Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Padini 20120229 2Q12

Caricato da

Farah AinDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Padini 20120229 2Q12

Caricato da

Farah AinCopyright:

Formati disponibili

Result Snapshot

Padini Holdings

Bloomberg: PAD MK

Reuters: PDNI.KL

Malaysia Equity Research PP 17581/11/2012(031103)

29 Feb 2012 BUY RM1.33

Price Target : RM 1.45 (Prev RM 1.40)

Selling like hotcakes

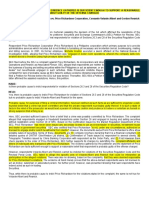

Reporting Period 2Q2012 Performance Above Mkt Cap RM882m US$291m FY 2011A 2012F 2013F EPS Pre-Ex (sen) 11.5 13.6 14.7 EPS Gth Pre-Ex (%) 24 19 8 EPS Revision 4 4

PE (x) 11.6 9.7 9.0

PBV (x) 3.2 2.6 2.2

Net Dividend Yield (%) 3.0 4.1 4.4

Result Summary

FY Jun (RM m) 2Q12 2Q11 % Chg YoY 1Q12 % Chg YoY

P&L items Sales Gross Profit EBIT Exceptional Gain/(Loss) Pre-tax Profit Net Profit EBIT Margin (%) BS & CF items Inventory Turnover Net Cash/(Debt) Operating Cash Flow

At a Glance 6MFY12 earnings beat expectations; declares 2sen net DPS, implying 46% quarterly payout Brands Outlets to drive FY12-14F growth, boosted by mega sales; FY12-14F earnings nudged up 3-4% Maintain Buy; TP nudged up to RM1.45

202.5 99.1 39.5 0.0 38.9 28.6 19.5

141.8 70.0 20.8 0.0 20.3 14.5 14.6

42.8 41.6 90.4 n.m. 91.8 97.1

178.1 88.0 37.2 0.0 36.7 26.9 20.9

13.7 12.7 6.2 n.m. 5.8 6.0

0.8x 100.4 47.2

0.6x 113.9 39.5

0.4x 89.6 18.2

Price Relative

RM 1.5 216 1.3 1.1 0.9 0.7 116 0.5 0.3 2008 96 76 2012 196 176 156 136 Relative Index

Comment on Results 2QFY12 net profit grew 97% (+6% q-o-q) on the back of elevated sales from an earlier Lunar New Year in 2012, as well as the Christmas season. Revenue was also lifted by opening of new stores in 1HFY12 - Brands Outlet stores in OneBorneo (Aug11), 1st Avenue Penang (Oct11) and 1 Utama (Jul11), as well as Padini and Vincci stores in Johor Premium Outlet (Dec11). This took 6MFY12 earnings to RM64.6m, above expectations at 65% of our and consensus estimates. Net margins improved 3.9ppt to 14.1% vs 2QFY11s 10.2% on higher cost efficiencies as inventories were moved quicker between outlets. Padini declared 2sen net DPS for the quarter, implying 46% payout. We expect FY12F to be strong for Padini driven by strong revenue from its Brands Outlet stores. Revenues should be lifted by the Malaysia GP Sale 2012 that will run from 10 Mar to 15 Apr 2012, and Malaysian Mega Sale and Year End Sale in 2H12. Hence, we nudged up FY12-14F earnings by 3-4%, underpinned by higherthan-expected same store sales growth and better performance at new outlets. Recommendation We like Padini for its focus on effective cost management, robust growth opportunities in its Brands Outlet stores, and stable dividend payout (we expect c.40% payout for FY12F, translating into 4.1% dividend yield). Maintain Buy with higher RM1.45 TP pegged to 10x CY12F EPS.

ANALYST: CHONG Tjen San +603 2711 2295

2009

2010

2011

Padini Holdings (LHS)

Relative KLCI INDEX (RHS)

tjensan@hwangdbsvickers.com.my

Malaysian Research Team +603 2711 2222 general@hwangdbsvickers.com.my

Refer to important disclosures at the end of this report

HWANGDBS

Result Snapshot Padini Holdings

This document is published by HWANGDBS Vickers Research Sdn Bhd (HDBSVR), a subsidiary of HWANGDBS Investment Bank Berhad (HDBS) and an associate of DBS Vickers Securities Holdings Pte Ltd (DBSVH). The research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. HDBSVR accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. DBS Vickers Securities Holdings Pte Ltd is a wholly-owned subsidiary of DBS Bank Ltd. DBS Bank Ltd along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this document. HDBSVR, HDBS, DBSVH, DBS Bank Ltd, and their associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking/corporate advisory and other banking services for these companies. HDBSVR, HDBS, DBSVH, DBS Bank Ltd and/or other affiliates of DBS Vickers Securities (USA) Inc (DBSVUSA), a U.S.-registered broker-dealer, may beneficially own a total of 1% or more of any class of common equity securities of the subject company mentioned in this document. HDBSVR, HDBS, DBSVH, DBS Bank Ltd and/or other affiliates of DBSVUSA may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain compensation for investment banking services from the subject company. DBSVUSA does not have its own investment banking or research department, nor has it participated in any investment banking transaction as a manager or co-manager in the past twelve months. Any US persons wishing to obtain further information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA exclusively. DBS Vickers Securities (UK) Ltd is an authorised person in the meaning of the Financial Services and Markets Act and is regulated by The Financial Services Authority. Research distributed in the UK is intended only for institutional clients.

Wong Ming Tek, Head of Research

Published and Printed by HWANGDBS Vickers Research Sdn Bhd (128540 U) Suite 26-03, 26th Floor Menara Keck Seng, 203, Jalan Bukit Bintang, 55100 Kuala Lumpur, Malaysia. Tel.: +603 2711-2222 Fax: +603 2711-2333 email : general@hwangdbsvickers.com.my

Page 2

HWANGDBS

Potrebbero piacerti anche

- BALIKDocumento1 paginaBALIKFarah AinNessuna valutazione finora

- Unit 3 - Helping RelationshipDocumento51 pagineUnit 3 - Helping RelationshipFarah AinNessuna valutazione finora

- Corporate FinanceDocumento4 pagineCorporate FinanceFarah AinNessuna valutazione finora

- 692 3415 2 PBDocumento8 pagine692 3415 2 PBFarah AinNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 11-Inventory Cost FlowDocumento28 pagine11-Inventory Cost FlowPatrick Jayson VillademosaNessuna valutazione finora

- Mod 2 Income Management-3Documento13 pagineMod 2 Income Management-3Shruti b ahujaNessuna valutazione finora

- Moody - S Credit Opinion FleuryDocumento12 pagineMoody - S Credit Opinion FleuryMr BrownstoneNessuna valutazione finora

- MGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsDocumento5 pagineMGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsJesus D. RiosNessuna valutazione finora

- Report Financial ManagementDocumento30 pagineReport Financial ManagementRishelle Mae C. AcademíaNessuna valutazione finora

- 2008.10 The Super Investor Walter Schloss InterviewDocumento4 pagine2008.10 The Super Investor Walter Schloss Interviewadjk97100% (4)

- It-5 Wht-Sale of Immovable PropertyDocumento1 paginaIt-5 Wht-Sale of Immovable PropertyZar NootNessuna valutazione finora

- Revised Corporation Code MnemonicsDocumento3 pagineRevised Corporation Code MnemonicsZicoNessuna valutazione finora

- Insurance MRPDocumento30 pagineInsurance MRPritesh0201100% (1)

- Journal EntriesDocumento12 pagineJournal Entriesg81596262Nessuna valutazione finora

- 2019 Debt Sustainability Analysis (DSA) ReportDocumento39 pagine2019 Debt Sustainability Analysis (DSA) ReportsenohiNessuna valutazione finora

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocumento12 pagineSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNessuna valutazione finora

- SEC vs. Price RichardsonDocumento1 paginaSEC vs. Price Richardsonhoney samaniegoNessuna valutazione finora

- The Green Register - Spring 2011Documento11 pagineThe Green Register - Spring 2011EcoBudNessuna valutazione finora

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDocumento1 paginaCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNessuna valutazione finora

- Cash and Cash EquivalentsDocumento3 pagineCash and Cash EquivalentsRheea de los SantosNessuna valutazione finora

- Bitcoin To $1M, Ethereum To $180,000 by 2030 ARKDocumento1 paginaBitcoin To $1M, Ethereum To $180,000 by 2030 ARKOwen HalpertNessuna valutazione finora

- Module 1Documento5 pagineModule 1Its Nico & SandyNessuna valutazione finora

- Characteristics of The RestaurantDocumento2 pagineCharacteristics of The RestaurantSudhansuSekharNessuna valutazione finora

- Ifsfm M2Documento98 pagineIfsfm M2Cally CallisterNessuna valutazione finora

- Alternative Sources of Finance, Private and Social Cost Benefit - RBI Grade B 2018Documento22 pagineAlternative Sources of Finance, Private and Social Cost Benefit - RBI Grade B 2018prashant soniNessuna valutazione finora

- Final Reviewer Mathematics InvestmentDocumento2 pagineFinal Reviewer Mathematics InvestmentChello Ann AsuncionNessuna valutazione finora

- SG Research Report Apt 2Q10Documento1 paginaSG Research Report Apt 2Q10siegelgallagherNessuna valutazione finora

- Financial Institutions and MarketDocumento19 pagineFinancial Institutions and MarketNilesh MotwaniNessuna valutazione finora

- RWJ Chapter 1 - EUDocumento17 pagineRWJ Chapter 1 - EULokkhi BowNessuna valutazione finora

- MRS V JPMC Doc 272, Declaration Rick Ivie - Jan 22, 2018 Declaration Rick IvieDocumento3 pagineMRS V JPMC Doc 272, Declaration Rick Ivie - Jan 22, 2018 Declaration Rick Ivielarry-612445Nessuna valutazione finora

- Rathna Bitotch - ProjectDocumento14 pagineRathna Bitotch - ProjectM SeshadriNessuna valutazione finora

- The Role of Investment Banking in IndiaDocumento13 pagineThe Role of Investment Banking in IndiaGuneet SaurabhNessuna valutazione finora

- Chapter One Extinction of ObligationsDocumento46 pagineChapter One Extinction of ObligationsHemen zinahbizuNessuna valutazione finora

- (Routledge Explorations in Development Studies) Ève Chiapello, Anita Engels, Eduardo Gonçalves Gresse - Financializations of Development - Global Games and Local Experiments-Routledge (2023) PDFDocumento291 pagine(Routledge Explorations in Development Studies) Ève Chiapello, Anita Engels, Eduardo Gonçalves Gresse - Financializations of Development - Global Games and Local Experiments-Routledge (2023) PDFRiset IndependenNessuna valutazione finora