Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Essay On Liberalization and Its Impact On The Indian Economy

Caricato da

Aravind MenonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Essay On Liberalization and Its Impact On The Indian Economy

Caricato da

Aravind MenonCopyright:

Formati disponibili

Essay on Liberalization and Its Impact on the Indian Economy

preserv earticles.com Essay on Liberalization and Its Im pact on the Indian Econom y Int roduct ion: The Econom ic reform s currently underway in India represent both continuity and a break with India's postindependence dev elopm ent. Its m ain objectiv e is to restore sustained high growth to allev iate pov erty and raise the standard of liv ing. Development of Thought : Changes in the policy packages towards deregulation, liberalization and opening up of the econom y were initiated in the late 7 0s and early 80s but it was not until 1 9 9 1 that m ajor econom ic reform s were undertaken. The m ajor changes in India's econom ic reform s fall broadly under fiv e heads-industrial, trade, financial, fiscal and m onetary . Howev er these m easures of stabilization are not by them selv es enough. The m ain im petus for sustainable econom ic growth has to originate with efficiency and productiv ity growth brought about through the expansion of inv estm ent and exports. Another im portant aspect to be considered is the large num ber of people in the country liv ing on the pov erty line. To m ake any reform process socially acceptable a pov erty allev iation program m e m ust be in. In the context of resource constraints, a serious thinking has to be done as to the extent and pace of econom ic reform s. Conclusion: India has to go through a painful period of adjustm ent before the liberalization can hav e its fruitful im pact upon the econom y . In liberalizing the econom y the gov ernm ent m ust not forget to protect the poor and the needs of hum an dev elopm ent. The present bout of econom ic reform s in India-those started in the nineties- m arks both continuity and a break with India's post-independence dev elopm ent strategy . India's dev elopm ent strategy after independence was largely influenced by reserv ation regarding the ability of the m arket forces to bring about, on their own, an optim um allocation of resources, thus balancing the country 's two m ain "Objectiv es "growth' and 'equity '. A realization has since dawned on policy -m akers, based on India's own experience and the experience of other countries, that: The dom estic econom y has now reached a threshold where for better utilization of resources the benefits of the m arket forces can be harnessed, by proper m arket-friendly m acro and m icro- econom ic policies helping both in higher growth and m ore equity . This has initiated a serious debate in the country on our dev elopm ent strategy for opening up the econom y and allowing m ore m arket orientation, by rem ov ing m ajor Gov ernm ent interv entions and regulations. Since 1 9 7 7 , and specially after 1 9 85-86 , the Gov ernm ent has em barked upon a series of econom ic reform s leading towards liberalization and deregulation Subsequently , there has been a significant im prov em ent in the growth rate of the country -from the long existing, low rate of incom e growth of 3 .5 percent to an av erage growth rate of 5.5 per cent and abov e. As noted, the changes in the policy packages towards deregulation, liberalization and opening up of the econom y had been initiated in the late 7 0s and early 80s. These changes were not sy stem atic and were nev er integrated into an ov erall fram ework. According to m any econom ists, these changes were rather slow but not m onotonic, until July 1 9 9 1 when the new Congress Gov ernm ent cam e to power. Since then the change in the policy packages hav e picked up m om entum . There hav e been m ajor changes since July 1 9 9 1 . The present Man Mohan Singh led Congress Gov ernm ent cam e into power in 2 004 . It has further extended the liberalization policy started in 1 9 9 1 . In its 2 004 -2 005 and 2 005-2 006 budgets, the gov ernm ent has brought along with alm ost sim ultaneous changes in trade and finance announced outside the Budget. These changes are prim arily confined to Central Gov ernm ent activ ities and hav e not been giv en an} general

policy directiv e to integrate with the ov erall policy packages of the State Gov ernm ent. The m ajor changes in India's econom ic reform s fall broadly under fiv e heads-industrial, trades, financial, fiscal and m onetary . The Gov ernm ent's key econom ic objectiv e is to restore sustained high growth which is essential to allev iate pov erty and raise the standard of liv ing. In pursuit of these objectiv es the Gov ernm ent's reform strategy aim s at achiev ing ov er the course of the next fiv e y ears: (1 ) a liberalized trade regim e characterized by tariff rates com parable to other industrializing dev eloping countries and the absence of discretionary im port licensing (with the exception of a sm all negativ e list); (2 ) an exchange rate sy stem which is free of the locativ e restrictions of trade; (3 ) a financial sy stem operating in a com petitiv e m arket env ironm ent and regulated by sound prudential norm s and standards; (4 ) an efficient and dy nam ic industrial sector subject only to regulations relating to env ironm ental security , strategic concerns- industrial safety and unfair trading and m onopolistic practices; and (5) an autonom ous, com petitiv e and stream lined public enterprise sector geared to the prov ision of essential infrastructure goods and serv ices, the dev elopm ent of key natural resources and areas of strategic concern. It inv olv es taking ev ery step necessary to ensure that the burden of adjustm ent is fairly distributed and that the v ery poor are protected. As a first step in this direction the Gov ernm ent has established a National Renewal Fund to prov ide social safety net. The thrust of the reform program m e would initially be on casing the country 's extrem ely tight external pay m ents situation and reducing inflation. In this context, the Gov ernm ent intends to pursue a. stab le exchange rate policy geared to m aintain the rupee constant in nom inal term s- and to rely on fiscal adjustm ent accom panied by a tight m onetary policy to contain inflation. But this is an initial phase. Stabilization by itself is not enough. As traditional dem and im pulses originating from fiscal policy will rem ain constrained in the next two to three y ears, the m ain im petus for sustainable econom ic growth has, to originate with efficiency and productiv ity growth brought about through the expansion of inv estm ent and exports. Under-pinning such a path of growth m ust be a consistent and com prehensiv e structural reform s strategy designed to prom ote exports, to im prov e the relationship between the return on inv estm ent and the cost of capital, and to increase the degree com petition between firm s in the dom estic and external m arkets so that there are adequate incentiv es for upgrading the technology , im prov ing efficiency and reducing costs. The m ain em phasis of the fiscal policy is to reduce the Central Gov ernm ent's fiscal deficit, within the broader context of adjustm ent of the ov erall public sector budget. Reducing the ov erall public sector budget will require increased financial discipline by the State Gov ernm ent as well, and the Central Gov ernm ent will encourage the State Gov ernm ent to take steps to im prov e their fiscal perform ance and to stream line the working of the enterprises. In this context a com prehensiv e tax reform is proposed. It will im prov e: (i) the elasticity of tax rev enue through identification of new areas and increasing the share of direct tax a proportion of total tax rev enue, (ii) a m ore equitable and broad based sy stem particularly with regard to com m odity taxation and personal taxation, (iii) the rem ov al of anom alies that distort econom ic incentiv es and sim plification and rationalizations of custom s, tariffs, elim ination of exem ptions as well as a reduction the av erage lev el of tariffs and finally im prov e com pliance of direct taxes and strengthen enforcem ents. In this context also, the need for rationalization and reduction of subsidies and for m ov ing to a m ore objectiv e sy stem of adm inistered price has been em phasized. Regarding exchange rate policy it em phasized the adjustm ent of exchange so as to prov ide a significant real depreciation, to im prov e export incentiv es and international com petitiv eness. In this context the Gov ernm ent

intended to keep the nom inal exchange rate stable by a suitable fiscal and m onetary policy . In the im m ediate future, to achiev e stabilization. Gov ernm ent v isualizes a tightening of credit and m onetary policies, free higher interest rates and higher cash reserv e ratios. It also proposes, by declining the recourse to financial sav ings the Gov ernm ent, a larger v olum e of supply of dom estic credit to the priv ate sector. The Gov ernm ent recognizes that trade reform is an essential elem ent securing supply response to facilitate the ov erall restructuring of the econom y and to restore external pay m ent v iability . There are fiv e key m edium term objectiv es in the Gov ernm ent's trade policy agenda: (1 ) The broadening and im plication of export incentiv e m easures and the rem ov al of restrictions on exports: (2 ) The elim ination of quantitativ e restrictions on im ports; (3 ) Substantial retail in the tariff rates; (4 ) The decanalisation of exports and im ports with the exception of a few item s and finally m ov ing to a foreign exchange sy stem which is free of locativ e restrictions for trade. The Gov ernm ent also recognizes that the tem porary restriction on im port which had to be im posed by the Reserv e Bank of India no to be relaxed. The Gov ernm ent recognized that a m ajor restructuring of Indian econom y , im plied by its agenda, will v ery m uch depend on the success of its industrial policy reform s. In this context a large num ber of sick firm s which constitute drain on the Gov ernm ent budget, with their unpaid outstanding loans, weaken the financial sy stem , in m any cases with the firm s closing down leav ing their creditors unreim bursed, hav e to be taken care of. For the restructuring of existing sick and loss-m aking com panies, both in the public and priv ate sector, Gov ernm ent will rev iew the existing prov isions of v arious laws gov erning labour relations, the State and the local gov ernm ent's role in restructuring regulation gov erning transfer of land, the procedure of liquidation under the Com panies ACT and other relev ant aspects. The Gov ernm ent is aware that the prerequisite of hav ing a safety net or social insurance schem e is to prov ide support for displace workers in the organised sector. The Gov ernm ent's industrial policy strategy m arks a m ajor step forward towards changing the regulatory structure of industries. It initiated m ajor changes, including com prehensiv e deli censing, abolition entry controls related to the MRTP Act and autom atic approv al of foreign technology agreem ents and foreign inv estm ents, am ong others. The changes policies concerning foreign technology and foreign inv estm ent will enable Indian industries to forge m uch m ore with foreign inv estors and suppliers of technology than has been possible in the past. The Gov ernm ent's ownership of the financial and banking institutions enabled it to achiev e the m ultiple objectiv es of m obilization of resources integration of the rural population into the financial m ainstream , enhancem ent av ailability of long-term loans to all lev els of industry and agriculture and increased access to credit to sm all industrialists, farm ers and weaker sections of sock. Howev er, there are weaknesses and im balances. The statutory liquidity ratio and cash reserv e ratio lev els are high, which im plies low return for com m ercial banks on their funds. This reduces the reserv es av ailable to nonpriority borrowers and raises their costs in m ov ing to m arket based operations of the financial institutions. Measures hav e been taken to strengthen the capital m arkets, the rates for debentures hav e been freed, and m utual funds hav e been opened to the priv ate sector and the full statutory powers are to be giv en to independent agencies to regulate security m arkets. The high lev el Narasim ham Com m ittee had been established to rev iew the structure. In line with the recom m endations of the Narasim ham Com m ittee further reform s of the financial sector will be form ulated to increase the efficiency of the financial interm ediation. The m easures required to m eet these objectiv es would particularly inv olv e a phased reduction of priority lending schem es towards the targeted deserv ing groups and ev entual elim ination of the subsidies inv olv ed, form ulation of prudential norm s and standards to guide efforts in recapitalization of the banking sector and full decontrol of deposit rates.

India's sev erely constrained budgetary circum stances create both the need and the opportunity for placing greater reliance on the priv ate sector for resources m obilization and inv estm ent. Public enterprises prov ide m any of the basic and critical inputs in India. It is a m atter of serious concern that inadequate attention has been paid to im prov ing their efficiency . In the context of public enterprise structuring it will be im portant to assess the social cost inv olv ed, with the closure of sick units, and to dev elop options and m easures for com pensation of retrenched labour. Enterprises in areas judged appropriate for continued public sector inv olv em ent will be prov ided with greater degree of m anagerial autonom y along with a progressiv e reduction in budgetary transfers and loans. Sale of selected firm s or partial div estm ent for specific sectors is being increasingly , pursued. The Gov ernm ent recognizes that adjustm ent program m es entail significant transitional cost. This cost includes potential loss of output, em ploy m ent and consum ption due to the deflationary im pact of fiscal consolidation and frictions in the restructuring process which m ust be equitably borne by all sections of the society . Howev er, a large proportion of India's population continues to be subject to m alnutrition and ill health. For this group, the Gov ernm ent is com m itted to m inim ise their share of the burden of adjustm ent. Thus the Gov ernm ent should prov ide higher outlay s on elem entary -education, rural drinking water supply , assistance to sm all and m arginal farm ers, program m es for wom en and children, program m es for welfare of scheduled caste and scheduled tribes and the weaker sections of the society , and increased expenditure on infrastructure and em ploy m ent generation projects in rural areas. Further steps hav e to be taken to re-allocate social expenditure, particularly in health and education for the poor. Additional cost-effectiv e com pensatory program m es, particularly in the areas of nutrition and em ploy m ent, should be strengthened and broadened. In this context the establishm ent of a National Renewal Fund has been proposed. Against this backdrop of proposed policy changes, the first set of changes introduced by the Gov ernm ent com prises increasing of taxes and reduction in Gov ernm ent expenditure, in order to reduce the deficit. Sim ultaneously , there hav e been adjustm ents in the exchange rates to m ake exports m ore attractiv e and to control im ports to narrow the balance of pay m ent gap. Along with this a tight m onetary policy was followed. Subsequent assessm ents howev er rev ealed that these m easures were insufficient to reduce excess dem and for im ports. Consequently , the Gov ernm ent im posed em ergency credit restrictions on im ports. Unfortunates although the Gov ernm ent took tim ely m easures in the field of trade, industrial policy and fiscal m easures, it took a com parativ ely longer tim e to introduce financial liberalization m easures, public enterprise reform and m easures affecting the m obility of labour and capital which are norm ally known as entry /exit policy . By introducing all these changes, the Gov ernm ent has been successful in its stabilization attem pts to a certain extent. For instance, the foreign exchange reserv e has reached 1 2 8.9 billion $ on 4 February , 2 005, increasing by $3 1 billion from 2 003 -04 , though it should be realized that this benefit is only a one tim e gain, resulting prim arily from m ultilateral aids. Thus a m ajor part of m ultilateral aid has been used for debt serv icing. Ev en NRI outflow which increased $1 0.2 billion in 2 002 -03 to $1 4 .3 billion in 2 003 -04 . Thus, the net inflow is still positiv e. There are differences of opinion as to the potential adv erse effect of attaining stabilization by this m ethod. For exam ple, to reduce the gap the contribution of export growth has long term stable im plications, but resorting to too m uch im port com pression, will affect adv ersely the possibility of export growth, and m ay prov e to be selfdefeating, especially if the im port com ponent of non-tradition exports is v ery high. The 2 005-06 budgets further has accelerated the reform process by reducing the deficit to 4 .3 per cent of GDP but again by a m odest increase in rev enue and a heav y reduction in expenditure, especially expenditure on capital form ation and on hum an dev elopm ent. For further reduction in fertilizer subsidy , nothing has been worked out. With regard to the im pact of econom ic reform s on social expenditure and pov erty allev iation it is noted that the reform s hav e affected public expenditure and m any of the key social serv ices areas like health, sanitation, water supply etc. which contribute to the welfare of the poor. It does not m ean that there is no scope for econom izing these expenditures but it im plies that it should be done

carefully . Any across the board reduction m ay be politically and adm inistrativ ely easy but would be harm ful to the poor. The essence of the present econom ic reform s, understandably , is to resort to the m arket and m ake price corrections according to the relativ e scarcity v alues and rates of returns for all inputs in the productiv e sy stem . But experience shows that in the long run, when the econom y is not growing at a fast pace (i.e., under a concretionary stabilization phase) these price shifts results in the reduction in the reduction in the welfare of som e sections of the society while benefiting other sections, both in absolute and relativ e term s. The fall in real consum ption per has resulted in a significant increase in the lev el of pov erty ratio and accordingly the num ber of people below the pov erty line. A conserv ativ e estim ate using Planning Com m ission m ethodology and database shows that nearly 6 to 7 Billion people went down the pov erty line during this period. This is a contrast with an annual im prov em ent of nearly 1 0 to 1 5 m illion m ov ing abov e the pov erty line ov er the last decade. Thus ov erall, it m akes a difference in term s of a in the pov erty allev iation pace by nearly 2 0 m illions, with reference to the trend v alues. This scenario has high political and social sensitiv ity . In order m ake the reform process m orally and socially acceptable and politically feasible, conscious positiv e program m e on pov erty allev iation will be needed. The need for such a program m e will be m ore felt if the m essage is that the present structural adjustm ent phase will last for m ore than 3 to 4 y ears. The econom ic reform process also breeds a class of "new poor". These are the people who will be affected by the restructuring process through 'closures', m any of them are at the higher and m iddle incom e lev el, m ostly in the organised or and easy to identify . They are the target groups which can be cov ered by the National Renewal Fund. In this context it should be noted that already there has been a significant increase in the percent of unem ploy ed. To prov ide a cushion to the poor against high price increase, the Gov ernm ent uses the Public Distribution Sy stem (PDS); howev er its effectiv eness needs to be im prov ed. For lance: (I) The inter-State PDS's allocation is m ade on a per capita basis regardless of incom e; (2 ) within a giv en area the poor-incom e groups are not functionally the m ost im portant beneficiaries of the PDS. In West Bengal, for am ple, the PDS financed 54 per cent of wheat consum ption of the rural highest incom e groups; (3 ) the PDS is grossly inadequate, especially in areas with high pov erty intensity . The incom e of the poor is m uch too low to take adv antage ev en of the PDS; and finally , the whole approach towards im pact on the v ulnerable section of the society should be rev iewed in the light of reduced public expenditure on social program m es. For exam ple, cuts in the health program m e could lead to increase in India's already high incidence of tropical diseases. In addition, a poor location program m e has its im pact not only on the rural wage of the poor but also in the driv e for export growth and adoption of better technology , by m aking the labour force m ore illiterate. The stabilization package is giv ing the anticipated results: it has also skillfully com bined som e of the structural adjustm ent changes. Howev er, the adequacy of the structural adjustm ent elem ents and the growth factors in the stabilization program m e of the Gov ernm ent has been questioned by m any econom ists. It is that m any of the m easures taken are on the soft side, as it does not rem ov e m any im plicit subsidies. In this context, m easures to contain the Gov ernm ent wages bill hav e not been giv en proper priority . With regard to taxation, it is felt that ev en now, the indirect tax rates in India, particularly on im ports, are v ery high com pared to other LDCs. Of the m easures on adjustm ent that hav e bet im plem ented, alm ost all are in the Central Gov ernm ent sector; whereas substantial fiscal deficit exists in the States, alm ost close to that of the Centre of nearly 1 .8 per cent of GDP. More exhaustiv e m easures need to be taken to curtail the States' expenditure pattern. With regard to the cut in the capital expenditure, is rightly realized that there are m any wasteful expenditure item s in the present com position of public inv estm ent. One should, howev er, be cautious not to reduce them indiscrim inately , since in this process, along with the unproductiv e, productiv e sectors, also m ay suffer a cut.

The 'exit rules' constraining firm s from liquidating their assets or retrench workers, rem ain m ajor hindrances to im prov ing their efficiency and new inv estm ents in the organised sector. Any postponem ent of a policy in this arc does not fit with the basic philosophy of structural reform and efficiency . As to the role of foreign inv estm ent, they should be giv en m ore open-ended facilities since ev en now there rem ain a large num ber of constraints in the form Gov ernm ent restrictions on rem ittances of profit, and Gov ernm ent's approv al required for som e m ajor productiv e sectors. In the field of financial liberalization a quicker action is needed on the Narasim ham Com m ittee's Report. Without a sound financial superstructure the passage to the m arket sy stem m ay result problem s, as was observ ed in the stock m arket debacle v ery recently . The financial reform s would strengthen the prudential financial recov eries and allow priv ate banks, foreign and dom estic, to bring com petition to the financial sector. In the field of agriculture, no specific action has been taken for its betterm ent. This is the area where coordination with the States Rector would be required. Public sector needs greater positiv e reform s in addition to reduction in the capital expenditure as giv en in the last two Budgets. The public sector should be allowed to adjust to the new policy fram e by focusing on issues like: (i) priv atization and (ii) closure of enterprises that would not surv iv e in a com petitiv e env ironm ent. Finally , although India has successfully div ersified and expanded its export base, the m ajor contribution in India's export growth has com e from the dem and pull of the receiv ing countries (especially the dev eloped countries). Only a v et; sm all portion can be accounted for by changes in m arket com position and price com petitiv eness. Indeed it is only the price factor and a prudent spread ov er different m arkets which can help in further increasing India's exports, in future. This is true especially when the international trade buoy ancy does not giv e rise to m uch optim ism . Howev er, for increasing exports, apart from reducing dom estic costs, the country will-need better links, with the international m arket. For this efficient transport and com m unication links will be needed to back our trade an inv estm ent policy . It is the experience of m ost countries that in the process of reducing costs and im prov ing quality of products the role of literate labour force and skilled m anpower should get high priority . Indeed, absorbing higher technology needs a correspondingly well-trained, literate and healthy labour force. In this context the heav y cut in hum an dev elopm ent expenditure under the recent budget and the low em phasis on dom estic R&D (needed to im prov e the ability to absorb and indigenize foreign technology ) are disappointing. India initiated the process of econom ic reform s with sev eral handicaps. A high pov erty ratio with nearly 3 2 to 4 0 per cent of the population liv ing below the pov erty line. A v ery low foreign exchange reserv e and lev el of confidence about India's credit worthiness. An unfav orable world scenario with its projected low incom e growth and increasing regionalism and a substantial loss in RPA trade (Form er USSR and Post European countries) for India. India's hang-up with anti -m arket socialistic dev elopm ent strategies and people's shaken confidence arising from unsatisfactory sporadic liberalization attem pts since 1 9 9 0s. The existence of a large but inefficient public sector with its own v ested interest. All these, in the light of inter-country experiences, forewarn of a longer gestation period with heav y social costs and raise doubts as to the tolerance lev el of Indian society for withstanding such less im pending social cost. Howev er, there are plus points: The liberalization package is preceded by the m inim um essential political setup: India's dem ocratic form of society . In the transform ation of econom y into a highly efficient one, m ov ing towards a m arket econom y , India can benefit from her past experience of a m ixed econom y . Indeed, this places India on a better footing v is-a-v is China, East Europe and other centrally planned econom ies. India has a v ery good track record of fulfilling international com m itm ents, with a com parativ ely low debt serv ice ratio com pared to Latin Am erican and som e of the African countries. India has a large supply of skilled m anpower and cheap labour. India has a reasonably good basic infrastructure.

It is against this backdrop, that India's stabilization m easures should be assessed. In the short run, it has fulfilled the specific stabilization objectiv es i.e., reducing the balance of pay m ents and the budgetary gaps and recouping all the losses in the foreign exchange reserv es. Howev er, a word of caution is needed, from the experience of other countries it has been observ ed that a shortterm success in the stabilization phase often tem pts policy -m akers to sit back and prolong the phase of stabilization process. In a num ber of cases this has led to stagflation. The continuance with too high a foreign reserv e ratio (as in India) against a heav y im port com pression requires a warning. Indeed, a large part of the present problem is due to India's lack of proper foreign exchange reserv e m anagem ent. This warning is specially needed when stabilization is achiev ed through soft option (im port and expenditure com pressions and heav y foreign exchange borrowings) regardless of the needs for growth and productiv ity (as observ ed in num ber of other countries). This m ay retard and render difficult the desired transition to growth. To av oid this, the adjustm ent process could be slowed down if necessary , specially in certain areas of reform (for exam ple, the rate of decline in the budget deficit as percentage of GDP). The therapeutic approach of a shock treatm ent in the reform process m ay not work in India. As observ ed in the case of other countries, a structural adjustm ent process is m uch m ore com plex than the stabilization process, and therefore should not be left only with the bureaucrats and politicians. There is no standard recipe for the structural adjustm ent phase, although there is a far degree of com m onality in the stabilization phase. In choosing proper sequencing a v ery strong financial and banking infrastructure is a pre-requisite to establishing appropriate m arket codes of conduct. Therefore financial liberalization should not be postponed for too long. Moreov er, in tune with the spirit of present econom ic reform , decisions on priv atization and exit policy should follow early in the gam e. Although a high rate of inflation is a problem the key issue is to rev am p the real growth of the econom y by suitable inv estm ents and incentiv es. In the context of im prov ing productiv ity and international com petitiv eness, technology im prov em ent should be the buzz word. The attem pts to reduce the costs exclusiv ely through fiscal. Monetary , financial and trade policies hav e their lim its. Ultim ately , it is the technological progress which m atters. Im ports of technology v ia foreign direct inv estm ent should accordingly feature at the centre as a necessary condition for increasing efficiency . Howev er, the absorption and indigenization of foreign technology alone will satisfy the requisite condition for success. This will be m ade possible by the growth of research and dev elopm ent in the dom estic econom y . Reform s, therefore, the research and dev elopm ent policy , m ust prov ide a clear strategy and sufficient resources. To conclude, when Liberalization reform s were initiated the econom y was suffering with the heav y foreign exchange constraints and im port com pression and a relativ ely unfav orable international scenario but India will hav e to go through a painful prolonged period of adjustm ent. Thus, the country m ust prepare itself to m eet this challenge by first protecting the poor and second by protecting the infrastructure and hum an dev elopm ent needs. You May Also Like:

Adv ertisem ent Free Subscription

Do you want some more information on this topic? Enter your email id:

Do you like this site?

If y ou enjoy reading Preserv eArticles.com , please share this site with y our friends.?

Potrebbero piacerti anche

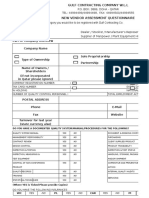

- QMS F 09A Rev 05 New Vendor Assessment QuestionnaireDocumento16 pagineQMS F 09A Rev 05 New Vendor Assessment QuestionnairermdarisaNessuna valutazione finora

- Endowment vs. GrantDocumento6 pagineEndowment vs. GrantamalekhNessuna valutazione finora

- Fiscal PolicyDocumento23 pagineFiscal Policyapi-376184490% (10)

- Sustainability Report 2021Documento27 pagineSustainability Report 2021Eugene GaraninNessuna valutazione finora

- 3.SAP Retail Using FioriDocumento7 pagine3.SAP Retail Using FioriGirishNessuna valutazione finora

- SQMP ManualDocumento81 pagineSQMP ManualAnkita DwivediNessuna valutazione finora

- Robert A. Schwartz, John Aidan Byrne, Antoinette Colaninno - Call Auction TradingDocumento178 pagineRobert A. Schwartz, John Aidan Byrne, Antoinette Colaninno - Call Auction Tradingpepelmarchas100% (1)

- Fiscal Policy: Dr. A.K.PanigrahiDocumento22 pagineFiscal Policy: Dr. A.K.PanigrahiDr.Ashok Kumar PanigrahiNessuna valutazione finora

- Implementing the Public Finance Management Act in South Africa: How Far Are We?Da EverandImplementing the Public Finance Management Act in South Africa: How Far Are We?Nessuna valutazione finora

- Appointment Letter: Sales Incentive: As Per The Prevailing Company SchemeDocumento3 pagineAppointment Letter: Sales Incentive: As Per The Prevailing Company SchemeRead2018Nessuna valutazione finora

- Business Environment-Chapter 4Documento25 pagineBusiness Environment-Chapter 4arun_idea50Nessuna valutazione finora

- What Is Fiscal Policy?Documento10 pagineWhat Is Fiscal Policy?Samad Raza KhanNessuna valutazione finora

- Economy Topic 2Documento20 pagineEconomy Topic 2Ikra MalikNessuna valutazione finora

- Economic ReformsDocumento11 pagineEconomic Reformspotturibhanu69Nessuna valutazione finora

- Fiscal Policy of BangladeshDocumento16 pagineFiscal Policy of BangladeshMdSumonMiaNessuna valutazione finora

- BuluDocumento20 pagineBulunarayanmeher07Nessuna valutazione finora

- Impact of LPG PDFDocumento12 pagineImpact of LPG PDFRavi Kiran JanaNessuna valutazione finora

- Unit 16-Public Finance N Fiscal PolicyDocumento32 pagineUnit 16-Public Finance N Fiscal Policynorasan27Nessuna valutazione finora

- Unit Budgetary Policy Indian Financial AND: ObjectivesDocumento20 pagineUnit Budgetary Policy Indian Financial AND: ObjectivesZenia KhanNessuna valutazione finora

- Economic Reforms TaskDocumento15 pagineEconomic Reforms Tasksanjay josephNessuna valutazione finora

- Task 3: Arise, Awake, Stop-Not Till The Goal Is Reached: Sub: Economic Reforms and GDP AnalysisDocumento18 pagineTask 3: Arise, Awake, Stop-Not Till The Goal Is Reached: Sub: Economic Reforms and GDP Analysissanjay josephNessuna valutazione finora

- Economic Reforms in IndiaDocumento10 pagineEconomic Reforms in IndiaRaghaNessuna valutazione finora

- TASK-3: Economic Reforms-The First PhaseDocumento12 pagineTASK-3: Economic Reforms-The First PhaseBijosh ThomasNessuna valutazione finora

- TASK-3: Economic Reforms-The First PhaseDocumento12 pagineTASK-3: Economic Reforms-The First PhaseBijosh ThomasNessuna valutazione finora

- Unit 16 PDFDocumento32 pagineUnit 16 PDFnitikanehiNessuna valutazione finora

- AndDocumento4 pagineAndAnanya BhandariNessuna valutazione finora

- Fiscal PolicyDocumento11 pagineFiscal PolicyVenkata RamanaNessuna valutazione finora

- Economic Liberalisation in IndiaDocumento5 pagineEconomic Liberalisation in IndiaShrikaranNessuna valutazione finora

- Indian Economy Progress and ProspectsDocumento14 pagineIndian Economy Progress and ProspectspradheepkNessuna valutazione finora

- Economic Reforms & Social JusticeDocumento15 pagineEconomic Reforms & Social JusticeJayjeet BhattacharjeeNessuna valutazione finora

- Macroeconomics AnalysisDocumento4 pagineMacroeconomics Analysisshinjan bhattacharyaNessuna valutazione finora

- 48 National Cost Convention, 2007: Inaugural Address On Sustaining The Higher GrowthDocumento8 pagine48 National Cost Convention, 2007: Inaugural Address On Sustaining The Higher Growthapi-3705877Nessuna valutazione finora

- Jism Jan14 FiscalDocumento16 pagineJism Jan14 FiscalramakntaNessuna valutazione finora

- Daming 4 FiscalDocumento16 pagineDaming 4 Fiscalkeithcacay82Nessuna valutazione finora

- Rakesh Mohan: Economic Reforms in India - Where Are We and Where Do We Go?Documento22 pagineRakesh Mohan: Economic Reforms in India - Where Are We and Where Do We Go?Rupesh RoshanNessuna valutazione finora

- Subject EconomicsDocumento10 pagineSubject EconomicsMubashirNessuna valutazione finora

- Public Finance IIDocumento8 paginePublic Finance IIBimo Danu PriambudiNessuna valutazione finora

- New Economic Policy of 1991Documento21 pagineNew Economic Policy of 1991Arinjay TyagiNessuna valutazione finora

- Economic Reforms in IndiaDocumento29 pagineEconomic Reforms in IndiaVishnu BralNessuna valutazione finora

- SAP UgandaDocumento21 pagineSAP UgandasdaakiNessuna valutazione finora

- Portugal: A Strong StartDocumento2 paginePortugal: A Strong StartMohamed EltahanNessuna valutazione finora

- Issues and Priorities: He Reform AgendaDocumento79 pagineIssues and Priorities: He Reform AgendaashokavikramadityaNessuna valutazione finora

- 5 EconomicReformsinIndiaDocumento13 pagine5 EconomicReformsinIndiarbushra1415Nessuna valutazione finora

- IMF - Concluding Statement On Israel's Economy For 2010Documento6 pagineIMF - Concluding Statement On Israel's Economy For 2010Economic Mission, Embassy of IsraelNessuna valutazione finora

- Reprofiling The EconomyDocumento3 pagineReprofiling The EconomyShakila MaSoomNessuna valutazione finora

- Fiscal Reforms in IndiaDocumento12 pagineFiscal Reforms in Indiaashish1981100% (1)

- India's Foreign TradeDocumento8 pagineIndia's Foreign TradeSammir MalhotraNessuna valutazione finora

- Https Digitalcollections - Anu.edu - Au Bitstream 1885 40329 3 KalirajanDocumento28 pagineHttps Digitalcollections - Anu.edu - Au Bitstream 1885 40329 3 KalirajanAshish MakwanaNessuna valutazione finora

- Fiscal Policy MeaningDocumento27 pagineFiscal Policy MeaningVikash SinghNessuna valutazione finora

- Eco 6 FDDocumento16 pagineEco 6 FD20047 BHAVANDEEP SINGHNessuna valutazione finora

- DPSM Question 1Documento14 pagineDPSM Question 1Shipra ChaudharyNessuna valutazione finora

- Macro InglesDocumento5 pagineMacro InglesFabi SalguerocosmeNessuna valutazione finora

- Indian Economy: Progress and Prospects : Deepak MohantyDocumento8 pagineIndian Economy: Progress and Prospects : Deepak MohantyalbaduwiNessuna valutazione finora

- Fiscal PolicyDocumento5 pagineFiscal Policysuman gautamNessuna valutazione finora

- Presentation On Economic Survey Final 2014-15 FinalDocumento87 paginePresentation On Economic Survey Final 2014-15 FinaltrvthecoolguyNessuna valutazione finora

- Economic Crisis & ReformsDocumento5 pagineEconomic Crisis & Reformsnandini11Nessuna valutazione finora

- Investing in IndiaDocumento5 pagineInvesting in IndiaAlok VermaNessuna valutazione finora

- Economic Liberalisation in India: Chapter-3Documento25 pagineEconomic Liberalisation in India: Chapter-3AnuragNessuna valutazione finora

- Economic Liberalisation in India: Chapter-3Documento25 pagineEconomic Liberalisation in India: Chapter-3Umesh IndoriyaNessuna valutazione finora

- Fiscal Policy V UNIT-1Documento10 pagineFiscal Policy V UNIT-1madhumithaNessuna valutazione finora

- Fiscal PolicyDocumento21 pagineFiscal PolicyDilpreet Singh MendirattaNessuna valutazione finora

- I. A Gradualist ApproachDocumento15 pagineI. A Gradualist ApproachdipuneneNessuna valutazione finora

- Introduction To Public FinanceDocumento36 pagineIntroduction To Public FinanceNeelabh KumarNessuna valutazione finora

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesDa EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNessuna valutazione finora

- Business Economics: Business Strategy & Competitive AdvantageDa EverandBusiness Economics: Business Strategy & Competitive AdvantageNessuna valutazione finora

- Equity Mid Cap 11 Jul 2023 1735Documento3 pagineEquity Mid Cap 11 Jul 2023 1735Aravind MenonNessuna valutazione finora

- List of Victims of Political Murders in Kerala - InfogramDocumento2 pagineList of Victims of Political Murders in Kerala - InfogramAravind MenonNessuna valutazione finora

- Poster Publication 2Documento2 paginePoster Publication 2Aravind MenonNessuna valutazione finora

- Compounding SheetDocumento1 paginaCompounding SheetAravind MenonNessuna valutazione finora

- 8 PDFDocumento6 pagine8 PDFAravind MenonNessuna valutazione finora

- Order Details Contact Details: IndigoDocumento1 paginaOrder Details Contact Details: IndigoAravind MenonNessuna valutazione finora

- XuturesoDocumento6 pagineXuturesoAravind MenonNessuna valutazione finora

- Answering The Questions.: Tier-I of The ExaminationDocumento3 pagineAnswering The Questions.: Tier-I of The ExaminationAravind MenonNessuna valutazione finora

- Mirae Asset Nyse Fang EtfDocumento2 pagineMirae Asset Nyse Fang EtfAravind MenonNessuna valutazione finora

- Main Recommendations of Punchhi CommissionDocumento2 pagineMain Recommendations of Punchhi CommissionAravind MenonNessuna valutazione finora

- Solved Paper SSC Combined Graduate Level Prelim Exam Held On 16.05.2010 First SittingDocumento21 pagineSolved Paper SSC Combined Graduate Level Prelim Exam Held On 16.05.2010 First SittingNaren N End NNessuna valutazione finora

- 3i Sustainabilityreport 2023Documento97 pagine3i Sustainabilityreport 2023Matthieu BlehouanNessuna valutazione finora

- Haryana Development and Regulation of Urban Areas Act, 1975 PDFDocumento45 pagineHaryana Development and Regulation of Urban Areas Act, 1975 PDFLatest Laws TeamNessuna valutazione finora

- Cover LetterDocumento1 paginaCover LetterIonel SîruNessuna valutazione finora

- PAS 36 Impairment of AssetsDocumento8 paginePAS 36 Impairment of AssetswalsondevNessuna valutazione finora

- A Reflection On The Global Capital MarketDocumento1 paginaA Reflection On The Global Capital MarketJaycel BayronNessuna valutazione finora

- Tara-Vel Travel and Tours: Organizational ChartDocumento4 pagineTara-Vel Travel and Tours: Organizational ChartArnel IgnacioNessuna valutazione finora

- Tech Tune Pvt. Ltd. BalancesDocumento3 pagineTech Tune Pvt. Ltd. BalancesHEMAL SHAHNessuna valutazione finora

- Pantene Brand Audit ReportDocumento3 paginePantene Brand Audit ReportSaad RazaNessuna valutazione finora

- Budgeted Lesson in Tle 6Documento3 pagineBudgeted Lesson in Tle 6AlmarieSantiagoMallabo100% (1)

- CCD FailureDocumento5 pagineCCD FailureSajan BhuvadNessuna valutazione finora

- PUR FO 01-09 Supplier Data SheetDocumento7 paginePUR FO 01-09 Supplier Data SheetManmohan SinghNessuna valutazione finora

- McKinsey Webinar FINAL PDFDocumento31 pagineMcKinsey Webinar FINAL PDFdlokNessuna valutazione finora

- Management Accounting Level 3/series 2 2008 (Code 3024)Documento14 pagineManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- MKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Documento4 pagineMKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Quỳnh VânNessuna valutazione finora

- Tech ContractsDocumento6 pagineTech ContractsGv AthvaidhNessuna valutazione finora

- Sap MRSDocumento16 pagineSap MRStapera_mangeziNessuna valutazione finora

- Classification and Occupation Services and Procedures Guide-ENG - V04Documento55 pagineClassification and Occupation Services and Procedures Guide-ENG - V04Adnan QayumNessuna valutazione finora

- Checklist of Requirements For Cosmetic LTO Application PDFDocumento2 pagineChecklist of Requirements For Cosmetic LTO Application PDFBianca Camille YlingNessuna valutazione finora

- Final Exam BUS 4005 PJT MGTDocumento3 pagineFinal Exam BUS 4005 PJT MGTMarc SchafradNessuna valutazione finora

- Tariff Petition MEPCO PDFDocumento170 pagineTariff Petition MEPCO PDFahmed khanNessuna valutazione finora

- Lean and Agile SAPDocumento45 pagineLean and Agile SAPPhil Johnson100% (1)

- Sap Bi ResumeDocumento4 pagineSap Bi ResumeVijay ChandraNessuna valutazione finora

- Magaya Cargo System OperationsDocumento17 pagineMagaya Cargo System OperationsMohammed Al-GhannamNessuna valutazione finora