Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Summary of Project Assumptions: Construction Costs

Caricato da

jowacocoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Summary of Project Assumptions: Construction Costs

Caricato da

jowacocoCopyright:

Formati disponibili

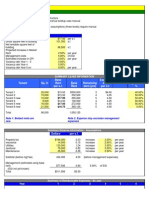

Summary of project assumptions

Source of funds

Subsidies Equity Credit Nominal interest rate Repayment period Grace period Capitalization Repayment of loan Total in MUSD Amortization 46 years 30% 30% 40% 6.0% 20 4 4 years years years 1 2 3 4 10% 30% 50% 10% 0% 170.00 17 51 85 17

Construction costs (VAT excluded, indexed on inflation)

Duration of works (years) Year 4 % years Amount (MUSD)

Traffic and Tariff

Initial traffic Traffic growth Toll rate (VAT included) (VAT excluded) (indexed on inflation) 20.6 5% 3.7 3.1 1000 vehicles/day per year USD per vehicle USD per vehicle

Operation costs (indexed on inflation)

Fixed part Variable part 1,000 0.1 kUSD per year USD per veh.

Economic

Inflation rate 4.0%

150,000

Project IRR (real/year50)

Equity IRR (real/year50)

ADSCR (min)

LLCR (min)

PV (VAT + Tax-Subsidies)

12.96%

100,000

Equity Debt Interest during construction Subsidies

22.95%

2.79

Revenues Shareholders account Dividends Principal

4.66

445,928

Interests Taxes Operating costs

50,000

-50,000

-100,000

COMMENTS:

-150,000

All figures in kUSD

Concession life

Construct. cost

Operation Cost

Initial Daily Traffic

Traffic Growth

Toll rate VAT incl.

Investment Subsidies

Equity

Debt maturity

Interest Rate

Grace Period

Inflation rate

Corporate tax rate

VAT rate

50

170,000

1,000

20.6

5.0%

3.7

30%

30%

20

6.0%

4.0%

30.0%

19.6%

Project IRR (real/year50)

9,000

Equity IRR (real/year50)

ADSCR (min)

LLCR (min)

PV (VAT + Tax-Subsidies)

12.96%

Principal Interests ADSCR LLCR Limit

22.95%

2.79

4.66

445,928

10.00 9.00

8,000

7,000

8.00

7.00

6,000

6.00

5.00

5,000

4,000

4.00

3,000

3.00

2,000

All figures in kUSD

1,000

2.00 1.00 0.00

COMMENTS:

Concession life

Construct. cost

Operation Cost

Initial Daily Traffic

Traffic Growth

Toll rate VAT incl.

Investment Subsidies

Equity

Debt maturity

Interest Rate

Grace Period

Inflation rate

Corporate tax rate

VAT rate

50

170,000

1,000

20.6

5.0%

3.7

30%

30%

20

6.0%

4.0%

30.0%

19.6%

Project IRR (real/year50)

80000

Equity IRR (real/year50)

ADSCR (min)

LLCR (min)

PV (VAT + Tax-Subsidies)

12.96%

Dividends

22.95%

2.79

4.66

445,928

30% 20%

60000

Equity project IRR (real)

10% 0%

-10% -20%

40000

equity IRR (real)

20000

-30%

-20000

-40% All figures in kUSD

-40000

-50%

COMMENTS:

Concession life

Construct. cost

Operation Cost

Initial Daily Traffic

Traffic Growth

Toll rate VAT incl.

Investment Subsidies

Equity

Debt maturity

Interest Rate

Grace Period

Inflation rate

Corporate tax rate

VAT rate

50

170,000

1,000

20.6

5.0%

3.7

30%

30%

20

6.0%

4.0%

30.0%

19.6%

Summary of Assumptions and Results

SUMMARY OF THE MAIN ASSUMPTIONS

GENERAL Concession life Construction Period Construction costs Amortization TOLL AND TRAFFIC Toll, VAT included Initial traffic Traffic growth

50 4 170,000 46

years years kUSD years

3.7 20,600 5.0%

USD per vehicle vehicles / day

FINANCIAL STRUCTURE Subsidy 30% of the construction costs Equity 30% of the construction costs Debt Maturity 20 years Interest rate 6.0% Grace period 4 years Repayment of loan P+I constant

OPERATING COSTS Fixed part Variable part

1,000 0.1

kUSD per year USD per vehicle

OTHER KEY PARAMETERS Inflation rate 4.0% Corporate tax 30.0% VAT rate 19.6%

SUMMARY OF THE RESULTS

FINANCING PLAN Uses (in kUSD) Construction costs (nominal terms) Capitalised Interests

197,167 188,343 8,824

Sources (in kUSD) Investment subsidy Equity Debt SHAREHOLDERS' RETURN Project IRR after tax (real terms) Project IRR after tax (nominal terms) Equity IRR (real terms) Equity IRR (nominal terms)

197,167 56,503 56,503 84,161

FINANCIAL RATIOS Minimum ADSCR (Annual Debt Service Coverage Ratio) Minimum LLCR (Loan Life Coverage Ratio) Minimum PLCR (Project Life Coverage Ratio) PUBLIC AUTHORITIES' FINANCIAL FLOWS PV on Subsidy (kUSD) PV on the VAT (kUSD) PV on the Coporate Taxes (kUSD) PV on the State revenues (kUSD)

2.79 4.66 21.32

12.96% 17.48% 22.95% 27.86%

-46,078 215,519 276,487 445,928

Potrebbero piacerti anche

- Graphical Model Operis v3Documento5 pagineGraphical Model Operis v3Abhishek SinghNessuna valutazione finora

- Simplifies LBO ModelDocumento8 pagineSimplifies LBO ModelAliya UmairNessuna valutazione finora

- BDP Financial Final PartDocumento14 pagineBDP Financial Final PartDeepak G.C.Nessuna valutazione finora

- Equity ValuationDocumento2.424 pagineEquity ValuationMuteeb Raina0% (1)

- Asset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)Documento12 pagineAsset: Exercise 1. Project Cost and Disbursement Schedule (In Thousand)kjmarts08Nessuna valutazione finora

- Gastronaut Ice CreamDocumento4 pagineGastronaut Ice CreamNAYANNessuna valutazione finora

- Zipcar FishboneDocumento24 pagineZipcar FishboneKrishna Srikumar0% (3)

- Assessments of Municipal Finances For The City of Mehasana: Finance Group Water Supply and Sanitation Lab. 07-08-2013Documento24 pagineAssessments of Municipal Finances For The City of Mehasana: Finance Group Water Supply and Sanitation Lab. 07-08-2013Swapneel VaijanapurkarNessuna valutazione finora

- DCF ValuationDocumento41 pagineDCF ValuationVarun BaxiNessuna valutazione finora

- Cash Flow Statement and Balance Sheet of A Solar Power Plant in APDocumento35 pagineCash Flow Statement and Balance Sheet of A Solar Power Plant in APSriharsha Vavilala100% (1)

- Metro InpiredDocumento16 pagineMetro InpiredOkky Pratama MartadirejaNessuna valutazione finora

- Development Cash Flow FeasibilityDocumento3 pagineDevelopment Cash Flow FeasibilityBenard ChedidNessuna valutazione finora

- Car Rental Own Company FinalDocumento10 pagineCar Rental Own Company FinalAkshaya LadNessuna valutazione finora

- Car Loan Using Flat Rate Scrap Value Calculation Before 31st May 2002Documento2 pagineCar Loan Using Flat Rate Scrap Value Calculation Before 31st May 2002ripcurlzNessuna valutazione finora

- Toll Road Financial Model v1-0Documento52 pagineToll Road Financial Model v1-0siby13172100% (3)

- The Martin Luther King Jr. East Busway: A Cost-Benefit AnalysisDocumento46 pagineThe Martin Luther King Jr. East Busway: A Cost-Benefit AnalysisSatyavan L RoundhalNessuna valutazione finora

- Particulars Year 0 Year 1Documento4 pagineParticulars Year 0 Year 1Utsab SenNessuna valutazione finora

- Case ProjectDocumento11 pagineCase Projectapi-251521127Nessuna valutazione finora

- DCF TakeawaysDocumento2 pagineDCF TakeawaysvrkasturiNessuna valutazione finora

- GMR Prowess Income STMTDocumento53 pagineGMR Prowess Income STMTMurugan MuthukrishnanNessuna valutazione finora

- Urban WatersDocumento15 pagineUrban WatersRahul Tiwari100% (2)

- How Much Car Can You BuyDocumento2 pagineHow Much Car Can You BuyChannarajayya MuganurmathNessuna valutazione finora

- Azam CFDocumento10 pagineAzam CFsahala11Nessuna valutazione finora

- Krakatau A - CGAR, BUMN, DupontDocumento27 pagineKrakatau A - CGAR, BUMN, DupontJavadNurIslamiNessuna valutazione finora

- Consolidated Performance HighlightsDocumento3 pagineConsolidated Performance HighlightsCodeSeekerNessuna valutazione finora

- Equity Chapter4Documento12 pagineEquity Chapter4bingoNessuna valutazione finora

- Nilai Konstruksi Rp4,776,623,283.30: Cash FlowDocumento14 pagineNilai Konstruksi Rp4,776,623,283.30: Cash FlowEsthi FebrianiNessuna valutazione finora

- Cost of Production & Profitability Statement Particulars 1st YearDocumento2 pagineCost of Production & Profitability Statement Particulars 1st Yearpradip_kumarNessuna valutazione finora

- Boeing: I. Market InformationDocumento21 pagineBoeing: I. Market InformationMohamed Ali SalemNessuna valutazione finora

- F1 Answers May 2010Documento12 pagineF1 Answers May 2010mavkaziNessuna valutazione finora

- Tata Steel AnalysisDocumento23 pagineTata Steel Analysisprachi_jain_26Nessuna valutazione finora

- Capital BudgetingDocumento75 pagineCapital BudgetingVedikaNessuna valutazione finora

- Smooth Drive TyresDocumento13 pagineSmooth Drive TyresRavi Kumar MahatoNessuna valutazione finora

- 360 Fin - MNGMNTDocumento16 pagine360 Fin - MNGMNTAin AtiqahNessuna valutazione finora

- Company NameDocumento6 pagineCompany NameAnamul HaqueNessuna valutazione finora

- 8-Security-Valuation 2Documento29 pagine8-Security-Valuation 2saadullah98.sk.skNessuna valutazione finora

- Creek Enrerprises Common-Size Income Statement For The Year Ended December 31 2012Documento2 pagineCreek Enrerprises Common-Size Income Statement For The Year Ended December 31 2012SoniaKasellaNessuna valutazione finora

- Ratio AnalysisDocumento17 pagineRatio AnalysisXain SyedNessuna valutazione finora

- Basic Economic EvaluationDocumento5 pagineBasic Economic EvaluationStephanie TraversNessuna valutazione finora

- PhuketBEach RashiDocumento9 paginePhuketBEach RashiShreya JainNessuna valutazione finora

- Total Application of Funds Fixed Assets Fixed AssetsDocumento14 pagineTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNessuna valutazione finora

- Market Assumptions Cal. Year Year Gr. Rate Equity AssumtionsDocumento3 pagineMarket Assumptions Cal. Year Year Gr. Rate Equity AssumtionsAnonymous 31fa2FAPhNessuna valutazione finora

- Combined AnalysisDocumento4 pagineCombined AnalysisziajehanNessuna valutazione finora

- Phuket Beach Hotel Proforma For FinalDocumento22 paginePhuket Beach Hotel Proforma For Finali_dinata100% (1)

- Value Based Management BCG ApproachDocumento14 pagineValue Based Management BCG ApproachAvi AhujaNessuna valutazione finora

- DCF ValuationDocumento19 pagineDCF ValuationVIJAYARAGAVANNessuna valutazione finora

- Toyota Common Size Balance Sheet For The Years 2005 & 2006 (Rs. in Crores)Documento25 pagineToyota Common Size Balance Sheet For The Years 2005 & 2006 (Rs. in Crores)balki123Nessuna valutazione finora

- IBO Fall Options 2013Documento108 pagineIBO Fall Options 2013Sarah DarvilleNessuna valutazione finora

- Tanzania Tax Guide 2012Documento14 pagineTanzania Tax Guide 2012Venkatesh GorurNessuna valutazione finora

- Financial Analysis For The Year Ended 2009Documento4 pagineFinancial Analysis For The Year Ended 2009Habiba KashifNessuna valutazione finora

- Analysing Company Accounts: (Return On Ordinary/common Shareholder's Funds)Documento8 pagineAnalysing Company Accounts: (Return On Ordinary/common Shareholder's Funds)mohdzarrin77Nessuna valutazione finora

- Transport Company Assignment1Documento19 pagineTransport Company Assignment1Rahmati RahmatullahNessuna valutazione finora

- Mumbai Sea LinkDocumento5 pagineMumbai Sea LinkCNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNessuna valutazione finora

- McDonalds Financial AnalysisDocumento11 pagineMcDonalds Financial AnalysisHooksA01Nessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- Myanmar Transport Sector Policy NotesDa EverandMyanmar Transport Sector Policy NotesValutazione: 3 su 5 stelle3/5 (1)

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Chapter 20 - Non-Current Assets Held For Sale and Discontinued OperationsDocumento35 pagineChapter 20 - Non-Current Assets Held For Sale and Discontinued OperationsVera Angraini50% (2)

- Banking Law PresentationDocumento15 pagineBanking Law PresentationSahana BalarajNessuna valutazione finora

- Product Release Oracle Banking Treasury Management Release 14.6.0.0.0 File NameDocumento64 pagineProduct Release Oracle Banking Treasury Management Release 14.6.0.0.0 File NamenajusmaniNessuna valutazione finora

- Sukhoi Superjet 100: Arrives To New CustomersDocumento5 pagineSukhoi Superjet 100: Arrives To New Customersvoldemar1974100% (1)

- COVID List of Manufacturers and Suppliers of Essential Maslk Items in TNDocumento282 pagineCOVID List of Manufacturers and Suppliers of Essential Maslk Items in TNSK Business group100% (2)

- Christmas Tree LCA - EllipsosDocumento91 pagineChristmas Tree LCA - EllipsoscprofitaNessuna valutazione finora

- g1 - Hss3013 Presentation in English (British Presence To India)Documento26 pagineg1 - Hss3013 Presentation in English (British Presence To India)veniNessuna valutazione finora

- Cess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Documento4 pagineCess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Darth VaderNessuna valutazione finora

- 14 - Splendour at 3950 - 1Documento1 pagina14 - Splendour at 3950 - 1Purva PatilNessuna valutazione finora

- Magana Jose Excel MasteryDocumento12 pagineMagana Jose Excel Masteryapi-377101001Nessuna valutazione finora

- 0 Method Statement-Trench Cutter FinalDocumento36 pagine0 Method Statement-Trench Cutter FinalGobinath GovindarajNessuna valutazione finora

- Book by Sadiku Link For ItDocumento6 pagineBook by Sadiku Link For ItShubhamNessuna valutazione finora

- DabbawalaDocumento3 pagineDabbawalaspamNessuna valutazione finora

- PPF CalculationDocumento8 paginePPF CalculationcholaNessuna valutazione finora

- Golangco SyllabusDocumento3 pagineGolangco SyllabusMaria Cresielda EcalneaNessuna valutazione finora

- Thesis ProposalDocumento30 pagineThesis ProposalmlachuNessuna valutazione finora

- PDFDocumento6 paginePDFdurga prasad peetaNessuna valutazione finora

- EY Global Mobility SurveyDocumento24 pagineEY Global Mobility SurveyEuglena VerdeNessuna valutazione finora

- Divide Your Risk Capital in 10 Equal PartsDocumento2 pagineDivide Your Risk Capital in 10 Equal PartsElangovan PurushothamanNessuna valutazione finora

- Types of Raw MaterialsDocumento27 pagineTypes of Raw MaterialsAppleCorpuzDelaRosaNessuna valutazione finora

- 2014 Albany County Executive BudgetDocumento339 pagine2014 Albany County Executive BudgetJohn PurcellNessuna valutazione finora

- Company Profile PT. Nikkatsu Electric WorksDocumento17 pagineCompany Profile PT. Nikkatsu Electric WorksDenny Ilyas Attamimi100% (1)

- Swot ShanDocumento4 pagineSwot Shanq_burhan_a33% (3)

- Presentation On 2 Wheeler Segment in IndiaDocumento19 paginePresentation On 2 Wheeler Segment in IndiaMayank BangarNessuna valutazione finora

- Pantawid Pamilyang Pilipino Program Beneficiarie1Documento9 paginePantawid Pamilyang Pilipino Program Beneficiarie1Kristine Ann Gocotano DadoleNessuna valutazione finora

- Investment Notes PDFDocumento30 pagineInvestment Notes PDFMuhammad NaeemNessuna valutazione finora

- Tut9 Soln SlidesDocumento20 pagineTut9 Soln SlidesNathan HuangNessuna valutazione finora

- Theory of Cost and ProfitDocumento11 pagineTheory of Cost and ProfitCenniel Bautista100% (4)

- Absa and KCB RatiosDocumento8 pagineAbsa and KCB RatiosAmos MutendeNessuna valutazione finora

- Economic RRL Version 2.1Documento8 pagineEconomic RRL Version 2.1Adrian Kenneth G. NervidaNessuna valutazione finora