Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Exercise (Final Accounts)

Caricato da

Abhishek BansalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Exercise (Final Accounts)

Caricato da

Abhishek BansalCopyright:

Formati disponibili

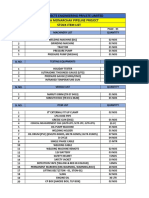

Financial Statements Q1 From the following calculate the gross profit Stock (1-4-2006) Purchases Sales Purchase return

Carriage inward Sales return Stock (31-3-2007) 10,500 31,500 53,000 1,500 2,000 3,000 6500 (GP: 14,000) Q2 Prepare a trading account of DCM for the year ending 31st March 2007 Stock (1-4-2006) 15,000 Purchases 63,000 Sales 1,14,000 Purchase return 3,000 Carriage 2,000 Wages 9,000 Factory expenses 4,000 Stock (31-3-2007) 12,000 (GP: 36,000) Q3 From the following calculate Gross Profit Opening stock 5,000 Purchases (Net) 1, 50,000 Direct expenses 13,000 Sales 1, 80,000 Closing stock 18,000 (GP: 30,000) Q4 Prepare Trading Account for the year ending 31st Mar 2005 Opening Stock 4,000 Purchases 39,000 Purchase Return 1,000 Sales 50,000 Sales Return 500 Factory Rent 200 Wages 4000 Carriage inward 400 Factory Lighting 100 Office Salaries 1,500 General Expenses 2,000 Closing Stock as on 31st Mar 2005 was Rs. 7,000 (GP: 9,800) Q5 From the following particulars prepare profit and loss account. Salaries 10,000 Advertising 8,500 Stationery Insurance 2,500 1,000 Discount (Dr.) Rent paid 1,500 5,000

4,500

Bad Debts

1,500

Carriage out Postage

7,500

Interest Received

4,000

The gross profit was 25% on sales and the sales for the year amounted to Rs. 2,00,000. (NP: 12,000) Q6 From the following figures prepare a profit and loss account for the year ending 31st Mar 2005. The Gross Profit was Rs. 50,000 Salaries 10,000 Commission Paid 4,500 Postage 4,000 Advertisement 5,300 Printing and stationery 2,000 Discount allowed 200 Insurance 3,500 Rent received 2,500 Interest on overdraft 2,500 Bad debts 3,000 Carriage on sales 3,000 Dividend received 4,500 (Net profit: 19000) Q7 From the following Trial balance of XYZ Co. as on 31st Mar 2006 prepare Final Accounts. Items Dr. Items Cr. Opening Stock Purchase Sundry Debtors Office Expenses Machinery Discount Salaries Building Repairs Carriage & Freight Cash in hand Cash at bank Wages

st

20000 64000 75000 1000 10000 1500 3500 40000 2000 5000 8000 29000 1000 2,60,000

Sale Sundry Creditors Capital

1,20,000 40,000 1,00,000

2,60,000

Stock as on 31 Mar 06 was valued at Rs. 28000. (GP: 49,000) (NP: 41,000)(Total of Balance Sheet: 1,81,000)

Q8 From the following balances prepare final Accounts 70,000 Cash in hand 3,600 Capital Building 37,500 Creditors 20,000 Returns Inward 900 Debtors 14,000 Salaries 2,220 General expenses 1,600 Discount allowed 400 Rent paid 7,420 Opening stock 33,000 Drawings 1,300 Bills payable 10,000 Electricity charges 380 Sales 1,27,000 Carriage inward 1,700 Purchases 93,700 Cash in bank 6,000 Wages 5,000 Machinery 1,8,500 Returns Outwards 220 Closing stock was valued at Rs. 36,420 (GP: 29,340) (NP: 17,320)(Total of Balance Sheet: 1,16,020) Q9 From the following trial balance prepare the final accounts of Hindustan Unilever Ltd. for the year ending 31 st December 2007. The closing stock was valued at Rs. 17,000. Dr. Balance Machinery Wages Salaries Furniture Carriage Inward Carriage Outward Building Manufacturing Expenses Insurance Goodwill Amount (Rs.) 20,800 34,985 16,000 9,545 1,880 2,050 24,000 9,955 Cr. Balance Sales Bank Loan Creditors Purchase Return Capital Amount (Rs.) 2,48,990 10,000 50,160 1,100 85,000

4,075 31,000

7,842 General Expenses Factory fuel & Power Debtors Factory Lighting Expenses on sales Opening Stock Purchases Sales Return Bad debts Bank Charges Cash at bank Cash in hand 1,176

78,000 1,086 2,513 34,000 1,02,600 4,100 1,483 500 7,545 115 3,95,250 3,95,250

(GP: 77,308) (NP: 42,845)(Total of Balance Sheet: 1,88,005) Q10 From the following trial balance of a trader you are required to prepare Trading and Profit and Loss Account for the year ending 31st March, 1991 and a Balance Sheet as on that date : Rs. Rs. Cash in hand 1,000 Stock 3,500 Creditors 3,900 Debtors 19,200 Drawings 5,130 Sales 92,800 Purchases 81,200 Wages 7,200

5,170 Furniture 4,000 Goodwill 3,000 Capital 32,700 Stock at the end was valued at Rs. 4,500 (GP: 5,400) (NP: 230)(Total of Balance Sheet: 31,700) Q11 From the following balances prepare final Accounts Dr. Cr. Capital 60,000 Drawings 10,260 Stock 38,400 Debtors and Creditors 57,000 7,800 Purchases and Sales 62,400 1,85,000 Wages and Salaries 7,200 Trade Expenses 7,200 Travelling Expenses 5,170 Furniture 6,000 Goodwill 58,000 Cash in hand 2,170 Advertisement 3,000 Bank Overdraft 4,000 The closing stock was valued at Rs. 15,000. (GP: 92,000) (NP: 76,630)(Total of B/S: 1,38,170) Q12 From the following Trial balance of Mr. Ram as on 31 st Dec 2006 prepare final accounts. Particulars Dr. Amount Cr. Amount Cash in hand 3,050 Purchases and sales 40,650 99,000 Debtors and creditors 8,700 6,000 Bills receivables 1,200 Capital 56,000 Wages 11,000 Stock 7,800 Building 30,000 Land 5,000 Machinery 25,000 Patents 8,000 Salaries 17,000 General expenses 3,000 Insurance 600 1,61,000 1,61,000

General Expenses

The closing stock was valued at Rs. 9,800. (GP: 49,350) (NP: 28,750)(Total of B/S: 90,750) Q13 Prepare Final Accounts for the year ending 31st Dec 2007 from the following Trial balance Particulars Debit Amount Credit Amount Capital Drawing Plant & Machinery Furniture Debtor Creditor Purchases Sales Wages Cash Salary Repair Opening Stock Rent Manufacturing Exp. Bills Payable Bad Debt Carriage on purchases Interest on Capital 1,000 320 2,000 1600 5200 1600 380 3,200 900 300 4700 4,000 8400 3,400 24,000 5,200 7,200 5,200 42,000

60,300

60,300

Total Adjustments Closing Stock was valued for Rs. 3200 Depreciate Plant & Machinery by 10% Depreciate Furniture by 10% Outstanding Wages Rs. 300 Prepaid Rent Rs. 100 (GP: 1,880) (NL: 7,080)(Total of B/S:41,720) Q14 Prepare Final Accounts for the year ending 31st Dec 2007 from the following Trial balance Particulars Dr. Amount Cr. Amount Capital Cash in hand Purchase Sales Cash at Bank Fixture & Fittings Freehold Premises Lighting & Heating Bills Receivable Return Inward Salary Creditor Debtor Opening Stock 57,000 30,000 8,850 2,250 15,000 650 8,250 300 10,750 18,900 300 89,900 1,10,600 76,700

Printing Bills payable Rent, Taxes & Insurance Discount Allowed Discount Received Total

2,250 18,750 1,900 2,000 4,450 2,29,400 2,29,400

Adjustments Closing Stock is Rs. 18000 Rs. 350 due and unpaid in respect of salary Rates and insurance has been paid in advance to the extent of Rs. 400 Depreciate fixture and fitting by Rs. 250 (GP: 8,400) (NL: 4,900)(Total of B/S:17,750) Q15 from the following trial balance prepare trading and profit and loss account and balance sheet for the year ending 31.12.2005. Particulars Dr. Amount Cr. Amount Capital 15,000 Purchases 55,000 Sales 75,000 Drawings 2,500 Stock 11,000 Bank 2,100 Furniture 1,300 Creditors 7,900 Land and building 10,000 Debtors 8,550 Rent 500 Sales return 1,000 Discounts 200 Insurance 1,000 Sundry expenses 2,000 Commission 1,000 Carriage inward 900 Printing and stationery 400 Motor car 5,000 Cash 600 Bad debt 450 Total 1,00,700 1,00,700 Adjustments:

1. 2. 3. 4.

Closing stock Rs. 9,900 Depreciate @ 5% on furniture & 10% on Motor car Prepaid insurance Rs. 200 Outstanding sundry expenses Rs. 250 Cr. Amount 5,00,000 10,000 2,000 5,000 3,000 2,00,000 30,000 20,000

Q16 From the following prepare final accounts. Particulars Dr. Amount Particulars Opening stock 20,000 Sales purchases 70,000 Purchase return Sales return 2,000 Discount received Carriage inward 1,000 Interest received Freight 5,000 Miscellaneous income Wages and salaries 25,000 Capital Advertisement 20,000 Creditors Printing and stationery 10,000 Bills payable Rent 67,000 Energy cost 20,000 Plant and machinery 3,80,000 Furniture and fixtures 50,000 Debtors 75,000 cash 25,000 7,70,000 Adjustments: 1. Closing stock is Rs. 25,000 2. Prepaid rent Rs. 5,000 3. Depreciation @ 5% on plant and machinery. Q17 From the following prepare final accounts. Particulars Opening stock purchases Return outward Productive wages Sales Sundry expenses Office rent Discount Bad debts Salaries Commissions Traveling expenses Insurance Sales promotion & Advertising Capital Creditors Bills payable Land and building Dr. Amount 20,000 55,400 3,000 1,08,000 3,200 2,700 800 250 18,000 700 1,350 2,200 9,400 75,000 30,000 25,000 50,000

7,70,000

Cr. Amount 2,500

43,000

Furniture Debtors

20,000

Cash in hand Cash at bank

6,000 5,900

Total 2,41,200 2,41,200 Adjustments: 1. closing stock Rs. 25,000 2. Outstanding expenses Rs. 2,000 3. Depreciation @ 5% on land and building, 20% on furniture & fixture. Q18 From the following prepare final accounts. Particulars Dr. Amount Capital Interest Rent 2,000 Wages 4,000 Salary 10,000 Machinery 15,000 Taxes and insurance 3,000 Sundry debtors 2,000 Sundry creditors commission Opening stock 7,000 Cash in hand 500 Cash at bank 1,000 Purchase and sales 20,000 Returns 2,000 Bills receivables & Payables 7,000 Furniture & fixtures 9,500 Total 83,000 Adjustments: 1. Closing stock Rs. 10,000 Cr. Amount 25,000 2,000

3,000 5,000

40,000 3,000 83,000

2. Outstanding wages Rs. 500 & outstanding salary Rs. 1,000 3. Depreciation @ 10% on machinery & 20% on furniture & fixture 4. Prepaid rent Rs. 300

Q19 prepare final accounts of Reliance Co. Ltd. For the year ending 31st Mar 2004. Particulars Opening stock Purchases Sales return Carriage inward Freight Wages Advertisement Printing & stationery Rent Salary Plant & machinery Furniture & fittings Debtors Cash Dr. Amount 20,000 70,000 2,000 1,000 5,000 25,000 20,000 10,000 65,000 20,000 3,80,000 50,000 75,000 25,000 7,68,000 Particulars Sales Purchase return Discount received Miscellaneous Receipts Capital Creditors Bills payable Cr. Amount 5,00,000 10,000 2,000 5,000 1,000 2,00,000 30,000 20,000

7,68,000

Adjustments: 1. Closing stock as on 31st Mar 2004 amounted to Rs. 25,000 2. Rent prepaid amounted to Rs. 5,000 3. Provide depreciation on plant and machinery @ 10%. Q20 Prepare trading account and profit and loss from the following balances. Particulars Amount Purchases 71,280 Computer 28,380 Cash at bank 4,000 Cash in hand 2,836 Furniture 1,540 Rent 12,540 Bills receivable 6,720 Trade charges 920 Sundry debtors 34,156 Drawings 5,200 Discount allowed 540 Wages 1,800 Salaries 16,780 Return inwards 1,000 Capital 60,000 Creditors 13,000 Bills payable 10,220 Discount received 22,000 Sales 70,720 Return outwards 11,432

Rent due 320 Adjustments: 1. Closing stock Rs. 25,600 2. Depreciate furniture @ 10% 3. Trade charges due Rs. 1200 4. Salaries prepaid Rs. 1,000 Q21 Prepare final accounts from the trial balance. Particulars Dr. Amount Cr. Amount Opening stock 20,000 Purchase of Raw material 80,000 Carriage inward 2,000 Commission received 5,000 Rent received 15,000 Wages 12,000 Salaries 18,000 Power & fuel 15,000 Purchase return 5,000 Land and building 2,50,000 Furniture & fittings 75,000 Creditors 34,000 Bills payable 20,000 Long term loan 2,00,000 Capital 2,80,000 Administrative expenses 12,000 Repairs & maintenance exp. 15,000 Marketing expenses 35,000 Cash in hand 5,000 Cash at bank 50,000 Debtors 20,000 Sales 2,50,000 Plant and machinery 2,09,000 8,09,000 8,09,000 Adjustments: 1. Closing stock is valued at Rs. 30,000 2. Depreciate land and building @ 5% , plant and machinery @ 20% , and furniture and fittings @ 10%. 3. Wages outstanding is Rs. 2,000

Preparation of Balance Sheet Q22 (Total Rs. 16177) Particulars Amount Bills payable 541 Particulars Bills Receivable Amount 2730

835

Closing Stock

3700

Cash Petty Cash

47

Creditors

1780

Bank Overdraft Capital Furniture

4000 9228 670

Net Profit Plant & Machinery Debtors Particulars Building Net profit Interest on capital Furniture Motor car Drawings in cash & goods Closing stock Cash at bank Outstanding wages Sundry creditors

628 6230 1965 Amount 15000 5575 10000 7500 25000 18000 32000 20000 500 10000 Amount 30000 230000 3000 70000 Amount 700 16000 4000 20000 2000 15000 7000 20000

Q23 (Total Rs. 124275) Amount Particulars Capital 100000 Debtors 28100 Interest on drawings 500 Loan from aadi 15000 Depreciation on 375 furniture Depreciation on 750 motor car Interest on 900 outstanding loan Prepaid insurance 300 Commission 800 received in advance Q24 (Total Rs. 398000) Particulars Amount Sundry creditors 220000 Stock in trade Cash at bank Prepaid expenses 70000 20000 5000

Particulars Outstanding expenses Debtors Cash in hand Furniture Particulars Cash Debtors Bills receivable Closing stock Fixtures & fittings Plant goodwill Freehold premises

Q25 (Total Rs. 122700) Particulars Amount Bills payable 6000 Creditors 24000 Long term loans 39000 Capital 40000 Net profit 18700 drawings 5000 Trade marks 13000 Leasehold land 25000

Potrebbero piacerti anche

- Golden Rules of Accounts: Prof. Pallavi Ingale 9850861405Documento32 pagineGolden Rules of Accounts: Prof. Pallavi Ingale 9850861405Pallavi Ingale100% (1)

- AAT Model Paper 2019 JulDocumento6 pagineAAT Model Paper 2019 JulShihan HaniffNessuna valutazione finora

- Final Accounts QuestionsDocumento6 pagineFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

- TallyDocumento4 pagineTallyNisarg Khamar100% (1)

- Six Day in Tally Class (What Is Ledger and How To Create Ledger in Tally)Documento9 pagineSix Day in Tally Class (What Is Ledger and How To Create Ledger in Tally)Kamlesh KumarNessuna valutazione finora

- Stock Item List PDFDocumento2 pagineStock Item List PDFRaj Kumar100% (1)

- YCI Tally NotesDocumento85 pagineYCI Tally NoteshxjdyufjNessuna valutazione finora

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalDocumento2 pagineProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanNessuna valutazione finora

- Tally AssignmentDocumento90 pagineTally AssignmentASHOK RAJ100% (2)

- Tally With GST Workshop Jan 2023 QuestionDocumento3 pagineTally With GST Workshop Jan 2023 QuestionAryan GuptaNessuna valutazione finora

- Problem in Subsidiary Book Cash BookDocumento2 pagineProblem in Subsidiary Book Cash Bookkamalkav0% (1)

- Tally Prime NotesDocumento54 pagineTally Prime Notesroshandhamankar0100% (2)

- Trading and Profit and Loss Account Further ConsiderationsDocumento5 pagineTrading and Profit and Loss Account Further ConsiderationsbillNessuna valutazione finora

- Accounting Bs 1st New Practice QuestionsDocumento14 pagineAccounting Bs 1st New Practice QuestionsJahanzaib ButtNessuna valutazione finora

- Fin Account-Sole Trading AnswersDocumento9 pagineFin Account-Sole Trading AnswersAR Ananth Rohith BhatNessuna valutazione finora

- Payroll Tally Notes With Assignment - SSC STUDYDocumento7 paginePayroll Tally Notes With Assignment - SSC STUDYParminder KaurNessuna valutazione finora

- Exercises On Acc Eqn - 26 QuesDocumento12 pagineExercises On Acc Eqn - 26 QuesNeelu AggrawalNessuna valutazione finora

- Tally Exercise 1 PDFDocumento1 paginaTally Exercise 1 PDFkumarbcomcaNessuna valutazione finora

- Tally Sample Paper With GST Feb 2023Documento3 pagineTally Sample Paper With GST Feb 2023Bhumi NavtiaNessuna valutazione finora

- Final Account With AnswersDocumento23 pagineFinal Account With Answerskunjap0% (1)

- Questions Journal, Ledger & TBDocumento9 pagineQuestions Journal, Ledger & TBHarsh GhaiNessuna valutazione finora

- 59journal Solved Assignment 13-14Documento12 pagine59journal Solved Assignment 13-14anon_350417051Nessuna valutazione finora

- Set 1 & 3 PDFDocumento6 pagineSet 1 & 3 PDFCorona VirusNessuna valutazione finora

- Ch-13 Cash Book Entry in Tally PrimeDocumento3 pagineCh-13 Cash Book Entry in Tally PrimeSanchita ChauhanNessuna valutazione finora

- Step by Step Payroll Tally NotesDocumento7 pagineStep by Step Payroll Tally NotesNew GlobalNessuna valutazione finora

- Basics of AccountingDocumento3 pagineBasics of AccountingAjesh Mukundan PNessuna valutazione finora

- Account Project MittalDocumento10 pagineAccount Project Mittalhit2011Nessuna valutazione finora

- Class 11 Accountancy Worksheet - 2023-24Documento17 pagineClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNessuna valutazione finora

- Chapter 13Documento12 pagineChapter 13palash khannaNessuna valutazione finora

- Tally GURU Syllabus PDFDocumento2 pagineTally GURU Syllabus PDFWedsa Kumari50% (2)

- Tally - Erp 9 Complete CourseDocumento12 pagineTally - Erp 9 Complete CourseMeghaNessuna valutazione finora

- Extra Journal QuestionsDocumento3 pagineExtra Journal QuestionsMba BNessuna valutazione finora

- Tally Example SumDocumento2 pagineTally Example SumGovindaraj Subramani0% (1)

- TallyDocumento27 pagineTallyRonak JainNessuna valutazione finora

- DK Goel Solutions Class 11 Accountancy Chapter 9 - Books of Original Entry - JournalDocumento69 pagineDK Goel Solutions Class 11 Accountancy Chapter 9 - Books of Original Entry - JournalVanyaNessuna valutazione finora

- Tally Practical (B) - 1Documento3 pagineTally Practical (B) - 1Bhaavya GuptaNessuna valutazione finora

- 10 Illustration of Ledger 24.10.08Documento7 pagine10 Illustration of Ledger 24.10.08denish gandhi100% (1)

- Problem #1: Adjusting EntriesDocumento5 pagineProblem #1: Adjusting EntriesShahzad AsifNessuna valutazione finora

- 3-Work Sheet - Cash AccountDocumento4 pagine3-Work Sheet - Cash AccountMonu NehraNessuna valutazione finora

- Job Costing in TallyDocumento2 pagineJob Costing in Tallysanku guptaNessuna valutazione finora

- Tally Financial Accounting ProgramDocumento24 pagineTally Financial Accounting ProgramCA Tanmay BhavarNessuna valutazione finora

- TS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalDocumento47 pagineTS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalRUSHIL GUPTANessuna valutazione finora

- Tally Assignment: Question Create A Company Using Tally SoftwareDocumento11 pagineTally Assignment: Question Create A Company Using Tally SoftwaregsaNessuna valutazione finora

- Tally Test No 1 Next LectureDocumento2 pagineTally Test No 1 Next Lecturesha_ash777Nessuna valutazione finora

- Tally AssignmentDocumento9 pagineTally AssignmentDebjit Naskar100% (1)

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocumento25 paginePrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Palindia Computer Education: Ledger CreationDocumento12 paginePalindia Computer Education: Ledger CreationRuturaj KadamNessuna valutazione finora

- Question Bank 1Documento5 pagineQuestion Bank 1lavarocks23100% (1)

- Tally TestDocumento2 pagineTally TestHK DuggalNessuna valutazione finora

- Journal Entries For The Month of November: Solutions To Handout # 1: in Class Problem # 1Documento8 pagineJournal Entries For The Month of November: Solutions To Handout # 1: in Class Problem # 1simran punjabiNessuna valutazione finora

- Sybcom AccountsDocumento42 pagineSybcom AccountsAnandkumar Gupta0% (1)

- BasicAcctng AsgnmtSpreadsheets Unit 02Documento9 pagineBasicAcctng AsgnmtSpreadsheets Unit 02Syeda Muneebaali67% (3)

- Tally InterviewDocumento6 pagineTally InterviewGST Point Taxation & Accounting ServicesNessuna valutazione finora

- Tally SlipsDocumento10 pagineTally Slipsmanishudasi689Nessuna valutazione finora

- JDocumento13 pagineJpalash khannaNessuna valutazione finora

- Chapter 7 LedgerDocumento18 pagineChapter 7 LedgerJumayma Maryam100% (1)

- Solutions JournalDocumento50 pagineSolutions JournalAnjali SharmaNessuna valutazione finora

- Assignment No-3Documento9 pagineAssignment No-3Ronit gawade100% (1)

- Final AcctsDocumento7 pagineFinal AcctsSyed ShabirNessuna valutazione finora

- AccountDocumento2 pagineAccountnomaanahmadshahNessuna valutazione finora

- MANALO Vs CADocumento2 pagineMANALO Vs CARmLyn MclnaoNessuna valutazione finora

- Report 3-Governance&Debtb PDFDocumento31 pagineReport 3-Governance&Debtb PDFIceberg Research100% (1)

- Suggestion of BankruptcyDocumento5 pagineSuggestion of BankruptcyMy-Acts Of-SeditionNessuna valutazione finora

- RFBT 4-Partnership Pre-TestDocumento4 pagineRFBT 4-Partnership Pre-TestCharles D. Flores0% (1)

- Financial Statement Analysis 20101Documento117 pagineFinancial Statement Analysis 20101konyatanNessuna valutazione finora

- Promissory Note - DraftDocumento3 paginePromissory Note - DraftFrancis Xavier Sinon100% (1)

- Final Financial Crisis ERFDocumento19 pagineFinal Financial Crisis ERFrabbi_iiucNessuna valutazione finora

- Evidence Spoliation OrderDocumento30 pagineEvidence Spoliation OrderMikey CampbellNessuna valutazione finora

- Affidavit of CreditDocumento2 pagineAffidavit of CreditMill Bey82% (11)

- Week 6Documento7 pagineWeek 6Nguyễn HoàngNessuna valutazione finora

- Campos Rueda Vs Pacific Comm. (1x5 5)Documento1 paginaCampos Rueda Vs Pacific Comm. (1x5 5)Angelic ArcherNessuna valutazione finora

- United States Bankruptcy Court Central District of California (Santa Ana Division)Documento6 pagineUnited States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsNessuna valutazione finora

- Lo V KJS Eco-Formwork System Phil., Inc.Documento4 pagineLo V KJS Eco-Formwork System Phil., Inc.Jf ManejaNessuna valutazione finora

- Abraham S. Robinson, As Trustee in Bankruptcy of R. Appel, Inc. v. Commercial Bank of North America, 320 F.2d 106, 2d Cir. (1963)Documento4 pagineAbraham S. Robinson, As Trustee in Bankruptcy of R. Appel, Inc. v. Commercial Bank of North America, 320 F.2d 106, 2d Cir. (1963)Scribd Government DocsNessuna valutazione finora

- Sunrise Medical HHG v. Health Focus of NY, Et Al - Document No. 33Documento5 pagineSunrise Medical HHG v. Health Focus of NY, Et Al - Document No. 33Justia.comNessuna valutazione finora

- HIST US A Country Defeated in Victory JMontgomeryDocumento82 pagineHIST US A Country Defeated in Victory JMontgomeryjohnadams552266100% (1)

- Chap 015Documento42 pagineChap 015Hemali MehtaNessuna valutazione finora

- United States Court of Appeals, Seventh CircuitDocumento8 pagineUnited States Court of Appeals, Seventh CircuitScribd Government DocsNessuna valutazione finora

- Compulsory Winding UpDocumento27 pagineCompulsory Winding UpUsman VpNessuna valutazione finora

- Control & Reconciliation - WorksheetDocumento3 pagineControl & Reconciliation - WorksheetRegina Dori FlowerastiaNessuna valutazione finora

- WWpart 3Documento182 pagineWWpart 3bperkyNessuna valutazione finora

- In Re - Sears Holdings Corporation, 7 - 19-Cv-07660, No. 51 (S.D.N.Y. Dec. 9, 2019)Documento82 pagineIn Re - Sears Holdings Corporation, 7 - 19-Cv-07660, No. 51 (S.D.N.Y. Dec. 9, 2019)Lyndell MooreNessuna valutazione finora

- An Overview of Asset Protection DocumentationDocumento4 pagineAn Overview of Asset Protection Documentationjan l.Nessuna valutazione finora

- General Awareness Questions PDFDocumento10 pagineGeneral Awareness Questions PDFRamu KNessuna valutazione finora

- 4 Liquidation of CompanyDocumento32 pagine4 Liquidation of CompanyKrrish KelwaniNessuna valutazione finora

- Occ Foreclosure Review - 3 Banks Go With Promontory Financial - Bank of America, Wells Fargo, PNCDocumento293 pagineOcc Foreclosure Review - 3 Banks Go With Promontory Financial - Bank of America, Wells Fargo, PNC83jjmackNessuna valutazione finora

- 12-03-2020Documento42 pagine12-03-2020AlishaNessuna valutazione finora

- Unit 14Documento4 pagineUnit 14Oktawia TwardziakNessuna valutazione finora

- CSDocumento124 pagineCSamdeepbhatia8489Nessuna valutazione finora

- ILEC Reading Sample TestDocumento10 pagineILEC Reading Sample TestketizabelaNessuna valutazione finora