Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Moody's App To RTG Con LN ABS 2012

Caricato da

Zaid AbdulrahmanDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Moody's App To RTG Con LN ABS 2012

Caricato da

Zaid AbdulrahmanCopyright:

Formati disponibili

STRUCTURED FINANCE

OCTOBER 12, 2012

RATING METHODOLOGY

Table of Contents

BACKGROUND 1

MAIN RISKS OF TYPICAL

TRANSACTION 3

1. STRUCTURAL FEATURES AND EFFECT

ON CREDIT ENHANCEMENT LEVELS 3

2. MAIN CHARACTERISTICS OF

SECURITISED CONSUMER LOAN

PORTFOLIOS 5

3. OUR MODELLING APPROACH TO

RATING CONSUMER LOAN

TRANSACTIONS 5

4. KEY LEGAL AND OPERATIONAL

RISKS APPLICABLE TO CONSUMER

LOAN SECURITISATION

TRANSACTIONS 12

5. PRINCIPAL SOURCES OF

UNCERTAINTY IN THIS

METHODOLOGY 13

6. MONITORING A CONSUMER LOAN

BACKED TRANSACTION 13

APPENDIX 1: CONSUMER LOAN

UNDERWRITING AND SERVICING 14

APPENDIX 2: OUR DATA TEMPLATE

FOR CONSUMER LOAN

TRANSACTIONS 15

APPENDIX 3 17

RELATED RESEARCH 20

Analyst Contacts

Paula Lichtensztein

Assistant Vice President Analyst

39.02.914.81.144

Paula.Lichtensztein@moodys.com

Valentina Varola

Vice President Senior Analyst

39.02.914.81.122

Valentina.Varola@moodys.com

ADDITIONAL CONTACTS:

Client Services Desk: 44.20.7772.5454

clientservices.emea@moodys.com

monitor.abs@moodys.com

Website: www.moodys.com

contacts continued on the last page

Moodys Approach to Rating Consumer Loan

ABS Transactions

Consumer Loan / Global

Background

This report details our approach to rating securitisation transactions that are backed by

unsecured consumer loan receivables (defined as personal or purpose loans) and builds

on our previously published reports, such as The Lognormal Method Applied to ABS

Analysis, in June 2000.

This methodology does not apply to revolving credit products (e.g., credit cards), secured

auto loans/leases or other particular consumer products, which require a different analytical

approach given the specifics of these assets.

1

We have rated consumer loan asset-backed securities (ABS) since the 1990s, when the

securitisation of consumer loans in Europe, the Middle East and Africa (EMEA), Asia/Pacific

and Latin America began in earnest. This type of securitisation provides funding and

regulatory capital relief to the specialised lenders and banks that originate unsecured

consumer loans.

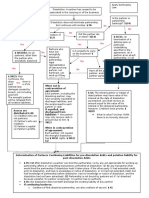

This report discusses the main risks of a typical transaction and describes the ratings process

in five incremental steps:

In the first section, we introduce a typical consumer loan securitisation structure and

discuss the effect that specific key structural features may have on the credit

enhancement levels of a hypothetical transaction.

In the second section, we summarise the main product types and loan characteristics of

the securitised portfolios.

In the third section, we focus on the quantitative analysis performed in determining

ratings for a consumer loan ABS transaction. This includes defining the asset-side model

inputs and describing our cash flow modelling processes.

In the fourth section, we examine the legal risks found in consumer loan ABS.

Finally, in section five, we identify the principal sources of uncertainty and ratings

volatility relevant to this methodology.

This report has been republished on October 12, 2012. The reference to the triangular distribution of losses in Latin

American transactions has been deleted because we will use a lognormal distribution of losses for these transactions going

forward. In addition, reference to Brazilian transactions being excluded from this methodology has been deleted.

2 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

Executive Summary

A typical consumer loan portfolio is made up of personal

loans and purpose loans. The former are usually granted to

individuals to bridge a temporary liquidity need, finance

one-off expenses or simply to refinance existing unsecured

indebtedness (although the bank may or may not require a

specific purpose to be disclosed). The latter are usually

originated at point of sale to finance the purchase of a

specific item (e.g., durable goods, furniture or auto

vehicles). Granularity and a short weighted-average life are

also characteristic of such portfolios. Securitised loans are

usually unsecured.

The first step in rating a transaction backed by a portfolio

of unsecured consumer loans is to parameterise the expected

default distribution based on the historical performance

data. We generally assume that defaults of a granular asset

portfolio are lognormally distributed.

Portfolio default distribution

The lognormal default distribution for the relevant

portfolio is defined by two key inputs: the mean and the

standard deviation. From these two parameters, we derive

the coefficient of variation (CoV), a measure of the

portfolios volatility relative to the mean.

Cumulative mean default assumption

For each securitised pool, we typically receive historical

performance data in the form of static cumulative default

ratios by vintage of origination. As recently originated

vintages have limited data points, we extrapolate the default

rates of these vintages to derive the expected lifetime mean

cumulative default rate. The average cumulative default

probability (DP) across the cohorts provides a starting

point mean DP of the portfolio. This value is then

adjusted to take into account different factors including:

observed performance trends in recent vintages,

underwriting and servicing quality of the originator, and

macroeconomic factors.

A timing of default curve is associated with the mean

cumulative DP for the portfolio. This curve describes the

proportion of defaults that occur in each modelled period.

Standard deviation and CoV

Historically observed cumulative default curves are used in

deriving the standard deviation and hence the CoV of the

lognormal distribution. A higher CoV implies a fatter tail

of the distribution (i.e., a higher likelihood of high default

scenarios materialising).

In order to better understand whether the parameterisation

of the lognormal distribution is appropriate and/or

consistent with other rated unsecured loan transactions, we

will benchmark the deal mean and CoV assumptions

against values assumed in other unsecured loan ABS and

secured RMBS transactions and calculate the portfolio

implied asset correlation and benchmark this against other

similar transactions as well as the Basel II standard.

Recovery rate

We give limited benefit to recoveries in modelling, due to

the unsecured nature of the loans backing the ABS notes.

Assumed recovery rates are usually in the 0%-30% range,

generally lower than the mean recovery rates assumed for

secured loans or leases (such as RMBS or auto ABS

transactions).

Other asset-based inputs to the model

Other key asset-based model inputs include the portfolio

prepayment rate, its weighted average yield and

amortisation profile.

The cash flow model

We aim to replicate the transaction structure in a cash flow

model, such as ABS ROM. A simplified version of the

model is available on www.moodys.com.

In addition to the asset-side modelling assumptions as

described above, other important transaction-specific inputs

include the hedging mechanism and the transaction specific

triggers.

ABS ROM basically produces a series of default scenarios.

In each default scenario, the corresponding loss for each

class of notes is calculated given the incoming cash flows

from the assets and the outgoing payments to third parties

and noteholders.

The expected loss (EL) for each tranche is the sum product

of: (i) the probability of occurrence of each default scenario;

and (ii) the loss expected in each default scenario for each

tranche.

The EL of each tranche is associated with a particular time

horizon in order to compare the EL to our benchmark for

that time horizon (Moodys Idealised Expected Loss table).

The relevant time horizon is the weighted-average life of the

tranche, which is calculated based on the timing of payment

of principal to the tranche under each default scenario.

We also run sensitivities to a variety of key asset inputs and

structural features in order to test the sensitivity of the notes

ratings.

Key legal and operational risks

As part of our analysis, we will review legal opinions to

obtain external comfort in relation to key legal risks in a

transaction. Each jurisdiction has different types of risk that

need to be assessed but the three main legal issues

commonly analysed in an unsecured consumer loan ABS

include: (i) national consumer protection law; (ii) set-off

risk; and (iii) commingling risk. In our analysis of the

3 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

transaction, we will take into account any risk on which we

have not received any legal comfort or that is not mitigated

structural features.

Finally, we will carefully assess the deal operational risk.

2

Indeed the performance of a securitisation also depends on

the effective performance by various parties such as

servicers, calculation agents, trustees and cash managers

(i.e., operational risk). When not adequately covered, this

risk may preclude the transaction from achieving the

highest rating.

Main Risks of Typical Transaction

We believe the following are the main risk drivers in a

consumer loan securitisation transaction:

Portfolio Credit Quality: An accurate assessment of the

collateral credit quality is the first key element to

project the potential losses on the structured notes.

Underwriting and servicing policies (originator

specific) together with the current and forecast

macroeconomic environment represent key elements in

our analysis. Furthermore, specific loan characteristics

(e.g., repayment method) may also affect the pool

credit profile.

Transaction Structure: Specific features make the deal

structure more or less efficient from an investor

perspective. For example, a stringent principal

deficiency ledger definition will lessen leakage of excess

spread in case of performance deterioration or an early

cash trapping trigger would ensure a quicker

deleveraging of the transaction. When modelling the

transaction, we endeavour to reproduce the main

structural features described in the deal documentation,

where possible .

Counterparty Risk: We will assess whether each deal

counterparty has a clearly defined role and

responsibilities. Specific roles (e.g., swap counterparty)

are more sensitive than other, as such we carefully

evaluate the level of delinkage of the transaction.

Legal Risk: Finally we would assess the likelihood of

any legal issue to affect deal performance. The most

common risks for consumer loan transactions include

set-off and commingling risk, which we expand upon

later in this report.

1. Structural Features and Effect on Credit

Enhancement Levels

A typical consumer loan transaction would have the

following structural features:

Cash structure with quarterly paying notes with a

variable interest rate

Two distinct waterfalls (interest and principal) with

sequential principal payment

3

Cash reserve to ensure a liquidity buffer and credit

support

Hedging mechanism to cover for potential interest rate

mismatch

More specifically, differing structural features within a

consumer loan ABS transaction can have a significant effect

on the ratings of ABS bonds and/or the levels of credit

enhancement required for target ratings. Structural features

that typically have a rating impact include:

Transaction default definition

Revolving versus static portfolio

Early amortisation triggers

Availability of excess spread

For the purposes of our example below, we have used a

simplified structure with the following characteristics:

4

Three classes of rated notes

Linear amortisation with fully sequential payment of

interest and principal

Constant excess spread

Transaction default definition: In most transactions, the

default definition is objectively defined (e.g., borrowers

enter into default if they are more than six months in

arrears). If the default definition is vague (e.g., at the

servicers discretion), we will assume the default definition

is long-dated. Long-dated implies a longer period in

which excess spread is not used to cover defaults because

these defaults have not been recognised. This assumption

will typically result in higher amounts of credit

enhancement required for a given target rating compared

with a transaction where a tight default definition is used.

Defaults need to be registered in the transaction before cash

flows can be used to cover these defaults. This is often

effected via the inclusion of a principal deficiency ledger

(PDL) in the structure, whereby the principal balance of

defaulted loans is debited against the PDL on each interest

payment date and excess spread (if available) is credited to

the PDL up to the amount debited. Excess spread credited

4 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

to the PDL is used to purchase additional eligible assets

during the revolving period and is passed through to

noteholders during the amortisation period. The

mechanism described is in place to re-balance any mismatch

in performing assets and liabilities due to asset defaults.

Consequently, the earlier the defaults are recognised, the

earlier available cash flows can be used to fill the gap

between the performing portfolio and the outstanding notes

balance, thus avoiding excess spread leakage.

Exhibit 1 shows the effect on the model output using: (i) a

six-month default definition; and (ii) an 18-month default

definition.

EXHIBIT 1:

Impact of Varying Default Definitions on Model Output

Levels

Class

Credit

Enhancement

Default Definition

Six Months

Default Definition

18 Months*

A 20.0% Aaa Aa1 (1)

B 7.3% A2 Baa2 (3)

C 6.0% Baa3 Ba3 (3)

Note: Numbers between brackets represent the number of notches of difference

between the model output of the relevant class in the two scenarios.

* Additional credit enhancement required to achieve a Aaa model output on Class A: 2%.

Revolving versus static portfolios: Unsecured consumer

loans usually have relatively short terms (two to six years).

As a result, most consumer loan ABS transactions have a

revolving period during which incoming principal

collections are used to purchase new receivables rather than

to amortise notes. Adding new receivables to the pool can

result in portfolio credit deterioration if riskier assets are

added. This risk may be partly mitigated by tight eligibility

criteria so that the quality of added portfolios remains in

line with that of the original portfolio. Among other things,

eligibility criteria may stipulate the maximum sub-pool

5

weights in the total pool, limits to geographical

concentrations, minimum seasoning, or may exclude the

addition of delinquent receivables.

Early amortisation triggers: These are typically linked to

the portfolio performance and are common features used to

mitigate investors exposure to worsening portfolio quality

over the revolving period.

6

Exhibit 2 shows the impact on the model output for a

hypothetical consumer loan transaction of: (i) the inclusion

of a revolving period; and (ii) the introduction of early

amortisation triggers.

EXHIBIT 2:

Impact of Different Structural Features on Model Output

Levels

Class

Credit

Enhance-

ment

Static

Structure

Three-Year

Revolving

Structure;

No Early

Amortisation

Triggers*

Three-Year

Revolving

Structure

with Early

Amortisation

Triggers**

A 20.0% Aaa A1 (4) Aa1 (1)

B 7.3% A2 Ba2 (6) Baa2 (2)

C 6.0% Baa3 B2 (5) Ba2 (2)

Additio

nal CE*

12.5% 1.0%

Note: Numbers in brackets represent the number of notches of difference between the

model output of the class in the relevant scenario with respect to the static structure

scenario.

*Additional credit enhancement required to achieve a Aaa model output on Class A.

**3 times mean default cumulative default trigger; one period unpaid PDL trigger.

Availability of excess spread: Excess spread is typically

calculated, and in fact modelled as, interest collections net

of senior expenses (e.g., servicing fees, bank account fees)

and interest paid on the notes. As interest rates charged on

unsecured consumer loans are generally relatively high,

excess spread is often an important source of credit

enhancement. In certain transactions, excess spread is

guaranteed via certain interest rate swap mechanisms.

The following example (Exhibit 3) shows that the reduction

of excess spread has a negative impact on all tranches and

junior notes are more sensitive to excess spread levels than

senior notes.

EXHIBIT 3:

Impact of Different Levels of Excess Spread on Model

Output Levels

Class

Credit

Enhancement 3% Excess Spread

0.5% Excess

Spread*

A 20.0% Aaa Aa1 (1)

B 7.3% A2 Baa3 (4)

C 6.0% Baa3 B2 (5)

Note: Numbers in brackets represent the number of notches of difference between the

model output of the relevant class in the two scenarios.

* Additional credit enhancement required to achieve a Aaa model output on Class A: 2.5%.

The benefit to noteholders provided by excess spread can

vary depending on the timing of defaults modelled. In

order to test the robustness of ratings, we will run model

sensitivities with different timings of default.

5 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

2. Main Characteristics of Securitised Consumer

Loan Portfolios

Exhibit 4 summarises the main characteristics of securitised

consumer loan portfolios:

EXHIBIT 4

Main Characteristics of Securitised Consumer Loan

Portfolios

a

Loan Purpose

Personal loans: Usually granted to individuals to

bridge a temporary liquidity gap, for one-off large

expenses or to refinance

b

existing unsecured

indebtedness.

c

Purpose loans (also known as point-of-sale

loans): Loans originated at point of sale to finance

the purchase of a specific item (e.g., vehicles,

d

durable goods or furniture).

Granularity The largest borrower generally represents a

maximum five basis points (bps) of the pool, with

the average loan size seldom exceeding an

equivalent amount between 5,000 and 10,000.

e

Maturity Tenor is seldom longer than six years.

f

Amortisation Profile Predominantly French amortisation profile (i.e.,

fixed instalment up to maturity date).

Payment Flexibility Not a widespread feature in securitised pools. The

borrower may have the right to request a

suspension of payment for a limited period (e.g.,

suspending payments for up to three monthly

instalments - payment holiday) or an extension

of the loan maturity date.

Geographical

Distribution

Countries portfolios are usually spread out across

different regions. A pools geographical

distribution can have a significant influence on the

credit quality of borrowers if certain areas are

more susceptible to or more affected by a

macroeconomic downturn than others.

Origination Channel Loans are usually originated either by the lender

directly (branches) or by dealers. Direct channel

origination tends to result in better quality loan

portfolios than portfolios originated through

brokers. However, we seldom have access to

performance data split by channel of origination.

a

Exhibit 4 lists the most common characteristics of consumer loan portfolios

securitised so far. Specific portfolio or loan characteristics - not listed in the exhibit -

may require specific consideration and adjustments in our assumptions, in addition

to those listed in this report. In such cases, a detailed description of our analysis will

be included in the relevant Pre-Sale Report/New Issue Report.

b

This product traditionally has not necessarily been marketed as a means of

refinancing delinquent positions. Indeed, many lenders routinely offer those clients

with no negative credit records the option to consolidate different exposures to

better manage their finances. In fact, most past consumer loan securitisations do

not have collateral composed of re-performing unsecured loans or re-aged loans.

c

Unsecured loans granted to individuals where the loan purpose was to purchase or

refurbish residential properties or even purchase a commercial activity may

sometimes fall under the personal loan category. This is the case most notably in

Spain where, as a consequence, the maximum size of a securitised loan can exceed

200,000.

d

Auto loans included in consumer loan portfolios do not usually benefit from any

form of security as the title of the vehicle remains with the obligor and it is not

pledged/transferred in favour of/to the lender, hence the issuer.

e

Please note that securitised portfolios may occasionally include large-sized loans.

For instance, the FTA Santander Financiacion-4 securitised pool included a 2.5

million loan. These are clearly exceptions and typically require further analysis to

understand the nature and credit risk of such outlier loans.

f

Exceptions to this are represented, for instance, by the Dutch deal Chapel 2007

in which the weighted-average original maturity of the pool was 15 years. (For more

details please refer to Chapel 2007 pre sale).

3. Our Modelling Approach to Rating Consumer

Loan Transactions

The first step in rating a transaction backed by a portfolio

of unsecured consumer loans is to parameterise the expected

default distribution based on the historical performance

data, any appropriate benchmarks and any qualitative

adjustments as further described below. We assume that

defaults of a granular asset portfolio are lognormally

distributed.

7

EXHIBIT 5

Characteristics of a Lognormal Default Distribution

To date, we have assumed that granular portfolio defaults

are lognormally distributed.

However, we note that one drawback of assuming that

defaults follow a lognormal distribution is that they are not

bound at 100% (i.e., default scenarios above 100% have a

probability greater than zero under the lognormal law). As

long as the mean default and standard deviation are

relatively low, the probability assigned to these extreme

scenarios (i.e., default greater than 100%) is close to zero.

In contrast, when either the mean or standard deviation is

high, extreme scenarios with default levels above 100% may

be assigned a relevant probability. In such cases, we may

adjust the distribution parameters and re-run the model

using an inverse normal default distribution and compare

the results.

Exhibit 6 illustrates the shape of the lognormal distribution

EXHIBIT 6

Lognormal Default Probability Distribution

0

%

5

%

1

0

%

1

5

%

2

0

%

2

5

%

3

0

%

3

5

%

P

r

o

b

a

b

i

l

i

t

y

BOX 1:

Characteristics of a Lognormal Default Distribution

To date, Moodys has assumed that granular portfolio

defaults are lognormally distributed.

However, we note that one drawback of assuming that

defaults follow a lognormal distribution is that they are

not bound at 100%, i.e. default scenarios above 100%

have a probability greater than zero under the lognormal

law. As long as the mean default and standard deviation

are relatively low, the probability assigned to these

extreme scenarios (i.e. default greater than 100%) is close

to zero. In contrast, when either the mean or standard

deviation is high, extreme scenarios with default levels

above 100% may be assigned a relevant probability. In

such cases, Moodys may adjust the distribution

parameters and re-run the model using an inverse normal

default distribution and compare the results.

Chart 1 illustrates the shape of the lognormal distribution

CHART 1

Lognormal default probability distribution

0

%

5

%

1

0

%

1

5

%

2

0

%

2

5

%

3

0

%

3

5

%

P

r

o

b

a

b

i

l

i

t

y

6 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

Each default scenario is then fed through a cash flow model

(ABS ROM

TM 8

or other excel-based cash flow models that

reflect the structural features of the deal and run through

cash flow allocations in each period during the transaction.

The loss and life for each class of notes is calculated in each

default scenario and a corresponding rating is derived.

Key Asset-Based Inputs to the Model

Default distribution: Mean default and standard deviation

The lognormal default distribution for the relevant

portfolio is defined by two key inputs: the mean and the

standard deviation. From these two parameters, we derive

the CoV, a measure of the portfolios volatility relative to

the mean. This allows better comparison of the variability

between different lognormal distributions.

9

Deriving the cumulative mean default assumption

For each securitised pool, we typically receive historical

performance data specifically, static cumulative default

ratios reported by vintage of origination.

10

This data should

be as representative as possible of the product being

securitised.

11

To be statistically relevant, each quarterly vintage should

include a sufficiently large number of loans (typically at

least 1,000 originated loans - please refer to Appendix 2 for

a detailed description of the Moodys Data Template for

consumer loan transactions). The historical data forms the

starting point in defining the mean cumulative DP and

CoV for the portfolio.

Given that recently originated vintages tend to have limited

data points, we extrapolate the default of these vintages to

derive the expected lifetime mean cumulative default rate.

12

The average cumulative DP across the cohorts provides a

starting point mean DP for the portfolio.

This starting point means DP is then adjusted to take into

account: (i) observed performance trends; (ii) portfolio

composition; (iii) underwriting and servicing quality of the

originator; (iv) internal scoring model PD assumptions; (v)

amount of historical data provided; and (vi)

macroeconomic factors.

13

i. Observed performance trends

a) Performance trends in recent vintages

b)

: A

worsening trend in the younger vintages could

prompt us to increase the mean DP assumption.

Conversely, a clear improving trend could prompt

us to decrease the assumption.

Dynamic delinquency data:

us to adjust the mean default assumption. In

general, increasing delinquencies would lead us to

increase the mean DP assumption and an

improving delinquency trend would likely lead us

to adjust the mean DP downward.

Early- and mid-stage

14

delinquency trends might not yet be reflected in

the vintage default data provided, and could lead

c) Unrepresentative vintages

ii.

: Certain cohorts of

origination may be eliminated when calculating

the mean DP if they are thought to be

unrepresentative. For instance, vintages with very

few points of observation, very low origination

volumes or different underwriting techniques may

not be relevant when deriving the expected mean

default for a securitised pool.

Portfolio composition:

iii.

If the securitised portfolio is

composed of different sub-pools with different

characteristics, we will ideally receive performance data

for each individual sub-pool (e.g., by type of

product/origination channel). The mean cumulative

DP may be calculated as a blend of each sub-pools

cumulative default assumption based on the mix of

each sub-pool in the portfolio. For revolving

transactions, the mean DP assumed for subsequent

portfolios added to the securitisation may be increased

or decreased to take into account the possible

migration in credit quality allowed by a transactions

eligibility criteria.

15

Underwriting and servicing quality of the originator:

We thus form an opinion on the originator/servicer

quality and adjusts the mean DP accordingly. For

instance, if an originator states that it has changed its

strategy to target a vastly riskier section of the market

(e.g., employees on temporary contracts), we will very

likely adjust the mean DP upwards from the data-

observed average. We will also compare the originators

historical performance with historical data provided by

its peers to better understand its risk appetite in the

context of the relevant market. Appendix 1 provides

further details on typical loan underwriting and

servicing procedures and how we assess them.

The quality of the lenders underwriting procedures a

key component in our analysis is assessed during an

operating review that we attend at the start of the

rating process. Among other things, we are particularly

keen to understand: (i) the originators target

population and risk appetite; (ii) the predominant

channel of origination; (iii) the size and trend of refusal

rate (how many applications are rejected and the

rationale); (iv) the originators underwriting

mechanisms, their understanding of the target market

and the interplay between risk and returns; and (v) the

growth rate of lenders portfolio (i.e., fast growing

portfolio volume could signal aggressive underwriting).

7 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

iv. Internal scoring model PD assumptions

v.

: The majority

of lenders use an internal scoring model to underwrite

new loans, while some calculate a loans one-year

default probability. If we have access to the securitised

portfolios weighted-average default probability, it can

be useful to compare this to our mean DP

assumption.

16

If there is significant divergence between

these two values, we would endeavour to investigate the

drivers of such gap.

Amount of historical data provided:

vi.

In certain cases,

the historical data provided may be extremely scarce.

This might occur if the originator has only recently

started originating the consumer loan product or if an

originator has greatly changed its target market or

underwriting strategy. In this latter case, any

performance data relating to a previously marketed

product or underwriting strategy would not be relevant

to the transaction being rated. If there is limited

performance data available, we would benchmark the

portfolio against peers and take a conservative mean

DP assumption for the pool.

Macroeconomic factors

Macroeconomic variables are a key driver of default risk

in a consumer loan portfolio, even more so in Latin

American countries that are usually subject to higher

macroeconomic volatility than EMEA or Asia/Pacific.

Moreover, we have observed that default rates are

usually highly correlated with a countrys GDP growth

rate, unemployment rate, and interest rate fluctuations.

In a benign economic environment, defaults are mainly

driven by idiosyncratic risks (e.g., divorce, health

problems, deterioration in a servicers collection

capabilities) whilst during a time of economic crisis,

systemic factors such as general unemployment and

personal bankruptcy levels, as well as wage growth,

have a significant influence on a portfolios observed

defaults. A rise in unemployment levels in a country

will affect many debtors within a pool, and this risk

driver tends to prevail over others.

17

Consequently, our

portfolios mean DP assumption would also factor in

our expectation of likely future economic scenarios.

Most likely, the mean DP assumption would be

adjusted upwards if historical performance data

provided covered a buoyant economic period whilst

GDP was forecast to contract over the life of the

transaction, resulting in an increase in the

unemployment rate.

: Historical portfolio default

data applied to derive the mean DP assumption should

ideally cover an entire economic cycle. However, as this

is seldom the case, we may rely on other portfolios with

data that covers a whole economic cycle to assess how

default rates move as economic conditions change.

EXHIBIT 7

Case Study: Spain

For illustrative purposes, we consider Spain one of the

main consumer loan securitisation markets in EMEA.

In the following exhibits (Exhibit 8 and Exhibit 9), we have

plotted the problematic loans (PL) ratio for Spanish

financial institutions consumer lending and other

household lending (approximately three-month

delinquencies) against GDP growth and the unemployment

rate. The PL ratio observed in Q1 2011 (flat year-on-year

GDP growth was recorded in this period, after a severe

contraction) is around 3.5 times the median observed over

the period 2000-2006 (an average yearly GDP growth rate

of 3.6% was observed during this period), indicating that

the PL ratio tends to be negatively correlated with GDP.

On the other hand, as expected, Exhibit 9 shows a positive

correlation between PL ratios and unemployment.

EXHIBIT 8

Spain: Consumer and Other Lending to Households

PL Ratio (%) vs. GDP

Source: Bank of Spain/OECD data and Moodys Economy

EXHIBIT 9

Spain: Consumer and Other lending to Households PL

Ratio (%) vs. Unemployment

Source: Bank of Spain/OECD data and Moodys Economy

We have also plotted the three-month weighted-average

delinquencies of rated EMEA consumer loan transactions

against GDP growth (Exhibit 10) and unemployment

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0% 0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

4

Q

-

9

8

2

Q

-

9

9

4

Q

-

9

9

2

Q

-

0

0

4

Q

-

0

0

2

Q

-

0

1

4

Q

-

0

1

2

Q

-

0

2

4

Q

-

0

2

2

Q

-

0

3

4

Q

-

0

3

2

Q

-

0

4

4

Q

-

0

4

2

Q

-

0

5

4

Q

-

0

5

2

Q

0

-

6

4

Q

-

0

6

2

Q

-

0

7

4

Q

-

0

7

2

Q

-

0

8

4

Q

-

0

8

2

Q

-

0

9

4

Q

-

0

9

2

Q

1

0

4

Q

1

0

G

D

P

g

r

o

w

t

h

(

r

e

v

e

r

s

e

d

a

x

i

s

)

C

o

n

s

u

m

e

r

a

n

d

O

t

h

e

r

l

e

n

d

i

n

g

t

o

H

o

u

s

e

h

o

l

d

s

P

L

r

a

t

i

o

(

%

)

Consumer and Other lending to Households PL ratio (%) (Left Axis)

GDP Growth y-o-y (Right, Reversed Axis)

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

4

Q

-

9

8

3

Q

-

9

9

2

Q

-

0

0

1

Q

-

0

1

4

Q

-

0

1

3

Q

-

0

2

2

Q

-

0

3

1

Q

-

0

4

4

Q

-

0

4

3

Q

-

0

5

2

Q

0

-

6

1

Q

-

0

7

4

Q

-

0

7

3

Q

-

0

8

2

Q

-

0

9

1

Q

1

0

4

Q

1

0

%

u

n

e

m

p

l

o

y

m

e

n

t

C

o

n

s

u

m

e

r

a

n

d

O

t

h

e

r

l

e

n

d

i

n

g

t

o

H

o

u

s

e

h

o

l

d

s

P

L

r

a

t

i

o

(

%

)

Consumer and Other lending to Households PL ratio (%) (Left Axis)

Unemployment rate (Right Axis)

8 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

(Exhibit 11). Here, the delinquency rate observed in

Q3/Q4 2009 (peak of the curve) is around three times the

median for the period up to 2006, confirming the negative

correlation between GDP growth and problematic loans.

EXHIBIT 10

EMEA Consumer Loan 90+ Day Delinquencies on Original

Balance (OB) vs. GDP Growth

Source: Moodys Economy and Moodys calculations

EXHIBIT 11

90+ Delinquencies on OB vs. Unemployment Rate

Source: Moodys Economy and Moodys calculations

If the portfolios provided default data shows a worsening

trend due to a deteriorating economic environment, the

portfolios declining credit profile will generally be captured

when extrapolating the default data. However, if the trend

is recent and the extrapolation exercise does not result in a

higher mean DP than generally observed over a benign

economic period, we will stress the mean DP upwards,

taking into account both the economic forecast and data

from previous recessions.

Deriving the Standard Deviation and CoV

We use observed cumulative default curves to ascertain the

standard deviation and hence the CoV of the lognormal

distribution. A higher CoV implies a fatter tail of the

distribution (i.e., a higher likelihood of high default

scenarios materialising).

Generally, the CoV may be adjusted for the same reasons

that the mean default is adjusted (as described in points (i)

to (vi) above). The CoV is usually adjusted upwards to

capture uncertainties in the economic environment at the

time the transaction is launched, as well as to capture any

lack of depth in the historical performance data provided.

Similarly, when making qualitative adjustments to the

mean default and CoV, we need to ensure that we do not

over-penalise or double-count the impact of given factors by

adjusting both the mean and the CoV.

The following verification is appropriate to better

understand whether the parameterisation of the lognormal

distribution is appropriate and/or consistent with other

rated unsecured and secured loan transactions:

1. Benchmark the mean and CoV against assumptions used

for other unsecured loan ABS and secured RMBS

transactions. Regularly updated EMEA Consumer Loan

Indices reports

18

provide an efficient tool to benchmark

performance assumptions against other securitised

portfolios.

2. Calculate the portfolio implied asset correlation

19

and

benchmark this against other similar transactions, as

well as the Basel II standard. By calculating the

portfolio implied asset correlation, we measure the

degree of pair-wise linear correlation between assets in

the portfolio. A high asset correlation means that

defaults tend to cluster. As such, a high asset

correlation implies a higher volatility in the portfolio

default distribution, which would, in turn, lead to

higher credit enhancement levels.

Asset correlation allows us to benchmark different

portfolios against each other using a single metric. A

value that is considered relatively standard for

consumer lending is 4.0%.This number corresponds to

the asset correlation parameter for revolving facilities as

defined in the Basel II Accord.

20

Although the assets

analysed are not revolving facilities, we deem the

underlying borrowers to be similar.

In the following exhibit, we provide an indication of

the CoV for different mean DPs if we set the asset

correlation at 4%:

EXHIBIT 12

Pair of Mean DP and CoV Approx. Values Associated With

a 4.0% Asset Correlation

Mean DP Standard Deviation CoV

3% 1.4% 45%

5% 2.2% 40%

10% 3.5% 35%

15% 4.5% 30%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0% 0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2

0

0

4

.

0

3

2

0

0

4

.

0

9

2

0

0

5

.

0

3

2

0

0

5

.

0

9

2

0

0

6

.

0

3

2

0

0

6

.

0

9

2

0

0

7

.

0

3

2

0

0

7

.

0

9

2

0

0

8

.

0

3

2

0

0

8

.

0

9

2

0

0

9

.

0

3

2

0

0

9

.

0

9

2

0

1

0

.

0

3

2

0

1

0

.

0

9

2

0

1

1

.

0

3

G

D

P

g

r

o

w

t

h

(

r

e

v

e

r

s

e

d

a

x

i

s

)

9

0

+

d

e

l

i

n

q

u

e

n

c

i

e

s

o

n

O

B

EMEA Consumer Loan ABS 90+ days delinquencies on OB (Left Axis)

GDP Growth y-o-y (Right, Reversed Axis)

5.0%

7.0%

9.0%

11.0%

13.0%

15.0%

17.0%

19.0%

21.0%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2

0

0

4

.

0

3

2

0

0

4

.

0

9

2

0

0

5

.

0

3

2

0

0

5

.

0

9

2

0

0

6

.

0

3

2

0

0

6

.

0

9

2

0

0

7

.

0

3

2

0

0

7

.

0

9

2

0

0

8

.

0

3

2

0

0

8

.

0

9

2

0

0

9

.

0

3

2

0

0

9

.

0

9

2

0

1

0

.

0

3

2

0

1

0

.

0

9

2

0

1

1

.

0

3

%

u

n

e

m

p

l

o

y

m

e

n

t

9

0

+

a

r

r

e

a

r

s

o

n

O

B

EMEA Consumer Loan ABS 90+ days delinquencies on OB (Left Axis)

Unemployment rate (Right Axis)

9 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

EXHIBIT 13

Cumulative Mean Default and Coefficient of Variation

Assumptions for Spanish, Italian and German Consumer

Loan ABS

21

The following exhibit (Exhibit 14) details our DP and CoV

assumption ranges for consumer loan ABS transactions in

Spain, Italy and Germany. The ranges have been split first

by country and further into two categories (pre-2008 and

post-2008). In Spain, pre-2008 assumptions were widely

revised during 2008 and 2009, in light of the stressed

economic environment and marked deterioration in

performance.

The DP assumption detailed in Exhibit 14 is the expected

mean cumulative default probability of a given pool as a

percentage of the original asset balance.

EXHIBIT 14

Consumer Loan Portfolio DP and CoV Assumptions in

EMEA Main Markets

a

Country

Pre-2008

DP Assump-

tions

Pre-2008

CoV Assump-

tions

Post-2008

DP Assump-

tions

Post-2008

CoV Assump-

tions

Spain 2.5% - 5.0%

3% average

25% - 40%

33% average

5.0% - 20.0%

10% average

25% - 50%

31% average

Italy 2.5% -4.5%

3% average

25% - 40%

33% average

5% - 8.5%

7% average

40% - 55%

46% average

Germany N/A N/A 2.5% - 7.5%

5% average

25% - 50%

40% average

a

For outstanding transactions as of June 2011

Timing of Defaults

Having determined the mean cumulative DP for the

portfolio, we define a timing of default curve and enter it

into the cash flow model. This curve describes the

proportion of defaults that occur in each period modelled.

The timing of defaults has an effect on the notes rating

levels as it determines how many defaults will occur in a

given period and, as such, how many of these defaults will

be covered by available excess cash flow or spread.

If defaults are modelled to occur when excess spread is at its

lowest levels (often the case towards the end of a transaction

when the portfolio balance has extensively amortised), fewer

defaults will be covered by excess spread. Therefore, we

tend to find that the EL on a note is higher when defaults

are back-loaded in the cash flow modelling.

Empirical evidence suggests that defaults tend to

concentrate during the early life of the loan (i.e., the first

12-24 months), gradually decreasing after this period.

19

However, due to the sensitivity of ratings to the default

timing assumption, we often test a variety of default timing

curves to measure the ratings sensitivities observed.

Several default timing assumptions are shown in Exhibit 15.

The solid line (base case) reflects a typical default timing

curve observed for an unsecured consumer loan portfolio.

EXHIBIT 15

Typical Default Timing Curves

Source: Moody's Investors Service, Moody's Performance Data Service, periodic

investor/servicer reports

Exhibit 16 shows model output changes given the different

timings of defaults shown in Exhibit 15, assuming that

annual excess spread of the underlying portfolio is 3.0%.

EXHIBIT 16

Impact on Model Output Levels of Different Default

Timings

Class

Credit

Enhancement Base Case

Back

Loaded

Front

Loaded

A 20.0% Aaa Aaa (0) Aaa (0)

B 7.3% A2 A3 (1) A3 (1)

C 6.0% Baa3 Ba1 (1) Ba1 (1)

Note: Numbers in brackets represent the number of notches of difference between the

model output of the relevant class in the two scenarios.

Recovery Rate and Timing

Typically, we give limited benefit to recoveries in

modelling, due to the unsecured nature of the loans backing

the ABS notes.

22

Recovery rates are usually in the 0%-30%

range and, as expected, generally lower than the mean

recovery rates assumed for secured loans or leases (such as

RMBS or auto ABS transactions). We use historical

cumulative recovery rates by vintage of default data

provided by the originator/servicer as a starting point to

determine the recovery assumption.

The recovery rate assumption is necessarily a function of the

specific transaction default definition, which generally

varies across jurisdictions (see Transaction default

definition).

For instance, a shorter definition of default (e.g., 90 days)

would typically be associated with a higher recovery rate, as

opposed to a longer definition of default (i.e., 18 months).

In fact, early defaults may be driven by a more temporary

aspect (e.g., temporary liquidity shortfall) in such

circumstances, the defaulted position may return to

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

quarters since origination

Base case Front loaded Back loaded

10 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

perform or the servicer may effectively recover the position

through debt restructuring.

Additional difficulties may arise when reviewing recovery

data because:

Recovery figures provided may include interest and

fees, as well as the principal component of the loan. As

a result, inflated recovery figures may be reported (in

some circumstances, recoveries in excess of 100% of

principal outstanding).

The defaulted loan may be restructured or sold, and a

recovery value of 100% recorded. This is clearly

misleading, as we have no assurance that the debtor will

maintain the restructured repayment plan and thus

make a full recovery

23

or that the originator will always

be able to sell this loan at par in the future. Structures

can be sensitive to recovery timing, especially in high

default scenarios, where the time lag between defaults

and cash flows from recoveries may result in a cash

shortfall in certain periods. We assume that recoveries

are either spread out over a certain period (e.g., half

occur in the first year and the remainder over the

following two years) or concentrated in a given period.

Economic downturn: in stressed economic times, the

average recovery rate would be negatively affected. We

stress the mean recovery rate observed to take into

consideration this specific factor.

The main factors that influence our assumptions on

recovery timing include the efficiency of the servicers

operations, its collection procedures and the historically

observed speed of recovery.

Prepayment Rate

24

and Asset Yield

We are provided with dynamic

25

historical prepayment data

by the originator and we test different prepayment scenarios

in the cash flow modelling. On the one hand, prepayments

are generally higher in a decreasing interest rate

environment or highly competitive market, where cheap

refinancing is readily available. During economic recessions,

tightening credit conditions tend to lead to a decrease in

prepayments made by borrowers. Conversely, deal-specific

prepayment rates may be driven up if lenders choose to

restructure loans for commercial reasons and, as such,

repurchase these loans from the securitisation vehicle.

High levels of prepayments may depress the cash yield

received in a transaction (and hence decrease available

excess spread) if higher yielding loans prepay first, as

debtors would have greater incentives to prepay when their

debt burden is elevated or if competitors are able to offer

cheaper re-financing options.

26

The higher the dispersion of

the interest rates in the portfolio, the higher the impact of

high-yield-loan prepayments on the available excess spread.

We typically stress the available excess spread in the

transaction if the portfolio has a widely dispersed interest

profile (please see a simplified example in Exhibit 17).

However, prepayments can also have a positive credit effect

given that borrowers who prepay their debt in full cannot

also default. In any case, we will take into account any

specificity of the market under analysis. If prepayments are

not particularly sensitive to changes in interest rates (e.g., in

Latin America), we would not apply the above approach,

but would assess, for instance, the impact that the ease of

refinancing may have on prepayments.

Once we have calculated the initial asset portfolios

weighted-average yield, it can be entered directly into the

cash flow model, which will make adjustments to the

incoming interest collections for delinquencies and defaults.

Alternatively, we may be provided with an initial portfolio

yield vector based on scheduled amortisation. However, as

discussed above, various factors including a portfolios

yield dispersion, prepayments, defaults and receivables

additions may cause yield to differentiate from the

projections provided over the life of the transaction. As

such, we will examine the dispersion of interest rates within

a pool together with the relevant eligibility criteria

27

in

order to decide whether to use the flat-charged yield, a flat-

stressed yield, the yield vector provided or a stressed yield

vector. If we choose to model a stressed yield, we are

effectively also stressing down the available excess spread.

EXHIBIT 17

How We Stress Portfolio Yield to Take Into Account

Prepayment Rates

In a decreasing interest rate environment, high interest rate

loans would tend to prepay more quickly than low interest

rate loans.

Having defined the constant prepayment rate (CPR)

assumption (e.g., 15%), we will assume that the whole

percentage is applied to loans that pay the highest rates and

will consequently calculate the appropriate portfolio yield

haircut.

Please refer to the following example:

Set of working assumptions

CPR 15%

Securitised portfolio weighted-average yield 3.15%

Simplified portfolio yield distribution

% Portfolio % Yield

15% 4%

85% 3%

We conservatively assume prepayment for all loans that

yield 4% (these loans have, for simplicity, been sized to

match the 15% CPR assumption). As a result, the portfolio

11 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

would ultimately yield 3% (i.e., 15bps lower than the

original portfolio).

Portfolio Scheduled Amortisation

28

The final asset-based key model input is the portfolio

amortisation profile. The initial portfolio amortisation

schedule is provided by the originator. If subsequent

portfolios are sold, we may either use the same amortisation

profile as per the initial pool or simulate different

amortisation schedules based on eligibility criteria. These

vectors determine the principal cash flows to be received by

the issuer in the absence of defaults and prepayments.

Final maturity of the deal is given by the issuer and

modelled accordingly. It usually falls a few years after the

maturity date of the longest maturing loan. This gap takes

into account the recovery lag of the latest defaults in the

deal.

The Cash Flow Model

We aim to replicate the transaction structure in a cash flow

model, such as ABS ROM. A simplified version of the

model is available on www.moodys.com.

9

.

Once we have determined the asset-side modelling

assumptions, other transaction-specific inputs need to be

inserted into the cash flow model.

Transaction expenses: These include (i) fees to be paid to

transaction parties such as the trustee, cash manager, and

servicer; and (ii) note coupons. We will stress the charged

servicing fee upwards if the level is not in line with market

rates, and we generally use a minimum servicing fee

assumption of 50bps. This is to ensure that the transaction

can withstand paying a market rate servicing fee if the

original and cheaper servicing contract were to be

terminated over the life of the transaction.

Hedging: Interest rate swaps are modelled as relevant in

the cash flow model and may impact yield and excess spread

assumptions.

Triggers: When breached, these portfolio performance-

based triggers result in early amortisation of the notes or an

alteration of the priority of payments. Where the trigger is

linked to a variable that we model (e.g., defaults or reserve

fund levels), we can include this trigger in the cash flow

modelling.

Once all of the asset-side modelling assumptions and

transaction-specific inputs are implemented, ABS ROM

produces a series of default scenarios. In each default

scenario, the corresponding loss for each class of notes is

calculated given the incoming cash flows from the assets

and the outgoing payments to third parties and

noteholders.

The expected loss or EL for each tranche is the sum product

of (i) the probability of occurrence of each default scenario;

and (ii) the loss expected in each default scenario for each

tranche.

The EL of each tranche is associated with a particular time

horizon in order to compare the EL to our benchmark for

that time horizon (Moodys Idealised Expected Loss table).

The relevant time horizon is the weighted-average life of the

tranche, which is calculated based on the timing of payment

of principal to the tranche under each default scenario. In

addition, we identify the default scenario under the current

modelling assumptions under which each rated tranche

suffers its first loss. An illustrative example is shown in

Exhibit 18.

EXHIBIT 18

First Loss Suffered by Each Tranche

The rating of each class of notes indicates the EL level for

the relevant class of notes over the weighted-average life of

the notes.

As a further step, it is useful to ascertain the lowest default

scenario in which each class of notes suffers its first loss, as

well as at what speed the loss increases in each subsequent

default scenario. We endeavour to publish a graph similar

to Exhibit 19 in each New Issue Report, which associates

the default scenario with the level of losses of each class of

rated notes.

EXHIBIT 19

Default Distribution and Expected Loss Level for Each

Tranche

We also run sensitivities to a variety of key asset inputs

(e.g., mean DP, CoV, prepayments) and structural features

(e.g., turning triggers on and off) in order to test the

sensitivities of note ratings. In particular, we publish

parameter sensitivities in our New Issue Reports.

29

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

0

%

5

%

1

0

%

1

5

%

2

0

%

2

5

%

3

0

%

3

5

%

L

o

s

s

%

P

r

o

b

a

b

i

l

i

t

y

Lognormal Default Probability Tranche A Loss

Tranche B Loss Tranche C Loss

12 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

Parameter sensitivities provide a quantitative, model

indicated calculation of the number of notches that a

structured finance security rated by us may vary if certain

input parameters used in the initial rating process differed.

Please note that rating models are just one tool used in the

ratings process and are not exclusively relied upon to assign

ratings. Ratings are determined collectively through the

exercise of qualitative judgment by rating committees

alongside the consideration of model results.

4. Key Legal and Operational Risks Applicable

to Consumer Loan Securitisation Transactions

As part of our analysis, we will review legal opinions to

obtain external comfort in relation to key legal risks in a

transaction. Each jurisdiction has different types of risk that

need to be assessed. Three main risks commonly analysed in

unsecured consumer loan ABS are discussed below.

Consumer protection laws

Most jurisdictions have consumer protection laws in place

to ensure that consumers are treated fairly by lenders. A

lenders failure to comply with these regulations could

potentially void the consumer loan contracts it has

originated and borrowers could consequently withhold

payments under the contract.

We will rely on legal opinions, which provide comfort that

the securitised credit agreements are highly unlikely to be

challenged under consumer protection law. We would also

rely on an originators representations and covenants as to

the fairness of its procedures for dealing with customers,

specifically in cases where the originator is highly rated and

supervised by the central bank.

Set-off risk

Set-off risk arises if the loan originator who is a deposit-

taking institution becomes insolvent. For instance, if a

borrower holds deposits with the bank and also owes money

to the bank under a loan contract, a borrower might be

entitled to set off the deposit amounts he or she has lost

against the outstanding loan amount. We would rely on a

jurisdiction-specific legal opinion to understand whether

borrowers have the right to set-off amounts against

securitised loans and, if so, the amounts that could be set

off. If borrowers set off amounts against a securitised loan

receivable, this would translate into reduced collections for

the ABS transaction.

However, in certain jurisdictions, we expect that deposit

guarantee schemes will ensure that consumers do not lose

their deposits following the insolvency of a bank (typically

up to a certain limit). As such, potential set-off loss may be

reduced and this is reviewed on a case-by-case basis.

30

If set-off risk is not fully mitigated through structural

protections (e.g., reserved against on a dynamic basis), we

will conservatively estimate the potential set-off exposure in

modelling this risk. In modelling set-off risk, we use the

originators rating to model the likelihood of originator

default and will assume that all borrowers who are able to

assert the right of set-off risk will do so following an

originators insolvency. We typically assume that there is a

50%-100% correlation between asset default scenarios and

originator default.

Exhibit 20 shows the incremental credit enhancement

required to target Aaa ABS ratings for an Aa2-rated, Baa2-

rated and B2-rated originator with a 10% set-off exposure.

EXHIBIT 20

Set-Off Risk and Different Originator Rating Levels:

Effect on Tranche Model Output Levels and Class A

Credit Enhancement

Set-off risk

No Set

Off Risk

Originator

Aa2

Originator

A2

Originator

Baa2

Originator

B2

Class A

Aaa Aa1 (1) Aa1 (1) Aa2 (2) A1 (4)

Class B

A2 A2 (0) A3 (1) Baa1 (2) Ba3 (7)

Class C

Baa3 Baa3 (0) Baa3 (0) Ba1 (1) B3 (6)

Additional

CE*

1.0% 2.5% 5.5% 1-to-1

sizing**

Note: Numbers in brackets represent the number of notches of difference between the

model output of the relevant class in the two scenarios.

* Additional credit enhancement required to obtain a Aaa model output on class A

** For lowly rated originators, Aaa(sf) would be achievable if set off exposure is fully

covered (i.e., via a dedicated reserve)

Commingling risk

If cash belonging to the issuer passes through collections

accounts in the name of the originator/servicer, as part of

our analysis, we must ascertain whether in an

originator/service insolvency scenario, the deal would be

exposed to the risk of either: (i) cash belonging to the

special purpose vehicle (SPV) becoming unavailable for a

given period of time (i.e., liquidity risk); or (ii) the SPV

having only an unsecured claim against this cash in the

bankruptcy estate of the originator/servicer (credit risk).

Unless we are satisfied that the originator will not receive

any collections after it becomes insolvent or that any

collections received by it will be excluded from the

insolvency estate, we generally assume that a certain amount

of collections will be subject to commingling. The assumed

amount of commingling loss is determined for each

transaction and is based on the frequency of the transfer of

collections from the originator/servicer account into the

SPV account as well as the arrangements in place to ensure

that borrowers stop paying into the insolvent servicers

account and switch payments to either the issuer SPV or the

13 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

successor servicers account. Assuming daily sweep of

collections into the SPV account, we generally assume that

a minimum of one month of collections will be

commingled. However, this minimum will vary depending

(among other things) on the means and frequency of

payment of the borrowers in the pool and the country of

the assets. Unless commingling exposure is suitably fully

enhanced for, we model the rating impact, having regard

for among other factors the originators senior

unsecured rating.

Collections may also be lost if the collections account bank

holding the SPVs cash becomes insolvent. This risk is

typically mitigated by the requirement that a bank holding

any cash belonging to the issuer has a minimum required

short-term rating of P-1. If the collections account bank is

downgraded below this rating level, the servicer would be

obliged to find another collections account bank or an

unconditional, first-demand guarantee on its obligations

provided by a P-1 rated institution.

As far as EMEA jurisdictions are concerned, a detailed

description of the risk and our approach on how to treat

this risk can be found in our Special Report Cash

Commingling Risk in EMEA ABS and RMBS

Transactions: Moodys Approach, published in November

2006 (SF85241).

Operational risk

The performance of a securitisation transaction depends not

only on the creditworthiness of the underlying portfolio but

also on the effective performance by various parties such as

servicers, calculation agents, trustees, and cash managers

(i.e., operational risk). When not adequately covered, this

risk may preclude the transaction from achieving the

highest rating. Please refer to Global Structured Finance

Operational Risk Guidelines: Moodys Approach to

Analysing Performance Disruption Risk (published March

2011).

5. Principal Sources of Uncertainty in this

Methodology

The key uncertainties in rating unsecured consumer loan

ABS arise from:

Limitations of historical data: We are typically provided

with static vintage default and recovery data covering five to

seven years. We often do not receive data over a stressed

economic period. Furthermore, historical data will not help

predict very severe potential portfolio credit migration due

to a change in a lenders underwriting practices.

No third-party assessment of obligors creditworthiness:

We are generally provided with the lenders historical

portfolio data and, in certain cases, with the lenders

expected portfolio PD and (loss given default) LGD.

However, we very rarely receive borrower or portfolio credit

bureau scores, which would allow us to benchmark a

portfolios credit quality against others using a uniform

metric.

Originator governance influence on loan performance:

Originators/servicers often retain the equity piece, and

sometimes a number of subordinated tranches. Especially in

revolving transactions, an originators underwriting risk

appetite has a significant influence over the pool

composition and its resultant performance. Originators

with a vested interest in the transaction may have an

increased interest in achieving a more conservative risk

profile and maximising collections from the asset portfolio.

If the originator/servicer has no exposure to the ABS

transaction, investors may be more at risk of a worsening

portfolio risk profile or less effective servicing.

6. Monitoring a Consumer Loan Backed

Transaction

As a first step, during the rating process, we will review the

transactcion reports as proposed to check all relevant

information is included. Any perceived deficiency would be

disclosed to the market. It is essential we are provided with

collateral performance data, including period and

cumulative default, delinquencies, prepayments, recoveries,

as well as data on loan restructuring and modifications.

A description of the payment allocation is regularly

provided, together with level of triggers and compliance

with such triggers.

We endeavour to monitor any rated transaction on an

ongoing basis to ensure performance is in line with

expectation. We will also check all supporting ratings.

In addition, at least once a year, we perform a detailed

review of each existing transaction to assess its performance

and potential rating effects.

Our quarterly EMEA Consumer Loan ABS Indices

18

allows

investors to compare the performance of any particular

transaction with the market performance, as well as market

performance of different jurisdictions.

14 OCTOBER 12, 2012 RATING METHODOLOGY: MOODYS APPROACH TO RATING CONSUMER LOAN ABS TRANSACTIONS

STRUCTURED FINANCE

Appendix 1: Consumer Loan Underwriting and

Servicing

Underwriting procedures for unsecured consumer loans

tend to be more streamlined than those of other assets such

as mortgage loans. This is generally due to the low amounts

typically financed (on average equivalent amount of

10,000) and the unsecured nature of these loans, which

means that security does not have to be evaluated.

A large part of the credit approval process is often carried

out automatically, specifically by credit models developed

by the lender. Manual intervention may be periodically

requested, for instance in cases where the loan amount is

unusually large.

Underwriting procedures generally take into account:

Borrowers repayment capability: This is assessed by

checking a borrowers credit history and outstanding

debt as well as verifying his/her sources of income

Scorecard results

History of relationship with the lender (where relevant)

Loan terms

Product characteristics

The adjudication process also aims to determine whether

the borrowers credit profile is in line with the lenders

desired borrower credit profile.

This is a function of each lenders risk appetite: lenders with

large books and diversified business activities may be ready

to assume higher risk, which is generally counterbalanced

by higher pricing.

A prudent lender will aim to continuously validate and

adjust its credit model, in order to take into account

changing economic conditions, applicant and product

characteristics.

Notwithstanding the substantial differences between an

unsecured consumer loan and other loan products (e.g.,

mortgage loans), these consumer loan products tend to be

affected by systemic factors (macroeconomic environment)

or life factors (e.g., death, health or divorce). However,

the severity of the impact of such events on an unsecured

consumer loan versus a mortgage loans performance may

vary, as it is arguable that a borrower who has both an

unsecured consumer loan and mortgage loan exposure

would tend to pay off the mortgage loan in order to avoid

the risk of house repossession. The above is clearly a

function of the specific legal environment within each

country.

We also note that the credit assessment carried out by a

bank before extending a mortgage loan is considerably more

detailed than the analysis carried out when offering a

consumer loan, given the larger amount and longer contract

length of a typical mortgage. Indeed, for the lender, the

impact of a consumer loan default would be less severe and

cumbersome to manage than a mortgage loan default.

We note that the purpose of a loan may play a significant

part in determining a consumer loan portfolios

performance. Personal loans tend to perform worse than

loans granted to finance the acquisition of durable goods

(e.g., household appliances). An unsecured new vehicle loan