Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SAP New GL # 1 Overview of New GL Document Splitting Process PDF

Caricato da

spani92Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SAP New GL # 1 Overview of New GL Document Splitting Process PDF

Caricato da

spani92Copyright:

Formati disponibili

Introduction to Document Splitting in new GL

Overview Document Splitting in new GL in SAP ECC is one of the key changes introduced by SAP to streamline multiple reporting requirements and to enable faster close process for its customers. No functionality was more keenly awaited as document splitting. Document Splitting We use Profit Centre as a scenario to explain the functionalities; however all processes that apply to Profit Centre also apply to the other scenarios (Segment, Business Area). New GL before SAP ECC Financial postings in SAP automatically generate values for certain characteristics (like profit centre) on the document. This generation of characteristic value is derived from characteristics already input by users and triggered either by a code inherent in SAP or due to user-defined derivation rules. However, certain lines items in the financial posting (like Payables, Receivables) would not generate any value for profit centre. This is because of an apparent conflict between the requirements for accounting and the requirements for management reporting of financial transactions.

For the purposes of reporting, a Vendor line item could belong to multiple profit centers depending on which profit centre bought goods/ services from it For the purposes of accounting, the Vendor line item belongs to the legal entity that is responsible for the accrual of expense/ vendor dues. All financial postings catered to accounting requirement of the posting they posted to the legal entity responsible for incurring the liability. At the month-end, users could execute a series of steps to transfer Vendor, Customer, Asset and Inventory balances to Profit Centers. During this transfer, the outstanding balance at the time of transfer would split by profit centre and post to respective profit centers. The disadvantage with this process was that the Trial balance by profit centre could only be reasonably generated at the end of the month after the balances were transferred to profit centers. Real-time reporting by profit centre for balance sheet items was not possible, unless the user manually split the lines during data entry. The process to transfer balances to Profit Centre increased the time to close books at end of the month.

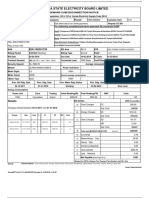

Vendor Invoice split before SAP ECC

New GL in SAP ECC Document splitting functionality in new GL performs automatic split in real-time of the line items on a financial document for the user-selected characteristics (called scenarios) like profit centre, segment. SAP delivers pre-configured splitting rules that can be used to perform the online document split. SAP customers can configure the rules to suit their business processes, if the pre-configured rules do not satisfy their business requirements. The document splitting functionality was delivered with another useful functionality zero/ selfbalancing. This functionality enables SAP customers to produce a complete AND a balanced balance sheet and Profit & Loss by Profit Centre. Functions of Document splitting in new GL in SAP: Active Split The amounts on the line items that do not have Profit Centre will be split in the ratio of the amounts on the base line items. The identification of the line item to be split and the base line item can be configured by users. Example of Document Splitting during Vendor Invoice processing (Active Split) Active split occurs when the amounts on the line items that do not have Profit Centre are split by the system based on preconfigured splitting rules.

Let us look at an example of a Vendor Invoice posted in new GL. The Vendor Invoice is posted to expense accounts for costs belonging to two profit centers. There is an input tax posted as part of this transaction. This view is called the data entry view. The Vendor Account is credited with AUD 440.00; this is the amount that is relevant for accounting.

Data entry view Active Split

SAP will split the document in the background based on pre-configured splitting rules. The split document is reflected in the General Ledger view will look as below.

General Ledger view Active split

The amounts on the Vendor line and the amounts on the Tax line are split to the profit centres in the ratio of the amounts of the expense lines. This is a reporting view of the same financial document; the vendor payable is AUD 440 in accounting view but is split by Profit Centre in the reporting view. Functions of Document splitting in new GL in SAP: Passive Split Passive split occurs when the amounts on the line items that do not have Profit Centre are split by the system based on preceding processes. This is defined within SAP code and cannot be configured. An example is when Vendor Invoice is paid, the Vendor line items on the payment document are split in the ratio of the original split in the preceding Vendor Invoice document. Example of Document Splitting during Vendor Payment processing (Passive Split) Let us look at passive split in a business process when the above Vendor Invoice is paid in full. The accounting document in data entry view is as below.

Data entry view Passive Split

SAP will carry over the split on the Vendor line item from the preceding process (Vendor Invoice process) and will split the Vendor line in the payment document in the same ratio. The split document is shown in the General Ledger view.

General Ledger view Passive Split

Functions of Document splitting in new GL in SAP: Self-balancing Document splitting functionality in new GL allows the users to produce a balance sheet by profit centre (or by scenario). However, the Balance Sheet is not a balanced Balance Sheet. If you notice in the document below, the total of Profit Centre 1100 is in the credit of $30 and the total of Profit Centre 1000 is in the debit of $30. The Profit Centre Managers do not have enough information in their respective Balance Sheets to analyse the cause of the difference or which Profit Centre is owing/ in debt to their Profit Centre.

Document not self-balanced by profit centre

The self-balancing functionality in new GL will produce additional entries in General Ledger view to offset the balance in each profit centre in the document. This process will normally occur when

multiple profit centers has been derived on all lines of the financial document and hence, active document splitting was not required the total amount on all lines for any given profit centre is not zero

Self-balanced document in SAP ECC newGL

As in the previous example, the self balancing entry is automatically posted based on configuration settings. In the self-balancing clearing entry below, you will notice that the line item has also populated a partner profit centre. This will allow Profit Centre Managers to analyse the clearing account by Profit Centre owing/ owed.

General Ledger view self balanced document

Conclusion Document splitting functionality provided in new GL in SAP is a very powerful feature of the new SAP version. It allows business users to generate trial balance by Profit Centre in real time. This also makes redundant the month end processes to transfer Balance Sheet balances to Profit Centers another feature of new GL thereby enabling faster month end close.

Potrebbero piacerti anche

- Tools to Beat Budget - A Proven Program for Club PerformanceDa EverandTools to Beat Budget - A Proven Program for Club PerformanceNessuna valutazione finora

- SAP New GL FunctionalityDocumento7 pagineSAP New GL FunctionalitypaiashokNessuna valutazione finora

- Introduction To Document Splitting in New GLDocumento8 pagineIntroduction To Document Splitting in New GLvenkat6299Nessuna valutazione finora

- New LedgerDocumento42 pagineNew LedgerMADHURA RAULNessuna valutazione finora

- Document Splitting in New General Ledger: BackgroundDocumento17 pagineDocument Splitting in New General Ledger: BackgroundBala RanganathNessuna valutazione finora

- Comparative Analysis Between New GL and Classic GL 1712255776Documento161 pagineComparative Analysis Between New GL and Classic GL 1712255776chirag jainNessuna valutazione finora

- FICO Interview AnswersDocumento160 pagineFICO Interview Answersy janardhanreddy100% (1)

- General Ledger: Main ProcessDocumento4 pagineGeneral Ledger: Main ProcessSachin AkNessuna valutazione finora

- New General Ledger IntroductionDocumento3 pagineNew General Ledger IntroductionManohar GoudNessuna valutazione finora

- Document Splitting in New General LedgerDocumento13 pagineDocument Splitting in New General LedgerraviNessuna valutazione finora

- Scenarios in SAP General Ledger AccountingDocumento6 pagineScenarios in SAP General Ledger AccountingAmin raufiNessuna valutazione finora

- Document SplittingDocumento20 pagineDocument SplittingShruti ChapraNessuna valutazione finora

- 3 New GLDocumento8 pagine3 New GLChirag SolankiNessuna valutazione finora

- FI Questionarie SET IDocumento7 pagineFI Questionarie SET IPrasanth KumarNessuna valutazione finora

- Document SplitDocumento11 pagineDocument SplitUmi PatNessuna valutazione finora

- Document Splitting in New General LedgerDocumento21 pagineDocument Splitting in New General LedgerRakesh Gupta100% (1)

- Unit 9. Reconciliation Between Management Accounting and Financial Accounting Reconciliation Ledger Business ExampleDocumento7 pagineUnit 9. Reconciliation Between Management Accounting and Financial Accounting Reconciliation Ledger Business ExampleItisham Nafis MuhammadNessuna valutazione finora

- New GLDocumento30 pagineNew GLkalkikaliNessuna valutazione finora

- Back To The Basics - : Account Amount Profit CentreDocumento14 pagineBack To The Basics - : Account Amount Profit CentreReddy BDNessuna valutazione finora

- SPRO Path (Fig. 01) :: Document Splitting Configuration in S/4 Hana FinanceDocumento5 pagineSPRO Path (Fig. 01) :: Document Splitting Configuration in S/4 Hana FinanceABDELMALEK .TEBOUDANessuna valutazione finora

- Ledger DefinitionDocumento21 pagineLedger DefinitionShruti ChapraNessuna valutazione finora

- New General Ledger Accounting 2Documento3 pagineNew General Ledger Accounting 2kgudurNessuna valutazione finora

- New GL ConfigDocumento30 pagineNew GL ConfigSridhar MuthekepalliNessuna valutazione finora

- Overview of New Ledger: With My SAP ChangesDocumento32 pagineOverview of New Ledger: With My SAP Changesjindalyash1234Nessuna valutazione finora

- Key Functionalities Enabled by SAP New GLDocumento1 paginaKey Functionalities Enabled by SAP New GLVijay Pratap Singh ChauhanNessuna valutazione finora

- S4 Hana Asset AccountingDocumento12 pagineS4 Hana Asset AccountingAkash100% (2)

- NewGL JVA DocumentationDocumento16 pagineNewGL JVA DocumentationDhanunjaya100% (1)

- Document Splitting in SAP New GLDocumento4 pagineDocument Splitting in SAP New GLAmin raufiNessuna valutazione finora

- Difference Between Active, Passive Document Splitting and Zero Balance MethodDocumento2 pagineDifference Between Active, Passive Document Splitting and Zero Balance Methoddude28spNessuna valutazione finora

- Curso New GL SAPDocumento47 pagineCurso New GL SAPFelipe VarelaNessuna valutazione finora

- Parallel Accounting in New General LedgerDocumento5 pagineParallel Accounting in New General LedgerbrcraoNessuna valutazione finora

- Asset Accounting Interview QuestionsDocumento18 pagineAsset Accounting Interview QuestionsBandita RoutNessuna valutazione finora

- SAP Asset AccountingDocumento27 pagineSAP Asset AccountingPrateekNessuna valutazione finora

- Accounting Exercise PDFDocumento61 pagineAccounting Exercise PDFAbdelhamid HarakatNessuna valutazione finora

- Ledger in R/3 Enterprise:: 1. The New General Ledger Has The Following Advantages Over The Classic GeneralDocumento5 pagineLedger in R/3 Enterprise:: 1. The New General Ledger Has The Following Advantages Over The Classic GeneralkmbrajNessuna valutazione finora

- Constants (Standard Account Assignment) in New General Ledger - ERP Financials - SCN WikiDocumento14 pagineConstants (Standard Account Assignment) in New General Ledger - ERP Financials - SCN WikiTrainer SAPNessuna valutazione finora

- Asset AccountingDocumento16 pagineAsset AccountingSarf FaizalNessuna valutazione finora

- PSCD Collections ManagementDocumento33 paginePSCD Collections Managementantonio.fortesNessuna valutazione finora

- SAP Financials Closing Operations User GuideDocumento49 pagineSAP Financials Closing Operations User Guidegergely_ridegNessuna valutazione finora

- New General Ledger: Important AdvantagesDocumento3 pagineNew General Ledger: Important AdvantagesBiranchi MishraNessuna valutazione finora

- Parallel Accounting in New General LedgerDocumento7 pagineParallel Accounting in New General Ledgerfylee74100% (1)

- Sap Fico Interview Questions On Fixed AssetsDocumento7 pagineSap Fico Interview Questions On Fixed AssetsPavan UlkNessuna valutazione finora

- Oracle EBS - Fixed Assets Overview - r12Documento3 pagineOracle EBS - Fixed Assets Overview - r12CarolynNessuna valutazione finora

- Simple Finance - The Convergence of The GL Account and The Cost ElementDocumento12 pagineSimple Finance - The Convergence of The GL Account and The Cost Elementjoseph davidNessuna valutazione finora

- Oracle R12 Upgrade Sub Ledger Accounting by EnrichDocumento20 pagineOracle R12 Upgrade Sub Ledger Accounting by EnrichEnrich LLCNessuna valutazione finora

- Document Splitting ProcessDocumento5 pagineDocument Splitting ProcessKiranNessuna valutazione finora

- New GL SegmentDocumento9 pagineNew GL SegmentDiego PazinNessuna valutazione finora

- SAP and Finance - Asset AccountingDocumento6 pagineSAP and Finance - Asset Accountingpawanjames7896Nessuna valutazione finora

- Sap Document SplittingDocumento6 pagineSap Document SplittingJose Luis GonzalezNessuna valutazione finora

- TB1100 EN Col96 FV A4Documento324 pagineTB1100 EN Col96 FV A4Julio Cesar R.Nessuna valutazione finora

- SAP New GL #8 Use Constants For Nonassigned Processes in SAP New GLDocumento7 pagineSAP New GL #8 Use Constants For Nonassigned Processes in SAP New GLspani92Nessuna valutazione finora

- A Case Study On r12 SlaDocumento15 pagineA Case Study On r12 Slawake12upNessuna valutazione finora

- Sap - RahulDocumento7 pagineSap - RahulRahulSekharNessuna valutazione finora

- SAP Accounting Powered by SAP HANA - FAQDocumento12 pagineSAP Accounting Powered by SAP HANA - FAQamaravatiNessuna valutazione finora

- Controlling - 1909 FPS02Documento85 pagineControlling - 1909 FPS02Sunil GNessuna valutazione finora

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsDa EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsNessuna valutazione finora

- Transporting Table Entries From One Server To AnotherDocumento7 pagineTransporting Table Entries From One Server To Anotherspani92Nessuna valutazione finora

- RAMcharitmanasundarkandDocumento27 pagineRAMcharitmanasundarkandpradeepsoni80Nessuna valutazione finora

- SAP New GL #8 Use Constants For Nonassigned Processes in SAP New GLDocumento7 pagineSAP New GL #8 Use Constants For Nonassigned Processes in SAP New GLspani92Nessuna valutazione finora

- SAP New GL #10 Document Splitting in Cross Company Code Vendor PaymentDocumento9 pagineSAP New GL #10 Document Splitting in Cross Company Code Vendor Paymentspani92100% (1)

- Notification UPSC Civil Services Exam 2013Documento159 pagineNotification UPSC Civil Services Exam 2013uppalamaheshNessuna valutazione finora

- Digital Signatures 20130304Documento152 pagineDigital Signatures 20130304Diana CarolinaNessuna valutazione finora

- Excel 2010 TablesDocumento26 pagineExcel 2010 Tablesspani92Nessuna valutazione finora

- Madhusudan DasDocumento229 pagineMadhusudan Dasspani92Nessuna valutazione finora

- 1109021 (1)Documento1 pagina1109021 (1)Cms Stl CmsNessuna valutazione finora

- Ch.2 Accounting For Bonus and Right IssueDocumento12 pagineCh.2 Accounting For Bonus and Right IssueAmrit SarkarNessuna valutazione finora

- Wachemo University School of Computing and Informatics Department of Computer Science Entrepreneurship Business PlanDocumento9 pagineWachemo University School of Computing and Informatics Department of Computer Science Entrepreneurship Business PlanAbe BerhieNessuna valutazione finora

- Corporate Advisory Services: Determining Financial Structure Portfolio ManagementDocumento3 pagineCorporate Advisory Services: Determining Financial Structure Portfolio ManagementK-Ayurveda WelexNessuna valutazione finora

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDocumento4 pagineABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFAlfredo del Mundo Jr.80% (5)

- Deutsche Finan ExcelDocumento6 pagineDeutsche Finan ExcelAnonymous VVSLkDOAC1Nessuna valutazione finora

- KsebBill 1165411013809Documento1 paginaKsebBill 1165411013809Jio CpyNessuna valutazione finora

- Blackbook Project On Merchant BankingDocumento66 pagineBlackbook Project On Merchant BankingElton Andrade75% (12)

- Course OutlineDocumento13 pagineCourse OutlineKabile MwitaNessuna valutazione finora

- High Light - Chapter 26Documento64 pagineHigh Light - Chapter 26Samira AlhashimiNessuna valutazione finora

- A Cat Bond Premium Puzzle?: Financial Institutions CenterDocumento36 pagineA Cat Bond Premium Puzzle?: Financial Institutions CenterchanduNessuna valutazione finora

- Evp6310009992783 - 2020 01 01 - 2021 09 16Documento184 pagineEvp6310009992783 - 2020 01 01 - 2021 09 16tunisiehyperNessuna valutazione finora

- Treasury Bond Claim Form Sav1048Documento7 pagineTreasury Bond Claim Form Sav1048aplaw100% (1)

- Mock Examination FinAccDocumento18 pagineMock Examination FinAccPaul Justin Sison MabaoNessuna valutazione finora

- Income Tax and VATDocumento498 pagineIncome Tax and VATshankar k.c.100% (2)

- Banik Luggage Centre: TotalDocumento1 paginaBanik Luggage Centre: TotalRounak GhoshNessuna valutazione finora

- 4.02 Business Banking Check Parts (B) - 2Documento7 pagine4.02 Business Banking Check Parts (B) - 2TrinityNessuna valutazione finora

- Grace-AST Module 4Documento2 pagineGrace-AST Module 4Devine Grace A. MaghinayNessuna valutazione finora

- Walt Disney Financial StatementDocumento8 pagineWalt Disney Financial StatementShaReyNessuna valutazione finora

- Financial Market.Documento65 pagineFinancial Market.CHARAK RAYNessuna valutazione finora

- Intro To MA Aug 2013Documento14 pagineIntro To MA Aug 2013Nakul AnandNessuna valutazione finora

- Steps in Accounting CycleDocumento34 pagineSteps in Accounting Cycleahmad100% (4)

- 21 VBHN-BTC 512873Documento78 pagine21 VBHN-BTC 512873LET LEARN ABCNessuna valutazione finora

- Capricorn 30: A Secret Business ConferenceDocumento2 pagineCapricorn 30: A Secret Business ConferenceStarlingNessuna valutazione finora

- CSEC POA June 2012 P1 PDFDocumento12 pagineCSEC POA June 2012 P1 PDFjunior subhanNessuna valutazione finora

- Selection Among AlternativesDocumento24 pagineSelection Among AlternativesDave DespabiladerasNessuna valutazione finora

- Difference Between IMF and World BankDocumento4 pagineDifference Between IMF and World BankSourabh ShuklaNessuna valutazione finora

- Financial Statement AnalysisDocumento26 pagineFinancial Statement Analysissagar7Nessuna valutazione finora

- Hire Purchase For Bcom and Nepal CADocumento14 pagineHire Purchase For Bcom and Nepal CANandani BurnwalNessuna valutazione finora

- Module 3Documento22 pagineModule 3Suprita Karajgi100% (1)