Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Economics 102 Lecture 5 Choice Rev

Caricato da

NoirAddictCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Economics 102 Lecture 5 Choice Rev

Caricato da

NoirAddictCopyright:

Formati disponibili

8/3/2009

1

Lecture 5: Theory of the Consumer:

Choice

Optimal choice

Consumer demand

Examples of demand

Utility functions from demand

functions

Implications of the MRS condition

An application: Taxes

Formal derivation of demand curves

8/3/2009

2

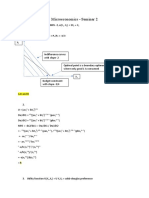

Object: find the bundle in the budget set that is on

the highest indifference curve

The bundle on the highest indifference curve that

just touches the budget line is labeled .

This is the optimal choice for the consumer.

It is the best bundle that she can afford, although

there are other bundles that she prefers.

See the following diagrams

) , (

*

2

*

1

x x

x

1

x

2

8/3/2009

3

x

1

x

2

Utility

Utility

x

2

x

1

8/3/2009

4

x

1

x

2

Utility

Utility

x

1

x

2

8/3/2009

5

Utility

x

1

x

2

Utility

x

1

x

2

8/3/2009

6

Utility

x

1

x

2

Utility

x

1

x

2

Affordable, but not

the most preferred

affordable bundle.

8/3/2009

7

x

1

x

2

Utility

Affordable, but not

the most preferred

affordable bundle.

The most preferred

of the affordable

bundles.

x

1

x

2

Utility

8/3/2009

8

Utility

x

1

x

2

Utility

x

1

x

2

8/3/2009

9

Utility

x

1

x

2

x

1

x

2

8/3/2009

10

x

1

x

2

Affordable

bundles

x

1

x

2

Affordable

bundles

8/3/2009

11

x

1

x

2

Affordable

bundles

More preferred

bundles

Affordable

bundles

x

1

x

2

More preferred

bundles

8/3/2009

12

x

1

x

2

x

1

*

x

2

*

x

1

x

2

x

1

*

x

2

*

(x

1

*,x

2

*) is the most

preferred affordable

bundle.

8/3/2009

13

At this choice, the indifference curve is tangent to

the budget line.

Tangency condition doesnt hold for all cases, but it

does hold for the more interesting cases.

What is always true is that at the optimal point, the

indifference curve cant cross the budget line

Exception: boundary optimum

8/3/2009

14

In general, tangency condition is only a

necessary condition for optimality.

It is not a sufficient condition as indicated in the

case of bent indifference curves or curves with

convex and nonconvex parts. Fig 5.4

Tangency condition of the budget line and

indifference curve is sufficient in the case of

convex preferences.

In general, there may be more than one bundle

that satisfies the tangency condition. However,

for strictly convex preferences (i.e., no flat spots

on IC), there is only one optimal choice on each

budget line.

7

8/3/2009

15

When x

1

* > 0 and x

2

* > 0 the optimal choice

bundle is INTERIOR.

If buying (x

1

*,x

2

*) costs P m then the budget

is exhausted.

x

1

x

2

x

1

*

x

2

*

(x

1

*,x

2

*) is interior .

(a) (x

1

*,x

2

*) exhausts the

budget; p

1

x

1

* + p

2

x

2

* = m.

(b) The slope of the indiff.

curve at (x

1

*,x

2

*) equals

the slope of the budget

constraint.

8/3/2009

16

(x

1

*,x

2

*) satisfies two conditions:

(a) the budget is exhausted;

p

1

x

1

* + p

2

x

2

* = m

(b) the slope of the budget constraint, -

p

1

/p

2

, and the slope of the indifference

curve, the MRS, containing (x

1

*,x

2

*) are

equal at (x

1

*,x

2

*).

Economic interpretation of the tangency condition:

MRS - as a rate of exchange where the consumer is just

willing to stay put.

Market is offering a rate of exchange equal to the ratio of

prices.

At equilibrium (optimal choice), the consumer must be at

a rate where MRS is equal to the rate of exchange.

If MRS is not equal to the price ratio, there could be some

scope for exchange of one good for another that is

affordable to the consumer.

Thus, whenever MRS is not equal to the price ratio, then

the consumer is not at the optimal choice.

8/3/2009

17

Demanded bundle or ordinary demand Optimal

choices of goods 1 and 2 at some set of prices and

income. It is the most preferred affordable bundle at the

given prices and budget.

Demand function Function that relates the optimal

choice, the quantity demanded to the different values of

prices and incomes

As prices and incomes change, the optimal bundle demanded

would also change.

Written as functions of both prices and income:

Different preferences lead to different demand functions

), , , (

), , , (

2 1 2

2 1 1

m p p x

m p p x

When x

1

* > 0 and x

2

* > 0 and (x

1

*,x

2

*)

exhausts the budget, and indifference curves

have no kinks, the ordinary demands are

obtained by solving:

(a) p

1

x

1

* + p

2

x

2

* = y

(b) the slopes of the budget constraint, -

p

1

/p

2

, and of the indifference curve

containing (x

1

*,x

2

*) are equal at (x

1

*,x

2

*).

8/3/2009

18

Suppose that the consumer has Cobb-

Douglas preferences.

Then

MU

U

x

ax x

a b

1

1

1

1

2

= =

c

c

MU

U

x

bx x

a b

2

2

1 2

1

= =

c

c

b a

x x x U(x

2 1 2 1

) , =

So the MRS is

At (x

1

*,x

2

*), MRS = -p

1

/p

2

so

.

/

/

1

2

1

2 1

2

1

1

2

1

1

2

bx

ax

x bx

x ax

x U

x U

dx

dx

MRS

b a

b a

= = = =

c c

c c

= =

ax

bx

p

p

x

bp

ap

x

2

1

1

2

2

1

2

1

*

*

* *

.

(A)

8/3/2009

19

(x

1

*,x

2

*) also exhausts the budget so

p x p x m

1 1 2 2

* *

. + =

(B)

So now we know that

*

1

2

1

*

2

x

ap

bp

x =

(A)

p x p x m

1 1 2 2

* *

. + =

(B)

8/3/2009

20

So now we know that

x

bp

ap

x

2

1

2

1

* *

=

(A)

p x p x m

1 1 2 2

* *

. + =

(B)

Substitute

So now we know that

x

bp

ap

x

2

1

2

1

* *

=

(A)

p x p x m

1 1 2 2

* *

. + =

(B)

p x p

bp

ap

x m

1 1 2

1

2

1

* *

. + =

Substitute

and get

This simplifies to .

8/3/2009

21

x

bm

a b p

2

2

*

( )

. =

+

Substituting for x

1

* in

p x p x m

1 1 2 2

* *

+ =

then gives

x

am

a b p

1

1

*

( )

. =

+

So we have discovered that the most preferred affordable

bundle for a consumer with Cobb-Douglas preferences

U x x x x

a b

( , )

1 2 1 2

=

is

( , )

( )

,

( )

.

* *

( ) x x

am

a b p

bm

a b p

1 2

1 2

=

+ +

8/3/2009

22

x

1

x

2

x

am

a b p

1

1

*

( )

=

+

x

bm

a b p

2

2

*

( )

=

+

b a

x x x x U

2 1 2 1

) , ( =

Property of the Cobb-Douglas - consumer always spends a

fixed fraction of his income on each good.

The size of the fraction depends on the exponents of the

function.

fraction spent on good 1:

substituting the demand function for good 1:

the same is true for good 2

This is why it is often convenient to represent the

exponents of the C-D function as equal to one.

m x p /

1 1

b a

a

p

m

b a

a

m

p

m

x p

+

=

+

=

1

1 1 1

8/3/2009

23

If either x

1

* = 0 or x

2

* = 0 then the ordinary

demand (x

1

*,x

2

*) is at a corner solution to

the problem of maximizing utility subject to

a budget constraint.

For instance, the demand for perfect

substitutes

Perfect substitutes

A consumer will purchase the cheaper one. If

they have the same price, then the consumer

doesnt care which one he purchases.

Demand function for good 1:

. when , 0

; when , m/p and 0 between no. any

; when , /

2 1

2 1 1

2 1 1

1

>

=

<

=

p p

p p

p p p m

x

8/3/2009

24

x

1

x

2

MRS = -1

x

1

x

2

MRS = -1

Slope = -p

1

/p

2

with p

1

> p

2

.

8/3/2009

25

x

1

x

2

MRS = -1

Slope = -p

1

/p

2

with p

1

> p

2

.

x

1

x

2

2

*

2

p

y

x =

0

*

1

= x

MRS = -1

Slope = -p

1

/p

2

with p

1

> p

2

.

8/3/2009

26

x

1

x

2

x

y

p

1

1

*

=

x

2

0

*

=

MRS = -1

Slope = -p

1

/p

2

with p

1

< p

2

.

So when U(x

1

,x

2

) = x

1

+ x

2

, the most

preferred affordable bundle is (x

1

*,x

2

*)

where

|

|

.

|

\

|

= 0 , ) , (

1

*

2

*

1

p

y

x x

and

|

|

.

|

\

|

=

2

*

2

*

1

, 0 ) , (

p

y

x x

if p

1

< p

2

if p

1

> p

2

.

8/3/2009

27

x

1

x

2

MRS = -1

Slope = -p

1

/p

2

with p

1

= p

2

.

y

p

1

y

p

2

x

1

x

2

All the bundles in the

constraint are equally the

most preferred affordable

when p

1

= p

2

.

y

p

2

y

p

1

8/3/2009

28

Perfect Complements: Optimal choice would always lie

on the diagonal, no matter what the prices are.

No matter what the prices, consumer is purchasing the

same amount of good 1 for each good 2 (or at the fixed rate

at which they complement one another).

Adding the budget constraint to this condition and solving

algebraically just gives us the optimal choice bundle.

it is as if the consumer were just spending all of her money

on a single good that has a combined price.

) /(

2 1 2 1

2 2 1 1

p p m x x x

m x p x p

+ = = =

= +

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

8/3/2009

29

x

1

x

2

MRS = 0

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

1

x

2

MRS = -

MRS = 0

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

8/3/2009

30

x

1

x

2

MRS = -

MRS = 0

MRS is undefined

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

8/3/2009

31

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

Which is the most

preferred affordable bundle?

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

The most preferred

affordable bundle

8/3/2009

32

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

1

*

x

2

*

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

1

*

x

2

*

(a) p

1

x

1

* + p

2

x

2

* = m

8/3/2009

33

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

1

*

x

2

*

(a) p

1

x

1

* + p

2

x

2

* = m

(b) x

2

* = ax

1

*

(a) p

1

x

1

* + p

2

x

2

* = m; (b) x

2

* = ax

1

*.

Substitution from (b) for x

2

* in (a) gives p

1

x

1

* + p

2

ax

1

* = m

which gives

A bundle of 1 commodity 1 unit and a commodity 2 units costs p

1

+ ap

2

;

m/(p

1

+ ap

2

) such bundles are affordable.

.

ap p

am

x ;

ap p

m

x

2 1

*

2

2 1

*

1

+

=

+

=

8/3/2009

34

x

1

x

2

U(x

1

,x

2

) = min{ax

1

,x

2

}

x

2

= ax

1

x

m

p ap

1

1 2

*

=

+

x

am

p ap

2

1 2

*

=

+

Discrete goods

good 1 - is a discrete good

good 2 is money spent on everything else

To look at optimal choice, two ways:

compare the bundles (1, m-p

1

), (2, m-2p

1

), (3,

m-3p

1

) and get the one which yields the highest

utility

Indifference curve analysis: Typically, as the

price decreases further, the consumer will

choose to consume more units of good 1.

8/3/2009

35

Concave Preferences

Optimal choice would be a boundary choice.

Non-convex preferences imply that if you dont

like to consume two things together (the

opposite of convex preferences), then youll

spend all of your money on one or the other

8/3/2009

36

x

1

x

2

x

1

x

2

8/3/2009

37

x

1

x

2

The most preferred

affordable bundle

Notice that the tangency solution

is not the most preferred affordable

bundle.

Neutrals and Bads

Neutral good - Consumer spends all her money

on the good she likes and doesnt purchase any

of the neutral good.

Bad - Consumer spends all her money on the

good.

8/3/2009

38

Using observed demand behavior, can we determine the kind of

preferences that generated that demand?

Example: A Cobb-Douglas utility function may be inferred if

demand behavior shows a certain constancy in the shares of

expenditures for each good

We can use this fitted utility function to analyze the effects of

policy changes.

In general:

Given observations of choice behavior, we try to determine

what is maximized.

After determining this, we predict choice behavior in new

situations and or evaluate proposed changes in the economic

environment.

Analysis can be extended by estimating preferences for certain

groups of individuals and analyzing differential impact of policy

changes on them.

If everyone is facing the roughly the same

prices for two goods and everyone is

optimizing and at an interior solution, then

everyone must have the same marginal rates

of substitution for the two goods.

The quantities consumed would differ

At quantities consumed however, the MRS

would be the same.

8/3/2009

39

Price ratios can be used to value possible

changes in consumption bundles.

Since prices measure the rate at which

people are just willing to substitute one

good for another, they can be used to value

policy proposals that involve making

changes in consumption.

If the government wants to raise a certain amount of

revenue, is it better to impose a quantity tax or an

income tax?

Budget constraint with the quantity tax:

Optimal choice should satisfy the budget

constraint:

The revenue raised by the tax is:

m x p x t p = + +

2 2 1 1

) (

m x p x t p = + +

*

2

*

1

2 1

) (

*

1

*

tx R =

8/3/2009

40

Budget constraint with the income tax:

substituting for R* :

This budget line has the same slope but will pass through

the point .

It is therefore an affordable choice for the consumer

*

2 2 1 1

R m x p x p = +

*

2 2 1 1

1

tx m x p x p = +

) , (

*

2

*

1

x x

However is not an optimal choice

with the income tax.

With the quantity tax, the MRS is

Income tax allows us to trade at

Income tax budget line cuts the indifference

curve at the optimal choices with the quantity

taxes, implying that there will be a point in the

budget line that will be preferred to it.

) , (

*

2

*

1

x x

2 1

/ ) ( p t p +

2 1

/ p p

8/3/2009

41

Therefore , an income tax is definitely better

than the quantity tax since you can raise the

same amount of revenue while leaving the

consumers better off.

8/3/2009

42

Limitations:

Assume only one consumer.

Assume that consumers income doesnt

change after the imposition of the tax, i.e.,

his income generating behavior doesnt

change.

Ignored the supply response.

Ways to derive the demand

curves:

By using MRS condition and the

budget constraint

By unconstrained maximization

By constrained maximization

8/3/2009

43

MRS condition and the budget constraint

Represent the consumers preferences by a

utility function :

Optimal choice must satisfy the condition

MRS can be expressed as the negative of the

ratio of derivatives of the utility function.

Substituting and canceling the minus signs :

) , (

2 1

x x u

2

1

2 1

) , (

p

p

x x MRS =

2

1

2 2 1

1 2 1

/ ) , (

/ ) , (

p

p

x x x u

x x x u

=

c c

c c

Optimal choices should also satisfy the budget constraint:

These give two equations in two unknowns, which can be solved.

One way is to express the budget constraint in terms of one of

the goods and substitute the definition into the MRS condition.

substituting into equation we get:

This has just one unknown variable x

1

, and can be solved for as a

function of the prices and income. The budget constraint then

yields the solution for x

2

as function of prices and income

m x p x p = +

2 2 1 1

1

2

1

2

2

x

p

p

p

m

x =

2

1

2 1 2 1 2 1

1 1 2 1 2 1

/ ) ) / ( / , (

/ ) ) / ( / , (

p

p

x x p p p m x u

x x p p p m x u

=

c c

c c

8/3/2009

44

Unconstrained maximization

i)

Unconstrained equivalent: define one variable in terms of the

other

ii)

Substitute in the utility function to get the unconstrained max

problem

iii)

m x p x p

x x u

= +

2 2 1 1

2 1

such that

) , ( max

1

2

1

2

1 2

) ( x

p

p

p

m

x x =

) ) / ( / , ( max

1 2 1 2 1

x p p p m x u

Differentiate with respect to x

1

, set the result equal to zero to

derive the first order condition of the form:

iv)

Differentiating equation in (ii) yields

v)

Substituting into (iv) gives us

Utilizing the condition that the optimal choice must satisfy the

budget constraint gives us two equations in two unknowns

0

)) ( , ( )) ( , (

1

2

2

1 2 1

1

1 2 1

=

c

c

+

c

c

dx

dx

x

x x x u

x

x x x u

2

1

1

2

p

p

dx

dx

=

2

1

2

* *

1

* *

/ ) , (

/ ) , (

2 1

2 1

p

p

x x x u

x x x u

=

c c

c c

8/3/2009

45

Constrained maximization

Construct the Lagrangian function:

Differentiate to get the first order conditions:

Solve the three equations in three unknowns by matrix algebra

). ( ) , (

2 2 1 1 2 1

m x p x p x x u L + =

. 0

0

) , (

0

) , (

2 2 1 1

2

2

*

2

*

1

2

1

1

*

2

*

1

1

= + =

c

c

=

c

c

=

c

c

=

c

c

=

c

c

m x p x p

L

p

x

x x u

x

L

p

x

x x u

x

L

Or reduce the equations by noting that:

This equation simply says that the MRS must equal the price

ratio.

The budget constraint gives us the other equation so we are back

to two equations in two unknowns

2

1

2

*

2

*

1

1

*

2

*

1

) , (

) , (

p

p

x

x x u

x

x x u

=

c

c

c

c

Potrebbero piacerti anche

- Ch5 Rational ChoiceDocumento74 pagineCh5 Rational ChoicethutrangleNessuna valutazione finora

- Ch5 ChoiceDocumento64 pagineCh5 ChoiceKrish ShahNessuna valutazione finora

- Lecture 12 ChoiceDocumento65 pagineLecture 12 Choicehibaelouadifi2005Nessuna valutazione finora

- API 111 Solutions 2Documento12 pagineAPI 111 Solutions 2Anonymous L7XrxpeI1zNessuna valutazione finora

- MicroeconomicsDocumento54 pagineMicroeconomicsselomonbrhane17171Nessuna valutazione finora

- UtilityDocumento39 pagineUtilityAsif AzizNessuna valutazione finora

- 3 The Utility Maximization ProblemDocumento10 pagine3 The Utility Maximization ProblemDaniel Lee Eisenberg JacobsNessuna valutazione finora

- Lecture 2Documento62 pagineLecture 2Kellen KathurimaNessuna valutazione finora

- Microeconomics Group Assignment ReportDocumento12 pagineMicroeconomics Group Assignment ReportMeselu TegenieNessuna valutazione finora

- Ch5 MacroeconomicsDocumento74 pagineCh5 MacroeconomicsVinella SantosNessuna valutazione finora

- Mathematical Economics Notes - III For V Sem: A. Diagram Discussion Economic RelationshipDocumento6 pagineMathematical Economics Notes - III For V Sem: A. Diagram Discussion Economic RelationshipAngad 2K19-PE-012Nessuna valutazione finora

- Microeconomics Seminar 2Documento7 pagineMicroeconomics Seminar 2sophieNessuna valutazione finora

- Lateral Earth Pressure Calculation by CLDocumento8 pagineLateral Earth Pressure Calculation by CLMohanned Al GharawiNessuna valutazione finora

- Consumer OptimumDocumento5 pagineConsumer Optimumpatelshivani033Nessuna valutazione finora

- GaloisDocumento8 pagineGaloismcaglar35Nessuna valutazione finora

- Solution 1Documento10 pagineSolution 1rajan20202000Nessuna valutazione finora

- Relation Between Longrun and Sort Run Average Cost CurveDocumento4 pagineRelation Between Longrun and Sort Run Average Cost CurveMh ParvezNessuna valutazione finora

- Lecture 02-2005Documento40 pagineLecture 02-2005Nidhi ZinzuvadiaNessuna valutazione finora

- 18 Sensi 1Documento24 pagine18 Sensi 1Potnuru VinayNessuna valutazione finora

- QTM (Unit 2)Documento11 pagineQTM (Unit 2)Arkhitekton DesignNessuna valutazione finora

- Plastic AnalysisDocumento4 paginePlastic AnalysisJan LhesterNessuna valutazione finora

- Math Camp Sample Problems F 2016Documento3 pagineMath Camp Sample Problems F 2016Nam Giang HàNessuna valutazione finora

- Preference PrintoutDocumento7 paginePreference Printoutcandy26ghoshNessuna valutazione finora

- x02 Workout1aDocumento7 paginex02 Workout1aThiago HenriqueNessuna valutazione finora

- Ch2.1. Optimal ChoiceDocumento92 pagineCh2.1. Optimal ChoiceNguyễn Thị Anh ĐàiNessuna valutazione finora

- All Vectors Are Written in Bold LettersDocumento12 pagineAll Vectors Are Written in Bold LettersDeepika SanthanakrishnanNessuna valutazione finora

- Micro - Exercises A Solutions (Sheet 1, 2, 3)Documento18 pagineMicro - Exercises A Solutions (Sheet 1, 2, 3)Nghĩa Nguyễn TrọngNessuna valutazione finora

- Cost Constraint/Isocost LineDocumento38 pagineCost Constraint/Isocost LinedongaquoctrungNessuna valutazione finora

- 4 - Choice: Intermediate MicroeconomicsDocumento51 pagine4 - Choice: Intermediate MicroeconomicsMowgli JangNessuna valutazione finora

- Economics Honors Exam 2008 Solutions Question 1: max (s, x) = p + βx − γxDocumento12 pagineEconomics Honors Exam 2008 Solutions Question 1: max (s, x) = p + βx − γxADITYANessuna valutazione finora

- 5.integral Calculus Objectives:: DX DyDocumento16 pagine5.integral Calculus Objectives:: DX DyAndyMavia100% (1)

- USA Mathematical Talent Search Solutions To Problem 3/2/18Documento2 pagineUSA Mathematical Talent Search Solutions To Problem 3/2/18ArsyNessuna valutazione finora

- PS1 UmaxDocumento2 paginePS1 UmaxebbamorkNessuna valutazione finora

- Chapter 4 - Part - BDocumento48 pagineChapter 4 - Part - BamoyalopNessuna valutazione finora

- Assignemnt IGNOU MT3 Dec 2020Documento13 pagineAssignemnt IGNOU MT3 Dec 2020Prashant LotankarNessuna valutazione finora

- Economics 102 Lecture 8 Ways To Measure Utility RevDocumento40 pagineEconomics 102 Lecture 8 Ways To Measure Utility RevNoirAddictNessuna valutazione finora

- CH 05 ChoiceDocumento50 pagineCH 05 Choiceltqtrang1302Nessuna valutazione finora

- 06 Modal PDFDocumento21 pagine06 Modal PDFBelaliaNessuna valutazione finora

- CH 05 ChoiceDocumento53 pagineCH 05 ChoiceNguyễn MaiNessuna valutazione finora

- CH 05 ChoiceDocumento50 pagineCH 05 ChoiceUyên MiNessuna valutazione finora

- Ch05 MoodleDocumento59 pagineCh05 Moodleyuriycan.kindNessuna valutazione finora

- Linear Programming: (Graphical Method)Documento10 pagineLinear Programming: (Graphical Method)Darya MemonNessuna valutazione finora

- Batch Planning and Resource Allocation - Laboratory 2Documento9 pagineBatch Planning and Resource Allocation - Laboratory 2LordTicNessuna valutazione finora

- Varian9e LecturePPTs Ch21Documento82 pagineVarian9e LecturePPTs Ch21王琦Nessuna valutazione finora

- Assignment SaPMDocumento3 pagineAssignment SaPMVinod DahiyaNessuna valutazione finora

- Operations Research Linear ProgrammingDocumento68 pagineOperations Research Linear ProgrammingPrateek RaoNessuna valutazione finora

- EigenmathDocumento50 pagineEigenmathJohnny Parrado100% (1)

- Linear Programming: Quantitative ModuleDocumento17 pagineLinear Programming: Quantitative ModuleManjari MundanadNessuna valutazione finora

- Notes LagrangeDocumento8 pagineNotes LagrangeLennard PangNessuna valutazione finora

- Choice and Revealed Preference: Varian, Intermediate Microeconomics, 8e, Ch. 5 and Sections 7.1-7.7Documento70 pagineChoice and Revealed Preference: Varian, Intermediate Microeconomics, 8e, Ch. 5 and Sections 7.1-7.7Tanya SinghNessuna valutazione finora

- 9-Cost MinimisationDocumento64 pagine9-Cost Minimisationabhinavmishra7838Nessuna valutazione finora

- Mathematics For Microeconomics: 6y y U, 8x X UDocumento8 pagineMathematics For Microeconomics: 6y y U, 8x X UAsia ButtNessuna valutazione finora

- Probset 3 KeyDocumento7 pagineProbset 3 KeyhoneyschuNessuna valutazione finora

- Vector Complex-3Documento95 pagineVector Complex-3Shail BNessuna valutazione finora

- Questions Section 4, OptimisationDocumento20 pagineQuestions Section 4, Optimisationagonza70Nessuna valutazione finora

- Methods of Microeconomics: A Simple IntroductionDa EverandMethods of Microeconomics: A Simple IntroductionValutazione: 5 su 5 stelle5/5 (2)

- Logical progression of twelve double binary tables of physical-mathematical elements correlated with scientific-philosophical as well as metaphysical key concepts evidencing the dually four-dimensional basic structure of the universeDa EverandLogical progression of twelve double binary tables of physical-mathematical elements correlated with scientific-philosophical as well as metaphysical key concepts evidencing the dually four-dimensional basic structure of the universeNessuna valutazione finora

- BOA MEMO For October 2010 ExamsDocumento7 pagineBOA MEMO For October 2010 ExamsmrgambitNessuna valutazione finora

- Economics 102 Lecture 10 Market Equilibrium RevDocumento62 pagineEconomics 102 Lecture 10 Market Equilibrium RevNoirAddictNessuna valutazione finora

- Rental Growth Steady Amid Rise in Future Completions: PhilippinesDocumento12 pagineRental Growth Steady Amid Rise in Future Completions: PhilippinesNoirAddictNessuna valutazione finora

- Economics 102 Lecture 7 Income and Substitution Effects RevDocumento31 pagineEconomics 102 Lecture 7 Income and Substitution Effects RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 6 Demand RevDocumento54 pagineEconomics 102 Lecture 6 Demand RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 8 Ways To Measure Utility RevDocumento40 pagineEconomics 102 Lecture 8 Ways To Measure Utility RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 4 Utility RevDocumento33 pagineEconomics 102 Lecture 4 Utility RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 3 Preferences RevDocumento32 pagineEconomics 102 Lecture 3 Preferences RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 2 Budget Constraint RevDocumento37 pagineEconomics 102 Lecture 2 Budget Constraint RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 3 Preferences RevDocumento32 pagineEconomics 102 Lecture 3 Preferences RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 2 Budget Constraint RevDocumento37 pagineEconomics 102 Lecture 2 Budget Constraint RevNoirAddictNessuna valutazione finora

- Economics 102 Lecture 1 The Market RevDocumento28 pagineEconomics 102 Lecture 1 The Market RevNoirAddictNessuna valutazione finora

- Organizational Structure and Management Plan: I. Business Type: CorporationDocumento6 pagineOrganizational Structure and Management Plan: I. Business Type: CorporationNoirAddictNessuna valutazione finora

- Lending-Schema (Branch-Name, Branch-City, Assets, Customer-Name, Loan-Number, Amount)Documento6 pagineLending-Schema (Branch-Name, Branch-City, Assets, Customer-Name, Loan-Number, Amount)nisha tiwariNessuna valutazione finora

- The Simplex Solution MethodDocumento16 pagineThe Simplex Solution MethodJehad SelaweNessuna valutazione finora

- Operators: Operators and Quantum MechanicsDocumento5 pagineOperators: Operators and Quantum MechanicsAniketRaikwarNessuna valutazione finora

- Integer ProgrammingDocumento41 pagineInteger ProgrammingGopalan KathiravanNessuna valutazione finora

- Maths Practice Set 6 Solved (Combined Graduate Level Exam (CGLE) )Documento12 pagineMaths Practice Set 6 Solved (Combined Graduate Level Exam (CGLE) )Ram rameshNessuna valutazione finora

- Walpole 2012 Textpages For Topic4Documento14 pagineWalpole 2012 Textpages For Topic4MULINDWA IBRANessuna valutazione finora

- HTTP WWW - Math.ufl - Edu Help Matlab-Tutorial Matlab-TutorialDocumento28 pagineHTTP WWW - Math.ufl - Edu Help Matlab-Tutorial Matlab-TutorialtimsykiNessuna valutazione finora

- Department of Education: Division Diagnostic Test Grade 5 MathematicsDocumento4 pagineDepartment of Education: Division Diagnostic Test Grade 5 MathematicsMichelle VillanuevaNessuna valutazione finora

- Oswal Suggested Study Plan. - CB1198675309Documento4 pagineOswal Suggested Study Plan. - CB1198675309Charvi GuptaNessuna valutazione finora

- Lecture 1.05 - Cartesian Product and FunctionsDocumento15 pagineLecture 1.05 - Cartesian Product and FunctionsAmelia AmeliaNessuna valutazione finora

- Homework 2Documento3 pagineHomework 2Ishi TiwaNessuna valutazione finora

- Basic Calculus Quarter 3 Module 3Documento15 pagineBasic Calculus Quarter 3 Module 3Orsan Cate Patilano100% (1)

- XII STD - Statistics English MediumDocumento280 pagineXII STD - Statistics English MediumSuvendu ChoudhuryNessuna valutazione finora

- Final Draft Class 12 2023 (1751)Documento5 pagineFinal Draft Class 12 2023 (1751)Himanshu GuptaNessuna valutazione finora

- Chapter 4Documento21 pagineChapter 4inirreNessuna valutazione finora

- Lecture-6 (Paper 1)Documento26 pagineLecture-6 (Paper 1)Ask Bulls Bear100% (1)

- Wulff ConstructionDocumento2 pagineWulff ConstructionSgk ManikandanNessuna valutazione finora

- 2013-01-31 Cofunctions and An Introduction To Trig IdentitiesDocumento4 pagine2013-01-31 Cofunctions and An Introduction To Trig Identitiessamjshah50% (2)

- Ellipse-04 - Exercise LevelDocumento17 pagineEllipse-04 - Exercise LevelRaju SinghNessuna valutazione finora

- Mathematics Level 8 31:3 PDFDocumento8 pagineMathematics Level 8 31:3 PDFLeow Zi LiangNessuna valutazione finora

- Sphere and CylinderDocumento4 pagineSphere and Cylinderapi-358952299Nessuna valutazione finora

- Unit4 - T1 - TBVP SRM TutorialDocumento1 paginaUnit4 - T1 - TBVP SRM Tutorialnobita upmanyuNessuna valutazione finora

- CH02 FUNCTIONS Class 12 Computer ScienceDocumento16 pagineCH02 FUNCTIONS Class 12 Computer ScienceJaganNessuna valutazione finora

- Decimals To Percentages WorksheetDocumento2 pagineDecimals To Percentages WorksheetDennis De GuzmanNessuna valutazione finora

- 27-05-2021-1622097292-6-IJGET-1. Dec - 2020-FOC - IJGET - Format-Relationship Between Shehu Transform With Some Other Integral TransformDocumento10 pagine27-05-2021-1622097292-6-IJGET-1. Dec - 2020-FOC - IJGET - Format-Relationship Between Shehu Transform With Some Other Integral Transformiaset123Nessuna valutazione finora

- Unit2 KCVDocumento47 pagineUnit2 KCVsanoopmkNessuna valutazione finora

- Modul Tok JiringDocumento18 pagineModul Tok Jiringyien mee tieNessuna valutazione finora

- Section 2. Symmetrical Components: N 3), The Three Sets AreDocumento5 pagineSection 2. Symmetrical Components: N 3), The Three Sets ArepepemirasNessuna valutazione finora

- 4.CI For Prop, Var, RatioDocumento36 pagine4.CI For Prop, Var, RatioHamza AsifNessuna valutazione finora

- Risk Theory The Insurance As A Tool To Mitigate Risks: The Model of Individual RisksDocumento36 pagineRisk Theory The Insurance As A Tool To Mitigate Risks: The Model of Individual RisksMariana GarzaNessuna valutazione finora