Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Steel Industry Update 283

Caricato da

Michael LockerCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Steel Industry Update 283

Caricato da

Michael LockerCopyright:

Formati disponibili

Steel Industry Update/283

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

March 2013

Tel: 212-962-2980

Click on the links below to go to a table

Table 1 Selected U.S. Steel Industry Data, 2009-2012 Table 2: U.S. Spot Prices for Selected Products, February & YTD, 2013 Table 3: World Crude Steel Production, January & Year-to-Date, 2013 Graph 1: World Crude Steel Production, February 2013 Graph 2: World Steel Capacity Utilization, February 2013 Table 4: World Crude Steel Production, 2005-2012 Table 5: Worlds Top Flat Product Producers, 2012 Table 6: Worlds Top 15 Flat Product Producers, 2012 Table 7: US Steel Company Results, 2012 Table 8: Steel Company Raw Materials Exposure, 2012 Table 9: U.S. Spot Prices for Selected Products, March & Year-to-Date, 2013 Table 10: Top Steel Industry Political Contributors, 2012

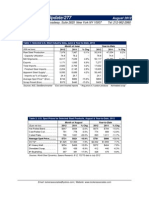

Table 1: Selected U.S. Steel Industry Data, January & YTD, 2013

(000 net tons)

Raw Steel Production. Capacity Utilization. Mill Shipments.. Exports.... Total Imports. Apparent Steel Supply.. Imports as % of Supply..

Sources: AISI, US ITA

Month of January 2013 2012 % Chg 8,002 8,497 -5.8% 77% 8,211 1,077 2,604 9,738 26.7 78% 7,483 1,262 2,722 8,943 30.4 -9.7% -14.7% -4.3% 8.9% --

2013 8,002 77% 8,211 1,077 2,604 9,738 26.7

Year-To-Date 2012 8,497 78% 7,483 1,262 2,722 8,943 30.4

% Chg -5.8% -9.7% -14.7% -4.3% 8.9% --

Table 2: U.S. Spot Prices for Selected Products, March & Year-to-Date, 2013

($ per net ton)

Hot Rolled Band.... Cold Rolled Coil........ Coiled Plate.................. Average Spot Price.... OCTG* #1 Heavy Melt... Shredded Scrap... #1 Busheling. Iron Ore ($/dmtu)*...... Pig Iron ($/tonne)**....

Month of March 2013 2012 % Chg 620 693 -10.5% 715 788 -9.3% 736 929 -20.8% $690 1,814 362 392 399 155 387 $803 2,045 397 439 459 140 442 -14.1% -11.3% -8.8% -10.7% -13.1% 10.7% -12.4%

2013 625 721 731 $692 1,846 347 379 385 153 387

Year-to-Date 2012 719 816 938 $824 2,030 403 447 478 140 442

% Chg -13.0% -11.6% -22.0% -16.0% -9.0% -14.0% -15.1% -19.5% 8.9% -12.4%

Sources: World Steel Dynamics, Spears Research; SteelontheNet.com; IndexMundi.com; *OCTG and iron ore data is 2/13; **pig iron data is 1/13, $/dmtu: US$/dry metric tonne unit

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/283

Table 3: World Crude Steel Production, February & Year-to-Date, 2013 Month of February Year-to-Date (000 metric tons) Region 2013 2012 % Chg 2013 2012 European Union. 13,384 14,171 -5.6% 27,045 28,329 Other Europe. 2,787 2,899 -3.9% 5,793 6,234 C.I.S. North America South America... Africa/Middle East..... Asia.. Oceania...... Total Country China....... Japan... United States.. India(e). Russia.. South Korea....... Germany... Turkey.. Ukraine... Brazil All Others.... 61,830 8,317 6,655 6,200 4,981 5,160 3,447 2,655 2,480 2,629 18,904 56,311 8,612 7,544 6,229 5,441 5,857 3,578 2,763 2,513 2,803 20,180 9.8% -3.4% -11.8% -0.5% -8.5% -11.9% -3.7% -3.9% -1.3% -6.2% -6.3% 125,452 17,180 14,017 12,966 10,733 10,865 7,032 5,514 5,228 5,451 38,599 113,429 17,242 15,251 12,827 11,216 11,906 6,946 5,898 5,386 5,594 40,717 10.6% -0.4% -8.1% 1.1% -4.3% -8.7% 1.2% -6.5% -2.9% -2.5% -5.2% 8,055 9,240 3,421 2,937 82,928 505 123,258 8,918 10,191 3,778 3,112 78,308 454 121,831 -9.7% -9.3% -9.4% -5.6% 5.9% 11.3% 1.2% 16,968 19,465 7,062 5,988 169,701 996 253,037 18,421 20,642 7,506 6,229 158,108 943 246,412

% Chg -4.5% -7.1% -7.9% -5.7% -5.7% -3.9% 7.3% 5.6% 2.7%

Source: World Steel Association, 3/13; e=estimate

Graph 1: World Crude Steel Production, February 2013

Source: World Steel Association, 3/13; in million metric tons

-2-

Steel Industry Update/283

Graph 2: World Steel Capacity Utilization, February 2013

Source: World Steel Association, 3/13

Table 4: World Crude Steel Production, 2005-2012

Source: World Steel Association, 2/13

-3-

Steel Industry Update/283

Table 5: Worlds Top Flat Product Producers, 2012 (million tonnes) Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Company ArcelorMittal Baosteel Nippon Steel POSCO JFE Steel US Steel AnBen Thyssen Krupp Severstal TATA Corus MMK Wuhan Iron & Steel China Steel Jiangsu Shagang Riva Group Nucor Shandong NLMK AK Steel Hebei Total Top 20 Total World

Source: World Steel Association, February 2013

Base Luxembourg China Japan Korea Republic Japan USA China Germany Russia India Russia China Taiwan China Italy USA China Russia USA China

Capacity 113.3 34.9 32.9 31.3 30.5 29.2 28.1 24.2 19.2 17.4 16.5 15.7 13.7 13.5 12.6 10.6 10.3 9.9 9.5 9.4 482.7 821.4

Table 6: Worlds Top 15 Long Product Producers, 2012 (million tonnes) Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Company ArcelorMittal Gerdau Evrazholding Group TATA Corus Nippon Steel Nucor JFE Steel Baosteel Hebei Steel Riva Group Celsa Group Wuhan Iron & Steel Severstal Metinvest Group Hyundai Group Total Top 15 Rest of World

Source: World Steel Association, February 2013

Base Luxembourg Brazil Russia India Japan USA Japan China China Italy Spain China Russia Ukraine Korea Republic

Capacity 54.4 25.1 18.4 11.9 11.1 10.8 10.2 9.4 9.1 9.0 8.6 8.1 7.9 7.8 7.0 214.8 735.9

-4-

Steel Industry Update/283

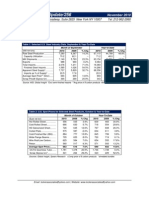

Table 7: US Steel Company Results, 2011 & 2012 Company Shipments

(mil net tons)

Sales

($ millions)

Sales/ton

($)

EBITDA

($ millions)

2012 AK Steel Nucor SDI U.S. Steel Total 5.4 23.1 5.4 16.0 49.9

2011 5.7 23.0 5.4 15.5 49.6

2012 $5,934 $19,429 $7,290 $11,976 $44,629

2011 $6,468 $20,024 $7,998 $11,776 $46,266

2012 $1,099 $841 $1,350 $749 $894

2011 $1,135 $871 $1,481 $760 $933

2012 $238 $1,534 $595 $891 $3,257.7

2011 $267 $1,926 $732 $937 $3,862.1

Source: World Steel Dynamics, 2/13; Company data is steel-related business only; U.S. Steel data is flat-rolled and tubular, excluding Europe

Table 8: US Steel Company Raw Materials Exposure, 2012 Ticker X AKS NUE STLD CMC SCHN Iron Ore 100%** 6% na 0% na na Coking Coal Contracted at $188/t Contracted near $190/t na Contracted near $190/t na na Coke 100% 60% na na na na Scrap Processing* 0 0 35% 50-100% 100% 100%

Source: Morgan Stanley; *Scrap processing capability / tons of scrap consumed; **N. American operations

Table 9: Vale Financial Results, 2008-2012

(in US $ million)

Operating revenues Adjusted EBIT Adjusted EBIT margin Adjusted EBITD Underlying earnings Capital and R&D expenses

2008 38,509 15,698 41.9 19,018 13,716 10,191

2009 23,939 6,057 26.0 9,165 4,885 9,013

2010 46,481 21,695 47.9 26,116 17,550 12,705

2011 60,389 28,599 48.5 33,759 23,234 17,994

2012 46,454 14,279 31.5 19,135 11,236 17,729

% Chg -23% -50% 35% 43% 52% 1%

Source: SteelGuru.com, 2/28/13; % Chg 2011-2012

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2013 by Locker Associates, Inc. All rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-5-

Steel Industry Update/283

Source: The Atlantic, 3/4/13

Source: The Atlantic, 3/4/13

-6-

Steel Industry Update/283

Source: Export Tax Advisors, 3/18/13

Table 10: Top Steel Industry Political Contributors, 2012 Company Renco Group Nucor Corp US Steel Elwood Group Kenwal Steel Worthington Industries Charlotte Pipe & Foundry Fry Steel Co American Iron & Steel Institute ArcelorMittal USA Midwest Steel Permian Enterprises AK Steel Allegheny Technologies Qualico Steel Damascus Steel Casting King Steel Steel Dynamics Superior Supply & Steel New Process Steel

Source: OpenSecrets.org, 2012

Amount $1,118,700 $439,854 $234,596 $202,450 $151,150 $150,000 $101,668 $100,000 $96,650 $87,161 $79,825 $74,000 $72,983 $70,850 $69,600 $61,050 $55,000 $50,550 $50,000 $50,000

-7-

Steel Industry Update/283

-8-

Steel Industry Update/283

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the competitiveness of businesses and industries on behalf of unions, corporate and government clients. By combining expert business and financial analysis with a sensitivity to labor issues, the firm is uniquely qualified to help clients manage change by: leading joint labor/management business improvement initiatives; facilitating ownership transitions to secure the long-term viability of a business; conducting strategic industry studies to identify future challenges and opportunities; representing unions in strategic planning, workplace reorganization and bankruptcy formulating business plans for turnaround situations; and performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing, transportation, distribution and mining industries. Typical projects involve in-depth analysis of a firms market, financial and operating performance on behalf of a cooperative labor-management effort. Locker Associates also produces a widely read monthly newsletter, Steel Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers Bank of Boston Congress Financial Santander Investment Securities AEIF-IAM/AK Steel Middletown Prudential Securities US Steel Joint Labor-Mgmt Comm LTV Steel Joint Labor-Mgmt Committee Intl Union of Electrical Workers Bethlehem Joint Labor-Mgmt Comm Inland Steel Joint Labor-Mgmt Comm Northwestern Steel and Wire Boilermakers American Federation of Musicians USS/KOBE Sysco Food Services of San Francisco International Brotherhood of Teamsters Development Bank of South Africa J&L Structural Steel Air Line Pilots Association/Delta Air Lines MEC Sharpsville Quality Products IPSCO International Association of Machinists CSEA/AFSCME United Auto Workers Service Employees International Union American Fed of Television & Radio Artists Supervalu United Mine Workers Algoma Steel North American Refractories UNITE/HERE AFL-CIO George Meany Center Watermill Ventures Wheeling-Pittsburgh Steel Canadian Steel Trade & Employment Congress Minn Gov's Task Force on Mining Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-Present): strategic industry research and ongoing advisement on major industry trends and companies to help enhance the competitive position of the unionized NYC construction industry Building & Construction Trades Council of Greater NY (BCTC) (2011-present): analysis and advisement regarding major trends in the New York City construction industry, including capital market developments which affect BCTC members Communication Workers of America (CWA) (2011-present): research and analysis to prepare CWA for nationwide contract negotiations with AT&T IBT-Supervalu (2010): assist union and management to identify major operational problems impacting warehouse performance and provide recommendations for joint improvement Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the world metallurgical coal market for a large metallurgical coal producer

-9-

Potrebbero piacerti anche

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Steel Industry Update #277Documento9 pagineSteel Industry Update #277Michael LockerNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Steel Industry Update #282Documento9 pagineSteel Industry Update #282Michael LockerNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Steel Industry Update #281Documento6 pagineSteel Industry Update #281Michael LockerNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 pagineCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Steel Industry Update #280Documento10 pagineSteel Industry Update #280Michael LockerNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Steel Industry Update #275Documento9 pagineSteel Industry Update #275Michael LockerNessuna valutazione finora

- Steel Industry Update #278Documento9 pagineSteel Industry Update #278Michael LockerNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Steel Industry Update #279Documento8 pagineSteel Industry Update #279Michael LockerNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Steel Industry Update #276Documento7 pagineSteel Industry Update #276Michael LockerNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Steel Industry Update #267Documento9 pagineSteel Industry Update #267Michael LockerNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Steel Industry Update #274Documento8 pagineSteel Industry Update #274Michael LockerNessuna valutazione finora

- Steel Industry Update #273Documento8 pagineSteel Industry Update #273Michael LockerNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Steel Industry Update #272Documento7 pagineSteel Industry Update #272Michael LockerNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Steel Industry Update #271Documento9 pagineSteel Industry Update #271Michael LockerNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Steel Industry Update #269Documento8 pagineSteel Industry Update #269Michael LockerNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Steel Industry Update #270Documento9 pagineSteel Industry Update #270Michael LockerNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Steel Industry Update #268Documento13 pagineSteel Industry Update #268Michael LockerNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Steel Industry Update #260Documento6 pagineSteel Industry Update #260Michael LockerNessuna valutazione finora

- Steel Industry Update #266Documento8 pagineSteel Industry Update #266Michael LockerNessuna valutazione finora

- Locker RPA Transcript 6-9-11Documento2 pagineLocker RPA Transcript 6-9-11Michael LockerNessuna valutazione finora

- Steel Industry Update #264Documento10 pagineSteel Industry Update #264Michael LockerNessuna valutazione finora

- Steel Industry Update #265Documento7 pagineSteel Industry Update #265Michael LockerNessuna valutazione finora

- Steel Industry Update #261Documento8 pagineSteel Industry Update #261Michael LockerNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Steel Industry Update #263Documento10 pagineSteel Industry Update #263Michael LockerNessuna valutazione finora

- Steel Industry Update #259Documento10 pagineSteel Industry Update #259Michael LockerNessuna valutazione finora

- Steel Industry Update #262Documento7 pagineSteel Industry Update #262Michael LockerNessuna valutazione finora

- Steel Industry Update #258Documento8 pagineSteel Industry Update #258Michael LockerNessuna valutazione finora

- Steel Industry Update #257Documento8 pagineSteel Industry Update #257Michael LockerNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Steel Industry Update #256Documento11 pagineSteel Industry Update #256Michael LockerNessuna valutazione finora

- CDI-AOS-CX 10.4 Switching Portfolio Launch - Lab V4.01Documento152 pagineCDI-AOS-CX 10.4 Switching Portfolio Launch - Lab V4.01Gilles DellaccioNessuna valutazione finora

- HP HP3-X11 Exam: A Composite Solution With Just One ClickDocumento17 pagineHP HP3-X11 Exam: A Composite Solution With Just One ClicksunnyNessuna valutazione finora

- France Winckler Final Rev 1Documento14 pagineFrance Winckler Final Rev 1Luciano Junior100% (1)

- EN 12449 CuNi Pipe-2012Documento47 pagineEN 12449 CuNi Pipe-2012DARYONO sudaryonoNessuna valutazione finora

- Case Study IndieDocumento6 pagineCase Study IndieDaniel YohannesNessuna valutazione finora

- TJUSAMO 2013-2014 Modular ArithmeticDocumento4 pagineTJUSAMO 2013-2014 Modular ArithmeticChanthana ChongchareonNessuna valutazione finora

- Reading Comprehension Exercise, May 3rdDocumento3 pagineReading Comprehension Exercise, May 3rdPalupi Salwa BerliantiNessuna valutazione finora

- Ecc Part 2Documento25 pagineEcc Part 2Shivansh PundirNessuna valutazione finora

- Oxgen Sensor Cat WEBDocumento184 pagineOxgen Sensor Cat WEBBuddy Davis100% (2)

- Pipeline Welding SpecificationDocumento15 paginePipeline Welding Specificationaslam.ambNessuna valutazione finora

- Maxx 1657181198Documento4 pagineMaxx 1657181198Super UserNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Special Power of Attorney: Benedict Joseph M. CruzDocumento1 paginaSpecial Power of Attorney: Benedict Joseph M. CruzJson GalvezNessuna valutazione finora

- MQC Lab Manual 2021-2022-AutonomyDocumento39 pagineMQC Lab Manual 2021-2022-AutonomyAniket YadavNessuna valutazione finora

- Condition Based Monitoring System Using IoTDocumento5 pagineCondition Based Monitoring System Using IoTKaranMuvvalaRaoNessuna valutazione finora

- 2021 Impact of Change Forecast Highlights: COVID-19 Recovery and Impact On Future UtilizationDocumento17 pagine2021 Impact of Change Forecast Highlights: COVID-19 Recovery and Impact On Future UtilizationwahidNessuna valutazione finora

- eHMI tool download and install guideDocumento19 pagineeHMI tool download and install guideNam Vũ0% (1)

- Individual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRADocumento4 pagineIndividual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRAChris21JinkyNessuna valutazione finora

- Factors of Active Citizenship EducationDocumento2 pagineFactors of Active Citizenship EducationmauïNessuna valutazione finora

- Legends and Lairs - Elemental Lore PDFDocumento66 pagineLegends and Lairs - Elemental Lore PDFAlexis LoboNessuna valutazione finora

- Trillium Seismometer: User GuideDocumento34 pagineTrillium Seismometer: User GuideDjibril Idé AlphaNessuna valutazione finora

- Combined Set12Documento159 pagineCombined Set12Nguyễn Sơn LâmNessuna valutazione finora

- Money Laundering in Online Trading RegulationDocumento8 pagineMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohNessuna valutazione finora

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocumento8 pagineCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNessuna valutazione finora

- SBI Sample PaperDocumento283 pagineSBI Sample Paperbeintouch1430% (1)

- Pasadena Nursery Roses Inventory ReportDocumento2 paginePasadena Nursery Roses Inventory ReportHeng SrunNessuna valutazione finora

- Inborn Errors of Metabolism in Infancy: A Guide To DiagnosisDocumento11 pagineInborn Errors of Metabolism in Infancy: A Guide To DiagnosisEdu Diaperlover São PauloNessuna valutazione finora

- Technical Specification of Heat Pumps ElectroluxDocumento9 pagineTechnical Specification of Heat Pumps ElectroluxAnonymous LDJnXeNessuna valutazione finora

- CENG 5503 Intro to Steel & Timber StructuresDocumento37 pagineCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachNessuna valutazione finora

- Annual Plan 1st GradeDocumento3 pagineAnnual Plan 1st GradeNataliaMarinucciNessuna valutazione finora

- Inventory ControlDocumento26 pagineInventory ControlhajarawNessuna valutazione finora