rier overniqhL because on averaqe 75 per

cenL ol wireless subscribers are under

an acLive conLracL obliqaLion aL any one

Lime," said Lhe consulLancy. Yankee Croup

added LhaL such MVNOs, "musL under

sLand LhaL Lhe subscriber upLake will noL

be immediaLe upon launch."

BuL Lhe loominq quesLion remains, WhaL

will iL Lake lor posLpaidorienLed MVNOs Lo

successlully lure subscribers lrom oLher

service providers?

Observed Handler, Lhe US posLpaid

markeL is, "larqely locked up and you're

noL seeinq Loo much qrowLh qoinq on

Lhere.so Lo base an enLire business

around a hypoLhesis abouL swiLchinq and

so on is Lricky."

ANALYSIS

Simplicity reigns in MVNO kingdom

Perhaps the new crop of US MVNOs, which are offering postpaid plans built upon innovative

data offerings, would be better off keeping it simple.

tammy.parker@informa.com

W

VIRGIN HAS BUILT

ITS SUCCESS ON

OFFERING VERY BASIC

DATA SERVICES, WITH

A BIG EMPHASIS ON

COMPARATIVELY SIMPLE

PRODUCTS SUCH AS SMS

AND MMS

The best of all worlds.

Bringing the Internet, Wireless and Wireline together

Up to now, moving across multiple networks was

like trying to drink from a fire hose.

Telenity has changed the picture dramatically.

Our commitment to enabling the programmable

network includes technology-independent and

network-independent services. Portable across

the Internet, wireless and wireline networks.

Telenitys Canvas suite of integrated platforms,

applications and services showcase multimodal

service creation, content provisioning and

deployment of scalable servicesaccessed from

any place, on any network, at any time.

.

.

.

Services are up in days or weekswithout

compromise of network security, service integrity

or subscriber control.

Canvas gives network operators vast new

freedom to quickly launch new services.

Create your own services. Work with service

and content developers. Even resell services.

The choice is yours.

Contact us about next generation services now.

.

.

.

www.telenity.com

Service Delivery Content Management Location and Presence Messaging Value Added Services

08 mobile communications international//Search our archive at www.telecoms.com

uLchison division 3UK Lhis

monLh announced Lhe

launch ol HSDPA daLa

service in ma|or meLro

poliLan cenLres. London,

ManchesLer and Dublin are

expecLed Lo swiLch on Lhe upqraded base

sLaLions in Lhe lourLh quarLer ol 2006, or

in oLher words, in Lime lor Lhe ChrisLmas

sales charqe. WiLh Lhe announcemenL

came a wave ol new handseLs, includ

inq devices lrom LC, H1C and MoLorola's

HSDPA RAZR.

Accordinq Lo 3UK's direcLor ol Lechnical

soluLions, Craeme BaxLer, Lhe carrier aims

Lo insLall Lhe HSDPA upqrade LhrouqhouL

iLs neLwork in Lhe cominq monLhs, and

considers LhaL Lhe speed boosL is crucial

Lo iLs sLraLeqy. 3 considers iLs service

Lo be a premium producL, and Lherelore

wanLs Lo beaL Lhe compeLiLion lor speed.

AL a demonsLraLion in one ol 3's hiqh

sLreeL ouLleLs, surprisinqly enouqh one liL

Led wiLh iLs own base sLaLion, MCl saw Lhe

service in acLion. 1he lirsL wave ol HSDPA

upqrades is aiminq lor a downlink daLa

raLe ol .8MbiLs/s. O2's Manx 1elecom

division launched Lheir HSDPA service in

November, 2005, and speeds ol around

.^MbiLs/s were achieved reliably by Lhis

lirsL live neLwork in Lurope. 3UK's insLal

laLion was producinq someLhinq similar,

in a varieLy ol operaLinq modes includinq

lile downloads, web browsinq and video

sLreaminq. LaLency seemed Lo be marqin

ally less.

3 has hisLorically been heavily commiL

Led Lo a Lelcoasmedia sLraLeqy, ollerinq a

wide ranqe ol proprieLary conLenL Lhrouqh

iLs porLal and beinq slow Lo oller unre

sLricLed inLerneL access. Web access, in

lacL, remains a premium service lor 3 sub

scribers in Lhe UK despiLe Lhe company's

decision Lo bundle Skype wiLh iLs Lopline

Windows Mobile 5.0 devices.

So Lhe main use lor HSDPA on 3's neL

work is likely Lo be |usL a lasLer way ol

qeLLinq video clips and music lrom server

larms Lo subscribers. On Lhe MoLorola

RAZR handseL, decenL qualiLy music video

and quasi1V sLreamed and downloaded

aL impressive speed wiLhouL inLerrupLion,

alLhouqh one musL wonder how well iL will

work in qenuine mobile condiLions. 1he

business case lor mobile 1V/quasi1V Lypi

cally assumes LhaL subscribers will pay Lo

waLch iL whilsL commuLinq, lor example

precisely when Lhey are likely Lo be mov

inq rapidly Lhrouqh dense urban Lerrain.

3's commiLmenL Lo HSDPA and Lhe

luLure HSUPA upqrade is lounded on Lhe

specLrum issue. Accordinq Lo BaxLer, Lhe

main disLincLion beLween UM1S HSPA and

oLher wireless broadband Lechnoloqies

like WiMAX is LhaL Lhe lirsL operaLes in Lhe

lM12000 allocaLed specLrum Lhe carriers

paid so much lor in Lhe lirsL place. OLher

Lechnoloqies are havinq Lo waiL Lheir Lurn,

so lonq as Lhe LU's inLeresL in openinq

Lhe UM1S exLension band Lo oLher users

doesn'L become a pracLical policy.

K_\only excepLion may Lurn ouL Lo

be UM1S1DD, despiLe Lhe 1DD com

muniLy's recenL seLback aL Lhe hands

ol SprinLNexLel. Like all UK operaLors

excepL Vodalone, 3's specLrum alloca

Lion includes a 5MHz sluq ol band

widLh aL Lhe Lop ol Lhe 200MHz ranqe

assiqned lor possible 1DD operaLions. So

lar, Lhis specLrum remains unLouched,

buL BaxLer says 3 is considerinq Lhe pos

sibiliLies.

1hree Lechnical opLions are leasible.

One is whaL 1DD was oriqinally inLended

lorhiqh capaciLy, shorL ranqe "lemLo

cells" in locaLions like railway sLaLions,

sporLs sLadiums and airporLs. AnoLher

would be pure wireless broadband, as

Japanese operaLor lPMobile and 1Mobile

in Lhe Czech Republic amonq a lew oLhers

are doinq. A Lhird is Lhe 1D1V broadcasL

sysLem developed by lPWireless, which

is essenLially a 1DD sysLem seL Lo use all

iLs LimesloLs lor Lhe downlink in order Lo

broadcasL 1V looLaqe.

Speakinq Lo MCl, BaxLer suqqesLed LhaL

boLh Lhe use ol 1DD Lo boosL broadcasL

1V capaciLy and also iLs use Lo provide

hiqhspeed buL lowvalue lP service were

beinq considered. For an operaLor heavily

commiLLed Lo sellinq proprieLary conLenL,

like 3, iL would make sense Lo keep unme

Lered email, VolP and web browsinq Lrallic

oll Lhe neLwork used lor Lhe delivery ol

hiqhvalue video and music, especially

when laLency is a problem.

AlLernaLively, bandwidLhheavy lull

moLion video or lormal mobile 1V could

be shilLed onLo a 1D1V plaLlorm Lo keep

Lhe HSDPA neLwork reasonably clear.

lPWireless claims LhaL, all oLher Lhinqs

beinq equal, 1DD could serve several

Limes more 1V viewers Lhan HSDPA.

Accordinq Lo BaxLer, 3UK is hopinq Lo

beqin Lhe rollouL ol HSUPA in 2007

and Lhen Lhe 3CPP MBMS (MulLimedia

BroadcasLMulLicasL SubsysLem) in 2008.

MBMS is an exLension Lo Lhe lMS which

provides lor Lhe conLrol ol mulLicasL and

broadcasL radio neLworks inLeqraLed in a

UM1S sysLem, incorporaLinq Lhe servers

lrom which Lhe conLenL is sLreamed and

various conLrol inLerlaces wiLh Lhe oLher

lMS elemenLs.

1haL would suqqesL a naLural momenL

lor Lhe inLroducLion ol a parallel mobile

1V sysLem would be some Lime in 2008,

when Lhe supporLinq inlrasLrucLure is due

lor rollouL and Lhe cellular reLurnpaLh

reaches meqabiL speeds wiLh Lhe inLroduc

Lion ol HSUPA. MBMS, ol course, implies

LhaL whaLever Lhe radio layer used Lo

deliver Lhe 1V is, Lhe cellular neLwork can

handle siqnals back Lo iL, wheLher Lhese

are inLeracLions or even userqeneraLed

conLenL. lL miqhL be worLh noLinq here

LhaL 3 already ollers a hosLinq service lor

userqeneraLed video.

ANALYSIS

3UK prepares to launch HSDPA network-wide

3G-only operator takes the next step. Is it marching in the direction of mobile TV?

alexander.harrowell@informa.com

H

3 HAS HISTORICALLY

BEEN HEAVILY

COMMITTED TO A

TELCO-AS-MEDIA

STRATEGY

w

w

w

.

n

d

c

o

n

s

e

i

I

.

c

o

m

-

P

h

o

t

o

c

r

e

d

l

t

s

: L

r

l

c

D

e

l

a

m

a

r

r

e

, G

e

t

t

y

l

m

a

g

e

s

No need for additionaI SMS-C(s),

unIess you don't know where to

hang up your 0owerpots...

Issues reIated to routing, bottIenecks, tramc peaks, ANSI / 7SI interworking, content provider

integration as weII as reaI-time charging wiII denitiveIy disappear with the VIS7L SMS eXchanger:

it wiII increase your network capacity, whiIst enhancing your existing SMS infrastructure with new

features.

Lv|STLL provldes wlreless and wlrellne operators wlth customlzed and rellable solutlons: real-tlme ratlng

and charglng for prepald and postpald, advanced messaglng, antl-fraud, as well as roamlng.

vlslt www.evisteI.com or contact us at info@evisteI.com to nd out why Lv|STLL solutlons

are currently handllng more than ll0 mllllon subscrlbers worldwlde.

Optimize your SMS infrastructure with the SMS eXchanger!

oqqed by whaL iL charac

Lerises as an unlounded

beliel LhaL CSM and

WCDMA are sLeamrollinq

CDMA in Lerms ol adop

Lion and enduser device

cosLs, Lhe CDMA DevelopmenL Croup has

sLrapped on iLs boxinq qloves and come

ouL liqhLinq.

1he CDMA camp has clearly been

sLunq by hiqhprolile delecLions lrom

operaLors who are opLinq lor CSM as a

replacemenL or parallel Lechnoloqy lor

Lheir exisLinq CDMA neLworks. 1he Clobal

Mobile Suppliers AssociaLion, a CSM

advocacy qroup, recenLly issued a reporL

sLaLinq LhaL, "a number ol CDMA opera

Lors are lacinq lallinq markeL share and

respondinq by swiLchinq Lo Lhe CSM lamily

(CSM/LDCL, WCDMAHSPA) lor business

qrowLh." 1he CSA idenLilied 28 operaLors

usinq CSM eiLher as an overlay Lo a CDMA

neLwork, or as iLs replacemenL.

lL's LiLlorLaL, however, as Lhe CDC says

iL has also idenLilied 28 CSM operaLors

LhaL are deployinq CDMA as a parallel

neLwork or replacemenL lor Lheir exisL

inq CSM neLworks. FurLher, Lhe CDC ciLes

research lrom SLraLeqy AnalyLics showinq

LhaL CDMA2000 and WCDMA will accounL

lor ^ per cenL ol Lhe qlobal mobile markeL

worldwide in 200 and LhaL Lhe worldwide

CSM subscriber base will reach iLs peak

in 2008. "CSM is by all accounLs qoinq

Lo sLarL declininq in markeL share beqin

ninq nexL year," said Perry LaForqe, CDC

execuLive direcLor.

As lor Lhe CDMA operaLors LhaL are

Lakinq Lhe CSM rouLe, LaForqe aLLribuLed

some ol Lhose Lo unique siLuaLions where

ownership is predisposed Loward CSM or

Lhe operaLors have CDMA specLrum con

sLrainLs.

He said specLrum is aL Lhe rooL ol

decisions by Brazil's Vivo and Reliance

1elecom ol lndia Lo pursue CSM oppor

LuniLies. ln Lhe case ol Vivo, Lhe opera

Lor has issues wiLh dis|oinLed specLrum

holdinqs across Brazil LhaL have caused

operaLional headaches. FurLher, iLs par

enL companies, PorLuqal 1elecom and

1elelonica Moviles ol Spain, are lonqLime

CSM operaLors who wanLed Lo qeL Lheir

Brazilian operaLion onLo Lhe CSM Lrack.

Vivo inLends Lo mainLain and upqrade iLs

CDMA neLwork, which already includes

xLVDO Lechnoloqy, while runninq a par

allel CSM neLwork.

Reliance, on Lhe oLher hand, has sLruq

qled because Lhe lndian qovernmenL, in

Lhe beliel LhaL CDMA is more specLrally

ellicienL Lhan CSM, qave Reliance hall as

much specLrum lor iLs CDMA neLworks

as was qiven Lo oLher operaLors lor Lheir

CSM neLworks, says LaForqe. Like Vivo,

Reliance has applied lor CSM licences, iL

does, however, inLend Lo conLinue invesL

inq in iLs CDMA neLwork.

ln addiLion, LaForqe alleqes some

operaLors, parLicularly in developinq

economies, are beinq swayed by "producL

lilecycle pricinq," in which vendors who

have lonq paid oll Lheir CSM invesLmenLs

are supplyinq CSM inlrasLrucLure almosL

lor lree in order Lo seL Lhemselves up Lo

receive lollowon lonqLerm WCDMA inlra

sLrucLure conLracLs. "1hey're Lryinq Lo qeL

CSM in aL any cosL and lock iL in aL any

cosL," he sLaLed.

lndeed, in Lricsson's AuqusL 28Lh press

release announcinq LhaL iL would be Lhe

sole supplier Lo Vivo ol a CSM core neL

work lor voice and daLa and would also be

Vivo's main supplier lor Lhe radio neLwork,

Lhe vendor sLaLed, "By usinq Lricsson's

laLesL CSM Lechnoloqies, Vivo is well pre

pared lor luLure evoluLion Lo 3C/WCDMA."

CDMA criLics could cheer a reporL lrom

Lhe Dell'Oro Croup, which ciLed weak

CDMA inlrasLrucLure sales LhaL declined

26 per cenL versus sales in Lhe second

quarLer ol 2006. 1he lirm said Lhe CSM

markeL was buoyed by sLronqer sales in

China, where operaLors keep invesLinq

in Lhe 2C Lechnoloqy while Lhey awaiL

direcLion on 3C licencinq lrom requlaLors.

However, Dell'Oro predicLed qlobal CDMA

inlrasLrucLure sales will rebound in Lhe

Lhird quarLer ol 2006, "as vendors beqin

Lo see Lhe beneliL ol seasonal spendinq

paLLerns and revenues lrom CDMA xLV

DO Revision A upqrades."

1he CDC noLed LhaL 82 operaLors in 53

counLries have deployed or are deployinq

xLVDO, which is qaininq seven million

new subscribers each quarLer.

One Lopic LhaL has earned Lhe CDMA

camp's umbraqe concerns handseL cosLs.

1he CSM communiLy's conLenLion LhaL

CSM handseLs are considerably cheaper

Lhan CDMA handseLs "is paLenLly wronq,"

said KaLhleen O'Connell, manaqer ol over

seas mobiliLy lor LucenL 1echnoloqies'

CDMA producL markeLinq uniL.

YeL lndian CDMA2000 operaLors

Reliance and 1aLa 1eleservices are boLh

on record as sLaLinq LhaL Oualcomm's roy

alLy raLes have kepL CDMA phones lrom

compeLinq pricewise wiLh ulLralowcosL

CSM phones. Vivo, Loo, has ciLed hiqh

CDMA handseL cosLs as a reason lor iL Lo

build a parallel CSM neLwork.

1he CDC counLers LhaL prices lor CDMA

handseLs are compeLiLive. CiLinq Yankee

Croup research, Lhe CDC says CDMA

devices accounLed lor 56 per cenL ol low

end, sub$50 handseL shipmenLs inLo lndia

durinq Lhe lirsL quarLer ol 2006. FurLher

Lhe qroup conLends LhaL considerinq Lhe

enLire mobile device porLlolio ollered in

lndia, Lhe averaqe wholesale price lor

CDMA2000 handseLs was $38 less Lhan

lor CSM handseLs.

1he CDC also ciLed analysis lrom

Siqnals Research Croup LhaL shows Lhe

averaqe price ol enLrylevel CDMA2000

X/LVDO phones will approach $33 by

2009, makinq Lhem a more allordable

alLernaLive Lo enLrylevel WCDMA hand

seLs, which are expecLed Lo be priced

around $88 in 2009.

D

10 mobile communications international//Search our archive at www.telecoms.com

CDG takes on CDMA naysayers

The GSM family of standards dominates the cellular world at the moment. The fight is anything but

over, though, according to the CDMA Development Group.

tammy.parker@informa.com

ANALYSIS

tammy.parker@informa.com

THE CDMA CAMP

HAS CLEARLY

BEEN STUNG BY

HIGH-PROFILE

DEFECTIONS

The more you mix

the more exciting it gets.

www.siemens.com/mn

IMS@vantage

IMS enables access to voice, data or multimedia services in parallel.

Multimedia communication is more than technology, its an experience. Thanks to

IMS@vantage, you can leverage all of the Third-Generation power of your network by

offering your customers easiest access to services. Enjoy the most mature product and

the most standard conform solution: single sign-on, Push and Talk, multimedia conferen-

cing, multiuser chatting. Its all there for the private or business user. And its personali-

zed. With such abundance, they are sure to come back for more. Again and again.

12 mobile communications international//Search our archive at www.telecoms.com

elelonica's UK mobile

operaLion, O2, inLro

duced iLs ownbranded

lce 3C handseL in early

SepLember, markinq

Lurope's lirsL device Lo

use Oualcomm's Brewbased uiOne

inLerlace.

uiOne is an operaLor cusLomisable

user inLerlace, which allows service

providers Lo creaLe dillerenL proliles or

home screens lor Lhe dillerenL services

on Lhe device, such as 1V, qaminq and

music.

Combined wiLh Lhe backend Brew

conLenL delivery plaLlorm, Lhe sysLem

is desiqned Lo laciliLaLe Lhe discovery ol

wireless daLa services. HerberL Vanhove,

vice presidenL ol Oualcomm lnLerneL

Services, Lurope, said, "enrichinq Lhe

cusLomer experience is key Lo encour

aqinq Lhe use ol daLa services and aL

presenL, iL is Lhe ease ol discovery ol

services and conLenL LhaL is Lhe issue."

O2 is planninq Lo roll ouL Lhe uiOne

inLerlace across a number ol iLs O2

branded devices, wiLh Lhe second model

due wiLhin Lhe nexL 2 monLhs. 1he oper

aLor said iL is evenLually aiminq Lo have

2030 per cenL ol iLs cusLomer base on a

Brewenabled device.

Speakinq aL Lhe launch ol Lhe lce

handseL, Phil 1aylor, direcLor ol wireless

inLerneL applicaLions and qlobal wireless

pracLice aL SLraLeqy AnalyLics, said Lhe

mobile markeL has reached a Lippinq

poinL where cusLomers are beqinninq Lo

consume conLenL, buL availabiliLy and

discovery are sLill Lhe key lacLors.

"DaLa services sLill leaLures low on Lhe

usaqe scale," he said, "and only around

Len per cenL ol UK mobile subscribers

are on 3C."

"However, 1elelonica and O2 are

drivinq daLa qrowLh in Lurope, wiLh O2

reporLinq around 30 per cenL ol rev

enues lrom daLa services and 1elelonica

Moviles recordinq around ^2 per cenL ol

revenues lrom daLa. 1his compares Lo

Vodalone's 5 per cenL revenue conLri

buLion lrom daLa services."

SLraLeqy AnalyLics believes LhaL

mobile daLa revenues in WesLern Lurope

are seL Lo Lop $52bn (E27.^bn) by 200.

AlLer considerable success wiLh Lhe

Brew plaLlorm in Lhe CDMA arena

almosL 70 operaLors have so lar siqned

up Lo deploy Brewbased services

Oualcomm has spenL Lhe pasL 8 monLhs

sLeppinq up plans Lo push Brew in Lhe

CSM space, wiLh Lhe inLroducLion ol

deliveryOnea conLenL delivery plaLlorm

desiqned Lo inLroduce Brew, sLreaminq

video, 3D qaminq and Lhe uiOne user

inLerlace.

K_\iniLiaLive was carried ouL Lhrouqh a

cooperaLive markeLinq aqreemenL wiLh

UK mobile conLenL delivery lirm LlaLa Lo

acceleraLe Lhe conLenL delivery sysLem

and provide supporL lor Brew, Java,

OMA, sLreaminq conLenL, rinqLones and

imaqes.

1hen Oualcomm acquired LlaLa lor

$57m in Lhe summer ol 2005, combininq

Brew wiLh LlaLa's own plaLlorm aqnosLic

ollerinq Lo consolidaLe boLh conLenL

services lor all device plaLlorms under

a sinqle service delivery sysLem. 1his

would enable operaLors Lo remain com

miLLed Lo Lheir exisLinq device porLlolio

while evolvinq Lheir line up Lo include

handseLs wiLh new capabiliLies.

ln June ol 2005, when O2 lirsL

announced iLs commiLmenL Lo Brew, Lhe

plaLlorm and inlrasLrucLure aqnosLic

sLrucLure ol Lhe Lechnoloqy allowed

iL Lo doveLail neaLly wiLh O2's plans ol

enhancinq iLs exisLinq conLenL ollerinq

known as O2 AcLive wiLh Japanese oper

aLor N11 DoCoMo's imode Lechnoloqy.

lan Clarke, head ol devices aL O2, said

Lhe decision Lo deploy Brew is based

around brand and individualisaLion, and

beinq able Lo keep LhaL brand and indi

vidualisaLion across Lhe devices sold by

Lhe operaLor. "From a consumer poinL ol

view iL is abouL LhaL consisLency ol expe

rience and LhaL's where we see Brew

uiOne cominq inLo play lor us wiLhin our

own branded device porLlolio."

DespiLe Lhe lacL LhaL iL has been Lech

nically possible Lo run Brew over CSM

lor some Lime now, Lhe CDMA pioneer

has sLruqqled Lo qain accepLance lor iLs

ollerinq in Lurope. Oualcomm iniLiaLed

iLs Brew lor CSM sLraLeqy in laLe 200^

wiLh Lhe $36m acquisiLion ol UK devel

oper 1riqenix, which developed Lhe CSM

user inLerlace lor Brew and had an exisL

inq relaLionship wiLh LlaLa.

AL Oualcomm's Brew Conlerence in

2005, MaLL Hooper, Lhen vice presi

denL ol sLraLeqic alliances aL LlaLa and

now direcLor ol producL manaqemenL

lor Oualcomm lnLerneL Services, said

Lhe deliveryOne plaLlorm would qive

operaLors Lhe abiliLy Lo conLrol exisLinq

daLa services and any new valueadded

services, wiLhouL inLerrupLinq or addinq

inlrasLrucLure Lo Lheir exisLinq sysLem.

"We see operaLors deployinq Brew

alonqside oLher plaLlorms such as Java

lor more llexibiliLy," he said.

BuL one ol Lhe biqqesL obsLacles lor

operaLors deployinq Brew as a plaLlorm

is LhaL Lhey are sLill required Lo deploy

Oualcomm chipseLs Lo use Lhe ollerinq

aL presenL. However, Lhe US vendor has

previously revealed LhaL iL is workinq on

a proqramme Lo licence Brew Lo run on

devices which do noL use Lhe Oualcomm

chipseL.

ANALYSIS

O2 Brew up cool content initiative

Qualcomm has finally realised its vision of deploying its homegrown Binary Runtime Environment for

Wireless (Brew) content delivery system over GSM.

james.middleton@informa.com

T

DESPITE THE FACT

THAT IT HAS BEEN

TECHNICALLY

POSSIBLE TO RUN

BREW OVER GSM

FOR SOME TIME

NOW, THE CDMA

PIONEER HAS

STRUGGLED TO GAIN

ACCEPTANCE FOR

ITS OFFERING IN

EUROPE

World-leading IM and Presence Server

solutions

Delivering certified OMA IMPS and

SIP/IMS support

Enabling new ARPU-increasing services

sales@colibria.com

www.colibria.com

The Colibria Companion IM and Presence Server is a powerful carrier-grade instant messaging and presence

enabler. An established powerhouse, Colibrias platform is providing more and more mobile operators and

strategic partners with a cost-effective, scaleable, and flexible resource to create a growing range of

compelling enhanced messaging services.

> Instant Messaging Server

> Presence Server

> Internet IM Gateway

> Mobile and PC Clients

Partner with the worlds leading developer of mobile IM and Presence

solutions. Accelerate messaging and voice revenue by realising the

potential of Presence.

SEE US ON STAND C16

SPRINT

SHOWS

REV. A

CARDS

US operaLor SprinL NexLel

has announced commercial

availabiliLy ol iLs hiqhspeed

cdma2000 x LVDO Revision

A daLa cards.

CompaLible wiLh lapLops

as well as Lhe soonLobe

available Linksys Wireless

CRouLer, Lhe Merlin S720

card manulacLured by

NovaLel Wireless allows

wireless broadband connec

LiviLy aL averaqe download

and upload speeds ol ^50

850kbps and 300^00kbps

respecLively.

SprinL plans Lo beqin iLs

roll ouL ol LVDO Rev. A dur

inq Lhe lourLh quarLer ol

2006 wiLh coveraqe expecLed

Lo reach more Lhan ^0 mil

lion people by yearend.

1he Merlin S720 will ini

Lially be sold Lhrouqh SprinL

indirecL and business sales

channels and online aL a suq

qesLed reLail price ol $2^9.99

or $99.99 wiLh a Lwoyear

subscriber aqreemenL.

Service plans lor Lhe card

currenLly ranqe lrom $39.99

per monLh lor ^0MB Lo

$79.99 per monLh lor unlim

iLed daLa usaqe.

YAHOO

LAUNCHES

GO FOR

WINDOWS

MOBILE

5earch giant Yahoo has

made its Yahoo Co Ior

Mobile service available

Ior consumers to down

load onto Windows Mobile

phones.

The service is an inte

grated suite oI Yahoo's

leading services including

mail, search and Yahoo

Photos, which allows auto

matic upload oI camera

phone pictures to a Yahoo

Photos account. Yahoo

Address Book and Calendar

is also included.

Marco Boerries, senior

vice president, connected

liIe at Yahoo said: "We are

making it even easier Ior

more consumers to take the

Yahoo experience with them

on their mobile phone."

5cott Horn, general man

ager at MicrosoIt said: "The

availability oI Yahoo Co Ior

Mobile on Windows Mobile

powered phones will allow

our customers to bring their

Iavourite Yahoo services

to the devices they already

rely on."

16 mobile communications international//Search our archive at www.telecoms.com

NEWS

EXPERTS WARN OF CROSS

PLATFORM WORM

Experts at Finnish

antivirus cutfit F-Secure

have enccuntered a

crcss pIatfcrm wcrm

that is capabIe~at Ieast

thecreticaIIy~cf spreadin

frcm a PC tc a mcbiIe

device and back.

The antivirus firm said

that the McbIer wcrm,

aIsc kncwn as Cardtrap, is

capabIe cf mcvin between

Symbian and Windcws

pIatfcrms.

"AIthcuh it's quite

nasty cn the Windcws side,

it dcesn't cause much

harm cn the Symbian

device. !t just ccpies itseIf

tc the memcry card and

tries tc trick the user

intc infectin his PC," the

ccmpany said.

0n the Symbian side

the damae is Iimited

because technicaIIy there

is nc autcmatic spreadin

mechanism aIIcwin McbIer

tc ccpy itseIf frcm cne

pIatfcrm tc ancther. The

maIware simpIy creates

a Symbian instaIIaticn

packae that inserts a

Windcws executabIe cn the

mcbiIe device's memcry

card.

Hcwever, this executabIe

is visibIe as a system

fcIder in Windcws ExpIcrer,

sc it is pcssibIe fcr the

user tc accidentaIIy cpen

the executabIe and infect

their PC whiIe brcwsin

fiIes cn the memcry card.

F-Secure beIieves that

virus writers ccuId use

McbIer as a bIueprint fcr

mcre maIicicus maIware

that is capabIe cf jumpin

between pIatfcrms. But

then aain, previcus crcss

pIatfcrm viruses have thus

far faiIed tc cause any

sinificant damae.

NTL MAY BE TARGET OF 10BN BID

N1L, Lhe cable qianL which

recenLly underwenL a meqa

merqer wiLh 1elewesL and

Virqin Mobile, could now be a

LarqeL iLsell. lL is undersLood

an invesLmenL consorLium

comprisinq Providence LquiLy

ParLners, BlacksLone, Kohlberq

Kravis RoberLs and Cinven has

Labled an oller ol E0bn lor

Lhe lirm.

1he equiLy parLners are

believed Lo have made an

approach Lo N1L lollowinq

Lhe company's disclosure ol

iLs second quarLer resulLs.

AlLhouqh inLeqraLion cosLs

Look Lheir Loll, lorcinq Lhe

company inLo a loss, revenues

lor Lhe quarLer almosL doubled

lrom E^82m a year aqo Lo

E88^m. However, cusLomer

churn liqures

showed LhaL inLen

silyinq compeLi

Lion meanL more

subscribers were

qoinq elsewhere.

1he board ol N1L is

rumoured Lo be relucLanL Lo

sell Lhe company, aL leasL aL

Lhe price ollered and Richard

Branson, Lhe previous owner

ol Virqin Mobile, is

also LhouqhL Lo be

opposed Lo Lhe deal.

Branson acquired

a 0.5 per cenL sLake

in N1L when he sold

Virqin Mobile Lo Lhe qroup

lor E96m earlier Lhis summer

and has Lhe riqhL Lo voLe his

sLock aqainsL any such Lakeo

ver deals.

TELMEX

BUYS INTO

PORTUGAL

Mexican carrier 1elmex has

become a ma|or shareholder

in PorLuqal 1elecom, acquir

inq a 3.^ per cenL sLake in Lhe

company. 1he move Lhrows

a spanner in Lhe works ol

PorLuquese conqlomeraLe

Sonae's E0.7bn (E7.^bn)

hosLile bid lor PorLuqal

1elecom.

1he sLake was acquired via

common sLock and iL is under

sLood Lhe 1elmex involvemenL

was unsoliciLed. lL is noL clear

wheLher 1elmex inLends Lo

increase iLs sLake in Lhe luLure.

PorLuqal 1elecom has been

resisLinq Sonae's Lakeover

aLLempL since March, sayinq

iL "is ol Lhe opinion LhaL Lhe

currenL and luLure value ol

PorLuqal 1elecom is consider

ably hiqher Lhan Lhe oller

price."

ZTE EXPANDS

SRI LANKA

CDMA

NETWORK

Chinese manufacturer

ZTE has stated that it

has been ccntracted tc

expand the CDMA netwcrk

cf Sri Lanka's fcrmer state

cwned carrier, Sri Lanka

TeIeccm.

ZTE has been ccmmis-

sicned tc depIcy an aII !P

cdma2000 netwcrk based

cn what it cIaims is the

wcrId's first ccmmerciaI

intercperabiIity specifi-

caticn (!0S) 5.0-based

system.

The depIcyment cf this

seccnd phase means the

netwcrk wiII be enIared

tc ccver apprcximateIy

300,000 subscribers aII

cver the isIand, whc have

Iimited access tc teIeccms.

17 www.telecoms.com: the first choice for data-led and independent comment//mobile communications international

NEWS

SAMSUNG DEMOS 4G

ln Lhe wake ol Vodalone's

E.35bn exiL lrom Lhe Belqian

markeL, Lhe rumour mill

has been qrindinq away.

SpeculaLion suqqesLs LhaL

Lhe company is lookinq Lo

slim down lurLher, pos

sibly by ollloadinq asseLs

in SwiLzerland, and Lhrows

more luel on Lhe lire ol Lhe

US quesLion.

lL is known LhaL Swisscom

is keen Lo buy back

Vodalone's 25 per cenL sLake

in Lhe Swiss operaLor, a move

which could allow Lhe pair

Lo mainLain a nonlinancial

parLnership.

Dan Bieler, analysL aL

Ovum, commenLed LhaL

such a move would liL wiLh

Vodalone's qreaLer locus on

core markeLs where iL has

operaLional conLrol. However,

Lhe operaLor's posiLion on

iLs ^5 per cenL US holdinq

is less clear, wiLh Lhe com

pany underlininq Lhe lonq

Lerm naLure ol Lhe exisLinq

VodaloneVerizon relaLion

ship. "We sLill Lhink LhaL aL

Lhe riqhL price Vodalone

miqhL exiL Lhe US," Bieler

said.

1he decidinq lacLor lor

Swisscom is likely Lo cenLre

on Lhe qovernmenL's pro

posed paLh lor privaLisaLion.

ln June, Lhe Swiss upper

house ol parliamenL voLed

aqainsL Lhe privaLisaLion ol

Lhe lormer Lelecoms monopo

ly, wiLh Lhe issue noL likely Lo

be reconsidered unLil Lhe nexL

naLional elecLions in 2007.

Swisscom has been aL

loqqerheads wiLh Lhe sLaLe

since lasL year when Lhe

qovernmenL decided iL

would ollload iLs 66. per

cenL holdinq in Swisscom.

1he qovernmenL insLrucLed

iLs represenLaLives on Lhe

board Lo voLe aqainsL pos

sible loreiqn acquisiLions,

insLead encouraqinq Lhe

disLribuLion ol lree capiLal

Lo shareholders. As a resulL

Swisscom is only allowed Lo

make resLricLed acquisiLions

abroad.

1he operaLor has repeaL

edly sLaLed Lhe need lor a

compleLe or parLial disposal

ol Lhe qovernmenL sLake as

Lhe only viable opLion lor

Lhe luLure developmenL ol

Swisscom.

1he rumours lollow

Vodalone decision Lo sell

iLs 25 per cenL sLake in

Belqium's dominanL Lel

ecoms qroup, Proximus, Lo

Belqacom. 1he sale, which

will qo Lowards reducinq

Vodalone's recenL heavy

losses, is worLh E2bn

(E.35bn).

Belqacom is 50 per cenL

owned by Lhe Belqian qov

ernmenL and already owns

75 per cenL ol Proximus.

1he deal will compleLe

Belqacom's ownership ol

Lhe qroup and, accordinq Lo

observers, make iL easier Lo

manaqe and reacL Lo markeL

Lrends.

VODAFONE TO EXIT SWISSCOM NEXT?

Korean kit vendor 5amsung

demonstrated 4C mobile

technology Ior what it

claimed was the Iirst

time in the world, at its

4C Forum on Je|u Island,

Korea.

The vendor claimed data

speeds oI 3.5Cbps using

SXS MIMC(MultiInput

MultiCutput) technology,

as well as standard nomad

ic speeds oI !Cbps.

There was also a dem

onstration oI mobile 4C

taking place in a specially

designed bus, which deliv

ered !00Mbps data trans

mission moving at speeds

oI 60kmph.

5pectrum allocation Ior

4C technology is expected

to be decided on at the

World Padiocommunication

ConIerence (WPC) in

Cctober 2007, while the 4C

mobile communications Ior

mat is expected to become

commercially available

around 20!0.

ERICSSON

SCORES

BIG TICKET

DEALS IN

CHINA

5wedish equipment vendor

Ericsson says it has won

over $550m (29!m) worth

oI C5M contracts with lead

ing Chinese cellco, China

Mobile.

The contracts, which

cover expansion pro|ects

in !7 regions, have been

agreed throughout the Iirst

halI oI the year and deliver

ies are already underway.

Under the contracts,

Ericsson will provide China

Mobile with core and radio

networks as well as deploy

ing its mobile soItswitch

solution. The implementa

tion oI soItswitches will help

IutureprooI the network

through China Mobile's evo

lution to 3C.

China is widely expected

to unveil its 3C licensing

strategy sometime this year,

with China Mobile expected

to receive a licence to roll

out WCDMA in the country.

CHINA

MOBILE

RECORDS

STRONG

FIRST HALF

China's leadinq mobile opera

Lor, China Mobile, announced

Wednesday a 25.5 per cenL

increase in neL proliL lor Lhe

lirsL hall ol 2006 Lo reach

RMB30bn (E.9bn). OperaLinq

revenue lor Lhe six monLh peri

od also increased 9.6 per cenL

year on year lrom RMB^bn Lo

RMB37bn on Lhe back ol sLronq

subscriber qrowLh.

China Mobile's CSM subscrib

er base increased 22.3 per cenL

year on year Lo Lop 27^.7 million

aL Lhe end ol June.

AlLhouqh Lhe Chinese opera

Lor has been Lhe world's biqqesL

cellco by cusLomer numbers lor

some Lime, earlier Lhis monLh iL

unseaLed Vodalone as Lhe mosL

valuable mobile operaLor.

China Mobile, ollicially

lormed on April 20, 2000,

now commands a markeL

value ol around E69.6bn while

Vodalone, ollicially lormed

in 982, dropped behind aL

E6^bn.

18 mobile communications international//Search our archive at www.telecoms.com

NEWS

Norweqian operaLor 1elenor

has awarded Finnish manu

lacLurer Nokia a qlobal lrame

aqreemenL lor iLs cellular

neLworks.

Under Lhe aqreemenL,

Nokia will supply 1elenor wiLh

Nokia Hopper microwave

radios Lo be used lor Lrans

mission lrom boLh base sLa

Lions and lixed applicaLions

when new siLes are deployed,

or an increase in capaciLy is

needed. 1he aqreemenL cov

ers all reqions where 1elenor

and iLs alliliaLed companies

have operaLions.

1he Lechnoloqy, which can

be inLeqraLed inLo exisLinq

CSM and WCDMA 3C neL

works, also meshes wiLh lixed

neLwork operaLions.

Meanwhile, Nokia has

Leamed up wiLh securiLy

vendor Sourcelire Lo puL Lhe

SnorL open source inLrusion

deLecLion sysLem on Nokia's

hiqhend lP kiL.

SnorL is widely reqarded

as Lhe de lacLo sLandard lor

inLrusion prevenLion and

Nokia will oller Lhe Lech

noloqy on iLs lP SecuriLy

PlaLlorms lor LradiLional and

mobile environmenLs, based

on Lhe hardened Nokia lPSO

operaLinq sysLem.

"1hreaLs are becominq

more sophisLicaLed, LarqeLinq

Lhe applicaLion, noL |usL Lhe

neLwork," said 1om Furlonq,

vice presidenL, SecuriLy

and Mobile ConnecLiviLy aL

Nokia. "SolLware such as

Sourcelire's Lo allow enLer

prises Lo add key securiLy ele

menLs as Lhey mobilise Lheir

workers."

Chris ChrisLiansen,

proqram vice presidenL,

SecuriLy ProducLs and

Services, aL indusLry ana

lysL lDC added: "Companies

are adopLinq mobile and

remoLe access Lechnoloqies

in qreaLer numbers Loday,

which leads Lo new secu

riLy concerns LhaL lirewalls

alone simply aren'L enouqh

Lo address. For LhaL reason,

soluLions such as lnLrusion

PrevenLion are becominq

viLally imporLanL lor proLecL

inq company neLworks."

NOKIA WINS NORWEGIAN CONTRACT

lnLerneL qianL

Cooqle has

launched a

lreely acces

sible wili

neLwork in iLs

homeLown ol

MounLain View.

Radios hanq

inq on lamp

posLs LhrouqhouL Lhe ciLy are

now broadcasLinq an 802.b/

q siqnal LhaL is publicly acces

sible by any residenLs, busi

nesses and visiLors wiLhin Lhe

area ol coveraqe.

Cooqle sLaLes Lhe neLwork,

"is a way lor us Lo qive back

Lo and enqaqe wiLh Lhe com

muniLy where our headquar

Lers are," while anoLher qoal

is Lo promoLe alLernaLive

access Lechnoloqies by usinq

MounLain View as an example

lor orqanisaLions considerinq

invesLinq in wili.

"We Lhink successlul mesh

wireless deploymenLs will

promoLe compeLiLion, creaLe

cheaper access alLernaLives,

and (il done correcLly) losLer

open, sLandardscompli

anL plaLlorms lor conLenL

and service

providers Lo

showcase Lheir

applicaLions

wiLhouL Lhe

hassle ol Lhe

LradiLional

walledqarden

approach," Lhe

company said.

While Cooqle has no

plans Lo charqe lor wili

access in MounLain View,

Lhe inLerneL search qroup

has also parLnered wiLh lSP

LarLhlink Lo cover Lhe ciLy

ol San Francisco wiLh a wili

neLwork.

Cooqle and LarLhlink's

|oinL proposal will see Lhe

companies ollerinq a Liered

paymenL sysLem lor inLerneL

access, includinq an LarLhlink

service LhaL will leL payinq

users connecL aL hiqher

speeds Lhan Lhose who con

necL lor Cooqle's lree serv

ice, which will be paid lor by

online adverLisinq.

SpeculaLion is now spread

inq LhaL Cooqle has iLs siqhLs

on creaLinq a wili neLwork Lo

cover Lhe whole ol Lhe US.

GOOGLE LAUNCHES FREE

WI-FI SERVICE AT HOME

Ihe IM8ready ortfoIIo that's aII the rae.

8eady to mIx It 07

If you want to deliver any service over any network to any device, it`s time to get the

party rolling. The Telcordia

Maestro

IMS Portfolio makes the promise of IMS

become a workable, cost-effective reality. Now, you can create, deliver, and charge for

new services more smoothly and quickly than ever before. Get ready to rock.

2006 Toloordia Toonnologios, no. All rignts rosorvod.

W W W T E L C O R D I A C O M M A E S T R O

MS Por t fol i o

20 mobile communications international//Search our archive at www.telecoms.com

NEWS

French mobile operaLor

Oranqe says iL has approved

Lhe Access Linux PlaLlorm

(ALP) lor use on iLs neLwork.

1he operaLor will use Lhe

Linux ollerinq, developed by

Japanese lirm Access, in con

|uncLion wiLh iLs own Oranqe

ApplicaLion Packaqe Lo equip

device manulacLures wiLh a

Lurnkey mobile Linux plaLlorm.

Oranqe anLicipaLes Lhe Linux

plaLlorm can Lhen be used Lo

develop new addiLions eas

ily and quickly Lo iLs ranqe ol

Oranqe SiqnaLure Devices.

Yves MaiLre, vice presidenL

ol devices aL Oranqe, said:

"1his is parL ol our wider

SiqnaLure sLraLeqy, which

delivers a consisLenL cusLomer

experience across a varieLy ol

devices and applicaLions and.

will enable us Lo losLer Lhe

qrowLh ol Lhe mobile Linux

markeL."

lndeed, Lhe announcemenL

may be Lhe lirsL mainsLream

implemenLaLion ol Linux by a

ma|or operaLor, as well as qood

news lor Access.

Michael Carroll, ol lnlorma

1elcoms & Media's Mobile

HandseL AnalysL said, "lL's

probably Lhe lirsL widespread

deploymenL ol Lhe new plaL

lorm, so iL will prove an inLer

esLinq LesL bed lor Lhe popular

iLy ol Lhe OS amonq users, noL

|usL solLware developers.

"Oranqe was one ol Lhe lirsL

carriers Lo adopL MicrosolL's

Windows Mobile solLware,

which helped Lhe solLware

qianL achieve a deqree ol cred

ibiliLy in Lhe mobile markeL LhaL

is now payinq oll in Lerms ol

increased deploymenLs. Access

will surely be hopinq lor Lhe

same."

Linux has been qaininq

some LracLion in Lhe markeL

recenLly. ln June, a consorLium

comprisinq MoLorola, NLC, N11

DoCoMo, Panasonic Mobile

CommunicaLions, Samsunq

LlecLronics and Lhe Vodalone

Croup esLablished a qlobal

open Linuxbased handseL

solLware plaLlorm locused

on lower developmenL cosLs,

increased llexibiliLy and a

"richer mobile ecosysLem".

Meanwhile, Access and

iLs wholly owned subsidiary,

PalmSource, also launched

Lhe Access Developer NeLwork

Monday, an online resource

desiqned Lo acceleraLe Lhe

creaLion, disLribuLion and

usaqe ol mobile Linux applica

Lions as well as Lo exLend Lhe

exisLinq PalmSource developer

communiLy.

PalmSource has inLended

lor some Lime Lo replace

Lhe proprieLary kernel in iLs

CobalL 6. handseL operaLinq

sysLem wiLh Linux. 1he com

pany believes LhaL wiLh mobile

operaLors demandinq more

opporLuniLies Lo cusLomise

handseLs, Lhe move Lo Linux is

noL only speedinq up Lhe Lime

Lo markeL ol Palm devices buL

also appeasinq cusLomers by

ollerinq a sLandardsbased

open source plaLlorm.

ORANGE BACKS LINUX ON THE MOBILE

Disney is reporLed Lo have

lrozen launch plans lor iLs UK

mobile virLual neLwork opera

Lor (MVNO) alLer a weak sLarL

lrom iLs US operaLion and

increasinq concerns in Lhe UK

markeL.

Disney, alonq wiLh a

number ol oLher MVNOs

such as Amp'd Mobile and

LarLhlink's Helio, made much

hyped launches earlier Lhis

year in Lhe US buL are larqely

sLruqqlinq Lo reach Lheir Lar

qeL cusLomer numbers.

ln May, Bob lqer, presidenL

and chiel execuLive ol Disney,

commenLed LhaL Lhe iniLial

resulLs lor Lhe LSPN back

MVNO venLure in Lhe US

"were a liLLle biL lower Lhan

we had hoped" causinq Lhe

company Lo chanqe iLs pricinq

approach.

NoL much was said on

Lhe proposed launch ol Lhe

UK operaLion when Disney

announced iLs laLesL liqures

lasL week buL Lhe compa

ny, which has already qoL

1elelonica's O2 siqned up

as a neLwork parLner, said

only LhaL iL "will keep one

eye on Lhe landscape"

over Lhe launch Lhe UK

service.

ConsolidaLion amonqsL

reLailers in Lhe UK has

increased compeLiLion lor

Lhe company in Lhe MVNO

markeL.

DISNEY TO SCRAP UK

MOBILE PLANS?

TISCALI SEEKING MOBILE

PARTNER IN THE UK?

JusL one day alLer buyinq iLsell

a Lriple play service, lLalian lSP

1iscali is LhouqhL Lo be eyeinq

Lhe mobile markeL.

Rumours abound LhaL

1iscali UK is holdinq meeLinqs

wiLh mobile operaLors 3 UK,

O2, 1Mobile and Vodalone

wiLh a view Lo leasinq capaciLy

on Lheir neLworks.

Mary 1urner, Lhe chiel exec

uLive ol 1iscali UK, previously

conlirmed Lo MCl's sisLer pub

licaLion aL lnlorma 1elecoms &

Media, 1elecom MarkeLs, LhaL

mobile services were on Lhe

radar in boLh Lhe UK and lLaly.

ll a Lwo way deal could be

sLruck, Vodalone may be a

liLLinq parLner as iL is seekinq

a broadband parLner |usL as

1iscali is on Lhe markeL lor a

mobile plaLlorm. Vodalone

chiel execuLive Arun Sarin

commenLed in May LhaL Lhe

operaLor plans Lo exLend iLs

ollerinqs in Lhe home and

ollice Lo include Lhe provision

inq ol DSL services.

1iscali conlirmed plans Lo

merqe iLs UK operaLions wiLh

Video NeLworks, owner ol

1V, broadband and Lelephony

player HomeChoice.

I

P Multimedia Subsystem (IMS)

is being widely accepted in the

industry as an ideal network &

service converge architecture

to replace the legacy PSTN

(Public Switched Telephone Network)

and build the future All-IP network.

As a leading global vendor of

telecommunication system solutions

including IMS, ZTE believes the IMS

will effectively change the telecom

landscape, enabling service providers

to quickly and easily offer new

multimedia services to end-users

using eilher hxed or mobile syslem.

At its most basic, IMS involves

telecommunications carriers moving

away from legacy technologies such

as ATM, Frame Relay, PSTN and over

to Internet Protocol (IP) systems.

The move to an IP infrastructure

means that the carrier can move a

vide variely of dala lrafhc across ils

network, generat-ing economies of

scale, and therefore savings, in both

capital and ongoing costs.

IMS nol only reduces lhe Iex, bul

also enhances the service models.

By building a walled garden in the

IP network, IMS enables carriers to

resist the threats of low-cost Internet

tele-phony services from the likes of

Skype and Vonage.

Featured by fast creation of services,

IMS can quickly help carriers develop

new services, and also enable

the newly developed services to

harmoniously work together with

other vendors telecom services

on their own service platforms.

Everybody knows that there is still

no universal application technol-

ogy available in the industry as yet.

However, a service platform based

on IMS throws light on such a killer

application of technology as it can

quickly offer right services at right

time to help operators create revenue

from a dynamic telecom market.

For telecoms users, the move by

carriers to an IMS-based architecture

will allow the introduction of

exciling nev lelecoms services such

as multime-dia services, converged

services through both wireless devices

and desklo hxed-line conneclions.

In this case, the differences between

wireline and wireless services are

blurred, as the core network for both

services will be the same. In other

words, users can always enjoy the

services anywhere anytime using

different access devices, no matter

whether they are on the move or at

home or in lhe ofhce.

Nevertheless, the initial costs of IMS

solutions on the market to date still

keep high. Whats more, multiple

applications and the like can only be

available as proprietary solutions.

Consequently, some operators still

hesitate to make commitment to IMS.

However, with IMS-related standards

getting more and more mature and

cosl-efhcienl IMS roducls markeled

to the industry, the IMS systems

are increas-ingly improved with

capabilities and performance. As

a result, the introduc-tion cost of

IMS technology is going down and

the deployment of IMS has become

a reality. The IMS technology is

updating the outlook of quite a many

operators at the moment.

Integration of xed Iine and ceIIuIar

services

In essence, IMS allows the carrier to

develop a common core network with

the delivery end of the connection

hxed or vireless being decided by

customer demand.

The last mile of the traditional

telecoms circuit, which the incumbent

lelcos have guarded so hercely,

effectively becomes open market,

as carriers and their customers can

elecl lo use hxed line (coer air1

broadband or hbre olic), WiIi or

cellular as their delivery mechanism

of choice. IMS provides seamless

access to any services, freeing up the

application layers from the network

layers and providing strong QoS.

One of the main reasons for

implementing IMS is to enable

smart charging of multimedia

sessions. Operators have a broad

range of charging options from a

micro approach charging for each

individual use of each available

product, to a macro approach

charging a single rate for access to all

services, and a number of approaches

in between.

From a customers perspective,

IMS opens up the possibility of

a whole new vista of advanced

telecommunications services

becoming available across both

hxed and vireless conneclions, al

exlremely comelilive ricing levels.

These advanced services could reach

critical mass in the marketplace

within a relatively short period of

time.

Win-win for carriers and teIcos

The adoption of IMS is a potential

win-win scenario for carriers and

telecoms users alike. The only

potential losers are telcos that fail

to evolve their networks with IMS

to take advantage of this brave new

telecoms world.

ZTE is developing a range of IMS

offerings for telecoms carriers,

building on the success that the

company has enjoyed with its

Softswitch technology, which will be

used as the baseline architecture for

IMS.

For the networks, IMS levels the

laying held belveen lhe incumbenl

telcos, the cable companies, and the

IP Multimedia Subsystems-updating

www.zte.com.cn

unbundled independent operators.

It also improves the ballgame for the

cellcos and WiFi service providers by

allowing carriers to bridge the gap

belveen hxed and mobile services

with the same series of applications.

IMS also represents a win-win

situation for the carriers customers,

giving them access to a wide range of

new services, such as IP-TV and VoIP,

without the carrier having to cost-

justify each service on its own. Also,

if a carrier offers a given service on its

hxed access nelvork, lhere are very

few reasons why that same service

cannot also be offered on the carriers

wireless access network.

ZTE is moving swiftly forward to

become a key player in the IMS

market, assisting carriers of all sizes

in their quest to offer advanced

telecommunica-tions services to

an increasingly multimedia-aware

business audience.

ZTE predicts a rapid evolution of

Iixed-lo-Mobile Convergence (IMC)

lechnologies in lhe nexl fev years.

This evolution trend, which will

depend in part on IMS, motivated

ZTE to heavily invest in IMS R&D.

The company has more than 1000

employees working on IMS develop-

ment and implementation now, taken

from our wireless, data, network and

handset divisions.

ZTL execls lhe hrsl IMS syslems

and compliant equipment to reach

the market some time during 2007,

but most carriers are already busy

developing the technology and skills

required to implement IMS on their

networks.

Research from ABI (www.

abiresearch.com) claims that, by 2010,

there will be an annual global capital

exendilure of US$ 6 billion on IMS

technology.

$100 biIIion additionaI

revenue by 2010

y 2O1O, lhe research hrm says,

carriers worldwide will be serving

350 million business and consumer

subscrib-ers using IMS-based

services, generaling US$1OO billion in

revenues. Even though this revenue

level is only 10 per cent of the world

s predicted telecoms revenues in

2010, it is all new revenue, over and

above income from traditional voice

services.

ZTEs strategic partnership with

national operators in China places

the company at the forefront of

IMS developments worldwide. In

February and March this year, a

well-known operator from China

tested ZTEs V3 platform based IMS

equipment includ-ing Call Session

and Breakout Gateway control

funclions (CSCI1I-CSCI1S-CSCI1

BGCF), IMS access equipment (SBC),

IMS terminals, IMS service platform

equimenl (IM-SSI1SII AS), IMS

billing system, IMS network gateway

equipment, and IMS interoperation

equimenl (MGCI1IM-MGW).

ZTEs IMS system passed all test

cases and scored highly on all key

test criteria. ZTE also believes that

its IMS system is easy to implement

and manage, which helped the test

engineers to quickly become familiar

vilh lhe syslem and execule lhe lesl

cases in a professional way.

ZTEs IMS Strength

ZTE does not anticipate any

interoperability issues with the

intro-duction of IMS to the telecoms

world, mainly because of our years

of lelecom exerlise and exeriences.

Our IMS technology allows for easy

interfacing with third-party systems,

including legacy hardware from

other suppliers. ZTE IMS system

complies with 3GPP, 3GPP2 and

TISIAN1ITU-T IMS slandards, vhich

makes it completely suitable for

various access networks. To protect

lhe exisling inveslmenl and make

best use of legacy resources, ZTE IMS

system interworks with mobile circuit

switching domains, PSTN and H323

networks.

ZTEs end-to-end IMS solution

consists of various terminals,

including the IMS soft client and

handsets, SIP phone and IAD. To

exand lhe sub-scriber caacily, ZTL

IMS system also supports legacy

POTS phone and legacy SIP terminals.

ZTE IMS solution provides

multimedia services for both

individuals and enterprises. For

examle, ZTL IMS syslem suorls

instant messaging, Presence, IP

Cenlrex, Mullimedia caller ID, Mulli

media ring back tone, etc. ZTE

s integrated IMS client and service

system SoftDA (Software Digital

Assistance) has been deployed by

China Mobile as their IMS client.

ZTEs IMS system is built on ZTEs

unihed hardvare lalform including

V3 platform. All of ZTE s leading IMS

products are based on this platform

including the CSCF, MGW, HSS and

Media server, etc., which allows easy

upgrade and maintenance.

Meanwhile, ZTE can customize IMS

solutions for individual carriers

secihc requiremenls, ensuring lhal

the end IMS solution delivers all the

benehls lhal lhe carrier is looking

for, both for the carrier and for its

customers.

the telecoms outlook

ZTE UK ofce:

Tel:44(0)20 8349 8058

Iax:44(O)2O 8349 8O48

haL is Millicom's currenL

merqer sLraLeqy? 1he

markeLs are inLriqued.

Havinq diLhered over iLs

own possible sale Lo a

ma|or operaLorLhouqhL

Lo be a dead cerL lor China Mobile unLil

Lhe deal collapsed aL Lhe lasL minuLe in

JulyiL has launched iLs own an acquisi

Lion lrenzy.

1he laLesL purchase, ol Colombia's

Lhird larqesL operaLor, Colombia Movil,

which carries Lhe brand Ola, is a poLen

Lially excellenL deal, despiLe Lhe lacL

LhaL Ola is aL Lhe momenL a consisLenLly

lossmakinq company.

For one Lhinq, Millicom qoL Ola aL

Lhe qovernmenL's minimum aucLion

price alLer lrishowned panCaribbean

operaLor Diqicel pulled ouL, leavinq iL

Lhe sole bidder. 1he qeneral lack ol

inLeresL in Lhis qovernmenL aucLion ol

Lhe operaLor has kepL Lhe biddinq price

low (Chilean mobile operaLor LnLel PCS

oriqinally showed inLeresL buL opLed ouL

ol Lhe biddinq).

BuL could Lhe deal Lo buy Lhe

Colombian operaLor oller poLenLial lor

rapid luLure qrowLh?

Millicom could cerLainly do wiLh a

biL ol cheer. 1he markeLs punished Lhe

operaLor badly when iL ended Lalks

wiLh unsoliciLed bidders LhaL could

have seen iL snapped up lor an inllaLed

price, mosL probably by China Mobile

alLer lnvesLcom dropped ouL. As usual,

once Lakeover speculaLion was priced

in, Lhe rebuLLal ol suiLors brouqhL pain.

Millicom's shares Look a 3 per cenL hiL

on news LhaL Lakeover Lalks had closed

wiLh no deal, buL Lhe operaLor held

iLs qround, poinLinq ouL LhaL "a com

binaLion ol condiLion, price and Lime"

made Lhe deal unaLLracLive and hinLinq

sLronqly LhaL, lor Lhe near luLure aL

leasL, Lalks were over.

1he lacL LhaL shareholders Lhrew a

LanLrum over Millicom's unwillinqness

Lo seal a deal is no real concern lor Lhe

operaLor. LrraLic share prices aside,

Millicom has powered ahead in Lhe lun

damenLals, where iL really counLs.

ln iLs second quarLer resulLs, iL posL

ed a 28 per cenL rise in underlyinq prol

iL lor Lhe second quarLer and laid ouL

ambiLious plans Lo massively increase

invesLmenL in new neLwork buildouL.

Core proliLs (earninqs belore inLer

esL, Lax, depreciaLion and amorLisaLion,

or LBl1DA) wenL up Lo $57m, lrom

$^2m in Lhe lirsL quarLer and $22m in

Lhe same period ol 2005. ReuLers news

analysLs had predicLed $^9m LBl1DA

lor Lhe second quarLer, so Millicom

exceeded expecLaLions. Second quarLer

revenues also lared well, risinq 39 per

cenL Lo $362m.

8e[Lhe luLure looks briqhL. 1he

company, which is ma|oriLy owned by

Swedish Lelecoms and media qroup

Kinnevik, now has over Len million

subscribers in 6 counLries LhrouqhouL

LaLin America, Alrica and Asia in mar

keLs many ol which have relaLively low

peneLraLion and hiqh markeL qrowLh

poLenLial.

Ol Lhese, iL is LaLin America LhaL

Millicom Lhinks holds Lhe mosL prom

ise. Chiel LxecuLive Marc Beuls made

iL clear in a recenL speech LhaL Lhe

primary drivers ol Millicom's earninqs

qrowLh have been in LaLAm counLries.

For insLance, revenues have increased

78 per cenL and 52 per cenL in CenLral

and SouLh America, respecLively.

lL was no doubL wiLh Lhis in mind LhaL

Lhe operaLor made iLs bid lor a conLrol

linq 50 per cenL plus one share sLake ol

Ola lor $^78m. WhaL is Lhe loqic ol Lhis