Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Business Owners Top Ten Excuses

Caricato da

PNWBizBrokerDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Business Owners Top Ten Excuses

Caricato da

PNWBizBrokerCopyright:

Formati disponibili

By Zane Markowitz Every business owner has a favorite reason for not selling.

Having heard them all over the years, I have collected a list of my favorite excuses. #10. I want to continue not going fishing every chance I get. Some business owners are just having too much fun. They in fact are having so much fun not selling their businesses that they don't ever want to stop not selling them. It doesn't take much time to attend get-acquainted meetings arranged by others. In fact, being courted, flattered and wooed becomes addictive. You might even be surprised: "not-forsale" sellers are acquired all the time by strategic buyers that see more value in their businesses than they do. And if you're one of those executives who plays well with others, a surprising number of CEOs turn out to be the former owners of the now-acquired companies they lead. #9. I am waiting 'til the business peaks again. Congratulations, but you're already too late! It will take 6 months to create a selling document and eliminate the tire kickers. It will take another 6 months to negotiate with the first serious buyers and another 6 months to complete negotiations with the final buyer. That adds up to a year and a half. To maximize price you might want to lower the risk to the buyer by accepting a 2-year earnout or a partial stock deal with a 2-year selling restriction. Remember that a positive outlook will drive your earnout or protect your stock position. Now we are talking 3.5 years (very likely at a minimum). Make no mistake, acquirors buy future earnings. #8. I'm getting ready to get ready. You're right. You're building a longer growth history that should be of value. It's important to the buyer, especially when you don't have it. But once you have established that strong sales history, your company's future will be discounted in some other way: your company's future always will be discounted on one basis or another. Too often, quite drastically and unexpectedly on the basis of circumstances you never anticipated. In 2006, a healthy 78 year old owned a Toyota dealership that boasted 20 years' uninterrupted sales and profit increases. The dealership was managed by a strong professional manager and its prospects were so bright that the owner outright refused an unsolicited offer of $300 million for the company. The dealer was absolutely certain of one thing: the business would be worth even more than that a few years down the road. Within months of rejecting the $300 million offer for his dealership, the owner experienced heart problems and his professional manager was fired for making "unauthorized withdrawals" from the business. Confronted by these unexpected circumstances, the owner began reevaluating his situation. He decided to reach out to his $300 million suitor the following year. The buyer was still very interested in acquiring the dealership and serious discussions ensued even as the real estate market silently crumbled and oil traders began to hedge

their positions and Bear Stearns collapsed and then Lehman Brothers. Discussions with this single prospective buyer stretched on for a year or more, by which time, gas prices had doubled, auto sales had plummeted (along with the stock markets) and the dealership experienced it first back-to-back monthly losses. The buyer did not want to insult the seller, and so he made offer for the dealership he once thought was worth $300 million. In the midst of a global recession and a raft of financial crises, the buyer said could not have raised the necessary capital anyway. And so it was that a $300 million Toyota dealership no longer is worth $300 million and very likely never will be. #7. I don't know where to better invest the proceeds. Few can be sure of where to invest their money in these times but one is certain. Were you to sell, no one could possibly convince you to invest the entire proceeds in a medium-sized, privately-held business, even if you were offered the titles of Chairman and CEO. Like you are now. #6. I'm waiting for the kids' IQ to improve. Well, there are lots of people holding out hope on that one. It certainly is most admirable wanting to eventually entrust your retirement to the hands of your children rather than dispassionate pubic company business executives who are expert in the management of millions or billions of dollars in corporate assets. #5. I can't spare the time. It does take a lot of time to manage the sale of a company, especially when the seller is dealing directly with the buyer. As one or more buyers becomes more serious about an acquisition, resulting discussions consume more and more of the seller's time. As a result, sellers may tend to focus on one buyer at a time, losing the advantage inherent in an auction process in which several prospective buyers compete to acquire the seller while also setting in motion a never-ending pattern of sequential negotiations by ending discussions with one buyer whose interest falters or whose terms disappoint only to enter into discussions with another interested party. Buyers know that unforeseen circumstances frequently arise (on an annual basis at least) that make every owner think more seriously about selling. By drawing out the getacquainted process through serial negotiations, the seller increases the odds that unforeseen circumstances will arise to force a sale at an inopportune time while giving the available buyer unexpected leverage in discussions with a seller who may have run out of room to maneuver. Sellers who are truly time haunted should consider the advantages of undertaking multiple simultaneous discussions. For less time than it takes to talk with one unsolicited suitor, 100 strategic buyers can review the opportunity. From that group, 10 serious buyers likely will emerge, requesting additional information and submitting offers. This process enables sellers to evaluate each suitor's relative seriousness even as the competitive process ensures that each buyer offers maximum value. Should prices fall short of expectations,

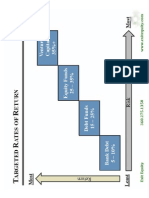

sellers will have learned the size of the gap, enabling them to create an appropriate action plan. Should unforeseen circumstances arise, remember who always wins the auction: the seller. #4. There are plenty of interested buyers: I get calls all the time... Most active acquirers maintain a prospect list that they routinely contact and they also tend to re-establish acquaintances during trade shows. To the greatest degree possible, they make every effort to avoid auctions because auctions always drive up the price. If you see no point in hiring an investment banking firm to keep the potential buyer honest because you really have no interest in selling, you may be absolutely right. However, if you think there is even a 1% chance that you will sell, consider this: if there is one thing buyers hate more than unrealistic sellers it is the specter of other overly anxious buyers entering the picture. If you already have taken the first step and met with the buyer and see enough potential for a second step, your next step should be to hire representation to identify 10 to 20 strategic buyers to keep the process honest because the next step probably will be signing a "stand still" agreement. Be sure to view the cost of representation as acquisition option insurance. For an investment of $35,000 to $50,000, your investment banker will produce a selling document and initial strategic buyer research that likely will save you 6 to 12 months of "getting ready to get ready" time. More importantly, the time savings and the value of an investment banker's insights and advice likely will increase the odds of hitting the narrow window of an ideal selling opportunity. Ideal selling windows tend to open for a very short time because of the multitude of variables involved, most of which lie beyond any seller's reach or control. For example, sellers have no control over interest rates that inevitably have a huge impact on prices that buyers are willing to pay (and afford). As interest rates rise, prospective buyers scale back prices they are willing to pay in order to maintain their return on investment ratios. Buyers begin to disappear from the market altogether as interest rates make acquisitions more and more prohibitive. The fewer buyers in the market, the lower the prices paid. Stock markets also have a major impact on valuations, especially when buyers plan to use stock to complete an acquisition. No one pays a premium with undervalued stock price. Strategic buyers come and go very quickly as do the perfect selling opportunities. #3. I don't want to face what it's not worth. Value is in the eye of the beholder and the best value is realized when you make sure you're talking to the right buyers. Financial buyers use a discounted cash flow model to establish value base upon the cost of capital, a worst case scenario of a 5 to 7 year payback and require every deal to be selffunding. They create added value by exercising greater financial control to improve profitability and expecting, in turn, to identify a strategic buyer willing to pay a crazy price in the next 5 to 10 years.

Strategic buyers use the same discounted cash flow model not to establish value but rather as a negotiation tool to ensure the seller's expectations remain reasonable. The valuation model they present to the board calculates the return on capital employed while featuring some synergistic benefits between the two companies or some avoidance cost showing the buyer making a killing. The bottom line is this: you never run into a price problem when the buyer recognizes a greater value than the seller sees. Not every buyer sees the same value but at any point in time, every business is worth a premium to someone. #2. I'm gonna live forever. Besides, you're riding a winning streak, and every gambler's motto is: "cash-in later." The plain truth is that few of us will know when we will be called to cash-in. You don't want that burden to fall on those left behind. Expecting a widow or children to manage the selling process from scratch, even when assisted by a good attorney, invites disaster. Your heirs will be pegged as "desperate" sellers by every suitor and the longer it takes to close a transaction, the worse things will become. #1. I'm waiting to lose a few more options: I always do best when I'm under pressure. If you're market share is slipping, your product line needs updating, key personnel are leaving, key customers are defecting to competitors, revenues and/or profits are declining, and your market is disappearing, what are you waiting for? Do you want to see your business model completely invalidated? 99% of all entrepreneurs hold on too long and sell their businesses 3 to 5 years too late. They postpone the inevitable decision until they find themselves trapped by "must sell" circumstances. Or, on the other hand, the seemingly "right time" to exit suddenly turns into the "wrong time" quite unexpectedly. Holding on till the last minute must be a "primate thing." In the 1930s and 1940s, there was a hunter and collector of big game named Frank Buck who created an adventure series called "Bring Em Back Alive." He captured baboons for zoos with nothing more than two feet of rope, a cider jug and a handful of peanuts. First, he baited the ground with a few peanuts. Then he dropped the rest of the peanuts into the jug. Baboons who found the nuts on the ground always wanted more. As if scripted for a "B" rated comedy, an enterprising baboon would reach down the narrow neck of a staked-down jug to grab just one more morsel. Unable to withdraw a clenched fist full of nuts and unwilling to let the nuts go, the baboon stubbornly sat, caught in a trap of his own making. While some might consider the analogy unflattering, business owners all too often fall victim to an unwillingness to let go at the appropriate time. Business owners recognize the critical importance of timing even as they admit to postponing the process, perpetuating delays even as they seem powerless to know when to let go and escape the inevitable trap.

Sooner or later, the executives recognize the true price of their reticence: Mr. "DeFault" winds up making their estate planning decisions.

Potrebbero piacerti anche

- Penny Stock Success: Tips for Investing in Cheap StocksDa EverandPenny Stock Success: Tips for Investing in Cheap StocksNessuna valutazione finora

- The Ultimate Guide To Wholesaling Real Estate: How To Find, Sign And Close Your First 100 DealsDa EverandThe Ultimate Guide To Wholesaling Real Estate: How To Find, Sign And Close Your First 100 DealsNessuna valutazione finora

- Value InvestingDocumento24 pagineValue InvestingjucazarNessuna valutazione finora

- Go For The GoldDocumento3 pagineGo For The GoldPratyoosh DwivediNessuna valutazione finora

- Manny Koshbin - Real StateDocumento11 pagineManny Koshbin - Real StateMichael A. Alonso RodriguezNessuna valutazione finora

- Options Trading For BeginnersDocumento146 pagineOptions Trading For BeginnersMohaideen Subaire100% (5)

- M&A Success - How Midsize Sellers Cash OutDocumento5 pagineM&A Success - How Midsize Sellers Cash OutQuynh Le Thi NhuNessuna valutazione finora

- Covered Call Expert ReportDocumento50 pagineCovered Call Expert Reporttvadmaker100% (2)

- 7 Stock Buying Mistakes and How To Avoid ThemDocumento5 pagine7 Stock Buying Mistakes and How To Avoid ThemMohammad IskandarNessuna valutazione finora

- 9 Points To Check Before Picking A MultibaggerDocumento17 pagine9 Points To Check Before Picking A MultibaggerbhatambarekarNessuna valutazione finora

- Buying Real Estate Without Cash or Credit (Review and Analysis of Conti and Finkel's Book)Da EverandBuying Real Estate Without Cash or Credit (Review and Analysis of Conti and Finkel's Book)Valutazione: 5 su 5 stelle5/5 (1)

- Tips of InvestmentDocumento6 pagineTips of InvestmentR.v. NaveenanNessuna valutazione finora

- Options Trading THE COMPLETE CRASH COURSE 3 Books in 1 How To Trade Options A Beginnerss Guide To Investing and Making - (Warren Ray Benjamin) (Z-Library)Documento168 pagineOptions Trading THE COMPLETE CRASH COURSE 3 Books in 1 How To Trade Options A Beginnerss Guide To Investing and Making - (Warren Ray Benjamin) (Z-Library)katiyarm51Nessuna valutazione finora

- Ultimate Income StrategyDocumento7 pagineUltimate Income StrategyPyrantel Pamoate0% (1)

- Book Review - One Upon Wall StreetDocumento20 pagineBook Review - One Upon Wall StreetPriya UpadhyayNessuna valutazione finora

- Rule 1Documento7 pagineRule 1margiant76100% (1)

- Stock Marketplace Guide That Will Work For Any Person.20121205.125834Documento2 pagineStock Marketplace Guide That Will Work For Any Person.20121205.125834anon_69098189Nessuna valutazione finora

- 7 Home Buying Secrets: What Every Home Buyer Needs To Know To Gain An Unfair AdvantageDa Everand7 Home Buying Secrets: What Every Home Buyer Needs To Know To Gain An Unfair AdvantageNessuna valutazione finora

- Jim Dalton's Principles To Live by in The New YearDocumento4 pagineJim Dalton's Principles To Live by in The New YearRichard Jones100% (5)

- Rule 1 of Investing: How to Always Be on the Right Side of the MarketDa EverandRule 1 of Investing: How to Always Be on the Right Side of the MarketValutazione: 4 su 5 stelle4/5 (3)

- Li Lu ExtractsDocumento3 pagineLi Lu ExtractsdasharathiNessuna valutazione finora

- Payback Time (Review and Analysis of Town's Book)Da EverandPayback Time (Review and Analysis of Town's Book)Nessuna valutazione finora

- Mini Storage Auctions: Step By Step Blueprint For Making Money With Mini Storage AuctionsDa EverandMini Storage Auctions: Step By Step Blueprint For Making Money With Mini Storage AuctionsNessuna valutazione finora

- Intelligent Investor: Investing Guide To Analyzing The Stock Market And Making Smart InvestmentsDa EverandIntelligent Investor: Investing Guide To Analyzing The Stock Market And Making Smart InvestmentsValutazione: 5 su 5 stelle5/5 (39)

- 115 Profitable Investing IdeasDocumento9 pagine115 Profitable Investing IdeasVinit DhullaNessuna valutazione finora

- Strong Negotiating Principles Set The Foundation For A Deal: Cma Management March 2010Documento5 pagineStrong Negotiating Principles Set The Foundation For A Deal: Cma Management March 2010Rahma WirdaNessuna valutazione finora

- Summary of Michelle Seiler Tucker & Sharon Lechter's Exit RichDa EverandSummary of Michelle Seiler Tucker & Sharon Lechter's Exit RichNessuna valutazione finora

- Jim Cramer's Real Money (Review and Analysis of Cramer's Book)Da EverandJim Cramer's Real Money (Review and Analysis of Cramer's Book)Nessuna valutazione finora

- Houseflipping PDFDocumento110 pagineHouseflipping PDFquedyah100% (2)

- It's A Whole New Ball Game: With Creative FinancingDocumento33 pagineIt's A Whole New Ball Game: With Creative Financingrnj1230Nessuna valutazione finora

- Trading Options My Way BookDocumento83 pagineTrading Options My Way BookkosurugNessuna valutazione finora

- Benjamin Graham Security Analysis PortfolioDocumento4 pagineBenjamin Graham Security Analysis PortfolioSen LeeNessuna valutazione finora

- 18 Real Estate Investing Tips & Strategies to Maximize ProfitsDa Everand18 Real Estate Investing Tips & Strategies to Maximize ProfitsValutazione: 5 su 5 stelle5/5 (1)

- AARM PSX Lesson 8Documento7 pagineAARM PSX Lesson 8mahboob_qayyumNessuna valutazione finora

- Ten Rules For Bargaining Success. You Do Not Have To Use A: 6.1 Rule 1: Be PreparedDocumento18 pagineTen Rules For Bargaining Success. You Do Not Have To Use A: 6.1 Rule 1: Be PreparedO KiNessuna valutazione finora

- 6 Common Problems Real Estate Brokers Encounter and How To Solve ThemDocumento2 pagine6 Common Problems Real Estate Brokers Encounter and How To Solve ThemKemuel RabiNessuna valutazione finora

- Making A Purchase Offer On A Small BusinessDocumento125 pagineMaking A Purchase Offer On A Small BusinessSuhail Gattan100% (2)

- Exit Strategies For Your BusinessDocumento6 pagineExit Strategies For Your Businessnajjarsteve100% (1)

- Don Fishback Ofb - 80 PDFDocumento90 pagineDon Fishback Ofb - 80 PDFCristina0% (1)

- In the Trader's Mind: Learn to Think Like a Real Trader and Manage Money Profitably to Generate Wealth and Live in AbundanceDa EverandIn the Trader's Mind: Learn to Think Like a Real Trader and Manage Money Profitably to Generate Wealth and Live in AbundanceNessuna valutazione finora

- 10 Estrategia para InvertirDocumento13 pagine10 Estrategia para InvertirMauricio Herrera DiazNessuna valutazione finora

- What Causes Small Businesses To FailDocumento11 pagineWhat Causes Small Businesses To Failmounirs719883Nessuna valutazione finora

- Selling Your Fitzroy Home: Insider Secrets for Getting Maximum Value in Any MarketDa EverandSelling Your Fitzroy Home: Insider Secrets for Getting Maximum Value in Any MarketNessuna valutazione finora

- GCAM Initial Letter 2020-03-27Documento13 pagineGCAM Initial Letter 2020-03-27Anil GowdaNessuna valutazione finora

- The Keys To Successful InvestingDocumento4 pagineThe Keys To Successful InvestingArnaldoBritoAraújoNessuna valutazione finora

- Trading HorsepowerDocumento15 pagineTrading HorsepowerfernandohNessuna valutazione finora

- Billion Dollar Portfolio: How to Create a Real Estate EmpireDa EverandBillion Dollar Portfolio: How to Create a Real Estate EmpireNessuna valutazione finora

- AS-IS:THE ROADMAP TO FLIPPING HOUSES: THE SECRET STEPS TO INVESTING IN REAL ESTATE, WHOLESALING, AND FLIPPING HOUSES WITH LITTLE TO NO MONEYDa EverandAS-IS:THE ROADMAP TO FLIPPING HOUSES: THE SECRET STEPS TO INVESTING IN REAL ESTATE, WHOLESALING, AND FLIPPING HOUSES WITH LITTLE TO NO MONEYNessuna valutazione finora

- Negotiation in Real EstateDocumento13 pagineNegotiation in Real EstateSiddhartha KamatNessuna valutazione finora

- OPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)Da EverandOPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)Nessuna valutazione finora

- Generate Monthly Cash Flow by Selling OptionsDocumento23 pagineGenerate Monthly Cash Flow by Selling OptionsCHAIMA CHICHA100% (2)

- Share Tweet: by Ben KillerbyDocumento4 pagineShare Tweet: by Ben KillerbyCarlos Mario AgueroNessuna valutazione finora

- Airline ConsolidationDocumento1 paginaAirline ConsolidationPNWBizBrokerNessuna valutazione finora

- Resurrection ChronologyDocumento1 paginaResurrection ChronologyPNWBizBrokerNessuna valutazione finora

- Bankers DozenDocumento3 pagineBankers DozenPNWBizBrokerNessuna valutazione finora

- LTR 18-03.17Documento1 paginaLTR 18-03.17PNWBizBrokerNessuna valutazione finora

- Capitilization RateDocumento1 paginaCapitilization RatePNWBizBrokerNessuna valutazione finora

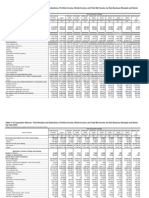

- 2009 Thru 2016 Econ StatsDocumento1 pagina2009 Thru 2016 Econ StatsPNWBizBrokerNessuna valutazione finora

- 2014 DealflowDocumento1 pagina2014 DealflowPNWBizBrokerNessuna valutazione finora

- SBA Loan 2Documento1 paginaSBA Loan 2PNWBizBrokerNessuna valutazione finora

- SBA Loan SecretsDocumento3 pagineSBA Loan SecretsPNWBizBrokerNessuna valutazione finora

- SBA Loan 2Documento1 paginaSBA Loan 2PNWBizBrokerNessuna valutazione finora

- ChemistryDocumento1 paginaChemistryPNWBizBrokerNessuna valutazione finora

- Sources of FinanceDocumento1 paginaSources of FinancePNWBizBrokerNessuna valutazione finora

- Calving The Cash CowDocumento1 paginaCalving The Cash CowPNWBizBrokerNessuna valutazione finora

- SBA LoanDocumento1 paginaSBA LoanPNWBizBrokerNessuna valutazione finora

- Master 44633 DME Profile1 2FBDocumento1 paginaMaster 44633 DME Profile1 2FBPNWBizBrokerNessuna valutazione finora

- Scan0067 Page1 Image1Documento1 paginaScan0067 Page1 Image1PNWBizBrokerNessuna valutazione finora

- Retail PharmaciesDocumento1 paginaRetail PharmaciesPNWBizBrokerNessuna valutazione finora

- Rates of Return PDFDocumento1 paginaRates of Return PDFPNWBizBrokerNessuna valutazione finora

- Aviation Related Business For SaleDocumento1 paginaAviation Related Business For SalePNWBizBrokerNessuna valutazione finora

- HR 2274Documento1 paginaHR 2274PNWBizBrokerNessuna valutazione finora

- Preparing For The SaleDocumento1 paginaPreparing For The SalePNWBizBrokerNessuna valutazione finora

- 1120S For S CorpsDocumento22 pagine1120S For S CorpsPNWBizBrokerNessuna valutazione finora

- Client 44660 ProfileDocumento1 paginaClient 44660 ProfilePNWBizBrokerNessuna valutazione finora

- PDFDocumento1 paginaPDFPNWBizBrokerNessuna valutazione finora

- A Tale of Three EEQ DealsADocumento1 paginaA Tale of Three EEQ DealsAPNWBizBrokerNessuna valutazione finora

- Sources of FinanceDocumento1 paginaSources of FinancePNWBizBrokerNessuna valutazione finora

- Business Owners Top Ten ExcusesDocumento3 pagineBusiness Owners Top Ten ExcusesPNWBizBrokerNessuna valutazione finora

- North South University: Course-ACT310, Sec: 01 Individual Assignment On APEX Foods LTDDocumento10 pagineNorth South University: Course-ACT310, Sec: 01 Individual Assignment On APEX Foods LTDMostafa haqueNessuna valutazione finora

- 197 Dodge v. Ford Motor Co.Documento1 pagina197 Dodge v. Ford Motor Co.MlaNessuna valutazione finora

- Paper Pattern: Do Not Copy The Questions OnDocumento4 paginePaper Pattern: Do Not Copy The Questions OnMANISHA GARGNessuna valutazione finora

- Appendix eDocumento2 pagineAppendix eapi-283357075Nessuna valutazione finora

- Defect and DeficiencyDocumento3 pagineDefect and DeficiencyNitish Pai DukleNessuna valutazione finora

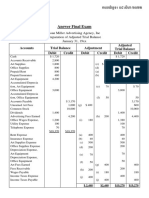

- Answer Final Exam (POA)Documento2 pagineAnswer Final Exam (POA)Phâk Tèr ÑgNessuna valutazione finora

- LGU Budget CycleDocumento3 pagineLGU Budget CycleDelfinNessuna valutazione finora

- Answer KeysDocumento26 pagineAnswer Keysmia uyNessuna valutazione finora

- Popescu & Diaconu (2009)Documento6 paginePopescu & Diaconu (2009)kautsarekaNessuna valutazione finora

- FRA Class NotesDocumento16 pagineFRA Class NotesUtkarsh Sinha100% (1)

- SAP Reports Record Third Quarter 2011 Software RevenueDocumento18 pagineSAP Reports Record Third Quarter 2011 Software RevenueVersion2dkNessuna valutazione finora

- Microns20 DraftDocumento294 pagineMicrons20 DraftadhavvikasNessuna valutazione finora

- Bessrawl Corporation Is A U S Based Company That Prepares Its ConsolidatedDocumento1 paginaBessrawl Corporation Is A U S Based Company That Prepares Its ConsolidatedFreelance WorkerNessuna valutazione finora

- Paradise Island Resort A Completed Business PlanDocumento30 pagineParadise Island Resort A Completed Business PlanMohdShahrukh100% (2)

- Lesson 10 - Manufacturing BusinessDocumento4 pagineLesson 10 - Manufacturing BusinessVISITACION JAIRUS GWENNessuna valutazione finora

- Bronze Adora Case StudyDocumento8 pagineBronze Adora Case StudyTitiNessuna valutazione finora

- RR No. 11-2018Documento90 pagineRR No. 11-2018Leticia TaclasNessuna valutazione finora

- RFM Business Review PDFDocumento32 pagineRFM Business Review PDFJessicaNessuna valutazione finora

- Wacc and MMDocumento2 pagineWacc and MMThảo NguyễnNessuna valutazione finora

- Syntech FibresDocumento33 pagineSyntech FibresSaaDii KhanNessuna valutazione finora

- Marc Lavoie History and Methods of Post Keynesian Economics 184458Documento34 pagineMarc Lavoie History and Methods of Post Keynesian Economics 184458José Ignacio Fuentes PeñaililloNessuna valutazione finora

- REED FileDocumento4 pagineREED FileJake VargasNessuna valutazione finora

- Installment Sales LectureDocumento10 pagineInstallment Sales LecturePenny TratiaNessuna valutazione finora

- Homework CVP & BEDocumento11 pagineHomework CVP & BEYamato De Jesus NakazawaNessuna valutazione finora

- Term Paper FinanceDocumento49 pagineTerm Paper FinanceKristine Astorga-NgNessuna valutazione finora

- FAR 2 Final Departmental Examination 2022Documento35 pagineFAR 2 Final Departmental Examination 2022ILOVE MATURED FANSNessuna valutazione finora

- 1701 Bir Form 2006 2013-2019Documento9 pagine1701 Bir Form 2006 2013-2019Jessie Boy Balino BalderamaNessuna valutazione finora

- Biotechnology Positioning and What Matters in 2014Documento196 pagineBiotechnology Positioning and What Matters in 2014dickygNessuna valutazione finora

- RER Appendix 46 1 SampleDocumento1 paginaRER Appendix 46 1 SampleMary Grace Lagdamen PerochoNessuna valutazione finora

- Quizzer rfbt1 PDFDocumento8 pagineQuizzer rfbt1 PDFleighNessuna valutazione finora