Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IB

Caricato da

niranjanaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IB

Caricato da

niranjanaCopyright:

Formati disponibili

Introduction to BPO in Indian Market The business process outsourcing industry in India refers to the business process outsourcing

services in the outsourcing industry in India, catering mainly to Western operations of multinational corporations. As of 2008, around 0.7 million people work in outsourcing sector (less than 0.1% of Indians). Annual revenues are around $11 billion, around 1% of GDP. Around 2.5 million people graduate in India every year. Wages are rising by 10-15 percent as a result of skill shortage. The industry has been growing rapidly. It grew at a rate of 38% over 2005. For the FY06 financial year the projections is of US$7.2 billion worth of services provided by this industry. The base in terms of headcount being roughly 400,000 people directly employed in this Industry. The global BPO Industry is estimated to be worth 120-150 billion dollars, of this the offshore BPO is estimated to be some US$11.4 billion. India thus has some 5-6% share of the total Industry, but a commanding 63% share of the offshore component. The U.S $7.2 billion also represents some 20% of the IT and BPO Industry which is in total expected to have revenues worth US$36 billion for 2006. The headcount at 400,000 is some 40% of the approximate one million workers estimated to be directly employs in the IT and BPO Sector. The related Industry dependent on this are Catering, BPO training and recruitment, transport vendors, (home pick up and drops for night shifts being the norm in the industry). Security agencies, Facilities management companies.

1. The factors affecting firm strategy, structure and rivalry involve the services offered by local firms, and how competitive locally provided services are against those provided by other countries. The factors involving demand conditions involve the evolving needs of the global market for call centre services, ranging from the basic service of answering inquiries based on predefined scripts to the more complex service of providing technical assistance and support. The sufficiency of related supporting industries will involve the state of local educational institutions, real estate, transportation and retail sectors and how these sectors contribute to sustain the growth of the local call centre industry. Finally the conditions affecting the key factors of production, such as local skilled labour and mission-critical technology, will also be discussed. 2. Demand Conditions: Despite the low-cost labor advantage offered by offshore call centers, companies continue to look for ways to gain even more cost savings, if not from a more efficient and thereby cheaper workforce, then from automation technology. Meta Groups technology research services group reported an increasing number of clients choosing to implement voiceautomation technology systems to handle standard, routine inquiries, e.g., account balances, product and service, payment offices, etc., instead of contracting the services of an outsourcer in a low-cost country or establishing their own call centre operations offshore. The eventual outcome of this development is that, with the existence of automation technology, only

customer calls requiring more complicated assistance will be routed to offshore call centres, perhaps from the Philippines or India. This direction means that customers will have higher expectations from call centre agents in offshore countries. Agents will no longer be able to rely on simplified question-and-answer instructions or scripts to answer more complex questions that will be asked them. Industry analysts observe that, out of 100 applicants, only three to five are hired given existing skill requirements. Support services for more complex inquiries, perhaps requiring technical information or instruction, will consequently require higher technical competency, as well as more than adequate communication and problemresolution skills. Should such requirements be made necessary, it is expected that the hiring rate will be lower in the years to come, unless initiatives are implemented to enhance the skills and capabilities of existing as well as future workers in this sector. 3. Sufficiency of Related Industries: Weakness in information technology infrastructure threatens the ability of the country to compete where value-added services require a higher telecommunications bandwidth. The apparent inconsistency between networked readiness and other IT competency ratings for the Philippines and the remarkable growth of IT-based services, made plain by records of investment, revenue, and employment actually generated by the sector, is attributed by industry analysts to the observation that indices and rankings comparing countries with each other consider all the regions in the country, from the most advanced areas to the undeveloped ones. Developed countries such as the United States, Japan, and Germany have progressed to a point where the availability of telecommunications technologies and other related services in the less urbanized regions are virtually at par with that of the most industrialized areas. Developing countries are characterized by a marked difference in infrastructure and economic activity between the centres of business and the rural, residential areas. 4. Factor Conditions: The 2006 Asian Contact Centre Industry Bench marketing Report ranks human resource management, particularly the areas of recruitment and agent turnover, as the greatest challenge faced by Asian contact centres. In the Philippines, the consistency of supply of qualified call centre personnel is threatenedas reflected in a very low 3% acceptance rate by apparent degradation of the quality of primary and secondary education in both private and public schools. Although it has been reported that the average 10-year-and-above literacy rate in the Philippines is above 93%, literacy is not enough to ensure a position for a call centre. Call centres are challenged to implement best practices in curbing employee attrition in the call centre industry such as a flexible and conducive environment, high incentives, and training schemes, and more importantly, a career path development plan to convince college graduates that being a call centre agent is not a dead-end type of job.

5. Govt. regulation policies: The question remains as to who will bear the cost of improvements required to strengthen all factors necessary to ensure the sustainability of the country in competitive advantage in the call centre industry. Some call centres have shouldered the cost themselves, offering free in-house training for new hires. Still others have established joint efforts with existing universities and the Technical Education and Skills Development Authority (TESDA) to incorporate call centre-oriented training requirements in their curricula and courses. Call centres have established personnel development initiatives, e.g., in-house training and evaluation, to enhance skill, and compensation and benefits initiatives, e.g., higher allowances, all-expense paid holidays and vacations, career development. Technology-supported activities such as wafer production and device design are still yet to reach the growth stage. Conclusion: Growth in this sector will get a further impetus as Indian BPO companies have robust security practices and emphasis is laid in developing trust with clients on this score. While earlier there were varying quality standards on this aspect, today there is focus on standardization of security, such as data and IP security.

Potrebbero piacerti anche

- EDU301Documento10 pagineEDU301Carly Notley100% (1)

- Industry Report: The Problem of Sustainable Competitive Advantage in Philippine Call CentersDocumento21 pagineIndustry Report: The Problem of Sustainable Competitive Advantage in Philippine Call Centersmarkdeguzman788333Nessuna valutazione finora

- Research On Call Center PhilippinesDocumento33 pagineResearch On Call Center Philippinesjohan_mico100% (1)

- Research MethodologyDocumento338 pagineResearch MethodologyKabutu Chuunga75% (8)

- Course Outline MIS 105Documento3 pagineCourse Outline MIS 105iteach_adeylNessuna valutazione finora

- William UryDocumento21 pagineWilliam UryCristian Catalina100% (2)

- FBPO HandoutsDocumento29 pagineFBPO HandoutsJhen-Jhen Geol-oh Baclas100% (1)

- Fundamentals Lesson 1Documento5 pagineFundamentals Lesson 1Jhen-Jhen Geol-oh BaclasNessuna valutazione finora

- Business Process OutsourcingDocumento8 pagineBusiness Process OutsourcingJuvin IcNessuna valutazione finora

- Introduction To Bpo: F.Y. Bcom - Banking and Insurance 1Documento29 pagineIntroduction To Bpo: F.Y. Bcom - Banking and Insurance 1Mitali MehtaNessuna valutazione finora

- Resrch Ratio AnalysisDocumento68 pagineResrch Ratio AnalysisGyan Bikram ShahNessuna valutazione finora

- Assignment ON Problam Faced by Indian Financial Service SecterDocumento10 pagineAssignment ON Problam Faced by Indian Financial Service SecterSapnaDeepNessuna valutazione finora

- Impact of The Global Meltdown On Employment in The iT-BPO SectorDocumento4 pagineImpact of The Global Meltdown On Employment in The iT-BPO Sectorsoumya_2688Nessuna valutazione finora

- Offshoring MckinseyDocumento8 pagineOffshoring MckinseyMark LooiNessuna valutazione finora

- Bpo in India: Presented byDocumento21 pagineBpo in India: Presented byAditya MaluNessuna valutazione finora

- Final Research ProjectDocumento69 pagineFinal Research ProjectJatis AroraNessuna valutazione finora

- OffshoringDocumento9 pagineOffshoringVishal DixitNessuna valutazione finora

- Over View of BpoDocumento76 pagineOver View of BpoajaynghNessuna valutazione finora

- Content 995Documento76 pagineContent 995Vinoth RoyNessuna valutazione finora

- Challenges of ITES Companies in IndiaDocumento9 pagineChallenges of ITES Companies in Indiaundagunda11Nessuna valutazione finora

- Business Process Outsourcing Project BackgroundDocumento4 pagineBusiness Process Outsourcing Project BackgroundMayank Jain NeerNessuna valutazione finora

- Human Resource in ITDocumento5 pagineHuman Resource in ITMamoona ChauhdryNessuna valutazione finora

- Managing BusinessDocumento12 pagineManaging BusinessJehan solutionsNessuna valutazione finora

- Attrition Rates % US Australia Europe India Global AverageDocumento8 pagineAttrition Rates % US Australia Europe India Global AverageShakeel RehmanNessuna valutazione finora

- Itbpo3 Module 01Documento16 pagineItbpo3 Module 01anne pascuaNessuna valutazione finora

- Indian Itsers'Ic'E C'Oinpwzies: To Gain Access To India'S Booming Business Process Outsourcing Market, IndianDocumento3 pagineIndian Itsers'Ic'E C'Oinpwzies: To Gain Access To India'S Booming Business Process Outsourcing Market, IndianVivek YadavNessuna valutazione finora

- BPO Module 01Documento15 pagineBPO Module 01Marinette MedranoNessuna valutazione finora

- Bpo ThesisDocumento5 pagineBpo Thesisbufukegojaf2100% (2)

- Asean Framework For Trade Negotiations: A Study Prepared For Pact / Emerge / UsaidDocumento26 pagineAsean Framework For Trade Negotiations: A Study Prepared For Pact / Emerge / UsaidFelipe NoromorNessuna valutazione finora

- Presentation On Human Resource Development of BpoDocumento13 paginePresentation On Human Resource Development of BpoAadhar PatangiaNessuna valutazione finora

- Attrition in InfosysDocumento3 pagineAttrition in InfosysANIMESH SABHARWALNessuna valutazione finora

- Key Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityDocumento6 pagineKey Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityshashankrandevNessuna valutazione finora

- A Study On Comparative Financial Statement OF: S&P Capital Iq Information System (India) P.V.T.LTDDocumento71 pagineA Study On Comparative Financial Statement OF: S&P Capital Iq Information System (India) P.V.T.LTDAashish KukretiNessuna valutazione finora

- Chapter - 3 Macro-Micro Economic AnalysisDocumento12 pagineChapter - 3 Macro-Micro Economic AnalysisKaviya KaviNessuna valutazione finora

- Pub Higher Ed Ict Egfsn Research 2012Documento15 paginePub Higher Ed Ict Egfsn Research 2012SeabanNessuna valutazione finora

- A Study On Training and Development Activities - in INCAPDocumento71 pagineA Study On Training and Development Activities - in INCAPPreethi GowdaNessuna valutazione finora

- Whitepaper ITES Industry PotentialDocumento6 pagineWhitepaper ITES Industry PotentialsamuraiharryNessuna valutazione finora

- BPO Sector in India - Opportunities, Threats and ChallengesDocumento3 pagineBPO Sector in India - Opportunities, Threats and ChallengesNeeraj AgrawalNessuna valutazione finora

- PANKAJDocumento54 paginePANKAJPankaj RaiNessuna valutazione finora

- A Group Assignment ON It Enabled Services: B.V.Patel Institute of BMC & ItDocumento6 pagineA Group Assignment ON It Enabled Services: B.V.Patel Institute of BMC & ItBhumika PatelNessuna valutazione finora

- A Project Report On: " Empowering The Growth in IT Industry Through Customer Awareness For IT Programs."Documento63 pagineA Project Report On: " Empowering The Growth in IT Industry Through Customer Awareness For IT Programs."Sukhjeet Kaur BatthNessuna valutazione finora

- Offshore Software Development MarketDocumento4 pagineOffshore Software Development MarkettranduyninhNessuna valutazione finora

- Top 10 Risks of Offshore Outsourcing: SummaryDocumento19 pagineTop 10 Risks of Offshore Outsourcing: SummaryRukshi ArawwalaNessuna valutazione finora

- Project Study ReportDocumento111 pagineProject Study Reportrkdhawan96170% (1)

- Week 001-003 BPODocumento5 pagineWeek 001-003 BPOkitaNessuna valutazione finora

- Call Centers in IndiaDocumento8 pagineCall Centers in IndiaDwayne LasradoNessuna valutazione finora

- Outsourcing To China Growing With ChinaDocumento217 pagineOutsourcing To China Growing With ChinaAlex ChuaNessuna valutazione finora

- SMP Reflection PaperDocumento4 pagineSMP Reflection PaperRogeilyn CalimpongNessuna valutazione finora

- Jom 05 03 006Documento9 pagineJom 05 03 006kureshia249Nessuna valutazione finora

- HR Practices and Organizational Strategies in Select: IT Companies in India "Documento59 pagineHR Practices and Organizational Strategies in Select: IT Companies in India "Sneha MehtaNessuna valutazione finora

- Executive Summary: 1 Team-Vladmir BraveheartDocumento17 pagineExecutive Summary: 1 Team-Vladmir BraveheartratttzzzNessuna valutazione finora

- HRM Systems in Indian IT Industry: Submitted By: Ishaan Khurana Gautam Thakur Rishabh Gupta Apanshu GoelDocumento8 pagineHRM Systems in Indian IT Industry: Submitted By: Ishaan Khurana Gautam Thakur Rishabh Gupta Apanshu GoelGautam ThakurNessuna valutazione finora

- TcsDocumento13 pagineTcsnafis20Nessuna valutazione finora

- IT BPM Consultation ReportDocumento40 pagineIT BPM Consultation ReportkrisNessuna valutazione finora

- Project Report HRDocumento58 pagineProject Report HRkapahi89Nessuna valutazione finora

- India: An Attractive IT DestinationDocumento14 pagineIndia: An Attractive IT DestinationAdhish VermaNessuna valutazione finora

- Motivation ProjectDocumento50 pagineMotivation ProjectYoddhri DikshitNessuna valutazione finora

- Strategic Flexibility in Service Sector Technology (Product) Based Integration Development of Multi Stakeholder STAR MODELDocumento15 pagineStrategic Flexibility in Service Sector Technology (Product) Based Integration Development of Multi Stakeholder STAR MODELHumberto FerreiraNessuna valutazione finora

- L&T ProjectDocumento54 pagineL&T ProjectAnki Bhagat100% (1)

- Economics of Business Process Outsourcing: By: April OcampoDocumento48 pagineEconomics of Business Process Outsourcing: By: April OcampoApril OcampoNessuna valutazione finora

- Emerging FinTech: Understanding and Maximizing Their BenefitsDa EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNessuna valutazione finora

- Reaping the Benefits of Industry 4.0 through Skills Development in High-Growth Industries in Southeast Asia: Insights from Cambodia, Indonesia, the Philippines, and Viet NamDa EverandReaping the Benefits of Industry 4.0 through Skills Development in High-Growth Industries in Southeast Asia: Insights from Cambodia, Indonesia, the Philippines, and Viet NamNessuna valutazione finora

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItDa EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNessuna valutazione finora

- Salary StructureDocumento4 pagineSalary StructureniranjanaNessuna valutazione finora

- Case LawDocumento5 pagineCase LawniranjanaNessuna valutazione finora

- Application 3: Top-Management Team at Ortiv Glass CorporationDocumento2 pagineApplication 3: Top-Management Team at Ortiv Glass Corporationniranjana100% (1)

- Business EthicsDocumento28 pagineBusiness EthicsniranjanaNessuna valutazione finora

- Council of Scientific andDocumento7 pagineCouncil of Scientific andniranjanaNessuna valutazione finora

- EntrepreneurshipDocumento21 pagineEntrepreneurshipniranjanaNessuna valutazione finora

- Environment ManagementDocumento45 pagineEnvironment Managementniranjana100% (1)

- Succession PlanningDocumento4 pagineSuccession PlanningniranjanaNessuna valutazione finora

- Competency: Group No 1 Mansee Desai - 12 Divya Iyer-21 Bhavna Patil - 99 Shilpa Susan - 138 (Hoc) Niranjana Chandran - 160Documento14 pagineCompetency: Group No 1 Mansee Desai - 12 Divya Iyer-21 Bhavna Patil - 99 Shilpa Susan - 138 (Hoc) Niranjana Chandran - 160niranjanaNessuna valutazione finora

- As Asked by You, PFA Ppt's and Articles Related To Topics That We Have Covered in Industrial RelationsDocumento1 paginaAs Asked by You, PFA Ppt's and Articles Related To Topics That We Have Covered in Industrial RelationsniranjanaNessuna valutazione finora

- Pillai's Institute of Management Studies & ResearchDocumento27 paginePillai's Institute of Management Studies & ResearchniranjanaNessuna valutazione finora

- With Amendments Made in The Eleventh Conference of CITU Held in Chennai From December 9-13, 2003Documento14 pagineWith Amendments Made in The Eleventh Conference of CITU Held in Chennai From December 9-13, 2003niranjanaNessuna valutazione finora

- Quality CirclesDocumento10 pagineQuality CirclesniranjanaNessuna valutazione finora

- Environment Management: Submitted By:-Niranjana ChandranDocumento4 pagineEnvironment Management: Submitted By:-Niranjana ChandranniranjanaNessuna valutazione finora

- Icebergs and WorldviewsDocumento14 pagineIcebergs and Worldviewsstanger_eGEJNessuna valutazione finora

- Sreb College Ready Literacy Course OverviewDocumento1 paginaSreb College Ready Literacy Course Overviewapi-373506180Nessuna valutazione finora

- Grammar in Use - ListDocumento2 pagineGrammar in Use - Listrobgomesrrr0% (1)

- PDFDocumento10 paginePDFSana RubabNessuna valutazione finora

- 9 Types of Curriculum AdaptationsDocumento2 pagine9 Types of Curriculum Adaptationsapi-354929856Nessuna valutazione finora

- The Leadership ChalengeDocumento88 pagineThe Leadership ChalengeSrinivas Rao GunjaNessuna valutazione finora

- Educ 404Documento18 pagineEduc 404Mary Cris MalanoNessuna valutazione finora

- Underground History of American Education - by John Taylor GattoDocumento352 pagineUnderground History of American Education - by John Taylor GattoAnderson Mansueto100% (1)

- Story Telling: Stories Around The WorldDocumento2 pagineStory Telling: Stories Around The WorldMagali MadariagaNessuna valutazione finora

- Teaching Portfolio Rationale - Standard 3 - Sub 3Documento1 paginaTeaching Portfolio Rationale - Standard 3 - Sub 3api-457603008Nessuna valutazione finora

- CV FormatDocumento1 paginaCV FormatNedzad AltumbabicNessuna valutazione finora

- Creativity TestDocumento8 pagineCreativity TestHaslina SaidNessuna valutazione finora

- Define PsychologyDocumento8 pagineDefine PsychologyRaniaNessuna valutazione finora

- MRF MT Sy 2023 2024Documento8 pagineMRF MT Sy 2023 2024Ailyn OcomenNessuna valutazione finora

- Audit ChecklistDocumento2 pagineAudit ChecklistBalasuperamaniam Raman100% (1)

- 04 Yunus EmreDocumento20 pagine04 Yunus EmreAria FandalyNessuna valutazione finora

- NCHD ApplicationDocumento14 pagineNCHD ApplicationIkramullah KhattakNessuna valutazione finora

- Andragoske Studije 2010-2gfjjkDocumento229 pagineAndragoske Studije 2010-2gfjjkSheldon CooperNessuna valutazione finora

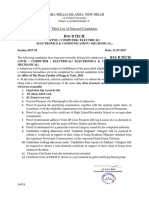

- Jamia Millia Islamia, New Delhi: B14: B.TECHDocumento11 pagineJamia Millia Islamia, New Delhi: B14: B.TECHMrinalNessuna valutazione finora

- List of Loan Beneficiaries For Undergraduates/ Degree Courses 2015/2016Documento25 pagineList of Loan Beneficiaries For Undergraduates/ Degree Courses 2015/2016The Campus Times100% (1)

- Board of Intermediate Education: Andhra Pradesh: HyderabadDocumento3 pagineBoard of Intermediate Education: Andhra Pradesh: HyderabadanulathaNessuna valutazione finora

- Character TraitsDocumento12 pagineCharacter Traitsapi-296854004100% (1)

- December 12-16, 2016 (WEEK 6) : GRADES 1 To 12 Daily Lesson Log Tabunoc Central School V Maria Angeles Y. Niadas 3 QuarterDocumento4 pagineDecember 12-16, 2016 (WEEK 6) : GRADES 1 To 12 Daily Lesson Log Tabunoc Central School V Maria Angeles Y. Niadas 3 QuarterGrace N Malik0% (1)

- Od ProcessDocumento56 pagineOd Processkavya_rani_2Nessuna valutazione finora

- LP - Creative WritingDocumento6 pagineLP - Creative Writingapi-294620957Nessuna valutazione finora

- Q1W8 FBS DLLDocumento4 pagineQ1W8 FBS DLLKei LansangNessuna valutazione finora