Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Performance Data in Philippine Peso (PHP)

Caricato da

Teresa Dumangas BuladacoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Performance Data in Philippine Peso (PHP)

Caricato da

Teresa Dumangas BuladacoCopyright:

Formati disponibili

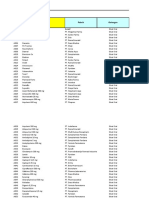

Philippine Wealth Bond Fund Liquidity Fund

HISTORICAL PERFORMANCE

12.0000

Fund Statistix January 2013

Performance Data in Philippine Peso (PHP)

SINCE INCEPTION

Fund Price

11.0000

10.0000

9.0000

A Haven during Volatile Times

T Fund provides a safe haven for existing clients who This wish to switch from their current funds during volatile market movements and switch back when there is less volatility in the market.

CUMULATIVE Highest Lowest

Average Cumulative Performance

1 Year

INTERVALS

3 Year

INTERVALS

5 Year

INTERVALS

3.67% 2.32% 2.79% 1 Year

INTERVALS

8.91% 7.83% 8.35% 3 Year

INTERVALS

n/a

CUMULATIVE Performance Since Inception

13.45%

5 Year

INTERVALS

* Cumulative is the TOTAL earnings performance of the fund in a given number of years.

ANNUALIZED

This fund is not a short-term investment and should be meant for your long-term needs to maximize the investment returns. RISK - RETURN COMPARISON OF AXA FUNDS

10 9 8 POTENTIAL RETURNS 7

6 5 4 3 2

Wealth Bond Fund Locked and Loaded Fund* Armor Fund* 3GX Fund Capital Investment Fund Liquidity Fund * no longer offered Premium Bond Icon Funds Oppurtunity Fund Wealth Equity Fund Wealth Balanced Fund

Highest Lowest

Average Annualized Performance

3.67% 2.32% 2.79%

2.88% 2.53% 2.70%

n/a

ANNUALIZED Performance Since Inception

2.76%

* Annualized is the Compounded Annual Growth Rate, or the simulated growth rate on a yearly basis if Principal plus Interest are re-invested annually.

The tables above show the historical highest and lowest earnings of this fund in a given number of years. It shows how much your investment would have performed if you have put your money in this fund at any point in time. For example, your investment could have earned as high as 3.67% and as low as 2.32% after 1 year.

There is risk the moment you get into investments. But risks can be managed. Based on historical data, the Lowest Annualized performance tends to go up as the number of years increases. The Highest Annualized performance on the other hand will tend to decrease and approach the Average Annualized Performance. This means that longer investment periods will lessen the risk of loss since the Lowest Annualized returns go up through the years. This also means that you can expect a more stable performance from your investments as the Highest Annualized returns approach the Average Annualized Performance.

1 0 0 1

Longer investment periods will lessen the risk of loss and lead to more stable returns.

7 8 9 10

5 6 RISK

Portfolio Allocation

BONDS EQUITIES 0.00% 0.00% 100.00% Money Market Equities 100.00% Bonds 0.00% n/a

as of January 11, 2013

* The portfolio allocation varies daily subject to allocation limits of the fund.

Fund Details

Net Asset Value (NAV) NAV Per Unit Initial NAV Per Unit Lowest NAV per Unit 1/11/2013 5/8/2008 05/08/08 Php 20,591,683 11.3482 10.0029 11.3482 10.0029

BOND HOLDINGS

WEIGHT 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

CASH

Highest NAV Per Unit 12/27/2012

0.00%

Fund Information

Launch Date Fund Currency Fund Manager Fund Admin and Custodian Dealing Schedule Risk Profile May 08, 2008 Philippine Peso Metrobank-Trust MBTC Thursday

n/a

TOP 5 EQUITY HOLDINGS

WEIGHT 0.00% 0.00% 0.00% 0.00% 0.00%

EQUITY HOLDINGS n/a

WEIGHT 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Call us at 5815 292, or refer to your AXA Financial Partner for more information.

The Fund figures reflected in this document are not indicative of future performance. Potential investors should be aware that the price of units per share and the potential income from them may go up or down depending on market fluctuations, and thus are not guaranteed. The figures are are exclusive of charges which will vary depending on the AXA Product where this fund will be used. The weekly unit prices of the AXA Funds are published every Tuesday in the Business Section of the Philippine Star. You can also get more information at http://www.axa.com.ph

Potrebbero piacerti anche

- Asset Allocation and Effective Portfolio Management: Part OneDa EverandAsset Allocation and Effective Portfolio Management: Part OneValutazione: 4 su 5 stelle4/5 (3)

- Performance Data in Philippine Peso (PHP)Documento1 paginaPerformance Data in Philippine Peso (PHP)Teresa Dumangas BuladacoNessuna valutazione finora

- Security Bank - UITF Investment ReportDocumento2 pagineSecurity Bank - UITF Investment ReportgwapongkabayoNessuna valutazione finora

- 21 Aug 2013 Fact Sheet (Bisb)Documento1 pagina21 Aug 2013 Fact Sheet (Bisb)faisaladeemNessuna valutazione finora

- 02 Oct 2013 Fact SheetDocumento1 pagina02 Oct 2013 Fact SheetfaisaladeemNessuna valutazione finora

- Long Term InvestingDocumento8 pagineLong Term InvestingkrishchellaNessuna valutazione finora

- 17 Nov 2013 Fact SheetDocumento1 pagina17 Nov 2013 Fact SheetfaisaladeemNessuna valutazione finora

- Uupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotesDocumento3 pagineUupt Powershares DB 3X Long Us Dollar Index Futures Exchange Traded NotessailfurtherNessuna valutazione finora

- Microequities High Income Value Microcap Fund July 2012 UpdateDocumento1 paginaMicroequities High Income Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNessuna valutazione finora

- Prospektus Schroeder Dana Mantap PlusDocumento1 paginaProspektus Schroeder Dana Mantap PlusJames McCulloughNessuna valutazione finora

- 29 Jan 2014 Fact Sheet1Documento1 pagina29 Jan 2014 Fact Sheet1faisaladeemNessuna valutazione finora

- Pfif PDFDocumento1 paginaPfif PDFcrystal01heartNessuna valutazione finora

- Wealth Balanced FundDocumento1 paginaWealth Balanced FundCourtney LewisNessuna valutazione finora

- 08 Jan 2014 Fact SheetDocumento1 pagina08 Jan 2014 Fact SheetfaisaladeemNessuna valutazione finora

- Microequities Deep Value Microcap Fund December 2011 UpdateDocumento1 paginaMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNessuna valutazione finora

- Liquid Money Guide For Banks, Corporates and SMEsDocumento9 pagineLiquid Money Guide For Banks, Corporates and SMEsSameer RastogiNessuna valutazione finora

- Ie00b5bmr087 - 01 01 2023Documento3 pagineIe00b5bmr087 - 01 01 2023Tanasa AlinNessuna valutazione finora

- The Vice Fund: Investor Class: Vicex A Share: Vicax C Share: Viccx Portfolio Emphasis: Long-Term Growth of CapitalDocumento2 pagineThe Vice Fund: Investor Class: Vicex A Share: Vicax C Share: Viccx Portfolio Emphasis: Long-Term Growth of CapitaladithyaindiaNessuna valutazione finora

- Innovative Investments in MalaysiaDocumento30 pagineInnovative Investments in MalaysiaNavin RajagopalanNessuna valutazione finora

- Jpmorgan Investment Funds - Income Opportunity Fund: August 2013Documento4 pagineJpmorgan Investment Funds - Income Opportunity Fund: August 2013james.dharmawanNessuna valutazione finora

- Key Information Document: PurposeDocumento3 pagineKey Information Document: PurposedeanNessuna valutazione finora

- JF Asia New Frontiers: Fund ObjectiveDocumento1 paginaJF Asia New Frontiers: Fund ObjectiveMd Saiful Islam KhanNessuna valutazione finora

- Mutual FundDocumento10 pagineMutual FundIndraneel BishayeeNessuna valutazione finora

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Documento5 pagineATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesNessuna valutazione finora

- Allan Gray Equity Fund: BenchmarkDocumento2 pagineAllan Gray Equity Fund: Benchmarkapi-217792169Nessuna valutazione finora

- 02 Jan 2014 Fact Sheet1Documento1 pagina02 Jan 2014 Fact Sheet1faisaladeemNessuna valutazione finora

- 209652CIMB Islamic DALI Equity Growth FundDocumento2 pagine209652CIMB Islamic DALI Equity Growth FundazmimdaliNessuna valutazione finora

- Osku Ob Kid Save June 2013 FactsheetDocumento3 pagineOsku Ob Kid Save June 2013 FactsheetRaymond Chan Chun LimNessuna valutazione finora

- Eu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enDocumento3 pagineEu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enAllanNessuna valutazione finora

- Asset Allocation Webcast: Live Webcast Hosted byDocumento60 pagineAsset Allocation Webcast: Live Webcast Hosted bysuperinvestorbulletiNessuna valutazione finora

- 11 15 16 Asset AllocationDocumento60 pagine11 15 16 Asset AllocationZerohedge100% (1)

- HDFC Prudence Fund Leaflet-July 2016 14072016Documento4 pagineHDFC Prudence Fund Leaflet-July 2016 14072016J.K. GarnayakNessuna valutazione finora

- One Sheeter Cpof5y4sDocumento2 pagineOne Sheeter Cpof5y4sRoshaan MahbubaniNessuna valutazione finora

- Mfi 0516Documento48 pagineMfi 0516StephNessuna valutazione finora

- Goldman Sachs - MarketPulse - Special Edition - Ten For 2013Documento3 pagineGoldman Sachs - MarketPulse - Special Edition - Ten For 2013cdietzrNessuna valutazione finora

- Arctos I KID PRIIPS Series A - v6Documento3 pagineArctos I KID PRIIPS Series A - v6FooyNessuna valutazione finora

- HLMM US Fund KIID Class A Acc 0922 1Documento2 pagineHLMM US Fund KIID Class A Acc 0922 1bhupstaNessuna valutazione finora

- ABF Aug2011Documento1 paginaABF Aug2011Charlene TrillesNessuna valutazione finora

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryDocumento3 pagineIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizNessuna valutazione finora

- ALFM Money Market FundDocumento3 pagineALFM Money Market Fundippon_osotoNessuna valutazione finora

- FT Global Total ReturnDocumento2 pagineFT Global Total ReturnxninesNessuna valutazione finora

- Tilson Funds Annual Report 2005Documento28 pagineTilson Funds Annual Report 2005josepmcdalena6542Nessuna valutazione finora

- Risk and Return AnalysisDocumento38 pagineRisk and Return AnalysisAshwini Pawar100% (1)

- PLTVF Factsheet October 2015Documento4 paginePLTVF Factsheet October 2015gadiyaranandNessuna valutazione finora

- Schroder Dana Prestasi Gebyar Indonesia II MF IDENDocumento1 paginaSchroder Dana Prestasi Gebyar Indonesia II MF IDENJohanes SetiawanNessuna valutazione finora

- Sgreits 020911Documento18 pagineSgreits 020911Royston Tan Keng SanNessuna valutazione finora

- Investment Fundamentals GuideDocumento36 pagineInvestment Fundamentals GuideHimanshu JauhariNessuna valutazione finora

- T Class Shares in Fundsmith Equity Fund: Key Investor InformationDocumento2 pagineT Class Shares in Fundsmith Equity Fund: Key Investor InformationJohn SmithNessuna valutazione finora

- Why Most Investors FailDocumento2 pagineWhy Most Investors FailINessuna valutazione finora

- Capital Letter August 2011Documento5 pagineCapital Letter August 2011marketingNessuna valutazione finora

- Investor Profile QuestionnaireDocumento4 pagineInvestor Profile QuestionnaireSubbu JustcoolNessuna valutazione finora

- Personal Fin Plan Assi 2Documento7 paginePersonal Fin Plan Assi 2Chandan Kumar SinghNessuna valutazione finora

- Elss Funds:-: Equity Mutual FundDocumento13 pagineElss Funds:-: Equity Mutual FundMohit BalaniNessuna valutazione finora

- Schroder Dana Istimewa: Fund FactsheetDocumento1 paginaSchroder Dana Istimewa: Fund FactsheetbtishidbNessuna valutazione finora

- Vanguard California Municipal Money Market Fund Summary ProspectusDocumento8 pagineVanguard California Municipal Money Market Fund Summary Prospectus76132Nessuna valutazione finora

- EEA Fact Sheet Feb 2009Documento2 pagineEEA Fact Sheet Feb 2009maxamsterNessuna valutazione finora

- Atc MM Combined Kiids Rda PtaDocumento12 pagineAtc MM Combined Kiids Rda PtaronNessuna valutazione finora

- Empower July 2011Documento74 pagineEmpower July 2011Priyanka AroraNessuna valutazione finora

- Ishares Barclays 7-10 Year Treasury Bond FundDocumento0 pagineIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezNessuna valutazione finora

- Leadership Secrets of Jesus Christ by Mike MurdockDocumento2 pagineLeadership Secrets of Jesus Christ by Mike MurdockTeresa Dumangas Buladaco0% (3)

- w14 Case DigestsDocumento15 paginew14 Case DigestsTeresa Dumangas BuladacoNessuna valutazione finora

- Case DigestsDocumento7 pagineCase DigestsTeresa Dumangas BuladacoNessuna valutazione finora

- Problem SolvingDocumento2 pagineProblem SolvingTeresa Dumangas BuladacoNessuna valutazione finora

- DIP Lecture1Documento12 pagineDIP Lecture1Manish SandilyaNessuna valutazione finora

- Transformers: Z Z Z S S Z S SDocumento17 pagineTransformers: Z Z Z S S Z S SSreenivasaraoDharmavarapu100% (1)

- Written Assignment Unit 4 Health ScienceDocumento6 pagineWritten Assignment Unit 4 Health SciencesafsdaNessuna valutazione finora

- TFU-Risk Assessment RA-11 - Use of Grooving & Threading MachinesDocumento1 paginaTFU-Risk Assessment RA-11 - Use of Grooving & Threading Machinesarshin wildanNessuna valutazione finora

- 3 14 Revision Guide Organic SynthesisDocumento6 pagine3 14 Revision Guide Organic SynthesisCin D NgNessuna valutazione finora

- Philips Healthcare: Field Change Order ServiceDocumento5 paginePhilips Healthcare: Field Change Order ServiceJimNessuna valutazione finora

- EE2401 Power System Operation and ControlDocumento93 pagineEE2401 Power System Operation and ControlPrasanth GovindarajNessuna valutazione finora

- Prepper MealsDocumento22 paginePrepper MealsmeineanmeldungenNessuna valutazione finora

- Ergo 1 - Workshop 3Documento3 pagineErgo 1 - Workshop 3Mugar GeillaNessuna valutazione finora

- Little Ann and Other Poems by Ann Taylor and Jane TaylorDocumento41 pagineLittle Ann and Other Poems by Ann Taylor and Jane Tayloralexa alexaNessuna valutazione finora

- The Preparation of Culture MediaDocumento7 pagineThe Preparation of Culture MediaNakyanzi AngellaNessuna valutazione finora

- Biology Project Cronary Heart Diseas (CHD)Documento7 pagineBiology Project Cronary Heart Diseas (CHD)احمد المغربي50% (2)

- HDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Documento5 pagineHDFC Life Insurance (HDFCLIFE) : 2. P/E 58 3. Book Value (RS) 23.57Srini VasanNessuna valutazione finora

- Essence Veda Vyasa Smriti PDFDocumento51 pagineEssence Veda Vyasa Smriti PDFmadhav kiranNessuna valutazione finora

- Data Obat VMedisDocumento53 pagineData Obat VMedismica faradillaNessuna valutazione finora

- ProAct ISCDocumento120 pagineProAct ISCjhon vergaraNessuna valutazione finora

- Proposal Semister ProjectDocumento7 pagineProposal Semister ProjectMuket AgmasNessuna valutazione finora

- Top 6 Beginner Work Out MistakesDocumento4 pagineTop 6 Beginner Work Out MistakesMARYAM GULNessuna valutazione finora

- 224 Chinese Healing ExercisesDocumento4 pagine224 Chinese Healing ExercisesKiné Therapeut-manuelle Masseur GabiNessuna valutazione finora

- Oral Rehydration SolutionDocumento22 pagineOral Rehydration SolutionAlkaNessuna valutazione finora

- Om Deutz 1013 PDFDocumento104 pagineOm Deutz 1013 PDFEbrahim Sabouri100% (1)

- PBL 2 Case PresentationDocumento12 paginePBL 2 Case PresentationRamish IrfanNessuna valutazione finora

- 2015 4-H Show & Sale CatalogDocumento53 pagine2015 4-H Show & Sale CatalogFauquier NowNessuna valutazione finora

- TCM Reach TrucksDocumento5 pagineTCM Reach TrucksMuhammad SohailNessuna valutazione finora

- Work of Asha Bhavan Centre - A Nonprofit Indian Organisation For Persons With DisabilityDocumento10 pagineWork of Asha Bhavan Centre - A Nonprofit Indian Organisation For Persons With DisabilityAsha Bhavan CentreNessuna valutazione finora

- DET Tronics: Unitized UV/IR Flame Detector U7652Documento2 pagineDET Tronics: Unitized UV/IR Flame Detector U7652Julio Andres Garcia PabolaNessuna valutazione finora

- Content of An Investigational New Drug Application (IND)Documento13 pagineContent of An Investigational New Drug Application (IND)Prathamesh MaliNessuna valutazione finora

- Electronic Over Current Relay (EOCR)Documento2 pagineElectronic Over Current Relay (EOCR)BambangsNessuna valutazione finora

- Supercritical Carbon DioxideDocumento3 pagineSupercritical Carbon DioxideRawda SeragNessuna valutazione finora

- MCS120 220 Error Ref - GAA30082DAC - RefDocumento21 pagineMCS120 220 Error Ref - GAA30082DAC - RefCoil98Nessuna valutazione finora