Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Shareholders of A Foreign

Caricato da

Rebel XDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Shareholders of A Foreign

Caricato da

Rebel XCopyright:

Formati disponibili

A concise plain English introduction to the U.S. tax rules for U.S.

shareholders, officer, directors and their financial and legal advisors regarding the U.S. tax rules for foreign corporations and other foreign entities owned by U.S. citizens, residents or corporations.

Cover Design by Angela Farley Designs

Description of U.S. Shareholders of a Foreign Corporation

This authority of taxation comes from the CFC rules that tax U.S. shareholders on "subpart F" income (described below). A CFC is one in which U.S. shareholders own more than 50%, by vote or value, of the foreign corporation. Only U.S. persons can be "U.S. shareholders." IRC Section 957(c) refers to IRC Section 7701(a)(30) for the definition of a U.S. person (that is very broadly defined to include individuals, partnerships, corporations, trusts and estates). A U.S. shareholder, for purposes of determining whether there is a CFC, is one who owns 10% or more, by vote, in the foreign corporation (IRC Section 951(b)). In determining the 10% or more ownership, the attribution rules (described below) of both IRC Section 958(a) and IRC Section 958(b) apply. Once it is determined (through direct ownership, indirect ownership under IRC Section 958(a) and constructive ownership under IRC Section 958(b)), that there are, in the aggregate, U.S. shareholders who own more than 50%, by vote or value, in the foreign corporation, it is classified as a CFC. Please note that only those shareholders that own (directly or indirectly) 10% or more of the foreign corporation stock are included in the "more than 50%" ownership test. Thus, if there are 20 U.S. shareholders with equal shares of 5% of the foreign corporation, it is not a CFC. Or, if a foreign person owns 50% or more of the corporation, then no combination of U.S. persons will be able to own "more than 50%" of the foreign corporation. If one U.S. person owns 40% of a foreign corporation, and ten U.S. persons each own 6%, it is not a CFC even though 100% of the stock is owned by U.S. persons. Only one of those U.S. persons is a "U.S. shareholder" as that term is defined for this purpose. However, each taxpayer's ownership percentage must take into account the attribution and constructive ownership rules. The phrase "attribution" means that one taxpayer is deemed to own the shares

of certain other related taxpayers, such as a spouse, child or parent because the law presumes that these persons have a common interest. "Constructive ownership" is similar to attribution but it is usually applied with respect to entities in which the taxpayer has some control or beneficial interest. A beneficiary of a trust or estate is deemed to own a portion of any stock owned by the trust or estate, based on the rights of the beneficiary with respect to distributions from the trust or estate. A shareholder of a corporation or partner in a partnership is deemed to have a proportionate interest in whatever stock may be owned by the corporation or partnership but only if the shareholder or partner has a 10% or greater interest in that corporation or partnership.[1] Thus, ownership of a foreign corporation is derived from the direct ownership of the taxpayer plus any indirect ownership arising from the attribution and constructive ownership rules. With respect to foreign corporations, these rules are insanely complicated and this is the shortest explanation we can offer without getting involved in the maze of IRC sections relating to this subject. However, these terms will be discussed further in connection with the explanation of "subpart F" income, below. IRC Section 958(b)(2) and (3), and IRC Section 318(a)(2)(C).

[1]

Potrebbero piacerti anche

- How 2 Setup TrustDocumento3 pagineHow 2 Setup TrustRebel X97% (237)

- SSN and BC TrustsDocumento4 pagineSSN and BC TrustsRebel X100% (9)

- Understanding Public Servant Bonds. Public Hazard BondDocumento4 pagineUnderstanding Public Servant Bonds. Public Hazard Bondsabiont100% (11)

- Internal Revenue Regulations, 2001 (LI 1675)Documento48 pagineInternal Revenue Regulations, 2001 (LI 1675)TIMOREGHNessuna valutazione finora

- Overview of Admiralty Maritime Law March 15 2004 Jean KeatingDocumento18 pagineOverview of Admiralty Maritime Law March 15 2004 Jean KeatingHenoAlambre100% (16)

- Webb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedDocumento2 pagineWebb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedHassan JanNessuna valutazione finora

- Final Exam Taxation 101Documento8 pagineFinal Exam Taxation 101Live LoveNessuna valutazione finora

- Mortgage Lending PracticesDocumento2 pagineMortgage Lending PracticesRebel XNessuna valutazione finora

- Private International LawDocumento5 paginePrivate International LawRebel X100% (1)

- Filing Under SealDocumento5 pagineFiling Under SealRebel XNessuna valutazione finora

- Designing An Income Only Irrevocable TrustDocumento15 pagineDesigning An Income Only Irrevocable TrusttaurushoNessuna valutazione finora

- Key Statements in LawDocumento1 paginaKey Statements in LawRebel XNessuna valutazione finora

- Self Directed Brokerage Option Mutual FundsxlsxDocumento528 pagineSelf Directed Brokerage Option Mutual FundsxlsxGlenn-anthony Sending-State HortonNessuna valutazione finora

- What To Say in Court When ChargedDocumento2 pagineWhat To Say in Court When ChargedAnonymous ErVmsTQ1NHNessuna valutazione finora

- Page 1 of 3: Ucc Affidavit/Lien (Ablien - Doc.C:/Rostrust/Fs1)Documento6 paginePage 1 of 3: Ucc Affidavit/Lien (Ablien - Doc.C:/Rostrust/Fs1)Bruce NonassumpsitNessuna valutazione finora

- Dynasty Trusts A Legitimate and Powerful Estate Planning Tool or An Economic Threat To The Realm and To The State of CaliforniaDocumento15 pagineDynasty Trusts A Legitimate and Powerful Estate Planning Tool or An Economic Threat To The Realm and To The State of CaliforniaChristopher S. ArmstrongNessuna valutazione finora

- Chapter 2: Deed of Trust Act: Short TitleDocumento8 pagineChapter 2: Deed of Trust Act: Short TitleRebel XNessuna valutazione finora

- CM Creditor Training GuideDocumento13 pagineCM Creditor Training GuideRebel X100% (1)

- Non-Citizen Guidance 063011Documento62 pagineNon-Citizen Guidance 063011bwidjaja73Nessuna valutazione finora

- Trust LanguageDocumento3 pagineTrust Languagemaribel priceNessuna valutazione finora

- Income-Only Trusts - A Win-Win-Win Option in Estate PlanningDocumento6 pagineIncome-Only Trusts - A Win-Win-Win Option in Estate PlanningtaurushoNessuna valutazione finora

- CapacityDocumento5 pagineCapacityRebel X100% (1)

- Banker As SuretyDocumento10 pagineBanker As SuretyManu AyilyathNessuna valutazione finora

- General BankingDocumento167 pagineGeneral BankingSuvasish DasguptaNessuna valutazione finora

- Addendum: Print ResetDocumento2 pagineAddendum: Print Resetandy millerNessuna valutazione finora

- ARTICLE 5B Uniform Power of AttorneyDocumento32 pagineARTICLE 5B Uniform Power of AttorneystillaireNessuna valutazione finora

- To Regulate The Value of Money by Ed VieiraDocumento36 pagineTo Regulate The Value of Money by Ed VieiraHal ShurtleffNessuna valutazione finora

- Power of Attorney (General)Documento3 paginePower of Attorney (General)Banerjee SuvranilNessuna valutazione finora

- I1099msc DFTDocumento11 pagineI1099msc DFTVa Kho100% (1)

- 0A6CCd01delivery of DeedDocumento204 pagine0A6CCd01delivery of DeediamsomedudeNessuna valutazione finora

- Social Security, 521 Form GenericDocumento1 paginaSocial Security, 521 Form GenericFreeman LawyerNessuna valutazione finora

- 12 U.S. Code 411 - Issuance To Reserve BanksDocumento2 pagine12 U.S. Code 411 - Issuance To Reserve BanksMin Hotep Tzaddik BeyNessuna valutazione finora

- Funny MoneyDocumento1 paginaFunny MoneytrustkonanNessuna valutazione finora

- Common-Law Trust Fictitious Name or Address Public Notice Public RecordDocumento4 pagineCommon-Law Trust Fictitious Name or Address Public Notice Public Recordin1or100% (2)

- Affidavit of DomicileDocumento1 paginaAffidavit of DomicileShevis Singleton Sr.Nessuna valutazione finora

- "DISBURSEMENT" Payment of Funds "Settles" A Debt!Documento3 pagine"DISBURSEMENT" Payment of Funds "Settles" A Debt!in1or100% (3)

- HowToRepresentYourselfBeforeTheIRS PDFDocumento73 pagineHowToRepresentYourselfBeforeTheIRS PDFBunny FontaineNessuna valutazione finora

- The Stamp Act 1899Documento47 pagineThe Stamp Act 1899bakhtiarahmed7362Nessuna valutazione finora

- Title Company As Trustee in Breach of Fiduciary DutyDocumento7 pagineTitle Company As Trustee in Breach of Fiduciary Dutyin1or100% (1)

- 04 ImmunityDocumento78 pagine04 ImmunityPadmini Subramaniam100% (1)

- Iary Principle, Purpose Trusts and Unincorporated AssociationsDocumento31 pagineIary Principle, Purpose Trusts and Unincorporated AssociationsstraNessuna valutazione finora

- FW 8 ImyDocumento8 pagineFW 8 ImyEla100% (1)

- Sample Request For Bank DocumentsDocumento27 pagineSample Request For Bank DocumentsKNOWLEDGE SOURCENessuna valutazione finora

- Public Inspection of Attachments To A 501 (C) (3) Organization's Form 990-T, Exempt Organization Business Income Tax ReturnDocumento69 paginePublic Inspection of Attachments To A 501 (C) (3) Organization's Form 990-T, Exempt Organization Business Income Tax Returndavidchey4617Nessuna valutazione finora

- Virginia Quit Claim Deed FormDocumento2 pagineVirginia Quit Claim Deed FormLj PerrierNessuna valutazione finora

- List of Securitization ViolationsDocumento7 pagineList of Securitization ViolationsAkil BeyNessuna valutazione finora

- F 13551Documento2 pagineF 13551IRSNessuna valutazione finora

- Without Prejudice: Protect YourselfDocumento7 pagineWithout Prejudice: Protect YourselfAnn-KristinNessuna valutazione finora

- Titles To PropertyDocumento17 pagineTitles To PropertyjpesNessuna valutazione finora

- Borrower in Custody Aka BICDocumento16 pagineBorrower in Custody Aka BICMichael FociaNessuna valutazione finora

- 3 Act of State EdDocumento5 pagine3 Act of State EdAnthony DavisNessuna valutazione finora

- Trusts OutlineDocumento8 pagineTrusts OutlineClint Bell100% (1)

- Living Beneficiary of The Estate Trust General Post Office Judicial DistrictDocumento2 pagineLiving Beneficiary of The Estate Trust General Post Office Judicial DistrictmragsilvermanNessuna valutazione finora

- Social Security SystemDocumento17 pagineSocial Security SystemImranAbubakarPangilinanNessuna valutazione finora

- Wraparound Rider To Deed of TrustDocumento3 pagineWraparound Rider To Deed of TrustEthan Barnes100% (1)

- US Internal Revenue Service: Irb07-39Documento72 pagineUS Internal Revenue Service: Irb07-39IRSNessuna valutazione finora

- TitleDocumento7 pagineTitlegeoraw9588Nessuna valutazione finora

- SSA-89 Form (2022)Documento2 pagineSSA-89 Form (2022)Melys Alamont100% (1)

- Household Balance Sheet Q2 2009Documento6 pagineHousehold Balance Sheet Q2 2009DvNetNessuna valutazione finora

- (Insert "Maker" If Maker and Borrower Are The Same EntityDocumento5 pagine(Insert "Maker" If Maker and Borrower Are The Same EntityJames neteruNessuna valutazione finora

- Photo Identification Affidavit TemplateDocumento2 paginePhoto Identification Affidavit Templateblcksource100% (1)

- Your Michigan Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for Michigan ResidentsDa EverandYour Michigan Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for Michigan ResidentsValutazione: 3 su 5 stelle3/5 (1)

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryDa EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNessuna valutazione finora

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithDa EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNessuna valutazione finora

- Sahih Muslim English TranslationDocumento1.850 pagineSahih Muslim English Translationnounou0018100% (3)

- Law of Persons NotesDocumento8 pagineLaw of Persons NotesRebel XNessuna valutazione finora

- Remedies in RightsDocumento6 pagineRemedies in RightsRebel X100% (1)

- Maxims of Islamic LawDocumento3 pagineMaxims of Islamic LawRebel XNessuna valutazione finora

- CapacityDocumento5 pagineCapacityRebel X100% (1)

- Privacy Act of 1974Documento20 paginePrivacy Act of 1974Rebel X100% (1)

- Key Statements in LawDocumento1 paginaKey Statements in LawRebel XNessuna valutazione finora

- Privacy Act of 1974Documento20 paginePrivacy Act of 1974Rebel X100% (1)

- CM Creditor Training GuideDocumento13 pagineCM Creditor Training GuideRebel X100% (1)

- Claim in A NutshellDocumento11 pagineClaim in A NutshellRebel X100% (3)

- American Expatriation Guide:: How To Divorce The U.S. GovernmentDocumento29 pagineAmerican Expatriation Guide:: How To Divorce The U.S. GovernmentDouglas Funk100% (5)

- Accepted DraftDocumento79 pagineAccepted DraftRebel X100% (3)

- Chapter 2: Deed of Trust Act: Short TitleDocumento8 pagineChapter 2: Deed of Trust Act: Short TitleRebel XNessuna valutazione finora

- Part VI Postal PowerDocumento7 paginePart VI Postal Powersabiont100% (6)

- Secured Transactions: UCC Title 9Documento17 pagineSecured Transactions: UCC Title 9Rebel X86% (7)

- Common Law DefaultDocumento2 pagineCommon Law DefaultRebel XNessuna valutazione finora

- Benedict On Admiralty - PracticeDocumento303 pagineBenedict On Admiralty - PracticeRebel XNessuna valutazione finora

- Suits in AdmiraltyDocumento18 pagineSuits in AdmiraltyRebel X100% (1)

- Ship Arrest PresentationDocumento17 pagineShip Arrest PresentationRebel XNessuna valutazione finora

- Special Purpose EntityDocumento4 pagineSpecial Purpose EntityRebel XNessuna valutazione finora

- Rule C. in Rem Actions: Special Provisions: AvailableDocumento10 pagineRule C. in Rem Actions: Special Provisions: AvailableRebel XNessuna valutazione finora

- Tort ClaimsDocumento11 pagineTort ClaimsRebel X100% (1)

- Transliteration GuideDocumento2 pagineTransliteration GuideRebel XNessuna valutazione finora

- Corporate Income TaxationDocumento3 pagineCorporate Income TaxationKezNessuna valutazione finora

- CIR vs. CA & Pajonar - DigestDocumento2 pagineCIR vs. CA & Pajonar - DigestArdy Falejo Fajutag100% (1)

- TaxDetails PDFDocumento1 paginaTaxDetails PDFsujitsaha1Nessuna valutazione finora

- ICT by DR.K.MALLIKARJUNA RAO PDFDocumento5 pagineICT by DR.K.MALLIKARJUNA RAO PDFdr_mallikarjunaraoNessuna valutazione finora

- Max Bill1Documento3 pagineMax Bill1sravyaNessuna valutazione finora

- Oluwale AdebayoDocumento1 paginaOluwale Adebayowhitneydemetria007Nessuna valutazione finora

- Top 500 Taxpayers in The Philippines 2011Documento10 pagineTop 500 Taxpayers in The Philippines 2011Mykiru IsyuseroNessuna valutazione finora

- Taxation Review Final Income TaxDocumento4 pagineTaxation Review Final Income TaxGendyBocoNessuna valutazione finora

- Common Questions TaxationDocumento5 pagineCommon Questions TaxationChris TineNessuna valutazione finora

- Ashutosh Sohil Salary 2020-03 PDFDocumento1 paginaAshutosh Sohil Salary 2020-03 PDFMohit Sharma100% (1)

- 12 Topmach Corporation 2022 Leads ScheduleDocumento216 pagine12 Topmach Corporation 2022 Leads ScheduleArvin TejonesNessuna valutazione finora

- Obillos v. CIRDocumento3 pagineObillos v. CIRRainNessuna valutazione finora

- IELM 7016 Second in Course Assignment Part1 PDFDocumento4 pagineIELM 7016 Second in Course Assignment Part1 PDFKA LOK CHANNessuna valutazione finora

- Tolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Documento7 pagineTolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Jennilyn Gulfan YaseNessuna valutazione finora

- Shawacademy Invoice Hr5518nRSAQFc0YeC PDFDocumento1 paginaShawacademy Invoice Hr5518nRSAQFc0YeC PDFAdrian Joseph NuñezNessuna valutazione finora

- CIR Vs Mirant PagbilaoDocumento2 pagineCIR Vs Mirant PagbilaoTonifranz Sareno50% (2)

- Subh LabhDocumento16 pagineSubh LabhKulbhushan BhagatNessuna valutazione finora

- Smart 2306Documento2 pagineSmart 2306Billing ZamboecozoneNessuna valutazione finora

- Excel SMS2 (Pt. Cemerlang)Documento14 pagineExcel SMS2 (Pt. Cemerlang)Zahratul WardiyahNessuna valutazione finora

- State Bank of India - Personal BankingDocumento2 pagineState Bank of India - Personal BankingeSupport GlobalIT Business Solutions LimitedNessuna valutazione finora

- Registration Form: Cspa@colburnschool - EduDocumento3 pagineRegistration Form: Cspa@colburnschool - EduSean YanNessuna valutazione finora

- Obillos V CIRDocumento1 paginaObillos V CIRjane ling adolfoNessuna valutazione finora

- Fee ChallanDocumento1 paginaFee ChallanManzoor HussainNessuna valutazione finora

- Tax 1 NotesDocumento13 pagineTax 1 NotesCamille Antoinette BarizoNessuna valutazione finora

- IOB419201761616PM - Iob Rtgs Form PDFDocumento2 pagineIOB419201761616PM - Iob Rtgs Form PDFpsgnanaprakash8686Nessuna valutazione finora

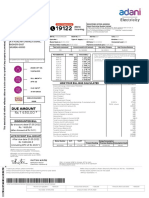

- VIMAL KUMAR Mumbai AdaniDocumento1 paginaVIMAL KUMAR Mumbai AdaniDHANU DANGINessuna valutazione finora

- PSPL TCSC - For Ad For RBI INDIADocumento29 paginePSPL TCSC - For Ad For RBI INDIAMd Rajikul IslamNessuna valutazione finora