Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Philippine Prudential explains PNCB termination

Caricato da

Raphy AlvarezTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Philippine Prudential explains PNCB termination

Caricato da

Raphy AlvarezCopyright:

Formati disponibili

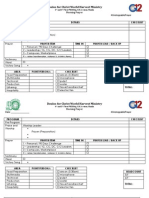

OFFICIAL STATEMENT OF PHILIPPINE PRUDENTIAL

Manila, 07 June 2013 -- In response to current customer and public concerns being raised in the media, Philippine Prudential Life Insurance Company, Inc. (Philippine Prudential) is issuing this explanation and clarification. The customers concerned are of Family First Future Provider Planholders of the Pre-Need Company Danvil Plans, Inc., which purchased the Protector Plan (also known by Planholders as PNCB). The PNCB is a very affordable Term Life Insurance protection which came with five riders: Accidental Death Benefit, Permanent Disability Benefit, Hospital Income Benefit, Burial Benefit and No Claim Bonus. The No Claim Bonus Rider entailed no additional cost to the client. Family First Future Provider Planholders who enrolled in the PNCB were covered under a Group Master Policy issued by former Life Insurance Company Berkley International Life Insurance Company, Inc. (Berkley International). In 2007, Philippine Prudential assumed the rights, interest and obligations of Berkley International as the insurer under the same Group Master Policy. The Insurance Commission required the assumption of Berkley Internationals obligations by Philippine Prudential in view of the surrender of Berkley International's license as an insurance company and its exit in doing business in the Philippines. The PNCBs sustainability was due to its maintaining a sufficient number of individuals covered under a Group Life Insurance Coverage. Thus, the Group Master Policy had expressly provided for a minimum participation requirement of all eligible Family First Future Provider Planholders. Group Life Insurance (wholesale life insurance or institutional life insurance) is Term Insurance covering a defined group of people, such as company employees, union or association members and, in this case, the Family First Future Provider Planholders. Individual proof of insurability is not the primary consideration, but more of the size, turnover and financial strength of the group. Over the years, the number of individuals enrolled under the PNCB had dwindled due to various reasons. At present, enrollment under the PNCB is way below the initial coverage and has fallen below the minimum seventy five percent (75%) mandatory participation. This makes it no longer viable for Philippine Prudential to continue with the coverage. Given that the minimum participation requirement was not met, Philippine Prudential has exercised its rights granted under the said Group Master Policy to terminate its coverage with Danvil Plans, Inc., which is the actual Policyholder, effective 25 March 2013. Continuing with this Policy would result to unsound insurance business which the Insurance Commission will not allow. Philippine Prudential had previously assured all concerned Danvil Planholders that their periodic premium payments did not go to waste since they were fully covered under the Protector Plan or PNCB during the entire time it was in force. Since no premiums were collected for the "No Claim Bonus Rider," the Company remains under no obligation to maintain the coverage. However, following a series of consultations and conferences with the Insurance Commission of the Philippines, the Management of Philippine Prudential, as a gesture of goodwill, has offered to refund to the concerned Danvil Planholders a substantial portion of the premiums paid by them. This offer and the specifics of its implementation are currently being evaluated by the Insurance Commission. Meanwhile, concerned customers may call the Philippine Prudential Customer Service Hotline at (02) 902-2300 or via E-Mail at mypolicy@philippineprudential.com for further inquiries.

####

Home Office: 3/F & 5/F AIC Burgundy Empire Tower, ADB Avenue Corner Garnet & Sapphire Roads, Ortigas Center, Pasig City, Philippines 1605 Customer Service Hotline: +63 (2) 902-2300 Trunk Line No.: +63 (2) 902-2330 Fax No.: +63 (2) 631-3228

www.philippineprudential.com

Potrebbero piacerti anche

- Temporary Arrangement STREET: - # PS Route To Day To Sequence To RemarksDocumento1 paginaTemporary Arrangement STREET: - # PS Route To Day To Sequence To RemarksRaphy AlvarezNessuna valutazione finora

- Brazil 2Documento8 pagineBrazil 2Raphy AlvarezNessuna valutazione finora

- Vergara V Hammonia Maritime Services Et AlDocumento2 pagineVergara V Hammonia Maritime Services Et AlRaphy AlvarezNessuna valutazione finora

- Run-Ons and Comma SplicesDocumento1 paginaRun-Ons and Comma SplicesRaphy AlvarezNessuna valutazione finora

- And, But, Or, Nor, So, For, Yet.: CommasDocumento3 pagineAnd, But, Or, Nor, So, For, Yet.: CommasRaphy AlvarezNessuna valutazione finora

- Sentence Snarls: Avoid Common Structural IssuesDocumento4 pagineSentence Snarls: Avoid Common Structural IssuesRaphy Alvarez100% (1)

- Insurance O: F E U I LDocumento22 pagineInsurance O: F E U I LRaphy AlvarezNessuna valutazione finora

- MAP 1 AND Map 2Documento2 pagineMAP 1 AND Map 2Raphy AlvarezNessuna valutazione finora

- Phil Intl Shipping Corp v. NLRCDocumento2 paginePhil Intl Shipping Corp v. NLRCRaphy AlvarezNessuna valutazione finora

- Capital Letter Ethan Frome:, My Best Friend, Their Apartment, New Car, The BookDocumento3 pagineCapital Letter Ethan Frome:, My Best Friend, Their Apartment, New Car, The BookRaphy AlvarezNessuna valutazione finora

- Sermon Addressing: Contribute MoneyDocumento3 pagineSermon Addressing: Contribute MoneyRaphy AlvarezNessuna valutazione finora

- The Five C'sDocumento3 pagineThe Five C'sRaphy AlvarezNessuna valutazione finora

- ACME PresentationDocumento6 pagineACME Presentationrockincathy17Nessuna valutazione finora

- Adjectives and Adverbs GuideDocumento6 pagineAdjectives and Adverbs GuideRaphy AlvarezNessuna valutazione finora

- Darell Caraan AquinoDocumento3 pagineDarell Caraan AquinoRaphy AlvarezNessuna valutazione finora

- Ak 81 Xoyo 4 FtoDocumento16 pagineAk 81 Xoyo 4 FtoKazuyano DoniNessuna valutazione finora

- Version3 1Documento7 pagineVersion3 1Raphy AlvarezNessuna valutazione finora

- Totally Accessible and Very Prime Location!!!: So Why Rent If You Can OWN???Documento2 pagineTotally Accessible and Very Prime Location!!!: So Why Rent If You Can OWN???Raphy AlvarezNessuna valutazione finora

- TypeDocumento3 pagineTypeRaphy AlvarezNessuna valutazione finora

- Labor and Employment Secretary Rosalinda DimapilisDocumento1 paginaLabor and Employment Secretary Rosalinda DimapilisRaphy AlvarezNessuna valutazione finora

- CrimProc San BedaDocumento56 pagineCrimProc San BedaJanheather SuycanoGonzalesNessuna valutazione finora

- MP Program TemplateDocumento2 pagineMP Program TemplateRaphy AlvarezNessuna valutazione finora

- (Oblicon) Reviewer - Natural Obligations To EstoppelDocumento6 pagine(Oblicon) Reviewer - Natural Obligations To EstoppelsjlaNessuna valutazione finora

- 1987 Philippine Constitution.Documento27 pagine1987 Philippine Constitution.Raphy AlvarezNessuna valutazione finora

- Fernando Collantes VDocumento1 paginaFernando Collantes VRaphy AlvarezNessuna valutazione finora

- Estrada vs. Sandigang BayanDocumento9 pagineEstrada vs. Sandigang BayanRaphy AlvarezNessuna valutazione finora

- Codal PFRDocumento43 pagineCodal PFRRaphy AlvarezNessuna valutazione finora

- People v. DelimaDocumento1 paginaPeople v. DelimaRaphy AlvarezNessuna valutazione finora

- Legal Ethics in ASEAN Legal EducationDocumento22 pagineLegal Ethics in ASEAN Legal EducationRaphy AlvarezNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- ITN v7 Release NotesDocumento4 pagineITN v7 Release NotesMiguel Angel Ruiz JaimesNessuna valutazione finora

- Fright ForwordersDocumento6 pagineFright ForworderskrishnadaskotaNessuna valutazione finora

- Fernando Medical Enterprises, Inc. v. Wesleyan University Phils., Inc.Documento10 pagineFernando Medical Enterprises, Inc. v. Wesleyan University Phils., Inc.Clement del RosarioNessuna valutazione finora

- WritingSubmission OET20 SUMMARIZE SUBTEST WRITING ASSESSMENT 726787 40065 PDFDocumento6 pagineWritingSubmission OET20 SUMMARIZE SUBTEST WRITING ASSESSMENT 726787 40065 PDFLeannaNessuna valutazione finora

- JKFBDDocumento2 pagineJKFBDGustinarsari Dewi WNessuna valutazione finora

- Bioassay Techniques For Drug Development by Atta-Ur RahmanDocumento214 pagineBioassay Techniques For Drug Development by Atta-Ur RahmanEmpress_MaripossaNessuna valutazione finora

- Pashmina vs Cashmere: Which Luxury Fiber Is SofterDocumento15 paginePashmina vs Cashmere: Which Luxury Fiber Is SofterSJVN CIVIL DESIGN100% (1)

- HRM ........Documento12 pagineHRM ........Beenish AbbasNessuna valutazione finora

- 01 ElectricalDocumento15 pagine01 ElectricalKrishna KrishNessuna valutazione finora

- CRUSADE of PRAYERS 1-170 Litany 1-6 For The Key To Paradise For DistributionDocumento264 pagineCRUSADE of PRAYERS 1-170 Litany 1-6 For The Key To Paradise For DistributionJESUS IS RETURNING DURING OUR GENERATION100% (10)

- APFC Accountancy Basic Study Material For APFCEPFO ExamDocumento3 pagineAPFC Accountancy Basic Study Material For APFCEPFO ExamIliasNessuna valutazione finora

- 6-Modul - PTI412 - IoT-1-2020Documento17 pagine6-Modul - PTI412 - IoT-1-202020200801015 Joko SulistyoNessuna valutazione finora

- Eng9 - Q3 - M4 - W4 - Interpret The Message Conveyed in A Poster - V5Documento19 pagineEng9 - Q3 - M4 - W4 - Interpret The Message Conveyed in A Poster - V5FITZ100% (1)

- RPP Microteaching TaruliDocumento9 pagineRPP Microteaching TaruliTaruli Sianipar 165Nessuna valutazione finora

- Strategies in Various Speech SituationsDocumento6 pagineStrategies in Various Speech SituationsSky NayytNessuna valutazione finora

- Management of Dyspnoea - DR Yeat Choi LingDocumento40 pagineManagement of Dyspnoea - DR Yeat Choi Lingmalaysianhospicecouncil6240Nessuna valutazione finora

- Recommender Systems Research GuideDocumento28 pagineRecommender Systems Research GuideSube Singh InsanNessuna valutazione finora

- Death and DickinsonDocumento12 pagineDeath and DickinsonHarshita Sohal100% (1)

- Reaction PaperDocumento1 paginaReaction Papermarvin125Nessuna valutazione finora

- Teaching Islamic Traditions by SlidesgoDocumento48 pagineTeaching Islamic Traditions by SlidesgoCallista Naira AzkiaNessuna valutazione finora

- Pharmacology of GingerDocumento24 paginePharmacology of GingerArkene LevyNessuna valutazione finora

- Untitled Document 3Documento10 pagineUntitled Document 3api-457501806Nessuna valutazione finora

- 5 Whys Analysis SheetDocumento3 pagine5 Whys Analysis SheetAjay KrishnanNessuna valutazione finora

- Sarina Dimaggio Teaching Resume 5Documento1 paginaSarina Dimaggio Teaching Resume 5api-660205517Nessuna valutazione finora

- Insecticide Mode of Action Classification GuideDocumento6 pagineInsecticide Mode of Action Classification GuideJose Natividad Flores MayoriNessuna valutazione finora

- Ujian NasionalDocumento41 pagineUjian NasionalKeisha SalsabilaNessuna valutazione finora

- State of Indiana, County of Marion, SS: Probable Cause AffidavitDocumento1 paginaState of Indiana, County of Marion, SS: Probable Cause AffidavitIndiana Public Media NewsNessuna valutazione finora

- CSEC English SBA GuideDocumento5 pagineCSEC English SBA GuideElijah Kevy DavidNessuna valutazione finora

- Homologation Form Number 5714 Group 1Documento28 pagineHomologation Form Number 5714 Group 1ImadNessuna valutazione finora

- Chippernac: Vacuum Snout Attachment (Part Number 1901113)Documento2 pagineChippernac: Vacuum Snout Attachment (Part Number 1901113)GeorgeNessuna valutazione finora