Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

21 Step To Investment Maturity

Caricato da

randzimmTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

21 Step To Investment Maturity

Caricato da

randzimmCopyright:

Formati disponibili

21 STEPS TO INVESTMENT MATURITY

The definitive white paper on Investing, the Hows, Wheres, Whens, Whats, Whos, everything you need to know and More

Investments are critical to the lifestyles and wellbeing of most of us, yet too often we are content to put ourselves at the mercy of others when investing money we have spent many years accumulating. One of the reasons for this is that the financial services industry has been riddled with confusion, and with such a vast array of investment products that frequently are sold indiscriminately by unscrupulous advisor. So to try and eliminate some of the confusion we have researched the options out there and have put together a series of easy to follow steps to help you make the right decisions for you!!! Lets look at these steps in brief that you can take to ensure success in the investment world 1. Getting ready for the Marathon 2. Good Advice 3. KIL Your Debt 4. What type of Return?? Capital, Income, Both?? 5. Select an asset class 6. Understand the risks 7. Know your risk profile 8. Diversify your investments 9. Understand market sectors 10. Find your investment style 11. Consider liquidity 12. Consider guarantees 13. Consider costs 14. Consider tax 15. Choose your investment product 16. Choose a product provider 17. Measure the results 18. Rebalance your portfolio 19. Revisit your investment strategy 20. Reinvest mature investments 21. Start all over again So with that brief overview lets go into details and explore each step .

Step 1 - Getting Ready for The Marathon.

Understand that investing is akin to running a marathon. This is not a sprint to see who can get there first. If you want success, you must plan carefully for the full distance, understand where & what you want, and get there in good condition. There is no such thing as a get-rich-quick investment scheme in which you start investing at the age of 50 and retire financially secure within 10 years. The sooner you start the better your chances of being able to retire Financially Free. Investments protect your savings against

inflation; provide a return and some protection for your capital. The preparation also includes getting in to the right mindset Getting your mind right is probably half the struggle. You need to make the decision not only to start out on a secure investment path, but also to do it within the framework of a well-considered structure. Get your mind right by: Setting well formed outcomes for your investments; Deciding how you will achieve your goals; Taking a reality check on your current financial situation and establishing whether your goals are realistic and reachable with your current resources; Modifying your goals when necessary; and Taking action. The clich is that it starts with a plan. It really starts with the first payment towards a savings plan. Remember that this does not mean that you should be killing yourself to make the payments, take small but significant action! A sound investment plan must be drawn up within your greater financial plan. The best approach is to do a financial needs-analysis regularly, with the assistance of a financial adviser.

Step 2 - Good Advise

People who fall prey to scams such as Masterbond often do so because they've had poor advice. Those who get it right do so because they have received sound advice or have followed simple logic in their decision making process. Advice is available on many different levels and different kinds of investments call for different kinds of advisers. Remember Logic dictates!!!!! If it does not make logic sense to you it might not work for you!!! First of all, you must distinguish between the different types of intermediaries, including life assurance agents, life assurance brokers, certified financial planners, and investment managers. In the past, many intermediaries tended to regard themselves as one-stop financial centers, offering advice, particularly on investments, without the necessary expertise. Find the advisor that understands you and your needs!! There are advisers, and advisers Before you place your business with an agent or an adviser, find out what type of intermediary you are dealing with, because this will determine what the adviser is qualified to sell you and what service you can expect him or her to deliver. You make informed decisions about other things in life so why not make them with investments?

A company agent - A company agent is only licensed to sell the products of a particular company. It is unlikely that he or she will be able to give you broad investment advice other than the products that they sell, except maybe at the most basic level of recommending products that invest across most types of financial assets (for example, a life assurance balanced policy or a managed flexible unit trust fund). Such an agent should be able to do a financial needs-analysis which will help you identify your investment goals. A general agent - This is an agent who is employed by one company but is allowed to sell the products of other companies (from a specified list of course!). General agents are normally quite highly skilled and are able to offer a wide range of products to meet your needs. A general agent will be able to do a financial needs-analysis, and will most likely base investment advice on your risk profile. Once again please make sure that you apply your experience to the process, the more general the advice is the more its like trying to play sniper with a shotgun. An independent financial adviser - These are advisers who are not tied to any particular company and should be able to give you advice on a wide range of products. However, their level of expertise can range from poor to excellent. You need to be sure the person is skilled. The top qualifications in the field are certified financial planner (CFP) and certified financial analyst (CFA). If you are unsure ask for the certifications and get proof on paper. A CFP will help you with your financial planning but will not necessarily be an expert in investment, although they are well acquainted with the issues and will be able to steer most people in the right direction. A CFA focuses entirely on investments and is only really needed by someone with very complex investment requirements. A CFA will not help you with your broader financial planning. A stockbroker - You can get different levels of service from a stockbroker, from basic execution of your investment orders through to on-going advice, or even full discretion over your portfolio. You must be careful when giving full discretion as some stockbrokers have a reputation for buying and selling shares unnecessarily to generate more fees. Buying and selling pushes up your costs and creates potential income tax and capital gains tax hazards. Adviser network - Increasingly, financial advisers are joining what are called adviser networks, which provide back-up expertise in such areas as investment and tax. Specialist investment portfolio companies, such as a private bank - These companies/banks provide much the same service as a stockbroker. In recent years there have been a number of new entrants who have been involved in dubious activities, including taking good investments and switching them into investments in (often unlisted) shares in their own companies. Remember one thing that all the above advisors dont always have your best interest at heart. Now I am not saying that they all are like this, there are those out there that really

have your financial well being at heart and will not steer you in the wrong direction. However there are some out there that are just in the business for their own benefit and they would sell you what you want to here and provide product that feed their own pocket before yours, so be mindful of those out there. If something smells fishy it probably is

Step 3 - KILL your Debt

Managing debt is an important part of any investment strategy. Debt can be a killer, particularly at times of interest rate volatility. Currently we are in a good place with regards to the Interest rate but be careful not to increase your debt to much because of the surplus cash you might have now. Rather reduce the current debt you have now with the surplus cash!!! If interest rates go up while you have a high level of debt, it will affect your investments in at least two ways: You will have to pay out more in interest from your monthly budget, so you will have to cut down in other areas. The big temptation will be to reduce retirement savings WRONG!!!; and You may be tempted to cash in savings if your debt becomes "unaffordable". If market values are low at the time, you will lose even more.

Very often our investment are the first to go when times are hard this is a wrong strategy to follow unless it is absolutely positively the only and I mean the only way of solving the problem!!! Be aware of these pitfalls so you dont end up cutting off your nose to spite your face, once again balance and logic must come into the thought process when you are dealing with debt reduction.

Step 4 - What type of Return?? Capital, Income, Both??

Understanding the difference between income growth and capital growth on your investments is critical to your planning, because you use different investment asset classes to achieve them. Most people invest to create a lump sum of money for future use (capital growth) or they invest a lump sum to generate an income. Different combinations of investments are used to achieve different targets. There are three basic ways to earn money on your investments: 1. Interest: (Income) - This is money that is paid to you for money you have invested. In other words, a person or an institution is paying you for the use of your money.

2. Dividends: (Income) - This is the share of profit that is paid to owners (shareholders) of a company. 3. Capital growth: (Capital Growth) - This is the profit you make when you sell something for more than you paid for it. These three ways of earning money come from two distinct groups of investments. These are: Lending investments. You invest by lending money - to the bank through an interest-earning savings account, or, for example, to the government when you buy a government bond; and Ownership investments. These include property (providing capital growth and rent) or shares in companies (providing capital growth and dividends). If you require an income, you use mainly lending investments, while capital growth comes mainly from ownership investments My personal strategy is to accumulate investments that provide a combination of these factors with varying priorities so that I have all bases covered, your strategy might differ no matter what you do make sure that it fits your lifestyle and will provide for that lifestyle when the time comes to cash in the chips

Step 5 - Type of Asset Class

All lending and ownership investments are based on what are called asset classes. In turn, asset classes are divided into hard assets and financial assets. HARD ASSETS - Hard assets are investments in exotics such as art, stamps, carpets, diamonds, gold coins, and shipping containers. Hard asset investments can be highly speculative and are not normally recommended by good financial advisers. If you wish to invest in hard assets, you must understand everything about the type of investment you select, from purchase and resale prices to the factors that effect quality and the re-selling of the asset. Often these assets are long term investments and resale is often an even longer so be careful. FINANCIAL ASSETS There are four main financial asset classes: cash, bonds, shares, and derivatives. Property can be both a hard asset and a financial asset, depending how you invest in the asset. Each asset class carries a different level of risk that you may lose your capital. 1. Cash investments. Cash is purely an interest-earning investment and provides no capital growth. Cash investments include: Term deposits: These are also called fixed deposits. You lend your money to a bank for a fixed period of time at a fixed interest rate - say six months or two years - after which the bank returns your money to you with interest. 6

Money markets: These are investments either in a bank account or a unit trust fund (offered by unit trust companies, mainly) in which your money is pooled with that of other small investors and lent to big institutions. This way you get a higher interest rate. Notional certificates of deposit: These are fairly substantial amounts of money lent to large institutions such as banks and big businesses. The three big attractions of cash investments are:

* Your capital is usually guaranteed; * Your rate of interest is often guaranteed; * You can get access to your money fairly quickly, particularly if it is in a money market account. The main disadvantage of cash investments is that they seldom keep up with inflation, particularly after tax is taken into account. 2. Bond investments. Do not muddle bond investments with your mortgage bond (home loan). Bonds (also known as gilts) are simply a way of lending money to a big institution, such as a government, local authority or a parastatal (Telkom or Eskom). Bonds are certificates that are issued when a big institution or a major company needs to borrow money. They borrow your money and pay you interest. Bonds are an interest-earning and a capital growth investment, since their underlying value can increase. (Both INCOME and CAPITAL GROWTH) Most bonds have what is called a coupon. The coupon states that you will be paid interest at a fixed rate, normally every six months. After bonds are issued, investors buy and sell them on what is called the secondary market. The price depends on where investors see interest rates in the future. Bonds are strange things, in that when interest rates are high no one wants to invest in them. The reason for this is that governments and other borrowers have to offer high interest rates to attract investors to lend them money. In terms of the secondary market, this means a bond that was issued at a low interest rate a few years previously, can be bought at a discount when interest rates go up (for example, the face value of the bond may be R1 million but you buy it for R980 000) because investors can get a better deal by owning the new bonds at the higher interest rate. In other words, when interest rates are high, bonds are sold at a discount to their original value because investors want to get a better and safer return elsewhere. Interest rates are pushed lower when a lot of investors want to buy bonds. When interest rates start dropping, the price of the bond starts going up because investors want to lend money to the institution. By selling when interest rates are dropping, you can make a capital profit.

So you can make money from interest as well as from an increase in the value of the bonds. If you buy a bond cheaply and sell it when it is expensive, you will make what is called a capital gain. In other words, your original investment (your capital) becomes worth more. If you invest in bonds when they are expensive and sell when they become cheap, you will suffer a capital loss. The bond market is very complex and bond traders spend many years getting experience in dealing in bonds. Very few individuals invest directly in bonds because of the significant amounts of money required. Bonds are used extensively as the underlying investments in annuities (pension payment investments). 3. Shares (equities). Shares in companies are both income-earning (dividends) and capital growth investments (their underlying value can increase). When you buy a share you are buying part of, or a share in, a company. You become a part owner. As a part owner you expect to get part of the profits. If a company has 10 shares and you buy one share, you can expect to get one-tenth of the profits. When profits are paid out to shareholders (people who own shares) the payment is called a dividend. Companies sell shares for a number of reasons, including to expand or buy new machinery or to buy another company. Once they have sold the shares to investors, the investors can also buy and sell shares on a secondary market, such as the JSE Securities Exchange. There are a number of reasons why you as a shareholder may not wish to hold onto the shares you own: you may need the money for something else; you may not like the way the company is being managed and feel that profits may drop; or the company's business may have fallen behind the times (for example, it may still be making widgets, which no one wants to buy, instead of whatits). The buying and selling prices of shares are influenced by supply and demand, which in turn is influenced by sentiment. The price of a share will go up or down depending on what investors think about the future profits of the company. If they think a company is going to make great profits, a lot of investors will want to buy the share, so the price will go up. Investors are notorious for buying shares when prices are high and selling them in a panic when the prices drop. So, as with bonds, you can also make a capital gain (if you buy the share when it is cheap and sell it when it goes up in price), but, again, you can make a capital loss when shares drop in value. You can buy shares both in companies listed on a stock exchange and in companies that are not listed. It is better to buy shares in listed companies because in order to be listed, these companies have to abide by certain regulations, and this gives you greater security.

It is also best to buy and hold shares in companies with sound track records, if you are looking to make a return from the dividend payments while maintaining long-term underlying value. 4. Derivatives. Derivatives are considered to be a new asset class even though they are not a tangible asset. A major advantage of derivative investments is that you can make money from them when the more traditional markets are moving sideways or down. In other words, you can make profits from derivative investments in both climbing as well as declining markets. Derivatives are mainly in capital growth investments. A derivative's value is derived from another asset, such as property, bonds, or shares. Most derivatives are based on what you expect the price of an asset to be at a date in the future - whether higher or lower. You invest by taking a bet on what you expect that price to be. There are many different forms of derivatives, but the best known are futures, options and warrants. Hedge funds, which deal mainly in derivatives, are becoming increasingly popular as alternative investment strategies. Hedge funds also come in many different forms. Derivative markets are very complex and call for a high level of investor sophistication. Large amounts of money may be made in derivative markets, but it is also possible to lose a fortune, and many people have done so. 5. Property investments Property is both an interest-earning and a capital growth investment (its underlying value can increase). A property investment can be a lot more than the purchase of your own home. There are plenty of different types of property investments, including: Residential property. You know the buy to rent model; Commercial or industrial property. Again, you own it and a business pays you rental; Property syndications. These are investments where you join up with a number of other buyers to purchase a commercial or industrial property. These investments have proved to be high risk but yet still provided high returns. The risk factor is due to the abilities of the syndicator in managing the property; Mortgage participation bonds. You lend money to someone else to buy property. A financial services company seeks out people needing money to buy property and investors to lend the money to them. The theory is that the borrower pays less interest than on a normal bond and the investor receives a higher-thannormal interest rate; Property unit trusts. These are not normal unit trust funds, but investments listed on the stock exchange. As with a unit trust fund, you can invest smaller amounts of money in companies that specialize in investing in property. Like unit trusts, too, property unit trusts are highly regulated. This type of investment allows you to use it as a saving plan, making small investments monthly; Property loan stocks. You invest in a company with a portfolio of properties listed on the JSE Securities Exchange. Unlike property unit trusts, property loan 9

stocks can borrow money to buy properties and do not require a management company; Normal unit trust funds that invest in property companies; and Life assurance endowments where the underlying investments are in property.

The pros of investing in property are: Property can provide an income stream (rent) that usually keeps ahead of inflation; You can get capital growth, too, if you buy in the right area.

The cons of investing in property are: You can get it wrong by buying in the wrong area. You need to be extremely careful with property investments, as buying in the wrong area can mean significant losses; You stand the risk of buying a building with design or other problems; The absence of a tenant can put your income stream at risk; To invest in property, you usually need fairly large amounts of money; The costs of buying and selling property are high when you take into account taxes, commissions and legal fees; Your money is difficult to access if you need it in a hurry (you have to find a buyer), although you may be able to borrow against the property investment.

So looking at the cons of property investment why are so many people making money out of it??? - RESEARCH RESEARCH RESEARCH!!!!!!!!!!!!!!!!!!!!!

Step 6 - Understand the risks in your Investment

Investment risk refers to your chances of losing all or part of your money. There are many different types of risk in investing, some greater than others. When investing, take into account the following types of risk: Systemic risk. The potential of a system, such as the banking system, collapsing; Prudential risk. The risk of an asset manager (someone who manages investments) making the wrong decisions; Advice risk. The risk of getting the wrong product advice; Market risk. The risk of a particular market failure (for example, the South African share market collapsing); Market sector risk. A sector of an investment market (for example, the banking sector) falling while another (for example, the mining sector) gains; Volatility risk. This refers to fluctuation in the value of an investment. If the value of the investment is down when you want to sell the investment, you will

10

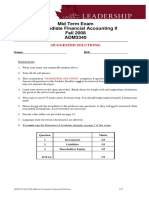

lose money. The share market is far more volatile than the bond market, but at the same time, historically, it has provided better returns over the long term; and Dishonesty. This continues to be a huge risk, particularly with foreign investment markets opening up to South Africans. Many scam artists operate in the financial services industry and you need to be on your guard at all times. We have all heard about the Nigerian Scams The best defence is to deal only with companies that are registered to do business in South Africa and have a sound track record. Generally, the higher the potential income or capital growth, the higher the risk associated with a particular product. The different asset classes have different levels of risk, which are summarized as low, medium or high risk, as follows:

Asset Class Cash Property Bonds (gilts) Shares (equities) Derivatives

Example Savings or deposit accounts Houses, shops and factories Loans to institutions Part ownership of companies Futures and options

Level of risk Low Low to medium Low to medium Medium to high Medium to high

Step 7 - Know your risk profile

Your risk profile will help determine how much risk you are prepared to take in investing. Your psychological make up will, to a large extent, determine your willingness to take risks. For example, if you are participating in a television game show and are offered one of the following options, which would you take: A. R10 000; B. A 50:50 chance of turning the R10 000 into R15 000; C. A one-in-five chance of doubling the R10 000; or D. A one-in-50 chance of turning the R10 000 into R100 000? If you select D, you should run off and get a Lotto Ticket rather than invest. Investing is not a gamble it is a science! It is not a game of chance in which you put all your resources at risk, with an outside chance of increasing its value. The most important question you need to ask yourself is: How much can I afford to lose if an investment goes wrong? The question should not be: How much do I wish to make?

11

Apart from your psychological make up, your risk profile is determined by the following other factors: The Time Period. The longer your investment period, the less likely you are to fall prey to market fluctuations. The greater the volatility, the greater the risk. Investment markets, and sectors of markets, do move up and down, often violently, but the longer the investment term, the less influence the volatility has on the overall trend in your investments. You should avoid investing in capital growth investments for periods of less than three years; Your age. The younger you are the more time you have make up for investment mistakes however LEARN from them!!! Dont do them again!!! The more mature you become the more stable or secure you investments should be and the more care you should take when investing... The amount of money you have to invest or the amount you earn. The more money you have, the more you can afford to take an investment. Your health. If you are unhealthy and suspect you may not be able to work indefinitely, your tolerance for risk should be lower than a healthy person's. Your investment knowledge. If you dont know you DONT Know!!! So then dont invest until you have consulted with experts and many of them until you get a consensus about which path you should follow. Your investment target. If you are investing for retirement, your risk profile should be lower than, if you were investing for desired item, such as a beach cottage.

Step 8 - Diversify

DONT put all your eggs in one basket - Ever heard that before? As a general rule, you should be applying the 5/10:1 rule to any investment. The rule state that you should not have more than 5% of your assets vested in a single product or investment and no more than 10% in a specific assets class or market segment. Diversification lowers your risk because: you will not lose everything if one investment sector goes wrong. This also gives you the ability to ride the wave when the going is good!! Not only does a properly diversified portfolio reduce risk, but it can also increase your potential growth. This rule also counts for any funds and annuities that you might be invested in. find out if the assets in the fund are properly diversified. If not find out why from the trustees or fund managers!! With the lifting of some exchange controls, you also may want to have investments in foreign markets. South Africas investment pool is small and we do not have access to all investments available. Most of us do not have the money to properly diversify by buying bonds and shares directly; for this you would need at least R250 000. But that should not stop you from having a properly diversified investment portfolio. The good news is that you can get the

12

same investment portfolio with the same share, bond, cash, and property profile as any billionaire. You will simply own less of each. This is made possible by what are called pooled or collective investments. So now is your change to start playing with the greats like Trump etc With a pooled/group investment, you and many thousands of other investors put your money into a single pool. The person managing the portfolio (the asset manager) can then go and buy the same investments as any billionaire. A pooled investment is likely to have anything up to at least R100 million in assets (a comparatively small pool), but some have many billions of rands. A retirement fund is a typical pooled investment where all the members put their retirement savings into one pot, enabling asset managers to invest their money in a properly diversified portfolio of assets, both here and offshore. For individual like us, the easiest way to diversify our investments is through unit trust funds and life assurance investment (endowment) policies. There are four main types of pooled investments. 1. Retirement funds; 2. Life assurance investment products, such as endowment policies and retirement annuities, which offer risk-adjusted investment portfolios; 3. Unit trust funds, which are known overseas as mutual funds; and 4. Multi-manager investments where asset managers who are experts in specific market sectors are given different parts of an overall portfolio to manage. The asset managers normally work for a number of different companies. A unit trust fund of funds is an example of a multi-manager product. The five big advantages of a pooled investment: 1. Diversity. Often these investments provide great diversity in assets. 2. Expertise. Just as they spread the risk they also spread the growth and expertise of the managers. They may not always get it right, but they are more likely to get it right than you are. 3. Time. You dont always have the time to control or manage your investments. 4. Investment amounts. You are able to invest small amounts. 5. Regulation. Group investments are regulated and therefore offer you security and peace of mind knowing you are protected against scams.

13

Step 10 - Understand the Market Sectors

Each financial asset has different underlying sectors. It is important that you understand this if you want to diversify your investments properly. While diversification of your assets is important, do not over-diversify. If you bought a number of investments that were all in one sector of the market, as in a selection of unit trusts, you would be overdiversifying. The best way to understand market sectors is to become informed - read the papers the share prices etc. On the stocks pages you will find categories and sub-categories for the JSE Securities Exchange that include: The mining and resources sector, The financial sector, and On the unit trust pages you will find the following four broad categories:

1. Domestic funds, which sub-divide into the three categories of equity funds (which invest in shares); asset allocation funds (which invest in all the financial asset classes); and fixed interest funds (which invest in bonds and money markets). 2. Regional funds, which sub-divide into the three sections, namely, equity general funds, equity varied specialist funds, and fixed interest varied specialist funds. The above section has to invest 85% or more in LOCAL markets and assets. 3. Foreign funds, which sub-divide into five sections, namely, equity general funds, equity varied specialist funds, fixed interest varied specialist funds, foreign fixed interest bond funds, and asset allocation flexible funds. 85% investment in foreign markets required. 4. Worldwide funds, which sub-divide into the three sections, equity varied specialist funds, equity technology funds and asset allocation flexible funds. Worldwide funds (except the asset allocation funds) invest at least 15% in SA markets and at least 15% in foreign markets. As share markets and regions of the world go through cycles, so will the underlying sectors. For example, before 1998 small companies around the world were flying high, while investors were ignoring large companies. Everyone was talking about the new economy and technology stocks. But after the fall in these sectors in 98 investors were scooting back to the old large companies, It is important to spread your investments across the different sectors. With unit trust funds, you can select specific sectors or you can have the job of diversification done for you by selecting general equity or asset allocation funds.

14

Step 10 - Find your GROOVE

Your investment style is the approach you adopt when selecting shares. The main styles are value investing and growth investing. Warren Buffet, the world's most successful investor, sticks rigidly to "value" investing.

Value investing Value investors identify companies that are "under-valued". There are a number of ways of finding under-valued companies. These include: The net asset value test. Every company holds assets of one type or another, whether it is intellectual property, such as in computer software companies, or bricks and mortar. If the total of the assets (INCOME) less the liabilities (EXPENSES) is worth more than the value of the total number of shares issued, then the company is under-valued. In other words, if the assets of the company were sold off they would provide more value than the total of the shares. The price/earnings (P/E) ratio test. You will often hear of the price/earnings or P/E ratio. It is a calculation that shows you how many years it will take to recover your initial investment from the profits made by the company. To calculate the P/E ratio you divide the total value of all shares issued by the company by the profit. (For example, R100 million in total value of shares divided by profit of R10 million equals a P/E of 10). The lower a P/E, the more value it has. Any company with a P/E of less than 15 would be in the range of a value investor. But you need to be careful, as a company with a low P/E may also be in trouble so there is no demand for the shares and the share price is low.

Once again get informed about your proposed investment!!!!!!!! Growth investing Growth investors target companies that are growing quickly, or are expected to do so, with the potential to provide big profits in the future. Growth companies will often have very high P/E ratios because investors expect the companies to provide extraordinary profits in the future. In the past, many of these companies were technology companies. Warren Buffet avoided growth shares, so when technology stocks collapsed in 2000, he was one of the few who avoided significant losses. Since the dot.bomb episode, growth asset managers have qualified their position, calling their style GARP, which stands for "growth at realistic prices". These explanations are very simple examples of investment styles. There is a lot more to investment styles, but asset managers generally promote themselves as being either a growth or a value manager. 15

You can select investments directly using the different styles, or you can get stylespecific unit trust investments where a style investment manager will do the selections for you.

Step 11 - Liquidity?? What is that?

Access to your money is one consideration when investing. If an investment is considered illiquid, it means it could take time to sell. If you attempt to rush a sale, you could lose money because of lack of demand at the time. Different asset classes have different levels of liquidity. For example: Money market - immediate access; Most shares, unit trusts and bank-term deposits - great liquidity; Life assurance products - medium liquidity; Property and most retirement funds - low liquidity.

In considering the liquidity of your investments, you must take into account any penalties you may incur for cashing in early. In other words, you may be allowed to cash in your ships but will pay certain penalties to do that.

Step 12 - Check for Guarantees

Guarantees can be a good thing, particularly for retirement savings. You must accept that guarantees cost and this will be reflected in lower performance than non-guaranteed investments. You need to be very sure about the guarantees you receive and any qualifications to the guarantees. You can get guarantees on the capital you invest and the return on that capital. GET IT ON PAPER!!! Now many guaranteed products are very complex. These products come with so many bells and whistles, that they can be very confusing and you may need expert advice to decipher them. Ensure that you have good advice and a great translator to explain all the ins and out of your guarantees. A regular occurrence in todays structured investment environment is that often you only need guarantees for about 1-5% of your investment so looking at the cost involved maybe dont get them in the first place The most popular and easy-to-understand guaranteed products are supplied by life assurance companies; these are structured to provide you with a guarantee on your capital and some growth. Additional growth in the form of annual bonuses is based on growth over a longer term.

16

Your investments should have flexibility and no onerous penalties for switching from a higher to lower risk. So make sure your investments are tailored to your needs at the time and can change with your needs Always get guarantees in writing.

Step 13 - Consider Costs

All investment products come with costs. You need to pay reasonable costs, but costs are often one of the most under-estimated obstacles to achieving investment targets. Costs also come in various forms. Always ask for full disclosure of costs, including commissions, as extraordinarily high commissions often point to a suspect product. Unscrupulous advisers often sell products based on the commissions rather than on suitability for your investment requirements. Check both initial and on-going commissions. Costs include initial costs, annual costs, withdrawal (or back-end) costs, hidden costs and layered costs. (These apply when you have a product wrapping underlying investments, which in turn invest in other underlying investments - for example, wrap funds, which invest in unit trust funds, which in turn invest in shares or bonds.) With pooled investments there is always an annual asset management fee charged by the asset manager and passed on to you. With more complex multi-manager investment products, these fees are often not properly disclosed. On top of this, these asset management fees are sometimes "secretly" shared with financial advisers. This can result in you being advised to invest in a product based on the "fee" it will earn the adviser, rather than on your best interests. Costs can be charged as a percentage of your invested assets, or as fixed charges.

Step 14 - Consider Tax

Tax is an important consideration when investing, but it should never be your priority. Too often people turn away from an investment purely because it has tax consequences. Tax issues are Income tax. Your retirement fund pays income tax on your behalf on any interest or net rental income (rent less costs) at a rate of 25%. Any savings you set aside that are not invested in a tax-incentivised savings vehicle, such as a retirement annuity or preservation funds, do not qualify for tax rebates. An example of a non tax-incentivised retirement savings vehicle is a unit trust or endowment policy. 17

Capital gains tax (CGT). You have to pay tax on any capital gains you make out of your investments.

Step 15 - Choose an Investment Product

Financial services companies offer a wide - and often confusing - array of products, but most fall into a relatively restricted range of generic products. Within these generic products you will find different combinations of asset classes. The different products can be used for different purposes - it is not a case of one type being necessarily better than another. You have six types of investment products to choose from: 1. A stock market share portfolio; 2. Life assurance endowment policies; 3. Unit trusts 4. Multi-manager products, 5. Hedge funds 6. Exchange-traded funds. 1: A stock market share portfolio You can own a share portfolio either directly or through a product offered by a multimanager, with shares as the underlying investments... Choice 2: A life assurance policy When you are looking at investing in a life assurance policy, you should consider the following factors: Contract period There is a minimum contract period of five years (or, in the case of a retirement annuity, a minimum age of 55). There are penalties for failing to pay the premiums or for canceling your policy before the maturity date and, with recurring premium investments, this could result in the loss of all or part of your investment. One of the disadvantages of endowments is that, even if the life assurer or asset manager under-performs, you are not able to change to a better asset manager without incurring substantial costs. However, you are offered some flexibility in that you can switch between the different investment portfolios offered by a particular life assurance company. This includes switching from a market-linked portfolio to a guaranteed portfolio. With the new-generation endowments, fairly extensive switching is permitted. Disciplined saving The contractual nature of the investment and the severe penalties for not sticking to the contract, help make life assurance investments a very disciplined form of saving and investing.

18

Premiums You agree at the start on the minimum amount you will save either as a recurring premium on a regular basis, usually every month, or as a lump sum. You can increase the amount you invest by a maximum of 20 percent in any one year. There are minimum levels of recurring and lump-sum premiums, which vary from policy to policy. Costs There are initial costs and annual costs: Initial costs. On recurring premium policies these are between three and 12 percent, but they are zero or close to zero on single-premium investments. Initial costs vary between life assurance companies and cannot be negotiated. Annual costs. These vary between two and 2.5 percent of the value of your investment, depending on the company. The annual charges are not negotiable. A monthly policy fee is also charged which varies between R5 and R30 a month. (The more complex the product, the more expensive it is likely to be. Be very aware of costs with policies that are structured for foreign investment.) Transparency Historically, the level of transparency on endowments has been comparatively poor. You were not given sufficient information to make an informed choice. However, since the introduction of Policyholder Protection Rules intermediaries are obliged to disclosure important issues, such as costs. Guarantees This is one of the major advantages of life assurance investments. Guarantees are available on your capital at maturity, on some growth and on investments that provide an income (annuities). Investment choices Investment choices have tended to be fairly limited on traditional endowments but have increased significantly in recent years. The main two choices you have are smoothed bonus investments and market-linked investments: Smoothed bonus investments. These products smooth out investment performance, with performance bonuses added on an annual basis. The smoothing effect is achieved by the company holding back part of the "profits" enjoyed during the good years and paying out these surpluses in the lean years. This is an advantage as you are not subject to the vagaries of the market. Many companies offer what are called progressive guarantees, so-called because they guarantee all or part of the bonuses that are declared from time to time. These products usually also guarantee your capital and some growth, particularly with the introduction of new-generation endowment policies, which allow you a wide selection across the broader financial services industry. Market-linked (related) investments. With this choice you take your chances on market conditions when your policy matures. If the market is up you will be fine, but if it is down when you want to withdraw the cash, you will lose. Despite the volatility, however, market-related portfolios have returned significant growth over the long term. The process can be compared with someone climbing a set of stairs with a yo-yo. The yo-yo goes up and down, but with every step the yo-yo goes higher and higher.

19

Investment performance There are no guarantees on performance in market-linked products. There are policies that perform well for both short and long periods, and there are policies that perform badly for both short and long periods. Performance depends on the skill of the asset managers who invest money on your behalf. Assurance on life and disability You can combine your investment policy with assurance against dying or being disabled, paying one premium for both. On death If you have named a beneficiary or beneficiaries in your policy, when you die the accumulated value of your investment can be paid directly to your dependants within days of your death. Although the amount is subject to estate duty (death taxes), it is not added to your estate where it would be subject to executor's fees of 3.5 percent (plus VAT). This is a significant advantage of a life assurance policy, as dependants need money on which to survive after the death of the sole or major provider. Estates can take many months to be finalized, which could leave dependants in dire financial straits and forced to take out loans. If you have not named a beneficiary, the amount will be added to your estate. Loans Life assurance companies give loans against endowment policy investments, but not against retirement annuities. The amount of the loan will vary from 60 to 90 percent of the value of the investment. In terms of legislation you are allowed only one loan in the first five years of the policy contract. Life assurance policies can be used as collateral against loans from banks and other lenders. Protection against creditors If your investment has assurance against death or disability attached, and you have dependants, the first R50 000 of the value of the total policies you own is protected against creditors, if the policy or policies have not been ceded to someone else. If the policy is housed within a tax-incentivised retirement vehicle, you have full protection against creditors. Investment security A life assurance company has to keep reserves to ensure that it can meet its commitments to you. However, if the company goes bankrupt you have no claim on the underlying assets used to make investments with your money. Your claim would be against the bankrupt company. Fund management restrictions Life assurance asset managers have wide discretion in selecting underlying investments. They can invest any amount in any company and there is no limit to the percentage of

20

shares they can buy in a company. The companies in which investments are bought need not be listed on a stock exchange. Investment may also be made directly in residential and commercial property. Unrestricted use may be made of derivative financial instruments. Although this gives greater investment flexibility to fund managers, it may also increase risk for investors. Choice 3: A unit trust fund Unit trust funds provide a widely diversified investment vehicle and come with both lowand high-risk profiles. Your main considerations when investing in unit trusts should include: 1. Contract period There are no minimum investment periods. You can invest and withdraw on the same day if you wish, although this is not advisable. Your investments are flexible. Not only can you adjust the amount you invest as and when you wish, but you can also withdraw your money at any stage. You can switch for free, in most cases, between funds of the same unit trust management company. However, you will pay a new set of initial costs if you switch between funds of different unit trust management companies. 2. Disciplined saving There is no enforced discipline to your investment plans as you can withdraw amounts or stop paying whenever you wish, which can be a disadvantage. However, you can discipline yourself by having a debit order for recurring premiums. 3. Premiums You can vary the amount you invest in a unit trust fund as you please. There are minimum levels of recurring and lump-sum payments, which vary from fund to fund. 4. Penalties There are seldom penalties for withdrawing your money or halting any recurring payment. Internationally, many funds charge exit fees and this principle is being considered in South Africa. However there is an indirect penalty, in that if you withdraw your money soon after you have made your investment, you may not have recovered the initial costs, which are up to seven percent of the value of your investment. 5. Costs There are both initial and annual costs: Initial costs. The maximum initial fee is about seven percent. You can negotiate this cost depending on the size of your investment and whether

21

you deal directly with a unit trust company (removing the need to pay broker commissions). Initial costs can vary between unit trust funds. Annual charges. These average about one percent, but on newer funds, annual charges have been increased, with some funds charging up to 2.5 percent a year of the value of your investment.

6. Transparency The level of transparency is good. Costs, historical performance, and information on underlying investments are freely available. The high level of disclosure allows for extensive analysis and comparisons of funds. 7. Guarantees There are no guarantees of any kind on unit trust investments. You are entirely vulnerable to investment market fluctuations. Highly specialized funds, such as small company funds, are also likely to be very volatile. 8. Investment choices You have an extensive range of investment choices, from broad-based investments to very narrow options, such as gold funds. You can also choose between what is called active management or passive management. Actively managed funds. These are unit trust funds where a small army of investment managers and analysts seek out what they believe will be the top-performing investments in a market or sector of a market. Passive funds (index funds). These are funds where the fund managers do not apply any skill. The fund managers merely try to match what is called an index. You get many different indices. An index is a measure of performance of a particular market or sector of a market and replicates the different shares in the market, mainly according to their value. So if company A represents 10 percent of the value of a sector of a market, it will make up 10 percent of the index. By watching an index, you can see if a market or a sector is moving up or down. The most well-known is the FTSE/JSE All Share Index. The fund manager merely buys the shares in the same proportion as the index. Passive management funds are, on the whole, cheaper than actively managed funds because there is no need to do any research.

9. Investment performance There are no guarantees on performance. There are funds that perform well for both short and long periods and there are funds that perform badly for both short

22

and long periods. Performance depends on the skill of the asset managers who invest money on your behalf and the sector in which your money is invested. 10. Comparability Unit trust prices and performance are comparable on a daily basis as most newspapers publish them. You must, however, compare like with like. For example, you should compare a general equity fund with another general equity fund, not with a gold fund. 11. Assurance on death and disability You cannot combine your unit trust investments with assurance against dying or being disabled. 12. On death The accumulated investment will be added to your estate and is subject to both estate duty and executor's fees. 13. Loans Unit trust companies do not provide for loans against unit trust investments, but you can cash them in whenever you wish. 14. Collateral Banks will accept unit trusts as collateral, but will only lend you about 50 percent of the market value of the unit trusts, as long as they are housed within a taxincentivised retirement vehicle. 15. Protection against creditors There is only protection against creditors if your units are housed within a taxincentivised retirement vehicle. A creditor can lay claim to your unit trust investments outside of retirement vehicles. 16. Investment security The unit trust management company must hold the portfolio (fund) "in trust" and you hold units in the "trust" fund. If the management company goes bankrupt, it has no access to the units in the trust. 17. Fund management restrictions Unit trust asset managers are generally only allowed to buy shares of companies listed on a stock exchange. Only five percent of the shares of a particular company may be owned by any one fund; and a maximum of five percent of the assets of a fund may be used for investment in any single company. Only limited use of derivative financial instruments is permitted. Although this limits investment flexibility, it does reduce the level of risk for unit trust investors. Choice 4: Multi-manager products (also known as split investments)

23

Multi-manager products are effectively another investment layer. With retirement products, this layer comes between the tax-incentivised vehicle (such as a retirement annuity) and the underlying investments (such as unit trust funds). Multi-manager products come in a number of different forms. You are offered access to a number of different asset managers, either directly or through other products, like underlying unit trust funds. The main argument in favour of multimanager investments are that you are offered the "best of breed" asset managers. The asset managers can work for any company. A manager of a multi-manager fund will seek out the best managers in various sectors and put them together in an attempt to give superior investment performance. The main vehicles are: unit trust multi-manager funds, unit trust funds of funds, linked investment products and wrap funds. Hedge funds are also included in this section. Although you can invest directly in hedge funds, most people will invest in these funds through a collective investment. 1. Unit trust multi-manager funds These funds seek out asset managers who are considered the best in their fields. Apart from not using one dedicated asset manager, these funds are exactly the same as other unit trust funds. 2. Unit trust funds of funds These funds seek out other unit trust funds (not asset managers), particularly sector specialist funds, which are considered the best in their fields. Apart from having underlying unit trust funds, these funds are exactly the same as other unit trust funds. 3. Linked investment products Linked investment product companies came into being as a result of the increasing number of specialist unit trust funds offered. The companies started off as an administrative platform that enabled you to keep a portfolio of unit trusts under one umbrella and switch between the various funds. With this the linked product companies offered various legal umbrellas in which to house your investments, such as retirement savings vehicles - including retirement annuity and preservation funds - where the underlying investments were in unit trust funds. However, linked product companies have become increasingly embroiled in controversy because of the manner in which they have limited investment choices, their ever-increasing cost structures, and the way they have allowed unskilled advisers to sell their products. 4. Wrap funds Wrap funds grew out of the linked investment product industry. With greater choice and switching ability allowed by the industry, many investors (often acting on the advice of unqualified investment advisers) switched around their investments in pursuit of the latest top-performing unit trust, mostly shortly before

24

it fell from grace. Many people made considerable losses. Most people who made these losses had forgotten a fundamental rule of investment: It is not about timing the market; it is about how long you are in the market. As a result, most linked product companies set up subsidiaries to mix and match unit trust funds into risk-profiled wrap funds. However, this created problems of its own. Costs were high, there was little transparency on costs or performance, there was no proper regulation, and the number of wrap fund choices soon equaled the number of unit trust funds. All this choice defeated one of their main purposes: To reduce the number of choices of unit trust funds. On top of growing criticism of wrap funds, capital gains tax was introduced in 2001. Switching between funds is subject to the new tax, which has the potential to undermine investment performance significantly. As a result, many wrap fund managers have converted to unit trust funds of funds, which are better regulated, cheaper and far more transparent. 5. Hedge funds Investment in hedge funds is increasingly an option for investors, particularly in current volatile markets. The attraction of hedge funds is that they can make money when markets are moving up and down. Although hedge funds can be accessed individually by investors, the amounts required are often very large and selection of the correct hedge fund is very difficult. Hedge funds have recently become generally available to South African investors through multi-manager options, mainly unit trust funds of funds. Hedge funds come in many shapes and guises - some low risk and some extremely high risk. The advantages of using the multi-manager concept include: Proper selection. Hedge funds vary dramatically, from funds that trade in currencies to those that trade in something as obscure as distressed municipal debt in the United States. An expert multimanager will know what is available and what to include. As an individual, you will hardly know what is available or how to select a hedge fund. Reduction of risk. A multi-manager is able to assess the risk of the different funds; and Investment access. Through multi-manager funds, hedge funds are made affordable for the ordinary investor.

How hedge funds work Most investment managers, particularly those looking after unit trust funds, are limited in the way they can invest. When markets are rising, they must select shares they expect will perform best. During volatile or shrinking markets, they must attempt to sell off the shares their research tells them will perform worse than others. In this way they try to

25

protect the value of the portfolio. In this scenario - which is known as investing "long" profits are derived only if the prices of the shares in the portfolio increase. As a result, a traditional "long" manager can at best only offer you performance relative to a benchmark, such as the FTSE/JSE All Share Index. This means that in bad times you will probably see the value of your investment shrink, even though your manager might be out-performing the benchmark. A traditional manager cannot offer you absolute returns, or an ever-growing investment. Yet this is what hedge fund managers set out to do. Hedge fund managers use "long" investments, but also hedge their bets by investing "short". This means the investment manager can make profits when share prices are falling. There are a number of ways to invest "short", or "short the market" on a particular investment. In simple terms, the fund manager will not only seek out investments that are expected to out-perform, but also those expected to under-perform. To achieve a profit on an investment expected to lose ground, the fund manager will: Sell an investment that is not currently owned at its current price (say R100); Purchase the share at its cheaper price after the share price has fallen (say to R50); and Deliver the share to the purchaser, who paid the R100, thereby making a R50 profit for the fund.

There are many variations of this basic tactic, using option and futures markets (where you buy an option to buy, or sell a share at a certain price at some date in the future). It is in these variations that risk comes into play with hedge fund investing. Hedge funds and risk Depending on the investment strategies of the hedge fund manager, these funds - as with any other investment class - can range from comparatively low risk to very high risk. What increases the risk of investing in hedge funds is the ability to leverage, or gear, a hedge investment. Normally, gearing/leverage means borrowing to buy an investment in the hope of selling the investment for a greater sum before the money must be repaid. Gearing is a bit more complex with hedge funds. In simple terms, a hedge fund manager uses a comparatively small sum of money that can be put down as a deposit to buy or sell a much larger amount (in value) of shares at some stage in the future. If the bet goes wrong and prices move against the original bet, the fund manager may have to pay out additional large sums of money. If the decision turns out to be right, the returns on the original investment are far greater. So, whereas a traditional "long" manager can only lose what is invested, a hedge fund manager, using gearing, can lose a lot more.

26

Although you get high-risk hedge funds, the funds can also be used to reduce the risk of losing money in volatile markets, because the managers can bet against a fall in the market. Hedge funds are perceived as high-risk investment strategies because the fund managers use derivatives and options to bet on the movement of stock markets, shares, bonds, currencies and commodities, while accentuating performance through leverage. Other criticisms of hedge funds include: Lack of transparency; Lack of proper risk control; Lack of regulation; Lack of knowledge by investors, leading to poor investment choices; High fees; and Difficulties in selling the investment. Choosing a hedge fund manager There are a lot of hedge fund multi-managers out there and you need to exercise caution in selecting the right one. Issues you should take into account include: The jurisdiction in which the manager is registered. You should preferably deal with a company registered in South Africa and subject to local regulation. The jurisdiction in which the product itself is registered. As hedge fund management is mainly an international practice, many products will be registered through offshore centers. These centers have varying levels of regulation. For South Africans, the better bet is usually a European offshore jurisdiction. Whether the manager has a track record of at least five years. Whether the investment has a minimum of 10 to 15 underlying funds. The liquidity of the investment. This is the ease with which you can buy and sell your investment. Transparency. Check whether you will receive regular reports about performance and selection of underlying funds and costs. The size of assets under management. A multi-manager with more sizeable assets has access to the widest range of funds.

Choice 5: Exchange-traded funds The first exchange-traded fund (ETF) in South Africa, the Satrix40, was launched in 2000. The fund is essentially an index fund which tracks the top 40 companies listed on the JSE Securities Exchange. Two more ETFs were launched in 2002 - one tracking the industrial index and the other the financial index. These funds, which are sponsored by the stock exchanges on which they are listed, are becoming increasingly popular with investors around the world. The costs of ETFs tend to be lower than unit trust index funds. 27

Step 16 - Choose a Product Provider

After selecting the investment products best suited to your needs, you should also select the product provider. There are a number of issues you must take into consideration when selecting a product provider: * Legality. Do not deal with a product provider that is not registered with the regulatory bodies. Whether you choice of provider requires or does not require very specific registration is very easy to check. The FSB (Financial Services Board) will be able to tell you which, if any regulatory bodies your choice of provider needs to be registered with, they will also be able to provide you with guide lines in choosing your provider. The FSB can be reached on 0800 110443 or 0800 202087. ONCE again make informed decisions!!! * Reputation. Only deal with companies that have a sound reputation for good, honest service * Past investment performance. Although historical performance is no guarantee of future performance, if the company has provided consistent, above-inflation returns in the past you should be fairly safe. Avoid companies that provide stellar performance in one year and are dogs the next.

Step 17 - Measure the Results

When you have made your investment choice, you must monitor the investment's performance. There are a number of ways to measure investment performance, most of which involve benchmarks. A benchmark is a pre-selected marker against which you can measure how your investment is doing. The benchmark must, of course, be appropriate. It is pointless, for example, measuring an investment in a bank account against the FTSE/JSE All Share Index because a bank account is not invested in shares. Benchmarks include: Inflation. This is probably the best benchmark you can use. If you manage to beat the inflation rate by three percent, you are doing well. Anything above that should be considered a windfall. Indices. A wide range of indices is used to measure performance. You must remember that an index benchmark is relative to the benchmark. It is not a measure of absolute performance. So, when an index is going up, you should see if you are doing better or worse than the index; and if the index is dropping, check whether you are dropping at a lower or faster rate. On the way up, you should outperform an index if the asset manager is worth what you are paying; and on the way down you should not drop as fast.

28

Step 18 - Rebalance your Portfolio

Rebalancing is an essential part of managing a portfolio. Among other things, it will ensure you maintain a properly diversified portfolio. For example, say in 1996 you invested in unit trust funds that specialized in technology stocks. At the time the investment amounted to five percent of your investments. A year later, this investment would have grown rapidly in relation to your other investments, and amounted to 15 percent of your investment portfolio. You would have been feeling pretty chuffed. But in 2001, the bottom fell out of the sector and your investment would have shrunk to only two percent of your portfolio. The trick, when you get abnormal growth, is to stick to your original investment plan by selling a portion of the out-performing share and maintaining the diversification of your portfolio. Using the same example, you would have reduced the 15 percent proportion to five percent. By doing this, you would have taken profits from the growing investment and reduced the risk of the growth bubble bursting. On the other hand, if the growth in technology stocks had continued, you would not have harmed your cause because the five percent to which you had reduced your investment in the sector would have continued to pick up the additional growth. It is advisable to rebalance your portfolio about once a year.

Step 19 - Revisit your Investment Strategy

If you have made properly considered investment decisions you should not have to switch them around. Many investors switch or get out of investments at the wrong time, which affects the value of their investments negatively. This does not mean that you should not make regular reality checks on your investments. You must still check to see that your investments are delivering what you expected and whether your goals are still realistic. Research, here and abroad, has proved that switching investments is generally a bad investment policy, particularly if you are trying to time your investments with market events. Trying to time your investments with market events normally results in: You realizing what could have been only a paper loss, as the markets are likely to improve; The payment of penalty fees for early withdrawal; and A reduction in the value of your investments because you have to pay a new set of costs.

Never switch an investment when:

29

Markets are volatile, as they were in 1998 in South Africa or after the terrorist attack on New York's World Trade Center in September 2001, which resulted in panic selling. Advisers claim they can get you a better deal elsewhere. Normally the only person receiving a better deal is the adviser who is generating a new set of commissions You hear that your dentist or hairdresser is making a fortune out of some or other investment You need urgent access to your money. Poor financial planning in the first place usually causes this.

Step 20 - Reinvest Mature Investments

When your investment matures and you do not need the money, it is often best to leave it exactly where it is. This is particularly the case where your investment is directly linked to the market. For example, say you have a life assurance endowment investment with performance linked directly to what is happening in the market sector in which you are invested and the market is down. If you withdraw the money when the market is low, you lock in the losses. You should rather extend the contract period so that you can withdraw when the market improves. Even if your investment matures when it is doing well, if you do not need the money, you should consider extending the contract. It will save you the costs and commissions of reinvesting. Unscrupulous advisers will often recommend that you switch to another investment product on maturity because that generates new commissions, while a rollover in the same product does not. When to switch or cash in an investment If your personal financial position changes; and If you experience prolonged poor performance, which is unrelated to underlying investment markets. Always check the performance of your investment against the benchmark that you have set.

Alternatives to cashing in investments The area of investment most often affected by a change of personal fortunes is life assurance. You should, however, think beyond simply keeping or cashing in a life assurance investment. There are other options open to you. You could: Make the policy "paid up". This means leaving the investment where it is but making no further contributions. You can always resume payments at a later date. If it is a retirement annuity policy, you cannot cash it in until the age of 55, but you are allowed to stop making contributions; or

30

Take a loan against the policy. You may not take a loan against a retirement annuity policy or use it for collateral for a bank loan; but with non taxincentivised retirement savings, such as a life assurance policy, you may be able to take a loan against the policy or use it for collateral at a bank.

Before cashing in investments Before you make any decisions to surrender or switch an investment, whether it is an umbrella investment, such as a life assurance policy, or an underlying investment in a tax-incentivised retirement savings vehicle, such as a retirement or preservation fund, you must: Reconsider the reason you made the investment; Carefully consider the reasons for switching or cashing-in the investment; Consider the alternatives; and If you are being encouraged to make the switch by a financial adviser, get the reasons in writing, and ask the company holding the investment what it thinks of these reasons. Life assurance is one of the areas most vulnerable to financial advisers encouraging investors to switch investments. There are stipulations about how a life assurance policy may be switched from one type of policy to another, but there is no protection if you are advised to switch to another product, such as a unit trust fund.

Step 21 - Start all over again.

Investing does not always end when you achieve a single goal. Your personal circumstances will never be static and you will have to change and adapt your investments as your personal circumstances and goals change. You will then have to set new investment goals using different strategies to achieve the best results. A good example is the process of building up retirement savings and then deciding at retirement how to invest those savings to provide an income. This means that you need to start again following the same investment steps. So just when you thought that it was over the whole process starts again ..

31

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Case 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDocumento3 pagineCase 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDoreen0% (1)

- MasterCAM X4 Handbook Volume 1Documento79 pagineMasterCAM X4 Handbook Volume 1tuanvn7675% (4)

- MasterCAM X4 Handbook Volume 1Documento79 pagineMasterCAM X4 Handbook Volume 1tuanvn7675% (4)

- The Peppers, Cracklings and Knots of Wool Cookbook PDFDocumento283 pagineThe Peppers, Cracklings and Knots of Wool Cookbook PDFrandzimmNessuna valutazione finora

- APG TemplateDocumento2 pagineAPG TemplateSHAKTI MOTWANINessuna valutazione finora

- Ciia Final Exam II March11 - SeDocumento15 pagineCiia Final Exam II March11 - SeadedejiajadiNessuna valutazione finora

- 101 BASIC Computer Games Mar75Documento252 pagine101 BASIC Computer Games Mar75randzimmNessuna valutazione finora

- Important Facts About Spark Erosion enDocumento44 pagineImportant Facts About Spark Erosion enrandzimmNessuna valutazione finora

- Lathe Tutorial: Step-by-Step Guide to Creating Toolpaths in Mastercam X5Documento8 pagineLathe Tutorial: Step-by-Step Guide to Creating Toolpaths in Mastercam X5lionlionsherNessuna valutazione finora

- Publication 426 084Documento4 paginePublication 426 084randzimmNessuna valutazione finora

- Pressure CookerDocumento130 paginePressure Cookerrandzimm100% (1)

- Civil Procedure Rule 59 Receivership GuideDocumento3 pagineCivil Procedure Rule 59 Receivership GuideRommel P. AbasNessuna valutazione finora

- Alekseev Innokenty 2002Documento66 pagineAlekseev Innokenty 2002Harpott GhantaNessuna valutazione finora

- Rearrangement ReactionsDocumento5 pagineRearrangement Reactionsblue_l1100% (1)

- Indian Debt Markets Evolution and InstrumentsDocumento33 pagineIndian Debt Markets Evolution and InstrumentsNainisha SawantNessuna valutazione finora

- Silane Curing InsulationDocumento26 pagineSilane Curing InsulationMandeep SinghNessuna valutazione finora

- CXC 20180206 PDFDocumento16 pagineCXC 20180206 PDFJoshua BlackNessuna valutazione finora

- L21 Worksheet 1Documento2 pagineL21 Worksheet 1maplecookieNessuna valutazione finora

- Liquids and Solids: Urooj FatimaDocumento46 pagineLiquids and Solids: Urooj FatimaHaram ShaikhNessuna valutazione finora

- Chem 1B final review keyDocumento11 pagineChem 1B final review keyRob KellerNessuna valutazione finora

- Mid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340Documento12 pagineMid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340yoonNessuna valutazione finora