Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NI Num 2011

Caricato da

Sanjana BhattTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

NI Num 2011

Caricato da

Sanjana BhattCopyright:

Formati disponibili

ecolokesh@yahoo.co.

in

98100-42777

Ques.1 Calculate GVAmp and NVAfc

Set 1

5000

Sales

500

Increase in stock

150

Depreciation

400

Indirect tax

100

Subsidies

1000

Purchase of raw material

400

Import of machine

100

Closing stock

NVAfc 4050

GVAmp 4500

Set 2

6000

400

250

250

50

2000

500

200

3950

4400

Set 3

5000

600

200

500

50

1500

630

358

3450

4100

Set 4

2500

200

300

800

400

800

600

50

1200

1900

Set 5

5500

300

500

600

200

2200

520

60

2700

3600

Set 6

7500

400

200

200

100

3500

560

50

4100

4400

Set 7

8000

800

700

400

150

2500

620

50

5350

6300

Set 2

600

5000

500

1500

300

1500

502

2000

3200

3400

Set 3

300

6000

100

1500

500

2500

652

1800

3900

3500

Set 4

500

8000

600

1900

800

2000

250

2000

5800

5600

Set 5

300

5000

500

2500

200

3000

600

2700

1600

1900

Set 6

300

5000

700

200

200

1500

500

500

3000

3500

Set 7

200

3000

600

500

300

1000

500

700

1700

2000

Set 2

2000

500

500

200

40

20

1820

1300

Set 3

5000

100

1000

300

60

30

3630

3700

Set 4

2000

600

700

400

60

50

310

900

Set 5

2000

500

500

200

50

40

750

1300

Set 6

3000

700

900

150

40

60

1230

1950

Set 7

1000

600

300

120

60

60

-20

580

Set 2

6500

600

1500

2000

200

500

800

3000

4400

7900

Set 3

7000

300

2000

2500

500

560

600

2300

6400

8100

Set 4

5000

400

1700

2200

300

610

600

2000

4300

6900

Set 5

8000

500

4100

3500

300

700

700

4500

7100

11100

Set 6

9000

500

1600

4000

500

505

500

2000

8100

13000

Set 7

6000

800

5000

2500

250

500

700

5200

5000

8050

Ques.2 Calculate GVAmp and NVAfc

Set 1

500

4000

200

1000

200

1000

250

800

NVAfc 2300

GVAmp 2300

Import of raw material

Sales

Depreciation

Opening stock

Subsidies

Purchase of raw material

Import of machine

Closing stock

Ques.3 Calculate GVAmp and NVAfc

Set 1

5000

200

700

1000

50

60

NVAfc 3090

GVAmp 3300

Sales

Excise duty

Intermediate consumption

Decrease in stock

Subsidies

Depreciation

Ques.4 Calculate sales and NVAfc

Set 1

5000

GVAmp

200

Deprecation

800

Subsidies

1000

Purchase of raw material

200

Import of raw material

410

Import of machine

500

Change in stock

1000

Indirect tax

NVAfc 4600

Sales 5700

ecolokesh@yahoo.co.in

98100-42777

Ques.5 Calculate sales and NVAfc

Set 1

6000

Compensation of employee

500

Decrease in stock

1000

Purchase of raw material

100

Consumption of fixed capital

1000

Operating surplus

200

Net indirect taxes

100

Import of machine

400

Rent

200

Subsidies

1200

Mixed income

Sales 10000

NVAfc 8200

Set 2

5000

1000

1500

400

1500

600

200

300

100

2000

12000

8500

Set 3

9000

600

500

200

500

200

150

250

500

1500

12500

11000

Set 4

6500

2000

1000

200

1000

500

400

200

200

2000

13200

9500

Set 5

8500

500

2500

1000

2500

500

200

120

400

2500

18000

13500

Set 6

8000

800

1000

100

1000

400

250

400

500

300

11600

9300

Set 7

9500

600

1400

50

1400

900

150

800

600

400

14250

11300

Set 2

6000

500

200

200

500

200

1000

1000

800

5200

5700

Set 3

4500

500

150

300

800

600

2000

1000

100

2620

3150

Set 4

1500

200

200

500

100

25

1200

4000

100

125

700

Set 5

4000

300

250

600

1000

900

1500

2500

500

2350

3050

Set 6

2100

400

100

800

500

400

300

500

400

1400

2300

Set 7

4500

500

700

300

400

150

2000

400

500

3150

3700

Set 1

1000

600

20

100

200

Set 2

1500

800

30

80

250

Set 3

1400

600

50

60

350

Set 4

900

700

10

70

450

Set 5

800

900

40

150

200

Set 6

1800

1000

60

250

250

Set 7

2000

1500

100

200

360

600

400

600

500

300

1000

1200

20

150

30

200

10

200

25

250

50

100

100

125

150

400

200

500

300

200

350

250

500

800

750

1400

1370

1300

1350

900

1045

1000

960

1550

1465

1800

1610

Ques.6 Calculate GVAmp and NVAfc

Set 1

5000

200

600

400

800

500

2000

1000

500

NVAfc 3100

GVAmp 3800

Sales

Increase in stock

Production for self consumption

Depreciation

Indirect tax

Subsidies

Purchase of raw material

Import of machine

Closing stock

Ques.7 Calculate GDPmp and NNPfc

Value of output by primary sector

Value of output by other sector

Consumption of fixed capital

Indirect taxes

Factor income from abroad

Intermediate consumption by

primary sector

Economic Subsides

Factor income to abroad

Intermediate consumption by

other sector

GDPmp

NNPfc

ecolokesh@yahoo.co.in

98100-42777

Ques.8

Calculate the value added by firm X.

Sales by firm Y to Firm X

Sales by firm X to household

Purchase by firm Z from firm X

Closing stock of firm X

Opening stock of firm X

Ans. Value added by firm X

Set 1

400

500

300

75

25

450

Set 2

800

1000

600

150

50

900

Set 3

1200

1500

900

225

75

1350

Set 4

1600

2000

1200

300

100

1800

Ques. 9

Calculate the value added by firm B.

Purchase by firm B from firm A

Sales by firm B to firm C

Sales by firm B to household

Opening stock of firm B

Opening stock of firm C

Closing stock of firm B

Purchase by firm B from firm D

Export by firm B

Ans.

Value Added by Firm B

Set 1

30

25

35

5

10

10

15

20

40

Set 2

60

50

70

10

20

20

30

40

80

Set 3

90

75

105

15

30

30

45

60

120

Set 4

120

100

140

20

40

40

60

80

160

Ques. 10

Calculate the value added by firm A & B.

Sales by firm A

Purchase form firm B by firm A

Purchase form firm A by firm B

Sales by firm B

Closing stock of firm A

Closing stock of firm B

Opening stock of firm A

Opening stock of firm B

Value added By firm A

Value added by firm B

Set 1

100

40

60

200

20

35

25

45

55

130

Set 2

200

80

120

400

40

70

50

90

110

260

Set 3

300

120

180

600

60

105

75

135

165

390

Set 4

400

160

240

800

80

140

100

180

220

520

Ques. 11

Calculate the value added by firm A & B.

Sales by firm B to general govt.

Sales by firm A

Purchase by household from firm B

Export by firm B

Change in stock of firm A

Change in stock of firm B

Import by firm A

Sales by firm C to firm A

Purchase by firm B from firm A

Ans. Value Added by firm A

Value Added by firm B

Set 1

100

500

300

50

20

10

70

250

200

200

260

Set 2

200

1000

600

100

40

20

140

500

400

400

520

Set 3

300

1500

900

150

60

30

210

750

600

600

780

Set 4

400

2000

1200

200

80

40

280

1000

800

800

1040

Calculate GDPmp, GDPfc, NVAfc , NNPfc

Sales

Opening stock of finished goods

Closing stock of finished goods

Raw material bought form other firms

Indirect taxes

Subside paid

Depreciation

Net factor income form abroad

Set 1

2350

960

705

450

70

20

105

50

Set 2

2500

260

60

400

500

200

150

600

Set 3

5000

500

1000

600

500

300

100

500

Set 4

6000

2000

1000

1500

1500

1000

600

- 500

Ques. 12

GDPmp

GDPfc

NVAfc

NNPfc

1645

1595

1490

1540

ecolokesh@yahoo.co.in

98100-42777

INCOME METHOD

Ques.13 Calculate NDPfc, NNPfc, and GDPmp.

Compensation of employee

Operating surplus

Net indirect taxes

Rent

Mixed income

Net factor income to abroad

Employers contribution to SSS

Consumption of fixed capital

NDPfc

NNPfc

GDPmp

Set 1

1000

4000

400

200

1000

100

800

200

6000

5900

6600

Set 2

1000

5000

300

600

1500

300

500

600

7500

7200

8400

Set 3

1000

6000

250

300

500

400

300

300

7500

7100

8050

Set 4

4000

2500

200

400

1000

300

800

400

7500

7200

8100

Set 5

2500

1000

120

200

2500

350

540

200

6000

5650

6320

Set 6

5000

1300

400

400

1000

250

650

400

7300

7050

8100

Set 7

6000

2000

800

700

1400

500

460

200

9400

8900

8300

Set 5

1500

200

8500

1000

540

2500

- 100

400

500

8700

8400

9700

4500

Set 6

2500

400

8000

100

650

1000

500

500

400

8400

8500

8500

4500

Set 7

1600

700

9500

50

460

1400

- 500

600

300

10200

9000

10250

6500

Set 5

500

100

8500

1000

200

120

1500

2500

- 100

500

400

13920

13720

14920

2820

Set 6

800

400

8000

100

250

400

1650

1000

500

400

500

12900

13000

13000

3500

Set 7

600

300

9500

50

150

800

1400

1400

- 500

900

600

15050

14250

15100

3850

Ques.14 Calculate GDPfc, NNPfc, GDPmp and Operating surplus

Compensation of employee

Consumption of fixed capital

NDPfc

Net indirect taxes

Rent

Mixed income

Net factor income from abroad

Employees contribution to SSS

Royalty

GDPfc

NNPfc

GDPmp

Operating surplus

Set 1

2000

200

6000

100

800

1000

400

200

400

6200

6400

6300

3000

Set 2

1000

600

5000

400

500

1500

500

100

500

5600

5500

6000

2500

Set 3

1500

300

9000

200

300

500

- 200

500

600

9300

8800

9500

7000

Set 4

2500

400

6500

200

800

1000

500

200

300

6900

7000

7100

3000

Ques.15 Calculate GDPfc, NNPfc, GDPmp and Operating surplus

Profit after tax

Consumption of fixed capital

Compensation of employee

Net indirect taxes

Profit tax

Interest on capital

Rent

Mixed income

Net factor income from abroad

Royalty

Employees contribution to SSS

GDPfc

NNPfc

GDPmp

Operating surplus

Set 1

500

200

6000

100

100

400

1000

1000

300

200

200

9400

9500

9500

2200

Set 2

1000

300

5000

400

200

300

1500

1500

200

600

100

10400

10300

10800

3600

Set 3

600

200

9000

200

150

250

1300

500

- 200

200

500

12200

11800

12400

2500

Set 4

2000

400

6500

200

400

200

1800

1000

400

500

200

12800

12800

13000

4900

ecolokesh@yahoo.co.in

98100-42777

Ques.16 Calculate NDPfc and NNPfc

Compensation of Employee

Interest

Rent

Profit

Consumption of fixed capital

Mixed Income of self employed

Profit Tax

Net factor income from abroad

Royalty

Net Indirect Tax

NDPfc (Domestic Income)

NNPfc (National Income)

Set 1

500

200

1000

1000

500

100

500

400

600

500

3400

3800

Set 2

300

400

200

1000

800

1000

2000

500

500

200

3400

3900

Set 3

100

200

200

1000

100

200

1000

- 200

300

500

2000

1800

Set 4

500

500

200

4000

100

2000

2000

500

5000

150

12200

12700

Set 5

500

1000

150

2500

500

100

200

- 100

500

500

4750

4650

Set 6

300

100

100

500

400

220

5400

500

2100

100

3320

3820

Set 7

500

140

300

600

500

800

300

- 500

700

200

3040

2540

Set 1

500

200

500

1000

1000

500

100

200

600

200

400

500

3600

4000

Set 2

3000

4000

400

200

1000

800

1000

100

200

200

500

200

9600

10100

Set 3

1000

200

250

200

1000

100

200

50

200

200

- 200

500

3000

2800

Set 4

500

5000

500

2000

4000

1000

2000

600

200

200

500

1000

13900

14400

Set 5

500

1000

600

1500

2500

500

100

150

500

200

- 100

500

6300

6200

Set 6

300

1000

200

1000

5000

4000

2200

50

200

400

500

100

10100

10600

Set 7

500

1400

600

3000

6000

500

800

50

400

300

- 500

200

12400

11900

Set 1

4000

500

500

1000

5000

200

100

100

1000

200

300

400

200

12100

11700

Set 2

5000

1000

100

200

2000

700

100

400

1000

300

500

300

500

10100

9800

Set 3

6000

400

500

1000

500

200

400

200

200

1000

500

250

100

10000

9750

Set 4

2500

2000

3000

2000

2000

1000

1000

200

200

1000

200

800

1000

10900

10100

Set 5

1000

2000

1000

200

2000

1000

2000

1000

2000

2000

100

1200

1000

11300

10100

Set 6

1300

1000

2000

500

2000

500

200

100

1000

2000

1000

400

400

9000

8600

Set 7

2000

1000

1000

2000

1000

2000

200

50

500

1000

1000

800

100

8700

7900

Ques.17 Calculate NDPfc and NNPfc

Wages and salaries in cash

Interest

Interest on public debt.

Rent

Profit

Consumption of fixed capital

Mixed Income of self employed

Economic subsidies.

Wages and salaries in kind

Social security cont. by employer

Net factor income from abroad

Indirect Tax

NDPfc

NNPfc

Ques.18 Calculate NDPfc and NNPfc

Wages and salaries

Interest

Interest National debt.

Rent

Dividend

Consumption of fixed capital

Mixed Income of self employed

Subsidies paid by govt.

Profit Tax

Retained Earning

Social security cont. by employer

Net factor Income To Abroad

Indirect Tax

NDPfc

NNPfc

ecolokesh@yahoo.co.in

98100-42777

EXPENDITURE METHOD

Ques.19 Calculate GDPmp and National income

Govt. final Consumption Expenditure

Household Consumption Expenditure

Gross Domestic Fixed Capital Formation

Increase in stock (inventories)

Export of goods and services

Import of goods and services

Consumption of fixed capital

Net factor income from abroad

Net Indirect Taxes

GDPmp

National income

Set 1

500

400

1000

200

1000

500

200

200

200

2600

2400

Set 2

800

300

1000

100

1000

600

600

300

500

2600

1800

Set 3

600

250

2000

500

400

200

300

- 500

200

3550

2550

Set 4

400

800

2000

200

1000

1200

400

800

100

3200

3500

Set 5

500

1200

5000

400

2000

1600

200

- 200

1000

7500

6100

Set 6

600

400

1000

500

500

800

400

400

400

2200

1800

Set 1

1000

4000

1000

500

200

200

50

200

200

500

4350

5050

4550

Set 2

1000

5000

2000

800

600

500

100

300

300

300

5500

6100

5800

Set 3

2000

6000

2000

600

300

200

500

100

- 500

200

6400

6700

5900

Set 4

2000

2500

1000

400

400

100

300

200

800

100

4000

4300

4800

Set 5

5000

1000

500

500

200

1000

700

450

- 200

250

6250

6950

6050

Set 6

1000

1300

300

600

400

400

500

250

400

300

2600

3150

3000

Set 1

1000

200

Set 2

4000

200

Set 3

2500

2000

Set 4

5000

1500

Set 5

6000

1000

Set 6

2000

3000

500

800

100

1000

500

4000

2000

1000

2000

200

5400

300

1000

500

200

600

100

600

500

4900

3700

4300

4300

1000

400

600

200

300

200

800

8100

6800

6600

7000

1000

250

500

150

200

- 200

100

8400

8300

8600

8100

4000

500

300

200

200

200

1000

12500

11100

12300

11300

2500

600

300

250

400

- 500

500

16450

16050

16950

15550

5000

200

600

100

200

200

4000

15200

10800

15000

11000

Ques. 20 Calculate GDPmp and National income

Govt. final consumption expenditure

Personal Disposable Income

Personal Saving

Net Domestic Fixed Capital Formation

Increase in Stock (inventories)

Export of goods and services

Import of goods and services

Consumption of fixed capital

Net factor income from abroad

Net indirect taxes

NDPfc

GDPmp

National income

Ques.21 Calculate GDPmp and National income

Pvt. Final consumption expenditure

COE paid by govt. sector

Net purchases of goods and services by

govt. in domestic market.

Direct purchases of non durables from

abroad by govt.

Net domestic fixed capital formation

Closing stock (inventories)

Net Export of goods and services

Opening stock (inventories)

Consumption of fixed capital

Net factor income paid to abroad

Net Indirect taxes

GDPmp

National income

GNPmp

NDPfc

ecolokesh@yahoo.co.in

98100-42777

Ques. 22 Calculate GDPmp, GNPmp, NDPfc and National income

Set 1

Set 2

Household Final consumption expenditure

1000

4000

COE paid by govt. sector

200

200

Net purchases of goods and services by govt.

in domestic market.

Direct purchases of non durables from

abroad by govt.

Net domestic fixed capital formation

Closing stock (inventories)

Final expenditure by non-profit organisation

Net Export of goods and services

Opening stock (inventories)

Consumption of fixed capital

Net factor income paid to abroad

Net Indirect taxes

Set 3

2500

2000

Set 4

5000

1500

Set 5

6000

1000

Set 6

2000

3000

500

800

100

1000

500

4000

2000

1000

2000

200

5400

300

1000

500

200

200

600

100

600

500

5100

3900

4500

4500

1000

400

500

600

200

300

200

800

8600

7300

8400

7500

1000

250

500

500

150

200

- 200

100

8900

8800

9100

8600

4000

500

200

300

200

200

200

1000

12700

11300

12500

11500

2500

600

300

300

250

400

- 500

500

16750

16350

17250

15850

5000

200

400

600

100

200

200

4000

15600

11200

15400

11400

Ques. 23 Calculate GDPmp, GNPmp, NDPfc and National income

Set 1

Set 2

Personal final consumption expenditure

5000

6000

Depreciation

200

300

Net indirect taxes

500

800

Gross residential construction investment

2000

1000

Export

1000

1000

Import

500

400

Gross public investment

200

500

Factor income form abroad

200

600

Factor income to abroad

600

200

Gross business investment

100

300

Gross inventory investment

600

200

Govt. final consumption expenditure

500

800

GDPmp 8900

9400

National income

7800

8700

Set 3

4500

500

100

2000

1000

250

500

500

150

200

200

100

8250

8000

Set 4

1500

600

100

200

4000

500

200

300

200

200

200

1000

7800

7200

Set 5

4000

800

500

5400

2500

600

300

300

250

400

500

500

13000

11750

Set 6

2100

300

4000

300

5000

200

400

600

100

200

200

4000

12000

8200

GDPmp

National income

GNPmp

NDPfc

Ques. 24 Calculate GDPmp and NNPfc (National income)

Set 1

Household final consumption expenditure

8000

Gross domestic investment

5000

Factor income to abroad

200

Net export

500

Govt. final consumption expenditure

1000

Deprecation

200

Net indirect tax

300

Factor income from abroad

500

GDPmp 14500

NNPfc 14300

Set 2

6000

1000

500

100

5000

300

400

100

12100

11000

Set 3

3000

4000

100

500

2000

1000

600

500

9500

8300

Set 4

5000

2000

150

3000

5000

1000

200

300

13000

11950

Set 5

3000

6000

700

1000

2000

2000

1200

1000

12000

9100

Set 6

2000

7000

1600

2000

3000

2000

1500

2000

14000

10900

ecolokesh@yahoo.co.in

98100-42777

Ques. 25 Calculate GDPmp, National income & Domestic income

Set 1

Set 2

Personal Final consumption expenditure

5000

2000

Gross Residential Construction

500

1000

Investment

Gross Public Investment

Govt. final Consumption Expenditure

Gross Business Investment

Gross Inventory Investment

Import of goods and services

Net Export of goods and services

Net Factor Income From Abroad

Net Indirect taxes

Consumption of fixed capital

GDPmp

National income

Domestic income

500

1000

200

300

500

300

200

200

100

7800

7700

7500

100

5000

300

400

100

500

- 100

500

250

9300

8450

8550

Set 3

4000

400

Set 4

7000

2000

Set 5

3000

2000

Set 6

2000

1000

500

2000

1000

600

500

500

500

700

300

9000

8500

8000

3000

5000

1000

200

3000

200

- 200

800

500

18400

16900

17100

1000

2000

2000

1200

1000

100

200

500

200

9500

9000

8800

2000

3000

2000

1500

2000

1000

100

600

400

12500

11600

11500

Private Income, Personal Income, Personal disposable Income and National Disposable Income

Ques.26 Calculate Private, Personal, Personal Disposable Income

Income from govt. prop & entrepreneurship

NFIFA

Net current transfers from govt.

Personal tax

Income accruing from private sector

Retained earning

National debt interest.

Net current transfers from ROW

Govt. mics. Recipt

Profit tax

Ans. Pvt. Income

Personal income

Personal disposable income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

2000

200

500

300

5000

600

500

300

200

400

6500

5500

5000

8000

500

500

200

2000

400

400

400

500

250

3800

3150

2450

4000

200

400

500

4000

500

500

500

600

350

5600

4750

3650

6500

650

600

600

2000

300

300

600

600

300

4150

3550

2350

5500

300

500

400

2500

250

500

700

250

450

4500

3800

3150

6000

600

400

450

3000

350

300

250

350

650

4550

3550

2750

Ques.27 Calculate Income accruing from private sector, Personal income , Personal Disposable Income

Private income

Corporate tax

NFIFA

Saving of private sector

Fee and fines (Govt. misc. recipt)

Net current transfers from ROW

Direct tax

Net current transfers from govt.

Interest on national debt

Ans.

Personal income

Personal disposable income

Income accruing from private sector

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

8000

200

400

200

150

200

150

500

125

7600

7300

6775

6000

300

250

150

100

500

250

320

75

5550

5200

4855

7500

250

300

250

50

200

200

250

100

7000

6750

6650

8500

150

350

350

250

250

500

200

250

8000

7250

7450

9000

400

250

400

350

350

320

150

200

8200

7530

8050

4800

300

200

100

150

450

250

250

150

4400

4000

2950

ecolokesh@yahoo.co.in

98100-42777

Ques.28 Calculate Private, Personal, Personal Disposable Income.

GNP mp

NDPfc from govt. sector

Net current transfers from Rest of the world

Depreciation

Personal tax

Net current transfers from govt.

Net indirect tax

Profit tax

Net factor income to abroad

Interest on national debt

Retained earning

Ans. Pvt. Income

Personal income

Personal disposable income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

5000

1000

200

100

250

400

300

500

100

500

400

4700

3800

3550

8000

2000

200

150

200

200

500

250

400

500

200

6250

5800

5600

5000

1500

300

250

300

300

400

600

250

300

500

3750

2650

2350

6000

800

400

200

400

300

200

350

200

400

300

5900

5250

4850

4000

600

600

250

500

500

500

200

350

250

400

4000

3400

2900

6000

700

400

300

600

350

300

300

300

200

200

5650

5150

4550

Ques.29 Calculate Private, Personal, Personal Disposable Income and National Disposable Income.

Current transfers form govt. Admn. Dept.

Saving of non- dept. govt. enterprise

NNPfc

NFIFA

Income from govt. prop & entrepreneurship

Net current transfer for ROW

National debt interest

Corporate tax

Saving of corporate sector

Direct tax

Net indirect taxes

Ans. Pvt. Income

Personal income

Personal disposable income

National Disposable Income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

18

1

473

-7

9

4

28

10

3

20

5

513

500

480

482

25

20

2500

100

300

150

200

250

200

50

10

2,555

2,105

2,065

2660

250

200

5000

- 200

1100

120

500

150

50

60

15

4,570

4,370

4,310

5135

300

500

6000

250

250

100

60

100

150

200

20

5,710

5,460

5,260

6120

500

300

5500

200

600

200

600

400

500

500

250

6050

5150

4650

5950

200

500

10000

500

900

500

400

600

200

400

200

9700

8900

8500

9200

Ques.30 Calculate Private, Personal, Personal Disposable Income and National Disposable Income.

Corporate tax

Undistributed profit

Personal consumption expenditure

Direct tax paid by household

Personal saving

National debt interest

Net current transfer form ROW

NFIFA

Transfer payment by govt.

Income from accruing to govt. sector

Net indirect taxes

Ans. Pvt. Income

Personal income

Personal disposable income

NDPfc

National Disposable Income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

1251

464

67,890

2,100

11,406

964

1,271

- 201

1,981

2,333

200

83,111

81396

79,296

81,429

82699

20

40

1800

50

1000

250

400

250

200

100

500

2,910

2,850

2,800

1,910

3060

600

500

10000

200

5000

400

100

- 200

100

500

600

16,300

15,200

15,000

16,400

16900

50

100

4000

10

500

40

50

150

100

800

800

4,660

4,510

4,500

5,120

5820

100

500

2000

400

3000

200

400

100

200

500

650

6000

5400

5000

5600

6750

300

500

6000

100

4000

500

500

300

800

200

600

10900

10100

10000

9000

10400

ecolokesh@yahoo.co.in

98100-42777

Ques.31 Calculate Private, Personal, Personal Disposable Income and National Disposable Income.

Wages and salaries

Net indirect tax

Deprecation

Net factor income to abroad

Interest on public debt

Income of govt. property and Admn. Dept.

Personal tax

Mixed income of self employed

Saving of corporate sector

Saving of govt. non- dept enterprises

Net current transfer form govt.

Corporation tax

Operating surplus

Net current transfer form ROW

Social security contribution of employer

Ans. NDPfc

Pvt. Income

Personal income

Personal disposable income

National Disposable Income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

5000

250

8000

200

5000

300

6000

400

4000

500

6000

600

200

500

700

800

500

600

500

400

1000

200

200

1500

300

500

800

400

300

1200

250

400

600

200

200

1400

300

500

500

200

100

1000

500

600

200

600

200

1500

200

500

7500

7000

6200

5900

7450

800

250

500

200

150

1000

500

1000

10800

9500

9100

8600

11300

700

300

400

300

250

500

200

1000

7200

6700

6150

5650

7400

900

400

300

150

350

2500

250

2000

11400

10200

9450

9250

11650

500

450

400

450

400

3500

350

1500

9500

9450

8600

8500

10100

400

550

100

250

100

1500

450

2000

9900

9100

8450

7450

10750

Ques.32 Calculate Net National Disposable Income and Gross National Disposable Income.

NNPfc

Consumption of fixed capital

Net Indirect tax

Net current transfers from govt.

Net Factor income from abroad

Net current transfers from ROW

Net National Disposable Income

Gross National Disposable Income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

7000

500

5000

300

9000

200

4500

400

6500

400

8500

200

1500

400

1000

100

500

200

700

250

900

350

600

550

200

500

300

500

400

500

800

200

400

500

300

600

9300

9800

6200

6500

9900

10100

5700

6100

7700

8100

9700

9900

Ques.33 Calculate Net National Disposable Income and Gross National Disposable Income.

GDPfc

Consumption of fixed capital

Indirect tax

Net current transfers from govt.

Factor income from abroad

Economic subsidies

Factor income to abroad

Net current transfers from ROW

Net National Disposable Income

Gross National Disposable Income

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

8000

200

7500

300

6000

500

8000

400

9000

300

6500

700

1500

400

1000

100

500

200

700

250

900

350

600

550

400

500

200

200

300

500

500

200

300

200

400

500

900

400

400

600

200

500

300

100

500

900

700

600

9300

9500

7700

8000

6400

6900

8500

8900

10400

10700

6700

7400

10

ecolokesh@yahoo.co.in

98100-42777

Ques. Calculate NNPfc, Operating Surplus Pvt. Income, Personal Income, PDI and NDI.

Set 1

Set 2

Set 3

Set 4

Set 5

Set 6

Set 7

Royalty

Rent

Net factor Income To Abroad

Income Acc. To Govt. sector

Mixed Income

W & S in cash

Dividend

Retained Earning

Interest on Public Debt

Consumption of Fixed capital

Corporation Tax

W & S in Kind

Net Current Trf. Form Govt.

Net Indirect Tax

Social Security By Employer.

Interest

Fee and Fine

Net Current Trf. Form ROW

Personal Tax

500

200

500

1000

1000

500

100

500

600

200

400

600

500

300

500

200

300

300

200

3000

4000

400

200

1000

8000

1000

2000

200

200

500

500

2000

200

1000

200

200

1000

100

1000

200

- 250

200

1000

1300

200

1000

200

200

200

300

500

200

200

100

500

1000

200

500

5000

500

2000

4000

1000

2000

2000

200

200

500

5000

1000

1000

200

3000

800

400

200

500

1000

600

1500

2500

500

100

200

500

200

100

500

500

400

500

1500

200

200

600

300

1000

200

1000

5000

4000

2200

5400

200

400

500

2100

100

200

900

200

700

400

600

500

1400

600

3000

6000

500

800

300

400

300

500

700

200

300

1000

100

800

300

700

NNPfc

Operating Surplus

National Disposable Income.

Pvt. Income

Personal Income

Personal Disposable Income

4000

1900

4600

4400

3500

3000

20800

10700

22000

23800

21200

20900

5750

2700

6950

7250

6050

5320

22700

13000

24100

23100

20600

19600

6800

3400

7400

6500

6100

5300

21400

9600

22000

21100

15200

13900

11200

3600

11800

9100

8200

6700

Ques. Calculate NNPfc, Pvt. Income, Personal Income, PDI and National Disposable Income.

Personal Final Consumption Exp.

Govt. Purchases

Direct Purchase made abroad by govt.

Saving by Pvt. Sector.

Net Domestic Fixed Capital Formation.

Change in stock

Consumption of fixed capital

Govt. Miscellaneous Receipt.

National Interest Debt.

COE paid by Govt.

Net current Trf. From Govt.

Export

Corporation Tax

Import

Net factor income from Abroad

Personal tax

Net current Trf. From ROW

Net indirect taxes

NDPfc from Govt. sector

GDPmp

NNPfc

National Disposable Income.

Pvt. Income

Personal Income

Personal Disposable Income

Set 1

4000

500

500

1000

5000

200

100

200

1000

200

300

400

200

200

100

500

200

200

2000

10700

10500

10900

10400

8800

8100

Set 2

5000

1000

100

200

2000

700

100

400

1000

300

500

300

100

500

200

100

300

200

1000

9000

8900

9400

9700

9400

8900

11

Set 3

6000

400

500

1000

500

200

400

2000

200

1000

500

250

500

100

100

100

400

300

500

9150

8550

9250

9150

7650

5550

Set 4

2500

2000

3000

2000

2000

1000

1000

200

200

1000

200

800

200

1000

200

600

200

400

800

12300

11100

11700

11100

8900

8100

Set 5

1000

2000

1000

200

2000

1000

2000

1000

2000

2000

100

1200

200

1000

200

300

600

500

900

11200

8900

10000

10500

10100

8800

Set 6

1300

1000

2000

500

2000

500

200

200

1000

2000

1000

400

100

1000

200

300

400

300

600

8400

8100

8800

9900

9300

8800

Set 7

2000

1000

1000

2000

1000

2000

200

200

500

1000

1000

800

200

1500

100

200

100

400

700

7500

7000

7500

8400

6200

5800

ecolokesh@yahoo.co.in

98100-42777

Ques. Calculate GVAfc, NNPfc, Pvt. Income, Personal Income, PDI and NDI.

Set 1 Set 2 Set 3

Sales

5000

8000 10000

Closing stock

800

200

300

Net current transfer form Abroad

200

400

500

Purchase of Raw Material

1000

2000

1000

Interest on Public Debt

500

400

800

Net current transfer form Govt.

500

600

400

Opening stock

500

50

500

Retained Earning of Pvt. Sector

200

300

500

Purchase of Machine

400

222

100

Consumption of Fixed capital

200

300

100

Personal tax

100

200

300

Subsidies

500

300

500

Net factor Income from abroad

200

300

400

Income Accruing from Govt. Sector.

1000

1200

1200

Corporation tax

200

200

300

GVAfc

4800

6450

9300

NNPfc

4800

6450

9600

National Disposable Income.

4500

6550

9600

Pvt. Income

5000

6650 10100

Personal Income

4600

6150

9300

Personal Disposable Income

4500

5950

9000

12

Set 4

7000

400

600

2500

200

500

500

100

700

250

500

300

100

1500

400

4700

4550

4850

4350

3850

3350

Set 5

5000

650

200

1500

250

500

350

100

500

500

300

200

500

2000

500

4050

4050

4050

3000

2400

2100

Set 6

6000

500

300

2000

200

400

500

200

200

800

200

100

200

1000

300

4100

3500

3700

3400

2900

2700

Set 7

4500

400

400

1000

100

400

600

250

1000

200

400

200

100

500

400

3500

3400

3600

3800

3150

2750

Potrebbero piacerti anche

- What Is SidbiDocumento14 pagineWhat Is SidbiSanjana BhattNessuna valutazione finora

- What Is Search EngineDocumento17 pagineWhat Is Search EngineSanjana BhattNessuna valutazione finora

- Assembly Line BalancingDocumento11 pagineAssembly Line BalancingAnonymous zQMzqJKNessuna valutazione finora

- Akshipriya Negi Gaurav Gupta Partha Sanjana Bhatt Sheetal Verma Shoib KhanDocumento14 pagineAkshipriya Negi Gaurav Gupta Partha Sanjana Bhatt Sheetal Verma Shoib KhanSanjana BhattNessuna valutazione finora

- BY - Nikhil Swati SanjanaDocumento15 pagineBY - Nikhil Swati SanjanaSanjana BhattNessuna valutazione finora

- Budget 2013Documento15 pagineBudget 2013Sanjana BhattNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 20852891627920AI21180Documento1 pagina20852891627920AI21180Ahmed MahmoudNessuna valutazione finora

- US Internal Revenue Service: f8453s - 2004Documento2 pagineUS Internal Revenue Service: f8453s - 2004IRSNessuna valutazione finora

- Tax Slabs FY 2020-21 - by AssetYogiDocumento2 pagineTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNessuna valutazione finora

- Taxau316 CSGDocumento732 pagineTaxau316 CSGBb 8Nessuna valutazione finora

- Febr-Mar 2019Documento7 pagineFebr-Mar 2019Ionut DumitrescuNessuna valutazione finora

- TDS Rates For AY 10-11 PDFDocumento1 paginaTDS Rates For AY 10-11 PDFjiten1986Nessuna valutazione finora

- FATCA CRS Self Certification Client FormDocumento4 pagineFATCA CRS Self Certification Client FormMax muster WoodNessuna valutazione finora

- Transactions 012024Documento1 paginaTransactions 012024Ion MoldovanuNessuna valutazione finora

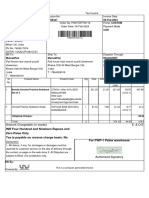

- Congratulations! You Are On One Airtel 1349 PlanDocumento10 pagineCongratulations! You Are On One Airtel 1349 Plansandeep salavarNessuna valutazione finora

- Nigeria WHT Need To KnowDocumento6 pagineNigeria WHT Need To KnowphazNessuna valutazione finora

- Invoice-PAYHOST - 4287 PDFDocumento1 paginaInvoice-PAYHOST - 4287 PDFdoge redNessuna valutazione finora

- Bus Tax Chap 6Documento3 pagineBus Tax Chap 6yayayaNessuna valutazione finora

- Tax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 0700Documento1 paginaTax Invoice: Janse Van Rensburg, Pieter Adriaan Po Box 506 Polokwane 0700Marlene0% (1)

- 1568166588816UGsd5mT3ZF2XLyzh PDFDocumento5 pagine1568166588816UGsd5mT3ZF2XLyzh PDFASHISH SINGHNessuna valutazione finora

- InvoiceDocumento1 paginaInvoicemainakpati03Nessuna valutazione finora

- List PDFDocumento4 pagineList PDFAlex RodriguezNessuna valutazione finora

- CustomInvoice 7670709745Documento1 paginaCustomInvoice 7670709745budi irawanNessuna valutazione finora

- Screenshot 2022-08-01 at 3.30.45 PMDocumento3 pagineScreenshot 2022-08-01 at 3.30.45 PMashish aroraNessuna valutazione finora

- U.S. Tax Planning For Non-U.S. Persons and Trusts: An Introductory OutlineDocumento22 pagineU.S. Tax Planning For Non-U.S. Persons and Trusts: An Introductory Outlinelakeshia1lovinglife1Nessuna valutazione finora

- Guidebook On Registering Property in Malaysia - 3Documento86 pagineGuidebook On Registering Property in Malaysia - 3Sixd Waznine100% (1)

- International Tax Law CourseraDocumento6 pagineInternational Tax Law CourseraStephanie LCNessuna valutazione finora

- Assignment Do It Yourself (Diy)Documento3 pagineAssignment Do It Yourself (Diy)Marites AmorsoloNessuna valutazione finora

- Journal EntryDocumento2 pagineJournal EntrySamantha BantidingNessuna valutazione finora

- Money and The Payments SystemDocumento27 pagineMoney and The Payments SystemFarapple24Nessuna valutazione finora

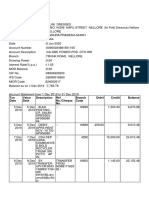

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocumento5 pagineTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancedileepNessuna valutazione finora

- Credit Card StatementDocumento3 pagineCredit Card StatementnagaNessuna valutazione finora

- Generate Demand LetterDocumento1 paginaGenerate Demand Letteraryan9411Nessuna valutazione finora

- Taxation, Individual Actions, and Economic Prosperity: A Review by Joshua Rauh and Gregory KearneyDocumento12 pagineTaxation, Individual Actions, and Economic Prosperity: A Review by Joshua Rauh and Gregory KearneyHoover InstitutionNessuna valutazione finora

- Dusters Total Solutions Services PVT - LTD.: Amount Deductions Earned AllowanceDocumento52 pagineDusters Total Solutions Services PVT - LTD.: Amount Deductions Earned Allowancerishichauhan25Nessuna valutazione finora

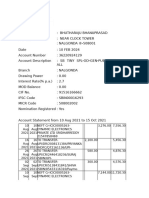

- Bhutharaju Bhanuprasad SbiDocumento2 pagineBhutharaju Bhanuprasad SbiprakashNessuna valutazione finora