Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Asset Liability Management in Banks

Caricato da

Vs RanaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Asset Liability Management in Banks

Caricato da

Vs RanaCopyright:

Formati disponibili

Asset Liability Management in Banks Components of a Bank Balance sheet: liabilities 1. Capital 2. Reserve & Surplus 3. Deposits 4.

Borrowings 5. Other Liabilities A Assets 1. Cash & Balances with RBI 2. Bal. With Banks & Money at Call and Short Notices 3. Investments 4. Advances 5. Fixed Assets 6. 6. Other Assets

Components of Liabilities:-1. Capital: Capital represents owners contribution/stake in the bank. - It serves as a cushion for depositors and creditors. - It is considered to be a long term sources for the bank.

2. Reserves & Surplus:

Components under this head includes: I. II. III. IV. V. Statutory Reserves Capital Reserves Investment Fluctuation Reserve Revenue and Other Reserves Balance in Profit and Loss Account

3. Deposits

This is the main source of banks funds. The deposits are classified as deposits payable on demand and time. They are reflected in balance sheet as under: I. II. III. Demand Deposits Savings Bank Deposits Term Deposits

4. Borrowings

(Borrowings include Refinance / Borrowings from RBI, Inter-bank & other institutions) I. Borrowings in India i) Reserve Bank of India ii) Other Banks iii) Other Institutions & Agencies II. Borrowings outside India

5. Other Liabilities & Provisions

It is grouped as under: I. II. III. IV. Bills Payable Inter Office Adjustments (Net) Interest Accrued Unsecured Redeemable Bonds (Subordinated Debt for Tier-II Capital) V. Others(including provisions)

Components of Assets

1. Cash & Bank Balances with RBI

I. Cash in hand (including foreign currency notes) II. Balances with Reserve Bank of India In Current Accounts In Other Accounts

2. BALANCES WITH BANKS AND MONEY AT CALL & SHORT NOTICE I. In India i) Balances with Banks a) In Current Accounts b) In Other Deposit Accounts ii) Money at Call and Short Notice a) With Banks b) With Other Institutions II. Outside India a) In Current Accounts b) In Other Deposit Accounts c) Money at Call & Short Notice

3. Investments

A major asset item in the banks balance sheet. Reflected under 6 buckets as under: I. Investments in India in : * i) Government Securities ii) Other approved Securities iii) Shares iv) Debentures and Bonds v) Subsidiaries and Sponsored Institutions vi) Others (UTI Shares , Commercial Papers, COD & Mutual Fund Units etc.) II. Investments outside India in ** Subsidiaries and/or Associates abroad

4. Advances

The most important assets for a bank. A. i) Bills Purchased and Discounted ii) Cash Credits, Overdrafts & Loans repayable on demand iii) Term Loans

B. Particulars of Advances : i) Secured by tangible assets (including advances against Book Debts) ii) Covered by Bank/ Government Guarantees iii) Unsecured

5. Fixed Asset

I. II. Premises Other Fixed Assets (Including furniture and fixtures)

6. Other Assets

I. II. III. IV. V. Interest accrued Tax paid in advance/tax deducted at source (Net of Provisions) Stationery and Stamps Non-banking assets acquired in satisfaction of claims Deferred Tax Asset (Net)

VI. Others

Contingent Liability:--Banks obligations under LCs, Guarantees, Acceptances on behalf of

constituents and Bills accepted by the bank are reflected under this heads.

Banks Profit & Loss Account:-A banks profit & Loss Account has the following components: I. II. Income: This includes Interest Income and Other Income. Expenses: This includes Interest Expended, Operating Expenses and Provisions & contingencies.

Components of Income:-1. INTEREST EARNED I. II. III. IV. Interest/Discount on Advances / Bills Income on Investments Interest on balances with Reserve Bank of India and other inter-bank funds Others

2. OTHER INCOME I. II. III. IV. V. VI. VII. Commission, Exchange and Brokerage Profit on sale of Investments (Net) Profit/(Loss) on Revaluation of Investments Profit on sale of land, buildings and other assets (Net) Profit on exchange transactions (Net) Income earned by way of dividends etc. from Miscellaneous Income subsidiaries and Associates abroad/in India

Components of Expenses:--1. INTEREST EXPENDED I. II. III. Interest on Deposits Interest on Reserve Bank of India / Inter-Bank borrowings Others 2. OPERATING EXPENSES I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. Payments to and Provisions for employees Rent, Taxes and Lighting Printing and Stationery Advertisement and Publicity Depreciation on Bank's property Directors' Fees, Allowances and Expenses Auditors' Fees and Expenses (including Branch Auditors) Law Charges Postages, Telegrams, Telephones etc. Repairs and Maintenance Insurance Other Expenditure

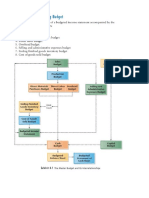

Assets Liability Management:- It is a dynamic process of Planning, Organizing & Controlling of Assets & Liabilities- their volumes, mixes, maturities, yields and costs in order to maintain liquidity and NII.

Significance of ALM:- Volatility Product Innovations & Complexities Regulatory Environment Management Recognition

Purpose & Objective of ALM

An effective Asset Liability Management Technique aims to manage the volume, mix, maturity, rate sensitivity, quality and liquidity of assets and liabilities as a whole so as to attain a predetermined acceptable risk/reward ration. It is aimed to stabilize short-term profits, long-term earnings and long-term substance of the bank. The parameters for stabilizing ALM system are: 1. 2. 3. Net Interest Income (NII) Net Interest Margin (NIM) Economic Equity Ratio

RBI DIRECTIVES:---- Issued draft guidelines on 10th Sept98. Final guidelines issued on 10th Feb99 for implementation of ALM w.e.f. 01.04.99. To begin with 60% of asset &liabilities will be covered; 100% from 01.04.2000. Initially Gap Analysis to be applied in the first stage of implementation. Disclosure to Balance Sheet on maturity pattern on Deposits, Borrowings, Investment & Advances w.e.f. 31.03.01 Liquidity Management

Banks liquidity management is the process of generating funds to meet contractual or relationship obligations at reasonable prices at all times. New loan demands, existing commitments, and deposit withdrawals are the basic contractual or relationship obligations that a bank must meet.

Adequacy of liquidity position for a bank

Analysis of following factors throw light on a banks adequacy of liquidity position: a. Historical Funding requirement b. Current liquidity position c. Anticipated future funding needs d. Sources of funds e. Options for reducing funding needs f. Present and anticipated asset quality

g. Present and future earning capacity and

h. Present and planned capital position

Funding Avenues

To satisfy funding needs, a bank must perform one or a combination of the following: a. Dispose off liquid assets b. Increase short term borrowings c. Decrease holding of less liquid assets d. Increase liability of a term nature

e.

Increase Capital funds

Types of Liquidity Risk

Liquidity Exposure can stem from both internally and externally. External liquidity risks can be geographic, systemic or instrument specific. Internal liquidity risk relates largely to perceptions of an institution in its various markets: local, regional, national or international

Other categories of liquidity risk

Funding Risk- Need to replace net outflows due to unanticipated withdrawals/non-renewal Time Risk- Need to compensate for non-receipt of expected inflows of funds Call Risk- Crystallization of contingent liability

Interest Rate Risk Management

Interest Rate risk is the exposure of a banks financial conditions to adverse movements of interest rates. Though this is normal part of banking business, excessive interest rate risk can pose a significant threat to a banks earnings and capital base. Changes in interest rates also affect the underlying value of the banks assets, liabilities and offbalance-sheet item.

Interest Rate Risk

Interest rate risk refers to volatility in Net Interest Income (NII) or variations in Net Interest Margin(NIM). Therefore, an effective risk management process that maintains interest rate risk within prudent levels is essential to safety and soundness of the bank.

Sources of Interest Rate Risk

Interest rate risk mainly arises from: Gap Risk Basis Risk Net Interest Position Risk Embedded Option Risk Yield Curve Risk Price Risk Reinvestment Risk

Measurement of Interest Rate Risk

Gap Analysis- Simple maturity/re-pricing Schedules can be used to generate simple indicators of interest rate risk sensitivity of both earnings and economic value to changing interest rates.

- If a negative gap occurs (RSA<RSL) in given time band, an increase in market interest rates could cause a decline in NII. - conversely, a positive gap (RSA>RSL) in a given time band, an decrease in market interest rates could cause a decline in NII.

Measurement of Interest Rate Risk

Duration Analysis: Duration is a measure of the percentage change in the economic value of a position that occur given a small change in level of interest rate.

Potrebbero piacerti anche

- Short document titleDocumento1 paginaShort document titleVs RanaNessuna valutazione finora

- Hello World DocDocumento1 paginaHello World DocVs RanaNessuna valutazione finora

- Hello World DocDocumento1 paginaHello World DocVs RanaNessuna valutazione finora

- Hello World DocDocumento1 paginaHello World DocVs RanaNessuna valutazione finora

- CRM Strategy in Synoweb Techn.Documento53 pagineCRM Strategy in Synoweb Techn.Vs RanaNessuna valutazione finora

- Hello World DocDocumento1 paginaHello World DocVs RanaNessuna valutazione finora

- LOW RATE OF SBI Moody'sDocumento3 pagineLOW RATE OF SBI Moody'sVs RanaNessuna valutazione finora

- iCICI BankDocumento20 pagineiCICI BankVs RanaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- PMTE - PM, TE and SAD Nominal AmountDocumento37 paginePMTE - PM, TE and SAD Nominal AmountarvmrkpNessuna valutazione finora

- Review Economics Mankiw Chap 5, Chap 6, Chap 13Documento47 pagineReview Economics Mankiw Chap 5, Chap 6, Chap 13Hà (NIIE) Võ Thị NgọcNessuna valutazione finora

- Hanlon Heitzman 2010Documento53 pagineHanlon Heitzman 2010vita cahyanaNessuna valutazione finora

- Introduction To Reliance PetroleumDocumento8 pagineIntroduction To Reliance Petroleumsubhamma16Nessuna valutazione finora

- ACCO 20053 Lecture Notes 5 - Accounting For ReceivablesDocumento6 pagineACCO 20053 Lecture Notes 5 - Accounting For ReceivablesVincent Luigil AlceraNessuna valutazione finora

- Cash Flow Statements Exercises and AnswersDocumento39 pagineCash Flow Statements Exercises and Answersszn189% (9)

- BSG Bus 497aDocumento31 pagineBSG Bus 497ajack stauberNessuna valutazione finora

- Weak Student Material - MacroDocumento14 pagineWeak Student Material - MacroP Janaki RamanNessuna valutazione finora

- CF 19-03-21 (BudgetDocumento21 pagineCF 19-03-21 (BudgetTarisya PermatasariNessuna valutazione finora

- Chapter 10 Analyzing Privately Held CompaniesDocumento33 pagineChapter 10 Analyzing Privately Held Companiesvega amaliaNessuna valutazione finora

- Revenue Recognition: When to Recognize RevenueDocumento6 pagineRevenue Recognition: When to Recognize RevenueFantayNessuna valutazione finora

- Break-Even Analysis: K6: Worksheet 1Documento7 pagineBreak-Even Analysis: K6: Worksheet 1cutie cailyNessuna valutazione finora

- Class 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IDocumento46 pagineClass 11 Accountancy NCERT Textbook Part-II Chapter 9 Financial Statement-IPathan KausarNessuna valutazione finora

- Financial reporting of cash and cash equivalentsDocumento8 pagineFinancial reporting of cash and cash equivalentsSamantha Suan CatambingNessuna valutazione finora

- Score Financial Spreadsheet TemplateDocumento29 pagineScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNessuna valutazione finora

- Acc 3 - RRNDDocumento27 pagineAcc 3 - RRNDHistory and EventNessuna valutazione finora

- Form 1608112023 131300Documento3 pagineForm 1608112023 131300baisanebuddheshNessuna valutazione finora

- Cost Accounting - Meaning and ScopeDocumento27 pagineCost Accounting - Meaning and ScopemenakaNessuna valutazione finora

- 1109021 (1)Documento1 pagina1109021 (1)Cms Stl CmsNessuna valutazione finora

- Lifo Fifo PDF NotesDocumento38 pagineLifo Fifo PDF NotesBALAKUMARAN S 20MBA1061100% (2)

- Fort Bonifacio Development Corporation V CIRDocumento1 paginaFort Bonifacio Development Corporation V CIRHoreb Felix VillaNessuna valutazione finora

- Ohlson's O ScoreDocumento3 pagineOhlson's O ScoreMark LinekarNessuna valutazione finora

- Fin668:Fundamental and Technical Analysis: Page:1/1Documento1 paginaFin668:Fundamental and Technical Analysis: Page:1/1Sun-Deep Kumar Chaudhary TharuNessuna valutazione finora

- Business Finance Lesson-Exemplar - Module 1Documento7 pagineBusiness Finance Lesson-Exemplar - Module 1Divina Grace Rodriguez - LibreaNessuna valutazione finora

- Public Borrowing 4Documento14 paginePublic Borrowing 4Corpuz Tyrone0% (1)

- Updates in Philippine Accounting StandardsDocumento7 pagineUpdates in Philippine Accounting Standardshot reddragon1123Nessuna valutazione finora

- IntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFDocumento9 pagineIntAcc1 - Midterm Examination - 1st Sem 2019 2020 PDFAndrea Nicole BanzonNessuna valutazione finora

- Analysis of DHL Vs FedExDocumento32 pagineAnalysis of DHL Vs FedExNir Islam100% (1)

- VIP Investment Thesis - Aug 2020Documento8 pagineVIP Investment Thesis - Aug 2020Rohit KadamNessuna valutazione finora

- Worksheet To PostClosing Trial BalanceDocumento11 pagineWorksheet To PostClosing Trial BalanceLemuel DioquinoNessuna valutazione finora