Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Valuation of Government Contractors

Caricato da

giorgiogarrido6Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Valuation of Government Contractors

Caricato da

giorgiogarrido6Copyright:

Formati disponibili

A BVR Special Report

Excerpt from

Key Trends in the Valuation of Government Contracting Firms

BVR

What Its Worth

Special thanks to Donald W. Nalley, Jr., CPA/CVA, ABV, ASA, for his expert guidance and contributions to this special report.

Copyright 2012 by Business Valuation Resources, LLC (BVR). All rights reserved. Printed in the United States of America. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher or authorization through payment of the appropriate per copy fee to the Publisher. Requests for permission should be addressed to the Permissions Department, Business Valuation Resources, LLC, 1000 SW Broadway St., Suite 1200, Portland, OR 97205, (503) 291-7963, fax (503) 291-7955. Information contained in this book has been obtained by Business Valuation Resources from sources believed to be reliable. However, neither Business Valuation Resources nor its authors guarantee the accuracy or completeness of any information published herein and neither Business Valuation Resources nor its authors shall be responsible for any errors, omissions, or damages arising out of use of this information. This work is published with the understanding that Business Valuation Resources and its authors are supplying information but are not attempting to render business valuation or other professional services. If such services are required, the assistance of an appropriate professional should be sought.

Editor: Jan Davis Publisher: Sarah Andersen Managing Editor: Janice Prescott Chair and CEO: David Foster President: Lucretia Lyons Vice President of Sales: Lexie Gross Customer Service Manager: Retta Dodge ISBN: 978-1-62150-023-0 Library of Congress Control Number: 2012953298

For the complete report and a list of other BVR publications, please visit www.bvresources.com/publications.

3. Enhanced Market Understanding Needed to Value Government Contractors

By Bob Kipps Federal budget battles, unclear tax positions, and domestic and international economic trends are creating a challenging environment for government contracting firms and the business appraisers that value them. BVR interviewed Bob Kipps, managing director of KippsDeSanto & Co., a defense and technology focused mergers and acquisitions banker, for insight into the current state of the government contracting market. BVR: How is the government contracting market changing? Bob Kipps: For the first decade of this century, government spending on wartime and homeland security efforts escalated significantly, and government agencies leaned heavily on contractors to provide consulting services, support, and solutions. However, over the last few years, government budgets have been mostly flat or declining. Government contractors are now operating in an extremely competitive environment with fewer new business opportunities outside of a handful of areas, such as cybersecurity, data analytics, cloud computing, health information technology (IT), and C4ISR (national security-oriented solutions for command, control, communications, computers, intelligence, surveillance, and reconnaissance). Efforts and programs related to the above areas are perceived to be less prone to potential budget pressure; in fact, on a relative basis, these areas are booming in terms of business growth and mergers and acquisitions. However, the companies that provide products and services in these areas represent less than 20% of the marketplace, and many of the remaining contractors are struggling. Given the broader budget trends, valuations for most other government contracting firmsincluding even the large public companieshave been flat to down over the last couple of years. As such, executives are rethinking strategies and becoming more aggressive in order to grow. Many

www.bvresources.com

Key Trends in the Valuation of Government Contracting Firms

large firms cash balances are at historic levels, and these firms are poised to make strategic acquisitions for building capability sets, expanding into new markets, and ultimately stimulating growth. M&A volume has picked up somewhat compared to 2011; 51 aerospace, defense, and government services transactions were announced in the third quarter of 2012 and 187 deals year-to-date (versus 180 year-to-date in 2011). Notably, M&A activity in the aerospace sector has surged in 2012 to volumes not seen since before the recession. Seventy-four aerospace deals were announced in the first three quarters of 2012, up significantly from the 54 announced through the equivalent period in 2011. The number of transactions in the defense and government services sectors, meanwhile, has declined slightly in 2012 relative to 2011. As we approach year-end, the threat of sequestration is becoming increasingly eminent. On the tax front, the previously extended breaks set forth by the Bush administration are due to expire, with uncertain probability of being extended into 2013. With a lack of clarity around the next fiscal year mounting, sellers are becoming more aggressive about reaching deal terms before closing the books on 2012. This portends a potential rise in activity during the fourth quarter of 2012. BVR: What drives government contractors value? BK: This question requires an understanding of the basics of the business. To work as a prime contractor with a governmental agency, a business must have: (1) desired products or services; (2) established customer relationships; and (3) a contract in place with those customers. As an aside, when looking at acquisitions, most buyers are focused on buying at least two, if not all three, of the above components. When it comes to placing value on such firms, the targets growth, risk, and leveragability also heavily influence the analysis. Growth. Especially in a tightening market like todays, the ability for a business to deliver sustainable medium-to-long-term growth is a crucial valuation input. That growth potential typically is a function of the companys customers (do they have growing needs and budgets?) and whether the solution offerings are experiencing increased need or demand (e.g., cloud computing or cybersecurity). Business risk. Like the valuation of any asset, inherent risk or uncertainty is a major valuation consideration. For government contractors, business risk includes the common factors such as management quality, strength of internal processes and procedures, and business diversification, as well as several unique considerations. In particular, the nature of their contracts can heavily influence the risk profile of government contractorsspecifically, the amount of their backlog (or awarded work less work performed to date), whether the business works as a prime contractor or subcontractors, and whether their contracts were awarded based on any government preference programs (perhaps based on the businesss size or minority ownership). Buyers are generally larger firms that do not qualify for these types of contracts and, as such, often are careful about placing much emphasis or value on them.

www.bvresources.com

3. Enhanced Market Understanding Needed to Value Government Contractors

Leveragability. Another value driver is what I call leveragability, or situations where the proverbial 1 plus 1 may equal more than 2. For example, a small business may have a new technology, but it cant do anything with it because the company doesnt have the reach, capital, or scale. Another example is when a company that has a large, attractive customer relationshipor in the government world, a large prime contract vehicle. A large contract vehicle often can be much more valuable to a large business than to a smaller company that may not be able to harvest business opportunity from it on its own. BVR: What advice can you give to business appraisers valuing small government contracting firms? BK: Valuations of government contractors are more difficult than in the past. First, theres the lack of publicly available data on smaller transactions. If youre not doing deals as an M&A advisor or if youre not otherwise heavily involved in the marketplace, you have almost no visibility into 90% of the transactions terms or more. Second, theres a larger dispersion of valuations in todays market than in the past. So valuing a government contracting company requires an enhanced level of market understanding in order not to dramatically overvalue some companies. Appraisers who value just one or two businesses a year might incorrectly assume that all government contracting companies are similar to the larger public firms or are at risk because federal spending is declining. There are very few pureplay public government contractors, so its very hard to find comparability. As mentioned earlier, business performance and prospects are very different for different sectors. Valuing a company that manufactures parts for unmanned air vehicles is very different from valuing a company that provides security guards in Afghanistan. It can be a mistake to use the public comparable financial data and deduce that a government contracting firm trades at a 12 P/E multiple or a 7 EBITDA multiple or 50% of revenue, whatever the case might be. The large bellwethers, such as Lockheed Martin and SAIC, are trading at very low market multiples because they have exposure to both the attractive and less attractive market areas. Appraisers who are not familiar with the particular niches should follow the announcements of transactions, read the analyst reports, and listen to analyst calls. But because a lot of information isnt publicly disclosed, appraisers need to do some investigative work because there is a dramatic difference in the valuation of a cloud computing or cybersecurity business and the valuation of Lockheed Martin or SAIC. Bob Kipps, managing director of KippsDeSanto & Co., can be reached at bkipps@kippsdesanto.com or (703) 442-1401.

www.bvresources.com

Potrebbero piacerti anche

- The Government Contractor's Guide: Navigating the World of Public ProcurementDa EverandThe Government Contractor's Guide: Navigating the World of Public ProcurementNessuna valutazione finora

- Becoming A Government Contractor: Your Detailed Guide To Building A Strong Company Foundation And Reputation.: Mastering Government Contracting, #1Da EverandBecoming A Government Contractor: Your Detailed Guide To Building A Strong Company Foundation And Reputation.: Mastering Government Contracting, #1Nessuna valutazione finora

- Embassy Us FederalDocumento12 pagineEmbassy Us FederalJennifer SchausNessuna valutazione finora

- Managing Govt RelationsDocumento9 pagineManaging Govt RelationsJanardhan PenchalaNessuna valutazione finora

- Digicon FinalpaperDocumento12 pagineDigicon FinalpaperWill DavisNessuna valutazione finora

- Government Contracts ToolkitDocumento8 pagineGovernment Contracts ToolkitAlejandro Enrique Fernandez Echezuría100% (1)

- Deal Forum: DigestDocumento12 pagineDeal Forum: DigestAnonymous Feglbx5Nessuna valutazione finora

- VIP Compliance GRCDocumento8 pagineVIP Compliance GRCdr_mahmoud71Nessuna valutazione finora

- Artko Capital 2016 Q4 LetterDocumento8 pagineArtko Capital 2016 Q4 LetterSmitty WNessuna valutazione finora

- Us M&A Trends ReportDocumento45 pagineUs M&A Trends ReportAnushree RastogiNessuna valutazione finora

- CitigroupDocumento15 pagineCitigroupAnurag PatelNessuna valutazione finora

- B2B Information Services: The Opportunity For Strategic GrowthDocumento10 pagineB2B Information Services: The Opportunity For Strategic GrowthuhsradNessuna valutazione finora

- Ford Restructing Plan As Submitted To CongressDocumento33 pagineFord Restructing Plan As Submitted To CongressFord Motor Company100% (41)

- The Purpose and Nature of External AuditDocumento9 pagineThe Purpose and Nature of External AuditFeb OktafihartoNessuna valutazione finora

- Value Drivers For Your BusinessDocumento5 pagineValue Drivers For Your BusinessBlumShapiroNessuna valutazione finora

- 4 Political Frame Worksheet 1Documento5 pagine4 Political Frame Worksheet 1api-678248054Nessuna valutazione finora

- Supplier Relationship Managemen Peter KraljicDocumento4 pagineSupplier Relationship Managemen Peter KraljicSeemaNessuna valutazione finora

- Corporate Reconstruction SaceDocumento13 pagineCorporate Reconstruction Sacemuskan khatriNessuna valutazione finora

- Foreign Companies - Selling To The US Govt B2GDocumento15 pagineForeign Companies - Selling To The US Govt B2Gjschaus100% (1)

- Salazar Research#2Documento5 pagineSalazar Research#2Darren Ace SalazarNessuna valutazione finora

- 5 Considerations in Divesting A Carveout To A SPAC - WSJDocumento7 pagine5 Considerations in Divesting A Carveout To A SPAC - WSJonkarNessuna valutazione finora

- Information Management in Financial ServicesDocumento18 pagineInformation Management in Financial Servicesf1sh01Nessuna valutazione finora

- Commercial Construction Business PlanDocumento13 pagineCommercial Construction Business Plan2010misc67% (3)

- POWER RANKING: The 10 Best Industries in 2020 For Entrepreneurs To Start Million-Dollar Businesses Despite The PandemicDocumento6 paginePOWER RANKING: The 10 Best Industries in 2020 For Entrepreneurs To Start Million-Dollar Businesses Despite The PandemicTung NgoNessuna valutazione finora

- February 2nd - February 15th, 2013: Rising Demand Propels Warehouse Market To Strong 2012 FinishDocumento4 pagineFebruary 2nd - February 15th, 2013: Rising Demand Propels Warehouse Market To Strong 2012 FinishAnonymous Feglbx5Nessuna valutazione finora

- Factors Affecting The Hotel IndustryDocumento12 pagineFactors Affecting The Hotel IndustryVivekNessuna valutazione finora

- BCG - Treasure Chest or Time BombDocumento10 pagineBCG - Treasure Chest or Time Bombmadhusri002Nessuna valutazione finora

- Survivor & Thriver: Capital IQ, JDP EstimatesDocumento4 pagineSurvivor & Thriver: Capital IQ, JDP EstimatesAndy HuffNessuna valutazione finora

- Goldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COODocumento7 pagineGoldman Sachs Presentation To The Sanford Bernstein Strategic Decisions Conference Comments by Gary Cohn, President & COOapi-102917753Nessuna valutazione finora

- Accounting Firm Marketing PlanDocumento31 pagineAccounting Firm Marketing PlanChristian Daniel AguillónNessuna valutazione finora

- Capability Statement 34Documento5 pagineCapability Statement 34Ulek BuluNessuna valutazione finora

- Vision & MissionDocumento6 pagineVision & MissionVishnu JeevandasNessuna valutazione finora

- C&B - MidTerm AssignmentDocumento7 pagineC&B - MidTerm AssignmentAyush NigamNessuna valutazione finora

- Hertz Investment ThesisDocumento5 pagineHertz Investment Thesistygocixff100% (2)

- Strategic Management Assignment - Chapter 3 - Nelson GuoDocumento2 pagineStrategic Management Assignment - Chapter 3 - Nelson Guonelly gNessuna valutazione finora

- Strategic Management Dis Bus 400Documento6 pagineStrategic Management Dis Bus 400nelly gNessuna valutazione finora

- PWC Chems Q3 2010Documento20 paginePWC Chems Q3 2010kanishkagaggarNessuna valutazione finora

- Fatima M. Chin MBA 2 November 29, 2020 Exercise 3 Driving Industry Competition That Are Affecting The Profitability of This Firm?Documento2 pagineFatima M. Chin MBA 2 November 29, 2020 Exercise 3 Driving Industry Competition That Are Affecting The Profitability of This Firm?Fatima ChinNessuna valutazione finora

- New Trajectories For The Aerospace and Defense IndustryDocumento12 pagineNew Trajectories For The Aerospace and Defense IndustryRavi Kr YadavNessuna valutazione finora

- Mastering Zillow: How To Get The Most Out of The Largest Real Estate Network On The WebDocumento40 pagineMastering Zillow: How To Get The Most Out of The Largest Real Estate Network On The WebmlsliNessuna valutazione finora

- SWOT Analysis: StrengthsDocumento8 pagineSWOT Analysis: StrengthsMUNSIF JAWEEDNessuna valutazione finora

- M&a PDFDocumento6 pagineM&a PDFHarshita SethiyaNessuna valutazione finora

- Surety Forecast Septermber 2011 - FinalDocumento6 pagineSurety Forecast Septermber 2011 - FinaltomsantoniNessuna valutazione finora

- UNIT 5 TR SirDocumento25 pagineUNIT 5 TR SirgauthamNessuna valutazione finora

- Assignment-Strategic ManagementDocumento7 pagineAssignment-Strategic ManagementRanjani SundarNessuna valutazione finora

- Trade Report February 09Documento7 pagineTrade Report February 09David DorrNessuna valutazione finora

- PWC 12 Reporting TipsDocumento28 paginePWC 12 Reporting Tipssathyasai1972Nessuna valutazione finora

- Deltek Clarity Report - 2020Documento80 pagineDeltek Clarity Report - 20209980139892Nessuna valutazione finora

- Why Mergers FailDocumento40 pagineWhy Mergers FaildearvikaskatariaNessuna valutazione finora

- Government Contracting Part 1 SlidesDocumento26 pagineGovernment Contracting Part 1 SlidesLouis McleodNessuna valutazione finora

- KjennyDocumento17 pagineKjennyGem Yiel100% (1)

- Porter's Five Forces Analysis - Retail/Real Estate IndustryDocumento3 paginePorter's Five Forces Analysis - Retail/Real Estate IndustrySrinivas NandikantiNessuna valutazione finora

- McKinsey M&a ValueDocumento7 pagineMcKinsey M&a Valuepeteman11111Nessuna valutazione finora

- Thesis DebtDocumento6 pagineThesis Debtafcnoxdhv100% (2)

- January 19, 2013 - February 1, 2013: Maryland Tax Credit Bill Aims To Spur Commercial DevelopmentDocumento4 pagineJanuary 19, 2013 - February 1, 2013: Maryland Tax Credit Bill Aims To Spur Commercial DevelopmentAnonymous Feglbx5Nessuna valutazione finora

- Optimize Mortgage White PaperDocumento5 pagineOptimize Mortgage White PaperGenghiz KhanNessuna valutazione finora

- Testing The Limits of Diversification: February 2012Documento5 pagineTesting The Limits of Diversification: February 2012leelakishanNessuna valutazione finora

- Business Brokers Industry ReportDocumento31 pagineBusiness Brokers Industry Reportjdamas1100% (1)

- Aviation Maintenance Intelligence Issue 00354Documento53 pagineAviation Maintenance Intelligence Issue 00354giorgiogarrido6Nessuna valutazione finora

- Survival Rates of Service Business - StudyDocumento14 pagineSurvival Rates of Service Business - Studygiorgiogarrido6Nessuna valutazione finora

- Manias and Mimesis: Applying René Girard To Financial BubblesDocumento34 pagineManias and Mimesis: Applying René Girard To Financial Bubblesbyrneseyeview100% (4)

- Emergency Debris Hauling - Dade BiddersDocumento5 pagineEmergency Debris Hauling - Dade Biddersgiorgiogarrido6Nessuna valutazione finora

- MRO 2017 Aeroturbine and AJW PG 52Documento170 pagineMRO 2017 Aeroturbine and AJW PG 52giorgiogarrido6Nessuna valutazione finora

- 5 de 5 A 3408 F 57150Documento27 pagine5 de 5 A 3408 F 57150Tony RocasNessuna valutazione finora

- Yelp A Fresh Perspective SQN Investors 01.16.2019Documento112 pagineYelp A Fresh Perspective SQN Investors 01.16.2019Phan AnNessuna valutazione finora

- Sum of The Parts - Mro ManagementDocumento4 pagineSum of The Parts - Mro Managementgiorgiogarrido6Nessuna valutazione finora

- AerCap Reshapes Used Parts Subsidiary To Supporting RoleDocumento16 pagineAerCap Reshapes Used Parts Subsidiary To Supporting Rolegiorgiogarrido6Nessuna valutazione finora

- MRI Interventions, Inc. Investor Presentation PDFDocumento30 pagineMRI Interventions, Inc. Investor Presentation PDFgiorgiogarrido6Nessuna valutazione finora

- Moving The Market - Mro ManagementDocumento3 pagineMoving The Market - Mro Managementgiorgiogarrido6Nessuna valutazione finora

- Wp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101Documento2 pagineWp-Content Uploads Sites 3 2014 12 Reading List For Life and Investment Fundamentals 101giorgiogarrido6Nessuna valutazione finora

- Aero - Dynamic - Ajw GroupDocumento19 pagineAero - Dynamic - Ajw Groupgiorgiogarrido6Nessuna valutazione finora

- MS - ThemathofvalueandgrowthDocumento13 pagineMS - ThemathofvalueandgrowthmilandeepNessuna valutazione finora

- This Post Was Originally Included in Our Quarterly Letter To Our LPs in Q4 2012Documento10 pagineThis Post Was Originally Included in Our Quarterly Letter To Our LPs in Q4 2012giorgiogarrido6Nessuna valutazione finora

- Arisaig Quarterly: The Great Disconnect I: Stocks and Economic ActivityDocumento13 pagineArisaig Quarterly: The Great Disconnect I: Stocks and Economic Activitygiorgiogarrido6Nessuna valutazione finora

- Reflections of A Value Investors in AfricaDocumento20 pagineReflections of A Value Investors in AfricaKevin MartelliNessuna valutazione finora

- Payments Outlook For 2016 January 7 20161Documento36 paginePayments Outlook For 2016 January 7 20161giorgiogarrido6Nessuna valutazione finora

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocumento26 pagineLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6Nessuna valutazione finora

- LBS - Massimo Fuggeta Investment Theory Vs PractuceDocumento26 pagineLBS - Massimo Fuggeta Investment Theory Vs Practucegiorgiogarrido6Nessuna valutazione finora

- Rail RenaissanceDocumento27 pagineRail RenaissanceEvan TindellNessuna valutazione finora

- Value Investors Club - Post Holdings Inc (Post)Documento11 pagineValue Investors Club - Post Holdings Inc (Post)giorgiogarrido6Nessuna valutazione finora

- Pitcairn Book ListDocumento11 paginePitcairn Book Listgiorgiogarrido6Nessuna valutazione finora

- History of Beiersdorf & CoDocumento28 pagineHistory of Beiersdorf & Cogiorgiogarrido6Nessuna valutazione finora

- 2015 Pacific Crest SaaS Survey 10.16.15 2Documento72 pagine2015 Pacific Crest SaaS Survey 10.16.15 2giorgiogarrido6Nessuna valutazione finora

- 2013 06 Greenwald Earnings Power Value EPV Lecture SlidesDocumento43 pagine2013 06 Greenwald Earnings Power Value EPV Lecture Slidesgiorgiogarrido6Nessuna valutazione finora

- Platform EconomicsDocumento459 paginePlatform Economicsgiorgiogarrido6100% (1)

- Navigating Planet Ad Tech: A Guide For MarketersDocumento10 pagineNavigating Planet Ad Tech: A Guide For Marketersgiorgiogarrido6Nessuna valutazione finora

- A Valuation of ABB Comparison of Organic and M A Growth StrategiesDocumento113 pagineA Valuation of ABB Comparison of Organic and M A Growth Strategiesgiorgiogarrido6Nessuna valutazione finora

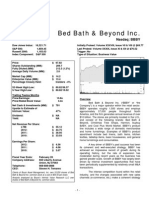

- BBBYDocumento13 pagineBBBYgiorgiogarrido6Nessuna valutazione finora

- TWIDO-TWD LCAE 40DRF DocumentDocumento8 pagineTWIDO-TWD LCAE 40DRF DocumentA MNessuna valutazione finora

- 1.2D Viewing TransformationsDocumento127 pagine1.2D Viewing TransformationsAbhigyan HarshaNessuna valutazione finora

- Glo Core Digital Twins in Logistics PDFDocumento39 pagineGlo Core Digital Twins in Logistics PDFRafael GimenoNessuna valutazione finora

- h110m ProvdeDocumento148 pagineh110m ProvdeBenjamin VillotaNessuna valutazione finora

- VBG08H-E: Ignition Coil Driver Power I.CDocumento34 pagineVBG08H-E: Ignition Coil Driver Power I.CAngel VelasquezNessuna valutazione finora

- Tictac ToeDocumento9 pagineTictac ToeMuthu Vijay DeepakNessuna valutazione finora

- Answer KeyDocumento10 pagineAnswer KeyNguyễn Huyên79% (14)

- Ranap Release CauseDocumento397 pagineRanap Release CauseKamana Khare0% (1)

- Studienreglement Master RW2017Documento26 pagineStudienreglement Master RW2017Fbgames StefNessuna valutazione finora

- Archiver ErrorDocumento11 pagineArchiver Errorjigar soniNessuna valutazione finora

- Man Inst Mru 5 r9Documento148 pagineMan Inst Mru 5 r9Miguel Martinez100% (1)

- CSS 4th PeriodicalDocumento2 pagineCSS 4th PeriodicalJefersonNessuna valutazione finora

- MailEnable System Manual PDFDocumento17 pagineMailEnable System Manual PDFDTVNessuna valutazione finora

- 3.1 Faster - R-CNN - Towards - Real-Time - Object - Detection - With - Region - Proposal - NetworksDocumento13 pagine3.1 Faster - R-CNN - Towards - Real-Time - Object - Detection - With - Region - Proposal - NetworksAmrutasagar KavarthapuNessuna valutazione finora

- Matsui Mat102 Manual InstructionsDocumento220 pagineMatsui Mat102 Manual InstructionsDaniele MozzoniNessuna valutazione finora

- Windloads On Offshore StructuresDocumento16 pagineWindloads On Offshore StructureschbeggyNessuna valutazione finora

- Common Source Amplifier PDFDocumento2 pagineCommon Source Amplifier PDFJennifer0% (1)

- Windows XP Sp2 SerialDocumento4 pagineWindows XP Sp2 SerialPapillon Rose FleurNessuna valutazione finora

- Rsae ITP QA: Document Review and Cover Sheet Company: Construction ContractorDocumento5 pagineRsae ITP QA: Document Review and Cover Sheet Company: Construction ContractorUtku Can KılıçNessuna valutazione finora

- 6762792 (1)Documento2 pagine6762792 (1)BenjaNessuna valutazione finora

- Multimedia Networking ApplicationsDocumento2 pagineMultimedia Networking ApplicationsHasanain AliNessuna valutazione finora

- Adding Responsibility To An Application User For Oracle EDocumento2 pagineAdding Responsibility To An Application User For Oracle EVaibhav KulkarniNessuna valutazione finora

- Special Documentation Proline Promass 500 FOUNDATION FieldbusDocumento52 pagineSpecial Documentation Proline Promass 500 FOUNDATION Fieldbuspaula marambioNessuna valutazione finora

- Diagnostic Trouble Codes (DTC) : DTC P281 O Solenoid G ElectricalDocumento5 pagineDiagnostic Trouble Codes (DTC) : DTC P281 O Solenoid G Electricalluis eduardo corzo enriquezNessuna valutazione finora

- MTA: Database Fundamentals: Lab Exercises & NotesDocumento24 pagineMTA: Database Fundamentals: Lab Exercises & NotesMA MaalejNessuna valutazione finora

- Block 1Documento57 pagineBlock 1riya guptaNessuna valutazione finora

- Forex InsiderDocumento17 pagineForex InsiderLewis LowNessuna valutazione finora

- Makerere University Entry Cutoff Points 2018-19Documento58 pagineMakerere University Entry Cutoff Points 2018-19kiryamwibo yenusu94% (16)

- Library and Information ScienceDocumento32 pagineLibrary and Information Scienceneilesh300100% (2)

- ReadmeDocumento2 pagineReadmes sivaNessuna valutazione finora