Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 15 Outline

Caricato da

amu_scribdDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 15 Outline

Caricato da

amu_scribdCopyright:

Formati disponibili

Checklist of Stuff to Know for Chapter 15 Corporate Capital: Define the following terms: o Common stock o Preferred Stock

k o Retained Earnings o Contributed Capital o Stockholders Equity o Additional Paid-in Capital o Stated Value o Shares Authorized o Shares Issued o Shares Outstanding o Treasury Shares Be able to record the journal entries for the issuance of common stock (with or without a par value or stated value). Be able to account for stock issued with other securities under the: o Proportional Method o Incremental Method What is the rule for the amount that should be recorded for stock issued in noncash transactions? Be able to record the journal entry for such a transaction. How does a company account for the costs of issuing stock? Reacquisition of Shares: What are the reasons that a company may re-purchase their outstanding stock? Be able to use the cost method of handling treasury stock for the following transactions & know how treasury stock transaction effect the balance sheet: o Repurchase of shares o Sale of Treasury Stock Above Cost Below Cost o Retiring Treasury Shares Preferred Stock (See the Appendix for further information on preferred stock): What are the features generally associated with preferred stock? How are dividends expressed for preferred stock? Be able to define the following: o Cumulative preferred stock o Participating preferred stock o Convertible preferred stock o Callable preferred stock o Redeemable preferred stock Be able to account for the issuance of preferred stock.

Dividend Policy & Stock Splits: Know the accounting rules and entries for the following types of dividends: o Cash dividends o Liquidating Dividends o Property dividends o Stock dividends Small Large What is a stock split and how does it affect the par value and number of shares outstanding? Presentation and Analysis of Stockholders Equity: Know how equity transactions affect the balance sheet. Be able to look at the stockholders equity section of the balance sheet and understand each component. For example make sure you understand each line of the equity section in Illustration 15-13. Know that the Statement of Changes in Stockholders Equity shows the beginning balance, additions & deductions, and ending balance for each component of equity. See Illustration 15-14. IFRS: Be able to describe briefly the major similarities and differences between GAAP and IFRS in regard to stockholders equity. Appendix on Dividend Preferences: Be able to handle the accounting for dividends under the following dividend preferences: o Cumulative and noncumulative preferred stock o Participating and nonparticipating preferred sock

Potrebbero piacerti anche

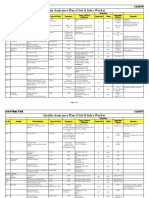

- Quality Assurance Plan - CivilDocumento11 pagineQuality Assurance Plan - CivilDeviPrasadNathNessuna valutazione finora

- Vietnamese Alphabet and PronounDocumento10 pagineVietnamese Alphabet and Pronounhati92Nessuna valutazione finora

- Financial Accounting and Reporting Study Guide NotesDa EverandFinancial Accounting and Reporting Study Guide NotesValutazione: 1 su 5 stelle1/5 (1)

- Business Association FlashcardsDocumento18 pagineBusiness Association FlashcardsSophia Veleda50% (2)

- Series 7 Key FactsDocumento2 pagineSeries 7 Key FactsMohit VermaNessuna valutazione finora

- Management of StutteringDocumento182 pagineManagement of Stutteringpappu713100% (2)

- Financial Statement AnalysisDocumento28 pagineFinancial Statement AnalysisSachin Methree75% (4)

- Understanding Financial StatementsDocumento25 pagineUnderstanding Financial StatementsFarah AtikahNessuna valutazione finora

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento115 pagineInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownKatrina Vianca Decapia100% (1)

- Trading Rules To Successful ProfitsDocumento89 pagineTrading Rules To Successful ProfitsOuattaraNessuna valutazione finora

- Chapter 3 Stock ValuationDocumento51 pagineChapter 3 Stock ValuationJon Loh Soon Weng50% (2)

- Al-Farabi Fusul Al MadaniDocumento107 pagineAl-Farabi Fusul Al MadaniDaniel G.G.100% (1)

- A Framework For Financial Statement AnalysisDocumento72 pagineA Framework For Financial Statement AnalysisSaif KhanNessuna valutazione finora

- Purchasing and Supply Chain Management (The Mcgraw-Hill/Irwin Series in Operations and Decision)Documento14 paginePurchasing and Supply Chain Management (The Mcgraw-Hill/Irwin Series in Operations and Decision)Abd ZouhierNessuna valutazione finora

- Analysis of The Statement of Shareholders' Equity: EF4314 Class 5Documento42 pagineAnalysis of The Statement of Shareholders' Equity: EF4314 Class 5Jerry LoNessuna valutazione finora

- Advanced Corporate Finance-S1Documento8 pagineAdvanced Corporate Finance-S1DCF DevizaNessuna valutazione finora

- Introduction To AccountingDocumento28 pagineIntroduction To AccountingMohamed Yousif HamadNessuna valutazione finora

- CH3 Part2Documento71 pagineCH3 Part2Yasmine Ben YedderNessuna valutazione finora

- Analysis of Financial Statements: Jian XiaoDocumento115 pagineAnalysis of Financial Statements: Jian XiaoLim Mei SuokNessuna valutazione finora

- S3-Managing Financial Health and PerformanceDocumento36 pagineS3-Managing Financial Health and PerformanceShaheer BaigNessuna valutazione finora

- Annual Report and Accounts ContentsDocumento5 pagineAnnual Report and Accounts ContentsTwinkle SuriNessuna valutazione finora

- Outline of Important Points For Chapter 13Documento1 paginaOutline of Important Points For Chapter 13amu_scribdNessuna valutazione finora

- FE1 Chapter 3Documento40 pagineFE1 Chapter 3Hùng PhanNessuna valutazione finora

- DP1 FM FaDocumento32 pagineDP1 FM FaananditaNessuna valutazione finora

- FINMAN Mod01 - 3e - 030512 2Documento46 pagineFINMAN Mod01 - 3e - 030512 2Anonymous XCpe2nNessuna valutazione finora

- Financial Statement AnalysisDocumento62 pagineFinancial Statement AnalysisCECILLE ALBAO100% (1)

- Revaluation of Partnership AssetsDocumento32 pagineRevaluation of Partnership AssetsERICK MLINGWANessuna valutazione finora

- Financial Accounting For MbasDocumento46 pagineFinancial Accounting For MbasHazim AbualolaNessuna valutazione finora

- Chapter 4Documento31 pagineChapter 4PresanaNessuna valutazione finora

- Financial StatementsDocumento12 pagineFinancial StatementsShrutika MoreNessuna valutazione finora

- Financial Accounting Ii: DR Nsubili Isaga School of Business (Daf)Documento66 pagineFinancial Accounting Ii: DR Nsubili Isaga School of Business (Daf)ERICK MLINGWANessuna valutazione finora

- Module 1: Framework For Analysis and Valuation: Business ActivitiesDocumento20 pagineModule 1: Framework For Analysis and Valuation: Business Activitiesarunvkumarindia1Nessuna valutazione finora

- Analyzing Financial StatementsDocumento9 pagineAnalyzing Financial StatementsAbsa TraderNessuna valutazione finora

- Business Finance Lessons, 2,3,7,8,9, and 10Documento53 pagineBusiness Finance Lessons, 2,3,7,8,9, and 10dollizonmishaeliezerNessuna valutazione finora

- Task 2&4Documento17 pagineTask 2&4Yashmi BhanderiNessuna valutazione finora

- Exam 3 Study GuideDocumento11 pagineExam 3 Study GuideMinh NguyễnNessuna valutazione finora

- Vdocument - in Financial Reporting Evolution of Global StandardsDocumento42 pagineVdocument - in Financial Reporting Evolution of Global StandardsCaroline jonathanNessuna valutazione finora

- MAS Handout - Financial AnalysisDocumento8 pagineMAS Handout - Financial AnalysisDivine VictoriaNessuna valutazione finora

- Lecture 6 Bus. MNGMNTDocumento69 pagineLecture 6 Bus. MNGMNTAizhan BaimukhamedovaNessuna valutazione finora

- ACC601 - Week 3 Lecture 3 - Disclosure Requirements of CompaniesDocumento27 pagineACC601 - Week 3 Lecture 3 - Disclosure Requirements of CompaniesprashnilNessuna valutazione finora

- BM Unit 3.4 Final Accounts HLDocumento81 pagineBM Unit 3.4 Final Accounts HLJacqueline Levana HuliselanNessuna valutazione finora

- Equity: Intermediate Accounting IFRS Edition Kieso, Weygandt, and WarfieldDocumento70 pagineEquity: Intermediate Accounting IFRS Edition Kieso, Weygandt, and WarfieldagustadivNessuna valutazione finora

- Diluted Earnings Per ShareDocumento13 pagineDiluted Earnings Per ShareMunashe MuzambiNessuna valutazione finora

- Financial Statements I, Vilgia Dan HannaDocumento18 pagineFinancial Statements I, Vilgia Dan HannaVilgia DelarhozaNessuna valutazione finora

- Lecture 1Documento5 pagineLecture 1eyooloNessuna valutazione finora

- Financial Reporting: Ms. Rabia Ishfaq Lec. in CommerceDocumento30 pagineFinancial Reporting: Ms. Rabia Ishfaq Lec. in CommercerabiaNessuna valutazione finora

- A Framework For Financial Statement AnalysisDocumento72 pagineA Framework For Financial Statement AnalysisNelly Yulinda100% (1)

- Unit I.3-Ratio AnalysisDocumento31 pagineUnit I.3-Ratio AnalysisRichabhi MaheshwariNessuna valutazione finora

- Financial Accounting Ii: DR Nsubili Isaga School of Business (Daf)Documento63 pagineFinancial Accounting Ii: DR Nsubili Isaga School of Business (Daf)ERICK MLINGWANessuna valutazione finora

- FIASDocumento15 pagineFIASTika GusmawarniNessuna valutazione finora

- Fsa 9NDocumento4 pagineFsa 9Npriyanshu.goel1710Nessuna valutazione finora

- Company Performance - Annual ReportDocumento13 pagineCompany Performance - Annual ReportPriya GunaNessuna valutazione finora

- Stock Exhange Module 1Documento45 pagineStock Exhange Module 1Rosh28Nessuna valutazione finora

- Finance 301 Learning Objectives by Chapter Chapter 1: IntroductionDocumento7 pagineFinance 301 Learning Objectives by Chapter Chapter 1: Introductionhughng92Nessuna valutazione finora

- Revaluation of Assets and Dissoultion-Nsubili IsagaDocumento32 pagineRevaluation of Assets and Dissoultion-Nsubili IsagaERICK MLINGWANessuna valutazione finora

- CH 15Documento30 pagineCH 15mohamedhusseindableNessuna valutazione finora

- Retail Book Chap06Documento21 pagineRetail Book Chap06Harman Gill100% (1)

- Analysis of Financial Statement: Indian Gaap V/s Us GaapDocumento32 pagineAnalysis of Financial Statement: Indian Gaap V/s Us Gaapshyam123112007Nessuna valutazione finora

- Company AccountsDocumento21 pagineCompany Accountsg2ygyyptm8Nessuna valutazione finora

- Chapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldDocumento22 pagineChapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldReza MaulanaNessuna valutazione finora

- Chapter 2Documento12 pagineChapter 2Ashekin MahadiNessuna valutazione finora

- HandoutsDocumento17 pagineHandoutsLinh Chi NguyễnNessuna valutazione finora

- Presentation of Financial Statements: The Auditor S ReviewDocumento20 paginePresentation of Financial Statements: The Auditor S ReviewPrem ManoNessuna valutazione finora

- How Cash Flows and Accrual Accounting May DifferDocumento9 pagineHow Cash Flows and Accrual Accounting May Differازاي - HowNessuna valutazione finora

- Financial Planning and Forecasting NewDocumento27 pagineFinancial Planning and Forecasting NewKinza gulNessuna valutazione finora

- auditing-CH 2 NotesDocumento4 pagineauditing-CH 2 Notesamu_scribdNessuna valutazione finora

- Chapter 1 - Test Bank Auditing UICDocumento15 pagineChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- CH 11Documento6 pagineCH 11amu_scribdNessuna valutazione finora

- Chap 00183Documento29 pagineChap 00183amu_scribdNessuna valutazione finora

- Outline of Important Points For Chapter 13Documento1 paginaOutline of Important Points For Chapter 13amu_scribdNessuna valutazione finora

- Chapter 11 Quiz Sect 903 SolutionsDocumento4 pagineChapter 11 Quiz Sect 903 Solutionsamu_scribdNessuna valutazione finora

- Chapter 17 OutlineDocumento2 pagineChapter 17 Outlineamu_scribdNessuna valutazione finora

- CH 1Documento8 pagineCH 1amu_scribdNessuna valutazione finora

- US GAAP Vs IFRSDocumento52 pagineUS GAAP Vs IFRSSumair ShahidNessuna valutazione finora

- Chapter 12 in Class ProblemsDocumento2 pagineChapter 12 in Class Problemsamu_scribdNessuna valutazione finora

- auditing-CH 2 NotesDocumento4 pagineauditing-CH 2 Notesamu_scribdNessuna valutazione finora

- CH 3-AuditDocumento2 pagineCH 3-Auditamu_scribdNessuna valutazione finora

- Solutions CH 18Documento65 pagineSolutions CH 18amu_scribdNessuna valutazione finora

- Chapter 13 In-Class PracticeDocumento3 pagineChapter 13 In-Class Practiceamu_scribdNessuna valutazione finora

- Solutions CH 18Documento65 pagineSolutions CH 18amu_scribdNessuna valutazione finora

- Chapter 10 Quiz SolutionsDocumento3 pagineChapter 10 Quiz Solutionsamu_scribd100% (1)

- CH 12Documento4 pagineCH 12amu_scribd100% (1)

- CH 11Documento6 pagineCH 11amu_scribdNessuna valutazione finora

- Alan Freeman - Ernest - Mandels - Contribution - To - Economic PDFDocumento34 pagineAlan Freeman - Ernest - Mandels - Contribution - To - Economic PDFhajimenozakiNessuna valutazione finora

- CBSE Class 12 Informatics Practices Marking Scheme Term 2 For 2021 22Documento6 pagineCBSE Class 12 Informatics Practices Marking Scheme Term 2 For 2021 22Aryan BhardwajNessuna valutazione finora

- Award Presentation Speech PDFDocumento3 pagineAward Presentation Speech PDFNehal RaiNessuna valutazione finora

- Digital Signatures: Homework 6Documento10 pagineDigital Signatures: Homework 6leishNessuna valutazione finora

- 1Documento14 pagine1Cecille GuillermoNessuna valutazione finora

- Characteristics: Our in Vitro IdentityDocumento4 pagineCharacteristics: Our in Vitro IdentityMohammed ArifNessuna valutazione finora

- Pepsi Mix Max Mox ExperimentDocumento2 paginePepsi Mix Max Mox Experimentanon_192325873Nessuna valutazione finora

- Language EducationDocumento33 pagineLanguage EducationLaarni Airalyn CabreraNessuna valutazione finora

- List of Practicals Class Xii 2022 23Documento1 paginaList of Practicals Class Xii 2022 23Night FuryNessuna valutazione finora

- Student Committee Sma Al Abidin Bilingual Boarding School: I. BackgroundDocumento5 pagineStudent Committee Sma Al Abidin Bilingual Boarding School: I. BackgroundAzizah Bilqis ArroyanNessuna valutazione finora

- Sel027 PDFDocumento9 pagineSel027 PDFSmart BiomedicalNessuna valutazione finora

- -4618918اسئلة مدني فحص التخطيط مع الأجوبة من د. طارق الشامي & م. أحمد هنداويDocumento35 pagine-4618918اسئلة مدني فحص التخطيط مع الأجوبة من د. طارق الشامي & م. أحمد هنداويAboalmaail Alamin100% (1)

- A Meta Analysis of The Relative Contribution of Leadership Styles To Followers Mental HealthDocumento18 pagineA Meta Analysis of The Relative Contribution of Leadership Styles To Followers Mental HealthOnii ChanNessuna valutazione finora

- Week 1-2 Module 1 Chapter 1 Action RseearchDocumento18 pagineWeek 1-2 Module 1 Chapter 1 Action RseearchJustine Kyle BasilanNessuna valutazione finora

- Datasheet of STS 6000K H1 GCADocumento1 paginaDatasheet of STS 6000K H1 GCAHome AutomatingNessuna valutazione finora

- Term Paper A and CDocumento9 pagineTerm Paper A and CKishaloy NathNessuna valutazione finora

- Test 1801 New Holland TS100 DieselDocumento5 pagineTest 1801 New Holland TS100 DieselAPENTOMOTIKI WEST GREECENessuna valutazione finora

- 1.nursing As A ProfessionDocumento148 pagine1.nursing As A ProfessionveralynnpNessuna valutazione finora

- Buku BaruDocumento51 pagineBuku BaruFirdaus HoNessuna valutazione finora

- (Biophysical Techniques Series) Iain D. Campbell, Raymond A. Dwek-Biological Spectroscopy - Benjamin-Cummings Publishing Company (1984)Documento192 pagine(Biophysical Techniques Series) Iain D. Campbell, Raymond A. Dwek-Biological Spectroscopy - Benjamin-Cummings Publishing Company (1984)BrunoRamosdeLima100% (1)

- 1000 Base - T Magnetics Modules P/N: Gst5009 LF Data Sheet: Bothhand USA Tel: 978-887-8050Documento2 pagine1000 Base - T Magnetics Modules P/N: Gst5009 LF Data Sheet: Bothhand USA Tel: 978-887-8050DennisSendoyaNessuna valutazione finora

- 42ld340h Commercial Mode Setup Guide PDFDocumento59 pagine42ld340h Commercial Mode Setup Guide PDFGanesh BabuNessuna valutazione finora

- Enzymatic Hydrolysis, Analysis of Mucic Acid Crystals and Osazones, and Thin - Layer Chromatography of Carbohydrates From CassavaDocumento8 pagineEnzymatic Hydrolysis, Analysis of Mucic Acid Crystals and Osazones, and Thin - Layer Chromatography of Carbohydrates From CassavaKimberly Mae MesinaNessuna valutazione finora

- Project Success - Stakeholders 1 PDFDocumento7 pagineProject Success - Stakeholders 1 PDFMoataz SadaqahNessuna valutazione finora