Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Feasibility Study

Caricato da

rajlaxmi_patilTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Feasibility Study

Caricato da

rajlaxmi_patilCopyright:

Formati disponibili

Introduction

Project Appraisal is the analysis of costs and benefits of a proposed project with a goal of assuring a rational allocation of limited financial resources amongst alternate investment opportunities with the objective of achieving specific goals. Project Appraisal is mainly the process of transmitting information accumulated through feasibility studies into a comprehensive form in order to enable the decision maker undertake a comprehensive appraisal of various projects and embark on a specific project or projects by allocating resources. Project Appraisal is the process of analyzing the technical feasibility and economic viability of a project proposal with a view to financing their costs. Project appraisal is the process of examining the various dimensions of a project be it technical, financial, social, environment and providing an assessment of the projects likelihood for success and its viability. It is the process of assessing and questioning proposals before resources are committed. It evaluates a projects ability to meet its stated objectives and to provide long term Economic growth in the larger framework of local and national needs. The project appraisal process is an essential tool in regeneration and neighbourhood renewal. An effective project appraisal offers significant benefits to partnerships and, most importantly, to local communities. A good appraisal justifies spending money on a project. It is an important tool in decision making and lays the foundation for delivery and evaluation. Getting the design and operation of appraisal systems right is important. The proper consideration of each of the components of project appraisal is essential. For the following reasons project appraisal is very much important It is a capital investment decision It has long term effects Decision once taken is irreversible Expenditures are high

The various Factors considered by Financial Institutions while appraising a project are: Market analysis: demand forecasting

Technical analysis: it seeks to determine whether the perquisites for successful commissioning of the project have been considered and reasonably good choices have been made with respect to location, size, process, etc.

Financial analysis: seeks to ascertain whether the proposed project will be financially viable in the sense of being able to meet the burden of servicing debt and whether the proposed project will satisfy the return expectations of those who provide the capital. The aspects which have to be looked into while conducting financial analysis are: Investment outlay and cost of project Means of financing Cost of capital Break-even point Cash flows of the project Investment worthwhileness judged in terms of various criteria of merit Projected financial position Level of risk

Sensitivity analysis In the evaluation of an investment project, we work with the forecasts of cash flows. Forecasted cash flows depend on the expected revenue and costs. Further, expected revenue is a function of sales volume and unit selling price. Similarly, sales volume will depend on the market size and the firms market share. Costs include variable costs, which depend on sales volume, and unit variable cost and fixed costs. The net present value or the internal rate of return of a project is determined by analyzing the after-tax cash flows arrived at by combining forecasts of various variables. It is difficult to arrive at an accurate and unbiased forecast of each variable. The reliability of the NPV of variable underlying the estimates of net cash flows. To determine the reliability id the projects NPV or IRR, we can work out how much difference it males in any of these forecasts goes wrong. We can change each of the forecasts, one at a time to at least three values: pessimistic, expected, and optimistic. The NPV of the project is recalculated under these different changing each forecast is called sensitivity analysis.

Sensitivity analysis is a way of analyzing change in the projects NPV (or IRR) for a given change in one of the variables. It indicates how sensitive a projects NPV (or IRR) is to changes in particular variables. The more sensitive the NPV, the more critical is the variable. The following three steps are unsolved in the use or sensitivity analysis:

Identification of all those variables, which have an influence on the projects NPV (or IRR). Definition of the underlying (mathematical) relationship between the variables. Analysis of the impact of the change in each of the variables on the projects NPV.

The decision-maker, while performing sensitivity analysis, compute the projects (or IRR) for each forecast under three assumptions: (a) pessimistic, (b) expected, and (c) optimistic. It allows him to ask what if question. For example, what (is the NPV) if volume increase or decreases? What (is the NPV) if variable cost of fixed cost increases or decreases? What (is the NPV) if the selling price increases or decreases? That (is the NPV) if the project is delayed or outplay escalate or he questions can be answered with the help of sensitivity analysis. It examines the sensitivity of the variables underlying the computation of NPV or IRR, rather than attempting to quantify risk. It can be applied to any variable, which is an input for the after-tax cash flows.

Potrebbero piacerti anche

- Part A Industry ProfileDocumento12 paginePart A Industry Profilerajlaxmi_patilNessuna valutazione finora

- Harish HandeDocumento6 pagineHarish Handerajlaxmi_patilNessuna valutazione finora

- The Impact of Commodity Transaction Tax On Futures Trading in IndiaDocumento10 pagineThe Impact of Commodity Transaction Tax On Futures Trading in Indiarajlaxmi_patilNessuna valutazione finora

- Jumbo King Vada PavDocumento6 pagineJumbo King Vada Pavrajlaxmi_patilNessuna valutazione finora

- 3x3 Writing ProcessDocumento2 pagine3x3 Writing Processrajlaxmi_patil100% (3)

- QuizDocumento2 pagineQuizrajlaxmi_patilNessuna valutazione finora

- India As A Developing EconomyDocumento6 pagineIndia As A Developing Economyrajlaxmi_patilNessuna valutazione finora

- Definition of A ConstraintDocumento9 pagineDefinition of A Constraintrajlaxmi_patilNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 10 1 3 RMDDocumento5 pagine10 1 3 RMDRay GalfianNessuna valutazione finora

- Anansi and His Six Sons An African MythDocumento3 pagineAnansi and His Six Sons An African MythShar Nur JeanNessuna valutazione finora

- 2 MercaptoEthanolDocumento8 pagine2 MercaptoEthanolMuhamad ZakyNessuna valutazione finora

- MAPEH-Arts: Quarter 3 - Module 2Documento24 pagineMAPEH-Arts: Quarter 3 - Module 2Girlie Oguan LovendinoNessuna valutazione finora

- Language Loss in Waray: Ni Voltaire Q. UyzonDocumento23 pagineLanguage Loss in Waray: Ni Voltaire Q. UyzonMary Rose OmbrogNessuna valutazione finora

- Test Iii Cultural Social and Political OrganizationDocumento2 pagineTest Iii Cultural Social and Political OrganizationTin NatayNessuna valutazione finora

- BIOL 2300 Homework 2 Summer2019Documento2 pagineBIOL 2300 Homework 2 Summer2019Tanner JohnsonNessuna valutazione finora

- Learning Activity No.2Documento1 paginaLearning Activity No.2Miki AntonNessuna valutazione finora

- Atlantis Implant Compatibility Chart 79214-US-1107Documento2 pagineAtlantis Implant Compatibility Chart 79214-US-1107Jean-Christophe PopeNessuna valutazione finora

- Solution Manual-Statistical Physics of Particles by Meheran KardarDocumento165 pagineSolution Manual-Statistical Physics of Particles by Meheran KardarDanielle Nguyen7% (14)

- Environmental and Chemical Policy Module3Documento47 pagineEnvironmental and Chemical Policy Module3jahazi1Nessuna valutazione finora

- Ninja 5e v1 5Documento8 pagineNinja 5e v1 5Jeferson Moreira100% (2)

- TheBigBookOfTeamCulture PDFDocumento231 pagineTheBigBookOfTeamCulture PDFavarus100% (1)

- Structural Engineering Formulas Second EditionDocumento224 pagineStructural Engineering Formulas Second Editionahmed_60709595194% (33)

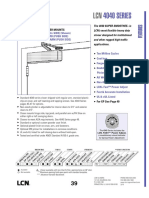

- 4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Documento11 pagine4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Melrose FabianNessuna valutazione finora

- MINDSET 1 EXERCISES TEST 1 Pendientes 1º Bach VOCABULARY AND GRAMMARDocumento7 pagineMINDSET 1 EXERCISES TEST 1 Pendientes 1º Bach VOCABULARY AND GRAMMARanaNessuna valutazione finora

- PCNSE DemoDocumento11 paginePCNSE DemodezaxxlNessuna valutazione finora

- Volcanic SoilsDocumento14 pagineVolcanic SoilsVictor Hugo BarbosaNessuna valutazione finora

- Grade 7 Math Lesson 22: Addition and Subtraction of Polynomials Learning GuideDocumento4 pagineGrade 7 Math Lesson 22: Addition and Subtraction of Polynomials Learning GuideKez MaxNessuna valutazione finora

- AromatherapyDocumento15 pagineAromatherapymurrmurreNessuna valutazione finora

- 250 Conversation StartersDocumento28 pagine250 Conversation StartersmuleNessuna valutazione finora

- EUROJAM Diary3Documento4 pagineEUROJAM Diary3Susan BakerNessuna valutazione finora

- Citadel Securities Australia Pty LTD - Company DetailsDocumento5 pagineCitadel Securities Australia Pty LTD - Company DetailsBrendan OswaldNessuna valutazione finora

- California Academy For Lilminius (Cal) : Lesson PlanDocumento4 pagineCalifornia Academy For Lilminius (Cal) : Lesson Plandarryl franciscoNessuna valutazione finora

- South San Francisco Talks Plans For Sports Park ImprovementsDocumento32 pagineSouth San Francisco Talks Plans For Sports Park ImprovementsSan Mateo Daily JournalNessuna valutazione finora

- GCGM PDFDocumento11 pagineGCGM PDFMiguel Angel Martin100% (1)

- TML IML DefinitionDocumento2 pagineTML IML DefinitionFicticious UserNessuna valutazione finora

- Cascade Configuration Tool: Installation and Operations ManualDocumento22 pagineCascade Configuration Tool: Installation and Operations ManualAndrés GarciaNessuna valutazione finora

- House Staff OrderDocumento2 pagineHouse Staff OrderTarikNessuna valutazione finora

- Sketch NotesDocumento32 pagineSketch NotesFilipe Rovarotto100% (8)