Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

1525

Caricato da

Sabby SinghCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

1525

Caricato da

Sabby SinghCopyright:

Formati disponibili

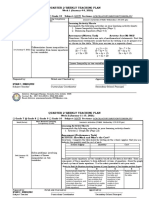

Assignment#2 Step1 The discussion of the free cash flow and the economic value added have been

very useful and provide in a great deal the basis for the evaluating the investment and growth opportunities. However it can be argued how well the economic value added methodology may be relied upon. This is to say that is it necessary that a project that generate economic value or which has higher economic valued added can be invested into. This might not be the case and there might be other factors that affect the investments. This might be the debt on the company, dividend being paid and the growth levels. Thus such analysis has to be made. Second thing is that the cash flow statement has three sections, namely, cash flow from investing, operating and financing activities however in this case only operating and investing activities have been considered. Thus it has raised the doubt that how financing activities are included in the statements which is an important part of the annual reports that have been prepared. Another important point that requires consideration is how to classify different heads under operating and investing heads. This is clearly shown in the article but at the same time it has been stated that these are interrelated but it has to be clearly identified which at times might be difficult. Step 2 Step 3 The contribution margin has been calculated for each product as the difference between the selling price and the variable cost. In order to maximize the profit from the sales of these products contribution margin per unit of material required will be considered. This is to say that the product that produces maximum profit for per unit consumption of raw material will have to be produced. Thus profit per unit consumption is calculated. This has been shown below. (a) Particulars Kayak All Day Contribution per unit of fibre glass $(-12.5) (b) Kayak With Style $200 ( c) Budget kayak $25 (d) Kayak Cruiser $150 (e) Great Gold Kayak $100

Thus from the above table it can be said that the product Kayak With Style should be produced to meet the complete demand, followed by Kayak Cruiser and then Great Gold Kayak. The below table shows that how much of each can be produced to attain maximum profit. Balance Glass 50,000 10,000 0 Fibre

Product Kayak With Style Kayak Cruiser Great Gold Kayak

Units Produced Fibre Glass Used 50,000 40,000 5,000 25,000 40,000 10,000

Profit $5,000,000 $6,000,000 $1,000,000

The methodology that has been discussed is complete scientific approach and thus will provide results that are very quite useful in maximizing the profit. There are a few

considerations that need to be considered while performing the analysis. Firstly there might be deviation in the demand of the product that has been provided and thus if the demand of the products that have been considered above fall, the complete profitability will be changed. Secondly the product may be included, like Kayak All Day in order to gain market share. Thus the strategy of the management is not considered and the approach to identify the production of each product is based on the rational approach. The decision should be supported by the management and thus a few changes might be there which will be based on the strategy of the management and changes related to costing of different products might not be there.

Assignment#3

Step 1 Step 2 The NPV, IRR and Payback Period for each machine have been calculated. These have been shown below. Machine A B NPV $13381.37 $12301.95 IRR 18% 19% Payback Period 3 years 4 years

As shown in the above table the NPV of Machine A is higher than Machine B but the IRR for B is better than A. Also as per the payback period analysis both machines can be considered for the investment as the payback period for Machine A is three years and that of Machine B is 4 years. However Machine A can be considered over machine B as the net present value of machine A is greater than machine B at the given cost of capital. At the given cost of capital of 10% since the NPV of machine A is better it can be considered for the investment.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- AIM - Individual Assignment Guidelines (Final) - Autumn 2014Documento9 pagineAIM - Individual Assignment Guidelines (Final) - Autumn 2014Sabby SinghNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 1214Documento4 pagine1214Sabby SinghNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- 8ab01MCT-List of SheetsDocumento1 pagina8ab01MCT-List of SheetsSabby SinghNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- MukeshDocumento1 paginaMukeshSabby SinghNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Indian Insurance Industry: Strategies Aimed at The Bottom of The PyramidDocumento4 pagineIndian Insurance Industry: Strategies Aimed at The Bottom of The PyramidSabby SinghNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Eureka Math Grade 2 Module 3 Parent Tip Sheet 1Documento2 pagineEureka Math Grade 2 Module 3 Parent Tip Sheet 1api-324573119Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Teaching Plan - Math 8 Week 1-8 PDFDocumento8 pagineTeaching Plan - Math 8 Week 1-8 PDFRYAN C. ENRIQUEZNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Andromeda: Druid 3 Warborn06Documento5 pagineAndromeda: Druid 3 Warborn06AlanNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- March 2023 (v2) INDocumento8 pagineMarch 2023 (v2) INmarwahamedabdallahNessuna valutazione finora

- Mehdi Semati - Media, Culture and Society in Iran - Living With Globalization and The Islamic State (Iranian Studies)Documento294 pagineMehdi Semati - Media, Culture and Society in Iran - Living With Globalization and The Islamic State (Iranian Studies)Alexandra KoehlerNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- I. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Documento5 pagineI. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Shelton Lyndon CemanesNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Adhesive Film & TapeDocumento6 pagineAdhesive Film & TapeJothi Vel MuruganNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- 762id - Development of Cluster-7 Marginal Field Paper To PetrotechDocumento2 pagine762id - Development of Cluster-7 Marginal Field Paper To PetrotechSATRIONessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Yojananov 2021Documento67 pagineYojananov 2021JackNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- 1Z0-061 Sample Questions AnswersDocumento6 pagine1Z0-061 Sample Questions AnswersLaura JohnstonNessuna valutazione finora

- Matokeo CBDocumento4 pagineMatokeo CBHubert MubofuNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Islcollective Present SimpleDocumento2 pagineIslcollective Present Simplecrisan mirunaNessuna valutazione finora

- AT10 Meat Tech 1Documento20 pagineAT10 Meat Tech 1Reubal Jr Orquin Reynaldo100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Korea Times - Korean-EnglishDocumento313 pagineKorea Times - Korean-EnglishgyeryongNessuna valutazione finora

- Alem Ketema Proposal NewDocumento25 pagineAlem Ketema Proposal NewLeulNessuna valutazione finora

- Space Saving, Tight AccessibilityDocumento4 pagineSpace Saving, Tight AccessibilityTran HuyNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Financial Statement AnalysisDocumento18 pagineFinancial Statement AnalysisAbdul MajeedNessuna valutazione finora

- M.T Nautica Batu Pahat: Clean Product Tanker 4,497 BHPDocumento1 paginaM.T Nautica Batu Pahat: Clean Product Tanker 4,497 BHPSuper 247Nessuna valutazione finora

- Practical Applications of Electrical ConductorsDocumento12 paginePractical Applications of Electrical ConductorsHans De Keulenaer100% (5)

- TSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishDocumento93 pagineTSC M34PV - TSC M48PV - User Manual - CryoMed - General Purpose - Rev A - EnglishMurielle HeuchonNessuna valutazione finora

- What Is Terrorism NotesDocumento3 pagineWhat Is Terrorism NotesSyed Ali HaiderNessuna valutazione finora

- NIFT GAT Sample Test Paper 1Documento13 pagineNIFT GAT Sample Test Paper 1goelNessuna valutazione finora

- PDF Synopsis PDFDocumento9 paginePDF Synopsis PDFAllan D GrtNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Regulated and Non Regulated BodiesDocumento28 pagineRegulated and Non Regulated Bodiesnivea rajNessuna valutazione finora

- Retail Visibility Project of AircelDocumento89 pagineRetail Visibility Project of Aircelabhishekkraj100% (1)

- Chemical Classification of HormonesDocumento65 pagineChemical Classification of HormonesetNessuna valutazione finora

- 506 Koch-Glitsch PDFDocumento11 pagine506 Koch-Glitsch PDFNoman Abu-FarhaNessuna valutazione finora

- A Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixDocumento12 pagineA Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixPraveen KumarNessuna valutazione finora

- Written Report in Instructional PlanningDocumento6 pagineWritten Report in Instructional PlanningRose Aura HerialesNessuna valutazione finora

- Intertext: HypertextDocumento8 pagineIntertext: HypertextRaihana MacabandingNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)