Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Billion Dollar Ideas

Caricato da

myownhminbox485Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Billion Dollar Ideas

Caricato da

myownhminbox485Copyright:

Formati disponibili

Management Tool Kit

Chris Manning Greg Lavery

Billion Dollar Ideas Finding Tomorrows Growth Engines Today

Contact Information Beirut Nabih Maroun Partner +961-3-278-851 nabih.maroun@booz.com Chicago Paul Leinwand Partner +1-312-578-4573 paul.leinwand@booz.com Cleveland Evan Hirsh Partner +1-216-696-1576 evan.hirsh@booz.com Dubai Karim Sabbagh Partner +971-4-390-0260 karim.sabbagh@booz.com Houston Kenny Kurtzman Partner +1-713-650-4175 kenny.kurtzman@booz.com London Jake Melville Partner +44-20-7393-3425 jake.melville@booz.com Greg Lavery Principal +44-20-7393-3333 greg.lavery@booz.com Mumbai Jai Sinha Partner +91-22-2287-2001 jai.sinha@booz.com New York Ken Favaro Partner +1-212-551-6826 ken.favaro@booz.com Justin Pettit Partner +1-212-551-6309 justin.pettit@booz.com Greg Rotz Partner +1-212-551-6821 greg.rotz@booz.com So Paulo Ivan De Souza Senior Partner +55-11-5501-6368 ivan.desouza@booz.com Sydney Chris Manning Partner +61-2-9321-1924 chris.manning@booz.com Tokyo Paul Duerloo Partner +81-3-6757-8615 paul.duerloo@booz.com

Tony Wessling also contributed to this Management Tool Kit.

Booz & Company

EXECUTIVE SUMMARY

Growth is back on the corporate agenda. But in todays flat global economy and with limited capital, executives at many companies need to find new sources of growth beyond the traditional avenues. To achieve new growth in this environment, companies need a robust framework that will enable them to develop a long list of opportunities, quickly assess them, and then focus on a short list of the very best ideas. For new growth initiatives to succeed internally and externally, this process must be comprehensive, efficient, rigorous, collaborative, and marketfocused. Booz & Companys Growth Lens methodology is an example of such a framework. It provides a set of five lensesshare of wallet, regulatory, technology/applications, capability, and business modelthat companies can use to generate long lists of new growth opportunities. It also offers a proven process for filtering ideas and building business cases for the most attractive opportunities.

Booz & Company

SEARCHING FOR NEW GROWTH

After several years in survival mode, companies in almost every industry are turning their attention to growth. But they are finding their options limited. Or worse, they are turning to the same set of ideas that were bouncing around the organization prior to the global financial crisis. Conventional avenues for growth include acquisition (either of a competitor or across the value chain), geographic expansion, and simply trying to outgrow competitors (through better pricing on the back of cost management, or by finding some form of differentiation in either products or services). The problem

is that these growth avenues, while well known, are limitedespecially when capital markets are tight and consumer demand is dampened. So how can companies meet shareholder requirements for above-average performance and the aggressive growth targets they imply? They must step out, expanding their horizons beyond business as usual, in order to identify and pursue new growth opportunities. Too often, companies fail to imagine and fully explore such opportunities because they have been focused on their existing businesses and markets

Many of todays largest companies achieved their greatest growth and success after recognizing and pursuing business opportunities far beyond their original offerings.

Booz & Company

so intently for so long. When this happens, they can miss new avenues of growth that could offer more lucrative rewards, potentially with less effort. In fact, many of todays largest companies achieved their greatest growth and success after recognizing and pursuing business opportunities far beyond their original offerings. Nokia, the worlds largest maker of mobile phones, was founded as a paper manufacturer. Nintendo made playing cards. American Express was an express mail service. Toyota started in the textile industry, making thread and looms. This is not to suggest that companies should wildly leap into new businesses or new markets. For every Nokia, Nintendo, American Express, or Toyota, there are scores of companies that fail to realize their new growth aspirations. Sometimes their search for new growth ideas is ad hoc and unfocused, and the best opportunities never surface. Sometimes companies implement

new ideas that are based on heroic or flawed assumptions. Sometimes they revive old ideas that didnt gain the support needed for implementation, often for good reason. In the worst cases, failed efforts can threaten the very survival of the company; even in the best cases, they are a waste of valuable time and resources. To reduce the risks and ensure that companies seeking new growth are directing their efforts and resources toward the best possible opportunities, senior executives need an idea generation and assessment process that can be described as follows: Comprehensive: ensuring that investment ideas stretch beyond existing thinking and are the best possible, not just the most obvious Efficient: ensuring that time, resources, and management attention are utilized properly Rigorous: ensuring that the criteria for the assessment and short-listing

of ideas are sound, unbiased, and fully articulated Collaborative: ensuring that the process draws on staff ideas, energizes the company, and garners wide support for implemented projects Market-focused: ensuring that the opportunities chosen for implementation will enable the company to secure an early-mover or other competitive advantage in the marketplace, thus setting up the venture for future success To meet the requirements listed, corporate leaders should use a standardized and proven framework for the surfacing and assessment of new growth opportunities. Booz & Company has created such a framework, which has been used by companies in a variety of industries and geographies to identify and successfully invest in new growth ideas: It is called the Growth Lens methodology.

Booz & Company

FIVE LENSES FOR GROWTH

growth market, it held less than 5 percent of a much larger market with numerous high-growth opportunities. The lenses focus a companys attention in five specific avenues of potential growth, collecting all of the new growth ideas related to each lens before moving on to the next (see Exhibit 1). Often, similar ideas are generated by different lenses. Thats OK. The point is that the lenses spark new thinking by redefining market boundaries in a nontraditional way. 1. Share of Wallet Lens The share of wallet lens focuses the idea generation effort on capturing a larger portion of the spending of existing customers by providing a wider range of products and services. The core question associated with this lens is What other products or services do our customers want or buy that we could potentially provide?

As the name implies, the Growth Lens methodology includes a set of lenses that are designed to expand a companys perspective on growth during the idea generation process and facilitate a fundamental redefinition of the size and shape of its markets. For instance, when a mining services company used the methodology in its quest to double revenues in three years, it identified a set of 13 opportunities, each of which had the potential to increase its annual revenue by US$1 billion. As a result, the company reframed the boundaries of its business: The methodology helped the company realize that although it held a 40 percent share of a low-

The share of wallet lens often surfaces ideas that create value for customers by offering one-stop shoppingwith all the savings in time and effort that entails. The benefits to the company include enhanced customer loyalty and lower churn, lower customer acquisition costs and cost of sales, and higher margins. These savings can be shared with customers in bundle or volume discounts. This lens requires a deep understanding of existing customers. For example, banks focus significant resources in data mining and understanding where they can cross-sell to customers across the full suite of financial services products including insurance, wealth management services and additional retail banking offerings. All designed to increase share of wallet and promote stickiness of the customer base. Richard Bransons Virgin Group has become a global conglomerate of more than

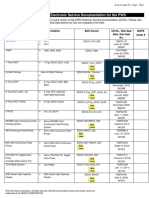

Exhibit 1 The Five Growth Lenses

1

Share of Wallet Lens Selling new products and/or services to existing customer segments

5

Business Model Lens Modifying how you do business to alter the customer value proposition in a market GROWTH Regulatory Lens Influencing and responding to new laws and regulations to create competitive advantage

4

Capability Lens Leveraging capabilities to create new offerings for existing markets or to enter new markets Technology/Applications Lens Developing applications of existing products or technologies for new markets

Source: Booz & Company

Booz & Company

300 companies by using its brand recognition and customer loyalty to offer consumer products and services in a wide variety of markets, including airlines, mobile phones, and fitness. Over the decades, auto manufacturers have repeatedly grown their share of wallet by expanding their product and service offerings. From manufacturing cars, many of them expanded into the retail sales of both new and used vehicles with company-owned and franchised dealerships. They offered repair services and aftermarket parts. Some of them built their share of wallet by adding financing, leasing, and insurance to their business portfolios. In each case, they captured new and profitable growth opportunities. The forces and trends that will affect customers in the future are also a rich source of ideas for new shareof-wallet growth. For example, both consumers and corporate buyers are increasingly seeking out green products. In response, companies such as Toyota, with its Prius hybrid vehicles, and GE, with its Ecomagination initiative, have successfully captured new and profitable revenue streams by meeting this demand. 2. Regulatory Lens The regulatory lens focuses idea generation on growth opportunities that stem from the requirements that governments, nongovernmental regulatory bodies, and large corporate customers impose on industries and markets. The core question associated with this lens is How can we shape or respond to the regulatory environment to create new and profitable business opportunities? The passing of new laws is the most common stimulus for new growth ideas in this lens. For example, the

emergence of regional and national emissions trading schemes around the world is creating a vast array of profitable business opportunities, from energy efficiency retrofits in buildings to carbon trading. J.P. Morgan tapped this source when it decided to develop its carbon trading capabilities in order to actively participate in the rapidly growing carbon marketa market that has grown from 9 billion (US$11.8 billion) in 2005 to 94 billion in 2009, an 80 percent compound annual growth rate. The private sector is increasingly imposing rules that govern markets and should also be considered when using the regulatory lens. For example, both Walmart and Procter & Gamble have imposed sustainability requirements on their suppliers. Given the large buying volume and market power of companies like these, such initiatives can become de facto industry standards. For example, when Walmart decided it would sell only concentrated laundry detergents to reduce shelf space, logistics, and packaging, the move precipitated a shift that affected every detergent manufacturer. Beyond reacting to regulation, companies can proactively shape the regulatory environment by influencing government actions and industry standards. And when they successfully shift the playing field to their advantage, they can prosper. For instance, Xeroxs competitors played an influential role in the U.S. Federal Trade Commissions decision to force the company to license the patents that enabled it to monopolize the plain paper copier business in the 1970s. This opened the market to low-cost Japanese competitors, such as Canon and Toshiba, and highend copier companies, such as IBM and Kodak.

3. Technology/Applications Lens The technology and applications lens focuses idea generation on how companies can apply their existing products and/or technologies to gain entry into new markets. The core question associated with this lens is Where could we use existing products or technologies to create customer value in a different market? For example, Black & Decker successfully applied its electric motor technology, developed for tools, to a vast array of other productsincluding toothbrushesto expand its markets and capture new growth. Kimberly-Clark has used its technology in paper manufacturing to create an expanded portfolio of products and drive growth (see Exhibit 2, page 6). The power of this lens derives from the fact that the products and technologies that will generate the new growth already exist. Often the company already has a competitive advantage and recognition in the market by virtue of its existing productsmany of which are proprietary. All that is necessary is to leverage them in different ways. Arm & Hammer accomplished this when it began promoting baking soda as an odor-eating air freshener, creating a huge new market. 4. Capability Lens The capability lens focuses the search for new growth opportunities on a companys greatest strengths: its core capabilities. These are formally defined as the explicit set of three to six mutually reinforcing capabilities that lead to the creation of cohesive corporate strategy that competitors cannot easily meet or beat. For example, Walmarts capabilities which include aggressive vendor management, point-of-sale data analytics, superior logistics, and rigorous

Booz & Company

working capital managementhave enabled it to pursue a low-price/highvolume strategy that its competitors cannot match. The core question associated with this lens is How can we use our capabilities to create new offerings for our existing markets or enter new markets? This lens generates growth ideas by exploring the business possibilities inherent to the companys capabilities to find opportunities to meet customer demands better than the market incumbents do. For example, the project management capability of a building company, which enables it to complete jobs on time and budget, might be employed gainfully to manage sporting events, such as Formula One motor races that require extensive track preparation, safety fencing, and temporary stand construction within tight time frames. When companies use the capability lens, they can often create chains of successful products that open new markets and win new customers. For example, a key Apple capability is

the seamless integration of different functionalities into digital devices. This led to the iPod, the iPhone, and most recently the iPada chain of products that has driven corporate growth to new heights and taken the company far beyond its roots in desktop computing. 5. Business Model Lens The business model lens focuses the new growth idea generation process on how modifications or format shifts in a companys business model can fundamentally alter the established customer value proposition in a market in the companys favor. Often, this enables the company to increase its margins, offer products at a lower price point than its competitors, and/or gain market share. The core question associated with this lens is How could we change the way we serve our customers to increase both our profitability and customer value? Most commonly, companies innovate with format shifts in their business models when sustained periods of poor industry returns force them to

rethink the way they do business. For example, when Fuji Xerox was facing closure in Australia because the cost of importing parts from Japan made it uncompetitive, it changed its business model. Instead of importing parts, it began remanufacturing components recovered from its installed base of copiers. Not only did this enable the business to return to profitability, but the new model was adopted internationally by Xerox and won global environmental awards. But the business model lens should not be reserved for crises. A significant source of its power is that it can be proactive and forward-lookingit enables companies to identify business model innovations that surprise competitors and customers, providing enhanced competitive advantage and profitability. Consider Dell, which perfected a direct-to-customer distribution model that blindsided the computer industrys major players. Southwest Airliness short-haul, point-to-point model allowed it to successfully compete at a lower price point than traditional hub-and-spoke carriers with high fixed costs.

Exhibit 2 Kimberly-Clarks Technology-Driven Growth

Core Technology

Feminine pads and kitchen towels

Creped cellulose wadding technology

CORE PRODUCTS Paper Tissues Technology adjacencies Expansion Opportunities Floor cleaning products

Diapers, swim pants, and training pants for children

Source: Booz & Company

Booz & Company

THREE ELEMENTS OF A HIGH-QUALITY SELECTION PROCESS

least attractive opportunities while focusing ever-greater attention on the most promising opportunities at each subsequent level of analysis. The Growth Lens methodology accomplishes this through an iterative process that includes four filtering stages. The number of ideas (companies often generate more than 100 ideas using the lenses) is reduced in each stage until only the top five remain. Filtering the ideas in the initial stage requires the development of a set of company-specific pass/fail criteria, such as whether the opportunity is above a threshold minimum revenue size, whether it will be profitable in the desired time frame, whether the sector margins are above acceptable levels, or whether the space is dominated by incumbents. These criteria are used to evaluate the ideas, and any idea that fails to meet any of the criteria is eliminated. Typically, this will reduce the opportunity list by two-thirds or more. In the next filtering stage, the remaining ideas are evaluated in greater detail, typically by a team of senior executives who have a

strategic-level view of the entire company. At this stage, ideas must pass scrutiny in terms of both market attractiveness and the companys ability to compete. Criteria used here include investment required, market growth rate, competitive advantage, and ability to enter. The third filtering stage, which usually includes fewer than 20 growth opportunities, involves the preparation of a mini business case for each idea, incorporating details of the market, target customer segments, products, value proposition, competitors, distribution, economics, and risks. These cases enable the senior executive team to evaluate each opportunity in a more detailed and rigorous way and reduce the ideas to the top five. In the final stage, detailed business cases are built for the remaining opportunities, including highlevel implementation plans, growth pathways, risk-mitigating actions, financials, partners, etc. The executive team can then pick which of the opportunities it will pursue, prioritize them, and allocate investment funds.

Companies that use the five growth lenses typically generate long lists of potential growth opportunities. But in and of themselves, lists are of little value. Companies need a way to assess the ideas they generate and then prioritize them, identifying and selecting the very best ideas for implementation. This requires a methodology that includes three elements that are vital to a rigorous and efficient ideation and assessment process: an iterative filtering framework, facilitated workshops, and fact-based assessment of ideas. 1. Iterative Filtering Framework The filtering framework enables companies to short-list the growth ideas generated from the five lenses. An efficient, effective filtering framework should allow the company to quickly eliminate the

Booz & Company

2. Facilitated Workshops The idea generation and assessment processes are typically executed in facilitated workshops. Expert facilitation helps minimize the politics and power plays that often occur when executives become enamored with pet projects, ensures that all ideas are drawn out, captured, and acknowledged, and keeps the process on track. Ideation workshops should include a cross-section of the company if they are to generate a robust list of ideas. Often, companies conduct a series of workshops early in the ideation process with representatives from across the organization to ensure that they are capturing ideas from all divisions and most staff levels. Adopting an inclusive approach also sets the stage for implementation success because it generates crossorganization ownership. Facilitated workshops also enable strands of ideas to be woven into coherent new ideas. Half-thoughts are often voiced and captured in workshops and then built on,

resulting in creative and innovative opportunities. When a leading Australian construction company used the Growth Lens methodology, it brought together in a series of ideation workshops more than 40 staff members from different levels and departments throughout the company. (It also interviewed a number of key clients and mapped the best growth strategies among a global set of construction companies.) More than 100 growth opportunities were identified in three facilitated workshops conducted in a half-day. The most attractive opportunity, surfaced using the capability lens, was an untapped $700 million highmargin market related to climate change, which is now being pursued by the company. 3. Fact-Based Assessment of Ideas Finally, having the appropriate information and skills to conduct fact-based analysis is vital to the credibility of the opportunity development process. The approach requires the following:

Access to a global network of expertise that can be tapped to identify best practices and provide analogous situations from which companies can learn. A global market scan of how best-practice companies in the same industry have solved the growth challenge can provide a wealth of ideas. The involvement of a broad range of industry- and sector-specific experts who can provide the facts needed to evaluate an opportunity that lies outside the companys current businesses. Experts may also be needed to provide information on the latest developments in new technologies, customer needs and trends, the regulatory arena, and business models. The skills to rapidly and objectively build and examine business cases using unambiguous quantitative evidence, which calls for capabilities and experience in corporate strategy, due diligence, business development, research, and financial modeling.

Booz & Company

About the Authors Chris Manning is a Booz & Company partner in Sydney. He leads the firms strategy practice in the region and specializes in developing innovative growth strategies designed to deliver sustainable competitive advantage for clients. Dr. Greg Lavery is a Booz & Company principal based in London. He is a member of the strategy practice and has helped a wide variety of companies develop and implement growth and profit improvement strategies. He is also a member of Booz & Companys low carbon and sustainability team.

NEW GROWTH HORIZONS

As economist and Nobel Prize winner Thomas Schelling says, One thing a person cannot do, no matter how rigorous his analysis or heroic his imagination, is to draw up a list of things that would never occur to him. But as illogical as it may sound, this is exactly what companies must strive to do if they are to succeed in low- and no-growth economies. And it can be doneif they use an idea generation and assessment process that enables them to reach past their current limitations and grasp the large number of growth opportunities that exist beyond business as usual.

Booz & Company

The most recent list of our offices and affiliates, with addresses and telephone numbers, can be found on our website, www.booz.com.

Worldwide Offices Asia Beijing Delhi Hong Kong Mumbai Seoul Shanghai Taipei Tokyo Australia, New Zealand & Southeast Asia Adelaide Auckland Bangkok Brisbane Canberra Jakarta Kuala Lumpur Melbourne Sydney Europe Amsterdam Berlin Copenhagen Dublin Dsseldorf Frankfurt Helsinki Istanbul London Madrid Milan Moscow Munich Oslo Paris Rome Stockholm Stuttgart Vienna Warsaw Zurich Middle East Abu Dhabi Beirut Cairo Doha Dubai Riyadh North America Atlanta Chicago Cleveland Dallas DC Detroit Florham Park Houston Los Angeles Mexico City New York City Parsippany San Francisco South America Buenos Aires Rio de Janeiro Santiago So Paulo

Booz & Company is a leading global management consulting firm, helpingthe worlds top businesses, governments, and organizations. Our founder, Edwin Booz, defined the profession when he established the first management consulting firm in 1914. Today, with more than 3,300 people in 61 offices around the world, we bring foresight and knowledge, deep functional expertise, and a practical approach to building capabilities and delivering real impact. We work closely with our clients tocreate and deliver essential advantage. For our management magazine strategy+business, visit www.strategy-business.com. Visit www.booz.com to learn more about Booz & Company.

2010 Booz & Company Inc.

Potrebbero piacerti anche

- Shortened WildernessRemoteFirstAidReferenceGuideDocumento120 pagineShortened WildernessRemoteFirstAidReferenceGuidemyownhminbox485100% (1)

- Aio Bios FW Sop Win7Documento20 pagineAio Bios FW Sop Win7myownhminbox485Nessuna valutazione finora

- Ipad User GuideDocumento169 pagineIpad User GuideEmilIancuNessuna valutazione finora

- Msva ManualDocumento207 pagineMsva Manualfudoken666Nessuna valutazione finora

- Emergency Rediplan: Four Steps To Prepare Your HouseholdDocumento17 pagineEmergency Rediplan: Four Steps To Prepare Your Householdmyownhminbox485Nessuna valutazione finora

- Msva ManualDocumento207 pagineMsva Manualfudoken666Nessuna valutazione finora

- How Do You Design (Design-Process)Documento147 pagineHow Do You Design (Design-Process)api-3823912100% (5)

- National Trunk Road Map1-2Documento1 paginaNational Trunk Road Map1-2myownhminbox485Nessuna valutazione finora

- London MapDocumento1 paginaLondon MapmimegumiNessuna valutazione finora

- Network Rail National MapDocumento1 paginaNetwork Rail National Mapmyownhminbox485Nessuna valutazione finora

- BoozCo The 2012 Global Innovation 1000 Media ReportDocumento22 pagineBoozCo The 2012 Global Innovation 1000 Media Reportmyownhminbox485Nessuna valutazione finora

- First Great Western Network MapDocumento2 pagineFirst Great Western Network MaptoobaziNessuna valutazione finora

- Ifw Process GimDocumento24 pagineIfw Process Gimmyownhminbox485Nessuna valutazione finora

- Rebuilding LegoDocumento12 pagineRebuilding Legomyownhminbox485100% (3)

- POV Corporate Immune SystemDocumento7 paginePOV Corporate Immune Systemmyownhminbox485Nessuna valutazione finora

- Csi Continual Service Improvement Itil v3Documento1 paginaCsi Continual Service Improvement Itil v3myownhminbox485Nessuna valutazione finora

- More4 GuidelinesDocumento13 pagineMore4 Guidelinesmyownhminbox485Nessuna valutazione finora

- Brand Standards Manual IssuuDocumento52 pagineBrand Standards Manual Issuumyownhminbox485Nessuna valutazione finora

- Customer InsightDocumento4 pagineCustomer Insightmyownhminbox485Nessuna valutazione finora

- Rebuilding LegoDocumento12 pagineRebuilding Legomyownhminbox485100% (3)

- Achieving Cost LeadershipDocumento8 pagineAchieving Cost Leadershipmyownhminbox485Nessuna valutazione finora

- Emeli Sande Clown TextDocumento2 pagineEmeli Sande Clown Textmyownhminbox485Nessuna valutazione finora

- PTP ProcessesDocumento4 paginePTP Processesmyownhminbox485Nessuna valutazione finora

- MOPAR CatalogueDocumento14 pagineMOPAR Cataloguemyownhminbox485Nessuna valutazione finora

- Cheverolet Trax Brochure 2013Documento6 pagineCheverolet Trax Brochure 2013myownhminbox485Nessuna valutazione finora

- Urbaser LATOP SPDocumento2 pagineUrbaser LATOP SPmyownhminbox485Nessuna valutazione finora

- 2004 KJ LibertyDocumento374 pagine2004 KJ LibertyAlberto Gonzalez Luque100% (1)

- MiPal Tablet PC IMDocumento45 pagineMiPal Tablet PC IMmyownhminbox485Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Xerox C315 MFP SM Initial PDFDocumento544 pagineXerox C315 MFP SM Initial PDFjorgeNessuna valutazione finora

- Xerox 7220-7225 Service ManualDocumento1.022 pagineXerox 7220-7225 Service Manualjannnu_sb94% (18)

- VB6BR 01u PDFDocumento4 pagineVB6BR 01u PDFRumen StoychevNessuna valutazione finora

- Faliure of Xerox: Prakriti Sanganeria BBA-3B Marketing Management 28905021093Documento13 pagineFaliure of Xerox: Prakriti Sanganeria BBA-3B Marketing Management 28905021093Prakriti SanganeriaNessuna valutazione finora

- Xerox Color C60/C70 Series Printer: Customer Expectation & Installation GuideDocumento34 pagineXerox Color C60/C70 Series Printer: Customer Expectation & Installation GuideChenna VijayNessuna valutazione finora

- Xerox Products Affected by Latest Encryption ProtocolsDocumento4 pagineXerox Products Affected by Latest Encryption ProtocolsApsara DilakshiNessuna valutazione finora

- BLI Report Xerox Versant 80Documento26 pagineBLI Report Xerox Versant 80Steve ManloveNessuna valutazione finora

- MAM Spring 2019 SPDocumento188 pagineMAM Spring 2019 SPFaysal KhanNessuna valutazione finora

- Xerox CAD Reprographics BrochureDocumento8 pagineXerox CAD Reprographics BrochureVignesh RNessuna valutazione finora

- Adler and Borys - 1996 - Two Types of Bureaucracy Enabling and CoerciveDocumento30 pagineAdler and Borys - 1996 - Two Types of Bureaucracy Enabling and CoerciveAndreaNessuna valutazione finora

- Xerox 6204Documento176 pagineXerox 6204BzsNessuna valutazione finora

- Xeroxwc3655 Service ManualDocumento462 pagineXeroxwc3655 Service Manualmeta4tech218578% (9)

- Xerox - History, Products, & Facts - BritannicaDocumento8 pagineXerox - History, Products, & Facts - BritannicanguyentuandangNessuna valutazione finora

- Xerox EX 180 Print Server Powered by FieryDocumento4 pagineXerox EX 180 Print Server Powered by FieryChenna VijayNessuna valutazione finora

- The Strategy of International BusinessDocumento19 pagineThe Strategy of International BusinessMurat BasimtekinNessuna valutazione finora

- 7500 SDocumento13 pagine7500 SAmr H Fadl HNessuna valutazione finora

- Physics 1 Research Paper XEROX MACHINEDocumento4 paginePhysics 1 Research Paper XEROX MACHINECorazon GerodiasNessuna valutazione finora

- Curriculum Vitae: Ranjeet BashyalDocumento5 pagineCurriculum Vitae: Ranjeet Bashyalp4passaNessuna valutazione finora

- Identify PDFDocumento31 pagineIdentify PDFAnonymous GKqp4Hn100% (1)

- Chapter 01 Introduction To M and ADocumento28 pagineChapter 01 Introduction To M and ASattagouda M PatilNessuna valutazione finora

- Product Design: BITS PilaniDocumento36 pagineProduct Design: BITS PilaniSabir Jadeja100% (1)

- ServitizationDocumento24 pagineServitizationjamal yousufiNessuna valutazione finora

- ContentGuard Complaint 121813Documento65 pagineContentGuard Complaint 121813belrilNessuna valutazione finora

- Edoc ListDocumento11 pagineEdoc Listluismiguel1789Nessuna valutazione finora

- Innovation Master Plan Chapter 3Documento25 pagineInnovation Master Plan Chapter 3Alejo Orjuela GarzonNessuna valutazione finora

- CH 3 Stra IntentDocumento14 pagineCH 3 Stra IntentAnjali Angel ThakurNessuna valutazione finora

- Xerox® EX-i 80 Print Server Powered by Fiery®: Parts List: Spare Parts and Part NumbersDocumento4 pagineXerox® EX-i 80 Print Server Powered by Fiery®: Parts List: Spare Parts and Part NumbersПетърХристовNessuna valutazione finora

- Factbook 2004-2005Documento52 pagineFactbook 2004-2005Rumen StoychevNessuna valutazione finora

- Sample Case For Analysis - Xerox Works To Meet Environmental ChallengesDocumento2 pagineSample Case For Analysis - Xerox Works To Meet Environmental ChallengesCyra CastroNessuna valutazione finora

- Corporate and Accounting Scandals Ethics XEROX PaperDocumento11 pagineCorporate and Accounting Scandals Ethics XEROX Paperahuatay100% (3)