Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax Ques

Caricato da

Kumar ChandramohanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tax Ques

Caricato da

Kumar ChandramohanCopyright:

Formati disponibili

Para 40

Income under the head 'Salaries' and its computation

Et

g. the portion of the annual accretion in any prel,ious year to the balance at the credit of ar. emplovee participating in a recognised provident fund to the extent it is taxablc ; /2. transferred balance in a recognised provident fund to the extent it is taxable; and I the contribution made bv the Central Government or any other emplover to the account of an employee under a notified pension schemc referred to in section 80CCD.

What is basis of charge of salary income

40. The basis of charge is explained in the following paras> Basis ol charge as per section.l5 - As per section 15, salary consists of : a. anv salary' duefrom an employer (or a former employer) to an assessee in the previous 1,ear. whether actually paid or not; b. anv salary paidor allou,edto him in the previous -vear by or on behalf of an employer (or a former emplover), though not due or before it became due; and c. any arrears of salary paid or allowed to him in the previous year by or on behalf of an employer (or a former employer), if not charged to income-tax for any earlier previous year. The same is explained in the table given belowIs it taxable as i:ncome of the previoas year

2012-t-3 Salary becornes

due during th pre

ve

20t2

pa

ng

same vear or not)

Salary'is received during the previous year 2012-13 (r,r'hether it becomes due

subscqueni -,-'ear)

in

Yes Yes

Ar-rears of salar-r-' received during the previous year 2012-13 although it pertains to one of the eariier vears and the same were not taxed earlier on due basis Ar-reals of salarv received during the previous year 2012-13 although it pertains to one of the earlier vear-s but the same were taxed earlier on due basis

No

> Salary b taxable on "d'ue" or "receipt" basb vvhichever b eat lier - Basis of charge in respect of salary income is fired bv section 15. Salary is chargeable to tax either on "duc" basis or on "receipt" basis, r.r'hichever matures earlier.

For instance, if salarv of 2013- 14 is received in advance in2O12-l3,it is included in the total income of the previous year 2012-13 on "receipt" basis (as tax incidence matures earlier on "receipt" basis, "due" basis is not relevant in this case; therefore, salan, will not be inciuded in total income of the previous year 2013- 14). On the other hand, if salarv rvhich has become due in 201 l-12 andreceived in2012-13, is included in total income of the previous ]'ear 201 1-12 on "due" basis (as incidence of tax matures earlier on "due" basis, "receipt" basis is inapplicable; salar-v will, therefore, not be included in total income of the previous vear 2012-13). ) Accotmting method ol the ernplol,ee ?1ot releyant - It is 'nl'orthwhile to mention that salary is chargeable to tax on "due" or "receipt" basis (r,r,hichever matures earlier) regardless of the fact

n,hether books of account, in respect of salary income, are maintained by the assessee on mercantile basis or cash basisr. Method of accounting cannot, therefore, r,arv the basis of charge fixed by section 15.

40-Pl

X ioins o compony on June 1 ,2012 on montl.rly solory oi Rs. 30,000 (he wos not in employment prior toJune',,2012).Asperthelermsof employmenl,solorylcecomesdueonthefirsidoyof thenextmonihond

is poid on the sevenih doy of the next month. Deiermine the omount of solory chorgeoble to tox for the

ossessmeni yeor 201 3-1 4.

1.

See

para

13.3.

89

What is basis of charge of salary income

Para 40

ossessre^t SOLUTION : The period from June 1,2012 to Morch 31 ,2C13 is the previous yeor {or the teor 2013-14. Soiory of ihe previous yeor sholl be colculoted os underDifferent monihs of ihe previous yeor Dote of poymenl July

1

)vne 2012 )uly 2012

Augusi 201 2 September 20 I 2

,2012

1

)uly 7 ,2012

August

7

Augusi 1, 201 2

September

,2A12

September

,2A12 7 ,2012 ,2012 ,2413 7,2013

7

Ociober 1 ,2012

November 1,2012

October 20,l2

November 20,l 2 December 20,] 2

Jonuor,r, 201 3

October 7 , 2A12 November 7 ,2012

December

.Jonuory

7

,2012 Jonuoryl,20l3

December I Februory

Februory 20 1 3

Morch

l, 20,1 3 l, 2Ol3

Februorv

Morch 2013

Solory

is

April 1, 2013

Morch 7, 2013 April 7, 2013

,;t, l"t" ,0i3. C;";Jqr"ntly, rolorioi,ra",-.n iOi3

1

dote is the "due toxoble either on "due" bosis or on "receipi" bosis, whichever is eorlier. As the eoriier The,prerlo:t, will be toxoble on due bos.is. ',"^oi.Td. "!.Y":tl,^3] tt-roior', in the obovJl;r;

(whichtecomes "due" q{terMorch 31,2013)is noitoxoble os

iheincomeo{ihepreuiousyeorendingMorch3l ,2Ol3.Therefore,thesolorytoxoblefortheossessmentyeor 2Ol3-14 will be ns. Z,ZO,bOO (Rs. 3b,000 per month {or 9 months)'

i find out the

pr ablem 40-P1 , the solory becomes ; 4O{I Srpp.r*, 'ioxobie

due {or poymenl on fhe lost doy of eoch rnonih'

salary for ihe ossessmen t year 201 3'1 4

",v thenextm"onth,ondiiisgenerollypoidonthefifthdoyo{thenextmonih.Findoutihesoiory ..*f.,"+ir*doyof

toxqble for the ossessment yeor 2013-1 4. SOLUTION : ln this cose X gets on onnuol increment o{ will be os follows

Rs

I 4O-P2X ioins o compony on December 1 ,2009 in ihe poy scole of Rs I0,000 - Rs' ,000 solory employment of per ihelenns As f Z,OOO1 Rr. ;i ot in" tir" of ioininJ i.li*;; lr"f

b::tff: !i""

Rs'

25'000

,000. The omouni oi solory for different yeors

Rs.

December 2009 to November 20,l 0 December 20'l0 to November 20,] I December 20,l I to November 20,]2

2,000 r 3,000

r

,000

Different monlhs lvlorch 201 2

Due dote of solclr fdue or receipt dofe whichever is eorlierJ

April2012

Moy 2012 )une 2012 July 2012 August 201 2 September 201 2

April 1 ,2012 Moy 1 ,2012

June 1 ,2012 July 1 ,2012 Augusi l, 201 2

14,000

I4,000

14,000 14,000 14,000 14,000

r r

Sepiember

,2012

October 1 ,2012

November 1 ,2012

December 1 ,2012 Jonuory l, 20,l 3 Februory I ,2013

October 2012

November 20,l 2 December 201 2 Jonuory 201 3 Februory 201 3

4,000 4,000 i4,000 r 5,000

I5,000

r 5,000 See Note

Morch

l,

20,l3

Morch 201 3

Totol

Aprii l, 20i 3

Para 40.I

Income under the head 'Salaries' and its computation

90

Noie:

{olls in the ne,Solory of Morch 20'13 is ioxoble on due bosis on April 1,2013. April previous yeor (i. e., 20I 3- l 4), it will be toxoble for the ossessment yeor 201 4-) 5. However, solory of Morc201 2 (which becomes "due" on April 1 , 2012) is toxo ble for the previous yeor 201 2-13 (i.e., the ossessme'' yeor 201 3-1 4).

,l,20,l3

40-82 Assume in prob,lern 40-P2 thal solary, $sqsmes due on the lost doy of eoch monfh, {ind aut lhe soiory chorgeobie io tox for ihe ossessm ent yeor 2013-14.

4O-P3 Up till June 30, 2012, X is in ihe employment of A Ltd. on the fixed solory of Rs. 25,000 per mont: which becomes "due" on ihe firsi doy of the next month. On July 1 , 201 2, X ioins B Ltd. (solory being Rs. 30,00C per month which becomes "due" on ihe lost doy of eoch month). Solory is octuolly poid on the seventidoy of the next month in both coses. Find out the omount o{ solory chorgeoble to tox for the ossessmeni yecr 2013-t 4.

SOLUTION : Compulotion of srslary for the previous yeor 2012-13 Dif{erent monihs whichever is eorirer

:

"Due" dote ar "receipt" dote,

April 1 ,2012 Moy 1, 2012

Jvne 1 ,2a12

)u1y

1

Amounl Rs.

25,000 25,000 25,000 25,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 30,000 3,70,000

10.

I

I

l. 2. 3. 4. 5. 6. 7. 8. 9. .

Morch 2012

April2012

May 2012

June 2012 July 2012 August 201 2

,2012

)uly 31 ,2012

August 31, 201 2 September 30,2012

Sepiember 2C 1 2

October 2012 November 201 2 December 20'l 2

.Jonuory 201 3 Februory 201 3

Oclober

31

,20)2

November 30,20)2

December 3l ,2012 Jonuory 31, 2013 Februory 28, 2013

12. 13. Morch 2013 t

Morch 3l , 20l 3

Totol

Ltd. ond on the first of the nexl doy yeor 201 3-l 4.

40-E3 Assume in problem 40-P3 thot so/ory becomes due on the iost doy of the monfh in ihe cose of A of month in ihe cose o f B Ltd., find ouf fhe toxob/e so/ory forlhe ossessrnent

4O.l Place of accrual of salary income [Sec.9( I )J -Income underthe head "Salaries" is deemed to accrue or arise at the place where the service (in respect of which it accrues) is rendered. Keeping in view the aforesaid general observation, the rules are given below> Under section 9(1Xlr, salary in respect of service rendered in India is deemed to accrue or arise in India even if it is paid outside India or it is paid or payable after the contract of employment in India comes to an end. > Pension paid abroad is deemed to accrue in India, if it is paid in respect of services rendered in India. > Likewise, leave salary paid abroad in respect of leave earned in India is deemed to accrue or arise in India. > Section 9( I )( i ir), however, makes a departure from the aforesaid rule. By virtue of this section, salary paid by the Indian Government to an Indian national is deemed to accrue or arise in India, even if service is rendered outside India. Deeming provisions of section 9(l)(ln) are applicable only in respect of salary and not in respect of allowances and perquisites paid or allor.r,ed by the Government to Indian nationals working abroad, as such allowances and perquisites are exempt under section 10(].

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Answer Key - Employee Benefits PDFDocumento3 pagineAnswer Key - Employee Benefits PDFglobeth berbanoNessuna valutazione finora

- Employee Timesheet Template: Day of The Week Start Finish Regulars Hours OvertimeDocumento8 pagineEmployee Timesheet Template: Day of The Week Start Finish Regulars Hours OvertimeErmi SusilowatiNessuna valutazione finora

- PayslipDocumento3 paginePayslipAbhay SinghNessuna valutazione finora

- Employees Pension Scheme 1995Documento34 pagineEmployees Pension Scheme 1995penusilaNessuna valutazione finora

- Assignment Day 3 DONEDocumento4 pagineAssignment Day 3 DONERuby Jamadar67% (3)

- Agreement of TenancyDocumento2 pagineAgreement of TenancyKashif MirzaNessuna valutazione finora

- Tenancy AgreementDocumento2 pagineTenancy AgreementbenNessuna valutazione finora

- Circular No. 75-2017Documento49 pagineCircular No. 75-2017banker_mcaNessuna valutazione finora

- Compound InterestDocumento35 pagineCompound InterestToukaNessuna valutazione finora

- Monthly Payslip SEP 2022Documento1 paginaMonthly Payslip SEP 2022vivekNessuna valutazione finora

- Edli: Employees' Deposit Linked Insurance Scheme 1976Documento7 pagineEdli: Employees' Deposit Linked Insurance Scheme 1976priyanka pinkyNessuna valutazione finora

- Deed of Assignment SampleDocumento2 pagineDeed of Assignment SamplePEK CEFNessuna valutazione finora

- Worksheet On WagesDocumento3 pagineWorksheet On WagesNaseeb Ali67% (3)

- Rent Agreement MatterDocumento3 pagineRent Agreement MatterAkshithaShindeNessuna valutazione finora

- Islamic Institute of The PhilippinesDocumento10 pagineIslamic Institute of The PhilippinesNheedz Bawa JuhailiNessuna valutazione finora

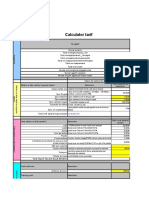

- Calculator Orar PaznicDocumento7 pagineCalculator Orar PaznicAndrei PopescuNessuna valutazione finora

- Concise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using FormulaDocumento42 pagineConcise Selina Solutions For Class 9 Maths Chapter 3 Compound Interest Using FormulaNarayanamurthy AmirapuNessuna valutazione finora

- 3.3 Break Even Charts and Break Even Analysis ActivityDocumento2 pagine3.3 Break Even Charts and Break Even Analysis ActivityZARWAREEN FAISALNessuna valutazione finora

- Form 7 JHS 2020Documento37 pagineForm 7 JHS 2020Francis Dave CabantingNessuna valutazione finora

- EPF Contribution Calculation: Key-In Your Basic Pay HereDocumento3 pagineEPF Contribution Calculation: Key-In Your Basic Pay HereHanisah Fadzil YusoffNessuna valutazione finora

- Oct 2022Documento1 paginaOct 2022sunil kumarNessuna valutazione finora

- 12 Employee BenefitsDocumento24 pagine12 Employee BenefitsAnum Zafar ButtNessuna valutazione finora

- Copies: Commissioner of ValuationsDocumento2 pagineCopies: Commissioner of ValuationsAnthony BasantaNessuna valutazione finora

- Salary Slip Oct-MergedDocumento4 pagineSalary Slip Oct-MergedPraveen Singh BhagelNessuna valutazione finora

- CPECC伊拉克分公司西古尔纳-1项目部 CPECC (IRAQ) West Qurna-I Project: Time SheetDocumento2 pagineCPECC伊拉克分公司西古尔纳-1项目部 CPECC (IRAQ) West Qurna-I Project: Time SheetNassim SabriNessuna valutazione finora

- PayslipDocumento1 paginaPayslipsuzieebillsNessuna valutazione finora

- Pension Schemes: CC-HR Pension GroupDocumento31 paginePension Schemes: CC-HR Pension GroupeenagpurcongNessuna valutazione finora

- Display PDFDocumento22 pagineDisplay PDFAlagammai SridharNessuna valutazione finora

- PRC Union Lr. AMCDocumento7 paginePRC Union Lr. AMCYELESWARAM NAGAR PANCHAYATNessuna valutazione finora

- Gratuity Calculation For Municipality) EmployeesDocumento4 pagineGratuity Calculation For Municipality) EmployeesPranab BanerjeeNessuna valutazione finora