Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Investment Banking

Caricato da

Yatheendra KumarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Investment Banking

Caricato da

Yatheendra KumarCopyright:

Formati disponibili

INVESTMENT BANKING : INVESTMENT BANKING An individual or institution which acts as an underwriter or agent for corporations and municipalities issuing

securities. Most also maintain broker/dealer operations, maintain markets for previously issued securities, and offer advisory services to investors. Investment banks also have a large role in facilitating mergers and acquisitions, private equity placements and corporate restructuring. Unlike traditional banks, investment banks do not accept deposits from and provide loans to individuals. also called investment banker

What does an Investment Bank offer? : What does an Investment Bank offer? Asset Management Issuing House (Capital Raising) Stock broking Business & Financial Advisory services Export Financing Project Finance An Investment Bank Offers :

Functions of Investment Banking : Functions of Investment Banking Investment banking help public and private corporations in issuing securities in the primary market, guarantee by standby underwriting or best efforts selling and foreign exchange management . Other services include acting as intermediaries in trading for clients. Investment banking provides financial advice to investors and serves them by assisting in purchasing securities, managing financial assets and trading securities. Investment banking differ from commercial banking in the sense that they don't accept deposits and grant retail loans. However the dividing line between the two fraternal twins have become flimsy with loans and securities becoming almost substitutable ways of raising funds. Small firms providing services of investment banking are called boutiques. These mainly specialize in bond trading, advising for mergers and acquisitions, providing technical analysis or program trading.

What Actually an Investment Banker Do ?: What Actually an Investment Banker Do ? Investment bankers are agents. Simply,they dont create anything and they dont buy anything; they just sell things that arent theirs to begin with. And they make a lot of money doing that. If the business world were like Entourage, bankers would be the agents, private equity firms and large companies would be the studios, and companies would be the actors and movies. Private equity firms buy and sell companies. Studios buy and sell actors and movies. Bankers make introductions and try to sell things. Agents make introductions and sell their clients.

Structure of an Investment Bank: Structure of an Investment Bank

What is an Investment Bank?: What is an Investment Bank? Traditional Investment Banking Research Sales & Trading Capital raising Debt Equity Strategic advisory services Mergers & acquisitions Restructuring Takeover defense Analysis and recommendations of stocks and bonds Includes company coverage and sector coverage Distribution and execution arm of the investment bank Sells and trades stocks and bonds Manages the firms risk and makes markets for the securities underwritten by the investment bank An investment bank typically consists of three distinct, but related businesses: 2

Slide 11: Large / Global Small / Regional Who are the Leading Investment Banks in the United States? 3 Structure of an Investment Bank Conduit to the Corporate Client: Structure of an Investment Bank Conduit to the Corporate Client Client Investment Banking Coverage Groups Other Product Groups M&A Capital Markets Bank Loans Inv. Grade Debt High Yield Equity Chinese Wall Financial Strategies Derivatives Liability Management Pensions Corporate Banking Sales & Trading Research Private Side Public Side 4

Products and Services: Products and Services Balance Sheet Management Hedging Share and Debt Repurchases Debt Exchanges Consent Solicitations Capital Raising Equity Investment Grade Debt High Yield Debt Syndicated Loans Bridge Commitments Advisory M&A Restructuring Financial Strategy An investment bank provides numerous corporate finance functions. 5

Industry Coverage Groups: Industry Coverage Groups Consumer Energy, Power & Chemicals Financial Entrepreneurs Financial Institutions Health Care Industrials Communications Real Estate Technology 6

Deal Teams and the Role of an Associate: Deal Teams and the Role of an Associate

Structure of a Typical Deal Team: Structure of a Typical Deal Team Client Investment Banking Coverage Officer IBD Support Accountants Associate Analysts Capital Markets Compliance/ Legal Attorneys The Coverage Officer has primary

client responsibility and the Associate ensures that all members of the working party, both internal and external, are informed and working together. 7

Strategic Advisory: Strategic Advisory A good investment banker is a trusted advisor to their client a CEOs first call for strategic advice Investment bankers are most valuable when they can provide unique insight regarding a companys operations or strategic direction As part of a normal client dialogue, investment bankers will show clients strategic ideas that may or may not be obvious to their client CEOs often use their bankers to approach potential counterparties on an informal basis Investment bankers typically handle negotiations and most other aspects of the M&A process, allowing management to focus on running their business Valuation Process management Structuring Fairness opinion Purchase/Sale documentation Whatever else it takes 8

Strategic Advisory M&A: Strategic Advisory M&A Purchasing other companies Friendly Mergers Hostile Takeovers Leveraged Buyouts Selling companies Selling entire companies Spin-off of subsidiaries Defending Company Buyouts Poison Pill 9

Life of an M&A Transaction: Life of an M&A Transaction The Pitch Specific pitch ideas Beauty contests The Mandate: Deal is Live Announcement Closing: Its Official! Preparation Solicitation of preliminary bids Solicitation of binding bids Negotiations Contract Signing Preparation for announcement Press release Q&A script Week of announcement Market reaction Roadshow? Bankers work is largely done once the deal is made public Between announcement & closing SH vote HSR Other regulatory approvals Closing Lucites Dinner 10

Valuation: The Foundation of Every Deal: Valuation: The Foundation of Every Deal Primary Valuation Techniques Discounted Cash Flow Analysis Public Market Analysis (Comparable Companies) Private Market Analysis (Precedent Transactions) LBO Analysis Secondary Valuation Techniques Pro Forma Consequences Analysis Accretion/dilution Capital Structure EPS Growth Rates Relative Contribution Analysis Liquidation Analysis How is my client trading relative to peers? WHY is it trading this way? Growth? Margins? Hot market versus fundamentals HOW can the company improve its valuation? Does an acquisition make sense? What is an appropriate price? Is cash or stock a better choice? What is appropriate leverage? How would the market

value the company in a public offering? How long will a company take to pay back debt holders? Do cash flows support an LBO? 11

Valuation and the Associate: Valuation and the Associate A single, quantitatively derived answer A precise number A static number Lots of number crunching More art than science Heavily dependent on judgment Valuation is NOT . . . Valuation is . . . The associate is responsible to ensure numbers are accurate and assumptions are realistic. 12

Raise Capital for Clients: Raise Capital for Clients One of the most common functions of investment bankers is to assist companies in raising capital Investment banks are the intermediaries between users of capital and providers of capital Equity IPO Secondary Offering Preferred Stock Debt Investment Grade High Yield Debt Structured & New Product Financing 13

Capital Raising Assignment: Capital Raising Assignment Pitching Pre-Filing Preparation Marketing Post-deal follow-up Pricing / Closing The associate manages the flow of information and therefore must be organized and anticipate everything. 14

Capital Raising: Pre-Filing: Capital Raising: Pre-Filing Screen the Deal Internally Put together all internal memos and coordinate meetings Commitment Committee Investor Issues Committee Organizational Meeting Establish agenda, timetable, information request list and working group list Due Diligence Meetings Drafting of Registration Statement Development of business section and positioning Participation in drafting sessions Work with underwriters counsel on underwriting agreement Marketing Preparation Prepare roadshow presentation with company Coordinate for reds to be delivered as necessary 15

Capital Raising: Marketing: Capital Raising: Marketing Prepare memos for sales forces Institutional sales memo Retail Sales Memo Coordinate dry-run (company presentation to sales force) Denver 3 one-on-ones Minneapolis 1 one-onone Milwaukee 2 one-on-ones Chicago 1 one-on-one Boston 7 one-on-ones 1 group mtg New York 6 one-on-ones 1 group mtg Philadelphia 6 one-on-ones 2 one-on-ones Kansas City 1 group call Europe San Francisco 1 one-on-one 1 group call 4 one-on-ones 1 group mtg San Diego Toronto 5 one-on-ones 1

group mtg Montreal 1 group mtg Roadshow: Responsible that ALL logistics run smoothly Accompany company to investor meetings keep meetings on time Feedback to Capital Markets desk: know how the book is building ANTICIPATE everything 16

Capital Raising: Pricing/Closing: Capital Raising: Pricing/Closing Pricing: Handled by ECM Coordinate bring down due diligence call prior to pricing Finalize registration statement Meet with lawyers and printers to add in final pricing information Closing: Help coordinate wiring of funds to company How much? Where? When? Wire instructions via memo to syndicate Post-deal client relationship Create post-mortem book Organize closing dinner Design Lucite 17

Keys to Success as an Associate: Keys to Success as an Associate Goals Develop credibility early with team, especially analysts Leadership: Delegating authority Time management skills: Balance multiple projects Understand the transaction and communicate both up and down Develop a rapport with the analysts and communicate the big picture Manage expectations and define responsibilities Get your hands dirty Dont be afraid to ask questions Proactive client interaction Educate senior bankers and exceed expectations Pitfalls Presenting materials with mistakes or typos Waiting to get involved Failure to anticipate Not leveraging firms resources appropriately Getting lost in the detail and missing the big picture Insubstantial interaction with clients Does not properly delegate work Losing confidence under pressure Lack of attention to detail Lack of follow through Lack of involvement in recruiting and training activities 18

MAJOR PLAYERS IN THE MARKET : MAJOR PLAYERS IN THE MARKET First Boston Goldman Sachs Merrill Lynch Morgan Stanley Salomon Brothers Lehman Brothers Citi Groups performance over its peers: Citi Groups performance over its peers

Citigroup is the #2 Global M&A Advisor YTD: Citigroup is the #2 Global M&A Advisor YTD Source: Securities Data Company, Inc. Note: Data as of September 30, 2006, based on rank date. Global U.S. Europe Volume ($B) Rank Volume ($B) Rank Volume ($B) Rank 769.5 1 437.9 1 326.1 5 714.7 2 315.1 3 440.9 1 664.3 3 315.3 2 384.9 2 592.2 4 260.4 5 371.0 3 524.2 5 185.0 7 344.8 4 472.9 6 166.5 8 279.6 8 452.8 7 297.6 4 175.3 13 19

Citi Group advised on 7 of the 10 Largest Deals YTD: Deal Size Companies $89 Billion $71 Billion $44 Billion $41 Billion $38 Billion Citi Group advised on 7 of the 10 Largest Deals YTD Source: Securities Data Company, Inc. Data as of September 30, 2006, based on rank date. Deal Size Companies $32 Billion $30 Billion $28 Billion $27 Billion $26 Billion 20

Citi Group have Advised on Many Landmark, Cross-Border Deals: Citi Group have Advised on Many Landmark, Cross-Border Deals Source: Securities Data Company, Inc. (1) Advising a non-U.S. or non-European client in a cross-border transaction. M&A deals rank-eligible 2004-YTD 2006 (as of August 31 st ). Announced Cross-Border (2004 YTD 2006) Volume (US$bn) International (1) Client Advisory (2004 YTD 2006) Volume (US$bn) Completed Advised on CNPC Internationals acquisition of PetroKazahkstan US$3,957 mm August 2005 Pending Advised on Mittal Steels proposed offer to acquire Arcelor US$43,632 mm January 2006 Pending Advised on Autostrade SpAs merger of equals with Albertis Infraestructuras US$28,389 mm April 2006 Pending Advised on NYSEs proposed merger with Euronext US$10,203 mm May 2006 Completed Advised on Bavarias sale of a 71.8% stake owned by Santo Domingo to SABMiller US$5,227 mm July 2005 Completed Advised on G-TECH Holdings sale to Lottomatica SpA US$4,736 mm January 2006 21

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- EXTENDED PROJECT-Shoe - SalesDocumento28 pagineEXTENDED PROJECT-Shoe - Salesrhea100% (5)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Termination LetterDocumento2 pagineTermination Letterultakam100% (1)

- CA Inter Group 1 Book November 2021Documento251 pagineCA Inter Group 1 Book November 2021VISHAL100% (2)

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Documento11 pagineIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaNessuna valutazione finora

- Sales and Distribution MGTDocumento89 pagineSales and Distribution MGTNitin MahindrooNessuna valutazione finora

- A Study On Inventory Management in Sungwoo Gestamp Hitech PVT Limited-ChennaiDocumento79 pagineA Study On Inventory Management in Sungwoo Gestamp Hitech PVT Limited-ChennaiYatheendra KumarNessuna valutazione finora

- PrintDocumento70 paginePrintYatheendra KumarNessuna valutazione finora

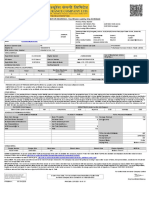

- Features: The Following Fire and Special Perils Are CoveredDocumento3 pagineFeatures: The Following Fire and Special Perils Are CoveredYatheendra KumarNessuna valutazione finora

- NAKSHATRADocumento2 pagineNAKSHATRAYatheendra KumarNessuna valutazione finora

- Air India LTDDocumento1 paginaAir India LTDYatheendra KumarNessuna valutazione finora

- Certificate of InternshipDocumento1 paginaCertificate of InternshipYatheendra KumarNessuna valutazione finora

- Academic Stress of College StudentsDocumento11 pagineAcademic Stress of College StudentsYatheendra KumarNessuna valutazione finora

- Life Insurance Life Insurance Corporation of IndiaDocumento7 pagineLife Insurance Life Insurance Corporation of IndiaYatheendra KumarNessuna valutazione finora

- Job Description For QAQC EngineerDocumento2 pagineJob Description For QAQC EngineerSafriza ZaidiNessuna valutazione finora

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDocumento3 pagineMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezNessuna valutazione finora

- What Caused The Slave Trade Ruth LingardDocumento17 pagineWhat Caused The Slave Trade Ruth LingardmahaNessuna valutazione finora

- BMA Recital Hall Booking FormDocumento2 pagineBMA Recital Hall Booking FormPaul Michael BakerNessuna valutazione finora

- Digital LiteracyDocumento19 pagineDigital Literacynagasms100% (1)

- Food and Beverage Department Job DescriptionDocumento21 pagineFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocumento1 paginaMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNessuna valutazione finora

- General Financial RulesDocumento9 pagineGeneral Financial RulesmskNessuna valutazione finora

- CLAT 2014 Previous Year Question Paper Answer KeyDocumento41 pagineCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNessuna valutazione finora

- Doas - MotorcycleDocumento2 pagineDoas - MotorcycleNaojNessuna valutazione finora

- M2 Economic LandscapeDocumento18 pagineM2 Economic LandscapePrincess SilenceNessuna valutazione finora

- P 1 0000 06 (2000) - EngDocumento34 pagineP 1 0000 06 (2000) - EngTomas CruzNessuna valutazione finora

- Dissertation On Indian Constitutional LawDocumento6 pagineDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- Hotel Reservation SystemDocumento36 pagineHotel Reservation SystemSowmi DaaluNessuna valutazione finora

- Prachi AgarwalDocumento1 paginaPrachi AgarwalAnees ReddyNessuna valutazione finora

- Reflections On Free MarketDocumento394 pagineReflections On Free MarketGRK MurtyNessuna valutazione finora

- Online EarningsDocumento3 pagineOnline EarningsafzalalibahttiNessuna valutazione finora

- 23 Things You Should Know About Excel Pivot Tables - Exceljet PDFDocumento21 pagine23 Things You Should Know About Excel Pivot Tables - Exceljet PDFRishavKrishna0% (1)

- Microsoft Word - Claimants Referral (Correct Dates)Documento15 pagineMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNessuna valutazione finora

- 1400 Service Manual2Documento40 pagine1400 Service Manual2Gabriel Catanescu100% (1)

- Delta AFC1212D-SP19Documento9 pagineDelta AFC1212D-SP19Brent SmithNessuna valutazione finora

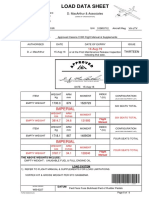

- Load Data Sheet: ImperialDocumento3 pagineLoad Data Sheet: ImperialLaurean Cub BlankNessuna valutazione finora

- CodebreakerDocumento3 pagineCodebreakerwarrenNessuna valutazione finora

- MRT Mrte MRTFDocumento24 pagineMRT Mrte MRTFJonathan MoraNessuna valutazione finora

- DC Servo MotorDocumento6 pagineDC Servo MotortaindiNessuna valutazione finora

- GL 186400 Case DigestDocumento2 pagineGL 186400 Case DigestRuss TuazonNessuna valutazione finora