Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Old 100 Moloney Keeper FINAL EXAM

Caricato da

spectrum_48Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Old 100 Moloney Keeper FINAL EXAM

Caricato da

spectrum_48Copyright:

Formati disponibili

BUSA 100

FINAL EXAM

Mr. Moloney

Multiple Choice (1.5 points each 45points total)

1. The balance sheet shows the financial position of a business as of a specific date. a. True b. False 2. The major sections of a balance sheet are assets, liabilities, owner's equity, revenues, and expenses. a. True b. False 3. In reconciling the bank balance on a bank reconciliation, the amount of an unrecorded bank service charge should be: a. added to the book balance of cash b. deducted from the book balances of cash c. added to the bank statement balance d. deducted from the bank statement balance e. ignored 4. If a business pays $300 to satisfy a previously recorded liability, the effect of the payment is to reduce the liability and a. owner's equity b. an expense account c. an asset account 5. When expenses are greater than revenues, a company will report a net loss. a. True b. False 6. The properties owned by a business enterprise are called a. assets b. liabilities c. capital d. income e. expense 7. The normal balance of any account is always on the debit side. a. True b. False 8. The Accumulated Depreciation account is a a. liability account b. capital account c. contra-asset account d. revenue account e. none of the foregoing

9. The cost of a piece of equipment was $10,000. The Accumulated Depreciation on that piece of equipment is $3,000. The book value of the piece of equipment is a. $10,000 b. $ 3,000 c. $13,000 d. $ 7,000 e. none of the foregoing 10. The order of preparation of financial statements in a business is a. Statement of Owner's Equity, Income Statement, Balance Sheet b. Income Statement, Statement of Owner's Equity, Balance Sheet c. Balance Sheet, Income Statement, Statement of Owner's Equity d. none of the foregoing 11. The balance of the Drawing account is closed at the end of an accounting period. a. True b. False 12. Real accounts are: a. unusual accounts b. income statement accounts c. balance sheet accounts d. temporary accounts e. journal accounts 13. Failure to record depreciation during a fiscal period results in an understatement of net income. a. True b. False 14. Prior to recording adjustment entries, the Office Supplies account had a $359 debit balance while a physical count of the supplies showed $105 of unused supplies on hand. The required adjusting entry is: a. debit Office Supplies $105 and credit Office Supplies Expense $105 b. debit Office Supplies Expense $105 and credit Office Supplies $105 c. debit Office Supplies Expense $254 and credit Office Supplies $254 d. debit Office Supplies $254 and credit Office Supplies Expense $254 e. some other entry 15. If the Cash Short and Over account has a debit balance at the end of the accounting period, it indicates a net shortage of cash for that period. a. True b. False 16. The amount of the outstanding checks included on the bank reconciliation is shown as a. deduction from the book balance of cash b. an addition to the bank statement balance c. a deduction from the bank statement balance d. an addition to the book balance of cash 17. Employers are generally required to pay payroll taxes consisting of the following: a. federal unemployment b. FICA (Social Security and Medicare) c. state unemployment d. all of the foregoing

18. Under terms of FOB Destination, the buyer pays the freight charges. a. True b. False 19. Which of the following accounts has a normal credit balance? a. Sales Discounts b. Freight In c. Sales Returns and Allowances d. Purchases Discounts e. none of the foregoing 20. If Current Assets are $85,000; Plant and Equipment is $124,000; Current Liabilities are $57,000; and Long-Term Liabilities are $118,000 the current ratio is: a. .69:1 b. .48:1 c. 1.49:1 d. l.05:1 e. none of the foregoing 21. On November 2, merchandise with a list price of $6,400 is sold, subject to a trade discount of 30 percent with terms of 2/10, n/30. Payment is received from the customer on November 12. The amount to be recorded for the sale is a. $4,390.40 b. $6,400 c. $4,480 d. $6,208 e. none of the foregoing 22. An annual accounting period (12 consecutive months) for a business is called a fiscal year. a. True b. False 23. The amount of the beginning merchandise inventory for an accounting period would be placed on the financial statements a. as a plant asset b. as a current asset c. in the cost of goods sold section d. both B and C 24. The account Interest Expense would be placed on the financial statements a. as a current asset b. as a plant asset c. as an administrative expense d. as an other expense

Questions 25 and 26: Balances of accounts at the end of the year, before adjustments, are as follows: Sales, $900,000; Purchases Discounts, $10,000; Sales Returns and Allowances, $30,000; Purchases, $750,000; Beginning Merchandise Inventory, $120,000; and Purchases Returns and Allowances, $40,000. The inventory of merchandise at the end of the year is $130,000.

25. The amount of the cost of merchandise sold is a. $690,000. b. $700,000. c. $715,000. d. $900,000. e. none of the foregoing 26. The amount of gross profit is a. $170,000. b. $180,000. c. $210,000. d. none of the foregoing 27. A return of $200 has been recorded on a purchase invoice for $2,200, terms 2/10, n/30 which is paid within the discount period. The amount of the discount is a. $40. b. $22. c. $44. d. $10. 28. The account Unearned Subscriptions at the end of the accounting period would be classified a. as an asset b. as a liability c. as revenue d. as an expense 29. The adjusting entry for rent received in advance that is partially earned during the year is a. Rent Income Income Summary b. Unearned Rent Rent Income c. Income Summary Rent Income 30. Fred Starskey earns a regular hourly salary of $4.50. He is paid time-and-a-half for all hours in excess of 40. Last week he worked a total of 50 hours. Before this week, Fred had earned $14,000. What is Fred's gross pay? a. $260 b. $225 c. $247.50 d. $270 e. none of the above

Problems: ANSWER ALL PROBLEMS ON PINK ANSWER SHEET

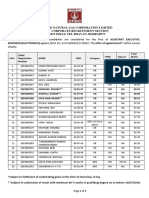

Payroll (10points)

31. The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Scott Medical Center are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.5 percent social security tax rate and a base of $60,000 for the calendar year. Assume a 1.5 percent Medicare tax rate and a base of $140,000 for the calendar year. Employee No. 1 2 3 December Salary $4,400 5,600 5,400 Y-T-D Earnings through Nov. 30 $48,400 61,600 59,400 Soc. Sec. Tax for Dec. __________ __________ __________ Medicare Tax for Dec. __________ __________ __________

Problems: ANSWER ALL PROBLEMS ON PINK ANSWER SHEET

32.

Bank Reconciliation (15 points)

On March 31, 20X5, the Home Improvement Center received a bank statement containing a balance of $9,550. The balance in the firm's checkbook and Cash account on the same date was $10,200. The difference between the two balances is caused by the items listed below.

* *

A $3,245 deposit made on March 30 does not appear on the bank statement. Check 358 for $550 issued on March 29 and Check 359 for $1,650 issued on March 30 have not yet been paid by the bank. * A credit memorandum shows that the bank has collected a $1,000 note receivable and interest of $100 for the firm. * A service charge of $15 appears on the bank statement. * A debit memorandum shows an NSF check for $465. (The check was issued by Donald Smith, a credit customer.) * The firm's records indicate that Check 341 of March 1 was issued for $900 to pay the month's rent. However, the canceled check and the listing on the bank statement show that the actual amount of the check was $800. * The bank made an error by deducting a check for $325 issued by another business from the balance of the Center's account. Instructions: A. Prepare a bank reconciliation statement for the firm as of March 31, 20X5. Make certain it is in the correct format with all the necessary details.. B. Record entries for any items on the bank reconciliation statement that must be journalized. Date the entries April 2, 20X5. Use page 4 of a general journal.

33.

Income Statement (25points)

The adjusted trial balance data given below is from the Murphy Company's worksheet for the year ended December 31, 20X6. Prepare a classified income statement for the year. The expense accounts numbered 511-515 represent selling expenses, and those numbered 521-531 represent general and administrative expenses. ACCT. NO. ACCOUNT NAME 399 Income Summary 401 Sales 451 Sales Returns and Allowances 501 Purchases 502 Freight In 503 Purchases Returns and Allowances 504 Purchases Discount 511 Sales Salaries Expense 513 Advertising Expense 515 Travel Expense 521 Office Salaries Expense 523 Office Supplies Expense 591 Interest Expense ADJ. TRIAL BALANCE DEBIT CREDIT 60,000 56,000 210,000 3,500 95,000 2,500 1,200 1,800 55,000 2,000 11,000 17,500 600 1,600

Problems: ANSWER ALL PROBLEMS ON PINK ANSWER SHEET

(1.) Selected account balances of Rich and Company as of December 31, the end of the fiscal year, are listed below in alphabetical order.

Instructions Prepare a classified balance sheet.

BUSA 100 FINAL EXAM Answer Section PROBLEM 1. NOTE: Use forms 1 and 4.

Mr. Moloney

HOME IMPROVEMENT CENTER Bank Reconciliation Statement March 31, 20X5 Balance on bank statement Additions: Deposit of March 30 in transit Check incorrectly charged to account Deductions for outstanding checks: Check 358 of March 29 Check 359 of March 30 Total outstanding checks Adjusted bank balance Balance in books Additions: Note receivable and interest collected by bank Correction of error recording Check 341 Deductions: NSF check Bank service charge Adjusted book balance 9,550 3,245 __325 13,120 550 1,650 _2,200 10,920 10,200 1,100 __100 11,400 465 ___15 _1,200 _3,570

__480 10,920 PAGE 4

GENERAL JOURNAL DATE 20X5 Apr. 2 DESCRIPTION P.R. DEBIT 1,100 1,000 100 100 100 465 465 15 15 CREDIT

Cash Notes Receivable Interest Income To record note collected by bank 2Cash Rent Expense To correct error for Check 341 2Accts. Rec./D. Smith Cash To record NSF check 2Miscellaneous Expense Cash To record bank service charge

2. NOTE: Use form 12. MURPHY COMPANY Income Statement Year Ended December 31, 20X6 Operating Revenue Sales Less Sales Ret. & Allow. Net Sales Cost of Goods Sold Merch. Inv., Jan. 1, 20X6 Purchases Freight In Delivered Cost of Purch. Less Purch. Ret. & Allow. Purchases Discount Net Delivered Cost of Purch. Total Merch. Avail. for Sale Less Merch. Inv., Dec. 31, 20X6 Cost of Goods Sold Gross Profit on Sales Operating Expenses Selling Expenses Sales Salaries Expense Advertising Expense Travel Expense Total Selling Expenses General and Admin. Expenses Office Salaries Expense Office Supplies Expense Utilities Expense Payroll Taxes Expense Uncollectible Accounts Expense Depr. ExpenseOffice Equip. Total Gen. and Admin. Exp. Total Operating Expenses Net Income from Operations Other Income Interest Income Other Expenses Interest Expense Net Nonoperating Expenses Net Income for Year 210,000 3,500 206,500 60,000 95,000 2,500 97,500 1,200 1,800 3,000 94,500 154,500 56,000 98,500 108,000 55,000 2,000 11,000 68,000 17,500 600 3,700 1,100 1,300 500 24,700 92,700 15,300 500 1,600 1,100 14,200

3. Employee No. 1: Soc. Sec. Tax, $286; Medicare Tax, $66 Employee No. 2: Soc. Sec. Tax, zero; Medicare Tax, $84 Employee No. 3: Soc. Sec. Tax, $39; Medicare Tax, $81

Reference: [13.5.54a]

[1]

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Steps For Pursuing PHD at Mumbai UnivDocumento5 pagineSteps For Pursuing PHD at Mumbai Univspectrum_48Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 1 Minister & PA Contact p4 & 6 Co-Op 17jun'21Documento6 pagine1 Minister & PA Contact p4 & 6 Co-Op 17jun'21spectrum_48Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- 10 Mar'95 Govt Directions To CHS JB PatelDocumento4 pagine10 Mar'95 Govt Directions To CHS JB Patelspectrum_48Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- 1 Maharashtra MLA ContactsDocumento2 pagine1 Maharashtra MLA Contactsspectrum_48100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Agri CompDocumento1 paginaAgri CompPankaj M MotwaniNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Accounting QuestionDocumento3 pagineAccounting Questionspectrum_48Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Statistical DistributionsDocumento35 pagineStatistical Distributionsspectrum_48Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Make My Caske Really RichiDocumento4 pagineMake My Caske Really Richispectrum_48Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- 129Documento3 pagine129Kaustubha ShahNessuna valutazione finora

- Global Supply Chain and Possible RemediesDocumento7 pagineGlobal Supply Chain and Possible Remediesspectrum_48Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hangkok SurvivorDocumento1 paginaHangkok Survivorspectrum_48Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- 312 Project01Documento4 pagine312 Project01spectrum_48Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- AccDocumento5 pagineAccspectrum_48Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Why This One Pension IssueDocumento4 pagineWhy This One Pension Issuespectrum_48Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- This Is My Life - WhyDocumento1 paginaThis Is My Life - Whyspectrum_48Nessuna valutazione finora

- Maha Summary For Global SystemDocumento1 paginaMaha Summary For Global Systemspectrum_48Nessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Why This AccountingDocumento8 pagineWhy This Accountingspectrum_48Nessuna valutazione finora

- Physical DemoDocumento1 paginaPhysical Demospectrum_48Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Maruti LaunchDocumento1 paginaMaruti Launchspectrum_48Nessuna valutazione finora

- Log TableDocumento17 pagineLog Tablespectrum_48Nessuna valutazione finora

- Assignment - 4 Jul 31Documento5 pagineAssignment - 4 Jul 31spectrum_48Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- CCD Opening SolutionDocumento14 pagineCCD Opening Solutionspectrum_4820% (5)

- Multi-Criteria Decision Making and Optimization: Ankur SinhaDocumento36 pagineMulti-Criteria Decision Making and Optimization: Ankur Sinhaspectrum_48Nessuna valutazione finora

- CRAFT Soln r1Documento7 pagineCRAFT Soln r1spectrum_48Nessuna valutazione finora

- Big Deal Vs SmallDocumento2 pagineBig Deal Vs Smallspectrum_48Nessuna valutazione finora

- Lovely Inc Cash Flow SystemDocumento5 pagineLovely Inc Cash Flow Systemspectrum_48Nessuna valutazione finora

- FY14 Balance SheetDocumento65 pagineFY14 Balance Sheetspectrum_48Nessuna valutazione finora

- Cash Flow SensitivityDocumento1 paginaCash Flow SensitivityVáclav ZoubekNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- DCF Analysis TemplateDocumento8 pagineDCF Analysis TemplateAdeel Qayyum100% (4)

- Performance Measures: An Application of Economic Value AddedDocumento9 paginePerformance Measures: An Application of Economic Value Addedmastermind_asia9389Nessuna valutazione finora

- Tiens Marketing PlanDocumento22 pagineTiens Marketing PlanKabir Ahmed Kamal100% (2)

- Coatings Word October 2012Documento84 pagineCoatings Word October 2012sami_sakrNessuna valutazione finora

- Evaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)Documento8 pagineEvaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)sekar arinNessuna valutazione finora

- Chapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)Documento2 pagineChapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)NotesfreeBookNessuna valutazione finora

- Credence - 补充翻译 doneDocumento3 pagineCredence - 补充翻译 doneMysarah NassirNessuna valutazione finora

- Merchant Integration Services: E-Stamp: IN-DL62129004404861PDocumento6 pagineMerchant Integration Services: E-Stamp: IN-DL62129004404861Pmkd2000Nessuna valutazione finora

- Philippine ZIP CodesDocumento22 paginePhilippine ZIP CodesKenneth Alfonso Manalansan EsturasNessuna valutazione finora

- MmkformDocumento9 pagineMmkformaltaf_charaniyaNessuna valutazione finora

- FAO Statistics Book PDFDocumento307 pagineFAO Statistics Book PDFknaumanNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Labour Unrest at Honda MotorcyclesDocumento7 pagineLabour Unrest at Honda MotorcyclesMayuri Das0% (1)

- ECS1601Documento68 pagineECS1601JamesHHowell50% (2)

- A Critical Analysis On The Role of The Chinese in The Development of Philippine EconomyDocumento5 pagineA Critical Analysis On The Role of The Chinese in The Development of Philippine EconomyAlexis0% (1)

- Certificate of OriginDocumento2 pagineCertificate of Originvanessa30Nessuna valutazione finora

- 2000 Upsc PrelimsDocumento38 pagine2000 Upsc PrelimsAmritpal BhagatNessuna valutazione finora

- Adm ANI 2005Documento15 pagineAdm ANI 2005Paul GalanNessuna valutazione finora

- PaystubDocumento1 paginaPaystubscalesjacob1997Nessuna valutazione finora

- #Last Will and TestamentDocumento3 pagine#Last Will and Testamentmatsumoto100% (1)

- Qei 18193271Documento3 pagineQei 18193271Hernan RomeroNessuna valutazione finora

- A Profile On Reader's DigestDocumento11 pagineA Profile On Reader's DigestAparna RameshNessuna valutazione finora

- General AwarenessDocumento137 pagineGeneral AwarenessswamyNessuna valutazione finora

- 002 PDFDocumento59 pagine002 PDFKristine Lapada TanNessuna valutazione finora

- 50 KWord EbookDocumento247 pagine50 KWord EbookLio PermanaNessuna valutazione finora

- Credit Report Clean PDFDocumento2 pagineCredit Report Clean PDFMarioBlanks100% (2)

- Aee Electronics 1Documento2 pagineAee Electronics 1Rashi SharmaNessuna valutazione finora

- Paramount InvoiceDocumento4 pagineParamount InvoiceDipak KotkarNessuna valutazione finora

- White Paper HealthCare MalaysiaDocumento28 pagineWhite Paper HealthCare MalaysiaNamitaNessuna valutazione finora

- Check Disbursement4Documento24 pagineCheck Disbursement4Jeff Jeansen BagcatNessuna valutazione finora

- Grade 11 Economics TextbookDocumento369 pagineGrade 11 Economics Textbookdagnachew mezgebuNessuna valutazione finora

- Project Report On: Submitted byDocumento47 pagineProject Report On: Submitted byManoj ParabNessuna valutazione finora

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora