Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Practise 3 Capital Structure

Caricato da

Kelly KohDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Practise 3 Capital Structure

Caricato da

Kelly KohCopyright:

Formati disponibili

FIN3101 Corporate Finance Practice Questions 3 Topic: Capital Structure

1. Explain whether the following statement is true in a Modigliani-Miller world with taxes: If a firm issues equity to repay some of its debt, the price per share of the firms stock will fall because the shares are less risky. 2. With its current leverage, Singmart will have net income (net of interest) next year of $3million. If Singmarts tax rate is 20% and it pays 8% interest on its debt, how much additional debt can Singmart issue this year and still receive the full benefit of the interest tax shield next year? 3. United has no debt. It has a market value of $160 million and a cost of equity capital of 10%. There is news that it plans to raise $40 million in debt and pay the proceeds to shareholders as a special cash dividend. The cost of debt capital is 6%. a) Assume no taxes and a Modigliani-Miller world. What is the value of United after the change in leverage? What are the cost of equity and the overall cost of capital after the change in leverage? b) Assume a corporate tax of 30% and a Modigliani-Miller world. What is the value of United after the change in leverage? What are the cost of equity and the overall cost of capital after the change in leverage? 4. MacKenzie Corporation currently has 10 million shares of stock outstanding at a price of $40 per share. The company would like to raise money and has announced a rights issue. The company plans to require five rights to purchase one share at a price of $40 per share. Assume perfect capital markets. a) Assuming the rights issue is successful, how much money will it raise? b) What will the share price be after the rights issue? Suppose instead that the firm changes the plan so that each right gives the holder the right to purchase one share at $8 per share. c). How much money will the new plan raise? d). What will the share price be after the rights issue? e). Which plan is more likely to raise the full amount of capital? f). Who gains from the rights issue in the first plan? In the second plan? 5. An unlevered firm has a market value of $7million. It is contemplating issuing $4m of 10% coupon bonds (permanent debt). The firm has a corporate tax rate of 30% and has estimated that the tax rates for its investors are 20% on stock income and 25% on bond income. a) If only corporate taxes exist, what is the total value of the firm and the gain from leverage? FIN3101 Page 1

b) With both corporate and personal taxes, what is the gain from leverage and the total value of the firm? c) Why is the gain from leverage lower in (b)?

FIN3101

Page 2

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Kelly's Finance Cheat Sheet V6Documento2 pagineKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Nature, Scope and Importance of International OrganisationsDocumento13 pagineNature, Scope and Importance of International OrganisationsDr. Afroz Alam93% (115)

- Sap FicaDocumento34 pagineSap Ficahoney_213289% (9)

- A Conference Interpreters View - Udo JorgDocumento14 pagineA Conference Interpreters View - Udo JorgElnur HuseynovNessuna valutazione finora

- Chap 4 Bodie 9eDocumento8 pagineChap 4 Bodie 9eKelly Koh100% (2)

- Case 1 TWG TeaDocumento2 pagineCase 1 TWG TeaKelly Koh33% (3)

- Marketing Plan On PepsicoDocumento24 pagineMarketing Plan On PepsicoWaqar AfzaalNessuna valutazione finora

- ACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFDocumento41 pagineACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFCami50% (2)

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocumento3 pagineFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohNessuna valutazione finora

- Select A Chart Style Go : © Euromonitor International 2013Documento1 paginaSelect A Chart Style Go : © Euromonitor International 2013Kelly KohNessuna valutazione finora

- (July 2019) - OT - AccomplishmentDocumento2 pagine(July 2019) - OT - AccomplishmentMark Kristoffer HilarionNessuna valutazione finora

- 8int 2006 Jun QDocumento4 pagine8int 2006 Jun Qapi-19836745Nessuna valutazione finora

- Lovell, Jonathan PDFDocumento2 pagineLovell, Jonathan PDFAnonymous viLMwYNessuna valutazione finora

- Four Fold TestDocumento19 pagineFour Fold TestNeil John CallanganNessuna valutazione finora

- BGV Form - CrisilDocumento3 pagineBGV Form - CrisilAkshaya SwaminathanNessuna valutazione finora

- Cityam 2011-09-19Documento36 pagineCityam 2011-09-19City A.M.Nessuna valutazione finora

- Profile Options in Oracle Projects: System Administrator's Guide)Documento16 pagineProfile Options in Oracle Projects: System Administrator's Guide)hello1982Nessuna valutazione finora

- Rousselot Gelatine: Dedicated To Your SuccessDocumento28 pagineRousselot Gelatine: Dedicated To Your SuccessChristopher RiveroNessuna valutazione finora

- Dollar General Case StudyDocumento26 pagineDollar General Case StudyNermin Nerko Ahmić100% (1)

- Intdiff Ltot Ldisrat Lusdisrat Lusprod LrexrDocumento4 pagineIntdiff Ltot Ldisrat Lusdisrat Lusprod LrexrsrieconomistNessuna valutazione finora

- Scheme of WorkDocumento45 pagineScheme of WorkZubair BaigNessuna valutazione finora

- Factors Affecting Option PricesDocumento10 pagineFactors Affecting Option PricesRajneesh MJNessuna valutazione finora

- Ooad LabDocumento149 pagineOoad LabNelson GnanarajNessuna valutazione finora

- RetailfDocumento2 pagineRetailfAbhishek ReddyNessuna valutazione finora

- ACC221 Quiz1Documento10 pagineACC221 Quiz1milkyode9Nessuna valutazione finora

- Wipro WInsights Sustainability ReportingDocumento3 pagineWipro WInsights Sustainability ReportingHemant ChaturvediNessuna valutazione finora

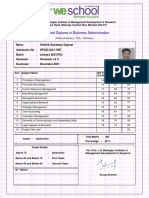

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDocumento1 paginaAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNessuna valutazione finora

- 7 P'sDocumento14 pagine7 P'sReena RialubinNessuna valutazione finora

- Thiruvananthapuram DipsDocumento28 pagineThiruvananthapuram DipsNithin SathianathNessuna valutazione finora

- Aula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IDocumento16 pagineAula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IfelippeavlisNessuna valutazione finora

- The Ideal Essay ST Vs PLTDocumento1 paginaThe Ideal Essay ST Vs PLTAlisha HoseinNessuna valutazione finora

- Professor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of MicroeconomicsDocumento9 pagineProfessor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of Microeconomicshyung_jipmNessuna valutazione finora

- IC Accounts Payable Ledger 9467Documento2 pagineIC Accounts Payable Ledger 9467Rahul BadaikNessuna valutazione finora

- 220221-Atom Diesel-Vietnam..Documento1 pagina220221-Atom Diesel-Vietnam..Tonny NguyenNessuna valutazione finora

- ASSIGNMENT 407 - Audit of InvestmentsDocumento3 pagineASSIGNMENT 407 - Audit of InvestmentsWam OwnNessuna valutazione finora

- Auditing NotesDocumento1 paginaAuditing NotesEhsan Umer FarooqiNessuna valutazione finora