Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lord John Eatwell, Shadow Treasury Minister Speech To Debate On Queen's Speech (Day 2 of 4) Business, The Economy, Local Government and Transport

Caricato da

api-110464801Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lord John Eatwell, Shadow Treasury Minister Speech To Debate On Queen's Speech (Day 2 of 4) Business, The Economy, Local Government and Transport

Caricato da

api-110464801Copyright:

Formati disponibili

Lord John Eatwell, Shadow Treasury Minister Speech to debate on Queens speech (Day 2 of 4) BUSINESS, THE ECONOMY, LOCAL

GOVERNMENT AND TRANSPORT 13 May 2013

My Lords, I am grateful to Lord Deighton for introducing this part of the debate on the Gracious Speech. And, like the whole House, I look forward to the maiden Speech of the Noble Baroness, Lady Lane-Fox. Lady Lane-Fox is an accomplished actress, and it is surely no accident that one of her most successful roles was as Miranda in the Tempest, since Miranda famously hails the Brave New World, that has such people int. Lady Lane-Fox has been a major force in guiding this country into the Brave New World of information technology, and she is one of the most remarkable people int. We are all delighted to see her in this House. My Lords, the whole House knows that the central issue facing Britain today is economic failure: no growth for 2 years, output still 2.5% below the level 4 years ago; a million young people unemployed, productivity below the level of 2008, the banking system still unreformed, and a government deficit that hasnt fallen significantly for 2 years the worst performance of any G7 economy other than Italy. Given the seriousness of our economic problems it has been widely remarked upon that there are no Treasury measures in the Gracious Speech, other than the welcome National Insurance Contributions Bill, and the Banking Bill carried over from the last session. But there should be no surprise at this in-action. It is the very essence of the Governments strategy that the Treasury has a very limited role other than maintenance of the austerity. Active economic policy is left to others. This is made abundantly clear in the recent outline of the Governments economic policy that accompanied the Chancellors letter defining the remit of the Financial Policy Committee: The Governments economic strategy consists of four key pillars: monetary activism and credit easing, stimulating demand, maintaining price stability and supporting the flow of credit in the economy; [all this is the task of the Bank of England] deficit reduction, returning the public finances to a sustainable position and ensuring that fiscal credibility underpins low long-term interest rates; [austerity] reform of the financial system, improving the regulatory framework to reduce risks to the taxpayer and build the resilience of the system; [that refers to the Banking Bill, of which more later] and a comprehensive package of structural reforms, rebalancing and strengthening the economy for the future, including an ambitious housing package and programme of infrastructure investment [predominantly farmed out to other departments]. Since these are the pillars on which the Governments entire strategy is built, its worth considering low sound they are.

First, monetary activism. Theres certainly been plenty of activity, from Quantitative easing and Merlin to the Funding for Lending scheme. The difficulty with this activism is that when there is a lack of demand its very difficult for monetary policy to achieve any traction, so QE2 follows QE1 and there no noticeable effect on lending. Funding for Lending offers banks cheap funds to lend on at highly profitable rates, there is no noticeable increase in lending. Now we have Funding for Lending 2 and, without any prospect of sustained growth of demand the result will be the same no noticeable increase in lending. In his letter defining the remit, the Chancellor appeals plaintively that the FPC takes into account, and gives due weight to, the impact of its actions on the near-term economic recovery. In other words Give me financial stability, but not yet. But what all this activism has achieved is a serious distortion of the monetary system. The rock bottom interest rates of which the Chancellor is so proud has put pension funds under severe strain, and pensioners have no chance of buying a worthwhile annuity. And the excess liquidity, unused for real investment, is funding a bubble in the stock market that bears no relation to Britains real economic condition. Conclusion: monetary activism may help growth a little bit, but fundamentally it doesnt work. Thats one pillar gone. What then of the next pillar: Reform of the Financial System. The key reform is the Banking Bill. But which Banking Bill? The watered down version of the Vickers proposals favoured by the Treasury? Or the beefed up Banking Bill proposed by the Parliamentary Commission on Banking Standards? The Banking Bill has already passed through Committee Stage in Another Place, where any amendments related to the serious criticisms of the Bill in the report of the Commission on Banking Standards published 11th March this year were resolutely voted down by the Government. A further report by the Commission is due at some time in the next 4 weeks or so. Will the Minister tell us how the Government intends to deal with the arguments of these two reports? Will the Government re-commit the Bill in another place? If not, how are the Commissions proposals to be dealt with in this House? Or has lobbying by the banks secured the Governments commitment to ignore the Commissions arguments? That pillar is decidedly shaky. Now let us turn to the ambitious housing package and programme of infrastructure investment that the Chancellor claims are at the heart of his comprehensive package of structural reforms. We certainly need an ambitious housing package. No peacetime Government since the 1920s has presided over fewer housing completions than has this Government in the past two years. And its getting worse - housing starts fell in 2012 by 11% to below 100,000, whilst house prices, particularly in London and the South East, spiral out of the reach of young people attempting to buy a first home. So what does the Government do? Unbelievably, it increases the affordable homes guarantee programme that applies to the existing housing stock as well as new-build, giving its own special twist to the housing price spiral. This British version of Fannie Mae should be focussed on new build that is what is needed.

Even this little bit of economic activism on housing is too much for the Treasurys do-nothing sensibilities. The decision on whether the guarantee scheme is to continue in 3 years time is to be handed over to unelected officials at the Bank of England. And what of the programme of infrastructure investment. Well, we were told in the Budget, the Government is planning a 3billion boost in 2 years time. Will the Minister tell us why not now? Why when infrastructure projects are notoriously slow to get started, cant work begin now? The Government has committed to borrow the money in 2 years time, why not borrow it now? As far as the railways are concerned, the paving legislation for HS2, proposed in the Gracious Speech, heralds a change of heart. But the investment in HS2 should not let us forget the damage of the 1.28bn cut in rail investment in the last spending review. The planned spending of 9.2bn for 5 years from next year is clearly needed, but will the Minster tell us how this is to be funded? How much of it is to be paid for by an increase in Network Rails debt, and how much by yet more inflation busting increases in rail fares? The infrastructure pillar will be in place at some time or other, but not today. Finally, My Lords, let us turn to the fourth pillar of the Governments economic strategy, austerity to ensure that fiscal credibility underpins low long-term interest rates. As all noble Lords will be well aware, there is an growing international consensus amongst all serious commentators on economic policy that austerity strategies have failed. The academic work that purported to validate the austerity policy has been demonstrated to be seriously flawed. And as far as Britain is concerned Olivier Blanchard, chief economist of the IMF, said the country was playing with fire if it allowed stagnation to continue. Coalition austerity transformed Britains growth rate from a steady 2% a year into a steady 0% a year, with little prospect of anything over 1% in the near future. The level of output remains stubbornly below the level of output attained in 2008, whilst other countries have, at least, recovered from the worst ravages of the global financial crisis. What is the Governments justification for clinging to this failed doctrine? The Treasury argues over and over again is that any change to the strategy they have followed for the last three years would damage the government's credibility in the financial markets and the subsequent increase in long-term interest rates would outweigh any benefits from cutting taxes or increasing spending. Since this is the only shred of justification for sticking to austerity its worth examining for a moment. First, with whom is the Government seeking the credibility? Answer the markets. Who are they? Well what they are not is some single malevolent force tying George Osbornes hands behind his back as he pleads to be set free to stimulate growth. In fact the markets comprise millions of individual traders pouring over their computer screens, trying to guess how markets will move in the next month, week or even in the next few seconds,

trying to make a secure return. In other words, theyre trying to guess what everyone else will do in response for example, to announcements by firms or governments, or to release of economic date, or to research reports. This isnt easy, but it is made much easier if an authoritative source make statements that every trader believes everybody else will accept. We have had a striking example of this in the Eurozone, where Mario Draghis statement that the ECB would do everything necessary to defend the Euro, convinced each trader that all the other traders would take Draghi at this word and accordingly the markets all moved together in exactly the way Mr. Draghi wanted. Authoritative statements can move markets. So if all traders are convinced that any relaxation of austerity will result in higher interest rates and hence falling bond prices in the UK, then it will. Credibility is a vice tightening around the heart of the British economy. And what do the clowns at the Treasury do about it they do everything they can to reinforce the traders beliefs. They cry from the rooftops that the markets will tighten the austerity vice because its the only justification they have left of a failed policy. At the same time they falsify the arguments for abandoning austerity. Nobody is expecting George Osborne to take himself off to the Tower of London, crying out to the world I was wrong, I was wrong. Though to think of it thats not such a bad idea! What we expect is a steady and careful staged change of emphasis: Bringing forward the increase in infrastructure spending. A British Investment Bank added to a strengthened Banking Bill. A Jobs guarantee to the long-term unemployed. A real new-build housing programme, and, to improve existing housing stock, reduced VAT on home repairs, maintenance and improvements. None of these requires a fanfare announcement. All they need is real activism from a donothing Treasury. So what is left of the four pillars? Monetary activism that doesnt work A Banking Bill that fails to reform the banks in the way that Britain needs. An infrastructure policy that recedes into the future and a housing policy that does precious little for the new build that homebuyers and the construction industry need. And last, but no means least, an austerity policy that isnt cutting the deficit but is cutting real incomes. What this Queens Speech reveals my Lords, is that the Governments economic policy doesnt have a leg to stand on. ENDS

Potrebbero piacerti anche

- A New Macroeconomic Strategy WebReady FinalDocumento36 pagineA New Macroeconomic Strategy WebReady FinalHeathwoodPressNessuna valutazione finora

- The Economi of Success: Twelve Things Politicians Don't Want You to KnowDa EverandThe Economi of Success: Twelve Things Politicians Don't Want You to KnowNessuna valutazione finora

- RT Hon Baroness Royall of Blaisdon Leader of The Opposition House of LordsDocumento12 pagineRT Hon Baroness Royall of Blaisdon Leader of The Opposition House of Lordsapi-110464801Nessuna valutazione finora

- According To Napier 10 2022Documento11 pagineAccording To Napier 10 2022Gustavo TapiaNessuna valutazione finora

- How to do more monetary stimulusDocumento31 pagineHow to do more monetary stimulusNorth41Nessuna valutazione finora

- Undertaking A Fiscal ConsolidationDocumento24 pagineUndertaking A Fiscal ConsolidationInstitute for GovernmentNessuna valutazione finora

- FISCAL POLICY Case Study (Answers)Documento3 pagineFISCAL POLICY Case Study (Answers)Shiqing wNessuna valutazione finora

- Draft ManifestoDocumento41 pagineDraft ManifestoThe Guardian91% (11)

- Stability Agility Opportunity Speech by Alex BrazierDocumento13 pagineStability Agility Opportunity Speech by Alex BrazierHao WangNessuna valutazione finora

- Australia: Open For BusinessDocumento7 pagineAustralia: Open For Businessapi-81108585Nessuna valutazione finora

- UK Facing Debt Crisis as Economy Remains Mired in Low GrowthDocumento34 pagineUK Facing Debt Crisis as Economy Remains Mired in Low Growthalastair82sNessuna valutazione finora

- Tullett Prebon Project Armagedon Aug 2011Documento34 pagineTullett Prebon Project Armagedon Aug 2011SwamiNessuna valutazione finora

- House of Commons Treasury Committee submission on QE and QT policyDocumento48 pagineHouse of Commons Treasury Committee submission on QE and QT policyplozlozNessuna valutazione finora

- 26 June 2013Documento3 pagine26 June 2013api-110464801Nessuna valutazione finora

- A Fate Worse than Debt A Beginner’s Guide to Britain’s National Debt from Boadicea to CameronDa EverandA Fate Worse than Debt A Beginner’s Guide to Britain’s National Debt from Boadicea to CameronNessuna valutazione finora

- Chancellor For A DayDocumento5 pagineChancellor For A DayNigel WatsonNessuna valutazione finora

- 2014 04 23 Speech Spectator - PressDocumento12 pagine2014 04 23 Speech Spectator - PressPolitical AlertNessuna valutazione finora

- NPC AddressDocumento15 pagineNPC AddressPolitical AlertNessuna valutazione finora

- Le Summing-Up de Pravind Jugnauth Pour Les Débats BudgétairesDocumento26 pagineLe Summing-Up de Pravind Jugnauth Pour Les Débats BudgétairesL'express MauriceNessuna valutazione finora

- Dr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryDa EverandDr. Mohamed A. El-Erian's The Only Game in Town Central Banks, Instability, and Avoiding the Next Collapse | SummaryValutazione: 4 su 5 stelle4/5 (1)

- The FY2011 Federal BudgetDocumento24 pagineThe FY2011 Federal BudgetromulusxNessuna valutazione finora

- Austerity: When is it a mistake and when is it necessary?Da EverandAusterity: When is it a mistake and when is it necessary?Nessuna valutazione finora

- Scribd Letter To The Prime Minister Regarding New Pension Economic Control Organisation.Documento5 pagineScribd Letter To The Prime Minister Regarding New Pension Economic Control Organisation.morganistNessuna valutazione finora

- Alex Salmond's Speech To Parliament September 7 2011Documento18 pagineAlex Salmond's Speech To Parliament September 7 2011theSNPNessuna valutazione finora

- Economic Challenges and OpportunitiesDocumento3 pagineEconomic Challenges and OpportunitiesAsif Khan ShinwariNessuna valutazione finora

- The Monetary Policy Toolbox in The Uk Speech by Dave RamsdenDocumento10 pagineThe Monetary Policy Toolbox in The Uk Speech by Dave RamsdenTusharNessuna valutazione finora

- Determination of National Income For UKDocumento12 pagineDetermination of National Income For UKrashelcu0% (1)

- Plan B: Boosting recovery while building a sustainable economyDocumento42 paginePlan B: Boosting recovery while building a sustainable economyZain SardarNessuna valutazione finora

- Congressional Testimony on Monetary Policy, Technology, and Economic GrowthDocumento6 pagineCongressional Testimony on Monetary Policy, Technology, and Economic GrowthSayed PiousNessuna valutazione finora

- Challenges Before New UK PMDocumento2 pagineChallenges Before New UK PMSujauddin SkNessuna valutazione finora

- 8783 BIS Sustainable Growth WEBDocumento32 pagine8783 BIS Sustainable Growth WEBbisgovukNessuna valutazione finora

- Labor 2013-14 Budget Savings (Measures No.1) Bill 2014 Second Reading SpeechDocumento4 pagineLabor 2013-14 Budget Savings (Measures No.1) Bill 2014 Second Reading SpeechPolitical AlertNessuna valutazione finora

- Uncertain Terrain: Issues and Challenges Facing Housing AssociationsDocumento11 pagineUncertain Terrain: Issues and Challenges Facing Housing AssociationsAlex MarshNessuna valutazione finora

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsDa EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNessuna valutazione finora

- MONEY AND BANKING (School Work)Documento9 pagineMONEY AND BANKING (School Work)Lan Mr-aNessuna valutazione finora

- In The Black LabourDocumento5 pagineIn The Black LabourZain SardarNessuna valutazione finora

- UK Economic Outlook 2025 Post BrexitDocumento3 pagineUK Economic Outlook 2025 Post BrexitKPSaiNessuna valutazione finora

- A Fiscal Cliff: New Perspectives on the U.S. Federal Debt CrisisDa EverandA Fiscal Cliff: New Perspectives on the U.S. Federal Debt CrisisNessuna valutazione finora

- The Broyhill Letter - Part Duex (Q2-11)Documento5 pagineThe Broyhill Letter - Part Duex (Q2-11)Broyhill Asset ManagementNessuna valutazione finora

- ICTU There Is A Better Fairer WaDocumento8 pagineICTU There Is A Better Fairer WaielearningNessuna valutazione finora

- Bank of England speech examines supply issues impacting inflationDocumento15 pagineBank of England speech examines supply issues impacting inflationplozlozNessuna valutazione finora

- Plan C - Shaping Up To Slow GrowthDocumento11 paginePlan C - Shaping Up To Slow GrowthThe RSANessuna valutazione finora

- Debt Super CycleDocumento3 pagineDebt Super Cycleocean8724Nessuna valutazione finora

- Speech To ENTERPRISE AND REGULATORY REFORM BILL, Second Reading, 14 November 2012Documento6 pagineSpeech To ENTERPRISE AND REGULATORY REFORM BILL, Second Reading, 14 November 2012api-110464801Nessuna valutazione finora

- Hacking The American Economy: Optimizing America Booklets, #1Da EverandHacking The American Economy: Optimizing America Booklets, #1Nessuna valutazione finora

- DownloadDocumento3 pagineDownloadnickedia17Nessuna valutazione finora

- Strategy: Can Deflation and The Highest UK CPI For 20 Years Coexist?Documento8 pagineStrategy: Can Deflation and The Highest UK CPI For 20 Years Coexist?blogology_grNessuna valutazione finora

- UK business closures by April 2021Documento27 pagineUK business closures by April 2021Muhammad MuaviaNessuna valutazione finora

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentDa EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentValutazione: 1 su 5 stelle1/5 (1)

- UK Economy HND AssignmentDocumento11 pagineUK Economy HND AssignmentShakirAhamedNessuna valutazione finora

- Protecting Economic Muscle: Finance and the Covid CrisisDocumento12 pagineProtecting Economic Muscle: Finance and the Covid CrisisHao WangNessuna valutazione finora

- DC Cuts: How the Federal Budget Went from a Surplus to a Trillion Dollar Deficit in 10 YearsDa EverandDC Cuts: How the Federal Budget Went from a Surplus to a Trillion Dollar Deficit in 10 YearsNessuna valutazione finora

- Working Paper 7 ADocumento144 pagineWorking Paper 7 Aziyad786123Nessuna valutazione finora

- 9 March 2016Documento6 pagine9 March 2016api-110464801Nessuna valutazione finora

- Baroness Angela Smith of Basildon, Shadow Leader of The LordsDocumento3 pagineBaroness Angela Smith of Basildon, Shadow Leader of The Lordsapi-110464801Nessuna valutazione finora

- Baroness Angela Smith of Basildon, Labour's Leader in The House of LordsDocumento1 paginaBaroness Angela Smith of Basildon, Labour's Leader in The House of Lordsapi-110464801Nessuna valutazione finora

- Baroness Angela Smith, Shadow Leader of The House of Lords: 16 March 2016Documento5 pagineBaroness Angela Smith, Shadow Leader of The House of Lords: 16 March 2016api-110464801Nessuna valutazione finora

- Library Note: Trade Union Bill (HL Bill 74 of 2015-16)Documento15 pagineLibrary Note: Trade Union Bill (HL Bill 74 of 2015-16)api-110464801Nessuna valutazione finora

- House of Lords Votes in The Parliamentary Session To Date - Government DefeatsDocumento2 pagineHouse of Lords Votes in The Parliamentary Session To Date - Government Defeatsapi-110464801Nessuna valutazione finora

- Baroness Angela Smith, Shadow Leader of The House of Lords: 22 February 2016Documento4 pagineBaroness Angela Smith, Shadow Leader of The House of Lords: 22 February 2016api-110464801Nessuna valutazione finora

- Lords DIARY: Baroness Sherlock Sees Credit Where It's Due in Week of WinsDocumento1 paginaLords DIARY: Baroness Sherlock Sees Credit Where It's Due in Week of Winsapi-110464801Nessuna valutazione finora

- Baroness (Angela) Smith of Basildon, Shadow Leader of The House of LordsDocumento3 pagineBaroness (Angela) Smith of Basildon, Shadow Leader of The House of Lordsapi-110464801Nessuna valutazione finora

- 13 January 2015Documento4 pagine13 January 2015api-110464801Nessuna valutazione finora

- Response To PM's Statement On Paris & The G20, 17 November 2015Documento2 pagineResponse To PM's Statement On Paris & The G20, 17 November 2015api-110464801Nessuna valutazione finora

- UntitledDocumento3 pagineUntitledapi-110464801Nessuna valutazione finora

- Speakers:: L MendelsohnDocumento2 pagineSpeakers:: L Mendelsohnapi-110464801Nessuna valutazione finora

- Speech To Move Motion in Support of Votes For 16 and 17 Year Olds in EU ReferendumDocumento6 pagineSpeech To Move Motion in Support of Votes For 16 and 17 Year Olds in EU Referendumapi-110464801Nessuna valutazione finora

- Baroness Angela Smith of Basildon, Shadow Leader of The LordsDocumento4 pagineBaroness Angela Smith of Basildon, Shadow Leader of The Lordsapi-110464801Nessuna valutazione finora

- Forthcoming Business 23 OCTOBER 2015: Government Whips' Office House of LordsDocumento9 pagineForthcoming Business 23 OCTOBER 2015: Government Whips' Office House of Lordsapi-110464801Nessuna valutazione finora

- Forthcoming Business 25 NOVEMBER 2015: Government Whips' Office House of LordsDocumento11 pagineForthcoming Business 25 NOVEMBER 2015: Government Whips' Office House of Lordsapi-110464801Nessuna valutazione finora

- Speech in Debate On The Case For Incremental Reform of Lords To Address Size of The HouseDocumento7 pagineSpeech in Debate On The Case For Incremental Reform of Lords To Address Size of The Houseapi-110464801Nessuna valutazione finora

- Peer Pressure: 80 - The House Magazine - 25 September 2015Documento2 paginePeer Pressure: 80 - The House Magazine - 25 September 2015api-110464801Nessuna valutazione finora

- A Programme For Progress: A Report To Labour PeersDocumento33 pagineA Programme For Progress: A Report To Labour Peersapi-110464801Nessuna valutazione finora

- Forthcoming Business 4 NOVEMBER 2015: Government Whips' Office House of LordsDocumento10 pagineForthcoming Business 4 NOVEMBER 2015: Government Whips' Office House of Lordsapi-110464801Nessuna valutazione finora

- UntitledDocumento9 pagineUntitledapi-110464801Nessuna valutazione finora

- Queens Speech Debate, 2 June 2015: Baroness Angela Smith of Basildon, Shadow Leader of House of LordsDocumento10 pagineQueens Speech Debate, 2 June 2015: Baroness Angela Smith of Basildon, Shadow Leader of House of Lordsapi-110464801Nessuna valutazione finora

- 16 June 2015Documento3 pagine16 June 2015api-110464801Nessuna valutazione finora

- Check Against Delivery Baroness (Angela) Smith of Basildon, Shadow Leader of The House of Lords Response To Government Statement On EVELDocumento5 pagineCheck Against Delivery Baroness (Angela) Smith of Basildon, Shadow Leader of The House of Lords Response To Government Statement On EVELapi-110464801Nessuna valutazione finora

- Thursday 11 June 2015: Baroness (Jan) Royall of Blaisdon Speech To House of Lords Debate On Civil SocietyDocumento3 pagineThursday 11 June 2015: Baroness (Jan) Royall of Blaisdon Speech To House of Lords Debate On Civil Societyapi-110464801Nessuna valutazione finora

- Response To The Queen's Speech, 27 May 2015: Baroness Jan Royall of Blaisdon Shadow Leader of The House of LordsDocumento10 pagineResponse To The Queen's Speech, 27 May 2015: Baroness Jan Royall of Blaisdon Shadow Leader of The House of Lordsapi-110464801Nessuna valutazione finora

- Queens Speech Debate, 2 June 2015: Baroness Angela Smith of Basildon, Shadow Leader of House of LordsDocumento10 pagineQueens Speech Debate, 2 June 2015: Baroness Angela Smith of Basildon, Shadow Leader of House of Lordsapi-110464801Nessuna valutazione finora

- Speech To Nottingham Trent University, Faculty of Social Sciences, Thursday 19 March 2015Documento5 pagineSpeech To Nottingham Trent University, Faculty of Social Sciences, Thursday 19 March 2015api-110464801Nessuna valutazione finora

- Ennwsoct 20020Documento2 pagineEnnwsoct 20020aryanNessuna valutazione finora

- Bolton FS18 - Promote engineering competition at SilverstoneDocumento11 pagineBolton FS18 - Promote engineering competition at SilverstoneHarris HossainNessuna valutazione finora

- API KHM DS2 en Excel v2Documento436 pagineAPI KHM DS2 en Excel v2Indra ZulhijayantoNessuna valutazione finora

- CE Project Costs and FeesDocumento5 pagineCE Project Costs and FeesJerichoRoiEspirituTabangNessuna valutazione finora

- DESIGNER BASKETS Vs Air Sea TransportDocumento1 paginaDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNessuna valutazione finora

- Account Payable Tables in R12Documento8 pagineAccount Payable Tables in R12anchauhanNessuna valutazione finora

- Chapter 5 Questions V1Documento6 pagineChapter 5 Questions V1prashantgargindia_930% (1)

- Indian Oil Corporation Limited: Supplier RecipientDocumento1 paginaIndian Oil Corporation Limited: Supplier RecipientparamguruNessuna valutazione finora

- Profit & Loss: Velka Engineering LTDDocumento10 pagineProfit & Loss: Velka Engineering LTDparthsavaniNessuna valutazione finora

- Carriage and Insurance Paid To CIPDocumento16 pagineCarriage and Insurance Paid To CIParun arunNessuna valutazione finora

- US Economics Digest: The 2014 FOMC: A New Cast of CharactersDocumento10 pagineUS Economics Digest: The 2014 FOMC: A New Cast of CharactersGlenn ViklundNessuna valutazione finora

- Sumit PassbookDocumento5 pagineSumit PassbookSumitNessuna valutazione finora

- Women Entrepreneurs in IndiaDocumento33 pagineWomen Entrepreneurs in Indiaritesh1991987Nessuna valutazione finora

- AFS Tables Quick Reference GuideDocumento14 pagineAFS Tables Quick Reference GuideSharanNessuna valutazione finora

- Beams 12ge LN22Documento51 pagineBeams 12ge LN22emakNessuna valutazione finora

- Chapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesDocumento7 pagineChapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesMishalNessuna valutazione finora

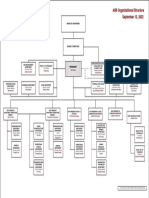

- AIIB Organizational StructureDocumento1 paginaAIIB Organizational StructureHenintsoa RaNessuna valutazione finora

- Ch04 Consolidation TechniquesDocumento54 pagineCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- KFC Case Study by MR OtakuDocumento36 pagineKFC Case Study by MR OtakuSajan Razzak Akon100% (1)

- Section25 Companies PDFDocumento55 pagineSection25 Companies PDFdreampedlar_45876997Nessuna valutazione finora

- Chapter 10 Cost Planning For The ProductDocumento44 pagineChapter 10 Cost Planning For The ProductMuhamad SyofrinaldiNessuna valutazione finora

- FINAL ASEAN Handbook 01 - Engineering ServicesDocumento92 pagineFINAL ASEAN Handbook 01 - Engineering ServicesGerry GsrNessuna valutazione finora

- Estimate Cost of Building Fifty PensDocumento4 pagineEstimate Cost of Building Fifty PensHelloLagbajaHelloLagbajaNessuna valutazione finora

- Final Internship ReportDocumento58 pagineFinal Internship ReportKrishna SahuNessuna valutazione finora

- Tax ComputationDocumento13 pagineTax ComputationEcha Sya0% (1)

- Audit BoyntonDocumento27 pagineAudit BoyntonMasdarR.MochJetrezzNessuna valutazione finora

- Software Process ModelsDocumento9 pagineSoftware Process Modelsmounit121Nessuna valutazione finora

- PH.D BA - Class Schedule 1-2018Documento1 paginaPH.D BA - Class Schedule 1-2018Adnan KamalNessuna valutazione finora

- Water Crisis Collection: Payment1 Payment2 Payment3Documento8 pagineWater Crisis Collection: Payment1 Payment2 Payment3Raghotham AcharyaNessuna valutazione finora

- India's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargDocumento2 pagineIndia's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargvnkatNessuna valutazione finora