Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chevron Phils. Inc. vs. BOC: Tax, Custom Duties, Importation of Oil

Caricato da

jane_rocketsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chevron Phils. Inc. vs. BOC: Tax, Custom Duties, Importation of Oil

Caricato da

jane_rocketsCopyright:

Formati disponibili

Case #13. CHEVRON PHILIPPINES, INC., VS. COMMISSIONER OF THE BUREAU OF CUSTOMS, [G.R. No.

178759, August 11, 2008] TOPIC: TAX and Custom Duties Facts: Chevron Phils. Inc., is engaged in the business of importing, distributing and marketing of petroleum products in the Philippines. In 1996, the importations subject of this case arrived and were covered by 8 bills of lading. The shipments were unloaded from the carrying vessels onto petitioners oil tanks over a period of 3 days from the date of their arrival. Subsequently, the import entry declarations (IEDs) were filed and 90% of the total customs duties were paid. The import entry and internal revenue declarations (IEIRDs) of the shipments were thereafter filed. The importations were appraised at a duty rate of 3% as provided under RA 8180 and petitioner paid the import duties amounting to P316,499,021. Prior to the effectivity of RA 8180 on April 16, 1996, the rate of duty on imported crude oil was 10%. Three years later, then Finance Secretary received a letter denouncing the deliberate concealment, manipulation and scheme employed by petitioner in the importation of crude oil, thereby resulting in huge losses of revenue for the government. This letter was endorsed to the Bureau of Customs (BOC) for investigation. On August 1, 2000, petitioner received a demand letter from the District Collector requiring the immediate settlement of the amount of P73,535,830 representing the difference between the 10% and 3% tariff rates on the shipments. Petitioner objected to the using of the 10% duty rate and insisted that the 3% tariff rate should instead be applied. Furthermore it raised the defense of prescription against the assessment pursuant to Section 1603 of the Tariff and Customs Code (TCC). Thus, it prayed that the assessment for deficiency customs duties be cancelled and the notice of demand be withdrawn. The Special Investigator found that there was an irregularity in the filing and acceptance of the import entries beyond the 30-day non-extendible period prescribed under Section 1301 of the TCC and in the release of the shipments after the same had already been deemed abandoned in favor of the government. Petitioner was then ordered to pay P1,180,170,769.21 representing the total dutiable value of the importations. The CTA en banc held that it was the filing of the IEIRDs that constituted entry under the TCC. Since these were filed beyond the 30-day period, they were not seasonably "entered" in accordance with Section 1301 in relation to Section 205 of the TCC. Consequently, they were deemed abandoned under Sections 1801 and 1802 of the TCC. It also ruled that the notice required under Customs Memorandum Order was not necessary in view of petitioner's actual knowledge of the arrival of the shipments. It likewise agreed with the CTA Division's finding that petitioner committed fraud when it failed to file the IEIRD within the 30-day period with the intent to "evade the higher rate." Petitioner was ordered to pay respondent the total dutiable value of the oil shipments amounting to P893,781,768.21. ISSUES: 1. Whether or not entry under Section 1301 in relation to Section 1801 of the TCC refers to the IED or the IEIRD; 2. Whether or not "entry" under Section 1301 in relation to whether fraud was perpetrated by petitioner and 3. Whether or not the importations can be considered abandoned under Section 1801.

RULING: 1. The position of petitioner, that the import entry to be filed within the 30-day period refers to the IED and not the IEIRD, has no legal basis. Under the relevant provisions of the TCC, both the IED and IEIRD should be filed within 30 days from the date of discharge of the last package from the vessel or aircraft. The IED serves as basis for the payment of advance duties on importations whereas the IEIRD evidences the final payment of duties and taxes. The operative act that constitutes "entry" of the imported articles at the port of entry is the filing and acceptance of the "specified entry form" together with the other documents required by law and regulations. The "specified entry form" refers to the IEIRD. The word "entry" refers to the regular consumption entry (the IEIRD) and not the provisional entry (the IED). 2. Evidence showed that petitioner bided its time to file the IEIRD so as to avail of a lower rate of duty. A clear indication of petitioner's deliberate intention to defraud the government was its non-disclosure of discrepancies on the duties declared in the IEDs (10%) and IEIRDs (3%) covering the shipments. Due to the presence of fraud, the prescriptive period of the finality of liquidation under Section 1603 was inapplicable. 3. Petitioner's failure to file the required entries within a non-extendible period of thirty days from date of discharge of the last package from the carrying vessel constituted implied abandonment of its oil importations. This means that from the precise moment that the non-extendible thirty-day period lapsed, the abandoned shipments were deemed the property of the government. Therefore, when petitioner withdrew the oil shipments for consumption, it appropriated for itself properties which already belonged to the government. Accordingly, it became liable for the total dutiable value of the shipments of imported crude oil amounting to P1,210,280,789.21 reduced by the total amount of duties paid amounting to P316,499,021.00 thereby leaving a balance of P893,781,768.21. Due notice was not necessary in this case. The purpose of posting an "urgent notice to file entry" is only to notify the importer of the "arrival of its shipment" and the details of said shipment. Since it already had knowledge of such, notice was superfluous. Notice to petitioner was unnecessary because it was fully aware that its shipments had in fact arrived. The oil shipments were discharged from the carriers docked in its private pier or wharf, into its shore tanks. From then on, petitioner had actual physical possession of its oil importations. It was thus incumbent upon it to know its obligation to file the IEIRD within the 30-day period prescribed by law. As a matter of fact, importers such as petitioner can, under existing rules and regulations, file in advance an import entry even before the arrival of the shipment to expedite the release of the same. However, it deliberately chose not to comply with its obligation under Section 1301. Petition DENIED. Petitioner Chevron Philippines, Inc. is ORDERED to pay P893,781,768.21 plus six percent (6%) legal interest per annum accruing from the date of promulgation of this decision until its finality. Upon finality of this decision, the sum so awarded shall bear interest at the rate of twelve percent (12%) per annum until its full satisfaction.

Potrebbero piacerti anche

- Agc Shortform Subcontractor Agreement FormDocumento3 pagineAgc Shortform Subcontractor Agreement Formapi-324291104Nessuna valutazione finora

- Section 800 of Ra 10863Documento35 pagineSection 800 of Ra 10863roxette78% (18)

- Manual On Cargo Clearance Process (E2m Customs Import Assessment System)Documento43 pagineManual On Cargo Clearance Process (E2m Customs Import Assessment System)Musa Batugan Jr.100% (1)

- Warranty and Defect Liability Period For Service ContractDocumento2 pagineWarranty and Defect Liability Period For Service ContractSiju Alex Cherian100% (5)

- NCBA RA 7653 Summary v2.0Documento18 pagineNCBA RA 7653 Summary v2.0Cha BL80% (5)

- ERLINDA SAN MATEO v. PEOPLE DIGESTDocumento3 pagineERLINDA SAN MATEO v. PEOPLE DIGESTKatrina PerezNessuna valutazione finora

- ASEAN Economic Community perceptionsDocumento6 pagineASEAN Economic Community perceptionsMNAVNessuna valutazione finora

- 1 Ncnda Imfpa D2 PrinDocumento8 pagine1 Ncnda Imfpa D2 Prinemt6382100% (2)

- Seizure - Forfeiture ProcedureDocumento1 paginaSeizure - Forfeiture ProcedureJil Mei IVNessuna valutazione finora

- CAO 03 - 2019 Customs Jurisdiction and Exercise of Police AuthorityDocumento50 pagineCAO 03 - 2019 Customs Jurisdiction and Exercise of Police Authorityrld LobianoNessuna valutazione finora

- Customs Reviewer 2017 (Final)Documento24 pagineCustoms Reviewer 2017 (Final)Chi Odanra83% (12)

- Yaokasin V Commissioner Case DigestDocumento1 paginaYaokasin V Commissioner Case Digesthistab100% (1)

- TCCP v. CMTADocumento45 pagineTCCP v. CMTAIvan Luzuriaga50% (2)

- Remigio Vs SandiganbayanDocumento5 pagineRemigio Vs SandiganbayanArahbells67% (3)

- Pricing Interrelated ProductsDocumento5 paginePricing Interrelated ProductsMaria Charise TongolNessuna valutazione finora

- Airlift Asia Customs Brokerage vs. Court of AppealsDocumento2 pagineAirlift Asia Customs Brokerage vs. Court of AppealsAlfonso Vargas75% (4)

- CMTA SummaryDocumento36 pagineCMTA SummaryAngie Douglas100% (2)

- Full Text Customs Broker Board ExamDocumento2 pagineFull Text Customs Broker Board ExamTheSummitExpress50% (4)

- G.R. No. 154486Documento3 pagineG.R. No. 154486Mila MovidaNessuna valutazione finora

- Yaokasin V Commissioner of Customs (Digest)Documento2 pagineYaokasin V Commissioner of Customs (Digest)Yvette Morales100% (1)

- ArtDocumento2 pagineArtAlfred GarciaNessuna valutazione finora

- Nutrition For Sport and ExerciseDocumento245 pagineNutrition For Sport and ExerciseManolo Santibanez100% (7)

- Contract of Lease for Angeles City ApartmentDocumento7 pagineContract of Lease for Angeles City ApartmentMJ CarreonNessuna valutazione finora

- Claim for Damages Against Defendants for Fatal AccidentDocumento13 pagineClaim for Damages Against Defendants for Fatal AccidentChristine C. ReyesNessuna valutazione finora

- Chevron PH Vs Commissioner of BOCDocumento4 pagineChevron PH Vs Commissioner of BOCTenet Manzano100% (1)

- EL GRECO vs. Commissioner of CustomsDocumento2 pagineEL GRECO vs. Commissioner of CustomsKevin Kho100% (1)

- CA Affirms Release of Rice Shipment and VesselDocumento2 pagineCA Affirms Release of Rice Shipment and VesselRobert Manto100% (1)

- Enrile V VinuyaDocumento2 pagineEnrile V VinuyaMiguel Castriciones80% (5)

- Tariff Reform ProgramDocumento5 pagineTariff Reform ProgramBro King Solomon0% (1)

- Draft PH Order On Establishment of Customs Facilities and WarehousesDocumento22 pagineDraft PH Order On Establishment of Customs Facilities and WarehousesPortCallsNessuna valutazione finora

- Agriex Co. LTD v. VillanuevaDocumento2 pagineAgriex Co. LTD v. VillanuevaannedefrancoNessuna valutazione finora

- TAX CASE MV Don Martin vs. Secretary of FinanceDocumento1 paginaTAX CASE MV Don Martin vs. Secretary of FinanceDiane UyNessuna valutazione finora

- Chua vs. Villanueva ruling on BOC jurisdictionDocumento1 paginaChua vs. Villanueva ruling on BOC jurisdictionKrizea Marie DuronNessuna valutazione finora

- Jardeleza V. PeopleDocumento4 pagineJardeleza V. PeopleGrace0% (2)

- Sec of Finance V CtaDocumento6 pagineSec of Finance V CtaRose AnnNessuna valutazione finora

- CDP LONG QUIZ EXAMDocumento26 pagineCDP LONG QUIZ EXAMElaine Antonette RositaNessuna valutazione finora

- Sof vs. KutangbatoDocumento13 pagineSof vs. KutangbatoMarianne SerranoNessuna valutazione finora

- Customs Valuation System PrelimDocumento26 pagineCustoms Valuation System Prelim2 BNessuna valutazione finora

- Asian Terminals, Inc. vs. Bautista-RicafortDocumento3 pagineAsian Terminals, Inc. vs. Bautista-RicafortNhassie John GONZAGANessuna valutazione finora

- Abstract BSCA 2010 2015Documento46 pagineAbstract BSCA 2010 2015Rea TapiaNessuna valutazione finora

- CIR vs Chevron Holdings Inc CTA Case on VAT RefundDocumento1 paginaCIR vs Chevron Holdings Inc CTA Case on VAT RefundKenette Diane CantubaNessuna valutazione finora

- CBW (Wefz Midterms1)Documento19 pagineCBW (Wefz Midterms1)Jay GalleroNessuna valutazione finora

- Cases On Authority of BOC CASE DIGESTSDocumento17 pagineCases On Authority of BOC CASE DIGESTSRhea Mae A. SibalaNessuna valutazione finora

- Marilao Water V Iac DigestDocumento3 pagineMarilao Water V Iac DigestRyan SuaverdezNessuna valutazione finora

- Midterm WarehousingDocumento8 pagineMidterm WarehousingAngelo Ace M. MañalacNessuna valutazione finora

- Tax Case DigestsDocumento15 pagineTax Case DigestsAngeline Rodriguez67% (3)

- Post Clearance Audit QuizDocumento10 paginePost Clearance Audit QuizJeammuel ConopioNessuna valutazione finora

- Customs Bureau Jurisdiction Over Seized Imported GoodsDocumento2 pagineCustoms Bureau Jurisdiction Over Seized Imported Goodsarriannecabiao0% (1)

- Forms of Escape From TaxationDocumento3 pagineForms of Escape From TaxationBeverly FGNessuna valutazione finora

- Tax 2 Notes (Cmta)Documento39 pagineTax 2 Notes (Cmta)Threes See0% (1)

- Cir vs. Dash Engineering Philippines, IncDocumento2 pagineCir vs. Dash Engineering Philippines, InclexxNessuna valutazione finora

- ASEAN Harmonized Tariff Nomenclature ExplainedDocumento3 pagineASEAN Harmonized Tariff Nomenclature ExplainedJojo Aboyme CorcillesNessuna valutazione finora

- Final RRLDocumento23 pagineFinal RRLWelvic B. Tagod100% (1)

- Title Iv Import Clearance and Formalities Goods DeclarationDocumento42 pagineTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNessuna valutazione finora

- De Sello, Kryzzle C. Bsba Iii - A Total Quality ManagementDocumento2 pagineDe Sello, Kryzzle C. Bsba Iii - A Total Quality ManagementKaryll JustoNessuna valutazione finora

- APC Baysa Chapter 1Documento7 pagineAPC Baysa Chapter 1Ellie Park50% (2)

- CMTA NotesDocumento7 pagineCMTA NotesGSSNessuna valutazione finora

- G.R. No.186312 - CAPATIDocumento2 pagineG.R. No.186312 - CAPATIEmNessuna valutazione finora

- Elements of The Dutiable ValueDocumento21 pagineElements of The Dutiable ValueJimmy Maban IINessuna valutazione finora

- Seven Days at Mazaua 85-86Documento4 pagineSeven Days at Mazaua 85-86Maria Julie Flor MacasaetNessuna valutazione finora

- Cao 4-2004Documento21 pagineCao 4-2004Philip Harold Tolentino100% (4)

- Cir vs. Metro Super Rama DigestDocumento3 pagineCir vs. Metro Super Rama DigestClavel TuasonNessuna valutazione finora

- Chevron Philippines vs. Commissioner of CustomsDocumento13 pagineChevron Philippines vs. Commissioner of CustomsGraceNessuna valutazione finora

- Chevron Philippines vs. Commissioner of Customs: Entry NO. Product Arrival Date IED IeirdDocumento13 pagineChevron Philippines vs. Commissioner of Customs: Entry NO. Product Arrival Date IED IeirdGraceNessuna valutazione finora

- Chevron Philippines tax case on 1996 oil importsDocumento2 pagineChevron Philippines tax case on 1996 oil importsDawn BarondaNessuna valutazione finora

- MIAA vs. City of PasayDocumento4 pagineMIAA vs. City of Pasayjane_rocketsNessuna valutazione finora

- Liability for Lost Shipment Based on Acquisition CostDocumento3 pagineLiability for Lost Shipment Based on Acquisition CostBernadetteNessuna valutazione finora

- 2015 de Castro-Remedial LawDocumento28 pagine2015 de Castro-Remedial Lawjane_rocketsNessuna valutazione finora

- 2.1 Government Risk Identification TemplateDocumento1 pagina2.1 Government Risk Identification Templatejane_rocketsNessuna valutazione finora

- HK Macau Shenzhen 2Documento6 pagineHK Macau Shenzhen 2jane_rocketsNessuna valutazione finora

- 2015 de Cas Tro-Political LawDocumento8 pagine2015 de Cas Tro-Political Lawjane_rocketsNessuna valutazione finora

- People vs. GecomoDocumento8 paginePeople vs. Gecomojane_rocketsNessuna valutazione finora

- Yap Kim ChuanDocumento6 pagineYap Kim Chuanjane_rocketsNessuna valutazione finora

- 2011 Bar Examination For Commercial Law Nego, InsuranceDocumento8 pagine2011 Bar Examination For Commercial Law Nego, Insurancejane_rocketsNessuna valutazione finora

- 2015 de Castro-Criminal LawDocumento25 pagine2015 de Castro-Criminal Lawjane_rocketsNessuna valutazione finora

- Joseph Victor G. Ejercito V. Sandiganbayan 509 Scra 190 (2006)Documento4 pagineJoseph Victor G. Ejercito V. Sandiganbayan 509 Scra 190 (2006)jane_rocketsNessuna valutazione finora

- Metropolitan WaterworksDocumento16 pagineMetropolitan Waterworksjane_rocketsNessuna valutazione finora

- Transpo 11 20Documento29 pagineTranspo 11 20jane_rocketsNessuna valutazione finora

- Past For TeachersDocumento8 paginePast For TeachersDjenela MabagosNessuna valutazione finora

- Case TranspoDocumento36 pagineCase Transpojane_rocketsNessuna valutazione finora

- People vs. CeloceloDocumento5 paginePeople vs. Celocelojane_rocketsNessuna valutazione finora

- People vs. GecomoDocumento8 paginePeople vs. Gecomojane_rocketsNessuna valutazione finora

- Yap Kim ChuanDocumento6 pagineYap Kim Chuanjane_rocketsNessuna valutazione finora

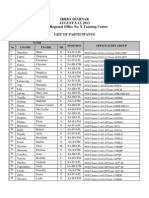

- List of Participants IRRBA Batch 2Documento2 pagineList of Participants IRRBA Batch 2jane_rocketsNessuna valutazione finora

- Mejssk: Booking DetailsDocumento6 pagineMejssk: Booking Detailsjane_rocketsNessuna valutazione finora

- Objection Responses Round OneDocumento8 pagineObjection Responses Round Onejane_rockets100% (1)

- Ybanez Energy Saver Forum, December 04, 2010Documento2 pagineYbanez Energy Saver Forum, December 04, 2010jane_rocketsNessuna valutazione finora

- POLITICAL LAW TO CRIMINAL LAWDocumento2 paginePOLITICAL LAW TO CRIMINAL LAWdayaners88% (16)

- Pre Trial Defense RapeDocumento6 paginePre Trial Defense Rapejane_rockets100% (1)

- 2010 Aar Negros Occidental Part02 FindingsDocumento42 pagine2010 Aar Negros Occidental Part02 Findingsjane_rocketsNessuna valutazione finora

- October 2013 Certified Public Accountants (CPA) Licensure Examination ResultsDocumento85 pagineOctober 2013 Certified Public Accountants (CPA) Licensure Examination ResultsPaul Michael Camania JaramilloNessuna valutazione finora

- List JudgesDocumento317 pagineList JudgesIa Bolos100% (1)

- Executive Summary Pdaf ComplaintsDocumento6 pagineExecutive Summary Pdaf Complaintsjane_rocketsNessuna valutazione finora

- Hotels CdoDocumento5 pagineHotels Cdojane_rockets100% (1)

- EvidenceDocumento25 pagineEvidenceAnonymous X5ud3UNessuna valutazione finora

- What Is A Political QuestionDocumento5 pagineWhat Is A Political Questionjane_rocketsNessuna valutazione finora

- Executive Summary Pdaf ComplaintsDocumento6 pagineExecutive Summary Pdaf Complaintsjane_rocketsNessuna valutazione finora

- Court Dismisses Application to Rectify Shareholder Register Due to Delay and Dispute Over FactsDocumento5 pagineCourt Dismisses Application to Rectify Shareholder Register Due to Delay and Dispute Over FactsChin Kuen YeiNessuna valutazione finora

- Higher OneDocumento3 pagineHigher OneRob PortNessuna valutazione finora

- The Unenforceable Contracts) 1Documento19 pagineThe Unenforceable Contracts) 1Rufino Gerard MorenoNessuna valutazione finora

- OSMEÑA VS RAMA DigestDocumento1 paginaOSMEÑA VS RAMA Digestcmv mendoza100% (1)

- Law Unit 2Documento4 pagineLaw Unit 2CheyenneCampbell100% (1)

- Missed Flight Negligence CaseDocumento15 pagineMissed Flight Negligence Casepooja ratanani100% (4)

- Mortgage Assignment Fraud - U.S. Bank National Assoc., As Trustee v. Ernest E. Harpster Sl-2007-CA-6684-ESDocumento4 pagineMortgage Assignment Fraud - U.S. Bank National Assoc., As Trustee v. Ernest E. Harpster Sl-2007-CA-6684-ESForeclosure Fraud100% (3)

- Answer NLRCDocumento13 pagineAnswer NLRCAlverastine AnNessuna valutazione finora

- Executive Order No. 292 (BOOK V - Title I - Subtitle A - Chapter 7-Discipline) - Official Gazette of The Republic of The PhilippinesDocumento7 pagineExecutive Order No. 292 (BOOK V - Title I - Subtitle A - Chapter 7-Discipline) - Official Gazette of The Republic of The PhilippinesJasonV.PanayNessuna valutazione finora

- 55 - Case Digest - Jalosjos v. Comelec - G.R. No. 191970Documento2 pagine55 - Case Digest - Jalosjos v. Comelec - G.R. No. 191970JeNovaNessuna valutazione finora

- Velliyakundam Impartible Estate Act, 1933 PDFDocumento2 pagineVelliyakundam Impartible Estate Act, 1933 PDFLatest Laws TeamNessuna valutazione finora

- In The Court of The Hon'Ble Additional Chief Metropolitan Magistrate, Mumbai At: Esplande CC No.: of 2022 BetweenDocumento4 pagineIn The Court of The Hon'Ble Additional Chief Metropolitan Magistrate, Mumbai At: Esplande CC No.: of 2022 BetweenriyaNessuna valutazione finora

- Agcaoili Vs GSISDocumento5 pagineAgcaoili Vs GSISGloria Diana DulnuanNessuna valutazione finora

- List of Cases For Insurance Law-MidtermsDocumento3 pagineList of Cases For Insurance Law-MidtermsJudith AlisuagNessuna valutazione finora

- Continue..: - Appointment of InvigilatorsDocumento6 pagineContinue..: - Appointment of InvigilatorsPawan KumarNessuna valutazione finora

- IRAC MethodDocumento4 pagineIRAC Methodroy rebosuraNessuna valutazione finora

- Consolidated EO 125 and 125-ADocumento9 pagineConsolidated EO 125 and 125-AJill BacaniNessuna valutazione finora

- Medina vs. CaDocumento4 pagineMedina vs. CaAnny YanongNessuna valutazione finora

- MNIT Jaipur HRA Application FormDocumento3 pagineMNIT Jaipur HRA Application Formarun14089Nessuna valutazione finora

- Food Fest Land, Inc vs. Romualdo C. SiapnoDocumento12 pagineFood Fest Land, Inc vs. Romualdo C. Siapnopot tpNessuna valutazione finora

- Case Digest PartnershipDocumento3 pagineCase Digest Partnershiplamadridrafael100% (1)

- MCMPDocumento2 pagineMCMPRaya Alvarez TestonNessuna valutazione finora