Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Credit Rating Score

Caricato da

sakib_nsu_082Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Credit Rating Score

Caricato da

sakib_nsu_082Copyright:

Formati disponibili

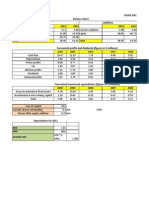

M/S Kashem Masla & Lachi Samai Methodology should cover analysis of following risks parameters (Score 100)

Company Financial Maximum Score Data 2012 A. Financial Risk: Capital Structure (Total: 08 Points) 1 Leverage(Less than 0.25 - More than 2.75 times) Liquidity Ratio (Total : 15 Points) 2 Current Ratio (Greater than 2.74 - Less than 0.70 times) 3 Cash Conversion Cycle (CCC) 4 5 6 7 8 Cash Ratio 93.63 Gross PM (Greater than 25% - Less than 1%) Net PM % ROA % ROE % 50.00 0.40 1.82 102.1 0.0100 17.40% 8.91% 16.64% 24.46% 8.00 5.00 5.00 5.00 4.00 4.00 3.00 3.00 Weight of Quantitative Score (75%) 22.46 5.96 2.06 1.88 1.13 2.06 1.88 2.25 2.25 Quantitative Score Achieved Weight of Qualitative Score (25%) 9.94 1.75 0.75 0.63 0.50 0.75 0.75 0.63 0.63 Qualitative Score Achieved Reasoning Total Score achieved Rating Long Term Rating Weighted Score

29.94 7.95 2.75 2.50 1.50 2.74 2.50 3.00 3.00

33.00 7.00 3.00 2.50 2.00 3.00 3.00 2.50 2.50 increased from 2010

32.39 7.71 2.81 2.50 1.63 2.81 2.63 2.88 2.88

decreased. But needs to decrease more.

AAA AA + AA AAA+ A ABBB+ BBB BBBBB+ BB BBB+ B BC D

91 88 84 81 78 74 71 68 64 61 58 54 51

100 90 87 83 80 77 73 70 67 63 60 57 53 50 47 43 40

Cashflow Coverage Ratio (Total: 07 Points) 9 Interest Coverage ratio (More than 5.00 - Less than 1.00 times) 10 Debt Coverage ratio (More than 2.00 - Less than 1.00 times) 0.62 11 Books of accounts are maintained 12 Audited by Quality Audit firm 13 Management reports are prepared B. Business / Industry Risk: Competitive Industry Position (Total: 11 Points) 14 Size of Business (>60.00 Tk. cr. -< 2.50Tk. cr.last years sale) 15 Age of Business(>10years-<2 years) 16 Business Outlook (Favorable - Cause for Concern) Industry Outlook (Total: 12 Points) 17 Industry Growth (10% + -<1%) 18 Competition (Dominant Player - Competitive) 19 Entry / Exit Barriers to Business (Difficult-Easy) Operating Risk (Total: 07 Points) 20 Risk Management 21 Foreign Exchange Risk Mangement (Hedging - If Any) C. Management Risk: 22 Experience (More than 10 years in there lated line of business - No experience) 23 Succession(Noexperience- Succession in question)& 24 Team Work (Very Good-Regular Conflict) 25 Corporate Governance 26 IT Environment and Technological Advancement D. Security Risk: 27 Security Coverage (Capable for fully pledged/cashcover/Reg. Mortgage - Not capable to provide security) 28 Collateral coverage (Capable for Registered Mortgage on Municipal corporation/Prime area property - Not capable for providing such collateral) 29 Support/Guarantee (Capable Personal guarantee with high net worth or Strong Corporate Guarantee - Not capable for Support/Guarantee 30 Legal Intervention (If Any) 31 Proper Documentation and Papers E. Bank Relationship Risk: 32 Bank Account Conduct (Maintain More than 3 (three) years accounts with faultless record Account(s) says Frequent Past dues & Irregular dealings) 33 Utilization of Loan Limit - If any (More than 60% - Less than 40%) 34 Compliance of covenants/conditions - lf any (Full Compliance - No Compliance)& 35 Personal Deposit (Personal accounts of the key business Sponsors/Principals are maintained in bank(s), with significant deposits - No depository relationship)

Decreasing trend Decreasing trend Improved from previous 2 years Improved from previous 2 years

5.5 0.43 Moderate Nil Moderate

4.00 3.00 2.00 2.00 2.00 30.00 3.00 3.00 5.00 4.00 4.00 4.00 4.00 3.00 10.00 2.00 2.00 1.00 2.00 3.00 5.00 1.00 1.00 1.00 1.00 1.00 5.00 1.00 1.00 2.00 1.00 100.00

3.00 0.00

4.00 0.00

0.94 0.38 1.00 0.25 1.00 9.25 0.50 0.75 1.00 0.63 0.75 0.63 3.00 2.00 1.50 0.50 0.38 0.06 0.06 0.50 5.00 1.00 1.00 1.00 1.00 1.00 1.25 0.25 0.25 0.50 0.25 26.94

3.75 1.50 1.00 0.25 1.00 17.00 2.00 3.00 4.00 2.50 3.00 2.50 3.00 2.00 6.00 2.00 1.50 0.25 0.25 2.00 5.00 1.00 1.00 1.00 1.00 1.00 5.00 1.00 1.00 2.00 1.00 66.00

3.94 0.38 1.00 0.25 1.00 22.41 1.28 3.00 4.38 2.88 3.75 2.13 3.00 2.00 6.38 2.00 1.88 0.44 0.44 1.63 5.00 1.00 1.00 1.00 1.00 1.00 5.00 1.00 1.00 2.00 1.00 71.17

48 44 41 38 & Not Classified (< 38) Short Term Rating Weighted Score 81 71 61 51 41 38 & less -

13.16 0.78 2.25 3.38 2.25 3.00 1.50

17.54 1.04 3.00 4.50 3.00 4.00 2.00

Rating AR - 1 AR - 2 AR - 3 AR - 4 AR - 5 AR - 6

22.4 More than 10 years Moderate Moderate Competitive Low Moderate Moderate More than 10 years Successful Low Low Low Capable Capable Capable None Moderate Good Capable Compliant Moderate

100 80 70 60 50 40

4.88 1.50 1.50 0.38 0.38 1.13 0.00

6.50 2.00 2.00 0.50 0.50 1.50 0.00

3.75 0.75 0.75 1.50 0.75 44.24

5.00 1.00 1.00 2.00 1.00 58.98

Long Term Short Term -

AAR - 3

Edit the blue cells only (Put numbers only in blue cells)

Assign Rating for Long Term

A-

Potrebbero piacerti anche

- SwapsDocumento38 pagineSwapsNavleen KaurNessuna valutazione finora

- OpenSAP Leo4 All SlidesDocumento52 pagineOpenSAP Leo4 All SlidesPradeep KavangalNessuna valutazione finora

- Class Notes - 1Documento32 pagineClass Notes - 1ushaNessuna valutazione finora

- GFMP - Debt Markets - Money MarketDocumento16 pagineGFMP - Debt Markets - Money MarketrudypatilNessuna valutazione finora

- 2022 - Chapter01 - Why Value ValueValueDocumento13 pagine2022 - Chapter01 - Why Value ValueValueElias MacherNessuna valutazione finora

- Basics On Investments FinalDocumento105 pagineBasics On Investments FinalRohitGuleriaNessuna valutazione finora

- Malaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)Documento6 pagineMalaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)nestleomegasNessuna valutazione finora

- International Finance - Module VDocumento38 pagineInternational Finance - Module VVishnu VishnuNessuna valutazione finora

- Class NotesDocumento77 pagineClass NotesSphamandla MakalimaNessuna valutazione finora

- Ipo PresentationDocumento12 pagineIpo Presentationqaraj44Nessuna valutazione finora

- MergedDocumento634 pagineMergedRishabh DabasNessuna valutazione finora

- RSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFDocumento98 pagineRSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFAli Gokhan KocanNessuna valutazione finora

- Innovations in Green Credit Markets (Working Paper) - Esohe Denise Odaro, Head of Investor Relations IFCDocumento19 pagineInnovations in Green Credit Markets (Working Paper) - Esohe Denise Odaro, Head of Investor Relations IFCedo7Nessuna valutazione finora

- S8 Options Online VersionDocumento51 pagineS8 Options Online Versionconstruction omanNessuna valutazione finora

- AFA 3e PPT Chap10Documento79 pagineAFA 3e PPT Chap10Quỳnh NguyễnNessuna valutazione finora

- 1 Corporate Finance IntroductionDocumento41 pagine1 Corporate Finance IntroductionPooja KaulNessuna valutazione finora

- Derivative Risk Management: BY Ca Umesh KolapkarDocumento42 pagineDerivative Risk Management: BY Ca Umesh KolapkarBhakti KhannaNessuna valutazione finora

- 1cr4dm8kl 930744Documento4 pagine1cr4dm8kl 930744DGLNessuna valutazione finora

- ITS Module 2Documento57 pagineITS Module 2Holy BankNessuna valutazione finora

- Exit Via Ipo in China: An Examination of The Exit EnvironmentDocumento23 pagineExit Via Ipo in China: An Examination of The Exit EnvironmentShirlene TsuiNessuna valutazione finora

- PrivCo Facebook Valuation: May 2012Documento25 paginePrivCo Facebook Valuation: May 2012privcoNessuna valutazione finora

- SPAC Vs IPO ModelDocumento5 pagineSPAC Vs IPO ModelJohnNessuna valutazione finora

- Fundamentals of FinancemangementDocumento103 pagineFundamentals of FinancemangementjajoriavkNessuna valutazione finora

- Ballerina Tech Assumptions & SummaryDocumento48 pagineBallerina Tech Assumptions & Summaryapi-25978665Nessuna valutazione finora

- The Theory of Trade and InvestmentDocumento52 pagineThe Theory of Trade and InvestmentaravindamritaNessuna valutazione finora

- Chicago Board of Trade - (CBOT)Documento10 pagineChicago Board of Trade - (CBOT)Debdoot MukherjeeNessuna valutazione finora

- International Trade and Foreign Direct InvestmentDocumento26 pagineInternational Trade and Foreign Direct InvestmentNgoc Linh BuiNessuna valutazione finora

- Term LoanDocumento39 pagineTerm Loanashok_gupta077Nessuna valutazione finora

- Cours Corporate FinanceDocumento126 pagineCours Corporate FinanceAlexandraNessuna valutazione finora

- Case No. 1 BWFM5013Documento8 pagineCase No. 1 BWFM5013Shashi Kumar NairNessuna valutazione finora

- Swaps NewDocumento46 pagineSwaps NewSimón AltkornNessuna valutazione finora

- Reeby Sports SARY1Documento13 pagineReeby Sports SARY1Santanu DasNessuna valutazione finora

- Simon Lim, Director - Listings 26 March 2008: Singapore ExchangeDocumento40 pagineSimon Lim, Director - Listings 26 March 2008: Singapore ExchangenetworkedNessuna valutazione finora

- Credit Derivatives & Structured Products: FRM (Term V) 2013Documento21 pagineCredit Derivatives & Structured Products: FRM (Term V) 2013NishantNessuna valutazione finora

- Chap3 MefDocumento51 pagineChap3 MefShantonu Rahman Shanto 1731521Nessuna valutazione finora

- Cfa l1 CurrencyDocumento35 pagineCfa l1 CurrencyRajesh ShahNessuna valutazione finora

- Fina6000 Module 2c - Capital RaisingDocumento22 pagineFina6000 Module 2c - Capital RaisingMar SGNessuna valutazione finora

- Big Picture Sustainable Accounting and FinanceDocumento21 pagineBig Picture Sustainable Accounting and FinancekwanNessuna valutazione finora

- 5 Stages of A SPACDocumento6 pagine5 Stages of A SPACmichaelNessuna valutazione finora

- Chapter 3 International Financial MarketsDocumento93 pagineChapter 3 International Financial Marketsธชพร พรหมสีดาNessuna valutazione finora

- Corporate Finance Cap Structure 1Documento140 pagineCorporate Finance Cap Structure 1Sabrina AlbaneseNessuna valutazione finora

- Swaps: Prof Mahesh Kumar Amity Business SchoolDocumento51 pagineSwaps: Prof Mahesh Kumar Amity Business SchoolasifanisNessuna valutazione finora

- cdf58sm Mod 3.1Documento68 paginecdf58sm Mod 3.1vibhuti goelNessuna valutazione finora

- Financial ManagementDocumento886 pagineFinancial ManagementKRISHNA PRASAD SAMUDRALANessuna valutazione finora

- Microsoft Corporation: Financial Analyis and ForecastDocumento40 pagineMicrosoft Corporation: Financial Analyis and ForecastPrabhdeep DadyalNessuna valutazione finora

- Z Score PresentationDocumento35 pagineZ Score PresentationAbhijeet DashNessuna valutazione finora

- Ronw Roce Fixed Assest T.ODocumento45 pagineRonw Roce Fixed Assest T.Ofbk4sureNessuna valutazione finora

- Checklist MindmapDocumento25 pagineChecklist Mindmapsadgh gyuhj0% (1)

- TradeoffDocumento20 pagineTradeoffaniketkaushikNessuna valutazione finora

- Finance Lesson 1Documento5 pagineFinance Lesson 1JM BalanoNessuna valutazione finora

- Building & Assessing Competencies: Dr. Anita MathewDocumento139 pagineBuilding & Assessing Competencies: Dr. Anita MathewSakshi GaurNessuna valutazione finora

- Hello & Welcome To Presentation: Lets Get StartedDocumento8 pagineHello & Welcome To Presentation: Lets Get StartedAalaa MohamedNessuna valutazione finora

- Morgan Stanley: Ka Him NG Kevin Yu Eric Long Ming ChuDocumento116 pagineMorgan Stanley: Ka Him NG Kevin Yu Eric Long Ming ChuvaibhavNessuna valutazione finora

- Capital Structure ToolkitDocumento132 pagineCapital Structure ToolkitOwen100% (1)

- Government Securities Market Development The Indonesia CaseDocumento31 pagineGovernment Securities Market Development The Indonesia CaseADBI EventsNessuna valutazione finora

- Optimal Capital StructureDocumento11 pagineOptimal Capital StructureHassan ChaudhryNessuna valutazione finora

- New Approaches To SME Finance Using Bank Account Information (Big Data)Documento19 pagineNew Approaches To SME Finance Using Bank Account Information (Big Data)ADBI EventsNessuna valutazione finora

- Chapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocumento22 pagineChapter 25. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesPrashantKNessuna valutazione finora

- Credit Risk Grading Matrix Reference No.: DateDocumento8 pagineCredit Risk Grading Matrix Reference No.: DateMD Rakibul Hassan RiponNessuna valutazione finora

- Morningstar® Portfolio X-Ray: H R T y UDocumento5 pagineMorningstar® Portfolio X-Ray: H R T y UVishal BabutaNessuna valutazione finora

- Technical AnalysisDocumento65 pagineTechnical AnalysisrinekshjNessuna valutazione finora

- Chapter 3: Ratio Analysis.: ST ST ST STDocumento36 pagineChapter 3: Ratio Analysis.: ST ST ST STmkjhacal5292Nessuna valutazione finora

- Certification in Integrated Treasury Management SyllabusDocumento4 pagineCertification in Integrated Treasury Management Syllabusshubh.icai0090Nessuna valutazione finora

- Market Outlook For 11 Feb - Cautiously OptimisticDocumento3 pagineMarket Outlook For 11 Feb - Cautiously OptimisticMansukh Investment & Trading SolutionsNessuna valutazione finora

- Capital Budgeting Decisions: A Primer: BM63002: Corporate FinanceDocumento38 pagineCapital Budgeting Decisions: A Primer: BM63002: Corporate FinanceSagaeNessuna valutazione finora

- Unholy Grails - A New Road To WealthDocumento10 pagineUnholy Grails - A New Road To WealthJ RNessuna valutazione finora

- Chapter 9 Stocks and Their ValuationDocumento24 pagineChapter 9 Stocks and Their ValuationHammad KamranNessuna valutazione finora

- Accounting ReviewDocumento76 pagineAccounting Reviewjoyce KimNessuna valutazione finora

- RCM Strategic PlanDocumento20 pagineRCM Strategic PlanTubagus Donny SyafardanNessuna valutazione finora

- HSBC Holdings PLCDocumento9 pagineHSBC Holdings PLCAnonymous P73cUg73LNessuna valutazione finora

- Pengaruh Likuiditas, Ukuran Perusahaan, Leverage, Dan Profitabilitas Terhadap Kebijakan DevidenDocumento22 paginePengaruh Likuiditas, Ukuran Perusahaan, Leverage, Dan Profitabilitas Terhadap Kebijakan DevidenYEREMIA WIRAWANNessuna valutazione finora

- Campbell's Soup ValuationDocumento10 pagineCampbell's Soup ValuationsponerdbNessuna valutazione finora

- Sadlier WH 2009 Annual ReportDocumento17 pagineSadlier WH 2009 Annual ReportteriksenNessuna valutazione finora

- Robert Kiyosaki - Rich Dad Secrets PDFDocumento23 pagineRobert Kiyosaki - Rich Dad Secrets PDFKonstantinos A. Smouliotis100% (4)

- Global Financial Accounting and Reporting 5Th Edition Full ChapterDocumento34 pagineGlobal Financial Accounting and Reporting 5Th Edition Full Chapterrobert.luckman563100% (23)

- 2 Aa2e Hal Errata 012015Documento37 pagine2 Aa2e Hal Errata 012015JohnNessuna valutazione finora

- Hospitality Financial Management 1St Edition Chatfield Test Bank Full Chapter PDFDocumento28 pagineHospitality Financial Management 1St Edition Chatfield Test Bank Full Chapter PDFJeremyMitchellkgaxp100% (11)

- The Case of The Unidentified IndustriesDocumento12 pagineThe Case of The Unidentified Industriesjloup123Nessuna valutazione finora

- Candlestick Charting and Technical Analysis (PDFDrive)Documento39 pagineCandlestick Charting and Technical Analysis (PDFDrive)Rathod arvinNessuna valutazione finora

- Panache TravelDocumento33 paginePanache TravelDevon Vernon100% (1)

- Quiz On MSDocumento8 pagineQuiz On MSEunize EscalonaNessuna valutazione finora

- LWSADocumento21 pagineLWSAandre.torresNessuna valutazione finora

- SIP GuidesDocumento6 pagineSIP Guidesnisarg_Nessuna valutazione finora

- Catastrophic Risk and The Capital Markets: Berkshire Hathaway and Warren Buffett's Success Volatility Pumping Cat ReinsuranceDocumento15 pagineCatastrophic Risk and The Capital Markets: Berkshire Hathaway and Warren Buffett's Success Volatility Pumping Cat ReinsuranceAlex VartanNessuna valutazione finora

- Fisher Separation TheoremDocumento31 pagineFisher Separation TheoremArdi Gunardi0% (3)

- Basics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsDocumento39 pagineBasics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsVrinda GargNessuna valutazione finora

- Deposit OperationsDocumento17 pagineDeposit OperationsArmela HasmucaNessuna valutazione finora

- Ex.C.BudgetDocumento3 pagineEx.C.BudgetGeethika NayanaprabhaNessuna valutazione finora

- Project Report - DseDocumento33 pagineProject Report - DseHarsha Vardhan ReddyNessuna valutazione finora

- Airbnb 2018 PDFDocumento8 pagineAirbnb 2018 PDFmoloko masemolaNessuna valutazione finora