Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SEMA4 Reimbursement Form

Caricato da

Dana A Daspit ConteDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SEMA4 Reimbursement Form

Caricato da

Dana A Daspit ConteCopyright:

Formati disponibili

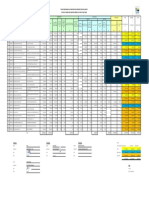

IN-STATE SHORT TERM ADVANCE Check if advance was issued for these expenses

OUT-OF-STATE RECURRING ADVANCE SEMA4 EMPLOYEE EXPENSE REPORT FINAL EXPENSE(S) FOR THIS TRIP?

Employee Name Home Address (Include City and State) Permanent Work Station (Include City and State) Agency 1-Way Commute Miles Job Title

Employee ID Rcd # Trip Start Date Trip End Date Reason for Travel/Advance (30 Char. Max) [example: XYZ Conference, Dallas, TX] Barg. Unit Expense Group ID

FY Fund Agency Org SOrg Appr Actv SObj Project Rpt Cat Description Distrib %

MAPS

CODE 0%

BLOCK(S) 0%

Itinerary Trip Total Trip & Mileage Meals 3 Total Meals Total Meals Personal

Date Daily Description (overnight (no overnight Lodging Parking Total

Miles Local Mi Rate stay) stay)

Telephone

Time Location B L D

Departure

Figure mileage reimbursement below

$0.00

Arrival

Departure

$0.00

Arrival

Departure

$0.00

Arrival

Departure

$0.00

Arrival

Departure

$0.00

Arrival

Departure

$0.00

Arrival

VEHICLE CONTROL # Total Miles Total MWI/MWO * Total MEI/MEO Total LGI/LGO Total PHI/PHO Total PKI/PKO Subtotal (A)

0 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

MILEAGE REIMBURSEMENT CALCULATION OTHER EXPENSES – See reverse for list of Earn Codes.

Total Mileage Earn

Rate Total Miles Date Comments Total

Amt. Code

1. Enter the rate, total miles, and amount for the mileage listed above being claimed at

a rate less than or equal to the IRS rate. $0.00 0 $0.00

2. Enter the rate, total miles, and amount for the mileage listed above being claimed at

a rate above the IRS rate. (if no mileage is claimed above the IRS rate, enter zero.) $0.00 0 $0.00

3. Add the total mileage amounts from lines 1 & 2. $0.00

4. Enter IRS mileage rate in place at the time of travel

5. Subtract line 4 from line 2 $0.00 Subtotal Other Expenses (B) $0.00

6. Enter total miles from line 2 0

7. Multiply line 5 by line 6. (taxable mileage) $0.00 $0.00

(Copy to Box C) Total taxable mileage greater than IRS rate to be reimbursed: (C) MIT or MOT

8. Subtract line 7 from line 3. If no mileage on line 7 enter mileage amount from line 1. $0.00 $0.00

(non-taxable mileage)

(Copy to Box D) Total nontaxable mileage less than or equal to IRS rate to be reimbursed: (D) MLI or MLO

Grand Total (A + B + C + D) $0.00

If using private vehicle for out-of-state travel: What is the lowest airfare to the destination? _______________________ Total Expenses for this trip must not Less Advance issued for this trip:

exceed this amount.

Total amount to be reimbursed to the employee:

Amount of Advance to be returned by the employee by deduction from paycheck:

I declare, under the penalties of perjury, that this claim is just and correct and that no part of it has been paid by the state of Min-

Approved: Based on knowledge of the necessity for travel and expense and on the basis of compliance with all provisions

nesota or reimbursed by another party except with respect to any advance amount paid for this trip. of applicable travel regulations.

I AUTHORIZE PAYROLL DEDUCTION OF ANY SUCH ADVANCE.

Supervisor Signature ___________________________________ Date _____________ Work Phone ________________

Employee Signature ____________________________________________________ Date ________________ Work Phone ___________________

Appointing Authority Designee Signature

* Earn code MEI and MEO are taxed at the supplemental rate. (Needed for Recurring Advance and Special Expenses) __________________________ Date ______________________

FI-00529-03 (04/03) Clear. Print Save As.

EMPLOYEE EXPENSE REPORT (Instructions)

Earn Code Earn Code

DO NOT PAY RELOCATION EXPENSES ON THIS FORM. Description In State Out of State Description In State Out of State

See form FI-00568 Relocation Expense Report. Relocation expenses must be sent to Advance ADI ADO Membership MEM

the Department of Finance, Statewide Payroll Services for payment. Airfare ARI ARO Mileage > IRS Rate MIT MOT

Baggage Handling BGI BGO Mileage < or = IRS Rate MLI MLO

Car Rental CRI CRO Network Services NWK

USE OF FORM: Use the form for the following purposes:

Clothing Allowance CLA Other Expenses OEI OEO

1. To reimburse employees for authorized travel expenses. Clothing-Non Contract CLN Parking PKI PKO

2. To request and pay all travel advances. Communications - Other COM Photocopies CPI CPO

3. To request reimbursement for small cash purchases paid for by employees. Conference/Registration Fee CFI CFO

Postal, Mail & Shipping

PMS

Svcs.(outbound)

Department Head Expense DHE Storage of State Property STO

COMPLETION OF THE FORM: Employee: Complete, in ink, all parts of this form that

Fax FXI FXO Supplies/Materials/Parts SMP

are applicable to the expenses you are submitting. If claiming reimbursement, enter Freight & Delivery (inbound) FDS Telephone, Business Use BPI BPO

actual amounts paid, up to the limits set for your bargaining unit or contract/plan. If you Hosting HST Telephone, Personal Use PHI PHO

do not know these limits, refer to your union contract or contact your agency's business Laundry LDI LDO Training/Tuition Fee TRG

expense contact person. Do not enter more than the set limit for any item. Lodging LGI LGO Taxi/Airport Shuttle TXI TXO

Meals With Lodging MWI MWO Vest Reimbursement VST

Meals Without Lodging MEI MEO

All of the data you provide on this form is public information, except for your home

address. You are not legally required to provide your home address, but the state of Minnesota cannot process certain mileage payments without it.

Supervisor: Approve the correctness and necessity of this request in compliance with existing labor contracts and all other applicable rules and policies. Forward to the agency business

expense contact person, who will then process the payments.

Final Expense For This Trip? Check this box if there will be no further expenses submitted for this trip. By doing this, any outstanding advance balance associated with this trip will be de-

ducted from the next paycheck that is issued.

1-Way Commute Miles: Enter the number of miles from your home to your permanent work station.

Employee ID: See pay stub for your Employee ID number.

Expense Group ID: Entered by accounting or payroll office at the time of entering expenses. The Expense Group ID is a unique number that is system-assigned. It will be used to refer-

ence any advance payment or expense reimbursement associated with this trip.

Earn Code: Select an Earn Code from the list that applies to the expenses for which you are requesting reimbursement. Be sure to select the code that correctly reflects whether the trip is

in state or out-of-state.

Travel Advances, Short-Term and Recurring: An employee can only have one outstanding advance at a time. Therefore, an advance must be settled before another advance can be

issued.

Travel Advance Settlement: When the total expenses submitted are less than the advance amount or if the trip is cancelled, the employee will owe money to the state. Except for rare

situations, personal checks will not be accepted for settlement of advances. Instead of submitting personal checks for the amount owed, a deduction will be taken from the employee's pay-

check.

MAPS Code Block: Funding source(s) for advance or expense(s)

Mileage: Use the Mileage Reimbursement Calculation table to figure your mileage reimbursement. If the mileage rate you are using is above the IRS rate at the time of travel (this is not

common), part of the mileage reimbursement will be taxed. Use the Mileage Reimbursement Calculation table to figure the taxable and non-taxable reimbursement amounts.

Vehicle Control Number: When a private vehicle is used by an employee in the seven-county metro area, the employee may be subject to the vehicle control number procedure. Mileage

may be authorized for reimbursement to the employee at one of two possible rates (referred to as the higher or lower rate.) The rates are specified in the applicable labor agreement or com-

pensation plan. When a vehicle control number is issued by the agency contact, it must be included on this form to be reimbursed at the higher rate. Ask your agency business expense

contact person for more information on the vehicle control number procedure.

Receipts: Attach original itemized receipts for all expenses except meals, taxi services, baggage handling, and parking meters, to this reimbursement claim. The Agency Designee may, at

its option, require attachment of meal receipts as well. Credit card receipts, bank drafts, or cancelled checks are not allowable receipts.

Copies and Distribution: Submit the original document for payment and retain a copy for your employee records.

FI-00529-03 (04/03)

Potrebbero piacerti anche

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Super Trader Tactics For TRIPLE-DIGIT RETURNSDocumento22 pagineSuper Trader Tactics For TRIPLE-DIGIT RETURNSjdalvaran85% (20)

- International BankingDocumento22 pagineInternational BankingMayankTayalNessuna valutazione finora

- AC517Documento11 pagineAC517Inaia ScottNessuna valutazione finora

- BBA Internship ProjectDocumento40 pagineBBA Internship Project68Rohan Chopra100% (1)

- Truck Refrigration Import Duty CostDocumento1 paginaTruck Refrigration Import Duty Costsrk1066997Nessuna valutazione finora

- Sample Microsoft Salary Certificate TemplateDocumento1 paginaSample Microsoft Salary Certificate TemplateDani StanisorNessuna valutazione finora

- Sample Expense ReportDocumento1 paginaSample Expense Reportmharaynel.afableNessuna valutazione finora

- Appendix 33 - Payroll - April 2021Documento2 pagineAppendix 33 - Payroll - April 2021Praise BuenaflorNessuna valutazione finora

- Abc Command CenterDocumento12 pagineAbc Command CenterRey Christopher CastilloNessuna valutazione finora

- Fao NP Service Accr Det ExcDocumento1 paginaFao NP Service Accr Det ExcRam VanagalaNessuna valutazione finora

- Op. Pel. Minor Sta 72+250 LDDocumento2 pagineOp. Pel. Minor Sta 72+250 LDYaser KhamilNessuna valutazione finora

- TA-DA-Form-for-Provincial EmployeesDocumento2 pagineTA-DA-Form-for-Provincial EmployeesMuhammad FahimNessuna valutazione finora

- Cost of Poor Quality (Copq) Management: Distribution of Failure Costs OvertimeDocumento50 pagineCost of Poor Quality (Copq) Management: Distribution of Failure Costs OvertimeNyadroh Clement MchammondsNessuna valutazione finora

- Work Program Format NEWDocumento2 pagineWork Program Format NEWmarjgumate1214Nessuna valutazione finora

- At Least 30% Are Women Involved in The M & EDocumento10 pagineAt Least 30% Are Women Involved in The M & EleahtabsNessuna valutazione finora

- Rejection Analysis 2021Documento7 pagineRejection Analysis 2021Abhishek AllenNessuna valutazione finora

- Practice 1Documento2 paginePractice 1ScribdTranslationsNessuna valutazione finora

- RMC - Sow Nov'20 PDFDocumento1 paginaRMC - Sow Nov'20 PDFThamNessuna valutazione finora

- Work Program - 230 PpeDocumento6 pagineWork Program - 230 PpeHarris DarpingNessuna valutazione finora

- TA Bill Claim FormDocumento7 pagineTA Bill Claim FormKULDEEP KAPOORNessuna valutazione finora

- COQ Model Rev12Documento50 pagineCOQ Model Rev12arunradNessuna valutazione finora

- Salary Pay Slip - Aug23Documento1 paginaSalary Pay Slip - Aug23TENDER AWADH GROUPNessuna valutazione finora

- DiscDoc ID43079 31-Aug-2023 ENGDocumento6 pagineDiscDoc ID43079 31-Aug-2023 ENGAndrew AmirNessuna valutazione finora

- For Local Sales Only: The Peak Taytay, Rizal February 04, 2022 12:38 AMDocumento1 paginaFor Local Sales Only: The Peak Taytay, Rizal February 04, 2022 12:38 AMGEN888 IGNessuna valutazione finora

- SFSC Travel-ReimbursementDocumento2 pagineSFSC Travel-ReimbursementElyChanNessuna valutazione finora

- For Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMDocumento1 paginaFor Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMGEN888 IGNessuna valutazione finora

- Time Scedul Jepon BogorejoDocumento1 paginaTime Scedul Jepon Bogorejoainana151719Nessuna valutazione finora

- Carrier Month Planning - FormatDocumento4 pagineCarrier Month Planning - Formatcalvin.bloodaxe4478Nessuna valutazione finora

- Annex 21 - COST COMPARISON SHEETDocumento1 paginaAnnex 21 - COST COMPARISON SHEETLarimel ValdezNessuna valutazione finora

- Monthly Targets - 2022Documento3 pagineMonthly Targets - 2022Enso ZaldivarNessuna valutazione finora

- 817 Preciario Quebrada Jardina Rev01Documento9 pagine817 Preciario Quebrada Jardina Rev01israel guijarro dominguezNessuna valutazione finora

- Mahatma Gandhi National Rural Employment Guarantee Act Muster Roll (For Unskilled Labourer)Documento3 pagineMahatma Gandhi National Rural Employment Guarantee Act Muster Roll (For Unskilled Labourer)deepak dashNessuna valutazione finora

- Invoice Records Loan Jica Ip-537: MultipolarDocumento2 pagineInvoice Records Loan Jica Ip-537: MultipolarHotmaNessuna valutazione finora

- Boq 160238Documento3 pagineBoq 160238Yogesh YadavNessuna valutazione finora

- Defined Risk Strategy (DRS) : "Prophesy As Much As You Like, But Always Hedge." - Oliver Wendell Holmes, 1861Documento4 pagineDefined Risk Strategy (DRS) : "Prophesy As Much As You Like, But Always Hedge." - Oliver Wendell Holmes, 1861Hasita VinodNessuna valutazione finora

- Analytics All Web Site Data Location 20190526-20191125 PDFDocumento213 pagineAnalytics All Web Site Data Location 20190526-20191125 PDFMohd Elfie Nieshaem JuferiNessuna valutazione finora

- Statement of Appropriations, Allotments, Obligations, Disbursements and Balances As at The Quarter Ending September 30, 2021Documento6 pagineStatement of Appropriations, Allotments, Obligations, Disbursements and Balances As at The Quarter Ending September 30, 2021Charles Decripito FloresNessuna valutazione finora

- Monthly Services Record: #127 Trans-Amadi Ind. Layout, Port Harcourt, Rivers StateDocumento3 pagineMonthly Services Record: #127 Trans-Amadi Ind. Layout, Port Harcourt, Rivers StateEhigiator JosephNessuna valutazione finora

- For Local Sales Only: Fortune Hill San Juan September 23, 2019 01:19 AMDocumento2 pagineFor Local Sales Only: Fortune Hill San Juan September 23, 2019 01:19 AMRey R SonicoNessuna valutazione finora

- FAR 1 1st Quarter CurrentDocumento3 pagineFAR 1 1st Quarter CurrentvisayasstateuNessuna valutazione finora

- Complete Before Wash and After Wash Measurement Status ReportDocumento14 pagineComplete Before Wash and After Wash Measurement Status ReportShoaibNessuna valutazione finora

- Frontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingDocumento52 pagineFrontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingSusheel GautamNessuna valutazione finora

- Sensitivity: LNT Construction Internal UseDocumento5 pagineSensitivity: LNT Construction Internal UseAnjum JauherNessuna valutazione finora

- Bicycle Manufacturing Industry - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportDocumento57 pagineBicycle Manufacturing Industry - : Market Survey Cum Detailed Techno Economic Feasibility Project ReportHarshal ShakkyaNessuna valutazione finora

- Draft Daily Report - 090223Documento1 paginaDraft Daily Report - 090223rico danuputraNessuna valutazione finora

- Portfolio Dashboard - Euro 11Documento1 paginaPortfolio Dashboard - Euro 11kvisaNessuna valutazione finora

- General Tyres Master FileDocumento51 pagineGeneral Tyres Master FileKâíñåt KháànNessuna valutazione finora

- Mira Valley 51922Documento2 pagineMira Valley 51922AlbertNessuna valutazione finora

- Sandia Homes Pricelist As of 09.25.20 Local OnlyDocumento1 paginaSandia Homes Pricelist As of 09.25.20 Local OnlyvicNessuna valutazione finora

- State of Florida Voucher For Reimbursement of Travel ExpensesDocumento6 pagineState of Florida Voucher For Reimbursement of Travel ExpensesFahad KhanNessuna valutazione finora

- Form29 - March 2024Documento1 paginaForm29 - March 2024Pardeep pooniaNessuna valutazione finora

- Suryanagar Approach RoadDocumento3 pagineSuryanagar Approach RoadBUKA RAMAKANTHNessuna valutazione finora

- Form 29Documento1 paginaForm 29arnabNessuna valutazione finora

- 1976 Capital Funds For Bicycle PlanDocumento1 pagina1976 Capital Funds For Bicycle PlanRandall MyersNessuna valutazione finora

- Project Weld Status Report: Rev. 2018.04.00 30-Apr-18 Saudi Aramco Test Report 3-Jul-18Documento1 paginaProject Weld Status Report: Rev. 2018.04.00 30-Apr-18 Saudi Aramco Test Report 3-Jul-18karthi51289Nessuna valutazione finora

- Annex G Work Program Osec Fms FormblankDocumento1 paginaAnnex G Work Program Osec Fms FormblankMetal WeebNessuna valutazione finora

- PalmRidge P3 Pricelist - LOT (In-House & Bank)Documento1 paginaPalmRidge P3 Pricelist - LOT (In-House & Bank)Vic CumpasNessuna valutazione finora

- Term Loan-31.12Documento1 paginaTerm Loan-31.12honey_januNessuna valutazione finora

- FAR 1 2nd Quarter ContinuingDocumento2 pagineFAR 1 2nd Quarter ContinuingJade MorenoNessuna valutazione finora

- Behavioral Asset Allocation Revised Victoria 100921Documento38 pagineBehavioral Asset Allocation Revised Victoria 100921Akanksha GuptaNessuna valutazione finora

- Kanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Documento2 pagineKanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Satyam TiwariNessuna valutazione finora

- Document (11) InvetoryDocumento1 paginaDocument (11) InvetoryNhedy HabitanNessuna valutazione finora

- 03 KPI DashboardDocumento2 pagine03 KPI DashboardTanjong Minyak Car Wash Sdn BhdNessuna valutazione finora

- Title Page 8Documento3 pagineTitle Page 8Dana A Daspit ConteNessuna valutazione finora

- TravelDocumento12 pagineTravelDana A Daspit ConteNessuna valutazione finora

- Schedule of IRS Form AddendumDocumento1 paginaSchedule of IRS Form AddendumDana A Daspit ConteNessuna valutazione finora

- Weekly Class Schedule1Documento1 paginaWeekly Class Schedule1Dana A Daspit ConteNessuna valutazione finora

- Fattach Get 5Documento3 pagineFattach Get 5Dana A Daspit ConteNessuna valutazione finora

- Year-End Tax Plan1Documento1 paginaYear-End Tax Plan1Dana A Daspit ConteNessuna valutazione finora

- Schedule M-2 PartnershipsDocumento2 pagineSchedule M-2 PartnershipsDana A Daspit ConteNessuna valutazione finora

- Promissory NoteDocumento2 paginePromissory NoteDana A Daspit ConteNessuna valutazione finora

- Partnership Organizer Qsba-14Documento2 paginePartnership Organizer Qsba-14Dana A Daspit ConteNessuna valutazione finora

- Schedule M-2 Corporation Sub SDocumento2 pagineSchedule M-2 Corporation Sub SDana A Daspit ConteNessuna valutazione finora

- Quick Finder 2008 Tax-OrganizerDocumento8 pagineQuick Finder 2008 Tax-OrganizerDana A Daspit ConteNessuna valutazione finora

- Schedule M-2 Corporate Sub-SDocumento1 paginaSchedule M-2 Corporate Sub-SDana A Daspit ConteNessuna valutazione finora

- 2005 Leased AutosDocumento15 pagine2005 Leased AutosDana A Daspit ConteNessuna valutazione finora

- Deprn WKSHTDocumento1 paginaDeprn WKSHTDana A Daspit ConteNessuna valutazione finora

- 2008 Tax OrganizerDocumento4 pagine2008 Tax OrganizerDana A Daspit ConteNessuna valutazione finora

- General JournalDocumento2 pagineGeneral JournalDana A Daspit ConteNessuna valutazione finora

- pdf/accounting GLDocumento17 paginepdf/accounting GLDana A Daspit ConteNessuna valutazione finora

- Credit Card Tracker Template: L&M Business DesignsDocumento6 pagineCredit Card Tracker Template: L&M Business DesignsDana A Daspit ConteNessuna valutazione finora

- GJE BLANK Qtrly RevisedDocumento2 pagineGJE BLANK Qtrly RevisedDana A Daspit ConteNessuna valutazione finora

- Travel ExpenseDocumento1 paginaTravel ExpenseDana A Daspit ConteNessuna valutazione finora

- Depreciation LegalDocumento2 pagineDepreciation LegalDana A Daspit ConteNessuna valutazione finora

- Equipment Ledger CardDocumento5 pagineEquipment Ledger CardDana A Daspit ConteNessuna valutazione finora

- Deprn WKSHTDocumento1 paginaDeprn WKSHTDana A Daspit ConteNessuna valutazione finora

- Checkbook Register1Documento4 pagineCheckbook Register1prasaad08Nessuna valutazione finora

- Chart ofDocumento50 pagineChart ofDana A Daspit ConteNessuna valutazione finora

- Quick Books Year End Combo ChecklistDocumento4 pagineQuick Books Year End Combo ChecklistDana A Daspit ConteNessuna valutazione finora

- EOY Check List BlankDocumento1 paginaEOY Check List BlankDana A Daspit ConteNessuna valutazione finora

- Box Calendar Green 12monthDocumento1 paginaBox Calendar Green 12monthDana A Daspit ConteNessuna valutazione finora

- Project Economics & Financial MangmentDocumento38 pagineProject Economics & Financial MangmentshardultagalpallewarNessuna valutazione finora

- CHP 9 PowerPointDocumento57 pagineCHP 9 PowerPointEva SacasaNessuna valutazione finora

- Department of Business Administration Education FM 223 - Course SyllabusDocumento7 pagineDepartment of Business Administration Education FM 223 - Course SyllabusMari ParkNessuna valutazione finora

- Sahara NidhiDocumento4 pagineSahara NidhiAyush DubeyNessuna valutazione finora

- Banking and Insurance (Bbh461) - 1515423225879Documento8 pagineBanking and Insurance (Bbh461) - 1515423225879SamarthGoelNessuna valutazione finora

- Security Valuations - Stocks EZDocumento9 pagineSecurity Valuations - Stocks EZAakash RegmiNessuna valutazione finora

- Cruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryDocumento11 pagineCruz, Leyra R. Bsba Block 1-9 Readings in Philippine HistoryBLOG BLOGNessuna valutazione finora

- ELSSDocumento15 pagineELSSSecure Plus100% (1)

- Examen 4 PDFDocumento8 pagineExamen 4 PDFJoseJavierToroCaballeroNessuna valutazione finora

- Vichitra StatementDocumento3 pagineVichitra Statementsatyam dixitNessuna valutazione finora

- Reuters Islamic Finance Development Report2018Documento44 pagineReuters Islamic Finance Development Report2018Rehan Farhat100% (1)

- ) ) @Ç!!4Bg!!!lJ6.qD : TotalDocumento5 pagine) ) @Ç!!4Bg!!!lJ6.qD : Totalchris johnsonNessuna valutazione finora

- Afar 08Documento14 pagineAfar 08RENZEL MAGBITANGNessuna valutazione finora

- Policy Documents - EncryptedDocumento15 paginePolicy Documents - EncryptedsuitaiaNessuna valutazione finora

- Beyond Greed and Scarcity: An Interview With By, Editor ofDocumento12 pagineBeyond Greed and Scarcity: An Interview With By, Editor ofsinnombrepuesNessuna valutazione finora

- Concepts in Financial ManagementDocumento3 pagineConcepts in Financial ManagementfeilohNessuna valutazione finora

- Trader's Psychology and Key Rules of Forex TradingDocumento3 pagineTrader's Psychology and Key Rules of Forex TradingAkingbemi MorakinyoNessuna valutazione finora

- Activities Undertaken by Banks Include Personal Banking, Corporate BankingDocumento7 pagineActivities Undertaken by Banks Include Personal Banking, Corporate BankingPrince Isaiah JacobNessuna valutazione finora

- Corporate FinanceDocumento18 pagineCorporate FinanceNishakdasNessuna valutazione finora

- Law and Practice of BankingDocumento2 pagineLaw and Practice of BankingJobin George100% (2)

- Class Notes: Class: XI Topic: Financial StatementDocumento3 pagineClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNessuna valutazione finora

- Braden River High School BandsDocumento2 pagineBraden River High School BandsAlex MoralesNessuna valutazione finora

- 04 Tutorial Exercise PDFDocumento2 pagine04 Tutorial Exercise PDFkc103038Nessuna valutazione finora

- Financial Accounting SyllabusDocumento2 pagineFinancial Accounting Syllabusp.sankaranarayananNessuna valutazione finora

- Report Myanmar Financial Sector - A Challenging Environment For Banks Nov2013Documento56 pagineReport Myanmar Financial Sector - A Challenging Environment For Banks Nov2013THAN HANNessuna valutazione finora

- Basic Concepts of Open EconomyDocumento44 pagineBasic Concepts of Open EconomyIvy Amistad Dela Cruz-CabalzaNessuna valutazione finora