Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Divisional CFO Finance VP in Washington DC Resume Howard Green

Caricato da

HowardGreen2Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Divisional CFO Finance VP in Washington DC Resume Howard Green

Caricato da

HowardGreen2Copyright:

Formati disponibili

HOWARD L. GREEN, JR.

415-735-1842 | howardleegreenjr@gmail.com | www.linkedin.com/in/howardleegreenjr/

__________________________________________________________________________________

Finance professional with a record of success in Fortune 500 and NASDAQ companies. Recognized for building and leading financial planning and analysis (FP&A) teams and driving financial and operational results. Seeking a senior finance or operational role in financial services, biotech/pharma or technology, where my business acumen and diverse background can be utilized to drive company performance. FUNCTIONAL EXPERTISE Finance: Transform corporate and divisional FP&A teams by leveraging a combination of finance expertise, leadership skills and a diverse background in multiple industries. Recognized for building strong relationships with business partners and forging new standards of organizational performance. Strategy: Collaborate with senior management and cross-functional teams to develop strategic plans for global companies, ranging from restructuring to high-growth environments. Operations: Evaluate and simplify operational processes. Spearhead expense reduction initiatives to generate near-term and sustained margin improvement. PROFESSIONAL EXPERIENCE Independent Consultant 2012 - Present Provide consulting services to Dominican Republican companies interested in establishing or expanding business relationships in the US and Canada. Leverage 20+ years of professional experience to advise Dominican business owners on American and Canadian business practices and cultural norms. Generate proposals, provide decision support and assist with securing bank financing. SERVICESOURCE, INC., San Francisco, California 2011 - 2012

A $200 million services company that manages the contract renewals process of maintenance and subscription agreements for technology companies (Major clients: AT&T, VMWare, Salesforce.com, Dell and Google). Vice President, Global Operations Finance Recruited by CFO and President to join the Global Inside Sales executive team three months after March 2011 IPO. Annual revenue $180 million (90% of total company), generated from 80+ multi-year client contracts ranging from $500,000 to $15 million. Post-IPO environment resembled a start-up, limited infrastructure and difficulty managing rapid growth (30-35% annually). Led process improvement, decision support, performance reporting and system upgrade efforts. Provided strategic and day-to-day financial support to a sales and support staff of 1,500. Led globally disbursed finance team. Reported to CFO. Collaborated with executive team to redesign the quarterly operations review process. Established new protocols and redesigned reporting tool for weekly global sales meeting. Developed companys first-ever account level P&Ls; facilitated fact-based account level analysis, resource allocation and pricing negotiations with existing and prospective clients. Implemented cost control initiatives, resulting in $15M (10%) annual expense reduction. Partnered with IT to improve processing and accuracy of sales metrics and dashboards. STUPSKI FOUNDATION, San Francisco, California 2010 - 2011

Private, operating non-profit foundation focused on improving life options for children of color and poverty. Chief Financial Officer Directed all financial and administrative management of the foundation finance, accounting, budgeting, payroll, internal controls, facilities and human resources (including management of 3rd party HR provider relationship). Partnered with CEO and executive team on strategy development. Member of Investment Committee responsible for driving 5-7% annual returns on a $225 million investment portfolio; returns funded annual operating expenses of $15M. Reported to CEO. Established in 1997, foundation discontinued operations in 2012 due to founders failing health.

HOWARD L. GREEN, JR. PAGE 2 _____________________________________________________________________________________ Reduced material findings of annual audit from three to zero. Provided guidance and leadership through organizational transition. Turned over 33% of foundation staff in nine months and changed CEOs three times in 12 months. Renegotiated 5-year office lease 18 months before expiration, resulted in 20% reduction in lease payments. NORTH COAST CAR RENTAL, Puerto Plata, Dominican Republic Rental car agency serving the north coast of the Dominican Republic. Co-Founder Relocated to the Dominican Republic to establish a boutique rental car company. Target clients included local Dominicans and 1.3 million Dominicans living in New York, New Jersey & Massachusetts that travel to their homeland to visit family and friends. Liquidated business February 2010 and returned to California. GENENTECH, South San Francisco, California 2005 - 2009 A leading biotech firm that develops, manufactures and commercializes drugs for significant unmet medical needs. Director, Manufacturing Finance 2007 - 2009 Provided executive team with decision support for Genentechs manufacturing plant network. Collaborated with cross-functional teams on special projects network optimization, make/buy decisions and capital investments. Led the 17-year strategic plan and annual operating plan processes. Presented monthly operational results and expense forecasts to executive team. Roche acquired Genentech March 2009, declined offer to relocate to Basel, Switzerland (Roche Headquarters) for similar role. Led all financial aspects of Genentech plant rationalization and subsequent divesture of a California facility ($560 million transaction). Partnered with Procurement to negotiate $50 million annual cost savings with Genentechs three largest suppliers (e.g. General Electric Healthcare). Director, Corporate Finance 2005 - 2007 Recruited to provide large company expertise and structure to a corporate FP&A function primarily focused on accounting. Led analytics, financial reporting, revenue and expense forecasting, and ad hoc analysis. Elevated profile and impact of the role by partnering with the CEO and executive team to ensure alignment between the 17-year strategic plan and the annual operating budget. Prepared briefing materials and presentations for Board meetings. Reported to Corporate Controller. Teamed with Sales & Marketing to redesign sales rep incentive plans to ensure bonus payouts and margin targets properly reflected the impact of 40% revenue growth. Improved revenue and expense forecasting accuracy by leading a process improvement initiative, resulting in forecast accuracy improving from +/-10% to +/-3%. Commissioned by CEO (two weeks after joining company) to identify and implement cost reduction initiatives; seven initiatives generated $45 million annual savings. CHARLES SCHWAB & COMPANY, INC., San Francisco, California Americas leading discount brokerage firm. Vice President, Financial Planning and Analysis 2003 - 2004 Oversaw FP&A function of $1.5 billion Retail division (60% of company revenues). CFO for three USbased call centers and Advice Planning. Full P&L responsibility. Drove annual business plan and prepared Retail President for quarterly performance reviews. Reported to SVP Retail Finance. Spearheaded detailed analysis of cost structure, resulting in $65 million (7%) annual expense savings. Developed three-year forecasts for new products to determine feasibility of $90 million net income lift projections. 1999 - 2004 2009 - 2010

HOWARD L. GREEN, JR. PAGE 3 ___________________________________________________________________________________________ Vice President, Retail Finance 1999 - 2003 Directed all aspects of financial management of the Retail Sales and Service. Provided finance support to 2,400 sales employees across 350 branch locations and 1,800 customer service representatives in five call centers. Led analytics to secure corporate funding for strategic initiatives. Trusted advisor to the Retail Sales and Service President and executive team through periods of rapid growth and contraction. Developed branch asset target-setting model using market demographics and sales team productivity. Created financial model to assist with branch site selection and prioritization of branch renovations. Led major restructuring effort prompted by the post-9/11 market downturn. Partnered with Retail President to develop a strategy to reduce field headcount by 30% (1,260) and close 52 branches (15%) and one call center (20%). Executed eight rounds of layoffs over two-year period and ensured each round aligned with financial and operational targets. AUTODESK, INC., Cupertino, California Provides design software and services to customers worldwide. Director, Finance and Administration, Americas Sales & Marketing Provided financial leadership for this $390 million organization. Led monthly close process and ensured compliance with software revenue recognition policy. Provided five regional sales directors with revenue forecasting, operating expense and inventory management support. Designed incentive compensation plans and established quarterly sales quotas. Traveled throughout the Americas for sales meetings and to resolve local financial and labor issues. Led globally disbursed finance team (US, Mexico, Brazil, Venezuela and Argentina). Reported to VP Sales & Marketing and Corporate Controller. Developed and rolled out consistent worldwide financial reporting. Improved quarter-end revenue forecasting by coordinating quarter-end production planning, reseller inventory management and bookings/shipments. HONEYWELL, INC., Phoenix, Arizona & Torrance California Aerospace Manufacturing Division Director, Program Planning & Control 1997 - 1998 Director, Financial Planning & Analysis 1996 - 1997 Manager, Manufacturing Finance 1995 - 1996 NESTLE BEVERAGE COMPANY, San Francisco, California UNITED AIRLINES, Oakland and San Francisco, California Aircraft Maintenance Division AEROJET, INC., Sacramento, California 1986 - 1990 1994 - 1995 1990 - 1994 1995 - 1998 1998 - 1999

EDUCATION B.S. Business Administration, Finance California State University, Sacramento

Potrebbero piacerti anche

- VP Finance CFO Controller in Los Angeles CA Resume Mark RussellDocumento3 pagineVP Finance CFO Controller in Los Angeles CA Resume Mark RussellMark RussellNessuna valutazione finora

- Chief Financial Officer VP in Atlanta GA Resume Tami WoodDocumento2 pagineChief Financial Officer VP in Atlanta GA Resume Tami WoodTami WoodNessuna valutazione finora

- Global Controller Finance Director in NYC Resume Sanjeev ParabDocumento2 pagineGlobal Controller Finance Director in NYC Resume Sanjeev ParabSanjeevParabNessuna valutazione finora

- Finance Manager in Chicago Schaumburg IL Resume Anthony VolinDocumento2 pagineFinance Manager in Chicago Schaumburg IL Resume Anthony VolinAnthonyVolinNessuna valutazione finora

- VP Finance Workforce Director in Salt Lake City UT Resume Edwin PrinceDocumento3 pagineVP Finance Workforce Director in Salt Lake City UT Resume Edwin PrinceEdwinPrinceNessuna valutazione finora

- Director Sales Finance Administration in Tampa ST Petersburg FL Resume Gary PapaDocumento2 pagineDirector Sales Finance Administration in Tampa ST Petersburg FL Resume Gary PapaGaryPapaNessuna valutazione finora

- CFO Director Finance Controller in Toronto ON Canada Resume Yvonne QuDocumento3 pagineCFO Director Finance Controller in Toronto ON Canada Resume Yvonne QuYvonneQuNessuna valutazione finora

- CFO Chief Financial Officer in Greensboro Winston-Salem NC Resume Barry LeonardDocumento2 pagineCFO Chief Financial Officer in Greensboro Winston-Salem NC Resume Barry LeonardBarryLeonardNessuna valutazione finora

- Director Finance Planning Analysis in New York City Resume Kevin BayneDocumento2 pagineDirector Finance Planning Analysis in New York City Resume Kevin BayneKevinBayneNessuna valutazione finora

- CFO Finance Director Controller in Los Angeles CA Resume Keith RowlandDocumento2 pagineCFO Finance Director Controller in Los Angeles CA Resume Keith RowlandKeithRowlandNessuna valutazione finora

- CFO Controller VP Finance in Monroe LA Resume Roy JohnsonDocumento2 pagineCFO Controller VP Finance in Monroe LA Resume Roy JohnsonRoyJohnsonNessuna valutazione finora

- VP Financial Planning Analysis in New Jersey Resume Robert PletchanDocumento2 pagineVP Financial Planning Analysis in New Jersey Resume Robert PletchanRobertPletchamNessuna valutazione finora

- CFO Controller Healthcare Financial Reporting in Dallas TX Resume Michael ExlineDocumento2 pagineCFO Controller Healthcare Financial Reporting in Dallas TX Resume Michael ExlineMichaelExlineNessuna valutazione finora

- Chief Financial Officer CFO in Washington DC Resume Gerald GoforthDocumento2 pagineChief Financial Officer CFO in Washington DC Resume Gerald GoforthGeraldGoforthNessuna valutazione finora

- Chief Financial Officer CFO in Midwest USA Resume David LindstaedtDocumento4 pagineChief Financial Officer CFO in Midwest USA Resume David LindstaedtDavidLindstaedtNessuna valutazione finora

- Government Software Project Management in United States Resume Burton John "BJ" MecheDocumento2 pagineGovernment Software Project Management in United States Resume Burton John "BJ" MecheBurtonJohnMecheNessuna valutazione finora

- Accountant Controller Finance Analyst in Lakeland FL Resume Fernando BertolliDocumento3 pagineAccountant Controller Finance Analyst in Lakeland FL Resume Fernando BertolliFernandoBertolliNessuna valutazione finora

- Vice President Finance in Orange County CA Resume Kurt EltzDocumento2 pagineVice President Finance in Orange County CA Resume Kurt EltzKurtEltzNessuna valutazione finora

- Global VP Director Finance in Atlanta GA Resume Delores WilliamsDocumento2 pagineGlobal VP Director Finance in Atlanta GA Resume Delores WilliamsDeloresWilliamsNessuna valutazione finora

- Director Finance in Fort Collins CO Resume Joanne CechDocumento2 pagineDirector Finance in Fort Collins CO Resume Joanne CechJoanneCechNessuna valutazione finora

- Accountant Auditor Financial Analyst in Chicago IL Resume Raj ShahDocumento3 pagineAccountant Auditor Financial Analyst in Chicago IL Resume Raj ShahRajShah5Nessuna valutazione finora

- Director Financial Planning Analysis in New York NY Resume Howard SchierDocumento2 pagineDirector Financial Planning Analysis in New York NY Resume Howard SchierHowardSchierNessuna valutazione finora

- CFO in Denver Colorado Resume Bruce PeeleDocumento2 pagineCFO in Denver Colorado Resume Bruce PeeleBruce PeeleNessuna valutazione finora

- Healthcare VP Sales Life Science in Philadelphia PA Resume Douglas DowdDocumento3 pagineHealthcare VP Sales Life Science in Philadelphia PA Resume Douglas DowdDouglasDowdNessuna valutazione finora

- Carol Sawatzky, CPA, CA (ON), CPA (MI, IL) - Personal & Corporate Accounting & TaxDocumento5 pagineCarol Sawatzky, CPA, CA (ON), CPA (MI, IL) - Personal & Corporate Accounting & TaxCarol SawatzkyNessuna valutazione finora

- Medical Pharmaceutical Sales Management in Grand Rapids MI Resume Scott BickleyDocumento2 pagineMedical Pharmaceutical Sales Management in Grand Rapids MI Resume Scott BickleyScottBickleyNessuna valutazione finora

- Director Manager Capital Planning FP&A in New York NY Resume Robert ShannonDocumento2 pagineDirector Manager Capital Planning FP&A in New York NY Resume Robert ShannonRobertShannonNessuna valutazione finora

- Regional VP National Account Director in Los Angeles CA Resume Ken MadanDocumento4 pagineRegional VP National Account Director in Los Angeles CA Resume Ken MadanKenMadanNessuna valutazione finora

- Director Marketing Communications in Seattle WA Resume David BetzDocumento2 pagineDirector Marketing Communications in Seattle WA Resume David BetzDavidBetz1Nessuna valutazione finora

- Innovative CFO VP Finance Controller in Houston TX Resume Thornton StewartDocumento2 pagineInnovative CFO VP Finance Controller in Houston TX Resume Thornton StewartThorntonStewartNessuna valutazione finora

- Account Field Reimbursement Manager in CA Resume Roger WortsmanDocumento2 pagineAccount Field Reimbursement Manager in CA Resume Roger WortsmanRogerWortsmanNessuna valutazione finora

- Pharmaceutical Specialty Sales Representative in Wilkes Barre Scranton PA Resume Scott Van EttenDocumento2 paginePharmaceutical Specialty Sales Representative in Wilkes Barre Scranton PA Resume Scott Van EttenScott Van EttenNessuna valutazione finora

- CFO Controller Accounting Manager in Fairfield County CT Resume Craig OdiernoDocumento3 pagineCFO Controller Accounting Manager in Fairfield County CT Resume Craig OdiernoCraigOdiernoNessuna valutazione finora

- VP Sales Marketing Health in Raleigh Durham NC Resume Donald SwankieDocumento4 pagineVP Sales Marketing Health in Raleigh Durham NC Resume Donald SwankieDonaldSwankieNessuna valutazione finora

- Larry Renshaw - Senior Business AnalystDocumento3 pagineLarry Renshaw - Senior Business AnalystLarry_RenshawNessuna valutazione finora

- National Account Sales Manager in Greater Atlanta GA Resume Timothy McNamaraDocumento3 pagineNational Account Sales Manager in Greater Atlanta GA Resume Timothy McNamaraTimothy McNamaraNessuna valutazione finora

- Resume - Bharati Desai Senior Accounting PositionsDocumento4 pagineResume - Bharati Desai Senior Accounting PositionsJeremy SmithNessuna valutazione finora

- CFO VP Director Finance in Houston TX Resume Michelle BakerDocumento3 pagineCFO VP Director Finance in Houston TX Resume Michelle BakerMichelleBakerNessuna valutazione finora

- M E & B B: Arketing Xecutive Rand UilderDocumento2 pagineM E & B B: Arketing Xecutive Rand Uilderlaiq3049Nessuna valutazione finora

- VP Sales Biotech Pharmaceuticals in Atlanta GA Resume Valerie DarlingDocumento2 pagineVP Sales Biotech Pharmaceuticals in Atlanta GA Resume Valerie DarlingValerieDarlingNessuna valutazione finora

- CFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinDocumento3 pagineCFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinChetLatinNessuna valutazione finora

- Business Development Sales Manager in San Francisco Bay CA Resume Philip WaldstreicherDocumento3 pagineBusiness Development Sales Manager in San Francisco Bay CA Resume Philip WaldstreicherPhilip WaldstreicherNessuna valutazione finora

- CFO VP Finance CPA in Chicago IL Resume Michael BennettDocumento2 pagineCFO VP Finance CPA in Chicago IL Resume Michael BennettMichael BennettNessuna valutazione finora

- CFO Controller VP Finance in Denver CO Resume Jon ZimbeckDocumento4 pagineCFO Controller VP Finance in Denver CO Resume Jon ZimbeckJonZimbeckNessuna valutazione finora

- Loker Grant WriterDocumento3 pagineLoker Grant WriterMarcelino AndreanNessuna valutazione finora

- Oncology Specialty Pharmaceutical Sales in San Antonio TX Resume Carrie MagnerDocumento2 pagineOncology Specialty Pharmaceutical Sales in San Antonio TX Resume Carrie MagnerCarrieMagnerNessuna valutazione finora

- Resume Matthew NelsonDocumento2 pagineResume Matthew Nelsonmtn3077Nessuna valutazione finora

- Silgy Portfolio CVDocumento5 pagineSilgy Portfolio CVapi-440741873Nessuna valutazione finora

- Jamsheer PoozhitharaDocumento4 pagineJamsheer PoozhitharaJamsheer PoozhitharaNessuna valutazione finora

- Chief Financial Officer Healthcare in United States Resume Stephen HueyDocumento3 pagineChief Financial Officer Healthcare in United States Resume Stephen HueyStephen HueyNessuna valutazione finora

- Specialty Pharmaceutical Sales Representative in Atlanta GA Resume Jill WilcoxDocumento2 pagineSpecialty Pharmaceutical Sales Representative in Atlanta GA Resume Jill WilcoxJillWilcoxNessuna valutazione finora

- CEO COO Healthcare in Denver CO Resume David BingamanDocumento5 pagineCEO COO Healthcare in Denver CO Resume David BingamanDavidBingaman1Nessuna valutazione finora

- VP Finance CFO Chief Financial Officer in San Francisco Bay CA Resume John ArthurDocumento3 pagineVP Finance CFO Chief Financial Officer in San Francisco Bay CA Resume John ArthurJohnArthur2Nessuna valutazione finora

- SAP Accounting Systems Manager in Dallas FT Worth TX Resume Don MooreDocumento4 pagineSAP Accounting Systems Manager in Dallas FT Worth TX Resume Don MooreDonMooreNessuna valutazione finora

- Project Officer Job Description SHARP - Mental HealthDocumento3 pagineProject Officer Job Description SHARP - Mental HealthSahil SahilNessuna valutazione finora

- Chief Financial Officer Controller in Baton Rouge LA Resume Cary PrejeanDocumento2 pagineChief Financial Officer Controller in Baton Rouge LA Resume Cary PrejeanCary PrejeanNessuna valutazione finora

- Healthcare CFO Operations Leader in Indianapolis IN Resume William Kevin FowlerDocumento3 pagineHealthcare CFO Operations Leader in Indianapolis IN Resume William Kevin FowlerWilliamKevinFowlerNessuna valutazione finora

- Director Financial Planning Analysis in Philadelphia PA Resume Tracy BondDocumento3 pagineDirector Financial Planning Analysis in Philadelphia PA Resume Tracy BondTracyBondNessuna valutazione finora

- Finance Director Resume SamplesDocumento7 pagineFinance Director Resume SamplesArojiduhu HalawaNessuna valutazione finora

- From Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Da EverandFrom Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Nessuna valutazione finora

- Magtajas vs. PryceDocumento3 pagineMagtajas vs. PryceRoyce PedemonteNessuna valutazione finora

- Ant Colony AlgorithmDocumento11 pagineAnt Colony Algorithmjaved765Nessuna valutazione finora

- Deception With GraphsDocumento7 pagineDeception With GraphsTanmay MaityNessuna valutazione finora

- Capital Structure: Meaning and Theories Presented by Namrata Deb 1 PGDBMDocumento20 pagineCapital Structure: Meaning and Theories Presented by Namrata Deb 1 PGDBMDhiraj SharmaNessuna valutazione finora

- Subject: Animal Breeding and Genetics - II Course Code: ABG-301Documento2 pagineSubject: Animal Breeding and Genetics - II Course Code: ABG-301Hamid Ali AfridiNessuna valutazione finora

- Hinog vs. MellicorDocumento11 pagineHinog vs. MellicorGreta VilarNessuna valutazione finora

- 0606 - s03 - 2 - 0 - QP PENTING KE 2Documento8 pagine0606 - s03 - 2 - 0 - QP PENTING KE 2Titin ChayankNessuna valutazione finora

- Equal Protection and Public Education EssayDocumento6 pagineEqual Protection and Public Education EssayAccount YanguNessuna valutazione finora

- History Paper 2 IB Study GuideDocumento6 pagineHistory Paper 2 IB Study Guidersuresh1995100% (4)

- HR Recruiter Interview Question & AnswerDocumento6 pagineHR Recruiter Interview Question & AnswerGurukrushna PatnaikNessuna valutazione finora

- Grunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsDocumento20 pagineGrunig J, Grunig L. Public Relations in Strategic Management and Strategic Management of Public RelationsjuanNessuna valutazione finora

- Media Kit (Viet)Documento2 pagineMedia Kit (Viet)Nguyen Ho Thien DuyNessuna valutazione finora

- Another Monster - Chapter 5 - Kinderheim 511Documento7 pagineAnother Monster - Chapter 5 - Kinderheim 511Jaime MontoyaNessuna valutazione finora

- Money Management Behavior and Spending Behavior Among Working Professionals in Silang, CaviteDocumento8 pagineMoney Management Behavior and Spending Behavior Among Working Professionals in Silang, CaviteAshley JoyceNessuna valutazione finora

- TLG 82201Documento7 pagineTLG 82201beatmymeat100% (2)

- Anthropology Chapter 2 ADocumento17 pagineAnthropology Chapter 2 AHafiz SaadNessuna valutazione finora

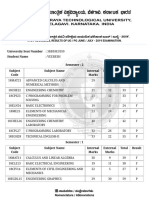

- VTU Result PDFDocumento2 pagineVTU Result PDFVaibhavNessuna valutazione finora

- Doloran Auxilliary PrayersDocumento4 pagineDoloran Auxilliary PrayersJosh A.Nessuna valutazione finora

- Virtue EpistemologyDocumento32 pagineVirtue EpistemologyJorge Torres50% (2)

- The Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmDocumento206 pagineThe Endless Pursuit of Truth: Subalternity and Marginalization in Post-Neorealist Italian FilmPaul MathewNessuna valutazione finora

- Theory of Interpersonal RelationsDocumento2 pagineTheory of Interpersonal RelationsAra Gayares Gallo100% (1)

- 208 C - Algebras: Marc Rieffel Notes by Qiaochu Yuan Spring 2013Documento55 pagine208 C - Algebras: Marc Rieffel Notes by Qiaochu Yuan Spring 2013Nikos AthanasiouNessuna valutazione finora

- The Concise 48 Laws of Power PDFDocumento203 pagineThe Concise 48 Laws of Power PDFkaran kamath100% (1)

- Resume UngerDocumento2 pagineResume UngerMichelle ClarkNessuna valutazione finora

- Lee Gwan Cheung Resume WeeblyDocumento1 paginaLee Gwan Cheung Resume Weeblyapi-445443446Nessuna valutazione finora

- Anecdotal Records For Piano Methods and Piano BooksDocumento5 pagineAnecdotal Records For Piano Methods and Piano BooksCes Disini-PitogoNessuna valutazione finora

- B2 First Unit 11 Test: Section 1: Vocabulary Section 2: GrammarDocumento1 paginaB2 First Unit 11 Test: Section 1: Vocabulary Section 2: GrammarNatalia KhaletskaNessuna valutazione finora

- Young Entrepreneurs of IndiaDocumento13 pagineYoung Entrepreneurs of Indiamohit_jain_90Nessuna valutazione finora

- People V Galano, Caubang v. PeopleDocumento2 paginePeople V Galano, Caubang v. PeopleHermay Banario50% (2)

- Quantile Regression (Final) PDFDocumento22 pagineQuantile Regression (Final) PDFbooianca100% (1)