Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

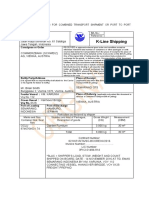

Bill of Exchange & Promissonary Note

Caricato da

Pratik JoshiDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bill of Exchange & Promissonary Note

Caricato da

Pratik JoshiCopyright:

Formati disponibili

NEGOTIABLE INSTRUMENTS Bill of exchange: In order to fully grasp the transactions relating to bill of exchange we thoroughly learn the

procedure. The following example will make it clear. Suppose A sells goods to the value of $500 to B. The most ready means of closing the transaction will be cash payment by B to A. But payment of this nature is not many in actual practice. The greatest volume of business is done on credit. That being the case A will have to wait for some time to receive payment from B. A, merchant can hardly afford to be out of funds for long. Moreover, to sell goods on credit is rather a risky job. Therefore as soon as A sells goods to B, he will draw a bill for $500 on B and forward the same to him together with the goods with instructions to B to accept the bill and return the same to A. Upon receipt of the bill, B would write on the face of the bill" accepted" and put his signature below. It means that B approves the bill and also binds himself to pay the amount thereof when due. The bill is thus complete and comes back to A to remain in his possession till maturity or can be endorsed or discounted by him. On the due date the holder of the bill presents it before the acceptor and receives payment of the bill from the acceptor. Promissory Note: There is another method of payment similar to bill of exchange i.e. promissory note. In this method, in place of the seller drawing a bill of exchange on the purchaser, the purchaser himself makes a written promise to pay the amount to the seller. It is defined as an instrument in writing containing an unconditional promise, signed by the maker to pay on demand or at a fixed or determinable future time, a certain sum of money only to or to the order of a certain person or to the bearer of the instrument. Cheques: Different types of cheques based on methods of issuing Open cheque or bearer cheque: The issuer of the cheque would just fill the name of the person to whom the cheque is issued, writes the amount and attaches his signature and nothing else. This type of issuing a cheque is also called bearer type cheque also known as open cheque or uncrossed cheque. The cheque is negotiable from the date of issue to three months. The issued cheque turns stale after the completion of three months. It has to be revalidated before presenting to the bank. A crossed cheque or an account payee cheque: It is written in the same as that of bearer cheque but issuer specifically specifies it as account payee on the left hand top corner or simply crosses it twice with two parallel lines on the right hand top corner. The bearer of the cheque

presenting it to the bank should have an account in the branch to which the written sum is deposited. It is safest type of cheques. A self cheque: A self cheque is written by the account holder as pay self to receive the money in the physical form from the branch where he holds his account. Pay yourself cheque: The account holder issues this type of crossed cheque to the bank asking the bank deduct money from his account into banks own account for the purpose buying banking products like drafts, pay orders, fixed deposit receipts or for depositing money into other accounts held by him like recurring deposits and loan accounts. Post dated cheque (PDC): A PDC is a form of a crossed or account payee bearer cheque but post dated to meet the said financial obligation at a future date. Various types of cheques based on their functionality Local Cheque: A local cheque is a type of cheque which is valid in the given city and a given branch in which the issuer has an account and to which it is connected. The producer of the cheque in whose name it is issued can directly go to the designated bank and receive the money in the physical form. If a given citys local cheque is presented elsewhere shall attract some fixed banking charges. Although these type of cheques are still prevalent, especially with nationalised banks, it is slowly slated to be removed with at par cheque type. At par cheque: With the computerisation and networking of bank branches with its headquarters, a variation to the local cheque has become common place in the name of at par cheque. At par cheque is a cheque which is accepted at par at all its branches across the country. Unlike local cheque it can be present across the country without attracting additional banking charges. Bankers cheque: It is a kind of cheque issued by the bank itself connected to its own funds. It is a kind of assurance given by the issuer to the client to alley your fears. The personal accountconnected cheques may bounce for want of funds in his account. To avoid such hurdles, sometimes, the receiver seeks bankers cheque. Travelers cheques: They are a kind of an open type bearer cheque issued by the bank which can be used by the user for withdrawal of money while touring. It is equivalent to carrying cash but in a safe form without fear of losing it. Gift cheque: This is another banking instrument introduced for gifting money to the loved ones instead of hard cash. FDI vs FII:

Both FDI and FII are related to investment in a foreign country. FDI or Foreign Direct Investment is an investment that a parent company makes in a foreign country. On the contrary, FII or Foreign Institutional Investor is an investment made by an investor in the markets of a foreign nation. What is the difference b/w Cheque and Demand Draft? Cheque is written by an individual and Demand draft is issued by a bank. People believe banks more than individuals. Both are used for transfer the amount b/w two accounts of same or different banks. Demand drafts are city specific. What are all the advantages of Demand draft over Cheque? You can 100% trusts in a DD. It is a banker's check. A check may be dishonoured for lack of funds a DD cannot. Is it possible to get a demand draft from one place and using it in other place without any charge? When you issue a DD, you have to mention the city in which it would be deposited. Mutual Funds Basics of mutual funds The article mentioned below, is for the investors who have not yet started investing in mutual funds, but willing to explore the opportunity and also for those who want to clear their basics for what is mutual fund and how best it can serve as an investment tool. Getting Started Before we move to explain what is mutual fund, its very important to know the area in which mutual funds works, the basic understanding of stocks and bonds. Stocks Stocks represent shares of ownership in a public company. Examples of public companies include Reliance, ONGC and Infosys. Stocks are considered to be the most common owned investment traded on the market. Bonds Bonds are basically the money which you lend to the government or a company, and in return you can receive interest on your invested amount, which is back over predetermined amounts of time. Bonds are considered to be the most common lending investment traded on the market. There are many other types of investments other than stocks and bonds (including annuities, real estate, and precious metals), but the majority of mutual funds invest in stocks and/or bonds. Regulatory Authorities

To protect the interest of the investors, SEBI formulates policies and regulates the mutual funds. It notified regulations in 1993 (fully revised in 1996) and issues guidelines from time to time. MF either promoted by public or by private sector entities including one promoted by foreign entities is governed by these Regulations. SEBI approved Asset Management Company (AMC) manages the funds by making investments in various types of securities. Custodian, registered with SEBI, holds the securities of various schemes of the fund in its custody. According to SEBI Regulations, two thirds of the directors of Trustee Company or board of trustees must be independent. The Association of Mutual Funds in India (AMFI) reassures the investors in units of mutual funds that the mutual funds function within the strict regulatory framework. Its objective is to increase public awareness of the mutual fund industry. AMFI also is engaged in upgrading professional standards and in promoting best industry practices in diverse areas such as valuation, disclosure, transparency etc. What is a Mutual Fund? A mutual fund is just the connecting bridge or a financial intermediary that allows a group of investors to pool their money together with a predetermined investment objective. The mutual fund will have a fund manager who is responsible for investing the gathered money into specific securities (stocks or bonds). When you invest in a mutual fund, you are buying units or portions of the mutual fund and thus on investing becomes a shareholder or unit holder of the fund. Mutual funds are considered as one of the best available investments as compare to others they are very cost efficient and also easy to invest in, thus by pooling money together in a mutual fund, investors can purchase stocks or bonds with much lower trading costs than if they tried to do it on their own. But the biggest advantage to mutual funds is diversification, by minimizing risk & maximizing returns. Types of Mutual Funds Schemes in India Wide variety of Mutual Fund Schemes exists to cater to the needs such as financial position, risk tolerance and return expectations etc. thus mutual funds has Variety of flavors, Being a collection of many stocks, an investors can go for picking a mutual fund might be easy. There are over hundreds of mutual funds scheme to choose from. It is easier to think of mutual funds in categories, mentioned below. Overview of existing schemes existed in mutual fund category: BY STRUCTURE 1. Open - Ended Schemes: An open-end fund is one that is available for subscription all through the year. These do not have a fixed maturity. Investors can conveniently buy and sell units at Net Asset Value ("NAV") related prices. The key feature of open-end schemes is liquidity.

2. Close - Ended Schemes: These schemes have a pre-specified maturity period. One can invest directly in the scheme at the time of the initial issue. Depending on the structure of the scheme there are two exit options available to an investor after the initial offer period closes. Investors can transact (buy or sell) the units of the scheme on the stock exchanges where they are listed. The market price at the stock exchanges could vary from the net asset value (NAV) of the scheme on account of demand and supply situation, expectations of unitholder and other market factors. Alternatively some closeended schemes provide an additional option of selling the units directly to the Mutual Fund through periodic repurchase at the schemes NAV; however one cannot buy units and can only sell units during the liquidity window. SEBI Regulations ensure that at least one of the two exit routes is provided to the investor. 3. Interval Schemes: Interval Schemes are that scheme, which combines the features of open-ended and close-ended schemes. The units may be traded on the stock exchange or may be open for sale or redemption during pre-determined intervals at NAV related prices. The risk return trade-off indicates that if investor is willing to take higher risk then correspondingly he can expect higher returns and vise versa if he pertains to lower risk instruments, which would be satisfied by lower returns. For example, if an investors opt for bank FD, which provide moderate return with minimal risk. But as he moves ahead to invest in capital protected funds and the profit-bonds that give out more return which is slightly higher as compared to the bank deposits but the risk involved also increases in the same proportion. Thus investors choose mutual funds as their primary means of investing, as Mutual funds provide professional management, diversification, convenience and liquidity. That doesnt mean mutual fund investments risk free. This is because the money that is pooled in are not invested only in debts funds which are less riskier but are also invested in the stock markets which involves a higher risk but can expect higher returns. Hedge fund involves a very high risk since it is mostly traded in the derivatives market which is considered very volatile. Overview of existing schemes existed in mutual fund category: BY NATURE 1. Equity fund: These funds invest a maximum part of their corpus into equities holdings. The structure of the fund may vary different for different schemes and the fund managers outlook on different stocks. The Equity Funds are sub-classified depending upon their investment objective, as follows: Diversified Equity Funds Mid-Cap Funds Sector Specific Funds Tax Savings Funds (ELSS) Equity investments are meant for a longer time horizon, thus Equity funds rank high on the riskreturn matrix. 2. Debt funds:

The objective of these Funds is to invest in debt papers. Government authorities, private companies, banks and financial institutions are some of the major issuers of debt papers. By investing in debt instruments, these funds ensure low risk and provide stable income to the investors. Debt funds are further classified as: Gilt Funds: Invest their corpus in securities issued by Government, popularly known as Government of India debt papers. These Funds carry zero Default risk but are associated with Interest Rate risk. These schemes are safer as they invest in papers backed by Government. Income Funds: Invest a major portion into various debt instruments such as bonds, corporate debentures and Government securities. MIPs: Invests maximum of their total corpus in debt instruments while they take minimum exposure in equities. It gets benefit of both equity and debt market. These scheme ranks slightly high on the risk-return matrix when compared with other debt schemes. Short Term Plans (STPs): Meant for investment horizon for three to six months. These funds primarily invest in short term papers like Certificate of Deposits (CDs) and Commercial Papers (CPs). Some portion of the corpus is also invested in corporate debentures Liquid Funds: Also known as Money Market Schemes, These funds provides easy liquidity and preservation of capital. These schemes invest in short-term instruments like Treasury Bills, interbank call money market, CPs and CDs. These funds are meant for short-term cash management of corporate houses and are meant for an investment horizon of 1day to 3 months. These schemes rank low on risk-return matrix and are considered to be the safest amongst all categories of mutual funds. 2. Balanced funds: As the name suggest they, are a mix of both equity and debt funds. They invest in both equities and fixed income securities, which are in line with pre-defined investment objective of the scheme. These schemes aim to provide investors with the best of both the worlds. Equity part provides growth and the debt part provides stability in returns. Further the mutual funds can be broadly classified on the basis of investment parameter viz, Each category of funds is backed by an investment philosophy, which is pre-defined in the objectives of the fund. The investor can align his own investment needs with the funds objective and invest accordingly By investment objective: Growth Schemes: Growth Schemes are also known as equity schemes. The aim of these schemes is to provide capital appreciation over medium to long term. These schemes normally invest a major part of their fund in equities and are willing to bear short-term decline in value for possible future appreciation Income Schemes: Income Schemes are also known as debt schemes. The aim of these schemes is to provide regular and steady income to investors. These schemes generally invest in fixed income securities such as bonds and corporate debentures. Capital appreciation in such schemes may be limited

Balanced Schemes: Balanced Schemes aim to provide both growth and income by periodically distributing a part of the income and capital gains they earn. These schemes invest in both shares and fixed income securities, in the proportion indicated in their offer documents (normally 50:50). Money Market Schemes: Money Market Schemes aim to provide easy liquidity, preservation of capital and moderate income. These schemes generally invest in safer, short-term instruments, such as treasury bills, certificates of deposit, commercial paper and inter-bank call money. Certificate of Deposit: A certificate of deposit is a promissory note issued by a bank. It is a time deposit that restricts holders from withdrawing funds on demand. Although it is still possible to withdraw the money, this action will often incur a penalty. For example, let's say that you purchase a $10,000 CD with an interest rate of 5% compounded annually and a term of one year. At year's end, the CD will have grown to $10,500 ($10,000 * 1.05). CDs of less than $100,000 are called "small CDs"; CDs for more than $100,000 are called "large CDs" or "jumbo CDs". Almost all large CDs, as well as some small CDs, are negotiable.

Commercial Paper: An unsecured, short-term debt instrument issued by a corporation, typically for the financing of accounts receivable, inventories and meeting short-term liabilities. Maturities on commercial paper rarely range any longer than 270 days. The debt is usually issued at a discount, reflecting prevailing market interest rates. Are certificates of deposit a kind of bond? There is a fair amount of overlap between certificates of deposit (CDs) and bonds; they are both fixed-income securities, which you generally hold on to until maturity. Simply put, you put your money into a CD or bond for a set period, and you know exactly what you will receive when that time is up. They are both debt based, meaning that you are the creditor - no different than having a friend ask for $10 today and give you an IOU promising to pay $11 dollars tomorrow. The interest ($1) is collected for the same reason that banks charge interest on loans: to compensate for delaying the ability to spend money. Loaning out $10 deprives you of having that $10 to use now for whatever you wish. We now know why bonds and CDs fit under the same broad category, but here is how they differ: 1. Issuer: In the case of bonds, the issuer is usually a company trying to raise funds for operations, the development of new products or the opportunity to take over another company. Investment-grade bonds have a very low default risk (the chance that your friend will take your

$10

and

never

come

back),

but

it

can

definitely

happen.

The issuer of CDs is usually a bank because CDs are not issued with the same motives that underlie bonds. CDs are similar to a savings account; they're basically a place to hold your money until you want to do something else with it. Because bonds issued by a company are riskier, they offer a favorable return to the people who buy them. The return on CDs, however, is typically less than bonds but a little better than a savings account. 2. Time/Maturity: This is the sticky part, but also the most significant point. Bonds are longerterm investments, generally maturing in more than 10 years. By contrast, CDs mature in as little as one month and as much as five years. The complication we run into now is that there are further distinctions or categories within the world of fixed-income debt securities, and they overlap everywhere. The loose categorization is as follows (put an imaginary "generally" in front of each description): T-Bills - mature in less than one year Notes - mature between one and 10 years Bonds - mature after a decade or more In other words, while a bond is technically a fixed-income security with a maturity of more than 10 years, people often use the term "bond" to refer to fixed-income securities in general - even those securities with a maturity of less than 10 years. The difference in time commitment for bonds and CDs is best expressed in terms of the investor's motives. As previously mentioned, CDs are generally considered short-term, low-risk, interestpaying storage for capital until a more profitable investment can be found. Bonds are considered long-term vehicles for guaranteeing a profit and, perhaps, offsetting some of the risk an investor may face in higher-yield investments such as equities. Money Market: What Is It? Filed Under 401K, Beginning Investor, Capital Market, Money Market, Retirement The money market is a subsection of the fixed income market. We generally think of the term fixed income as being synonymous to bonds. In reality, a bond is just one type of fixed income security. The difference between the money market and the bond market is that the money market specializes in very short-term debt securities (debt thatmatures in less than one year). Money market investments are also called cash investments because of their short maturities. Money market securities are essentially IOUs issued by governments, financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market and the stock market is that most money

market securities trade in very high denominations. This limits access for the individual investor. Furthermore, the money market is a dealer market, which means that firms buy and sell securities in their own accounts, at their own risk. Compare this to the stock market where a broker receives commission to acts as an agent, while the investor takes the risk of holding the stock. Another characteristic of a dealer market is the lack of a central trading floor or exchange. Deals are transacted over the phone or through electronic systems. The easiest way for us to gain access to the money market is with a money market mutual funds, or sometimes through a money market bank account. These accounts and funds pool together the assets of thousands of investors in order to buy the money market securities on their behalf. However, some money market instruments, like Treasury bills, may be purchased directly. Failing that, they can be acquired through other large financial institutions with direct access to these markets. There are several different instruments in the money market, offering different returns and different risks. In the following sections, we'll take a look at the major money market instruments.

Money Market: Treasury Bills (T-Bills) Filed Under 401K, Beginning Investor, Capital Market, Money Market, Retirement Treasury Bills (T-bills) are the most marketable money market security. Their popularity is mainly due to their simplicity. Essentially, T-bills are a way for the U.S. government to raise money from the public. In this tutorial, we are referring to T-bills issued by the U.S. government, but many other governments issue T-bills in a similar fashion. T-bills are short-term securities that mature in one year or less from their issue date. They are issued with three-month, six-month and one-year maturities. T-bills are purchased for a price that is less than their par (face) value; when they mature, the government pays the holder the full par value. Effectively, your interest is the difference between the purchase price of the security and what you get at maturity. For example, if you bought a 90-day T-bill at $9,800 and held it until maturity, you would earn $200 on your investment. This differs from coupon bonds, which pay interest semi-annually. Treasury bills (as well as notes and bonds) are issued through a competitive bidding process at auctions. If you want to buy a T-bill, you submit a bid that is prepared either noncompetitively or competitively. In non-competitive bidding, you'll receive the full amount of the security you want at the return determined at the auction. With competitive bidding, you have to specify the return that you would like to receive. If the return you specify is too high, you might not receive any securities, or just a portion of what you bid for. (More information on auctions is available at the TreasuryDirect website.) The biggest reasons that T-Bills are so popular is that they are one of the few money market instruments that are affordable to the individual investors. T-bills are usually issued in denominations of $1,000, $5,000, $10,000, $25,000, $50,000, $100,000 and $1 million. Other

positives are that T-bills (and all Treasuries) are considered to be the safest investments in the world because the U.S. government backs them. In fact, they are considered risk-free. Furthermore, they are exempt from state and local taxes. (For more on this, see Why do commercial bills have higher yields than T-bills?) The only downside to T-bills is that you won't get a great return because Treasuries are exceptionally safe. Corporate bonds, certificates of deposit and money market funds will often give higher rates of interest. What's more, you might not get back all of your investment if you cash out before the maturity date. Money Market: Certificate Of Deposit (CD) Filed Under 401K, Beginning Investor, Capital Market, Money Market, Retirement A certificate of deposit (CD) is a time deposit with a bank. CDs are generally issued by commercial banks but they can be bought through brokerages. They bear a specific maturity date (from three months to five years), a specified interest rate, and can be issued in any denomination, much like bonds. Like all time deposits, the funds may not be withdrawn on demand like those in a checking account. CDs offer a slightly higher yield than T-Bills because of the slightly higher default risk for a bank but, overall, the likelihood that a large bank will go broke is pretty slim. Of course, the amount of interest you earn depends on a number of other factors such as the current interest rate environment, how much money you invest, the length of time and the particular bank you choose. While nearly every bank offers CDs, the rates are rarely competitive, so it's important to shop around. A fundamental concept to understand when buying a CD is the difference between annual percentage yield (APY) and annual percentage rate (APR). APY is the total amount of interest you earn in one year, taking compound interest into account. APR is simply the stated interest you earn in one year, without taking compounding into account. (To learn more, read APR vs. APY: How The Distinction Affects You.) The difference results from when interest is paid. The more frequently interest is calculated, the greater the yield will be. When an investment pays interest annually, its rate and yield are the same. But when interest is paid more frequently, the yield gets higher. For example, say you purchase a one-year, $1,000 CD that pays 5% semi-annually. After six months, you'll receive an interest payment of $25 ($1,000 x 5 % x .5 years). Here's where the magic of compounding starts. The $25 payment starts earning interest of its own, which over the next six months amounts to $ 0.625 ($25 x 5% x .5 years). As a result, the rate on the CD is 5%, but its yield is 5.06. It may not sound like a lot, but compounding adds up over time. The main advantage of CDs is their relative safety and the ability to know your return ahead of time. You'll generally earn more than in a savings account, and you won't be at the mercy of the stock market. Plus, in the U.S. the Federal Deposit Insurance Corporation guarantees your investment up to $100,000.

Despite the benefits, there are two main disadvantages to CDs. First of all, the returns are paltry compared to many other investments. Furthermore, your money is tied up for the length of the CD and you won't be able to get it out without paying a harsh penalty.

Money Market: Commercial Paper For many corporations, borrowing short-term money from banks is often a laborious and annoying task. The desire to avoid banks as much as possible has led to the widespread popularity of commercial paper. (See Why do companies issue bonds instead of borrowing from the bank?) Commercial paper is an unsecured, short-term loan issued by a corporation, typically for financing accounts receivable and inventories. It is usually issued at a discount, reflecting current market interest rates. Maturities on commercial paper are usually no longer than nine months, with maturities of between one and two months being the average. For the most part, commercial paper is a very safe investment because the financial situation of a company can easily be predicted over a few months. Furthermore, typically only companies with high credit ratings and credit worthiness issue commercial paper. Over the past 40 years, there have only been a handful of cases where corporations have defaulted on their commercial paper repayment. Commercial paper is usually issued in denominations of $100,000 or more. Therefore, smaller investors can only invest in commercial paper indirectly through money market funds.

Required Documents you Should Carry for IBPS Common Interviews Friends, here is the list of documents you should carry with you for IBPS PO Common Interviews. Interview Call Letter sent by IBPS (you can download it from the website) Proof of Identity Proof of Date of Birth All Marks Sheets of your Education Provisional or Original Graduation Degree certificate Computer Knowledge certificate (if any) Caste certificate (as per format) Two Character Certificates (as per format) 2 Sets of Photostat Copies of all your Certificates with self attestation (actually they're asking for one set along with Character Certificate, but its better to take two) No Objection Certificate (if you have experience in any Public Sector Bank or any Govt office). No need to submit NOC if you work for Private Sector. No need of the print out of Score Card (better to take, but they are not asking for this) If you dont have any of the above Certificates then you should write a letter of undertaking that you will submit the certificate within the duration of 30 days.

Potrebbero piacerti anche

- 1996 If You Are The Defendant by Otto SkinnerDocumento245 pagine1996 If You Are The Defendant by Otto Skinnernetgazer79Nessuna valutazione finora

- Price Per Visit Quantity Demanded Quantity SuppliedDocumento4 paginePrice Per Visit Quantity Demanded Quantity SuppliedGrace FranzNessuna valutazione finora

- Research The Organizational Chart and International Business Strategy VinamilkDocumento24 pagineResearch The Organizational Chart and International Business Strategy VinamilkKhánh Huyền PhạmNessuna valutazione finora

- Articles of Incorporation of LendingDocumento3 pagineArticles of Incorporation of LendingJhoey Castillo Bueno100% (1)

- The Great British Mortgage Swindle - Next-Steps - 1Documento8 pagineThe Great British Mortgage Swindle - Next-Steps - 1Slim Jim100% (1)

- Sales Sample Q Sans F 09Documento17 pagineSales Sample Q Sans F 09Tay Mon100% (1)

- Backup Withholding - What Is It and How Can I Obtain A RefundDocumento35 pagineBackup Withholding - What Is It and How Can I Obtain A RefundAyodeji Badaki100% (1)

- 1951a How To Pay MortgageDocumento52 pagine1951a How To Pay MortgageAriesWayNessuna valutazione finora

- 1934 Citizenship Act 73rd CongressDocumento2 pagine1934 Citizenship Act 73rd CongresspatriotlindaNessuna valutazione finora

- Right of Way - AccountingDocumento3 pagineRight of Way - AccountingVeronica RiveraNessuna valutazione finora

- SPC Trust Instructions Visual Aid No Highlights - 2.5.16Documento100 pagineSPC Trust Instructions Visual Aid No Highlights - 2.5.16duvard purdueNessuna valutazione finora

- Jurisprudence NewDocumento72 pagineJurisprudence Newseshu187100% (1)

- Funky Bookkeeping 101 - MOCEE: by Anna Von ReitzDocumento3 pagineFunky Bookkeeping 101 - MOCEE: by Anna Von ReitzWayne LundNessuna valutazione finora

- 02 FiduciariesDocumento95 pagine02 FiduciarieshiltonqNessuna valutazione finora

- Trusts OutlineDocumento8 pagineTrusts OutlineClint Bell100% (1)

- Diplomatic and Consular ImmunityDocumento27 pagineDiplomatic and Consular Immunitytbelote7Nessuna valutazione finora

- Notice Concerning Fiduciary Relationship: IdentificationDocumento2 pagineNotice Concerning Fiduciary Relationship: IdentificationMike SiscoNessuna valutazione finora

- Public Notice. Pope Declares Bankruptcy of UNITED STATESDocumento1 paginaPublic Notice. Pope Declares Bankruptcy of UNITED STATESin1orNessuna valutazione finora

- Hecht v. Malley, 265 U.S. 144 (1924)Documento15 pagineHecht v. Malley, 265 U.S. 144 (1924)Scribd Government DocsNessuna valutazione finora

- Banker NotesDocumento134 pagineBanker NotesEdward MokweriNessuna valutazione finora

- 5 Usc Part IiiDocumento4 pagine5 Usc Part IiiMike SiscoNessuna valutazione finora

- The Revolution Will Be DigitizedDocumento4 pagineThe Revolution Will Be DigitizedToronto Star100% (1)

- Senate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceDocumento53 pagineSenate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceScribd Government DocsNessuna valutazione finora

- Dictionary of BankingDocumento113 pagineDictionary of Bankingمحمود الحروب100% (1)

- Treasury Rules 1 Complete PDFDocumento322 pagineTreasury Rules 1 Complete PDFroohullah khanNessuna valutazione finora

- 537 QuestionsDocumento95 pagine537 QuestionsJohnnyLarsonNessuna valutazione finora

- Tutorial 020Documento5 pagineTutorial 020Jason HenryNessuna valutazione finora

- UntitledDocumento1 paginaUntitledCarlosNessuna valutazione finora

- BANK OF AMERICA, NT & SA Vs CADocumento10 pagineBANK OF AMERICA, NT & SA Vs CAMaria VictoriaNessuna valutazione finora

- War Powers Act VetoDocumento3 pagineWar Powers Act VetoChristopher Chiang100% (1)

- OID Demystified (Somewhat)Documento6 pagineOID Demystified (Somewhat)Reznick Group NMTC PracticeNessuna valutazione finora

- July 2, 2014 Leave A CommentDocumento3 pagineJuly 2, 2014 Leave A CommentMaryann BarberanNessuna valutazione finora

- 6-Two Faces of DebtDocumento29 pagine6-Two Faces of DebtscottyupNessuna valutazione finora

- Hailey College of Banking and FinanceDocumento18 pagineHailey College of Banking and Financesea waterNessuna valutazione finora

- Collector Letter One.Documento2 pagineCollector Letter One.Mike SiscoNessuna valutazione finora

- Tutorial 000Documento13 pagineTutorial 000Jason HenryNessuna valutazione finora

- Chapter - 1 Concept of PersonDocumento24 pagineChapter - 1 Concept of PersonShivangi AgrawalNessuna valutazione finora

- 7 CFRDocumento1 pagina7 CFREl-Seti Anu Ali ElNessuna valutazione finora

- Tutorial 010Documento4 pagineTutorial 010Jason HenryNessuna valutazione finora

- How You Became A Commodity - The Creation of Constructive TrustsDocumento6 pagineHow You Became A Commodity - The Creation of Constructive TrustsSteveManningNessuna valutazione finora

- Negotiable Instruments Act, 1881Documento23 pagineNegotiable Instruments Act, 1881Arvind Mallik100% (1)

- Department of Probation, Parole and Pardon Services: Henry Mcmaster Jerry B. AdgerDocumento4 pagineDepartment of Probation, Parole and Pardon Services: Henry Mcmaster Jerry B. Adgerashish14321100% (1)

- Mankiw 2003 Principles of EconomicsDocumento23 pagineMankiw 2003 Principles of EconomicsDiego LopezNessuna valutazione finora

- Appointment of A ReceiverDocumento8 pagineAppointment of A ReceiverMichael FociaNessuna valutazione finora

- Depository Receipts Information Guide - CitigroupDocumento58 pagineDepository Receipts Information Guide - CitigroupyasheshthakkarNessuna valutazione finora

- Senate Hearing, 111TH Congress - Mortgage Fraud, Securities Fraud, and The Financial Meltdown: Prosecuting Those ResponsibleDocumento124 pagineSenate Hearing, 111TH Congress - Mortgage Fraud, Securities Fraud, and The Financial Meltdown: Prosecuting Those ResponsibleScribd Government DocsNessuna valutazione finora

- Balance of PaymentsDocumento6 pagineBalance of PaymentsChanti KumarNessuna valutazione finora

- Identification of Debt InstrumentsDocumento12 pagineIdentification of Debt InstrumentsXNessuna valutazione finora

- Jura L Assembly HandbookDocumento213 pagineJura L Assembly Handbookvj xiver100% (1)

- Reclaiming Your Strawman BookDocumento15 pagineReclaiming Your Strawman Bookffnc496m8wNessuna valutazione finora

- US Internal Revenue Service: p1212 - 2005Documento112 pagineUS Internal Revenue Service: p1212 - 2005IRSNessuna valutazione finora

- CFR 2000 Title21 Vol6 Part558Documento114 pagineCFR 2000 Title21 Vol6 Part558ukakahfianaNessuna valutazione finora

- On The Road : Is Driving A Licensable Occupation?Documento36 pagineOn The Road : Is Driving A Licensable Occupation?MaxNessuna valutazione finora

- Private Law 2 2020 PDFDocumento12 paginePrivate Law 2 2020 PDFАнна ЛерерNessuna valutazione finora

- Federal Register / Vol. 63, No. 153 / Monday, August 10, 1998 / Proposed RulesDocumento7 pagineFederal Register / Vol. 63, No. 153 / Monday, August 10, 1998 / Proposed RulesCarlosNessuna valutazione finora

- Depository AND Custodial ServicesDocumento16 pagineDepository AND Custodial Servicesshivakumar NNessuna valutazione finora

- Promissory NoteDocumento1 paginaPromissory Notepauldavey18100% (1)

- The Road Vehicles (Display of Registration Marks) Regulations 2001Documento25 pagineThe Road Vehicles (Display of Registration Marks) Regulations 2001sseagal_1980Nessuna valutazione finora

- Sample: MERS Mortgage Language Has Been Inserted As Blue TextDocumento3 pagineSample: MERS Mortgage Language Has Been Inserted As Blue TextRichie CollinsNessuna valutazione finora

- Land of Oppression Instead of Land of OpportunityDa EverandLand of Oppression Instead of Land of OpportunityNessuna valutazione finora

- Current Affairs February 2013Documento3 pagineCurrent Affairs February 2013Pratik JoshiNessuna valutazione finora

- GK February 2013Documento1.854 pagineGK February 2013Pratik JoshiNessuna valutazione finora

- EPCG SchemeDocumento2 pagineEPCG SchemePratik JoshiNessuna valutazione finora

- Assessment of Working Capital Finance Project by NonameDocumento91 pagineAssessment of Working Capital Finance Project by NonameHema RushiNessuna valutazione finora

- A Study On Customer Based Brand Equity (CBBE) of Amazon Amongst Millennial's of Surat City. (ResponsesDocumento5 pagineA Study On Customer Based Brand Equity (CBBE) of Amazon Amongst Millennial's of Surat City. (ResponsesMohammed GodilNessuna valutazione finora

- InvestmentDocumento3 pagineInvestmentAngelica PagaduanNessuna valutazione finora

- Dayrit V CA DigestDocumento3 pagineDayrit V CA DigestReplyNessuna valutazione finora

- PHP KF Ma ASDocumento32 paginePHP KF Ma ASEat BestNessuna valutazione finora

- Bill of Lading AustriaDocumento2 pagineBill of Lading AustriaTitik KurniyatiNessuna valutazione finora

- Dokumen PDFDocumento21 pagineDokumen PDFMark AlcazarNessuna valutazione finora

- Marine Insurance (Chapter 08)Documento16 pagineMarine Insurance (Chapter 08)Abu Muhammad Hatem TohaNessuna valutazione finora

- Infosys-A Case Study Decision SheetDocumento3 pagineInfosys-A Case Study Decision SheetRAW STARNessuna valutazione finora

- Dkeff Guarantor FormDocumento2 pagineDkeff Guarantor FormDallas SmithNessuna valutazione finora

- Forex Trading Journal: DateDocumento3 pagineForex Trading Journal: DateFloraNessuna valutazione finora

- SS - 9 - Forfeiture of SharesDocumento3 pagineSS - 9 - Forfeiture of SharesMihir MehtaNessuna valutazione finora

- Supply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Documento19 pagineSupply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Shahrukh Ghulam NabiNessuna valutazione finora

- Human SecurityDocumento10 pagineHuman Securitykrish_7Nessuna valutazione finora

- Facture Att LaurisDocumento4 pagineFacture Att LauriscedricNessuna valutazione finora

- Week 3 - Lecture #1 Foundational Concepts of AISDocumento25 pagineWeek 3 - Lecture #1 Foundational Concepts of AISChand DivneshNessuna valutazione finora

- When Designing Tests of Controls and Substantive Tests of TransactionsDocumento3 pagineWhen Designing Tests of Controls and Substantive Tests of TransactionsHira ParachaNessuna valutazione finora

- DSD Fee Study 12.04.202Documento27 pagineDSD Fee Study 12.04.202April ToweryNessuna valutazione finora

- Finance Lecturers by Course and Size UNSWDocumento2 pagineFinance Lecturers by Course and Size UNSWhello248Nessuna valutazione finora

- Copyright in ChinaDocumento237 pagineCopyright in ChinaccoamamaniNessuna valutazione finora

- (FIX) FOH Budget and COGS BudgetDocumento26 pagine(FIX) FOH Budget and COGS BudgetAlifia Zulfa SalsabilaNessuna valutazione finora

- Leadership ActivityDocumento2 pagineLeadership ActivityCecilia Arreola ArceoNessuna valutazione finora

- Fin 254 Final ProjectDocumento36 pagineFin 254 Final ProjectDpn BzNessuna valutazione finora

- A Descriptive Analysis of Consumer'S Adoption of E-WalletsDocumento19 pagineA Descriptive Analysis of Consumer'S Adoption of E-WalletsAndrea TugotNessuna valutazione finora

- SAP-APO - Create Field Material ViewDocumento8 pagineSAP-APO - Create Field Material ViewPArk100Nessuna valutazione finora

- Lecture 3 MoodleDocumento29 pagineLecture 3 MoodlepisicutzaaNessuna valutazione finora

- Business Continuity & IT Disaster Recovery - Document Business Continuity Requirements Course Dubai - Business Continuity Plan Course Dubai - RDocumento4 pagineBusiness Continuity & IT Disaster Recovery - Document Business Continuity Requirements Course Dubai - Business Continuity Plan Course Dubai - Rnader aliNessuna valutazione finora