Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2004 Illustrative NFS Parent Rev 02 05

Caricato da

Rheneir MoraDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2004 Illustrative NFS Parent Rev 02 05

Caricato da

Rheneir MoraCopyright:

Formati disponibili

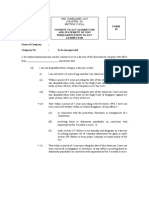

ABC MANUFACTURING COMPANY (A Wholly Owned Subsidiary of XYZ Holdings Corporation) NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2004

AND 2003 1. CORPORATE INFORMATION The ABC Manufacturing Company (the Company1) was incorporated in the Philippines, and is a wholly owned subsidiary of XYZ Holdings Corporation (XYZ)2, a domestic company. The Company holds 100% interests in D Company and S Corporation, 40% interest in TXT Co, and 50% interest in Extinguishers Limited, a jointly controlled entity3, which are all domestic entities. The Company is presently engaged in the manufacture and distribution of electronic components, the manufacture and installation of insulation products, and the manufacture and sale of ready-to-wear clothes. The registered office4 of the Company and XYZ5 is located at 123 Maganda Street, Future Village, Makati City. The Company operates within the Philippines and had 1,734 and 1,543 employees and officers as of December 31, 2004 and 2003, respectively. The financial statements of the Company for the years ended December 31, 2004 and 2003 were authorized for issue by the Board of Directors on March 31, 2005.6

Or ABC, however, the term chosen should be used consistently within the notes to financial statements.

1

The name of the parent company and the ultimate parent company of the group should be disclosed.

2

Related party relationships where control exists should be disclosed irrespective of whether there have been transactions between the related parties.

3 4

Or principal place of business, if different from the registered address.

Disclosure of the registered office of the ultimate parent is only required if the Company does not present consolidated financial statements.

5

Refer to AAR 04-03 for discussion on the relationship of the date of clients authorization for the issuance of the financial statements and the date of the auditors report thereon.

6

-2-

The Company does not present consolidated financial statements as it is a wholly owned subsidiary of XYZ7.

Under SFAS 27/IAS 27, a parent company that does not present consolidated financial statements should disclose the reason for such together with the manner of accounting for investment in its subsidiaries.

-3-

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Preparation of Financial Statements The financial statements have been prepared in accordance with generally accepted accounting principles in the Philippines. The financial statements have been prepared on a historical cost basis, except for the measurement at market value of marketable equity securities. The accounting policies have been consistently applied by the Company and are consistent with those used in the previous year, except for the adoption of new accounting standards as stated below. Adoption of New Accounting Standards In 2004 and 2003, the Company adopted the following Statements of Financial Accounting Standards (SFAS)/International Accounting Standards (IAS) issued by the Accounting Standards Council (ASC) which became effective on January 1, 2004 and 2003, respectively, that are relevant to the Company: 2004 SFAS 12/IAS 12 SFAS 17/IAS 17 2003 SFAS 8A : : Income Taxes Leases

: Deferral of Foreign Exchange Differences SFAS 10/IAS 10 : Events After the Balance Sheet Date SFAS 37/IAS 37 : Provisions, Contingent Liabilities and Contingent Assets SFAS 38/IAS 38 : Intangible Assets

The effects of the Companys adoption in 2004 of SFAS 12/IAS 12 and SFAS 17/IAS 17 and in 2003 of SFAS 8A and SFAS 38/IAS 38 are discussed in Note 3. Adoption of other new accounting standards did not result in material adjustments to the financial statements of the current and prior years. Certain accounts in the 2003 financial statements have been reclassified to conform to the 2004 presentation and classification. 8

88

The nature, amount of, and reason for, any reclassification of comparative amounts should be disclosed. When it is impracticable to reclassify comparative amounts, the reason for not reclassifying and the nature of the changes that would have been made if amounts were reclassified.

-4-

-5-

Impact of New and Revised Accounting Standards Effective Subsequent to 20049 In 2004, the ASC issued a series of new accounting standards that are adopted from existing IAS, revised IAS and new International Financial Reporting Standards (IFRSs) issued by the International Accounting Standards Board (IASB). The new ASC accounting standards are effective in the Philippines for financial statements covering periods beginning on or after January 1, 2005. Also, the ASC re-named its accounting standards to correspond better with the IASB pronouncements. Philippine Accounting Standards (PASs) correspond to the adopted IASs, while Philippine Financial Reporting Standards (PFRSs) correspond to the adopted IFRSs. Existing SFASs and SFASs/IASs not yet superseded will be reissued by the ASC as PASs. The new ASC pronouncements that are effective in 2005 are the following: (Alternatively, the NFS may mention only those that are relevant to the Company; in this case, the sentence will be: Of the new ASC pronouncements, the following standards are relevant to the Company. Then the list below shall show only those relevant standards that will be applied by the Company starting 2005.) PAS 1 PAS 2 PAS 8 PAS 10 PAS 16 PAS 17 PAS 19 PAS 21 Rates PAS 24 PAS 27 Statements PAS 28 PAS 29 Economies PAS 30 Banks and : : : : : : : : : : : : : Presentation of Financial Statements Inventories Accounting Policies, Changes in Accounting Estimates and Errors Events after the Balance Sheet Date Property, Plant and Equipment Leases Employee Benefits The Effects of Changes in Foreign Exchange Related Party Disclosures Consolidated and Separate Financial Investments in Associates Financial Reporting in Hyperinflationary Disclosures in the Financial Statements of Similar Institutions Interests in Joint Ventures Financial Instruments: Disclosures and

PAS 31 : PAS 32 Presentation

9

When any of the new accounting standards is applied early (i.e., before January 1, 2005), that fact should be disclosed, together with the other information required under the specific standard.

-6-

PAS 33 : PAS 36 : PAS 38 : PAS 39 Measurement PAS 40 : PAS 41 : PFRS 1 : PFRS 2 : PFRS 3 : PFRS 4 : PFRS 5 : Discontinued

Earnings per Share Impairment of Assets Intangible Assets Financial Instruments: Recognition and Investment Property Agriculture First-time Adoption of PFRS Share-based Payment Business Combinations Insurance Contracts Non-current Assets Held for Sale and Operations

-7-

The Company will apply the relevant new accounting standards in 2005 in accordance with their transitional provisions. It is currently evaluating the impact of those standards on its financial statements and has initially determined that the following new standards may have significant effects on the financial statements for 2005, as well as for prior and future periods: (Include here brief discussions on the relevant standards that are expected to have material effects on the Companys FS, using the format of the samples given below. The samples below should be reworded to consider the specific circumstances of the client.) PAS 19, Employee Benefits. This new accounting standard prescribes the accounting and disclosure by employers for employee benefits. Employee benefits are all forms of consideration given by an entity in exchange for service rendered by employees. These benefits include short-term benefits (such as short-term compensated absences and profit sharing and bonus plans), post-employment benefits (such as pension plans), other long-term benefits (such as long-service leave or sabbatical leave) and termination benefits. Presently, the Company provides short-term benefits to its employees and recognizes employee benefits on its defined benefits pension plan. The Companys application of PAS 19 may increase the employee benefits that it will recognize as expense starting 2005. PAS 21, The Effects of Changes in Foreign Exchange Rates. PAS 21 requires the recognition of foreign exchange differences as income or expense in the period in which they arise. Capitalization of foreign currency differences is no longer allowed even under severe currency devaluation. As of December 31, 2004, the remaining undepreciated balance (P1.0 million) of the foreign exchange losses capitalized in prior years as part of the carrying value of certain imported machinery will be written off in 2005. (If applicable, i.e., in the case of a subsidiary or branch of a foreign company that is qualified to use a functional currency other than the peso, add the following: The standard also replaced the notion of reporting currency with the notions of functional currency and presentation currency. Functional currency is the currency of the primary economic environment in which the entity operates; presentation currency is the currency in which the financial statements are presented. The Companys functional currency is the U.S. dollar and it will present its financial statements for future years in U.S. dollars after the necessary approval for the use of

-8-

the functional currency is obtained from the appropriate government agencies. PAS 32, Financial Instruments: Disclosures and Presentation. PAS 32 prescribes the requirements for the presentation of financial instruments and identifies information that should be disclosed about them. The presentation requirements apply to the classification of financial instruments, from the perspective of the issuer, into financial assets, financial liabilities and equity instruments, as well as the classification of the related income and expense items. The required disclosures include information that affect the amount, timing and certainty of future cash flows relating to the financial instruments, the accounting policies applied to those instruments and the risks associated with them and managements policies for controlling those risks. The standard also requires and provides guidance on the separation of the liability and equity components of a compound financial instrument.

-9-

PAS 39, Financial Instruments: Recognition and Measurement. This new standard prescribes the principles for recognizing, measuring and disclosing information about financial instruments in the financial statements of companies. It requires initial recognition of a financial asset or liability at fair value, which is normally the transaction price (i.e., the fair value of the consideration given or received). Subsequent measurement is at fair value, amortized cost using the effective interest method, or cost depending on the classification of the financial asset or liability. Recognition of gains or losses mainly from changes in the fair values, amortization, impairment and derecognition also depends on the classification of the financial instruments. The initial adoption by the Company of PAS 39 in 2005 may give rise to recognition of previously unrecognized assets and liabilities, the derecognition of previously recognized assets and liabilities and recognition of gains or losses from fair value changes that may have material impact on its financial statements. PAS 40, Investment Property. This new standard prescribes the accounting treatment for investment property and related disclosure requirements. Investment property is property (generally land or a building or part of a building) held to earn rentals or for capital appreciation, rather than for use in production or supply of goods or services or for administrative purposes, or sale in the ordinary course of business. Investment property is initially recognized at cost. For measurement after initial recognition, an entity shall choose as its accounting policy either the fair value model or the cost model in valuing investment property. Under the fair value model, the investment property is measured at fair value which changes in fair value recognized in profit or loss. Under the cost model, the investment property is measured at depreciated cost (less any accumulated losses). While the Company expects to make reclassification of certain assets as investment property in 2005, it still has to decide on the model to adopt for measuring those assets. PFRS 2, Share-based Payment. PFRS 2 requires an entity to recognize share-based payment transactions (i.e., acquisitions of goods or services) in its financial statements, including transactions with employees or other parties to be settled in cash, other assets or equity instruments of the entity when it obtains the goods or as the services are received. The new standard sets out measurement principles and specific requirements for these three types of share-based payment transactions: (a) equity-settled share-based payment,

- 10 -

(b) cash-settled share-based payment, and (c) transactions in which the terms of the arrangement provide a choice of settlement in cash or by issuing equity instruments. The stock options granted by the Company to its employees are considered share-based payments under the standard and the Company expects that the adoption of the standard may require recognition of additional expense for employee compensation relating to such stock options. As for the other new accounting standards, the Company has initially assessed that they will not result in significant changes to the amounts or disclosures in its financial statements.

- 11 -

Cash and Cash Equivalents Cash and cash equivalents are defined as cash on hand, demand deposits and short-term, highly liquid investments readily convertible to known amounts of cash and which are subject to insignificant risk of changes in value. Trade and Other Receivables Trade receivables, which generally have 30-90 day terms, are recognized and carried at original invoice amounts less allowance for any uncollectible amounts. An estimate for doubtful debts is made when collection of the full amount is no longer probable. Bad debts are written off when identified. Inventories Inventories are valued at the lower of cost and net realizable value. Costs incurred in bringing each product to its present location and condition are accounted for as follows: Raw materials purchase cost on a first-in, first-out basis; and, Finished goods and work-in-process cost of direct materials and labor and a proportion of manufacturing overheads based on normal operating capacity.

Net realizable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and the estimated costs necessary to make the sale. Investments Investments are initially recorded at cost at the time of acquisition, which is generally measured by the purchase price of the security, or the fair value of the asset given up or the security received in the exchange and other costs directly related to the acquisition. Subsequent to acquisition, the carrying values of the investments are determined as follows: Marketable equity securities Investments in marketable equity securities (classified as current) are carried at the lower of its aggregate cost or market value at the balance sheet date. The excess of aggregate cost over market value is accounted for as valuation allowance. Realized gains and

- 12 -

losses and changes in the valuation allowance are recognized in income of the period in which they occur. In computing realized gains or losses, cost is determined on the average cost basis.

- 13 -

Investments in marketable equity securities (classified as noncurrent) are carried at the lower of its aggregate cost or market value at the balance sheet date. The excess of aggregate cost over market value is accounted for as valuation allowance. Realized gains and losses are recognized in income of the period in which they occur; the cost of the sold securities is determined on the average cost basis. The accumulated changes in the valuation allowance are included as a separate component of equity in the balance sheet until realized. Investments in subsidiaries and associate These are accounted for at cost plus the Companys equity in net earnings and other changes in its share in net assets of the investee from date of acquisition, less any impairment in value. Equity in net earnings is being adjusted for the straightline amortization, over a 15-year period10, of the difference between the Company's cost of such investments and its proportionate share of the underlying net assets at date of acquisition, which represents goodwill. Dividends received from investees are not considered income but are deducted from the investment account. Interest in joint venture The Companys interest in a jointly controlled entity is accounted for using the equity method. Other investments, consisting mainly of shares of stock and real estate, are carried at cost.

Property, Plant and Equipment Property, plant and equipment are stated at cost less accumulated depreciation and any impairment in value. The cost of an asset comprises its purchase price and directly attributable costs of bringing the asset to working condition for its intended use. Expenditures for additions, major improvements and renewals are capitalized; expenditures for repairs and maintenance are charged to expense as incurred. When assets are sold, retired or otherwise disposed of, their cost and related accumulated depreciation and impairment losses are removed from the accounts and any resulting gain or loss is reflected in income for the period. Depreciation is computed on the straight-line basis over the estimated useful lives of the assets as follows: Buildings and improvements Machinery and equipment

10

10-20 years 5-12 years

The new ceiling for the amortization of goodwill and other intangible assets is now 20 years unless, it can be reasonably justified that the useful life exceeds 20 years.

- 14 -

Office furniture, fixtures and other equipment5-10 years Transportation equipment 3-5 years Fully depreciated assets are retained in the accounts until they are no longer in use and no further charge for depreciation is made in respect of those assets.

- 15 -

Goodwill and Intangible Assets11 The excess of the cost of acquisition over the fair value of identifiable net assets of a subsidiary, associate or joint venture at date of acquisition, which represents goodwill, is stated at cost less accumulated amortization and any impairment in value. Such goodwill is included in the carrying amounts of the investments. Goodwill is amortized on a straight-line basis over its estimated useful economic life of 15 years. Other intangible assets are recorded at cost less accumulated amortization and any impairment in value. The cost of the asset is the amount of cash or cash equivalent paid or the fair value of the other considerations given to acquire an asset at the time of its acquisition or production. Licenses and franchises The costs relating to patents and licenses acquired are capitalized and amortized using the straight-line method of amortization over their lives, not exceeding 10 years.

Research and development costs Research costs are expensed when incurred. Development costs which relate to the design and testing of new or improved materials, products or processes are recognized as assets when the Company can demonstrate that the assets will generate probable future economic benefits and resources are available to complete, use and obtain the benefits from the assets. Deferred development costs are amortized on a straight-line basis over their useful lives, not exceeding 6 years, from the date of commercial production of the product or from the date the process is put into use. Revenue Recognition Revenue is recognized to the extent that it is probable that the economic benefits will flow to the Company and the revenue can be reliably measured. The following specific recognition criteria must also be met before revenue is recognized: Sale of goods Revenue is recognized when the risks and rewards of ownership of the goods have passed to the buyer and the amount of revenue can be measured reliably.

The new ceiling for the amortization of goodwill and other intangible assets is now 20 years unless, it can be reasonably justified that the useful life exceeds 20 years.

11

- 16 -

Rendering of services Revenue from the installation of insulation products is recognized by reference to the stage of completion. The stage of completion is measured by reference to the labor hours incurred to date as a percentage of total estimated labor hours for each contract. Where the outcome of the contract cannot be measured reliably, revenue is recognized only to the extent of the expenses recognized that are recoverable.

- 17 -

Interest Revenue is recognized as the interest accrues (taking into account the effective yield on the asset). Dividends Revenue is recognized when the stockholders right to receive the payment is established.

Leases12 Company as lessee Leases, which transfer to the Company substantially all risks and benefits incidental to ownership of the leased item, are classified as finance leases and are recognized as assets and liabilities in the balance sheets at amounts equal at the inception of the lease to the fair value of the leased property or, if lower, at the present value of minimum lease payments. Lease payments are apportioned between the finance charges and reduction of the lease liability so as to achieve a constant rate of interest on the remaining balance of the liability. Finance charges are directly charged against income. Capitalized leased assets are depreciated over the shorter of the estimated useful life of the asset or the lease term. Leases, which do not transfer to the Company substantially all the risks and benefits of ownership of the asset are classified as operating leases. Operating lease payments are recognized as expense in the statement of income on a straight-line basis over the lease term. Company as lessor Leases, wherein the Company substantially transfers to the lessee all risks and benefits incidental to ownership of the leased item, are classified as finance leases and are presented as receivable at an amount equal to the Companys net investment in the lease. Finance income is recognized based on the pattern reflecting a constant periodic rate of return on the Companys net investment outstanding in respect of the finance lease.

Foreign Currency Transactions The accounting records of the Company are maintained in Philippine pesos. Foreign currency transactions during the year are translated into Philippine pesos at exchange rates which approximate those prevailing on transaction dates. Foreign currency monetary assets

Par. 23 of SFAS 17/IAS 17, Leases, requires a general description of significant leasing arrangements including, but not limited to, (a) the basis on which contingent rent payments are determined; (b) the existence and terms of renewal or purchase options and escalation clauses and (c) restrictions imposed by the lease arrangements.

12

- 18 -

and liabilities at the balance sheet date are translated into Philippine pesos at exchange rates which approximate those prevailing on that date. Exchange gains and losses are recognized in income for the period, except for the amounts capitalized and deferred in prior years (see Note 3).

- 19 -

Provisions Provisions are recognized when the Company has a present obligation (whether legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. Provisions are reviewed at each balance sheet date and adjusted to reflect the current best estimate. Impairment of Assets The carrying values of property, plant and equipment; investments in subsidiaries and an associate; interest in joint venture; other longterm investments; goodwill; and other intangible assets are reviewed for impairment when events or changes in circumstances indicate that their carrying values may not be recoverable. If any such indication exists and where the carrying values exceed the estimated recoverable amount, the assets or cash generating units are written down to their recoverable amount. The recoverable amount of property, plant and equipment is the greater of net selling price and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pretax discount rate that reflects current market assessments of time value of money and the risks specific to the asset. For an asset that does not generate largely independent cash inflows, the recoverable amount is determined for the cash-generating unit to which the asset belongs. Impairment losses are recognized in the income statement. If there is any indication at the balance sheet date that an impairment loss recognized for an asset in prior years may no longer exist or may have decreased, the Company estimates the recoverable amount of that asset and the carrying amount of the asset is adjusted to the recoverable amount resulting in the reversal of the impairment loss. Employee Benefits The Company has a defined benefit pension plan covering all regular full-time employees. The pension plan is tax-qualified, noncontributory and administered by a trustee. The cost of providing benefits under the plan is determined using the projected unit credit actuarial valuation method, which utilizes the normal cost, actuarial accrued liability and unfunded actuarial liability concepts. Past service cost is amortized and actuarial gains and losses are

- 20 -

recognized over the expected remaining working lives of the employees covered by the plan.

- 21 -

Borrowing Costs Borrowing costs are recognized as expenses in the period in which they are incurred, except to the extent that they are capitalized. For financial reporting purposes, borrowing costs that are attributable to the acquisition, construction or production of a qualifying asset (i.e., an asset that takes a substantial period of time to get ready for its intended use or sale) are capitalized as part of cost of such asset. The capitalization of borrowing costs commences when expenditures for the asset are being incurred, borrowing costs are being incurred and activities that are necessary to prepare the asset for its intended use or sale are in progress; capitalization ceases when substantially all such activities are complete. For income tax purposes, borrowing costs are treated as deductible expenses in the period in which they are incurred. Income Taxes13 Deferred income tax is provided, using the balance sheet liability method effective 2004 (see Note 3), on all temporary differences at the balance sheet date between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes. Under the balance sheet liability method, deferred tax liabilities are recognized for all taxable temporary differences: except where the deferred tax liability arises from goodwill amortization or the initial recognition of an asset or liability in a transaction that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss; and, in respect of taxable temporary differences associated with investments in subsidiaries, associates and interests in joint ventures, except where the timing of the reversal of temporary differences can be controlled and it is probable that the temporary difference will not reverse in the foreseeable future.

Deferred tax assets are recognized for all deductible temporary differences and the carryforward of unused tax losses and unused tax credits to the extent that it is probable that taxable profit will be available against which the deferred tax assets can be utilized:

SFAS 12/IAS 12, Income Taxes, provides the disclosure requirements for accounting for income taxes.

13

- 22 -

except where the deferred tax asset relating to the deductible temporary difference arises from the initial recognition of an asset or liability in a transaction that is not a business combination and, at the time of the transaction, affects neither the accounting profit nor taxable profit or loss; and, in respect of deductible temporary difference associated with investments in subsidiaries, associates and interests in joint ventures, deferred tax assets are only recognized to the extent that it is probable that the temporary difference will reverse in the foreseeable future and taxable profit will be available against which the temporary difference can be utilized.

- 23 -

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is probable that sufficient taxable profit will be available to allow all or part of the deferred income tax asset to be utilized. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted at the balance sheet date. 3. CHANGES IN ACCOUNTING POLICIES Income Taxes14 On January 1, 2004, the Company adopted the balance sheet liability method of accounting for income taxes under SFAS 12/IAS 12, Income Taxes, which became effective on January 1, 2004. Prior to 2004, the Company used the method of accounting for income taxes wherein deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences mainly between the taxable income and accounting income and tax consequences of net operating loss carryover. The Companys adoption of the new accounting standard did not result in material adjustments to the financial statements, except for the reclassification of deferred tax assets amounting to P10,584,259 as of December 31, 2003, previously shown among current assets in the 2003 balance sheet, to non-current assets in the 2004 balance sheet and disclosures of additional information required under the new accounting standard (see Note 19). Leases15 In 2003, the Company became a party to non-cancellable leases covering certain warehouses and offices with lease terms ranging from four to ten years. Annual rent payments amounted to P1,000,000 and P500,000, respectively, with annual escalation rates of 10%. The Company recognized rent expense in 2003 equivalent to the annual rental rates stipulated on the lease contracts. On January 1, 2004, the Company adopted the provisions of SFAS 17/IAS 17, Leases. Under SFAS 17/IAS 17, lease payments under an

When the presentation or classification of items in the balance sheet is amended, an entity is required to reclassify the comparative amounts and disclose the nature of the reclassification, the amount of the reclassification and the reason for the reclassification.

14 15

Refer to SFAS 17/IAS 17 for details.

- 24 -

operating lease should be recognized as expense in the statement of income on a straight-line basis over the lease term unless another systematic basis is representative of the time pattern of the users benefits. Retrospective application of SFAS 17/IAS 17 is encouraged but not required. The Company adopted SFAS 17/IAS 17 prospectively and, accordingly, recognized as expense the average rent computed on the remaining lease terms. This resulted in an increase in the rent expense of P394,714 in 2004.

- 25 -

As of January 1, 2004, the Company is a lessee under existing leases covering certain transportation equipment with lease terms ranging from three to five years which the Company classified and recognized as finance leases in previous years. The carrying amount of transportation equipment held under finance leases amounting to P1.5 million as of December 31, 2003 (see Notes 10 and 23) is deemed to have been properly determined, hence, the Companys application of SFAS 17/IAS 17 on these leases in 2004 did not result in any adjustment to the financial statements, except for the disclosure of additional information required under the new accounting standard.16 On December 29, 2004, the Company entered into a lease contract, the Company being the lessor, covering certain specialized equipment. The lease has been classified and recognized as a finance lease in accordance with SFAS 17/IAS 17 (see Note 23). Foreign Exchange Differences In 2003, the Company adopted SFAS 8A, Deferral of Foreign Exchange Differences, which became effective on January 1, 2003. SFAS 8A eliminated the deferral of foreign exchange differences previously allowed as an option in accounting for foreign exchange differences. As of January 1, 2003, the Company had unamortized balance of P3.4 million of deferred foreign currency losses arising from its longterm foreign currency-denominated debt. To comply with the requirements of SFAS 8A, the Company eliminated the balance of the deferred foreign exchange losses against retained earnings as of January 1, 2003, as allowed under the benchmark treatment. This resulted in an increase in net income of P762,500 in 2003 representing the scheduled amortization in 2003. Preoperating Expenses Prior to 2003, the Company capitalized expenses incurred prior to the start of its operations and amortized the capitalized amount over a period of five years. On January 1, 2003, the Company adopted SFAS 38/IAS 38. Under this new accounting standard, expenditures on start-up activities or start-up costs, including preopening and preoperating costs, are required to be recognized as expenses when incurred instead of being capitalized and amortized over a specified period.

SFAS 17/IAS 17 requires, among others, the disclosure of the net carrying amount for each class of asset under a finance lease as at the balance sheet date.

16

- 26 -

The Company adopted the benchmark treatment under SFAS 38/IAS 38 and eliminated the balance of preoperating expenses as of December 31, 2002 of P3.9 million as an adjustment to the balance of retained earnings as of January 1, 2003. This resulted in an increase in net income of P1.3 million in 2003 representing the scheduled amortization in 2003. For income tax purposes, preoperating expenses are continued to be amortized over a period of five years up to 2005.

- 27 -

4.

CASH AND CASH EQUIVALENTS Cash and cash equivalents were as follows as of December 31: 2004 Cash on hand and in banks Short-term placements P3,445,563 17,566,539 2003 P 4,883,365 17,763,883

P21,012,102 P22,647,248 Cash accounts with the banks generally earn interest at rates based on daily bank deposit rates. Short-term placements are made for varying periods of between 15 to 30 days and earn interest at the respective short-term placement rates ranging from 4.2% to 6.5% in 2004 and 5.4% to 7.9% in 2003. The balances of the Cash on Hand and in Banks as of December 31, 2004 and 2003 did not include an amount of about P2.5 million which is shown as part of the Other Long-term Investments account in the balance sheets. Such amount is not available for the general use of the Company in accordance with a restriction under a loan covenant (see Notes 9 and 13). 5. MARKETABLE EQUITY SECURITIES The details of this account are shown below: Current portfolio: Aggregate cost Valuation allowance 763,883 ) Aggregate market value 2004 2003

P7,107,965 P 6,350,965 ( 763,883) ( P6,344,082 P 5,587,082

Non-current portfolio (included in Other Long-term Investments) (see Note 9): Aggregate cost P65,026,072 P63,026,072 Valuation allowance ( 3,000,000) ( 2,757,000 ) Aggregate market value P62,026,072 P60,269,072

The Company recognized a net realized loss of P500,000 in 2004 (shown as part of Miscellaneous Other Operating Expenses) and a

- 28 -

net realized gain of P100,500 in 2003 (shown as part of Gain on Sale of Assets) from the sale of certain current marketable equity securities (see Note 18). In 2004 and 2003, the Company recognized the declines in value of non-current marketable equity securities of P243,000 and P882,000, respectively, which were charged to a separate component of equity.

- 29 -

6. TRADE AND OTHER RECEIVABLES This account is composed of the following: 2004 Current: Trade receivables Due from related parties Due from related parties (see Note 20) Advances to officers and employees (see Note 20) 1,125,008 Others 98,965 2003

P19,251,912 P26,140,079 1,945,985 2,874,992 1,905,008 108,000

23,210,905 30,239,044 Allowance for doubtful accounts (2,449,284 )( 2,449,284 ) P20,761,621 P27,789,760

Non-current: Loans to directors (see Note 20) 7,571,023 Others 127,489 Allowance for doubtful accounts 1,700,000 )

6,297,832P 27,489

6,325,321 7,698,512 (2,000,000 )( P 5,998,512

P4,325,321

The loan to directors are payable on various dates beginning 2004 with interests ranging from 6.5% to 9% per annum in both years (see Note 20).

- 30 -

7.

INVENTORIES Except for the portion of finished goods stated at net realizable value, inventories at the end of 2003 and 2002 were stated at cost.17 The details of inventories are shown below: 2004 Finished goods: At cost At net realizable value Work in progress Raw materials (see Note 20) 4,559,225 Materials in transit Inventories at cost and net realizable value P6,124,155 27,012,132 33,136,287 24,456,155 457,845 2003 P 8,439,245 31,640,369 40,079,614 27,686,672 2,100,029 1,845,457

P60,150,316 P74,170,968

Raw materials amounting to P3,215,400 and P4,125,890 in 2004 and 2003, respectively, have been released under trust receipt agreements (see Note 13). 8. PREPAYMENTS Prepayments includes the following: 2004 Prepaid insurance Prepaid rent Others P3,976,462 2,400,125 2,038,728 P8,415,315 9. LONG - TERM INVESTMENTS In addition to its investments in marketable equity securities (see Note 5), the Company also holds long-term investments consisting of investments in subsidiaries and associate, interest in a joint venture and other long-term investments.

It was assumed in this presentation that the rest of the inventory items are stated as cost. If all or more than one of the inventory items consist of items that are stated at cost and at net realizable value (NRV), present separate rows of items at cost and at NRV. Disclosure should also include reversal of write-down that is recognized as income in the period, if any, and the circumstances or events that led to the reversal of a write-down of inventories.

17

2003 P 4,178,925 3,929,378 2,038,728 P10,147,031

- 31 -

Investments in Subsidiaries and Associate The components of the carrying values of investments in subsidiaries and associate accounted for under the equity method are as follows: 2004 Acquisition costs: D Company 100% owned 88,299,200 S Corporation 100% owned 47,993,960 TXT Co. 40% owned P 2003 88,299,200 47,993,960 20,354,376 20,354,376

156,647,536 156,647,536 Accumulated equity in net earnings: Balance at beginning of year 21,553,858 19,155,378 Equity in net earnings for the year (net of goodwill amortizationsee below) 2,112,521 2,848,480 Dividends received ( 450,000 )( 450,000 ) Balance at end of year 178,201,394 23,216,379 P179,863,915 21,553,858 P

A reconciliation18 of goodwill, or the difference between the carrying value of the Companys investment in D Company and the amount of its underlying equity in net assets of the subsidiary (included in the carrying amount of the investment), is shown below: 2004 2003

Goodwill at beginning of year, net of amortization P6,900,000 P 8,625,000 Amortization during the year (charged against equity in net earnings of subsidiary see above)19 ( 1,725,000 )( 1,725,000 ) Goodwill at end of year, net of amortization P5,175,000 P 6,900,000

SFAS 22/IAS 22 requires the disclosure of a reconciliation showing the gross carrying amounts and accumulated amortization (and impairment, if any) of goodwill at the beginning and at the end of the year and the changes during the year.

18

SFAS 22/IAS 22 also requires disclosure of the line item of the income statement in which the amortization of goodwill is included.

19

- 32 -

Goodwill at gross amount Accumulated amortization 18,975,000 ) Net carrying amount

P25,875,000 P25,875,000 ( 20,700,000 )( P5,175,000 P 6,900,000

- 33 -

Interest in Joint Venture and Other Long-Term Investments The details of these accounts are shown below: 2004 Interest in joint venture: Interest in Extinguishers Limited, a 50% owned joint venture at equity Acquisition cost P7,577,631 Accumulated equity in net earnings: Balance at beginning of year 178,778 Equity in net earnings for the year 629,666 808,444 Balance at end of year 2003

P 7,577,631 808,444 2,399,830

3,208,274 8,386,075 60,269,072 2,500,000 4,800,000

10,785,905 Other long-term investments: Non-current marketable equity securities (see Note 5) 62,026,072 Restricted cash in banks (see Note 4) 2,500,000 Others - at cost 6,557,000

P78,354,977 P75,955,147 Included in non-marketable equity securities are preferred shares obtained by the Company upon conversion of part of its deposits amounting to P4.8 million in a closed bank into preferred shares of the bank that acquired the closed bank. The Companys share in the assets, liabilities, revenues and expenses of the joint venture as of December 31 and for the years then ended are as follows20: 2004 P Current assets 10,462,500 Non-current assets Current liabilities 12,585,002 Non-current liabilities 16,924,623 ) ) P 2003 15,150,158

37,001,589 27,433,200 52,151,747 35,895,700 ( 20,154,125 )( ( 21,211,717 )(

SFAS 31/IAS 31 requires a venturer which reports its interests in jointly controlled entities using the line-by-line reporting format for proportionate consolidation or the equity method to disclose the aggregate amounts of each of current assets, long-term assets, current liabilities, long-term liabilities, income and expenses related to its interests in joint ventures.

20

- 34 -

Share in the Underlying Net Assets 8,386,075

10,785,905

Revenues 97,332,581 Costs and operating expenses 95,301,400 ) Income before tax Tax expense Share in Net Income

P107,122,120 (101,823,502 )

P (

5,298,618 2,031,181 (2,898,788) ( 1,401,515) P2,399,830 P 629,666

- 35 -

10. PROPERTY, PLANT AND EQUIPMENT21 A reconciliation22 of the carrying amounts at the beginning and end of 2004 and the gross carrying amounts and the accumulated depreciation of property, plant and equipment are shown below:

Machinery Construction in Equipment Office Furniture, Buildings and Fixtures and Other and Equipment Improvements Equipment Land Transportation Progress Total

Balance at January 1, 2004, net of accumulated depreciation and impairment P 32,619,984 P 15,763,521 80,331,153 Additions 3,458,787 16,344,440 Depreciation charge for the year ( 3,217,080) ( 2,667,891 ) Impairment loss ( 1,200,000 ) 1,200,000 ) Balance at December 31, 2004, net of accumulated depreciation and impairment P31,661,691 83,462,132 January 1, 2004 Cost 138,239,042 Accumulated depreciation ( 55,907,889 Accumulated impairment loss P 68,934,997 ( ) ( 2,000,000 ) P 15,763,521

P 6,609,545 3,267,444 ( 3,461,233 ) ( -

P 6,881,975 3,703,831 2,667,257) -

P 7,540,808 4,548,781 -

P10,915,320 -

P 1,365,597 ( 12,013,461 ) (

P 16,363,074

P 6,852,143

P 8,763,499

P 7,540,808

P12,280,917

21,724,318 )(

P 16,129,672 5,960,797 P 6,609,545 )(

P 12,993,927 9,520,127 P 6,881,975 )(

P 7,540,808 6,111,952 ) P 7,540,808

P10,915,320 -

34,315,013

( 2,000,000 ) P

Net carrying amount P32,619,984 80,331,153 December 31, 2004 Cost 154,583,482 Accumulated depreciation ( 67,921,350 Accumulated impairment loss P 72,393,784 ( ) ( 3,200,000 )

P10,915,320

24,991,762 )(

P 19,833,503 8,628,688 P 6,852,143 )(

P 17,542,708 12,981,360 )( P 8,763,499

P 7,540,808 8,779,209 ) P 7,540,808

P12,280,917 -

37,532,093 -

( 3,200,000 ) P

Net carrying amount P31,661,691 83,462,132

P 16,363,074

P10,915,320

Land and building and improvements with a total carrying value of about P60 million are used as collaterals for certain interest-bearing loans and borrowings (see Note 13). Construction in progress pertains to accumulated costs incurred on the new building being constructed as part of the Companys expansion program, including borrowing costs capitalized during the period of about P3.8 million in 2004 and P2.8 million in 2003, representing the actual borrowing costs incurred on loans obtained to fund the construction project.

Covers disclosures when property, plant and equipment are carried at cost (benchmark treatment) subsequent to initial recognition.

21

SFAS 16/IAS 16 requires the disclosure, for each class of property, plant and equipment, of a reconciliation showing the gross carrying amounts and accumulated depreciation (and impairment, if any) of property, plant and equipment at the beginning and at the end of the year and the changes during the year.

22

- 36 -

In 2004 and 2003, the Company recognized impairment losses of P3.2 million and P2.0 million, respectively, to write-down to recoverable amount certain assets following a reorganization within the electronics segment. The recoverable amount was based on value in use and was determined at the cash-generating unit level. In determining the value in use for the cash-generating unit, the cash flows were discounted at a nominal rate of 12.1% in 2004 and 12.3% in 2002 on a pre-tax basis.

- 37 -

As of December 31, 2004 and 2003, the carrying amount of transportation equipment held under finance leases amounted to P1.5 million and P1.6 million, respectively (see Note 23).23 11. INTANGIBLE ASSETS A reconciliation24 of the carrying amounts at the beginning and end of 2004 and the gross carrying amounts and the accumulated amortization of intangible assets (other than goodwill see Note 9) are shown below: Deferred Licenses and Development Franchises Costs Total Balance at January 1, 2004, net of accumulated amortization P2,400,000 P1,500,000 P3,900,000 Amortization expense for the year (see Note 18)25 (1,100,000 )( 750,000 )( 1,850,000 ) Balance at December 31, 2004, net of accumulated amortization P1,300,000 P750,000 P2,050,000 January 1, 2004: Cost P8,500,000 P3,750,000 P12,250,000 Accumulated amortization (6,100,000 )( 2,250,000)( 8,350,000 ) Net carrying amount P2,400,000 P1,500,000 P3,900,000 December 31, 2004: Cost P8,500,000 P3,750,000 P12,250,000 Accumulated amortization (7,200,000 )( 3,000,000)( 10,200,000 )

SFAS 17/IAS 17 requires, among others, the disclosure of the net carrying amount for each class of asset under a finance lease as at the balance sheet date.

23

SFAS 38/IAS 38 requires the disclosure, for each class of intangible assets, of a reconciliation showing the gross carrying amounts and the accumulated amortization (and impairment, if any) of intangible assets at the beginning and end of the year and the changes during the year.

24

SFAS 38/IAS 38 also requires disclosure of the line item of the income statement in which the amortization of intangible assets is included.

25

- 38 -

Net carrying amount P1,300,000 P750,000

P2,050,000

- 39 -

12. OTHER ASSETS The composition of this account as of December 31 is shown below: 2004 Current: Input value-added tax Miscellaneous P1,440,283 1,305,217 P2,745,500 Non-current: Abandoned property and equipment - at net realizable value P 28,750,062 Miscellaneous 1,796,966 2003 P 5,998,238 2,921,217 P 8,919,455

28,750,062 1,924,623

P30,547,028 P30,674,685 13. INTEREST-BEARING LOANS AND BORROWINGS26 At December 31, the short-term and long-term interest-bearing loans and borrowings were as follows: 2004 2003 Current: Bank loans P10,000,000 P12,000,000 Acceptances payable and liabilities under trust receipts (see Note 7) 4,000,000 5,000,000 Obligations under finance leases (see Note 23) 180,000 192,700 Others 2,472,700 2,146,633 19,339,333 P16,652,700 P

Non-current: Long-term debt P53,600,000 40,530,000 Obligations under finance leases (see Note 23) 1,400,000 42,000,000 P55,000,000

P 1,470,000 P

Separately disclose/indicate if interest-bearing loans and borrowings include items denominated in foreign currency.

26

- 40 -

The bank loans represent secured and unsecured loans from a local commercial bank. The loans bear annual interest rates ranging from 10.75% to 16.5% in both years, subject to monthly repricing.

- 41 -

The long-term debt represents the US$760,000 loan obtained by the Company on December 2000 from a local bank. The debt is payable up to 2006 and bears interest at an annual average rate of 8% in 2004 and 9% in 2003. On December 29, 2003, the Company obtained an additional loan from the same bank. The new loan, which is payable up to 2010, bears interest at 10% per annum. Certain Company assets and properties are used as collaterals for the secured short-term bank loans and the long-term debt (see Notes 4 and 10). 14. TRADE AND OTHER PAYABLES This account consists of: Trade (see Note 20) Accrued expenses Others 2004 2003

P40,661,477 P44,140,079 15,542,050 10,112,534 1,781,125 2,670,300 P57,984,652 P56,922,913

15.

PROVISIONS The changes in each class of provisions during the year are as follows27:

Product Warranty Provision for Retirement Benefits (Note 16)

Total

Balance at January 1, 2004 P11,438,511 P 5,634,001 Additions (deductions) during the year: Additional provisions 4,379,620 916,773 Amounts used ( 5,456,030) 5,456,030 ) Unused amount reversed ( 750,654) Balance at December 31, 2004 December 31, 2004 Current Non-current P10,362,101 P 8,511,981 1,850,120 P10,362,101 December 31, 2003 Current Non-current

27

P17,072,512 5,296,393 ( ( 750,654)

P5,800,120 P 5,500,120 300,000 P5,800,120 P 5,389,113 244,888

P16,162,221 P14,012,101 2,150,120 P16,162,221 P15,008,012 2,064,500

P 9,618,899 1,819,612

SFAS 37/IAS 37 requires disclosure, for each class of provisions, of the carrying amount at the beginning and end of year and the changes during the year.

- 42 P11,438,511 P 5,634,001 P17,072,512

- 43 -

A provision is recognized for expected warranty claims on products sold during the last three years, based on the Companys past experience of the level of repairs and returns. It is expected that a significant portion of the provision will be incurred in 2005. In 2003, based on current sales level and current information about warranty claims experience, management reversed to income about P1.9 million of the provision for product warranty. The amount reversed is shown as part of Other Revenues in the 2003 statement of income (see Note 18). 16. COST OF GOODS SOLD AND COST OF SERVICES The details of these accounts are shown below: 2004 Cost of goods sold: Finished goods at beginning of year 35,613,236 2003 P40,079,614

Cost of goods manufactured Raw materials at beginning year 4,559,225 10,503,928 Work-in-process at beginning year 27,686,672 24,510,069 Net purchases during the year 25,051,000 31,802,726 Direct labor 20,438,854 21,323,984 Manufacturing overhead (see Note 23) 9,609,714 11,289,168 Raw materials at end of year ( 2,100,029 )( 4,559,225 ) Work-in-process at end of year ( 24,456,155)( 27,686,672) 60,789,281 67,183,977 ( Finished goods at end of year 40,079,614) ( 33,136,287) P

62,717,599

P67,732,608

Cost of services: Direct costs and expenses Salaries, wages and benefits P6,512,500 P 6,319,624 Materials, supplies and facilities 1,447,125 1,247,922 Outside services 754,125 801,079 Depreciation 305,120 267,026 Rental (see Notes 3 and 23) 180,120 178,019

- 44 -

Others

75,725 P9,274,715

87,210 P 8,900,880

- 45 -

17.

EMPLOYEE BENEFITS The Company maintains a tax-qualified, noncontributory retirement plan that is being administered by a trustee covering all regular fulltime employees. Total retirement benefit expense shown as part of Salaries and Employees Benefits in the statements of income amounted to about P2.2 million in 2004 and P2.0 million in 2003. Based on the latest actuarial valuation report as of January 1, 2003, the fair value of the plan assets exceeds the actuarial present value of retirement benefits, based on the assumed rate of return of 9%, by about P1.4 million. Actuarial valuations are made every two years to update the retirement benefit costs and the amount of contributions. The annual contribution to the retirement plan covers the current service cost and the amortization of the past service cost.

18.

OTHER REVENUES AND OTHER OPERATING EXPENSES These accounts are composed of the following: 2004 Other revenues: Interest P 572,150 Dividends 450,000 Reversal of provision (see Note 15) 1,880,000 Gain on sale of assets (see Note 5) 325,000 P1,022,150 Other operating expenses: Advertising and promotions (see Note 20) P1,975,811 Amortization of intangible assets (see Note 11) 1,850,000 Taxes and licenses 956,788 Insurance 775,450 Communications 489,154 Security and janitorial 410,150 Transportation and travel 885,221 Representation and entertainment 920,145 Supplies 245,021 Rental (Notes 3 and 23) 206,981 2003 P 462,094 450,000

P 3,117,094

P 2,174,557 1,850,000 1,995,358 980,132 900,978 405,309 354,018 300,160 685,302 319,880

- 46 -

Repairs and maintenance 585,315 Miscellaneous (see Note 5) 2,244,823 P9,865,562

150,012 2,147,017 P13,947,020

- 47 -

19.

INCOME TAXES The major components of tax expense for the years ended December 31 are as follows: 2004 Statement of income: Current tax:28/29 At 32% At 20% 10,320,539 Deferred tax relating to origination and reversal of temporary differences30 710,715 Tax expense reported in statement of income 11,449,273 Statement of changes in equity: Deferred tax arising from adoption of new accounting standards (see Notes 3 and 21)31 2003

P12,087,409 P10,205,016 143,038 115,523 12,230,447

1,953,235

P10,277,212

P 1,582,966

In the ITR, only the current tax at 32% will be shown in line 22B of the ITR (or line 22A if PEZA or BOI registered); hence, the income item subjected to 20% or 7.5% (final tax) should be shown as a reconciling item in Section E of the ITR. This is because, for tax purposes, the final tax is reported using a different BIR form.

28

An alternative presentation is to show the total current tax as one line item (at 32% plus at 20%) and just disclose as part of the note the amount of the 20% final tax (e.g., the current income tax includes final tax on interest income amounting to P143,038 and P115,523 in 2004 and 2003, respectively).

29

Utilization of unused NOLCO, if any, should be presented as a separate line item under deferred tax.

30

With regard to the adoption of SFAS 8A, the tax effect of the adjustment to equity (retained earnings) arising from the unamortized deferred foreign exchange losses and the increase in the related debt arising from restatement (which gave rise to such deferred foreign exchange losses) will offset each other (since in this Illustrative FS, it is assumed that the amortization period and the debt repayment period are the same). Hence, no amount of the income tax expense is allocated to such adjustment.

31

If this is not the case, the amount allocated should also be disclosed (refer to SFAS 23).

- 48 -

The reconciliation of tax on pretax income computed at the applicable statutory rates to tax expense attributable to continuing operations is as follows:32/ 33 2004 2003

Tax on pretax income: At 32% P10,531,219 P 9,179,655 At 20% 143,038 115,523 Tax effects of: Nondeductible expenses 1,190,907 2,993,083 Dividend income not subject to tax ( 144,000 )( 144,000) Equity in income of subsidiaries, associate and joint venture net of goodwill amortization ( 1,443,952 )( 1,113,007 ) Tax expense reported in statement of income

32

P10,277,212 P11,031,254

An alternative presentation of reconciliation is as follows:

2004

2003

Tax on pretax income at 32% P 10,760,080 P 9,364,492 Adjustment for income subjected to lower tax rate * ( 85,823 )( 69,314 ) Tax effects of: Nondeductible expenses 1,190,907 2,993,083 Dividend income not subject to tax ( 144,000 )( 144,000) Equity in income of subsidiaries, associate and joint venture net of goodwill amortization ( 1,443,952 )( 1,113,007 ) Tax expense reported in statement of income P10,277,212 P11,031,254

* Computed based on the difference between the statutory income tax of 32% and the final tax rate (e.g., 32%-20% = 12% x gross interest income) The reconciliation of the tax expense and pretax income may be presented in a numerical reconciliation between the average effective tax rate and applicable tax rate, disclosing also the basis on which the applicable tax rate is computed.

33

- 49 -

- 50 -

The net deferred tax assets as of December 31 related to the following:

Balance Sheets 2004 2003 Statements of Income 2004 2003

Deferred tax assets: 34 Provisions P5,171,911 P 5,463,204 P291,293 P 201,901 Write-down of inventories to net realizable values 3,530,1471,282,438 (2,247,709) 1,270,808 Unamortized past service cost 1,805,162 955,612 ( 849,550) ( 849,550) Allowance for doubtful accounts 1,423,7701,327,771 ( 95,999) ( 100,190) Impairment loss on property, plant and equipment 1,024,000 640,000 ( 384,000) Unamortized portion of preoperating expenses (for tax purposes) 418,219 836,438 418,219 Unrealized foreign exchange losses 393,640 1,729,052 1,335,412 187,746 Accrued rental 126,308 ( 126,308) Deferred tax liability: Undepreciated capitalized borrowing costs ) Deferred Tax Expense (Income) 710,715 Net Deferred Tax Assets (P1,953,235 P12,537,494 P 10,584,259 ) P

1,355,663)

( 1,650,256

)(294,593 )( -

The NOLCO of the Company which arose in 2001 amounting to P21,254,493 was fully utilized in 2003 (P7,547,266) and 2002 (P13,707,227) as deduction from the respective years taxable income.35

Under SFAS 12/IAS12, unused tax credits pertaining to income taxes recoverable in future periods should be included as part of deferred tax assets. Accordingly, MCIT and creditable withholding taxes should be shown under deferred tax assets.

34

If there are several layers of NOLCO and MCIT amounts (i.e., NOLCO incurred and MCIT paid in different years), disclose in a tabular form the necessary information such as amount incurred in each year, prescription period, amount utilized and amount expired. The following is a sample presentation for NOLCO (assuming a different set figures):

35

Year Until 2004 2007 2003 2006

Original Amount P

Applied in Previous Year P -

Applied in Expired Current Year P P -

Remaining Balance P

Valid Balance 1,200,521 120,215

1,200,521 120,215

- 51 -

The Company is subject to the minimum corporate income tax (MCIT) which is computed at 2% of gross income, as defined under the tax regulations. In 2002, the Company recorded MCIT amounting to P758,555 which was included in the Other Current AssetsMiscellaneous account as of December 31, 2002 (see Note 12). The total MCIT was applied against the regular income tax in 2003. No deferred tax liability has been recognized on the accumulated equity in net earnings of subsidiaries, associates or joint ventures (see Note 9). The Company has no liability for tax should the amounts be declared as dividends since dividend income received from domestic corporations is not subject to income tax. Also, there are no tax consequences attaching to the payment of dividends by the Company to its parent company, which is a domestic entity.36 No deferred tax asset was also recognized on the net unrealized losses on non-current marketable equity securities of P243,000 and P882,000 as of December 31, 2004 and 2003 presented in the statement of changes in equity.37 20. RELATED PARTY TRANSACTIONS38

2002 2005 2001 2004 P 3,727,600 204,736 5,253,072 P 1,343,000 160,353 1,503,353 P 2,184,500 28,045 2,212,545 P 16,338 16,338 P 1,520,836 200,100

Under SFAS 12/IAS 12, disclosure should be made of the aggregate temporary differences associated with investments in subsidiaries, branches and associates and interests in joint ventures for which deferred tax liabilities have not been recognized, as well as the amount of income tax consequences of dividends to stockholders.

36

SFAS 12/IAS 12 also requires disclosure of the amount (and expiry date, if any) of deductible temporary differences, unused tax losses and unused tax credits for which no deferred tax asset is recognized in the balance sheet.

37

Under SFAS 24/IAS 24, no disclosure of related party transactions is required (a) in consolidated financial statements in respect of intra-group transactions; (b) in parent company FS when they are made available or published with the consolidated FS; (c) in FS of a wholly-owned subsidiary if its parent is incorporated in the same country and provides consolidated FS in that country; and (d) in FS of state-controlled enterprises of transactions with other state-controlled enterprises.

38

While SFAS 24/IAS 24 does not require the disclosure of related party transactions in the above situations, we should encourage clients to provide the relevant disclosures in the FS of individual entities in the group. This is to avoid issues being raised over nondisclosure of such transactions as the SEC and other regulatory agencies may be doing the reviews of FS on individual entity basis not on the basis of group reporting.

- 52 -

The significant transactions of the Company in the normal course of business with related parties are described below: a. The Company obtains from and grants advances to its subsidiaries and associate for working capital requirements and other purposes. The net advances to such entities for working capital requirements amounted to P664,144 and P2,590,000 in 2004 and 2003, respectively. Outstanding receivables arising from these transactions are shown as part of Due from Related Parties (see Note 6). On the other hand, net advances from these related parties in 2004 and 2003 for the Companys construction project amounted to P2,000,000 and P5,500,000, respectively, and are shown under the Due to Related Parties account in the balance sheets. b. The Company buys raw materials from its subsidiaries at normal market prices. Purchases totaled P53,052,321 in 2004 and P63,988,012 in 2003. Outstanding liabilities amounted to P5,032,010 and P3,902,145 as of December 31, 2004 and 2003, respectively, and are shown as part of Trade and Other Payables account in the balance sheets (see Note 14). c. The Company also purchases raw materials from Integrated Industries Limited, of which the wife of the Companys President is a director and a controlling stockholder. Purchases at normal market prices totaled P2,000,000 in 2004 and P500,000 in 2003. Outstanding liabilities amounted to P1,000,000 and P250,000 as of December 31, 2004 and 2003, respectively, and are included in Trade and Other Payables account in the balance sheets (see Note 14). d. In 2002, the Company entered into a marketing and distribution agreement with TXT Co., an associate, for the exclusive marketing and distribution of the Companys products. Charges arising from this agreement amounted to P2,000,000 in 2004 and P1,200,000 in 2003 and are presented as part of Advertising and Promotions (see Note 18). There are no outstanding liabilities arising from these transactions. e. At the Annual General Meeting held on May 26, 2003, the Board of Directors approved a non-interest-bearing loan up to a maximum of P1,000,000 to be made as necessary to the Companys Technical Director to enable him to meet expenditure to be incurred at production seminars and tours that he will attend in the United States. During the year, P750,000 was advanced to him for this purpose and at December 31, 2003, the whole amount was outstanding and is included in Advances to Officers and Employees account (see Note 6).

An alternative format for disclosure of related party transactions is a tabular presentation where the relevant data and balances (e.g., sales, purchases, receivables, payables) are presented in columnar format. Additional information is presented in narrative.

- 53 -

f.

The executive members of the Board of Directors received remuneration totaling P1,950,000 and P1,700,000 for the years ended December 31, 2004 and 2003, respectively, while the nonexecutive members received fees totaling P554,000 and 476,900, respectively, for the same years. In addition, during 2003, the Company paid P590,890 to an executive director who retired. All charges arising from these transactions are included in the Salaries and Employees Benefits account in the statements of income.

g. The Company also grants interest-bearing loans to its directors. In 2004, loans made to directors amounted to P769,138 and P1,230,000 in 2003. The outstanding receivables arising from these transactions are shown in Loans to Directors (see Note 6).

- 54 -

21.

CAPITAL STOCK AND RETAINED EARNINGS Capital Stock Capital stock consists of:

Shares 2004 2003 Preferred 10% cumulative, non-participating , convertible into common shares P100 par value Authorized, issued and outstanding 100,000 100,000 10,000,000 Common shares P10 par value Authorized 35,000,000 shares Issued: Balance, beginning of year 10,000,000 79,200,000 Issued during the year 2,080,000 Balance, end of year 10,000,000 100,000,000 Subscribed: Balance, beginning of year 1,900,000 12,000,000 Additions during the year 700,000 Balance, end of year 1,900,000 19,000,000 Subscriptions receivable: Balance, beginning of year 1,200,000 ) Additions during the year Balance, end of year 3,750,000 ) Amount 2004 2003

P10,000,000

7,920,000 100,000,000 20,800,000 10,000,000 100,000,000

1,200,000 19,000,000 7,000,000 1,900,000 19,000,000

(3,750,000 )

(2,550,000) (3,750,000 ) (

P125,250,000 125,250,000

Each preferred share is convertible to ten common shares at the option of the Company. Retained Earnings The balance of Retained Earnings includes the Companys accumulated equity in income of subsidiaries, associate and joint venture of P26,424,653 and P22,362,302 in 2004 and 2003, respectively, which are not currently available for dividend declaration (see Note 9). On June 30, 2004 and 2003, the Board of Directors approved the declaration of cash dividends of P1.14 per common share (or a total

- 55 -

of P13,554,600) and P1.20 per common share (or a total of P12,342,994), respectively, payable to stockholders of record as of July 15, 2004 and 2003, respectively. The dividends were paid within their respective year of declaration and approval. The aggregate amount of cumulative preferred dividends in arrears as of December 31, 2004 and 2003 amounted to P4 million and P3 million, respectively, or P4 per share and P3 per share, respectively.

- 56 -

A summary of the adjustments to the balances of retained earnings as of January 1, 2003, net of tax effects of P1.6 million in 2003, arising from the Companys adoption in 2003 of new accounting standards (see Note 3) is shown below: Elimination of unamortized deferred foreign exchange losses P 2,280,625 Elimination of unamortized preoperating expenses 2,666,144 P 4,946,769 22. EVENTS AFTER THE BALANCE SHEET DATE39 On January 28, 2005, the Companys distribution warehouse was severely damaged by fire. Loss of inventory was limited, but there was and continues to be, a significant disruption in the flow of distribution. It is expected that insurance proceeds will fall short of costs or rebuilding and loss of inventories by about P1.2 million. The loss will be taken up in 2005. 23. COMMITMENTS AND CONTINGENCIES40 The following are the significant commitments and contingencies involving the Company: Operating Lease Commitments Company as Lessee The Company is a lessee under non-cancellable operating leases covering certain warehouse and offices. The leases have terms ranging from four to ten years, with renewal options, and include annual escalation rates of 10%. The future minimum rentals payable under these non-cancellable operating leases as of December 31 are as follows:41 2004

39

2003

SFAS 10/IAS 10 requires that when non-adjusting events after the balance sheet date are of such importance that non-disclosure would affect the ability of the users of the financial statements to make proper evaluations and decisions, an enterprise should disclose the following information for each significant category of non-adjusting event after the balance sheet date: (a) the nature of the event; and (b) an estimate of its financial effect, or a statement that such an estimate cannot be made. Under SFAS 37/IAS 37, the disclosure for each class of contingent liability should include a brief description of the nature of the contingent liability and, where applicable: (a) an estimate of its financial effect; (b) an indication of the uncertainties relating to the amount or timing of any outflow; and (c) the possibility of reimbursement.

40

SFAS 17/IAS 17, Leases, requires the disclosure of information on future minimum rental payable for more than five years.

41

- 57 -

Within one year P1,815,000 After one year but not more than five years 6,220,610 More than five years 6,450,254

P 1,650,000 6,177,171 8,221,815

P14,442,425 P16,092,425

- 58 -

Total rentals from these operating leases amounted to P2.0 million in 2004 and P1.5 million in 2003, of which the major portion was charged to manufacturing overhead (see Notes 16 and 18). Finance Lease Commitments Company as Lessee 42 The Company has finance leases covering certain transportation equipment with terms ranging from three to six years. The leases provide options to purchase the transportation equipment at the end of the lease terms. Future minimum lease payments (MLP) under the finance leases together with the present value (PV) of the net minimum lease payments (NMLP) are as follows:

2004 Future PV of MLP NMLP 2003 Future PV MLP of NMLP

Within one year P210,000 180,000 P 215,000 P 192,700 After one year but not more than five years 1,034,000 900,000 1,110,000 820,000 More than five years 700,000 500,000 800,000 650,000 Total MLP 1,944,000 1,580,000 2,125,000 1,662,700 Amounts representing finance charges ( 364,000 ) ( 462,300 Present value of minimum lease payments 1,662,700 P 1,662,700 P 1,580,000 P1,580,000 P

The liabilities relating to the finance leases are shown as part of Interest-bearing Loans and Borrowings (see Note 13). Finance Lease Company as Lessor On December 29, 2004, the Company entered into a finance lease covering certain specialized equipment with a lease term of six years. Future minimum lease payments receivable (MLPR) under this finance lease together with the PV of minimum lease payments receivable are as follows: Future MLPR Within one year After one year but not more than five years More than five years Total MLPR Amounts representing

42

PV of MLP P 943,333 3,773,332 943,335 5,660,000

P1,108,901 3,990,091 1,209,019 6,308,011

SFAS 17/IAS 17, Leases, requires a reconciliation between the total of minimum lease payments at the balance sheet date, and their present value. In addition, an enterprise should disclose the total of the minimum lease payments at the balance sheet date, their present value, for each of the periods disclosed above.

- 59 -

unearned finance income

648,011

P5,660,000

P 5,660,000

The net investment relating to this finance lease is presented under the Receivable from a Finance Lease accounts (current and noncurrent) in the balance sheet (see Note 13).

- 60 -

Legal Claims Litigation is in process against the Company relating to a dispute with a competitor who alleges that the Company has infringed patents and seeks damages amounting to P50.0 million. The legal counsel has advised that it is probable that the Company will not be found liable. Hence, no provision for the claim has been made in the financial statements as of December 31, 2004. Capital Commitments As of December 31, 2004, the Company has commitments of about P10.5 million for the acquisition of new plant and machinery. Others As of December 31, 2004, the Company has unused letters of credit amounting to P35.0 million. The Philippines continues to experience economic difficulties relating to currency fluctuations, volatile stock markets and slowdown in growth. Management is of the opinion that losses, if any, from these events and conditions will not have material effects on the Companys financial statements.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Form45 1Documento1 paginaForm45 1Rheneir MoraNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Form45 3Documento2 pagineForm45 3Rheneir MoraNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Form 45 TemplateDocumento3 pagineForm 45 TemplateELNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Form45 3Documento2 pagineForm45 3Rheneir MoraNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- RDO No. 83 - Talisay City, CebuDocumento619 pagineRDO No. 83 - Talisay City, CebuNiki Daymiel MalazarteNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Cit U Bsa ProspectusDocumento4 pagineCit U Bsa ProspectusRheneir MoraNessuna valutazione finora

- RDO No. 80 - Mandaue City, CebuDocumento798 pagineRDO No. 80 - Mandaue City, CebuCecil GubaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- RDO No. 47 - East MakatiDocumento83 pagineRDO No. 47 - East MakatiRheneir MoraNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Sci PoDocumento1 paginaSci PoRheneir MoraNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- REVISED ZONAL VALUES FOR MAASIN CITY AND NEARBY MUNICIPALITIESDocumento465 pagineREVISED ZONAL VALUES FOR MAASIN CITY AND NEARBY MUNICIPALITIESRamonbeulaneo Rances100% (1)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Cit U Bsais ProspectusDocumento5 pagineCit U Bsais ProspectusAtty. Rheneir MoraNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Cit U Bsma ProspectusDocumento4 pagineCit U Bsma ProspectusRheneir MoraNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Attendance SheetDocumento4 pagineAttendance SheetRheneir MoraNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Tax Alert Jan 16 To Feb 15, 2020 FinalDocumento11 pagineTax Alert Jan 16 To Feb 15, 2020 FinalRheneir MoraNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Creative Solutions + Sound Business Judgment: Success ManagementDocumento4 pagineCreative Solutions + Sound Business Judgment: Success ManagementRheneir MoraNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Collaborative and RevenueDocumento7 pagineCollaborative and RevenueRheneir MoraNessuna valutazione finora

- Tax Alert (April 2020) FinalDocumento30 pagineTax Alert (April 2020) FinalRheneir MoraNessuna valutazione finora

- 49 Insights June 2022V2Documento24 pagine49 Insights June 2022V2Rheneir MoraNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- October 2020 Tax AlertDocumento5 pagineOctober 2020 Tax AlertRheneir MoraNessuna valutazione finora