Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Services Factoring Problem

Caricato da

Aditya BvDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Services Factoring Problem

Caricato da

Aditya BvCopyright:

Formati disponibili

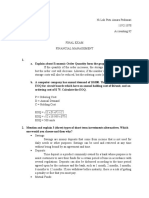

Date: 23rd November Evaluation of Factoring: Factoring Problems In credit sales money is blocked.

For such money, we had chance of getting money using factoring. In case of factoring, we had to pay commission, only some proportion of amount we get. We had to decide either to go factoring or banker for loan with interest rate. 1. A firm furnishes you the following details: Total Credit sales = Rs. 7500000 per annum ACP (Avg collection period)= 60 days Estimated bad debt losses = 1% of credit sales. Current spending on credit administration Rs. 1 lakh per annum.

The firm is planning to approach a factor in order to finance its credits sales. A factor charges 2% a commission and makes an advance at interest of 17% retaining 10% as reserve. If the cost of a similar source of short term funds in the market is 18%. Advise the firm, whether to go for the factoring option or not. Set up year calculations assuming 360 days. Solution: Evaluation there are 2 methods. 1. Net benefit method 2. Effective interest rate method 1. Net benefit method: Calculate all expenditure of factoring and banking and see the best low expenditure 2. Effective Interest rate method: Calculate based on interest rate. Calculation or computation of effective factoring efficiency Step 1: Calculate average account receivables level 360 Days 7500000

60 Days ? 7500000 x (60/360) = Rs. 1250000 i.e., total credits sales *(collection period/annum) Step 2: ACP factoring commission ACP Factoring commission: 2% * Rs. 1250000 = Rs. 25,000 Step 3: ACP Reserve 1250000 * (10/100) =Rs. 125000

Step 4: Gross advance = step 1 (step 2 + step 3 ) =1250000 (25000+12500) = Rs. 11,00,000 Step 5: ACP interest on factoring advance = 11,00,000*17% * (60/360) = Rs. 31,167 Step 6: Net factoring advance = Gross advance - interest = 11,00,000 -31167 = Rs. 10,68,833 Till now have calculated till the time period of 60 days. Let us calculate for annual basis Step 7: ANNUALIZED FACTORING COMMISSION 75,00,000 * 2% = Rs. 1,50,000 Step 8: ANNUALIZED INTEREST CHARGES 60 -> Rs. 31,167 360 ? = (360/60) x 31167 = Rs. 1,87,000 24th Nov 2009

Step 9: Total Annual Factoring Cost = AFC + Annual Interest charges = 150000+ 187000 = Rs. 3,37,000

Step 10:

In-house credit expenditure =1,00,000 Step 11: Bad Debts Losses avoided= 1% x75,00,000 = Rs. 75,000

Step 12: Total In-house credit administration expenditure = 1,00,000 +75,000 = Rs. 1,75,000

Step 13: Net Factoring Cost = Step 9 Step 13 = Total Annual Factoring Cost - Total In-house credit administration expenditure = Rs. 1,62,000 Step 14: Net Benefit Method:

i) ii) Alternative source = Gross Advance x interest rate of bank = 11,00,000 x 18% = Rs. 1,98,000 Alternative sources Factoring cost = 198000-162000 = 36,000

Note: If net benefit is negative then better to borrow from bank

Step 15: Effective Interest Rate Method

= (Net Factoring cost x 100)/ Net Factoring advance= (1,62,000 x 100)/ 10,68,833 = 15.16% Hence, it is better to go for factoring than borrowing from other sources like interest rate from bank as interest rate of bank is 18%. Note: If net benefit is negative then better to borrow from bank

23rd December 2009 A firm is considering engaging in order to be relived substantially from the risk of in house credit administration. You have been asked to examine the firms request in this regard. The company furnishes you the following details. Total credit sales: Rs. 85 lakhs ACP(Avg collection period ) = 90 days Estimated bad debt losses 1% of credit sales. Current spending on credit administration: 1lakh rupees per annum. Factors commission 2% Factors reserve 18% Interest on advance = 15%. Cost of alternative sources = 19% Calculations are done assuming 360 days. Solution: Calculation or computation of effective factoring efficiency Step 1: Calculate average account receivables level 360 Days 8500000 60 Days ? 8500000 x (90/360) = Rs. 2125000 i.e., total credits sales *(collection period/annum) Step 2: ACP factoring commission ACP Factoring commission: 2% * Rs.2125000 = Rs. 42,500

Step 3: ACP Reserve 2125000 * (18/100) =Rs. 3,82,500

Step 4: Gross advance = step 1 (step 2 + step 3 ) =2125000 (42500+382500) = Rs. 17,00,000 Step 5: ACP interest on factoring advance = 17,00,000*15% * (90/360) = Rs. 63,750 Step 6: Net factoring advance = Gross advance - interest= 17,00,000 -63750 = Rs. 16,36,250 Till now have calculated till the time period of 90 days. Let us calculate for annual basis Step 7: ANNUALIZED FACTORING COMMISSION 85,00,000 * 2% = Rs. 1,70,000 Step 8: ANNUALIZED INTEREST CHARGES 90 -> Rs. 63,750 360 ? = (360/90) x 63750 = Rs. 2,55,000

Step 9: Total Annual Factoring Cost = AFC + Annual Interest charges = 170000+ 255000 = Rs. 4,25,000

Step 10: In-house credit saved =1,00,000 Step 11: Bad Debts Losses avoided= 1% x85,00,000 = Rs. 85,000 (saving)

Step 12: Total In-house credit administration saved including bad debts = 1,00,000 +85,000 = Rs. 1,85,000 Step 13: Net Factoring Cost = Step 9 Step 12 = Total Annual Factoring Cost - Total In-house credit administration saving = Rs. 4,25,000 - 1,85,000 = 2,40,000 Step 14: Net Benefit Method:

Cost of Alternative source = Gross Advance x interest rate of bank = 17,00,000 x 19% = Rs. 3,23,000 i) Net benefit method = Cost of Alternative sources Factoring cost = 3,23,000-240000 = 83000

Hence, it is better to go for factoring than borrowing from other sources like interest rate from bank as interest rate of bank is 19% as interest is high. Note: If net benefit is negative then better to borrow from bank

Step 15: Effective Interest Rate Method

= (Net Factoring cost x 100)/ Net Factoring advance= (2,40,000 x 100)/ 16,36,250 = 14.67% Hence, it is better to go for factoring than borrowing from other sources like interest rate from bank as interest rate of bank is 19% as interest rate. Here factoring interest rate is 14.67%

Potrebbero piacerti anche

- Calculate Interest ExpensesDocumento13 pagineCalculate Interest ExpensesThái Minh Châu100% (1)

- Food Cost ManualDocumento105 pagineFood Cost ManualVivek Sharma100% (12)

- Final Review Questions SolutionsDocumento5 pagineFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Online SFG Calculation - 2Documento2 pagineOnline SFG Calculation - 2Swarna RSNessuna valutazione finora

- BrokersDocumento47 pagineBrokersManjunath ShettigarNessuna valutazione finora

- FM Solved PapersDocumento83 pagineFM Solved PapersAjabba87% (15)

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Documento14 pagineParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNessuna valutazione finora

- Suggested SolutionsDocumento7 pagineSuggested SolutionsSunder ChaudharyNessuna valutazione finora

- LeonsDocumento34 pagineLeonsFeilix BennyNessuna valutazione finora

- CH 18 ADocumento9 pagineCH 18 AAlex YaoNessuna valutazione finora

- SFMSOLUTIONS Master Minds PDFDocumento10 pagineSFMSOLUTIONS Master Minds PDFHari KrishnaNessuna valutazione finora

- 7TH Loans PayableDocumento4 pagine7TH Loans PayableAnthony DyNessuna valutazione finora

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Documento6 pagineWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNessuna valutazione finora

- Working Capital MGTDocumento17 pagineWorking Capital MGTJeffrey MooketsaneNessuna valutazione finora

- Financial Management: (Presentation) On Working Capital Management & Investment DecisionDocumento23 pagineFinancial Management: (Presentation) On Working Capital Management & Investment DecisionAsif KhatriNessuna valutazione finora

- Ias 18Documento10 pagineIas 18Butt ArhamNessuna valutazione finora

- Chit Funds CalculatorDocumento17 pagineChit Funds CalculatortrichysayeeNessuna valutazione finora

- Holding Co. QuestionsDocumento77 pagineHolding Co. Questionsअक्षय गोयलNessuna valutazione finora

- CASE STUDY ON MODULE A - UnlockedDocumento16 pagineCASE STUDY ON MODULE A - UnlockedRitesh UpadhyayNessuna valutazione finora

- Theory and Numericals Types of FactoringDocumento7 pagineTheory and Numericals Types of FactoringShweta YadavNessuna valutazione finora

- Chapter 06 PDFDocumento21 pagineChapter 06 PDFnsfaheemNessuna valutazione finora

- UBS Capital BudgetingDocumento19 pagineUBS Capital BudgetingRajas MahajanNessuna valutazione finora

- Finance OverviewDocumento19 pagineFinance OverviewyomoNessuna valutazione finora

- Accounts Receivables and Payables A&BDocumento9 pagineAccounts Receivables and Payables A&BAb PiousNessuna valutazione finora

- BRIEF Exercises CHP 5Documento6 pagineBRIEF Exercises CHP 5khanNessuna valutazione finora

- Analysis and Application of Financial InformationDocumento15 pagineAnalysis and Application of Financial InformationSuman Kumar SamantaNessuna valutazione finora

- Working Capital Problem SolutionDocumento10 pagineWorking Capital Problem SolutionMahendra ChouhanNessuna valutazione finora

- 2019 Exam - Moed A - Computer Science - (Solution)Documento11 pagine2019 Exam - Moed A - Computer Science - (Solution)adoNessuna valutazione finora

- M 14 Final Financial Reporting Guideline AnswersDocumento16 pagineM 14 Final Financial Reporting Guideline Answersmj192Nessuna valutazione finora

- SHRT TRM FinxxxDocumento9 pagineSHRT TRM FinxxxMamun RashidNessuna valutazione finora

- Acc 501 Midterm Preparation FileDocumento22 pagineAcc 501 Midterm Preparation FilesephienoorNessuna valutazione finora

- Abhinav AnandDocumento5 pagineAbhinav AnandAnkitKumarJhaNessuna valutazione finora

- N1227106 Busi48901 261123Documento11 pagineN1227106 Busi48901 261123malisiddhant2602Nessuna valutazione finora

- Chapter 17 - Short-Term Credit For Financiang Current AssetsDocumento12 pagineChapter 17 - Short-Term Credit For Financiang Current Assetslou-92450% (4)

- BCM Corporate Finance IDocumento10 pagineBCM Corporate Finance IquynhnannieNessuna valutazione finora

- Student Id: 1800028 Programme: Mifp Course: IB5023 Date of Exam: 8 May 2020 (2pm To 5pm)Documento14 pagineStudent Id: 1800028 Programme: Mifp Course: IB5023 Date of Exam: 8 May 2020 (2pm To 5pm)KhayraNessuna valutazione finora

- Chapter 10Documento21 pagineChapter 10RBNessuna valutazione finora

- Accounting Chapter 10Documento11 pagineAccounting Chapter 10Andrew ChouNessuna valutazione finora

- Numerical Questions 5Documento3 pagineNumerical Questions 5nabin bkNessuna valutazione finora

- Week10 - Updated-BAMA 1101, CH6, Installment and MortgageDocumento54 pagineWeek10 - Updated-BAMA 1101, CH6, Installment and MortgageImran ZeeNessuna valutazione finora

- Business Math Activity 1Documento6 pagineBusiness Math Activity 1gabezarate071Nessuna valutazione finora

- Capital BudgetingDocumento47 pagineCapital BudgetingShaheer AliNessuna valutazione finora

- Forex 16 CW Q42 - Extra Q Answer PDFDocumento5 pagineForex 16 CW Q42 - Extra Q Answer PDFprabhat khandelwalNessuna valutazione finora

- NHTM - BTDocumento16 pagineNHTM - BTNguyễn Hải Thanh100% (1)

- Working Capital Problems and SolutionsDocumento13 pagineWorking Capital Problems and SolutionsvarunjajooNessuna valutazione finora

- COMM 229 Notes Chapter 4Documento4 pagineCOMM 229 Notes Chapter 4Cody ClinkardNessuna valutazione finora

- Test 3 Corprate FinanceDocumento10 pagineTest 3 Corprate FinancekeelyNessuna valutazione finora

- Eng Econ Ass 1Documento4 pagineEng Econ Ass 1katrina99Nessuna valutazione finora

- Financial Forecasting: SIFE Lakehead 2009Documento7 pagineFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNessuna valutazione finora

- IAS 23 Borrowing CostDocumento6 pagineIAS 23 Borrowing CostButt ArhamNessuna valutazione finora

- IAS 23 Borrowing CostDocumento6 pagineIAS 23 Borrowing CostArm ButtNessuna valutazione finora

- Business Mathematics Week 1Documento24 pagineBusiness Mathematics Week 1Jewel Joy PudaNessuna valutazione finora

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Documento3 pagineAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariNessuna valutazione finora

- Chapter 17 - Answer - noPWDocumento13 pagineChapter 17 - Answer - noPWNami TsuruokaNessuna valutazione finora

- Buisness Math, Chapter 2. CommissionDocumento7 pagineBuisness Math, Chapter 2. CommissionMike JanNessuna valutazione finora

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocumento7 pagine2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNessuna valutazione finora

- FCM MCQ 1Documento15 pagineFCM MCQ 1capt.athulNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNessuna valutazione finora

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Da EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Valutazione: 4 su 5 stelle4/5 (9)

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesDa EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNessuna valutazione finora

- Burger King PhilippinesDocumento14 pagineBurger King PhilippinesAditya BvNessuna valutazione finora

- Project On TATA MotorsDocumento142 pagineProject On TATA MotorsAditya BvNessuna valutazione finora

- Retail MarketingDocumento10 pagineRetail MarketingSandhya RaniNessuna valutazione finora

- Finance Specialization SyllabusDocumento9 pagineFinance Specialization SyllabusAditya BvNessuna valutazione finora

- Save A LotDocumento12 pagineSave A LotAditya Bv100% (1)

- Group 6 HotelDocumento16 pagineGroup 6 HotelAditya BvNessuna valutazione finora

- Bajaj Finserv 24Documento1 paginaBajaj Finserv 24Aditya BvNessuna valutazione finora

- Presentation On Harshad MehtaDocumento14 paginePresentation On Harshad Mehtarupesh_nair14Nessuna valutazione finora

- A02 Coverletter Worksheet1Documento2 pagineA02 Coverletter Worksheet1Aditya BvNessuna valutazione finora

- Workshop AssignmentDocumento3 pagineWorkshop AssignmentAditya BvNessuna valutazione finora

- Presentation On Harshad MehtaDocumento14 paginePresentation On Harshad Mehtarupesh_nair14Nessuna valutazione finora

- Changing Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketDocumento36 pagineChanging Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketgouravawanishraviNessuna valutazione finora

- Assignment OF International Financial ManagementDocumento3 pagineAssignment OF International Financial ManagementAditya BvNessuna valutazione finora

- Expert Systems With ApplicationsDocumento3 pagineExpert Systems With ApplicationsAditya BvNessuna valutazione finora

- CEKA Annual Report 2017 Final YearDocumento89 pagineCEKA Annual Report 2017 Final YearSalsaNessuna valutazione finora

- Depew v. D. Andrew Beal Et AlDocumento21 pagineDepew v. D. Andrew Beal Et AlbealbankfraudNessuna valutazione finora

- P 1formDocumento1 paginaP 1formbcwilesNessuna valutazione finora

- Maritime CommerceDocumento7 pagineMaritime CommerceAyeDingoasen-CabalbalNessuna valutazione finora

- Consolidated Financial Statements - Intercompany Asset TransactionsDocumento15 pagineConsolidated Financial Statements - Intercompany Asset TransactionsImran Abdul HamidNessuna valutazione finora

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Documento4 pagineName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaNessuna valutazione finora

- 11 NIQ Soil Testing PatharkandiDocumento2 pagine11 NIQ Soil Testing Patharkandiexecutive engineer1Nessuna valutazione finora

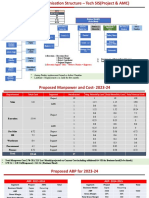

- Proposed Org Chart - Tech SIS.Documento5 pagineProposed Org Chart - Tech SIS.Santosh KumarNessuna valutazione finora

- RSM Webinar - Vat Updates 2022Documento44 pagineRSM Webinar - Vat Updates 2022Iqbhal RamadhanNessuna valutazione finora

- My Record of Group ContributionDocumento16 pagineMy Record of Group ContributionMemey C.Nessuna valutazione finora

- Examination: Subject CT8 Financial Economics Core TechnicalDocumento148 pagineExamination: Subject CT8 Financial Economics Core Technicalchan chadoNessuna valutazione finora

- Admin Law Cases Week 3Documento18 pagineAdmin Law Cases Week 3bidanNessuna valutazione finora

- Pitchbook: The Private Equity 2Q 2012 BreakdownDocumento14 paginePitchbook: The Private Equity 2Q 2012 BreakdownpedguerraNessuna valutazione finora

- HSBC Bank Malta PLC ProspectusDocumento54 pagineHSBC Bank Malta PLC ProspectusBilly LeeNessuna valutazione finora

- Reading 32 Introduction To Commodities and Commodity DerivativesDocumento5 pagineReading 32 Introduction To Commodities and Commodity Derivativestristan.riolsNessuna valutazione finora

- 1627 - 2001 - QD-NHNN Bank BorrowDocumento11 pagine1627 - 2001 - QD-NHNN Bank Borrowjetnguyenulis93Nessuna valutazione finora

- Elliott Wave: Fact or Fiction?: by F. David MinbashianDocumento5 pagineElliott Wave: Fact or Fiction?: by F. David Minbashianapi-19771937Nessuna valutazione finora

- CHAPTER 4 Partiner ShipDocumento22 pagineCHAPTER 4 Partiner ShipTolesa Mogos100% (1)

- PT Surya Gemilang AinunDocumento30 paginePT Surya Gemilang AinunYuli Dhika DinaNessuna valutazione finora

- The PPDA Act 2003 (Uganda)Documento32 pagineThe PPDA Act 2003 (Uganda)Eric Akena100% (5)

- Charge BackDocumento9 pagineCharge Backسرفراز احمدNessuna valutazione finora

- IMLI-Marine Insurance LawDocumento25 pagineIMLI-Marine Insurance LawHERBERTO PARDONessuna valutazione finora

- BAFS SAMPLE - SMEs Mangement (Partial)Documento11 pagineBAFS SAMPLE - SMEs Mangement (Partial)Phoebe WangNessuna valutazione finora

- Ar 20 Nissan GandharaDocumento152 pagineAr 20 Nissan GandharaGravel coNessuna valutazione finora

- Catalog: Welcome To Marketplace Books..Documento32 pagineCatalog: Welcome To Marketplace Books..prashantNessuna valutazione finora

- Elizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoDocumento6 pagineElizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoChoi ChoiNessuna valutazione finora

- Proyecto de Modificaciones A La Niif para Las PymesDocumento60 pagineProyecto de Modificaciones A La Niif para Las PymesKevin JimenezNessuna valutazione finora

- Internship Offer LetterDocumento1 paginaInternship Offer LetterChujja ChuNessuna valutazione finora