Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Central Bank

Caricato da

Vivian ClementCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Central Bank

Caricato da

Vivian ClementCopyright:

Formati disponibili

CENTRAL BANK

In the words of will Rogers, There have been three great inventions since the beginning of time: fire, the wheel and the central banking. Central bank occupies an important place in the monetary and banking system of every country. It is apex bank of a country. It is responsible for the maintaining the economic stability of a country. In case of under developed economies, it is instrumental in the process of growth. It is the sole agency of note-issue of a country. It controls all the banks and serves as a banker to the government. It also controls credit of the country. In India, Reserve Bank, in England Bank of England and in America Federal Reserve System operate as central bank. Although the first central bank in world was set up in 1668 in Sweden, effective central banking came into being in 1694 with the establishment of bank of England.

Definition of Central Bank

(i) (ii) According to Samuelson, Every central bank has one function. It operates to control economy, supply of money and credit. In the words of Vera Smith, The primary definition of central bank is the banking system in which a single bank has either a complete or residuary monopoly of note issue.

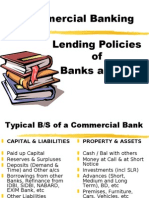

Difference between Central Bank and Commercial Banks

(1) The main aim of central bank is public welfare while the main aim of commercial bank is profit-motive. (2) Central bank has no direct link with the public while the commercial banks have. (3) Central bank is state owned institution where as commercial banks may not be state owned. (4) Central bank does not complete with commercial bank rather it functions as bankers bank and as a lender of the last resort. (5) Central bank has the monopoly of note issuing. Commercial bank can not issue notes. (6) Central bank controls the entire banking system of the country. Commercial banks operate under the direct control and supervision of the Central bank. (7) Central bank is the custodian of countrys foreign exchange. Commercial banks do foreign exchange only on the approval of the Central bank. (8) Central bank is the banker of the government. All banking activities of the government are performed by the central bank. Commercial banks do governments banking business as agent of the Central bank. (9) Central bank is the banker of other commercial banks. The latter have to keep a part of their total deposits with the former as cash reserve.

(10) Central bank controls credit and also functions as a Clearing House of other banks. Other banks can perform this function as agent of the central bank.

Functions of Central Bank

(1) Issuing of Notes: In modern times, central bank alone has exclusive right to issue notes in every country of the world. The notes issued by the central bank are unlimited legal tender throughout the country .According to De Kock, almost every where privilege of note issue is associated with the origin and development of central banking. Actually till the beginning of 20th century these banks are known as bank of issue. Before the growth of central banking system, right of note issue was enjoyed either by state or the commercial banks. But both the agencies proved to be misfit for the purpose. Notes issued by them lacked homogeneity and the apprehension of over issue of notes was always there. Moreover, the shortcomings, note issuing was gradually interested to the central bank. Large number of central banks has divided their functions into two departments-Banking department and Issue Department. It is the issue department that is responsible for note issuing. In accordance with the law enacted by the government, central bank issues the notes the security of gold, silver and credit instruments. In 1844, it was bank of England that got the monopoly right, first of all, to issue notes. Imparting monopoly right of note-issuing to the central bank is generally based on the following points (i) Right of note-issue by the central bank will impart uniformly to monetary system (ii) Peoples confidence in the currency of the countries grows stronger because the bank enjoys the patronage of the government. (iii) It automatically solves the problem of control on credit creation (iv) Central bank being the apex bank of the country has the complete knowledge of countries monetary requirements. It can impart sufficient elasticity to the monetary system by increasing or decreasing the supply of paper currency. (v) Issuing of notes is a profitable business. When it is done by the central bank the profit so earned goes to the state exchequer. (vi) Another reason of bestowing right of monopoly to issue notes on central bank is that it can maintain stability in the internal and external value of the currency.

(2)

Banker to the Government

Central bank acts as a banker, agent and financial advisor to the government. As a banker to the government it keeps the account of all governments bank and manages government

treasuries. It performs the same function for the government as a commercial banks do for their customers. The loans are given to the government without any interest for shortterm. It also transferred governments funds. It also buys and sell securities, treasury on behalf of the government. Being the apex bank of the country, it advises the government time to time on economic, financial and monetary matters

(3)

Bankers Bank

It performs functions of a banker to all the other bans in the county. Central bank has almost the same relation with all other banks as an ordinary bank has with its customers. Central bank keeps part of the cash balances of all commercial banks as deposit with as a view of meeting liabilities of these banks in times of crises. These cash balances are kept by the commercial bank in two ways (a) Part of the cash balances with themselves and (b) Another part with the commercial bank, as deposit. The balances kept with the central bank are also treated as a cash balances by the commercial banks. Initially, keeping of the cash balance or reserve with the central bank was voluntary on the part of commercial banks but now in almost all countries of the world such cash reserves have been made statutory. It has several advantages (i) It imparts elasticity to credit system (ii) Central bank can help those member banks which need additional funds to tide over their financial crises. (iii) It facilitates credit control (iv) Cross obligation of the bank are settled through the central bank

(4)

Lender of the Last Resort

The central bank also acts as lender of the last resort for the other bank of the country. It means that if a commercial bank fails to get financial accommodation from anywhere it approaches the central bank as a last resort. Central bank advances loan to such a bank against approved securities. In this way central bank helps the commercial banks. All commercial banks of the country can avail of loan facilities from the central bank in two ways. They can get their securities or bills of exchange rediscounted from the central bank. Or they borrow from the central bank against their securities. Such loans facilities prove to be beneficial in the following manner (i) Commercial bank can do with small cash reserves (ii) Banks get financial accommodation during crises period (iii) Central bank gets an opportunity to exercise control over banking system of the country

(5) Custodian of the Nations Reserves of Foreign Exchange

Central bank also functions as a custodian of foreign exchange reserves. It is the responsibility of the central bank to keep the external value of countrys currency stable. In order to discharge this function successfully central bank maintains reserves of foreign currencies. Besides, central bank maintains foreign exchange reserves in order to promote international trade and stabilize exchange rate.

(6)

Clearing House Function

Central bank also performs the function of a clearing house. Every bank keeps cash reserves with the central bank. The claim of banks against one another can be easily and conveniently settled by simple transfers from and to their accounts. Supposing A-bank receives a cheque of Rs. 10,000 drawn on B- bank and B-bank receives a cheque of Rs. 15,000 drawn on A-bank. The most convenient method of setting or clearing their mutual claims is that A-bank should issue a cheque amounting to Rs. 5,000in favor of B-bank, drawn on central bank. As a result of this transference, a sum of Rs. 5,000 will be debited to the account of A-bank and credited to the account of B-bank. There will be no need of cash transaction between the banks concerned. Another advantage of clearing house facility is that commercial banks can create credit to a large extent on the basis of small cash reserves. Demand for cash in reduced to the minimum because of the existence of clearing houses.

(7)

Control of Credit

The most important function of the central bank is to control the credit activities of the commercial banks. Credit control refers to the increase or decrease in the volume of credit money than necessary leads to the monetary requirements of the country. More expansion of credit money than necessary leads to the situation of inflation. Greater contraction of credit money, on the other hand, might create a situation of deflation. Central bank seeks to contain credit money within reasonable limits. With central bank keeping credit under proper control, stability in general price level and increase in output and employment can be achieved in the country.

(8)

Collection of Statistics

Central bank collects a variety of statistics information and publishes the same periodically. Statistics relating to banking, currency and foreign exchange position of the country reflect the rate of economic progress. This plays a vital in the formulation of planning and macro level decision making. Moreover statistics facilitate comparative study of economic situations of different countries.

(9) Other Function

(i) (ii) (iii) (iv) Agriculture Credit: central banks of many countries provide credit facilities for the development of agriculture. International Monetary Conference: Central Banks represents their countries in International Monetary Conference like International Monetary fund, World Bank and such like other conferences and seminars. Money and Bill Market: Central bank also endeavors to organize money and bill market in the country. Return to Torn-notes Central bank gets back old and torn notes and issue new ones in their place.

Qualitative credit control

Main objective of quantities control is to control the total of bank credit and rate of interest. In other words, those methods by which central bank control the quantity of credit in a country are called quantitative methods. Under this methods are included: (i) Bank Rate (ii) (ii) Open Market Operations (iii) Change in cash reserve ratio (iv) Change in liquidity ratio

Bank Rate

Bank rate is an important instrument of credit control. Bank rate is the rate of interest at which central bank rediscount the first class securities of other bank. The bank rate is variable that is the central bank of the country changes it from time to time. It also called discount rate.

Definitions

(1) In the words of R.A. Young Bank rate is a publicly announced charge applied by the central bank on discount of securities or advances to the member bank. (2) According to Spalding Bank rate is the minimum rate at which the central bank rediscounts the approved securities or advances loans to other banks.

Difference Relation between Bank Rate and Rate of Interest

Bank rate is different from the market rate of interest. Market rate is the rate at which commercial banks advances loans to the public. While bank rate is the rate at which central banks advances the loans to other banks. However bank rate and market rate are directly related. An increase in bank rate invariably leads to an increase in market rate of interest and a fall in bank will result in the reduction of the market rate of interest.

Bank Rate Policy

(a) Contraction of Credit: Whenever a central bank wants to contract credit in the country it raises the bank rate. The purpose of raising the bank rate is to render central bank loan to commercial banks more expensive. As a consequence, commercial banks to raise their market rate of interest. Because of the rise in market rate traders and investors are expected to reduce their borrowings. Thus, there will be contraction of credit. (b) Expansion of Credit: When the central bank wants to expand credit in the country, it lowers the bank rate. Central banks loans for the commercial bank become cheap. As a result of it, market rate of interest will also go down. Traders and investors etc. will now borrow more from the banks and there will be expansion of the credit.

Conditions of the Success of the Bank Rate

(a) Relationship between Different Rates: Bank rate policy will be successful if change in it causes corresponding change in interest rates in the money market. In other words, increase in bank rate should result in increase in market rate of interest and decrease in bank rate should result in decrease in market rate. (b) Elasticity in the Economy: There should be perfect elasticity in the economy which means that every increase or decrease in bank rate should have corresponding effect on investment, output, employment, wages, prices etc. (c) Psychology of the investors: Psychology of the investors also determines the success of bank rate policy. If prices are rising in the market, traders industrialists will be optimistic and may borrow more even if the bank rate is high. Consequently, there will be no contraction of credit.

Limitations of Bank Rate Policy in Underdeveloped Countries

(1) Long Term Effect: In most underdeveloped countries change in bank rate does not make any instant effect on other rates of interest in the market. Only has lagged effect. Bank rate policy, therefore, fails to achieve its objectives. (2) Less Elastic System: There is lack of elasticity in underdeveloped economies. Hence changes in bank rate do not have full impact on prices, output and employment. (3) Unorganized Bill market: In most underdeveloped countries, there is lack of development bill market. Consequently changes in the bank rate do not have any considerable effect on rate of interest. (4) International flow of Capital: The influence of bank rate has diminished these days because of control over international flow of capital. Bank rate was more effective during the days of gold standard. (5) Less Dependence: Dependence of Commercial banks on Central bank of lender of the last resort has also diminished considerably. (6) Ignores the Rate of Profit: During the period of boom, when profit is rising, increase in the bank rate neither contract credit nor the volume of investment. Fall in bank rate during depression proves still more ineffective. During this period, there is no demand for loans for investment despite fall in the rate of interest because marginal efficiency of capital is very low. (7) Less Effective in Planned economies: Most f economies are planned economies these days. Large amount of investment is made by the government in public sector. Direct methods are employed by the government to raise the necessary investment funds. Consequently, importance of bank rate has been neglected to the background.

Open Market Operations

In modern times, open market is being used increasingly as an instrument of credit control. This term is used in two senses. In the broader sense, open market operations refer to the sale and purchase of securities by the central bank in the open market. In the narrow sense, it refers to the sale and purchase of only Government Securities by the central bank.

Open Market Operation Policy

(1) Contraction of Credit: When credit is to be contracted in the country, the central bank begins to sell securities in open market. People have more confidence in the central bank than other banks. They buy securities issued by the central bank either by withdrawing their money from the commercial banks or by their cash hoardings. In this way, while money begins to flow into the central bank, cash reserves of commercial banks begin to fall. Commercial banks are accordingly forced to contract their landings.

(2) Expansion of Credit: If the central bank wants to expand credit, it begins to buy securities in the open market. It causes increase in the quantity of money. People deposits more money in banks. With rise in cash reserve of bank they are able to create more credit.

Objective of Open market Operations

(a) (b) (c) (d) (e) To remove the effects of inflow and outflow of gold under gold standard To check the export of capital to other countries To the power of the banks to expand credit To remove the shortage of money in the money market To control credit properly by supplementing bank rate policy in the event of bank rate proving ineffective.

Limitations of Open Market

(1) Influence On the Cash Reserves of the Banks: The extent to which the cash reserves of the commercial banks are influence measures the success of open market operations. If the central bank sells securities it should reduce the cash balances of the commercial banks. But many a time it does not happen because people buy the securities and make payment not by withdrawing their funds from the banks but out of their cash hoardings or out of foreign exchange earned due to favorable balance of payments. On the other hand when the central bank buys the securities, it is not essential that cash reserves of commercial bank may increase, because people may keep the cash with themselves or spent it on foreign imports. (2) Change in Credit Policy of the Bank: open market operations will be successful if there is no change in the credit policy of the commercial banks. For instance, if central bank buys securities in order to expand credit but commercial banks do not want to create credit than central bank can not succeed in its policy of credit control.

Potrebbero piacerti anche

- Project On Banker and CustomersDocumento85 pagineProject On Banker and Customersrakesh9006Nessuna valutazione finora

- Session 2 - Unit and Branch BankingDocumento20 pagineSession 2 - Unit and Branch BankingMohamed AhmedNessuna valutazione finora

- RBI As Central BankDocumento28 pagineRBI As Central BankShrutiNessuna valutazione finora

- ROLE OF BANKS IN ECONOMIC DEVELOPMENTDocumento25 pagineROLE OF BANKS IN ECONOMIC DEVELOPMENTZabed HossenNessuna valutazione finora

- Sarfaesi ActDocumento3 pagineSarfaesi ActJatin PanchiNessuna valutazione finora

- Unit Banking:: 1. Local DevelopmentDocumento3 pagineUnit Banking:: 1. Local Developmentlavanyasundar7Nessuna valutazione finora

- INVSTMNT LAW COURSEDocumento6 pagineINVSTMNT LAW COURSEVarsha ThampiNessuna valutazione finora

- Customer For A Bank:: The Rights and Responsibilities of A Banker Towards Their CustomersDocumento17 pagineCustomer For A Bank:: The Rights and Responsibilities of A Banker Towards Their Customerssyeda_yaseenNessuna valutazione finora

- National DP 2016 E VersionDocumento27 pagineNational DP 2016 E VersionRiky HidayatNessuna valutazione finora

- Regulatory Role of RBI and Its Monitory PolicyDocumento19 pagineRegulatory Role of RBI and Its Monitory PolicyManish Bhoir100% (1)

- Deposit InsuranceDocumento14 pagineDeposit InsuranceHarshdeep SinghNessuna valutazione finora

- 1 Chapter 5 Internal Reconstruction PDFDocumento22 pagine1 Chapter 5 Internal Reconstruction PDFAbhiramNessuna valutazione finora

- Reseach Paper On Consumer ProtectionDocumento21 pagineReseach Paper On Consumer ProtectionsNessuna valutazione finora

- Impact of NPAs on profitability of public sector banks in IndiaDocumento21 pagineImpact of NPAs on profitability of public sector banks in IndiapriyaNessuna valutazione finora

- Cash Reserve RatioDocumento6 pagineCash Reserve RatioAmitesh RoyNessuna valutazione finora

- Banking LawDocumento5 pagineBanking Lawrishabh1511900% (3)

- Banking Regulation Act Made EasyDocumento11 pagineBanking Regulation Act Made EasywahilNessuna valutazione finora

- Central Bank Functions and Interest RatesDocumento19 pagineCentral Bank Functions and Interest RatesNiranjan KumavatNessuna valutazione finora

- The Banking Regulation Act CooperativeDocumento10 pagineThe Banking Regulation Act CooperativeBhawana SharmaNessuna valutazione finora

- Types of Cheques and Endorsements ExplainedDocumento21 pagineTypes of Cheques and Endorsements ExplainedSabbir HossainNessuna valutazione finora

- Functions of RbiDocumento4 pagineFunctions of RbiMunish PathaniaNessuna valutazione finora

- 10 Chapter 3.outputDocumento33 pagine10 Chapter 3.outputajith kumarNessuna valutazione finora

- IosDocumento76 pagineIoskeshavborhadeNessuna valutazione finora

- The Securities Contracts (Regultion) Act, 1956Documento7 pagineThe Securities Contracts (Regultion) Act, 1956RRSS SSRRNessuna valutazione finora

- Export FinanceDocumento6 pagineExport FinanceMallikarjun RaoNessuna valutazione finora

- Vulnerable Groups in India: Chandrima Chatterjee Gunjan SheoranDocumento39 pagineVulnerable Groups in India: Chandrima Chatterjee Gunjan SheoranThanga pandiyanNessuna valutazione finora

- IosDocumento6 pagineIosVineeth ReddyNessuna valutazione finora

- FM ProjectDocumento9 pagineFM Projectkhyati agrawalNessuna valutazione finora

- Challenges Faced by NBFC in IndiaDocumento150 pagineChallenges Faced by NBFC in Indiaprayas sarkarNessuna valutazione finora

- Tribunal Decision on Cenvat Credit Unsettles Settled PositionDocumento97 pagineTribunal Decision on Cenvat Credit Unsettles Settled PositionshantX100% (1)

- Evolution of The Indian Financial SectorDocumento18 pagineEvolution of The Indian Financial SectorVikash JontyNessuna valutazione finora

- Indian Depository RecieptDocumento24 pagineIndian Depository Recieptadilfahim_siddiqi100% (1)

- Corporate Governance in Indian Banking Sector:: Page - 1Documento56 pagineCorporate Governance in Indian Banking Sector:: Page - 1ZEN COMPNessuna valutazione finora

- NPA & Categories Provisioning NormsDocumento26 pagineNPA & Categories Provisioning NormsSarabjit KaurNessuna valutazione finora

- RBI Role as India's Central BankDocumento6 pagineRBI Role as India's Central Bankabhiarora07Nessuna valutazione finora

- Liability of Directors in Dishonour of Cheques by R. Rajesh 7Documento4 pagineLiability of Directors in Dishonour of Cheques by R. Rajesh 7somrajNessuna valutazione finora

- Business EnvironmentDocumento29 pagineBusiness EnvironmentShreyaNessuna valutazione finora

- Place of Effective Management - A Critical Analysis - Corporate Law Reporter PDFDocumento9 paginePlace of Effective Management - A Critical Analysis - Corporate Law Reporter PDFAbhinav Singh Chandel0% (1)

- Project-Law of Crimes: Amithab Sankar 1477 Semester 5Documento6 pagineProject-Law of Crimes: Amithab Sankar 1477 Semester 5Sankar100% (1)

- Role of Banking Sector in IndiaDocumento75 pagineRole of Banking Sector in IndiaOna JacintoNessuna valutazione finora

- The Provincial Insolvency Act, 1920Documento36 pagineThe Provincial Insolvency Act, 1920Nayab Waheed ChaudhryNessuna valutazione finora

- Role of Trade Unions in Public Sector BanksDocumento17 pagineRole of Trade Unions in Public Sector BanksAKSHATNessuna valutazione finora

- Banking NotesDocumento23 pagineBanking Notesgopan009Nessuna valutazione finora

- Banking Regulation Act.Documento26 pagineBanking Regulation Act.ratneshiilm0% (1)

- Consumer ProtectionDocumento20 pagineConsumer Protectionsaranya pugazhenthiNessuna valutazione finora

- Role of Merchant Bankers in Capital MarketsDocumento23 pagineRole of Merchant Bankers in Capital MarketschandranilNessuna valutazione finora

- Banking Ombudsman ExplainedDocumento59 pagineBanking Ombudsman ExplaineddynamicdeepsNessuna valutazione finora

- Insurable InterestDocumento6 pagineInsurable InterestShivani BishtNessuna valutazione finora

- Comparing Derivatives Markets in India and USADocumento52 pagineComparing Derivatives Markets in India and USANikhilChainani100% (1)

- Assigment On Module 1 of Banking and Insurance Law PDFDocumento21 pagineAssigment On Module 1 of Banking and Insurance Law PDFShashwat MishraNessuna valutazione finora

- Social Control Over Banking2-LibreDocumento31 pagineSocial Control Over Banking2-LibreDebayan N Sen100% (1)

- RBI An OverviewDocumento23 pagineRBI An OverviewAunneshaa DeyNessuna valutazione finora

- Role of CRR and SLRDocumento9 pagineRole of CRR and SLRVineeta Malan50% (2)

- Central Bank Functions ExplainedDocumento7 pagineCentral Bank Functions ExplainedTilahun MikiasNessuna valutazione finora

- Functions of Central BanksDocumento4 pagineFunctions of Central BanksAndrea NaquimenNessuna valutazione finora

- CHAPTER ONE BankingDocumento29 pagineCHAPTER ONE BankingshimelisNessuna valutazione finora

- Money Banking Central BankDocumento19 pagineMoney Banking Central Bankebsa ahmedNessuna valutazione finora

- Economics Assignment 2Documento3 pagineEconomics Assignment 2Amar ChotaiNessuna valutazione finora

- Central Bank and Its FunctionsDocumento4 pagineCentral Bank and Its FunctionsHassan Sardar Khattak100% (4)

- Central BankDocumento7 pagineCentral BankRohanNessuna valutazione finora

- 02 Final Advertisement CASE-2013Documento8 pagine02 Final Advertisement CASE-2013कल्पेश प्रविण देशपांडेNessuna valutazione finora

- WP 4Documento23 pagineWP 4Vivian ClementNessuna valutazione finora

- The Misapplication of Mr. Michael Jensen Dobbin and JungDocumento19 pagineThe Misapplication of Mr. Michael Jensen Dobbin and JungJailson FigueirêdoNessuna valutazione finora

- Payment Advice Form - NMATDocumento1 paginaPayment Advice Form - NMATVivian ClementNessuna valutazione finora

- Banking Terminology - Guide4BankExamsDocumento29 pagineBanking Terminology - Guide4BankExamsSampathhhhh Sai TadepalliNessuna valutazione finora

- P3Q-C 2013Documento249 pagineP3Q-C 2013Vivian ClementNessuna valutazione finora

- Regression FileDocumento8 pagineRegression FileVivian ClementNessuna valutazione finora

- Priti Prakash Kakde: ProfileDocumento3 paginePriti Prakash Kakde: ProfileVivian ClementNessuna valutazione finora

- Gbe Notes 1Documento15 pagineGbe Notes 1sreekhan007Nessuna valutazione finora

- Buffett's Alpha - Frazzini, Kabiller and PedersenDocumento33 pagineBuffett's Alpha - Frazzini, Kabiller and PedersenVivian ClementNessuna valutazione finora

- RL Result of Bba (G) 2nd, 4th & 6th Sem Batch 2006 To 2009, E.T. Exam May 2010Documento16 pagineRL Result of Bba (G) 2nd, 4th & 6th Sem Batch 2006 To 2009, E.T. Exam May 2010Vivian ClementNessuna valutazione finora

- 300 ANTONYMS QuestionsDocumento11 pagine300 ANTONYMS QuestionsvickyNessuna valutazione finora

- Annexure-III - App FormatDocumento3 pagineAnnexure-III - App FormatVivian ClementNessuna valutazione finora

- RBI - Grade B Officer Question Paper (Exam Held On 11-10-2009) - 1Documento18 pagineRBI - Grade B Officer Question Paper (Exam Held On 11-10-2009) - 1Vivian ClementNessuna valutazione finora

- Google Says Hello Motto: Vivian ClementDocumento14 pagineGoogle Says Hello Motto: Vivian ClementVivian ClementNessuna valutazione finora

- 1844 DT New CourseDocumento7 pagine1844 DT New CourseVivian ClementNessuna valutazione finora

- Buffett's Alpha - Frazzini, Kabiller and PedersenDocumento33 pagineBuffett's Alpha - Frazzini, Kabiller and PedersenVivian ClementNessuna valutazione finora

- 02 Final Advertisement CASE-2013Documento8 pagine02 Final Advertisement CASE-2013कल्पेश प्रविण देशपांडेNessuna valutazione finora

- Google Says Hello Motto: Vivian ClementDocumento14 pagineGoogle Says Hello Motto: Vivian ClementVivian ClementNessuna valutazione finora

- Summer Training Project Report ON: Submitted byDocumento55 pagineSummer Training Project Report ON: Submitted byVivian Clement100% (2)

- CbseschoolcodesDocumento772 pagineCbseschoolcodesTempMania100% (2)

- Bank of Baroda Specialist Officer Exam 08: Reasoning AbilityDocumento43 pagineBank of Baroda Specialist Officer Exam 08: Reasoning AbilityVivian ClementNessuna valutazione finora

- Woodford Rules Jackson Hole WyomingDocumento97 pagineWoodford Rules Jackson Hole WyominglatecircleNessuna valutazione finora

- Financial Strength of EscortsDocumento19 pagineFinancial Strength of EscortsVivian ClementNessuna valutazione finora

- Dena Bank Specialist Officer Exam 07 Quantitative AptitudeDocumento38 pagineDena Bank Specialist Officer Exam 07 Quantitative AptitudeVivian ClementNessuna valutazione finora

- Valuation: Lecture Note Packet 1 Intrinsic Valuation: Aswath Damodaran Updated: September 2012Documento302 pagineValuation: Lecture Note Packet 1 Intrinsic Valuation: Aswath Damodaran Updated: September 2012Vivian ClementNessuna valutazione finora

- Uni FlashDocumento31 pagineUni FlashVivian ClementNessuna valutazione finora

- Uni FlashDocumento31 pagineUni FlashVivian ClementNessuna valutazione finora

- Application FormDocumento3 pagineApplication FormMd SharibNessuna valutazione finora

- Introduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyDocumento30 pagineIntroduction To Introduction To Introduction To Introduction To Monetary Accounts Monetary Accounts YyHaris HandyNessuna valutazione finora

- Commercial Banks in IndiaDocumento14 pagineCommercial Banks in IndiaAnonymous UwYpudZrANessuna valutazione finora

- Zahid - Customer Service With Sevice Marketing PerespectiveDocumento78 pagineZahid - Customer Service With Sevice Marketing PerespectiveMohammed Zahidul IslamNessuna valutazione finora

- Fed Reserve Chapter 04 TestDocumento3 pagineFed Reserve Chapter 04 TestRohan GopalNessuna valutazione finora

- Lending Policies of Indian BanksDocumento47 pagineLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)

- CBP Circular No. 905-82 deregulates interest ratesDocumento6 pagineCBP Circular No. 905-82 deregulates interest ratesEmil BautistaNessuna valutazione finora

- Internship Report Nepal SBI Bank PDFDocumento67 pagineInternship Report Nepal SBI Bank PDFPrinita Shrestha88% (8)

- Nucleus PresentationDocumento4 pagineNucleus Presentationachopra14Nessuna valutazione finora

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocumento38 pagineY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaAudithya KahawattaNessuna valutazione finora

- Commercial Banking in IndiaDocumento71 pagineCommercial Banking in IndiaSharath Unnikrishnan Jyothi NairNessuna valutazione finora

- Buisness Management Answers Over 100 QuestionsDocumento53 pagineBuisness Management Answers Over 100 Questionsskulls993Nessuna valutazione finora

- Functions of Central BanksDocumento4 pagineFunctions of Central BanksAndrea NaquimenNessuna valutazione finora

- Bank ManagementDocumento198 pagineBank ManagementSooraj Kallooppara0% (1)

- How Banks Create MoneyDocumento28 pagineHow Banks Create MoneyMathew Beniga Gaco100% (1)

- Financial Institutions and ServicesDocumento17 pagineFinancial Institutions and Servicesanand.av8rNessuna valutazione finora

- Services and Banking Products ProvidedDocumento21 pagineServices and Banking Products ProvidedpoddaranilshrutiNessuna valutazione finora

- AEC 501 Question BankDocumento15 pagineAEC 501 Question BankAnanda PreethiNessuna valutazione finora

- Legal Forms Second Batch FINALDocumento101 pagineLegal Forms Second Batch FINALClaudine ArrabisNessuna valutazione finora

- Banking Industry OverviewDocumento27 pagineBanking Industry OverviewNicole JoanNessuna valutazione finora

- Banking & Insurance ManagementDocumento2 pagineBanking & Insurance ManagementVishal Mandowara100% (1)

- UK Money Creation GuideDocumento2 pagineUK Money Creation Guidematts292003574Nessuna valutazione finora

- Commercial BanksDocumento37 pagineCommercial Banksshanpearl100% (2)

- Bhs Inggris NickoDocumento10 pagineBhs Inggris NickoKhoirul Fikri SmunjuNessuna valutazione finora

- CBE Annual Report 2009-10Documento35 pagineCBE Annual Report 2009-10Asteraye Waka0% (2)

- Dhanalaxmi Bank Final Project Report by YkartheekgupthaDocumento75 pagineDhanalaxmi Bank Final Project Report by YkartheekgupthaYkartheek GupthaNessuna valutazione finora

- Commercial Banking in KenyaDocumento16 pagineCommercial Banking in KenyaJared Opondo100% (6)

- BofA Organization HierarchyDocumento49 pagineBofA Organization HierarchySteven WaltnerNessuna valutazione finora

- Arun Uco Bank Internship ReportDocumento66 pagineArun Uco Bank Internship ReportArun SudhakarNessuna valutazione finora

- Financial System in MalaysiaDocumento8 pagineFinancial System in MalaysiaqairunnisaNessuna valutazione finora

- Report On Sutex BankDocumento55 pagineReport On Sutex Bankjkpatel221Nessuna valutazione finora