Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PDF: Vermont Health Exchange Final Premium & Deductible Examples

Caricato da

Philip TortoraCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PDF: Vermont Health Exchange Final Premium & Deductible Examples

Caricato da

Philip TortoraCopyright:

Formati disponibili

March 29, 2013 Examples: Different Scenarios for Vermonters Moving from Catamount and Traditional Health Insurance

to the Exchange Here are some examples of what it would mean for different Vermonters to purchase health insurance in the Vermont Exchange instead of todays commercial market based upon the proposed filed rates that are subject to review by the Green Mountain Care Board. Example #1 A couple with Catamount shops in the Exchange Ellen and Tom have a family income of $32,000 a year and no children. Before 2014, Ellen and Tom were enrolled in Catamount Health policies with a premium of $911per month. Ellen and Tom received Catamount Health Assistance and paid a total of $248 per month. In 2014, when Ellen and Tom buy a policy in the Vermont Health Benefit Exchange, their monthly premiums will be about $895 per month. They will qualify for a federal premium tax credit of $721 per month and state premium assistancei of $40. Together these would reduce their monthly premium to $134. Their total annual savings in 2014 compared to 2013 would be $1368 per year. CurrentCatamount Monthly Premium Charged Federal Premium Assistance per month State Premium Assistance per month Monthly Premium Paid $911 $0 $663 $248 2014Vermont Health Connect proposed rates $895 $721 $40 $134

Example #2 -- A single person buying coverage in the Exchange Bill is a single self-employed electrician in St. Johnsbury. He earns $40,000 and buys one person non-group coverage. Bills premium is $600 per month. In 2014, when Bill purchases coverage in the Exchange, Bills premium will be $448 per month. Bill will qualify for a federal premium tax credit of $283, but will not qualify for state premium assistance. Financial assistance will reduce his cost of coverage to $317 per month. His savings will be $283 per month and he will have reduced what he spends on health insurance by 47%. Currentnon-group Monthly Premium Charged Federal Premium Assistance per month State Premium Assistance per month Monthly Premium Paid $600 $0 $0 $600 2014Vermont Health Connect proposed rates $448 $131 $0 $317

Example #3 A Family looks at buying in the exchange John and Mary are a couple with two children. Together, their annual income is $32,000. Before 2014, they bought family non-group coverage with a $10,000 deductible that costs $700 monthly. In 2014, when they shop in the Vermont Health Connect they will find that a family plan costs $1257 a month. They are eligible for premium assistance and reduced cost sharing. Their federal premium tax credit of $1171 and state premium assistance of $41 will reduce their monthly premium cost to $45 per month. Instead of paying a $10,000 deductible, their deductible will be $100.

Currentnon-group Monthly Premium Charged Federal Premium Assistance per month State Premium Assistance per month Monthly Premium Paid $700 $0 $0 $700

2014Vermont Health Connect proposed rates $1257 $1171 $41 $45

Example #4 A small company purchases exchange coverage XYZ Company is owned by Mr. Jones who has seven employees. The XYZ payroll looks like this: Mr. Jones $150,000 Employee #1 $41,400 Employee #2 $37,000 Employee #3 $37,000 Employee #4 $37,000 Employee #5 $37,000 Employee #6 $37,000 Employee #7 $37,000 Mr. Jones and five of the employees have family coverage and by coincidence they each are married and have three children; employees #6 and #7 are unmarried and have no children. Prior to 2014, XYZ buys small group coverage with a $2,500 personal deductible for everyone. This coverage costs $12,800 per month or $153,600 annually, and he and his employees contribute 20% of their premium ($30,720). Comparable health insurance in the Exchange will cost XYZ about $10,000 per month. The company will also be eligible for a small-employer tax credit equal to 16% of its contribution to the cost of health insurance benefits. Currentsmall group Monthly Premium Charged to Employer Federal Premium Assistance per month State Premium Assistance per month Monthly amount paid by Employer $12,800 $0 $0 $10,240 2014Vermont Health Connect $10,000 Small Employer Tax Credit at end of year $0 $8,000

Pending approval by the Legislature. State premium assistance is calculated based on the proposal included in the House Appropriations budget.

Potrebbero piacerti anche

- Quinnipiac Presidential PollDocumento9 pagineQuinnipiac Presidential PollPhilip TortoraNessuna valutazione finora

- Woolf: Inflation-Adjusted Spending Per Vermont PupilDocumento1 paginaWoolf: Inflation-Adjusted Spending Per Vermont PupilPhilip TortoraNessuna valutazione finora

- Woolf: Vermont Earned Income Tax CreditDocumento1 paginaWoolf: Vermont Earned Income Tax CreditPhilip TortoraNessuna valutazione finora

- Woolf: Number of Vermont Married CouplesDocumento1 paginaWoolf: Number of Vermont Married CouplesPhilip TortoraNessuna valutazione finora

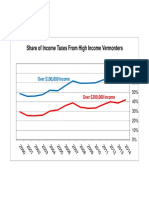

- Woolf: Share of Income Taxes From High Income VermontersDocumento1 paginaWoolf: Share of Income Taxes From High Income VermontersPhilip TortoraNessuna valutazione finora

- Woolf: Vermont Family Characteristics by CountyDocumento1 paginaWoolf: Vermont Family Characteristics by CountyPhilip TortoraNessuna valutazione finora

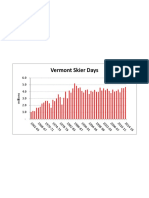

- Woolf: Vermont Skier DaysDocumento1 paginaWoolf: Vermont Skier DaysPhilip TortoraNessuna valutazione finora

- Woolf: Vermont Median Family Income Jan 2016Documento1 paginaWoolf: Vermont Median Family Income Jan 2016Philip TortoraNessuna valutazione finora

- Woolf: Vermont Labor Force and JobsDocumento1 paginaWoolf: Vermont Labor Force and JobsPhilip TortoraNessuna valutazione finora

- Woolf: Initial Claims For Unemployment InsuranceDocumento1 paginaWoolf: Initial Claims For Unemployment InsurancePhilip TortoraNessuna valutazione finora

- Woolf: Vermont Gasoline and Fuel Oil PricesDocumento1 paginaWoolf: Vermont Gasoline and Fuel Oil PricesPhilip TortoraNessuna valutazione finora

- Art Woolf: Vermont Payroll EmploymentDocumento1 paginaArt Woolf: Vermont Payroll EmploymentPhilip TortoraNessuna valutazione finora

- Bernie Sanders Medical ReportDocumento1 paginaBernie Sanders Medical ReportPhilip TortoraNessuna valutazione finora

- Woolf: Vermont PopulationDocumento1 paginaWoolf: Vermont PopulationPhilip TortoraNessuna valutazione finora

- November 2012 Vaughan Real Estate Market UpdateDocumento5 pagineNovember 2012 Vaughan Real Estate Market Updateinfo7761Nessuna valutazione finora

- PDF: Northfield Fatal Fire Search Warrant ApplicationDocumento10 paginePDF: Northfield Fatal Fire Search Warrant ApplicationPhilip TortoraNessuna valutazione finora

- Woolf: Vermont Labor Force & JobsDocumento1 paginaWoolf: Vermont Labor Force & JobsPhilip TortoraNessuna valutazione finora

- Woolf: Vermont Media Income by Household TypeDocumento1 paginaWoolf: Vermont Media Income by Household TypePhilip TortoraNessuna valutazione finora

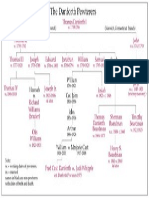

- The Danforth PewterersDocumento1 paginaThe Danforth PewterersPhilip TortoraNessuna valutazione finora

- Affidavit: United States vs. Mark McLoudDocumento9 pagineAffidavit: United States vs. Mark McLoudPhilip TortoraNessuna valutazione finora

- Art Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedDocumento1 paginaArt Woolf: Percentage of Students Achieving A Score of Proficient or AdvancedPhilip TortoraNessuna valutazione finora

- Art Woolf: Vermont Percent of Under 65 Population Without Health InsuranceDocumento1 paginaArt Woolf: Vermont Percent of Under 65 Population Without Health InsurancePhilip TortoraNessuna valutazione finora

- Art Woolf: State and Local Taxes As A Share of Personal IncomeDocumento1 paginaArt Woolf: State and Local Taxes As A Share of Personal IncomePhilip TortoraNessuna valutazione finora

- Woolf: Keurig Green Mountain Stock PriceDocumento1 paginaWoolf: Keurig Green Mountain Stock PricePhilip TortoraNessuna valutazione finora

- Art Woolf: FY12 Vermont Government SpendingDocumento1 paginaArt Woolf: FY12 Vermont Government SpendingPhilip TortoraNessuna valutazione finora

- PDF: Court Papers Filed in Randy Quaid CaseDocumento18 paginePDF: Court Papers Filed in Randy Quaid CasePhilip TortoraNessuna valutazione finora

- Art Woolf: Vermont Construction EmploymentDocumento1 paginaArt Woolf: Vermont Construction EmploymentPhilip TortoraNessuna valutazione finora

- Vermont State Police AMBER Alert ReviewDocumento5 pagineVermont State Police AMBER Alert ReviewPhilip TortoraNessuna valutazione finora

- PDF: Court Papers Filed in Evi Quaid CaseDocumento23 paginePDF: Court Papers Filed in Evi Quaid CasePhilip TortoraNessuna valutazione finora

- Art Woolf: Vermont Employment Change Since RecessionDocumento1 paginaArt Woolf: Vermont Employment Change Since RecessionPhilip TortoraNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Topics For Oral PresentationDocumento6 pagineTopics For Oral PresentationMohd HyqalNessuna valutazione finora

- Reflection Frog 1Documento3 pagineReflection Frog 1mariamNessuna valutazione finora

- S L Dixon Fluid Mechanics and Thermodynamics of TurbomachineryDocumento4 pagineS L Dixon Fluid Mechanics and Thermodynamics of Turbomachinerykuma alemayehuNessuna valutazione finora

- Read The Text and Answer The QuestionsDocumento5 pagineRead The Text and Answer The QuestionsDanny RuedaNessuna valutazione finora

- Luigi Cherubini Requiem in C MinorDocumento8 pagineLuigi Cherubini Requiem in C MinorBen RutjesNessuna valutazione finora

- APPSC GR I Initial Key Paper IIDocumento52 pagineAPPSC GR I Initial Key Paper IIdarimaduguNessuna valutazione finora

- 2062 TSSR Site Sharing - Rev02Documento44 pagine2062 TSSR Site Sharing - Rev02Rio DefragNessuna valutazione finora

- 0apageo Catalogue Uk 2022Documento144 pagine0apageo Catalogue Uk 2022Kouassi JaurèsNessuna valutazione finora

- The Way of The Samurai, Shadowrun BookDocumento19 pagineThe Way of The Samurai, Shadowrun BookBraedon Montgomery100% (8)

- Fish Siomai RecipeDocumento12 pagineFish Siomai RecipeRhyz Mareschal DongonNessuna valutazione finora

- Segmentation of Qarshi Industries Private Limited PakistanDocumento6 pagineSegmentation of Qarshi Industries Private Limited PakistanReader100% (1)

- Reverse LogisticsDocumento37 pagineReverse Logisticsblogdogunleashed100% (7)

- Engineering Economics1Documento64 pagineEngineering Economics1bala saiNessuna valutazione finora

- Sci5 q3 Module3 NoanswerkeyDocumento22 pagineSci5 q3 Module3 NoanswerkeyRebishara CapobresNessuna valutazione finora

- PDF Cambridge Experience Readers American English Starter A Little Trouble in California Sample Chapter PDF CompressDocumento11 paginePDF Cambridge Experience Readers American English Starter A Little Trouble in California Sample Chapter PDF CompressSandra MacchiaNessuna valutazione finora

- OD - SAP Connector UtilityDocumento22 pagineOD - SAP Connector UtilityShivani SharmaNessuna valutazione finora

- SAP IAG Admin GuideDocumento182 pagineSAP IAG Admin GuidegadesigerNessuna valutazione finora

- 1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyDocumento1 pagina1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyMCarmen López CastroNessuna valutazione finora

- Computerised Project Management PDFDocumento11 pagineComputerised Project Management PDFsrishti deoli50% (2)

- Law MCQ 25Documento3 pagineLaw MCQ 25nonoNessuna valutazione finora

- CHAPTER I KyleDocumento13 pagineCHAPTER I KyleCresiel Pontijon100% (1)

- Alpha Tech India Limited - FinalDocumento4 pagineAlpha Tech India Limited - FinalRahul rNessuna valutazione finora

- 20171025141013chapter-3 Chi-Square-Test PDFDocumento28 pagine20171025141013chapter-3 Chi-Square-Test PDFNajwa WawaNessuna valutazione finora

- Antonov 225 - The Largest - Airliner in The WorldDocumento63 pagineAntonov 225 - The Largest - Airliner in The WorldFridayFunStuffNessuna valutazione finora

- Adore You - PDFDocumento290 pagineAdore You - PDFnbac0dNessuna valutazione finora

- Aggregate Production PlanningDocumento5 pagineAggregate Production PlanningSarbani SahuNessuna valutazione finora

- Journal of Power Sources: Binyu Xiong, Jiyun Zhao, Zhongbao Wei, Maria Skyllas-KazacosDocumento12 pagineJournal of Power Sources: Binyu Xiong, Jiyun Zhao, Zhongbao Wei, Maria Skyllas-KazacosjayashreeNessuna valutazione finora

- Fuel Injection PDFDocumento11 pagineFuel Injection PDFscaniaNessuna valutazione finora

- rOCKY Dem Manual (010-057)Documento48 paginerOCKY Dem Manual (010-057)eduardo huancaNessuna valutazione finora

- MY-SDK-10000-EE-005 - Method Statement For Concrete Pole Installation - GVB Rev1Documento7 pagineMY-SDK-10000-EE-005 - Method Statement For Concrete Pole Installation - GVB Rev1Seeths NairNessuna valutazione finora